Original author: Lauren Stephanian, Partner at Pantera Capital

Original compilation: Luffy, Foresight News

Two years ago, we published the reportOptimize token distribution”, this is an analysis report on the token distribution model, aiming to help founders better think about network token distribution. Trends in the crypto space are changing rapidly, and given the renewed enthusiasm in the market, more and more founders are drafting their own token distribution models and issuing tokens. This report combines the latest data with our updated analytical framework to provide founders with a valuable reference.

As a reminder, protocol founders often raise funds in order to issue tokens to private investors and their community. These tokens generally represent governance rights, allowing holders (insiders, private investors, and the community) to participate in the decision-making process of a product, service, or protocol. Protocols typically have a fixed supply of tokens, and teams must allocate tokens carefully, optimize the recipient pool, and allocate tokens to users and partners.

In our 2022 exploration, we explored key trends in token distribution using data pulled from private pitch platforms, public media posts and blogs, and Github READMEs dating back to 2014. Now, two years later, we have improved the dataset and further explored the latest trends in token distribution.

Please note: This report was published in March 2024 and uses publicly available information as well as aggregated and anonymized private data points. The authors of this report have not independently verified the accuracy of these token allocations.

Key Trends in Token Distribution

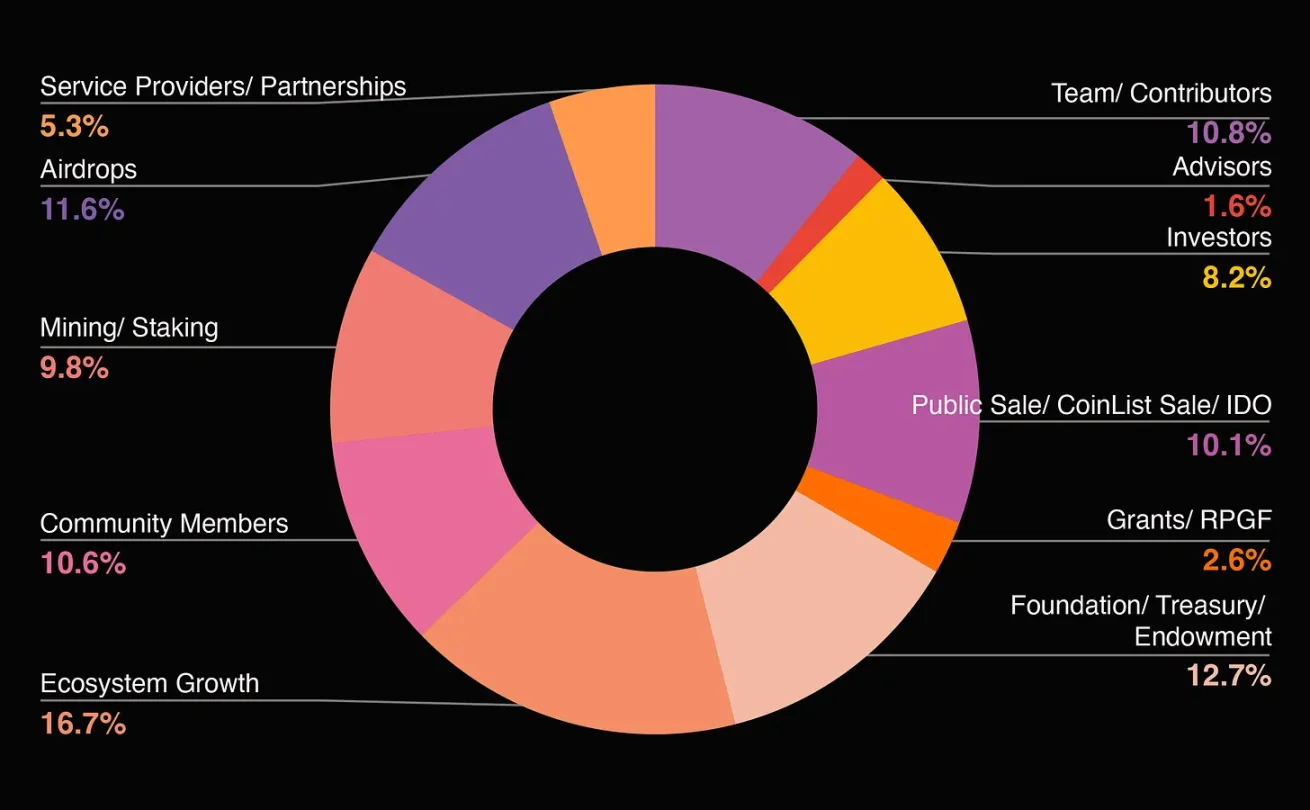

Token distribution can be divided into 7 main parts:

core team

private investor

community finance

Ecosystem incentives

airdrop

public sale

Partners and suppliers

We have compiled the token allocations of over 150 projects and protocols to provide a more comprehensive analysis of the clear trends in the space.

