Eigenlayer operating mechanism overview

Restaking refers to using ETH pledged for Ethereum network verification to re-stake, share security with other protocols, and earn additional interest. Eigenlayer can receive native ETH participating in Ethereum PoS, or LST after a layer of packaging.

On EigenLayer, re-stakers can choose to delegate their re-pledged assets to Operators. Specifically, after the re-staker delegates their assets to the Operator, the Operator will provide verification services for AVS (Actively Validated Services). Operators participate in the AVS verification process by installing the necessary software to ensure the correct and secure operation of AVS. In return, Operators receive verification rewards provided by AVS and return them to the re-staker.

Image source: DeSpread Research

LRP (Liquid Restaking Protocol) is based on the principle of restaking. It participates in Eigenlayer on behalf of users (for example, users do not need to participate in the subsequent selection of Operators), and at the same time issues another layer of LRT (Liquid Restaking Token) of the same value to users.

Image source: DeSpread Research

In-depth understanding of Operators AVS

How do I become an Operator? Which service do I run? What functions does it have?

Operators can be individuals or organizations, and any Ethereum address can act as an Operator by registering in EigenLayer. An address can act as both a Restaker and an Operator at the same time (this dual role is not mandatory). Operators enable ETH stakers to delegate their staked assets (native ETH or LST). Operators can participate in the EigenLayer network without re-mortgaging any tokens. Most Operators will receive token delegations from other re-mortgagers within the network, otherwise Operators can choose to self-delegate by allocating their re-mortgaged token balances.

Specifically, the Operator node is based on Docker and Linux. After completing the configuration and registration in eigenlayer-CLI (there is a step in the middle that requires depositing at least 1 ETH), and meeting the standardized requirements of the corresponding node class, you can run the AVS software service.

How to become an AVS? Which service does AVS run?

AVS is any system that requires its own distributed verification semantics for verification, such as side chains, data availability layers, new virtual machines, guardian networks, oracle networks, bridges, threshold encryption schemes, trusted execution environments, etc.

Each AVS can design and implement the contract it sees fit, as long as their entry point (called ServiceManager in the specification) implements the interface expected by the EigenLayer protocol.

How does Operator run multiple AVS services? Does AVS have any choice?

Quorums are a set of policies that AVS uses for shared security measures.

Specifically, after the Operator completes the task given by AVS, it signs the result with a BLS signature and sends its signature to the aggregator entity. The aggregator combines these signatures into a single aggregate signature using BLS signature aggregation. Once the Operators reach the quorum threshold, the aggregator sends the aggregate signature back to the AVS contract. The AVS contract then verifies whether the result meets the arbitration threshold and whether the aggregate signature is valid. Through this design, AVS aggregates the calculations of multiple Operators to improve security.

Operators, in turn, can choose to join the validation of one or more AVSs (killing two birds with one stone), depending on their preferences and the design of the AVS runs, as long as they have sufficient TVL.

Currently, the Eigenlayer official website can view which AVSs different Operators are involved in. Most of them are running multiple AVS services, a few have only joined one AVS (such as ether.fi-8 and some have only joined EigenDA), and some, such as Puffer, have not yet joined any AVS verification.

The AVS side provides a standardized description of the workload (e.g., lightweight, heavyweight), the design of the minimum work unit, and the conditions for Slashing, but cannot reversely select the Operator.

The underlying logic of the business model: Can the Operator obtain token incentives from AVS? Why should the Operator help AVS with security verification?

When Operators run the software required by AVS and participate in verification tasks, they ensure the security and correct operation of AVS. These verification tasks may include the execution of consensus protocols, verification of data availability, etc. After successfully completing the task, the AVS contract will pay the Operator corresponding verification rewards, which include the users re-staking income.

Operators also face the risk of being fined for misconduct or failure to perform verification duties. The core contract of EigenLayer contains a strict penalty mechanism. If an Operator exhibits malicious behavior or fails to verify as required while participating in AVS, its staked ETH may be fined.

In terms of the rewards for ordinary users’ participation, neither the Eigen official website nor PoS browsers such as StakeRewards have found a clear APY that the Operator can give. Therefore, for ordinary users, there is no single authoritative indicator to choose an Operator. The data that can be seen include the concentration of the stake, the AVS of the operator’s participation, the restaked value, the stakers, and some other dimensions of reputation evaluation. Users need to judge and choose the Operator by themselves. If the user uses other LRP protocols, this step can be ignored because the protocol has already been operated on their behalf.

