Original author: 0xWeilan

The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

After the COVID-19 crisis, the story of the United States using the dollars status as the worlds largest reserve currency to reap other economies through the dollar tide seems to be becoming a reality. All economies are under pressure, and the yen-dollar exchange rate has fallen to a low level last seen in 1986.

—— On June 5, Canada cut interest rates, and on June 6, the Euro cut interest rates. Why hasn’t the Federal Reserve cut interest rates yet?

——Because only the Japanese yen exchange rate has collapsed, it is not full yet.

Europe cant hold on, Canada cant hold on, only the United States can hold on. The U.S. dollar index continues to rise, causing huge pressure on the equity market.

Under the huge pressure of macro-finance, the crypto asset market ended its rebound in May and fell 7.12% in June, continuing the deep consolidation after BTC hit a record high. This consolidation has lasted for nearly 4 months. There are few sectors in the entire crypto market that have developed independent trends.

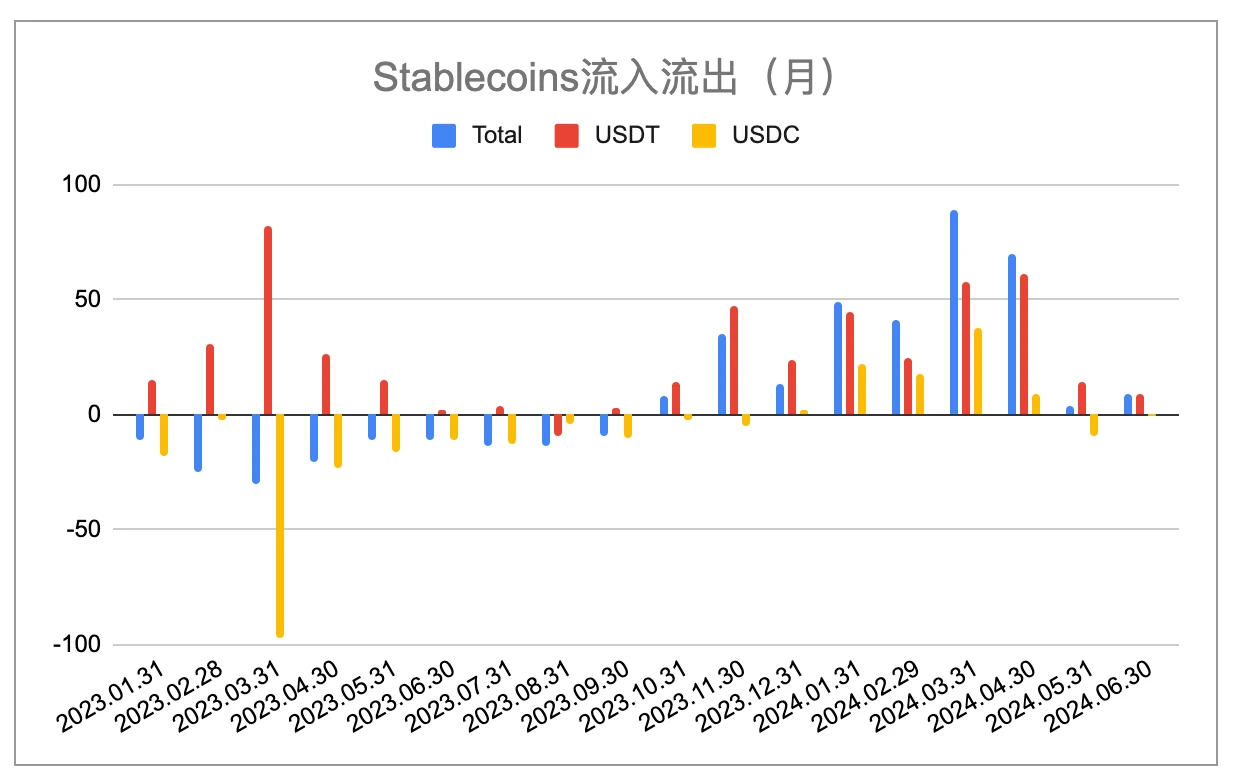

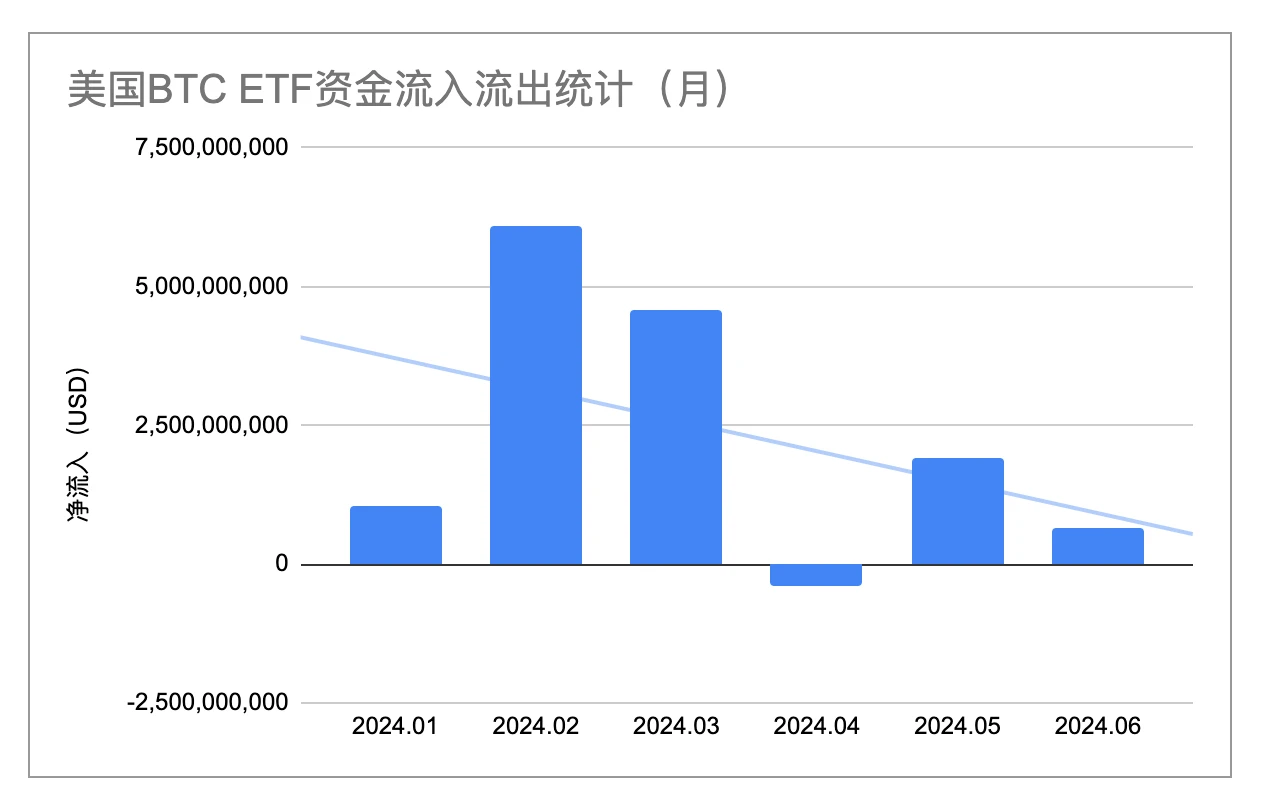

Although the inflow of stablecoins on the capital side has recovered to $856 million compared with May, it still remains at a low level. The ETF channel funds are 641 million, far lower than 1.9 billion last month.

On-chain activities are polarized. On the one hand, BTC data continues to deteriorate, while on the other hand, public chains such as Ethereum and Solana are still active. These data make people believe that the bull market is still going on.

Macro Finance

On June 12, the US released its May CPI, which fell by another percentage point from April to 3.3%, lower than the expected value of 3.4%. So far, the US CPI has fallen for two consecutive months in a high interest rate environment. At the same time, the PMI data on the corporate side fell from 49.2% to 48.7%, accelerating the contraction, which also provided support for the downward trend of CPI.

The downward trend of economic data exceeded market expectations, raising expectations for interest rate cuts, which made the Nasdaq continue to price in expectations for interest rate cuts. In the end, the Nasdaq closed up 5.69% in June, achieving two consecutive months of gains. Although the SP 500 index did not hit a record high like the Nasdaq, it also maintained a monthly upward trend.

