Original - Odaily

Author - Loopy

Bitcoin spot ETFs have been approved too many times. From Cointelegraphs intern scandal to the hacking incident officially promoted by the SEC, the market has witnessed too many ETF approvals.

Today, ETF approval finally came into effect.

However, even the SECs approval of this official announcement seems particularly crying wolf. At the beginning of the official announcement, people still couldnt believe it and were still waiting for the final reversal.

When the initial approval was granted, a 22-page PDF document began circulating on the Internet. Documents show that 11 spot Bitcoin ETFs were approved. People who downloaded this file said they obtained it from official SEC channels. But after onlookers clicked on the PDF link, they saw a 404 error message.

This also means that just a few minutes after the approved document was published, the document was removed from the SEC’s official website. People continue to fall into doubt. Is it possible that there was another mistake? Are ETFs really approved?

Bloomberg ETF analyst James Seyffart said: It is almost confirmed that the SEC does not intend for anyone outside the SEC to obtain this document/link. I confirm that I downloaded this document through the SEC official website, which is an approval order. A reissue from the SEC is expected soon.”

Soon, after VanEck confirmed the news of approval to the media, the market finally believed that the ETF was really here.

About 40 minutes later, the PDF was officially released from the SEC again at another URL.

What information does this 22-page document actually show? Odaily brings you a summary interpretation.

What was approved?

This document lists all 11 approved ETFs as follows:

Grayscale Bitcoin Trust

Bitwise Bitcoin ETF

Hashdex Bitcoin ETF

iShares Bitcoin Trust

Valkyrie Bitcoin Fund

ARK 21 Shares Bitcoin ETF

Invesco Galaxy Bitcoin ETF

VanEck Bitcoin Trust

WisdomTree Bitcoin Fund

Fidelity Wise Origin Bitcoin Fund

Franklin Bitcoin ETF

Additionally, rule change proposals submitted by the NYSE Arca, Nasdaq and BZX exchanges were approved. These exchanges have made certain changes to trading rules, including clarifying the trust shares and trading units of ETFs, including trading hours, trading volume limits, pricing, monitoring and information disclosure.

Exchanges need to ensure that the listing and trading of these products does not create unfairness or opacity to the market and prevents potential fraud and manipulation.

Is Bitcoin “easily manipulated”?

The SEC believes that ETFs can meet the requirements of the Securities Act and requires exchanges to have rules designed to prevent fraud and manipulation. The reason why approved ETFs can meet these requirements is based on the following key factors:

Strong correlation with CME futures

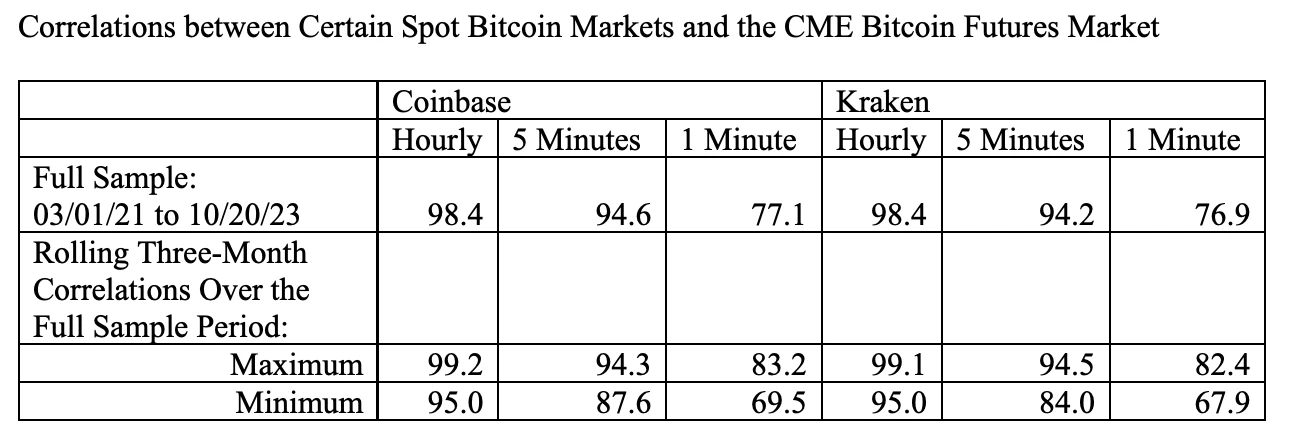

CME futures are already compliant products. Therefore, the price correlation with CME is naturally the best choice for spot BTC to prove itself. In the approval document, the SEC listed the correlation between BTC prices and CME futures prices on two crypto exchanges, Coinbase and Kraken, starting in 2021.

The SEC conducted a correlation analysis and found that the two were “highly correlated” with price changes in the CME Bitcoin futures market. If hourly data is used, the correlation result is no less than 94.2%. Using minute-by-minute data, the result is no less than 67.9%.

This means that if fraud or manipulation occurs in the spot Bitcoin market, it is likely that these actions will also affect the futures market and be detected by CME’s monitoring systems.

Monitor sharing and prevent manipulation

The exchange on which this ETF is listed has the ability to monitor its market transactions, including real-time monitoring and historical data analysis to identify abnormal trading patterns and potential manipulation.

The exchange has also established comprehensive monitoring sharing agreements with regulated markets such as the Chicago Mercantile Exchange (CME). Such an agreement facilitates information sharing, thereby improving the detection and prevention of potential market manipulation.