Opportunities to participate

Operators with the expectation of issuing tokens:

Puffer: 100 $Eigen can get 1000 Puffer points, but Puffer has not yet joined any AVS verification.

InfStones: 110M has been raised, and it is currently the second largest operator on Eigenlayer (by the number of stakers), joining the 11 AVSs already on the official website. You can earn Infstones loyalty points. It is highly recommended. Currently, points can be earned through staking delegation, invitation, and early bird bonus. In addition, there are additional milestone rewards that will be distributed according to the loyalty points ranking.

Delegation Earning: All delegators who delegate to InfStones on EigenLayer will start accumulating loyalty points from day one. Each delegated ETH can accumulate 1,000 loyalty points per day. Example: 10 ETH delegated for 90 days can accumulate 900,000 loyalty points.

Early Bird: Users who delegate InfStones on EigenLayer within the first 4 weeks will receive an additional 15% boost to their overall loyalty points. Example: If 10 ETH is delegated to InfStones on EigenLayer within the first 4 weeks and kept for 90 days. Early Bird Reward: 10 * 1,000 * 90 * 15% = 135,000 Loyalty Points.

Referral Bonus: Increase your points by referring a friend to InfStones and earn an extra 10% of your Loyalty Points. Example: If there are 3 referrals, each of them gets 10,000 Loyalty Points. Loyalty Points from referrals: 10,000 * 3 * 10% = 3,000 Loyalty Points.

How to obtain AVS project tokens

Judging from the AVS project Omni that has already issued tokens, the number of tokens allocated to Eigenlayer Restakers is 400k, accounting for approximately 4% of the tokens unlocked in this TGE.

Omni tokens are not distributed based on Operators, but are airdropped based on Eigen points. The top 15,000 accounts from high to low can receive Omni airdrops.

Crossover between investors

The investors of Eigenlayer generally do not overlap much with the investors of AVS projects that have completed financing in the ecosystem, but some projects overlap. In terms of projects, Polychain Capital and Hack VC, which invested in AltLayer, are also investors in Eigenlayer, and a16z and Polychain Capital, which invested in Espresso, are also investors in Eigenlayer; the financing parties of several other AVS (Omni, Lagrange, Hyperlane) have no overlap with those of Eigenlayer.

Latest News

On April 10, EigenLayer and EigenDA were launched on the mainnet.

On April 30, the Eigenlayer Github repository updated the $EIGEN white paper .

