A poll was launched last Friday, After $BTC $ETH, what token do you think will be the next to be hyped for ETFs? As a result, 63.6% of people chose SOL.

After the ETH ETF was approved, the market did have a strong demand for SOL:

🔸Geoffrey Kendrick, head of foreign exchange and digital assets research at Standard Chartered Bank: 2025 may see the approval of cryptocurrency ETFs such as SOL and XRP.

🔸Anthony Scaramucci, founder and managing partner of SkyBridge Capital: We will be ready for the SOL ETF.

🔸BKCM CEO Brian Kelly said on CNBC: Solana may be the next cryptocurrency ETF.

Why do so many people choose SOL?

Obviously, it is because it is supported by consensus.

The embodiment of consensus is simply market capitalization. From this dimension, if we open coingecko and look at the top 10 or top 5, SOL is indeed the most likely.

And what is the biggest problem with SOL?

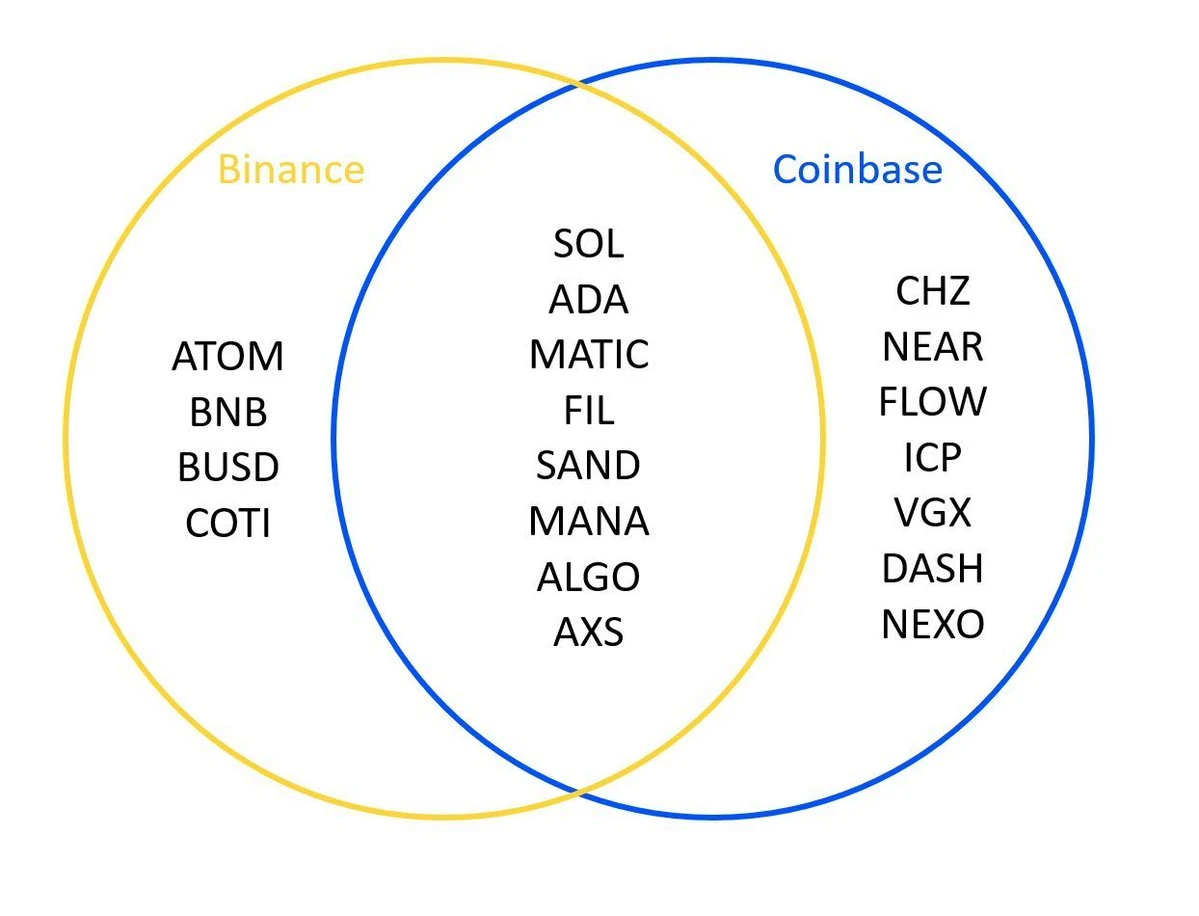

2023/6/5, SEC listed SOL as a security in Binance case

2023/6/6, SEC classifies SOL as a security in Coinbase case

Why is it difficult for an ETF to be approved if it is determined to be a security? What is the relationship between the two?

In the United States, securities are regulated by the SEC and need to comply with a series of regulations, including meeting the SECs registration and disclosure requirements, possible trading restrictions, etc. The whole process is quite strict.

For example: SEC = supermarket 🏪, cryptocurrency = fruit 🍎, ETF = fruit basket 🧺

🔸Being considered a non-security is like labeling a fruit as “ordinary fruit”, which makes it easy to put it in the fruit basket

🔸Being considered a security is like labeling a fruit as a special fruit. Then it needs to meet more rules and requirements of the supermarket, so it is difficult to be put into the fruit basket.

A year ago, the SEC classified SOL as a security. It is impossible for them to immediately turn around and say that SOL is not a security (they also want to save face), so a SOL ETF is not possible in the short term.

In addition, in the above two lawsuits, 18 tokens were judged to be securities, including BNB, BUSD, ADA, MATIC, ATOM, FLOW, ICP, etc. Similarly, it is impossible for these tokens to pass ETF in a short time.

Good news - FIT 21

On May 22, 2024, the FIT 21 bill was passed by the U.S. House of Representatives with 279 votes to 136. This has far-reaching significance for the industry, which is no less than the passage of the ETH ETF (although the markets attention is average).

FIT 21 Act highlights for us:

🔸Clarify the two types of digital currencies and their regulators

Decentralized tokens = digital commodities, regulated by the CFTC

Non-decentralized tokens = securities, regulated by the SEC

🔸Definition of decentralization

No one can control the entire blockchain network alone

No one person owns more than 20% of the digital assets or voting rights

FIT 21 improves the regulatory system of the entire digital currency and expands the industry’s freedom. Especially the two points excerpted above have the meaning of paving the way for more ETFs.

To learn more about FIT 21, read a16z’s article:

https://a16z crypto.com/posts/article/fit 21-why-it-matters-what-to-do/

Summarize

The Americans are notoriously fickle. Just because something is now called a security token doesn’t mean it will always be defined as a security.

Back to the original topic, who will be the third cryptocurrency to pass the ETF? I think SOL is one of the most likely targets. Whether it will be in the next year or in the next three to five years depends on the progress of the subsequent FIT 21 bill (the process for a bill to become law: House of Representatives ✓ - Senate - Presidential Signature) and how to implement the definition of digital goods and securities in it.

*The above is only my personal opinion, not investment advice, DYOR