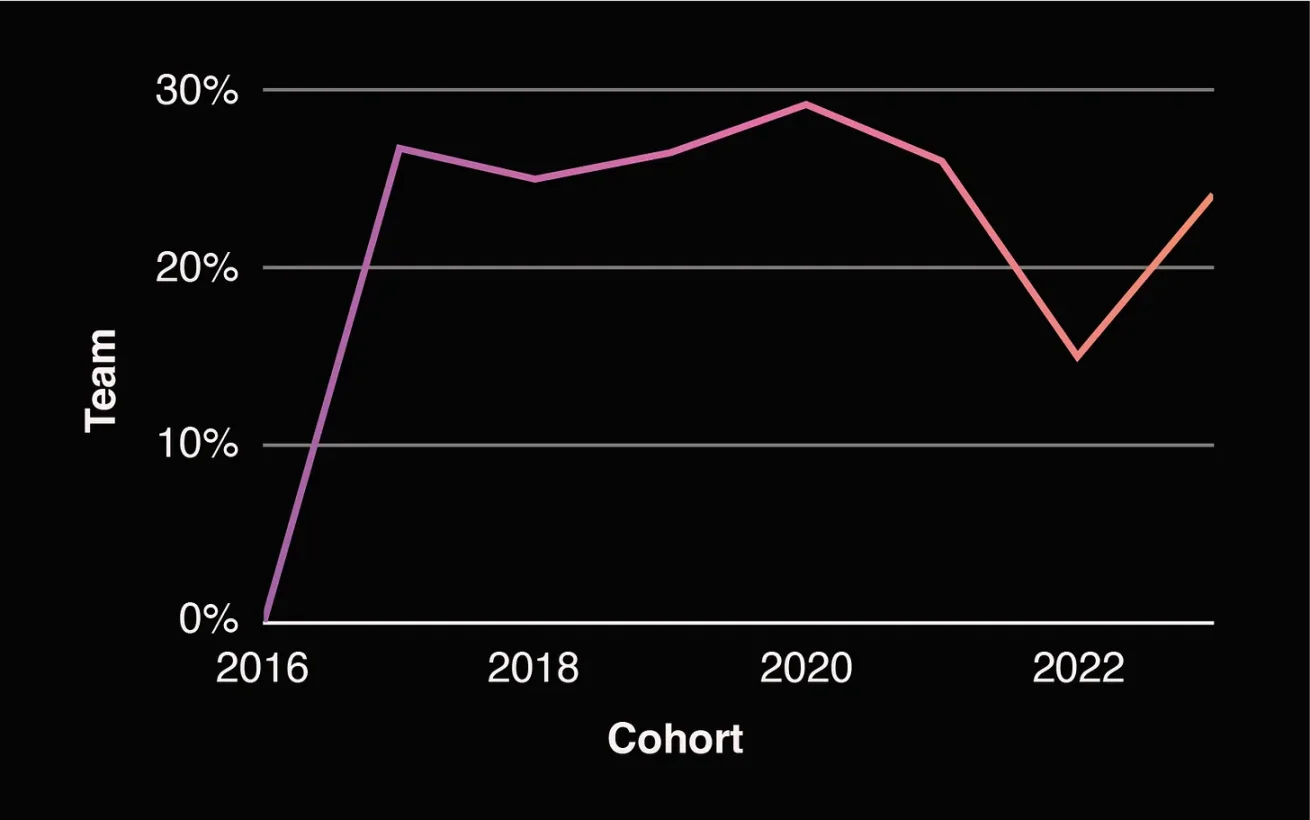

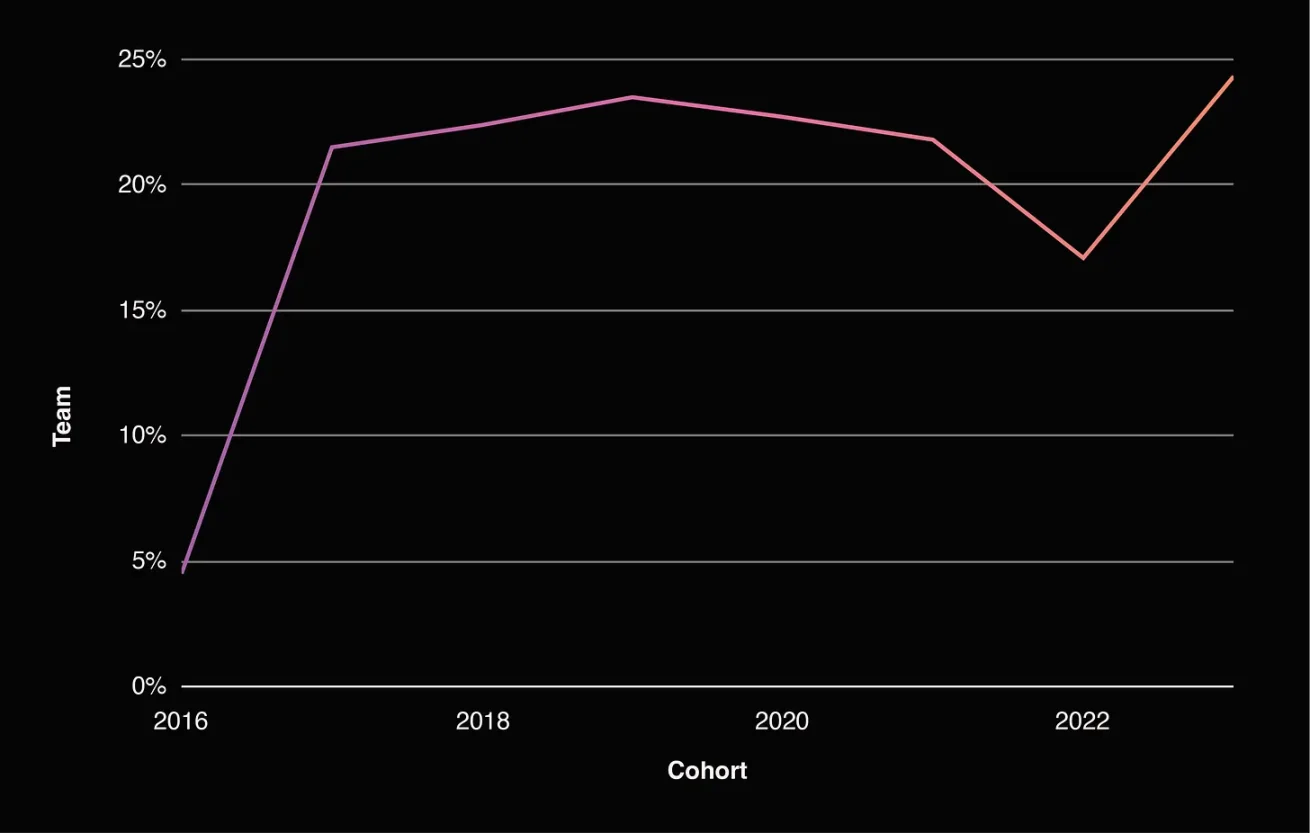

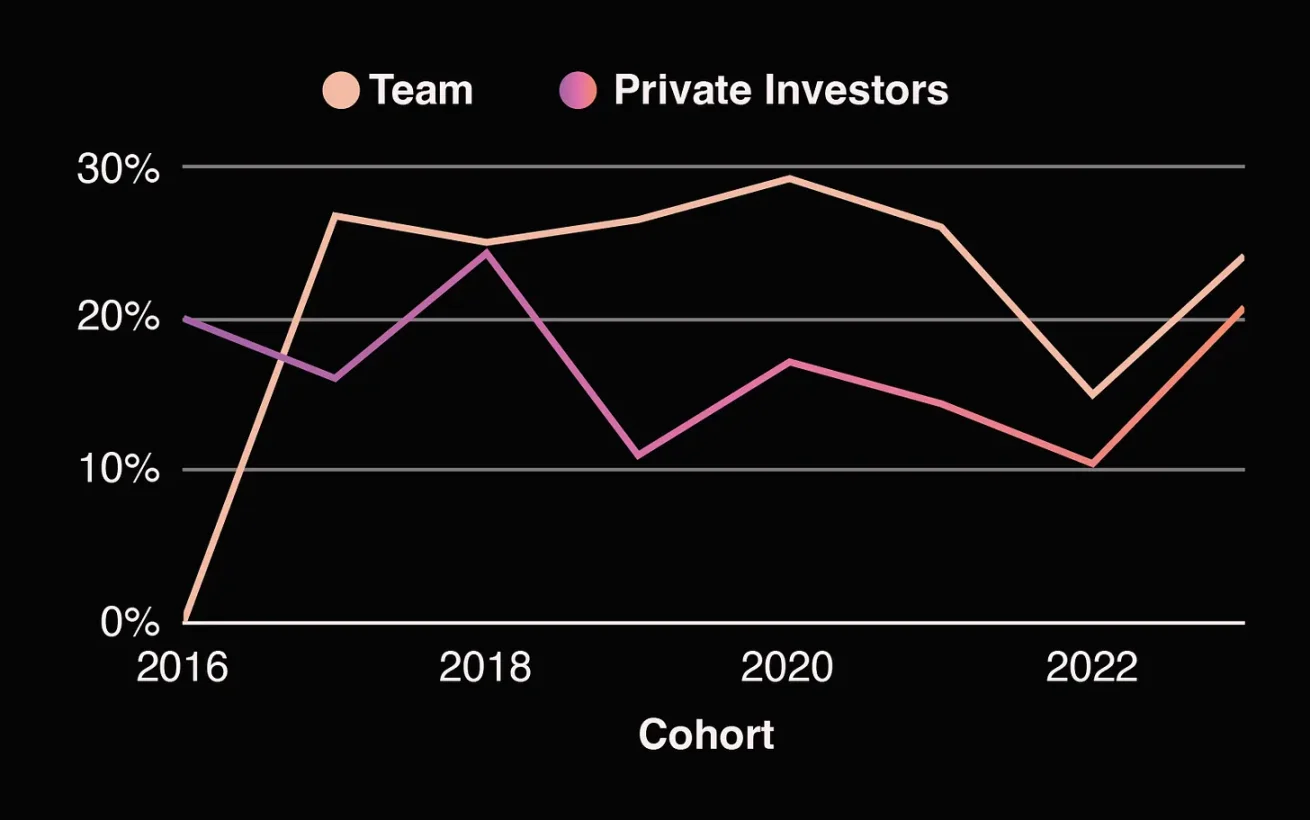

team

This is an allocation of tokens reserved for founders, past and future employees, and advisors. These tokens typically have the longest lock-up period, which usually coincides with the investor’s lock-up period.

The team assignments shown above include core contributors, future contributors, and advisors. For a more detailed look at the core team, take a look at the chart below, which shows the core team allocation share gradually increasing.

Core team assignment

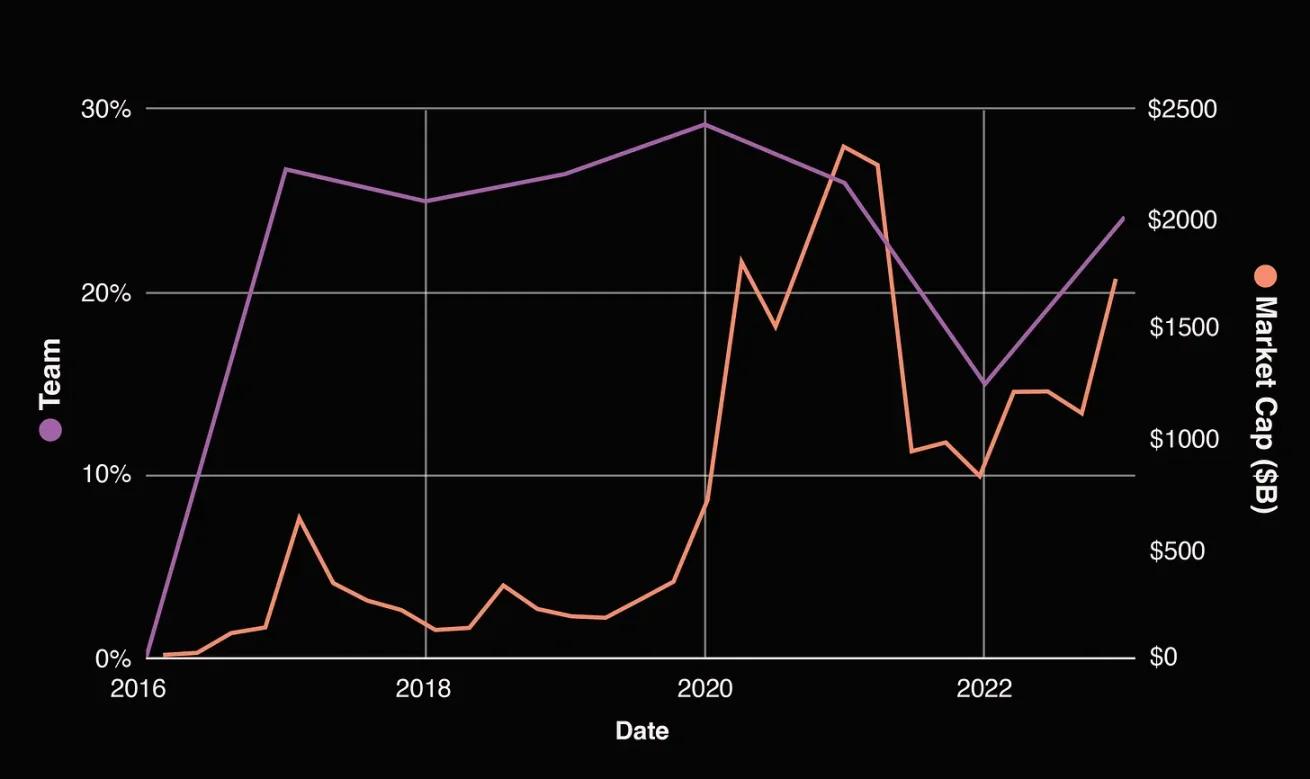

Team assignments seem to have some correlation to where we are in the market cycle, which isnt surprising, but still worth noting. When the total cryptocurrency market cap grows, the funds allocated to the team also increase, and when the market cap shrinks, the funds allocated to the team also shrink.