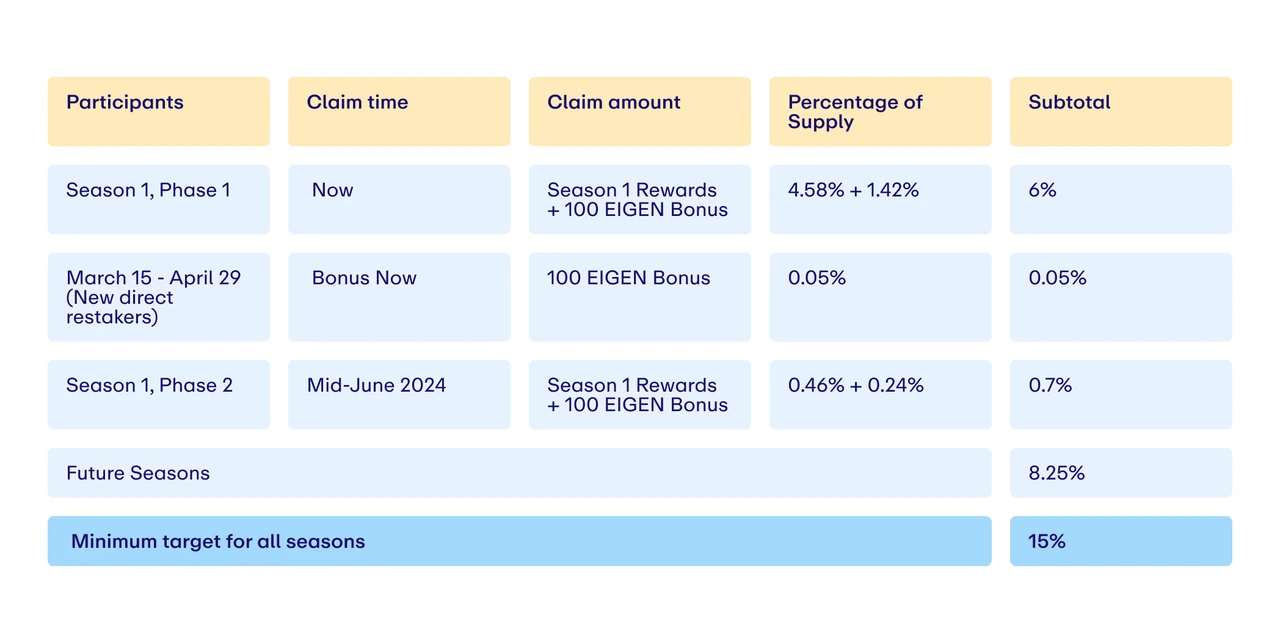

The token application will be opened on May 10. The newly established independent non-profit Eigen Foundation will become the entity that issues the tokens. The total supply of Eigen tokens at the time of issuance is 1.67 billion. The foundation has allocated 45% of the tokens to its community, which is further divided into equity investment (15%), community initiatives (15%) and ecosystem development (15%). In addition, 29.5% of the tokens will be allocated to investors, while early contributors will receive 25.5%. It is reported that the total lock-up period for investors and early contributors is three years, which will be completely locked in the first year, and then gradually released at a rate of 4% per month in the next two years.

A total of 113 million EIGEN will be issued in the first season, 6.05% of the initial supply will be allocated to the first phase, 0.7% of the tokens will be allocated to the second phase; the remaining 8.25% of the tokens will be allocated to future airdrop seasons (the first and second phases are expected to start in mid-June).

AVS Ecosystem Project Inventory

EigenDA

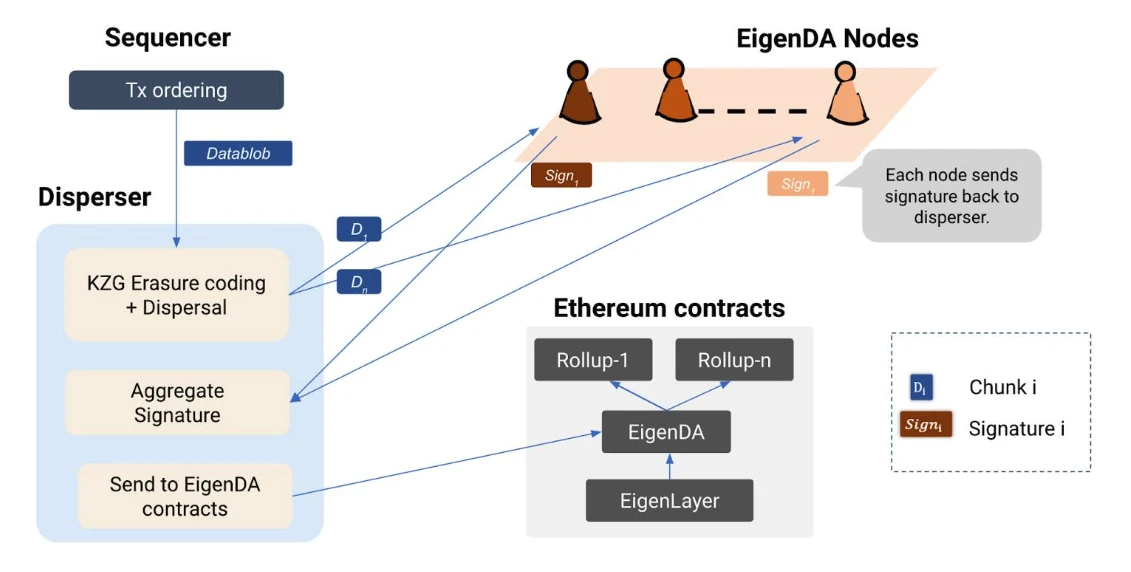

EigenDA is the first DA (Data Availability) service officially launched by Eigen, and is now online on the mainnet. EigenDA follows the expansion path of Ethereum Danksharding, so the DA layer technology path it adopts is also highly related to the technical path of Ethereum Danksharding expansion. Furthermore, EigenDA adopts technologies such as erasure coding, KZG commitment, ACeD (Authenticated Coded Dispersal), and decouples DA from consensus, and performs well in transaction throughput, node load, and DA cost. Rollup publishes data to EigenDA to obtain lower transaction costs, higher transaction throughput, and secure composability in the EigenLayer ecosystem.