Exchanges may need to add rules to prevent market manipulation, such as by monitoring abnormal trading behavior, restricting large transactions, implementing trading suspensions, etc.

Transparency and disclosure

The proposal includes measures to improve transparency and information disclosure, such as providing real-time pricing information for trust shares and units, position information on trust assets, etc., which will help market participants make more informed trading decisions and reduce the room for manipulation. .

Exchanges that trade ETFs provide quote and last trade information for each trust through securities information processors;

Information related to the Trusts IIV and NAV is provided on each Trusts website;

The exchange updates the IIV every 15 seconds during its normal trading hours;

the Exchanges monitoring procedures and ability to obtain information regarding transactions in the Trusts shares;

The exchange establishes the conditions for suspension and suspension of trading;

Requirements for a registered market maker for each trust.

The issuance and trading of shares and units of the Trust must comply with all applicable securities regulations, including the Securities Act of 1933 and the Securities Exchange Act of 1934. These regulations are designed to protect investors from fraudulent and manipulative practices.

Investor protection measures

The proposals also include investor protection measures, such as ensuring fair and transparent trading of trust shares and units, and providing investors with the necessary information to enable them to make informed investment decisions.

As a regulator, the SEC closely scrutinizes rule changes by exchanges to ensure that they meet standards to prevent fraudulent and manipulative practices.

Based on the above factors, the SEC believes that the exchanges rule change proposal meets the requirements of the Securities Exchange Act and can design an effective mechanism to prevent fraud and manipulation, thereby protecting investors and the public interest. This review process ensures that exchanges can provide a safe and fair market environment when listing and trading Bitcoin-related products.

SEC considers commenters comments

The document states that the committee also considered other comments regarding Bitcoin ETPs.

Some commenters claimed that the Commission would have to approve these proposals because CME Bitcoin futures are already open for trading on other national securities exchanges. Since spot Bitcoin ETFs and CME Bitcoin futures ultimately track the same underlying asset, the committee should approve these proposals.

Some commenters claimed that the Commission should approve these proposals for various investor protection reasons. A spot Bitcoin ETP will provide investors with a lower-cost, more efficient way to hold Bitcoin exposure. This is more convenient and secure than holding Bitcoin directly, and will be subject to more regulation.

Some commenters argued that the SEC should reject these proposals on investor protection grounds because some market participants may take advantage of retail investors.

The document states,The committee acknowledges these concerns. However, under the Securities Act, the SEC believes that this proposal complies with the requirements of the securities laws, and therefore the CommissionMust approve。

Are ETF products safe?

The SECs security concerns were also cited in the filing. This includes both the security of the blockchain itself and whether the custodian can keep it properly.

Blockchain security

The document mentioned that the decentralized nature and encryption technology of the Bitcoin blockchain provide a certain degree of security, but there is also the risk of being hacked.

Despite the security risks, some commentators see the transparency of the Bitcoin blockchain as an advantage, as it allows for real-time tracking of the trust’s Bitcoin holdings.

Double spending risk

Some commenters expressed concerns about “reverse hacking” attacks, whereby the blockchain is manipulated to alter transaction records and thereby impact the ETF’s asset value.

What does the SEC think?

The SEC acknowledged these concerns in its filing. They said the SEC considered these risks but believed the proposal would meet the requirements of the Securities Act and protect investors and the public interest.

Is BTC custody reliable?

The document states that the ETF’s Bitcoins are held by a custodian rather than directly owning the Bitcoins. This structure can introduce risks because if the custodians security measures are insufficient, the Bitcoins can be stolen.

The SEC acknowledges that custodians may introduce risks to this product. However, as with the aforementioned issues, the SEC “if it finds that the proposal complies with the requirements of the Securities Act,Must approvethis proposal.

Another risk of custody is that assets are not covered. If the shares issued by the trust are not backed by sufficient Bitcoin, it may result in the trust being uncovered, which may result in losses to investors.

Regarding this issue, the SEC believes that the non-coverage issue is a risk that can be prevalent on all ETPs, not just those that hold Bitcoin. Any such issues could constitute a potential breach and be sufficient to initiate delisting proceedings. In addition, this behavior may also constitute an illegal act against the Securities Law and the Commodity Exchange Law.

in conclusion

This approval order is based on each exchanges representations and descriptions in their respective amended filings, which the Commission has carefully evaluated in light of the discussion above. For the reasons set forth above, including the Commissions analysis of relevance, the Commission determines, pursuant to Section 19(b)(2) of the Exchange Act, that these proposals are consistent with the requirements of the Exchange Act and the rules and regulations applicable to national securities exchanges, In particular, the requirements of Section 6(b)(5) and Section 11A(a)(1)(C)(iii).

Therefore, pursuant to Section 19(b)(2) of the Exchange Act,ORDER APPROVAL OF THE FOLLOWING PROPOSALS(SR-NYSEARCA-2021-90; SR-NYSEARCA-2023-44; SR-NYSEARCA-2023-58; SR-NASDAQ-2023-016; SR-NASDAQ-2023-019; SR-CboeBZX-2023-028; SR -CboeBZX-2023-038; SR-CboeBZX-2023-040; SR-CboeBZX-2023-042; SR-CboeBZX-2023-044; SR-CboeBZX-2023-072), and approval is hereby accelerated.

——Published by the Committee

recommended article

Related topics

BTC spot ETF passes, the bullish narrative begins in the next 20 years