The relationship between team allocation and cryptocurrency market capitalization, source: Market Cap

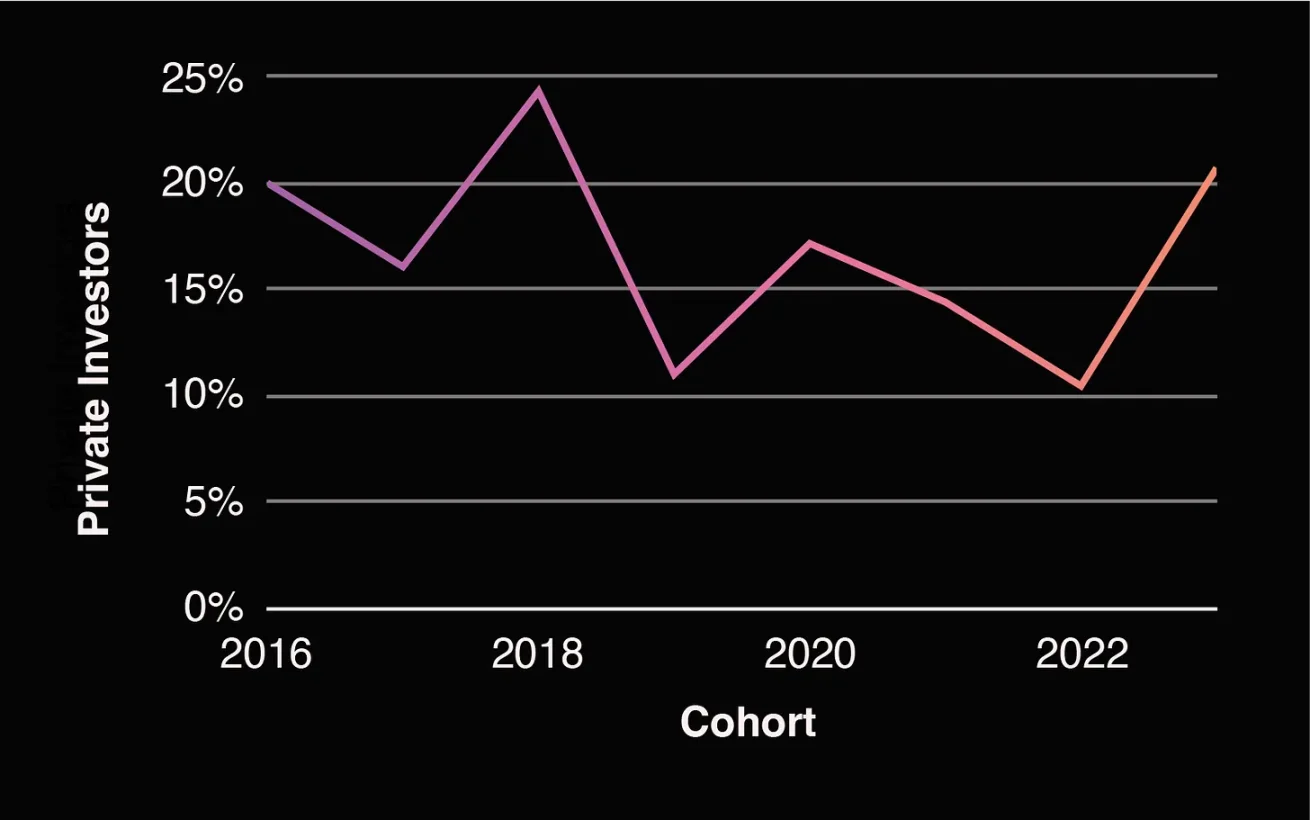

private investor

This is the share allocated to capital providers who purchase rights to future tokens or equity, which rights are subsequently converted into tokens. These tokens are subject to a lock-up period, usually aligned with the core team.

Private Investor Token Distribution

Interestingly, while we would expect investor allocations to be inversely related to team allocations, this ratio has actually been trending upward over the past year as well. Currently, this ratio is roughly at 2018 levels.

Team versus private investor allocations

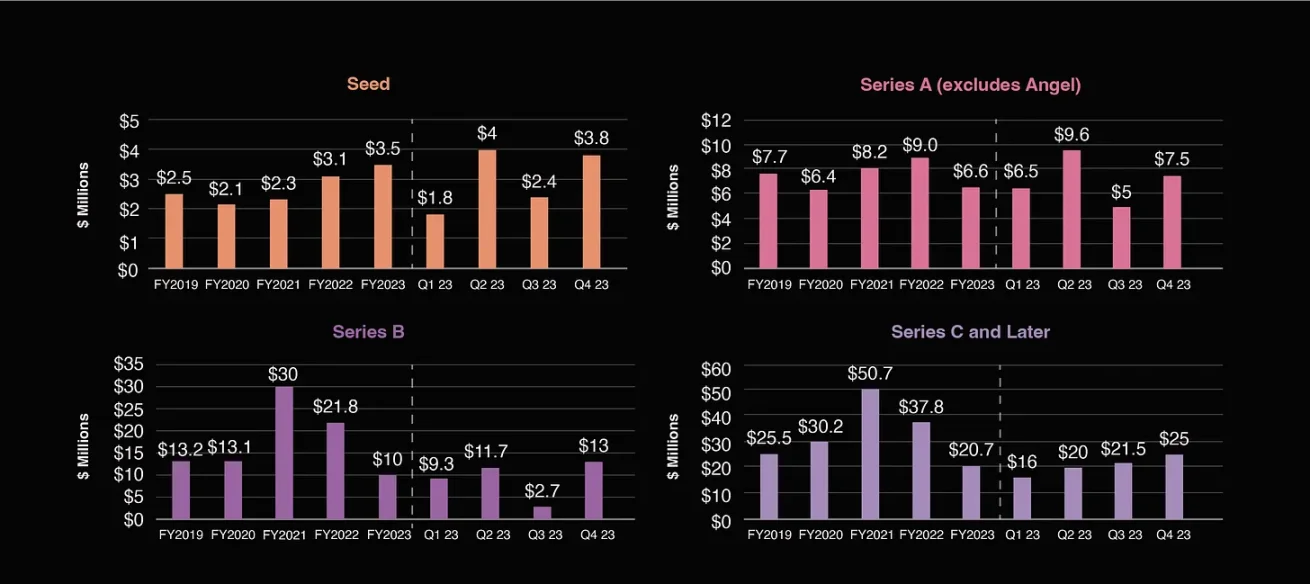

Initially, I thought this might be related to a large funding round in late 2023, but looking at industry funding data, this doesnt make much sense as the increase in valuation is higher than the increase in amount raised.

Median financing amount

median valuation

This may have something to do with founders waiting out the recent bear market to raise capital they didnt urgently need.

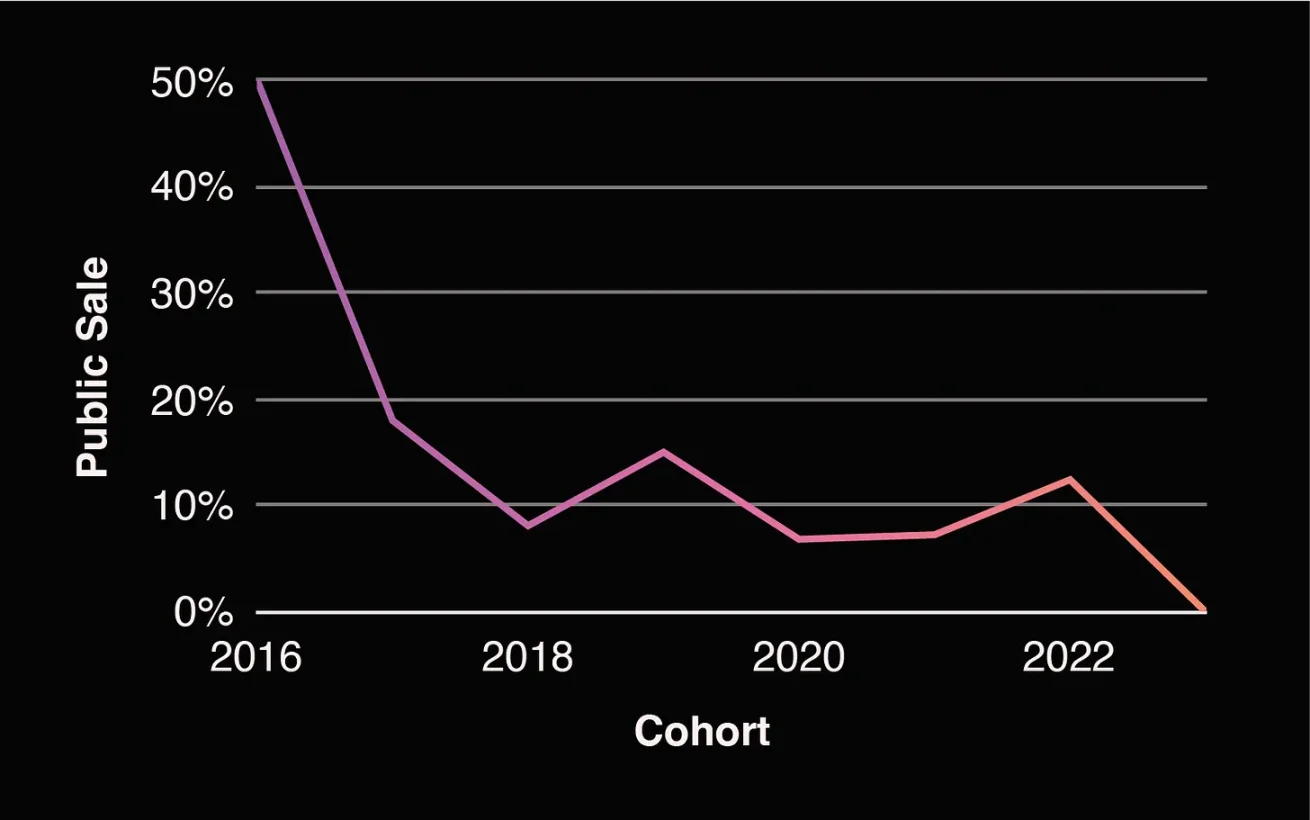

public investors

This is a distribution of tokens for sale to the public. Public sales of tokens, formerly known as ICOs, are sold when the tokens are issued and all are circulated.

Unsurprisingly, the share of public sales gradually approaches 0 due to regulatory risks.