As of May 8, the TVL of the EigenDA mainnet has reached 3.2M ETH, with a market value of 9.7B, accounting for about 4% of the total market value of ETH. Currently, AltLayer, Caldera, Celo, Layer N, Mantle, Movement, Polymer Labs and Versatus have reached cooperation with EigenDA and plan to use EigenDAs DA services.

EigenDAs technical route is based on three components: operators, dispersers (untrusted), and retrievers (untrusted). Operators run the EigenDA node software and are responsible for storing blobs associated with valid storage requests. Dispersers are hosted by EigenLabs and are responsible for Reed-Solomon encoding blobs, calculating KZG commitments for encoded blobs, and generating KZG proofs for each block. Dispersers then send blocks, KZG commitments, and KZG proofs to operators, who return signatures. Dispersers aggregate these signatures and upload them to Ethereum in the form of calldata of the EigenDA contract to punish operators who misbehave. Retrievers are used to query blob blocks and verify their accuracy to reconstruct the original blob. The specific implementation process includes: the Rollup Sequencer creates a data blob and requests a split from the disperser, the disperser encodes the data blob and generates a KZG certificate, sends the data block, KZG commitment and KZG certificate to the EigenDA node for verification and signing, and finally uploads the signature aggregation to the EigenDA contract of the Ethereum mainnet.

AltLayer

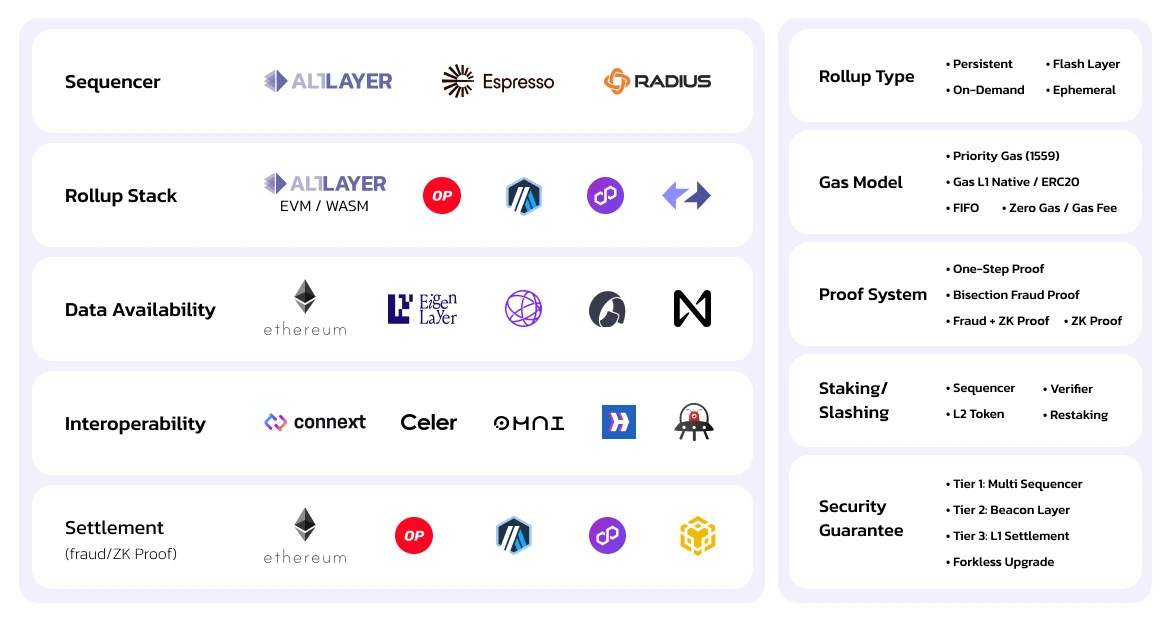

AltLayer is a Rollups as a Service (RaaS) provider that specializes in deploying and managing Rollups customized for different application needs. AltLayer has launched and supports more than 30 application-specific Rollups, covering blockchain stacks such as OP Stack, Arbitrum Orbit, Polygon CDK, ZKStack, and many of them integrate EigenDAs DA service.

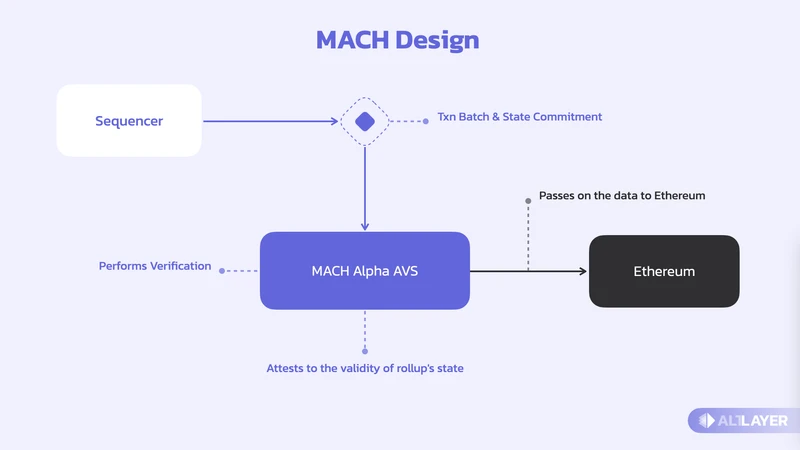

AltLayer uses Restaked Rollup technology, combining restaking and Rollup technology to enhance the security, decentralization and performance of the blockchain. AltLayer introduces three modular components for decentralized sorting, state correctness verification and fast finality: VITAL, MACH and SQUAD, which are used for decentralized verification of aggregated state, fast finalization and decentralized sequencing respectively. MACH is AltLayers AVS for different Rollups (Eigenlayers AVS interface shows AltLayer MACH), providing fast confirmation of rollups transactions, cryptoeconomic security (can detect malicious network participants) and decentralized verification of rollups status.

AltLayer has raised 21.6M in funding, with Binance Labs participating in the project, and the strategic financing on February 19 was led by Polychain Capital and Hack VC. Currently, AltLayers market value is 420M and FDV is 3.8B.

Brevis

Brevis is a ZK coprocessor implemented through AVS, with a modular architecture, and proposed a coChain solution to reduce the cost of ZK coprocessors that are fully based on smart contracts and zero-knowledge proof technology. Brevis coChain is a PoS chain that protects its security through ETH staking, combines the OP mechanism and the ZK mechanism, and can generate ZKP to initiate challenges and punish malicious parties.

Brevis architecture includes three components: zkFabric, zkQueryNet, and zkAggregatorRollup. zkFabric collects block headers from all connected blockchains, generates consensus proofs after proving their validity through ZK light client circuits, and provides block headers and blockchain state access for dApps. zkQueryNet is an open market for ZK query engines that accepts data queries from on-chain smart contracts and generates query results and ZK query proofs. zkAggregatorRollup acts as an aggregation and storage layer for zkFabric and zkQueryNet, verifies and stores proof data, and submits zk proof state roots. Brevis demonstrated its powerful ZK light client circuit performance in the proof-of-concept, supporting Ethereum PoS, Cosmos, and BNB Chain, enabling EVM and non-EVM chains to access the states of these three chains in a trustless manner.