Token distribution for public sale

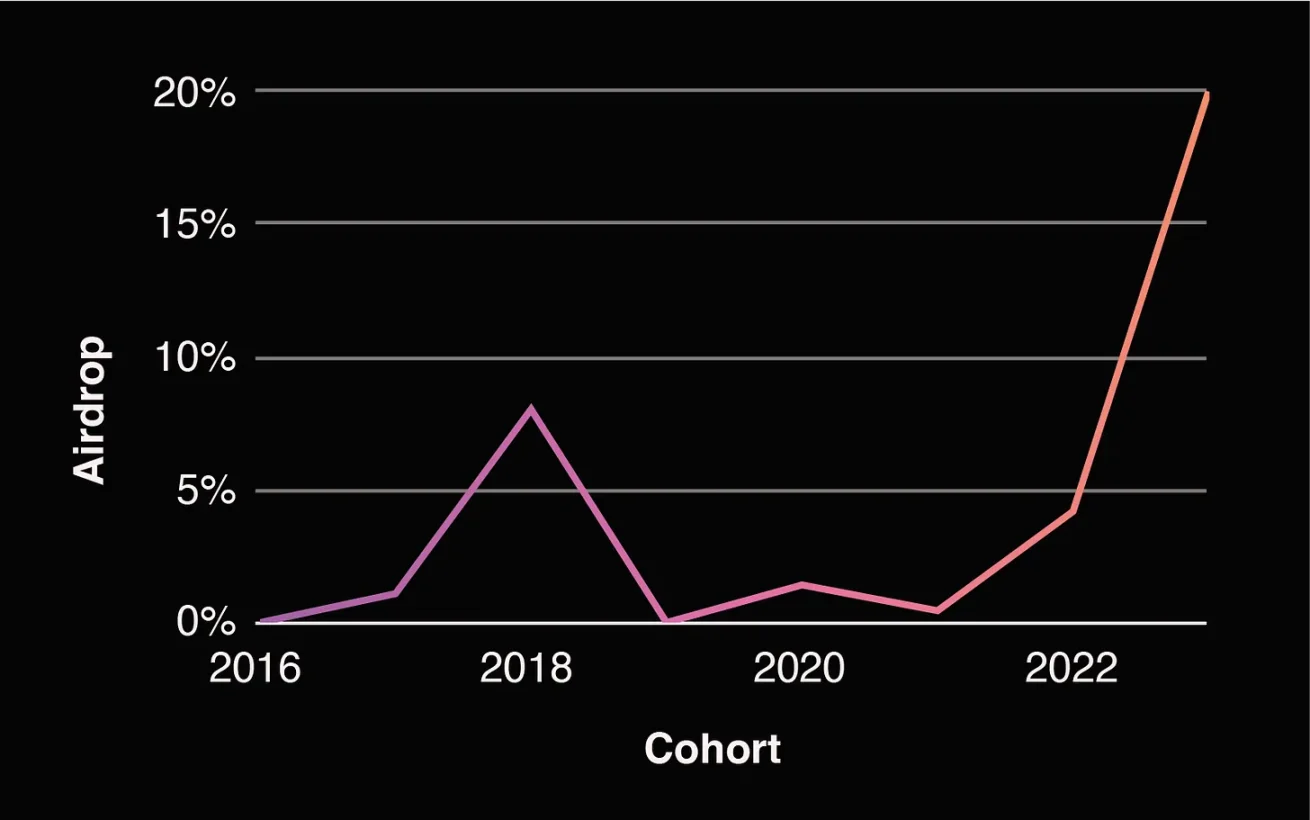

airdrop

The disappearance of the public token sale model begs the question: How do you get tokens into the hands of the community? One potential method is airdrops.

Airdrop distribution

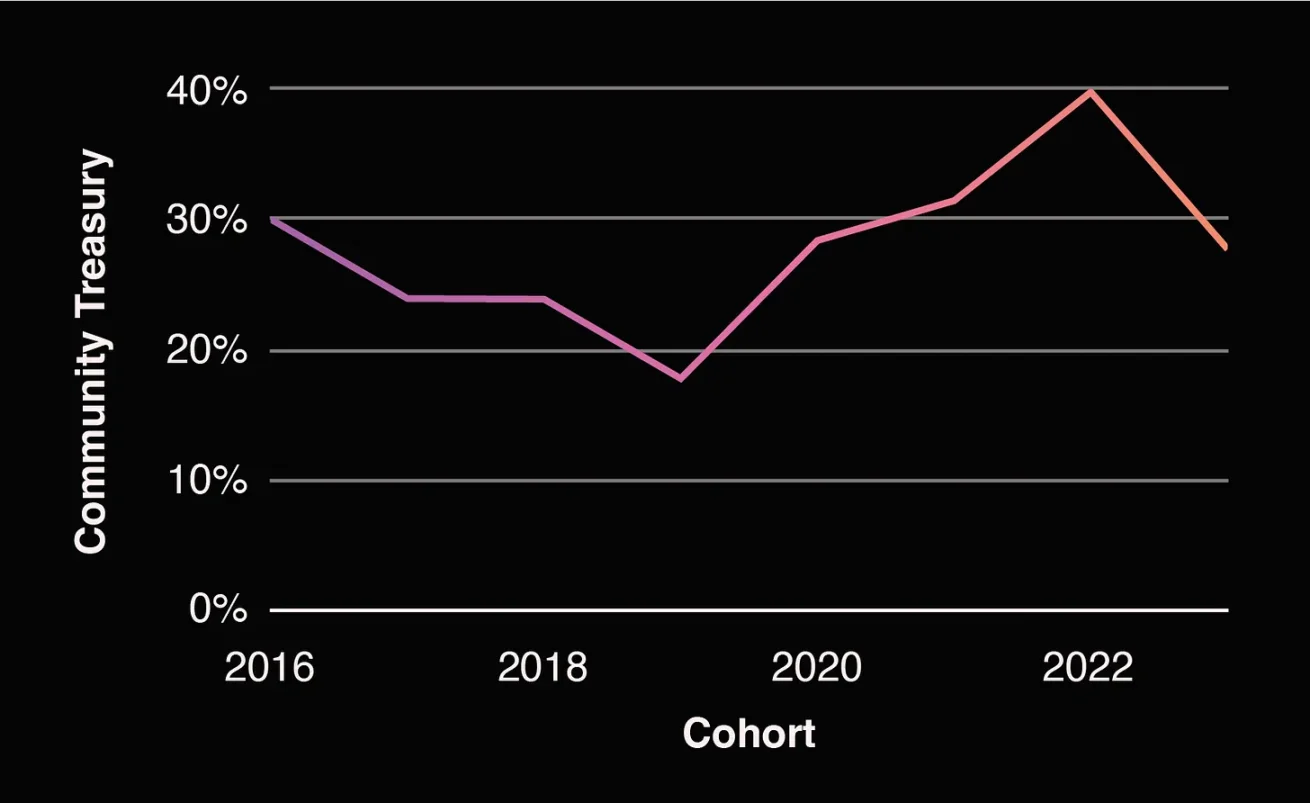

treasury

These tokens will be reserved for future distribution through governance. Treasury tokens are often viewed as a project’s “reserve pool”—distributed to different stakeholders through voting proposals.

Treasury allocations have fluctuated over time, peaking in 2022. Following a downward trend, we may see a decrease in treasury allocations due to increases in other categories.

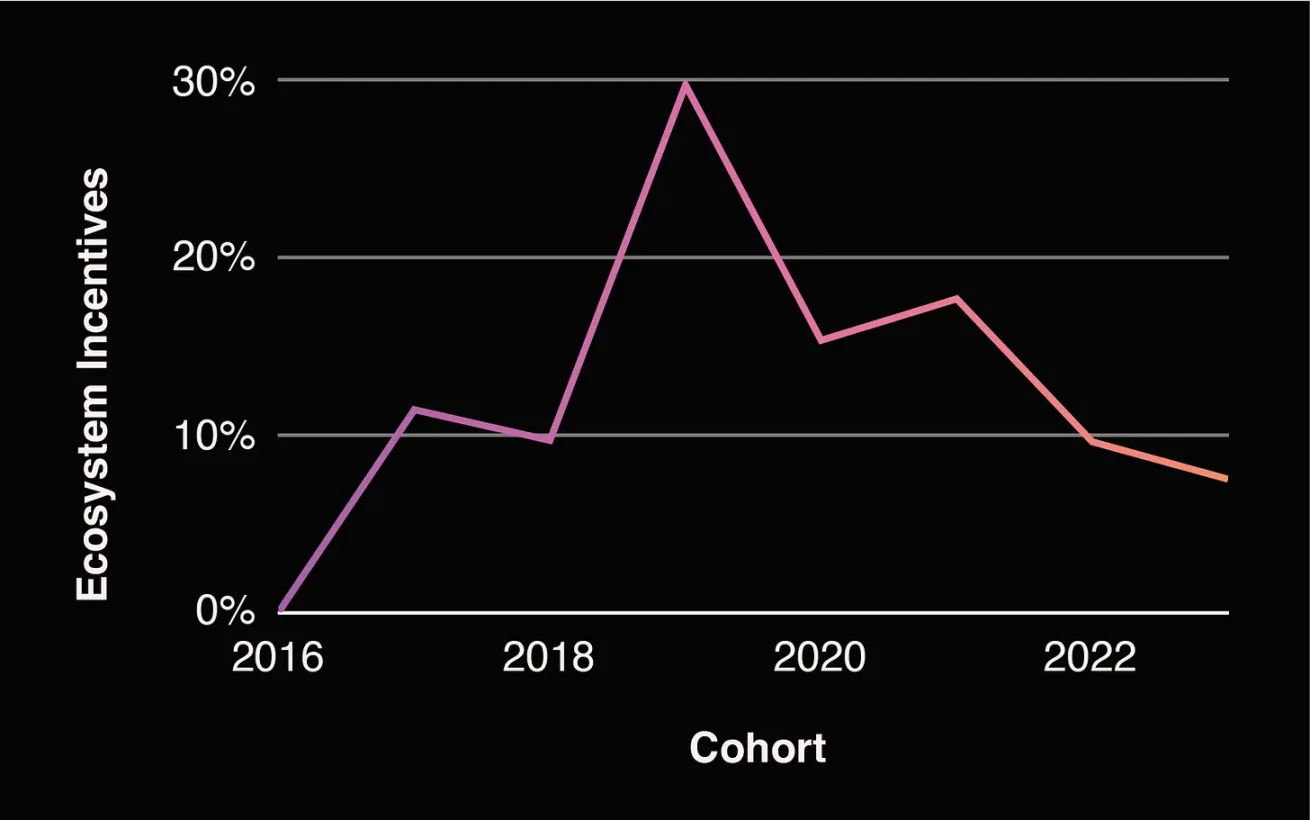

Ecosystem incentives

These tokens are earmarked for growth plans at launch, allowing users to profit from a pre-specified pool of tokens. Incentives have emerged as alternatives to public sales, including growth plans and liquidity mining.

The distribution ratio of ecosystem incentives is declining, but given the rapid increase in airdrop proportions, many founders are likely to view incentives as a larger category, so you can think of this decline as closely related to the large increase in airdrops.