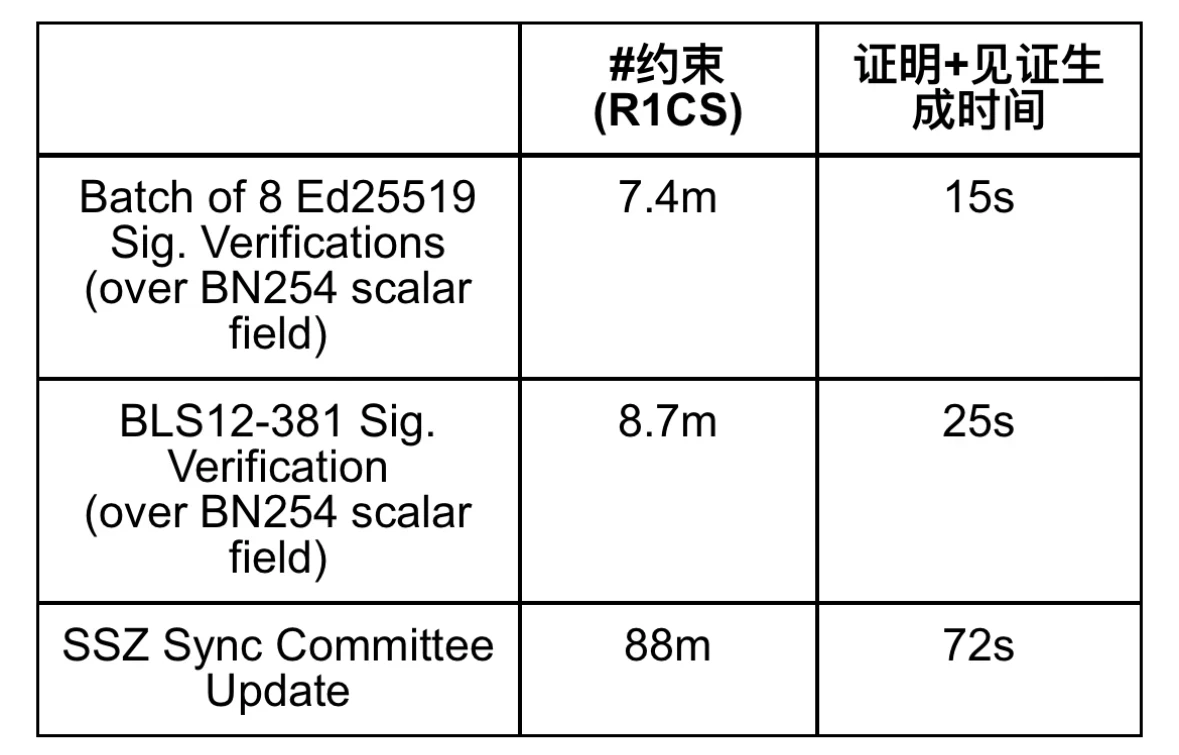

The following table summarizes some key circuit performance benchmark data (data obtained by a 20-core, 2.3 GHz, 384 GB memory Linux server, the test did not use GPU acceleration). Using these ZK light client circuits, a user-facing asset zkBridge that supports cross-chain between Ethereum Goeril and BNB Chain was implemented.

Eoracle

Eoracle is a modular and programmable oracle network whose security is natively guaranteed by ETH rather than using external tokens such as LINK. Eoracles technology stack uses eBF, which consists of a consensus engine (IBFT) and an external validator set configuration protocol (Aegis). eBFT uses the IBFT consensus engine to seal blocks, provide network capabilities, and govern the network. Eoracles smart contracts on Ethereum work in conjunction with a Tendermint-based consensus engine to fully implement the Aegis protocol. The validator set configured by eBFTs Aegis configures the validator set through a re-mortgage function and records the commitment of the eoracle state. Its features include: instant block finality, that is, only one block is proposed per chain height to avoid forks and uncle blocks; reduce the time between blocks and increase the block rate; high data integrity and fault tolerance, ensuring that each block proposal is verified by about 66% of validators, thereby ensuring the security and performance of the chain.

Lagrange

Lagrange is a parallel ZK coprocessor focused on cross-chain interoperability. The project completed a round of financing in May 2023, raising a total of $4M, led by 1kx, with participation from CMT Digital, Maven 11 Capital, Lattice, and Daedalus. Lagrange is distinguished by its parallel architecture, which distinguishes it from Brevis. In mid-2023, Lagrange has launched testnets on Base, Arbitrum, and Optimism. Each node that joins the Lagrange cross-chain state committee must stake more than 32 ETH.

Witness Chain

Witness Chain is a DEPIN network designed for decentralized IoT devices. The network contains multiple components, such as DCL (DePIN Coordination Layer), which provides basic services required by the DePIN ecosystem, such as the security of the chain itself, the bandwidth and physical location of the nodes, etc. These basic services are called Watchtowers, which are used to measure the above data and generate valid proofs in the DCL layer for use. The watchtower mechanism of Witness Chain achieves hyper-scaling by verifying transactions on another chain and publicly publishing transaction data for anyone to view. If an erroneous transaction is detected, Ethereum validators can use fraud proofs for arbitration. The Rollup Watchtower Network acts as the internal DePIN of the Witness Chain and is the first line of defense for L2 Op-Rollups such as Optimism and Base, enabling operators to actively verify aggregated transactions and ensure that any fraud is detected.