Ecosystem incentive distribution

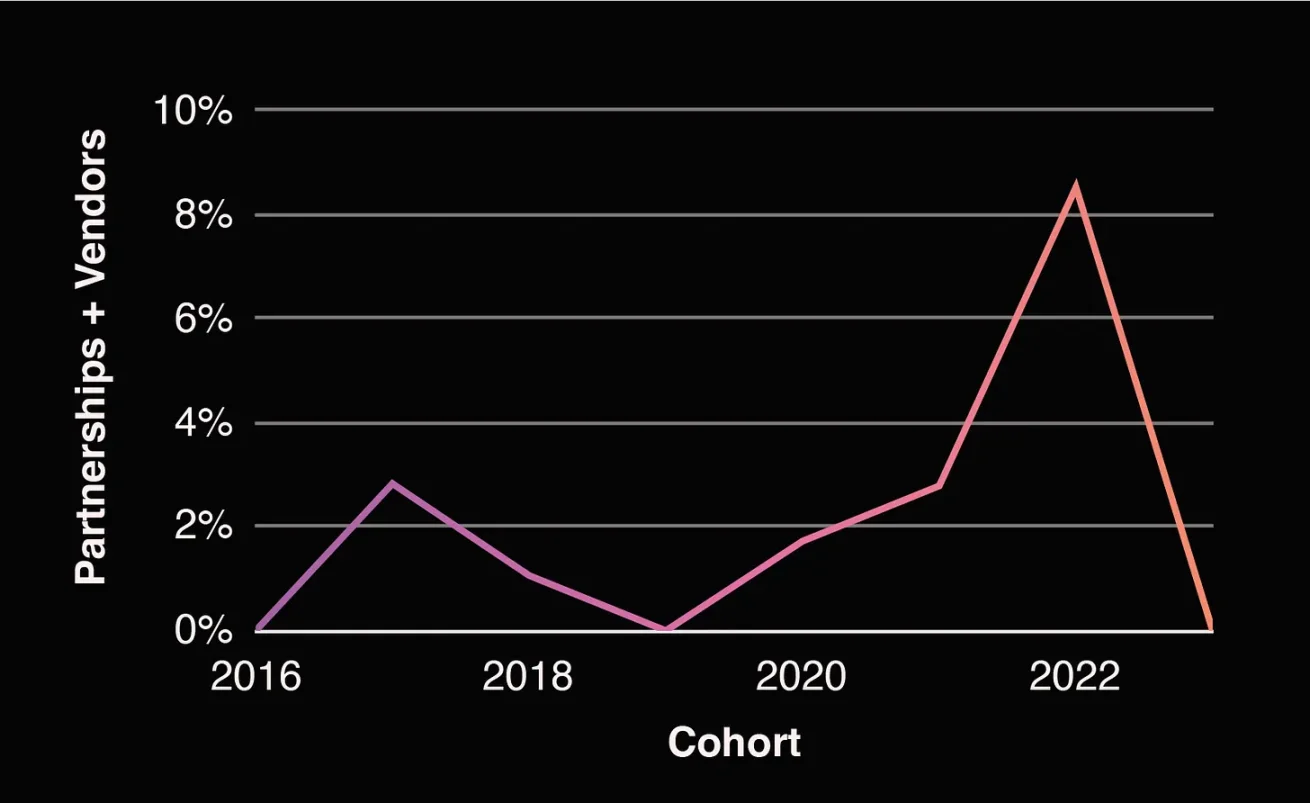

Partners and suppliers

These tokens include a pool of funds used to pay for legal, rent, third-party marketing, and more. The reason for the decline may simply be that these charges are uncategorized and lumped together with the vault.

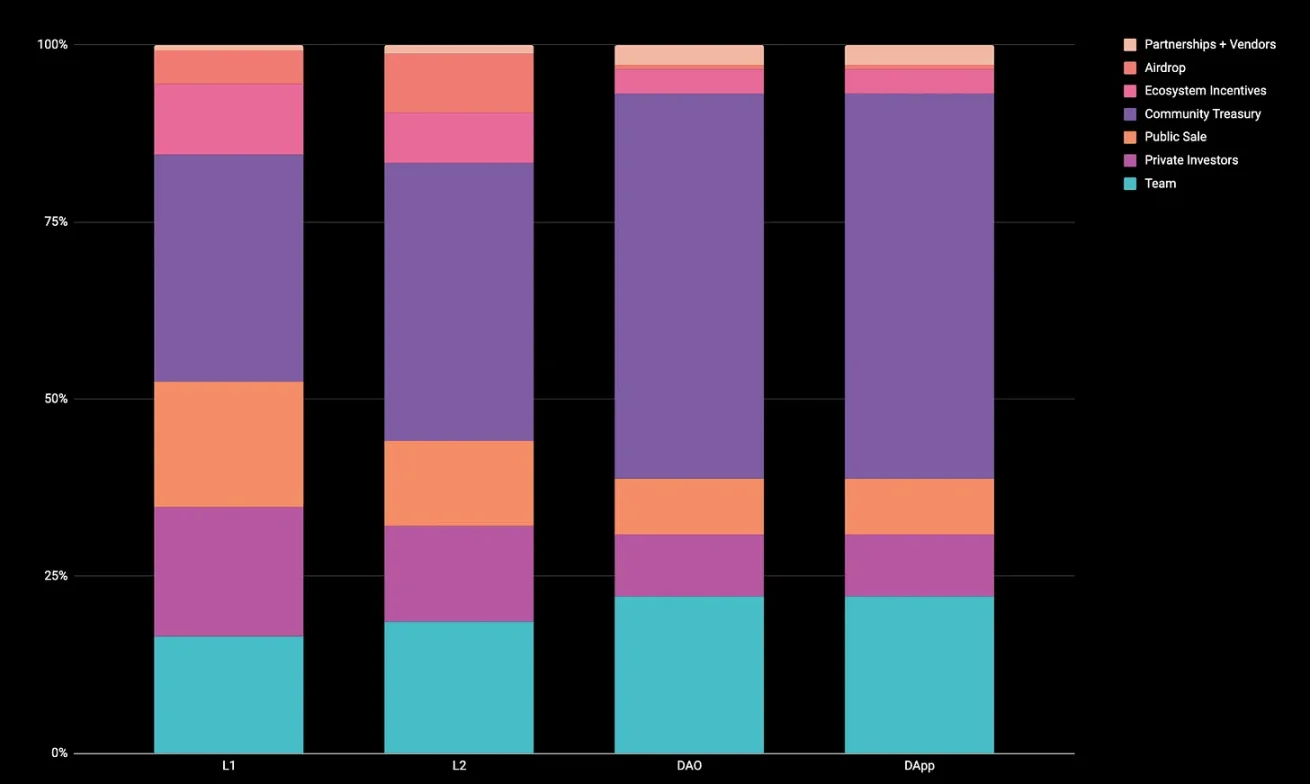

Token distribution by project type

Each type of project will have a unique allocation model.

The following is the specific performance of each type of project. Note that these are post-pandemic averages.

Not surprisingly, the DAO prefers to allocate more tokens to its treasury/foundation, while L1 prioritizes airdrops and (at least until 2023) public sales. L2 tends to prioritize ecosystem growth incentives, which may later be used for airdrops as well. DApps spend the most on community incentives, but not necessarily through airdrops, but through other methods such as liquidity mining.

Now, we’ll explore each segment category in more depth.

DAO

Over time, we have seen some changes in DAO allocations. Community funding has remained high over the years, while team allocations have tapered off and fund allocations have increased. Unfortunately, we dont have enough data after 2023 to calculate an average.

DAO’s token allocation details

“Typical” DAO Token Distribution in 2022

DApp

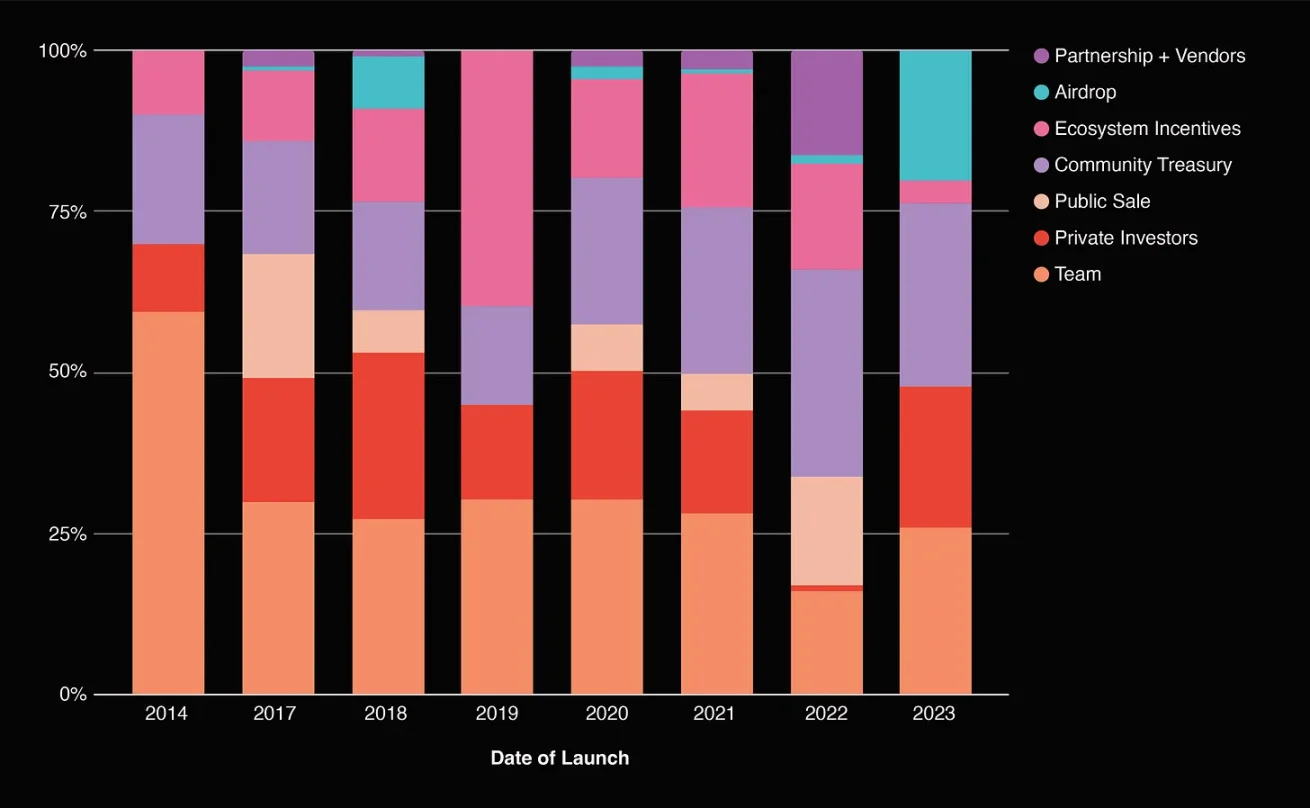

Digging deeper into DApp token distribution, we can see that team allocations have been slowly decreasing over time (with a big drop after 2014), while investor allocations and airdrop allocations have been increasing.

Token allocation details of DApp

Infrastructure: L1 and L2

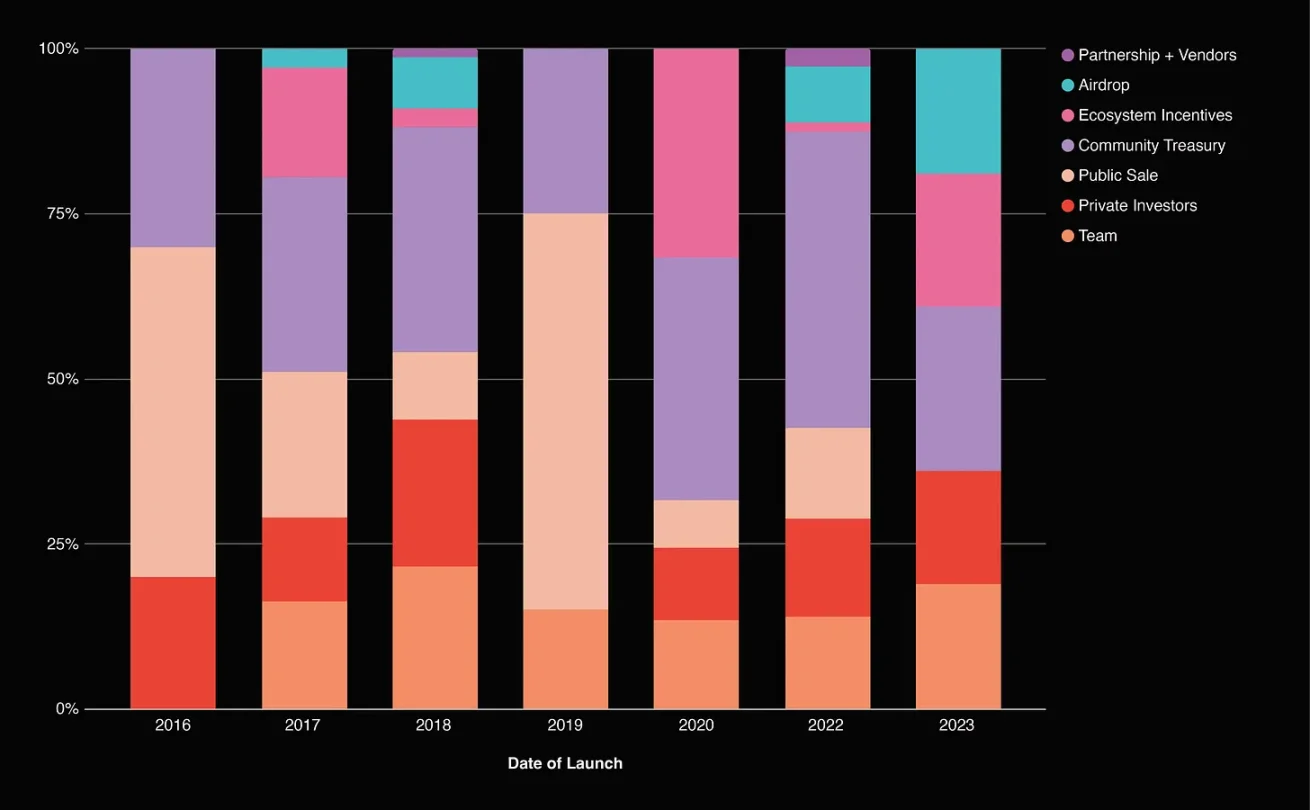

The chart below combines L1 and L2 token allocations since they are very similar. We can see that public sales allocations decline over time. Community allocations have fluctuated slightly over the years, while investor and team allocations have both increased in 2023. A large portion of the token allocation in 2023 is earmarked for airdrops.

L1 and L2 token allocation details

Looking closely at the differences between typical L1 and L2 token allocations, youll see that L2 tends to reserve less funds for the ecosystem growth pool and allocate more funds for public sales and airdrops. L2 teams also tend to receive smaller allocation proportions.

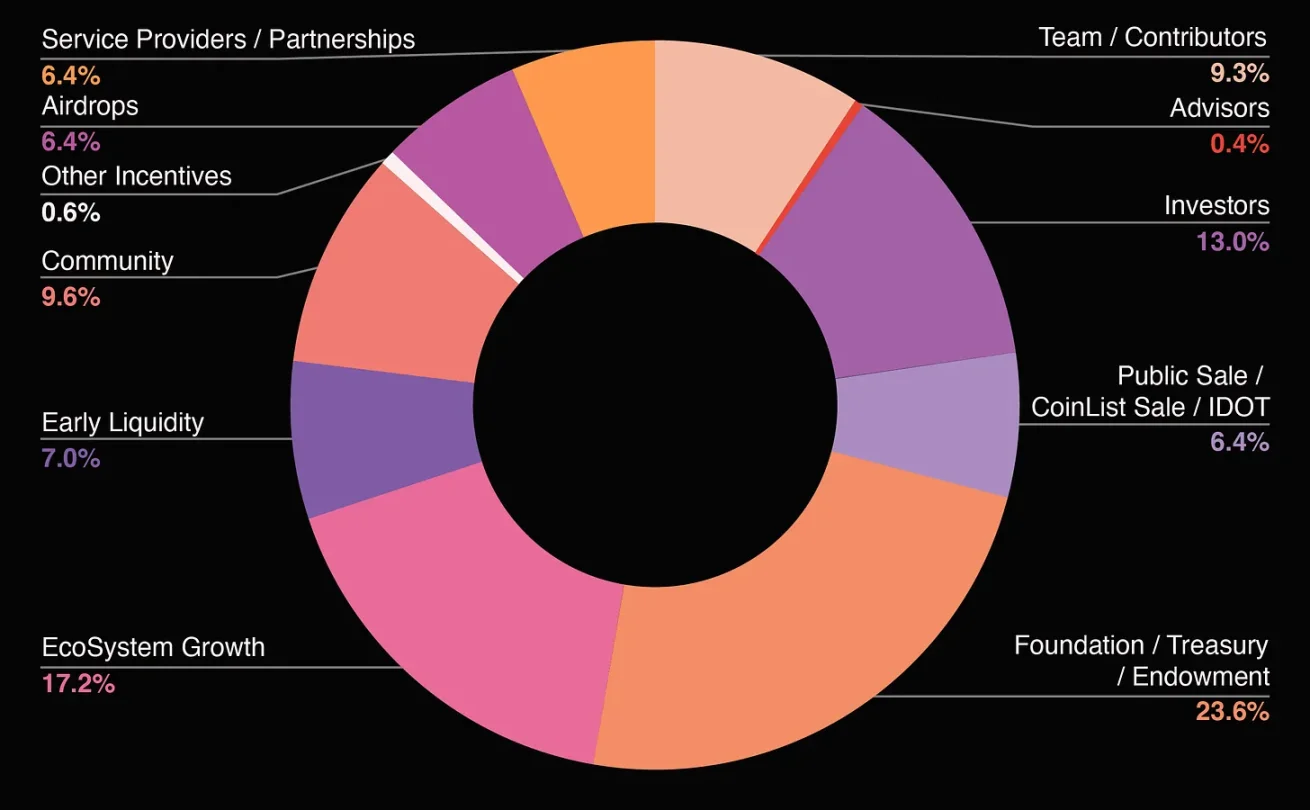

Typical L1 Token Distribution: Due to lack of data for 2023, only 2022 data is provided

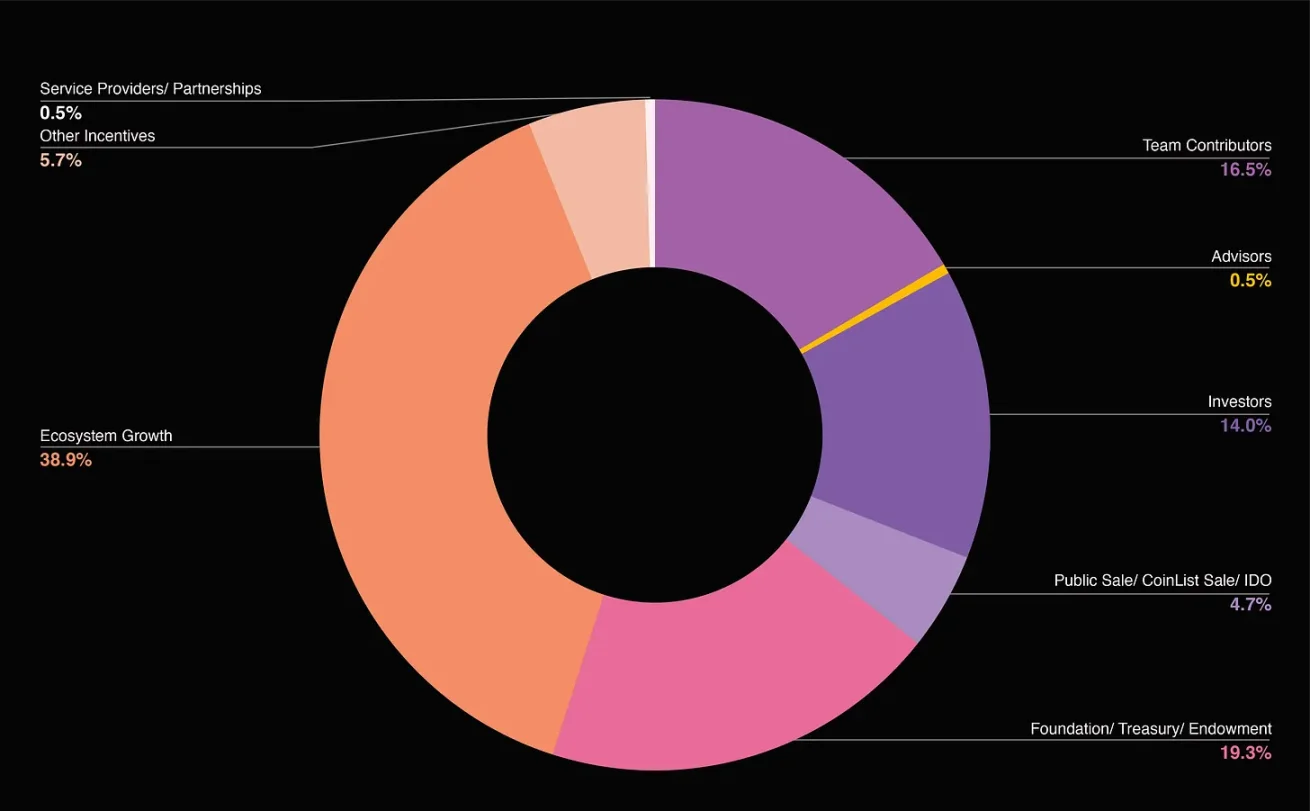

Typical L2 Token Distribution: 2022 and 2023 Data

interview

All of the charts above show historical averages over time. This time, we’ll share anecdotal data from some founders during their early token launch days to understand their regrets and satisfaction with token distributions.