AETHOS

AETHOS is a decentralized policy engine that enforces customizable rules and conditions for on-chain transactions. It leverages off-chain computation and cryptoeconomic consensus implemented through EigenLayer to provide a flexible and secure policy layer for blockchain applications. AETHOSs network powers include pre-transaction policies, set at the smart contract level, which execute transactions only if the rules set by the corresponding smart contract are followed. It can access on-chain and off-chain data (such as historical fund flows, blockchain analysis, verifiable credentials, dynamic permission lists, etc.) to enforce policies. AETHOS provides a trust-minimized rule-making system for application developers to implement policies enforced by a network of economically incentivized operators, and policies can be issued and modified by specific individuals, groups, or communities.

Blockless Network

Blockless Network is a modular network architecture with dynamic resource matching and random distribution capabilities. Blockless uses a random allocation algorithm for task allocation to reduce the risk of malicious behavior on the network. It also has a WASM secure runtime, which enables it to support applications built on multiple mainstream programming languages (including Python, JavaScript, Go, and Rust), expands accessibility, and allows developers to easily integrate their applications. Blocklesss dynamic verification mechanism further enhances its security and performance.

Drosera

Drosera is a security protocol that uses hidden security intent to contain and mitigate attacks. The protocol detects and responds to potential network threats and attacks through stealthy security operations, thereby enhancing the overall security of the blockchain network.

Espresso

Espresso provides a decentralized sequencer solution (shared sequencing market and final result tool) connected to the L2 solution. Espresso is building a shared sequencing market that allows rollups to auction the right to build their blocks. Its core technologies include Espressos sequencing market and HotShot shared final layer. Compared to Metis, Espresso provides a modular Sequencer shared component to handle the transaction ordering needs of all Rollups.

On March 22, 24, Espresso Systems completed a $28 million Series B financing round led by a16z. The latest round of financing brings Espressos total funding to more than $60 million.

The users transaction request first passes through Espressos shared Sequencer center, and then returns the status to layer 2 after batch processing. Use the Hotshot Proof of Stake system to ensure the decentralization and reward and punishment mechanism of the Sequencer. Utilize the Ethereum security consensus provided by Eigenlayer.

Espressos sequencing market allows L2 Rollups to sell their sequencing rights in combined lottery runs, and a simple version of the market is planned to be launched in Q2 2024. HotShot shared final layer is Espressos consensus protocol and shared final layer, completing the results of combined lottery and L2 transactions. Nodes participating in HotShot consensus also constitute Tiramisu (Espressos data availability layer). L2 applications (including Rollups) interact with Espresso and interact with L1 chains to facilitate trustless state checkpoints. Espresso runs smart contracts on Ethereum, tracks HotShot state commitments, and allows other projects to reuse these state commitments on other chains.

Ethos

Ethos is a security layer that enables Cosmos chains to bootstrap validator networks with the economic security of re-staked ETH. ETH stakers can re-stake their ETH on EigenLayer by delegating tokens to operators that support Ethos. These operators assign the delegated stake to a set of elected guardians who validate Ethos Layer 1 chains (called “Guardian Chains”). By opting in to a shared security mechanism, these Guardians can collectively validate or delegate to protect any combination of L1 chains, extending the security of re-staked ETH beyond the Ethereum ecosystem. The Ethos ecosystem consists of three layers: AVS contracts deployed on EigenLayer can delegate the security of re-staked ETH to Ethos Guardians; use re-staked ETH to collectively validate or delegate to other L1 Guardian chains; and chains powered by Ethos that leverage Guardians to easily bootstrap a decentralized trust network and/or improve their economic security.

Hyperlane

Hyperlane is a universal and permissionless interoperability layer (application building platform) built for modular blockchain stacks. In September 2022, Hyperlane completed an $18.5 million financing led by Crypto Investor Variant, with participation from Galaxy Digital, CoinFund, Circle, Figment, Blockdaemon, Kraken Ventures and NFX. In September 2023, Hyperlane launched the V3 mainnet.

Near

NEAR is a chain abstraction stack that uses sharding and PoS L1 blockchain. NEARs current main narratives are three-fold: chain abstraction (CA), data availability (DA), and artificial intelligence (AI). These narratives demonstrate NEARs technological diversity and innovation capabilities, making it an important player in the blockchain ecosystem and providing developers and users with rich features and application scenarios.