Heres what they said:

Livepeer

Livepeer was founded in 2017, long before DAO governance tools existed and when cryptocurrencies were still in their infancy.

Im generally happy with the way the tokens are distributed, initially through an algorithm we created called Merklemine, a decentralized and open mechanism, and then continued distribution through inflation to distribute the tokens to the network of node operators and other active participants. This keeps the tokens in the hands of those who directly help the network, while also allowing access to everyone and allowing thousands of users to discover Livepeer in the process of receiving tokens through MerkleMine .

As for what changes I would make, if the DAO-based governance tools were more mature and available when the network was launched 6 years ago, it would be nice to leverage them for fiscal community governance. This will aid future ecosystem growth as it will be able to send tokens directly into the hands of video developers and others who do not receive direct rewards from the network. But at the time, the tools were immature and complex to build, so it wasnt a priority. We do not want to have centralized control over token distribution, so do not maintain a treasury managed by a large company.

——Doug Petkanics, founder of Livepeer

Well-known DApp established in 2018

“I think for us, the token distribution itself ended up working out so well that I rarely thought: If only.

But if I could go back in time, I would put more emphasis on raising funds from people who: 1) can actively engage in quantitative trading, 2) dare to speak out, and 3) actively participate in governance.

One of the things we do best as founders is not take too high a share - this allows us to compensate important players in the network and still have leeway.

——Founder of the well-known DeFi protocol established in 2018

What is the best way?

Following the release of the 2022 report, it was noted that average is not always optimal. So it would be interesting to reverse engineer some of the most noteworthy and recent token offerings across categories.

Reverse engineering the token issuance of top projects

Layer 2

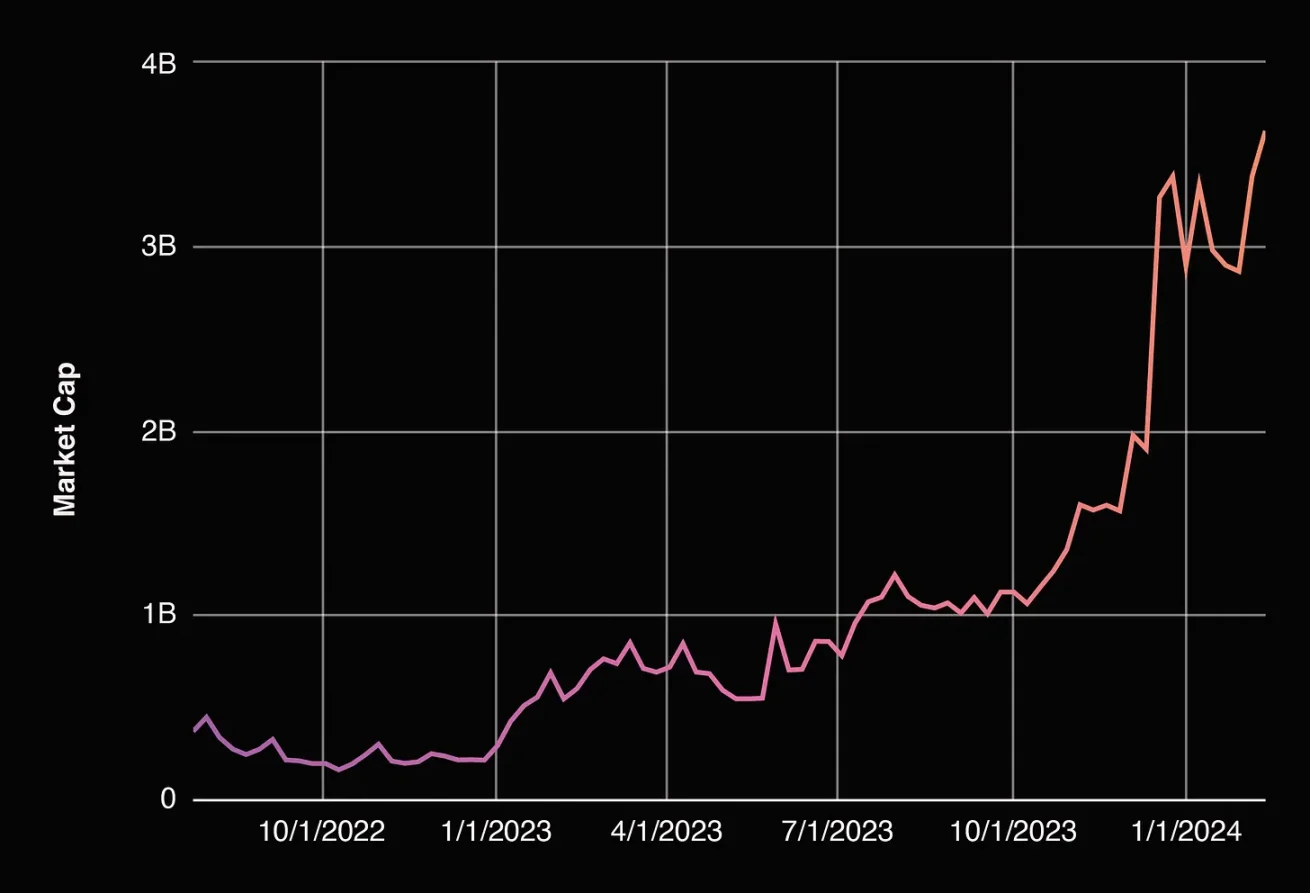

OP market capitalization (as of March 2024)

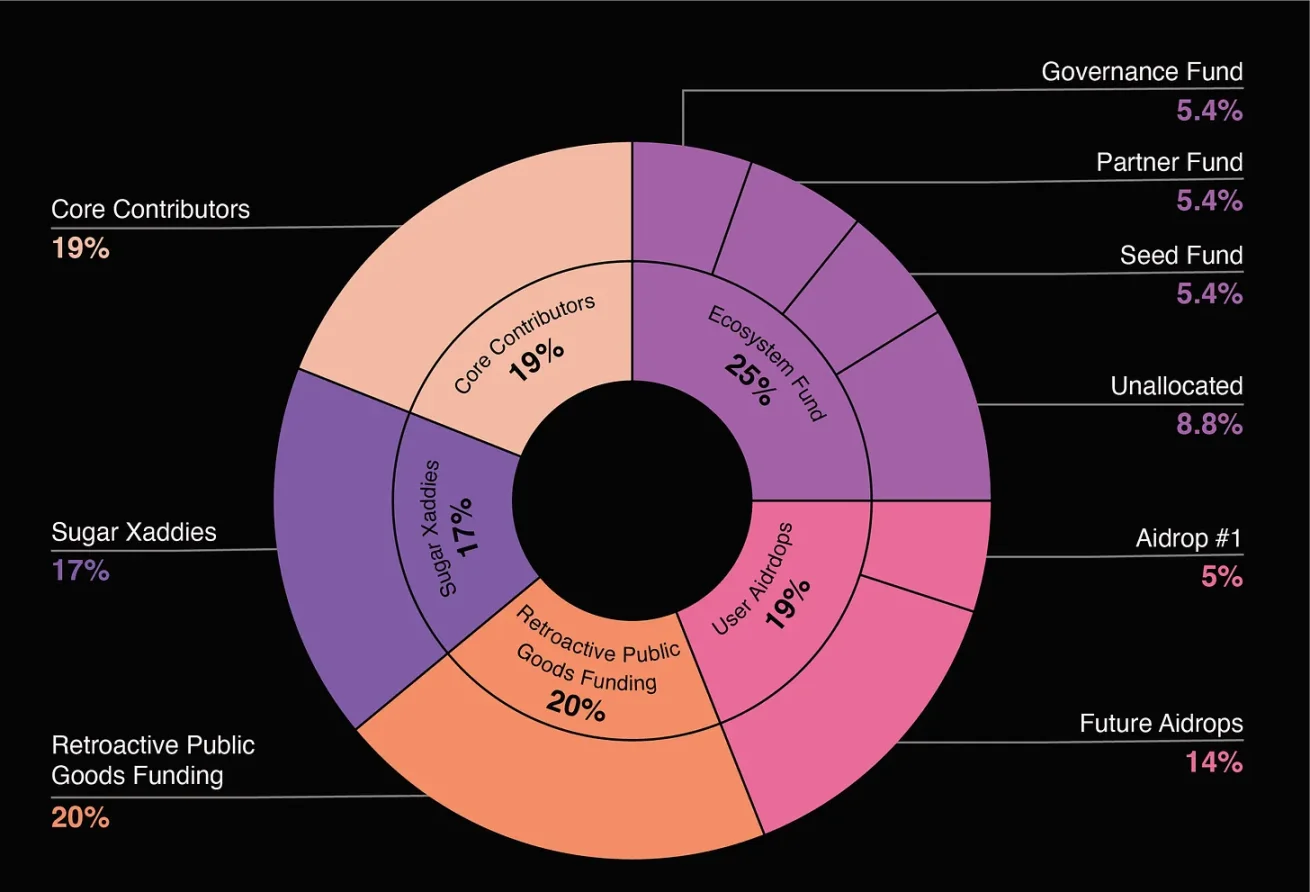

Look at Optimism, they have a large fund dedicated to RPGF, which is a new strategy to incentivize builders to participate in their platform. Funds usually provide a certain amount of funds to investors and core contributors, and airdrops are also an important part of this.

Optimism token allocation, source: https://community.optimism.io/docs/governance/allocations/

Layer 1

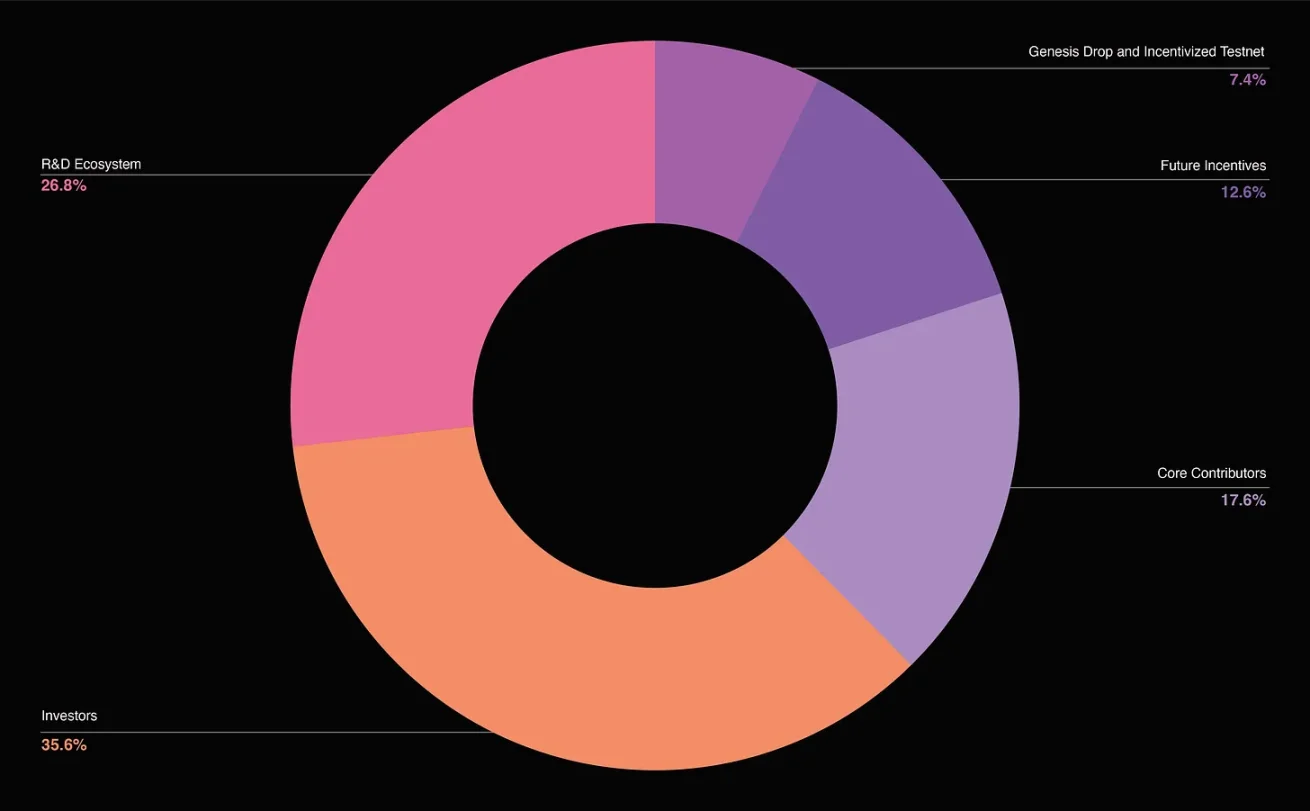

Celestia is a Layer 1 protocol. They allocate most of the tokens to investors and a large portion to ecosystem developers. Incentive distribution also accounts for a relatively large part.

Celestia token distribution, source: https://docs.celestia.org/learn/staking-governance-supply

DApp

GMX market capitalization (data as of March 2024)

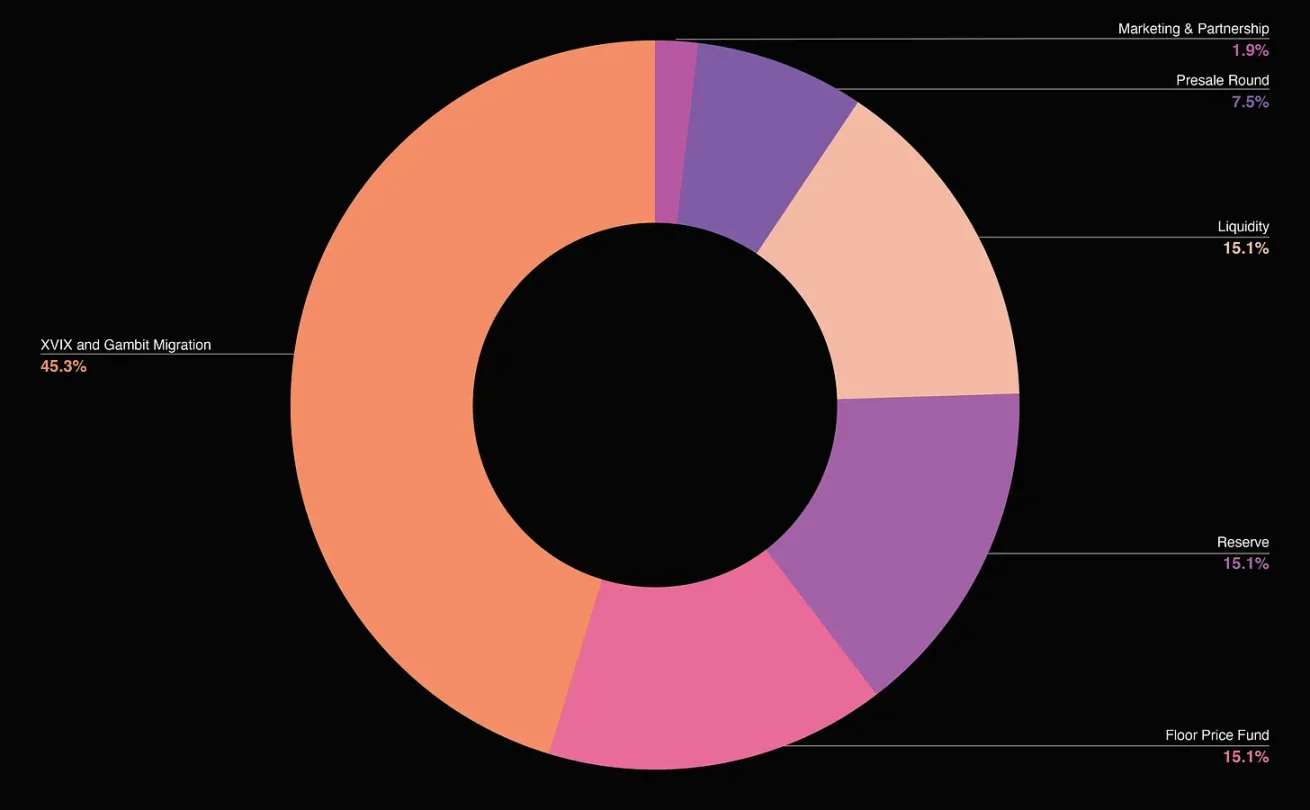

As a DeFi DApp, GMXs token distribution is more complex, and a large part of it is used to meet the long-term operation requirements of the DApp, especially related to maintaining the normal operation of the product, that is, liquidity reserves, etc.

GMX token distribution, source: https://tokenomicsdao.substack.com/p/tokenomics-101-gmx

Summarize

With the recent bull run, the past year has seen a dramatic change in the way tokens are distributed.

team

In 2023, the average team will receive an allocation of 24%.

Team allocation is related to market timing, and in this bull market, the team will have greater influence.

The allocation of teams and investors is not necessarily inversely proportional. In fact, in this bull market, both are trending upward.

private investor

In 2023, private investors will receive an average allocation of 20%.

community finance

In 2023, the average distribution ratio of community treasury will be 28%.

public sale

In 2023, the percentage of public sales will be almost zero.

Ecosystem incentives

In 2023, the average distribution ratio of ecosystem incentives will be 8%.

airdrop

In 2023, the average distribution ratio of airdrops will be 20%.

Airdrops have become an important part of community building, and airdrop strategies are important.

A successful token launch requires the distribution of a majority of tokens to community holders as well as future incentives for the core team.

In a bull market, teams have the upper hand as VC firms scramble to get in on the action. Founders reduced ownership during the last bear market, but current ownership percentages are back to levels seen during the last bull market in 2021. One of the difficult questions founders in the crypto space need to solve is striking a balance between incentives and semi-retirement of core team members upon initial token vesting.

Additionally, the popularity of airdrops has grown exponentially, which has triggered a flurry of participation — both good and bad — from crypto users, who have become more sophisticated over time: users will not only join the protocol Setting up a wallet on the protocol also bridges the protocol, participates in transactions, submits code requests on the protocols GitHub, and more - often to the frustration of builders.

The crypto space is ever-changing, and we’re always seeing innovations in marketing, ecosystem development, fundraising, and team compensation. Interestingly, we seem to have accepted the reality of earning tokens for participating in the protocol, but the question is how to extend participation and get users familiar with using your platform.

An evolution of the airdrop framework is a points system where points can be used to incentivize activity while retaining full control of the ability of the founding team. Perhaps this is detrimental to the community as this allows founders to incentivize users to participate without fully committing to allocating tokens.

RPGF is also an emerging topic and is a way to incentivize the creation of utilities that provide tools to the ecosystem to make it easier to access or build upon. Utilities are extremely important Layer 1 and Layer 2, but they are generally not venture-backed. RPGF is used to incentivize the construction of these utilities and enhance the entire ecosystem, classified as ecosystem growth. To date, it has distributed more than $300 million to more than 1,000 entities.