Omni

Omni is Ethereums integrated Rollup layer, solving the L1 of Rollups interoperability. Omnis narrative is to solve the fragmentation caused by Rollups (which Omni believes is the biggest existential threat facing Ethereum). As Rollups continue to gain popularity, Ethereums users and their capital are increasingly dispersed into isolated ecosystems, reducing global network effects. Omni solves this problem by integrating all Rollups into a cohesive, interoperable network. Omnis features include: dual staking model (ETH + OMNI), fast verification using Tendermint and CometBFT, support for diverse Rollups, and backward compatibility.

The TGE was completed on April 17, 24, with a current market value of $149M and FDV of $1.42B.

Silence Laboratories

Silence Laboratories provides a versatile toolkit for MPC-TSS and privacy-preserving computations that is fast, general, and extensible. Although the project does not have much information on Twitter and documentation, its MPC library has shown great potential and practicality in the fields of multi-party computation and privacy-preserving computation.

Xterio

Xterio is an Alt derivative chain, focusing on the L2 blockchain of the gaming ecosystem. Xterio uses AltLayers RaaS to issue a second-layer blockchain based on EigenDA and OP Stack, focusing on AI and Web3 game-related scenarios. Xterio L2 uses AltLayer MACH (AVS for fast finality), and AltLayer also provides MACH services to Optimisms mainnet. Through these technologies, Xterio provides an efficient and powerful blockchain platform for game developers and users.

Aligned Layer

Aligned Layer is based on ETH and aims to provide affordable zero-knowledge proof verification.

On April 25, 2024, it announced the completion of a $20 million Series A financing, led by Hack VC, with participation from dao 5, L2 IV, and Nomad Capital. Ten days before the Series A financing, on April 15, 2024, it completed a $2.6 million seed round of financing, led by Lemniscap, with participation from Bankless Ventures and Paper Ventures Sreeram Kannan, Brandon Kase, Daniel Lubarov, DCbuilder, Chainyoda, Weikeng Chen, Sami BENYAKOUB (samnode_), Peter Fittin (SizeChad), and Lucas Kozinski, as well as strategic investment from StarkWare and O(1)Labs.

AlignedLayer is designed to be a universal verification layer that will no longer be limited by the speed and cost of the EVM. AlignedLayer receives proofs from different sources, which vary in size and verification time. It has a dedicated validator that can quickly check the validity of each proof and publish the results to Ethereum. Users can choose to get fast soft finality on AlignedLayer or wait for hard finality on Ethereum. The current progress is expected to be launched on the Eigenlayer public testnet in May and the mainnet in September.

Automata Network 2.0

Automata is a modular proof layer that proposes a TEE (Trusted Execution Environment) coprocessor (a new concept in EigenLayer AVS). The narrative is to help Rollups become open, modular, and verifiable. In its Proof of Machinehood, Op Rollup and zero-knowledge proof are used to implement hardware authentication on the chain to ensure the authenticity and uniqueness of the machine. Positioned as Multi-Prover AVS, it allows decentralized networks to use TEEs from multiple heterogeneous vendors to securely execute and verify calculations. AltLayer supports one-click deployment of the modular framework of Automata Network.

As early as February 2022, Automata Network received strategic investment from Binance Labs. In August 2023, Automata Network announced that the Automata 2.0 testnet was officially launched (in cooperation with AltLayer), extending machine-level trust to Ethereum.

Openlayer

Openlayer is described as a modular data layer. In terms of implementation, OVC (optimistic verifiable computation) and modular verification components are used. The project is building an AVS called OpenOracle, which allows user-operated nodes to provide and verify external data sources for smart contracts in an optimistic and cryptographically provable manner.

It is endorsed by a16z CSX, Geometry Ventures, LongHash Ventures and others.

Dodo

DODOchain is positioned as Omni Trade Layer 3, supported by Arbitrum Orbit, EigenLayer and AltLayer (built on AltLayer MACH). DODOchain will use EigenDA to provide Ethereum consensus and security features. It connects the Ethereum aggregation and Bitcoin networks, integrating liquidity into one platform for seamless cross-chain transactions.

Tokens issued, $DODO market value 103 M, FDV 168 M.