In June, the Nasdaq rose 5.96%, setting a new record high.

The new non-farm payrolls data released on June 7th far exceeded the forecast (182,000), reaching 272,000. The market pointed out that there were major problems with the statistical caliber of this data, which was suspected of suppressing expectations of interest rate cuts.

The market is choosing the direction it is willing to believe in, such as interest rate cuts. There is still money betting on two interest rate cuts in 2024 in the interest rate swap market. UBS claims that the market underestimates the extent of this round of interest rate cuts and even predicts that the first cut will still be in September. Against the backdrop of the US dollar index breaking through 106, the Nasdaq continues to hit new highs. These long funds are betting based on their own judgment.

The hawkish remarks released by the US government and the Federal Reserve in June may have reached the highest dose this year. US Treasury Secretary Yellen said that there is no sign that the United States is about to enter a recession, while Federal Reserve Board member Bowman emphasized that inflation still has upside risks, and there may be no interest rate cuts in 2024.

Although CPI has declined for two consecutive months, the strong employment data allows the Federal Reserve to buy more time to maintain high interest rates and wait for CPI to approach 2%.

The high interest rate environment of the US dollar has put tremendous pressure on the global capital market, and the crypto market is no exception.

EMC Labs believes that as BTC hits a record high, some investors continue to sell to lock in profits, while high US dollar interest rates have significantly reduced the amount of money flowing into the crypto asset market, ultimately resulting in selling pressure that cannot be absorbed by sufficient buying power. This is the fundamental reason why the current crypto market cannot effectively break through and even constantly challenges the lower edge of the adjustment box.

Crypto Market

In June, BTC opened at $67,473.07 and closed at $62,668.26, with a monthly drop of $4,804.15, or 7.12%, with an amplitude of 20.10%. The trading volume has shrunk for three consecutive months.

BTC monthly trend

In June, BTC diverged from the Nasdaq trend. Against the backdrop of a strong rise of 5.69% in the Nasdaq, BTC fell 7.12% for the whole month, losing most of the rebound in May.

Technically, affected by the news of BTC distribution by Mt.Gox exchange and the German government selling BTC, the BTC price retraced the upward trend line since October last year on June 24 and bottomed out. On the same day, the BTC price also completed the retracement of the lower edge of the new high consolidation range (that is, $58,000). The support of these two technical trend lines is relatively strong. After that, the BTC price rebounded to above $63,000, which is safe in the short term, but the mid-line is still confused.

BTC daily trend

Affected by the expectation of the ETFs upcoming approval, ETHs trend is slightly stronger than BTC. This month, the ETH/BTC trading pair basically preserved the results of ETHs rebound in May and did not give up significantly, indicating that the industry capital in the market is still betting on the launch of ETH ETF.

The ETH/BTC trading pair has basically preserved the results of the ETH rebound in May.

The ETH ETF is likely to be approved for trading in July. However, given the current severe shortage of funds, once the favorable news is realized, ETH may face a large selling pressure in the short term. After the official trading, can the ETH ETF bring a considerable net inflow of funds like the BTC ETF? At present, it is not optimistic.

liquidity

The bull market is first and foremost a financial phenomenon.

Based on the source of funds, we can divide the trend of BTC since last year into 4 stages:

2023.01 ~ 2024.06 BTC market 4 stages

2023.01 ~ 09: Stablecoins have a net outflow, and the buying power comes from the top-escaping funds in the market to cover their positions. The BTC price has risen from 16,000 to 32,000 US dollars;

2023.10 ~ 2024.01: Driven by the approval of BTC ETF and the expectation of production cuts, the net inflow of stablecoins turned positive and continued to rise, pushing the price of BTC from US$32,000 to US$49,000;

2024.02 ~ 04: After the BTC ETF was approved and speculative funds were withdrawn, the ETF channel fiat currency funds and stablecoin channel funds continued to flow in, pushing BTC to a new high of $73,000. Because the ETF channel funds exceeded expectations, BTC hit a new high for the first time before the production cut. Starting in January, long and short profit-taking began to sell in large quantities to lock in profits. The selling peaked in early March, and then the BTC price peaked on March 18 and started to pull back.

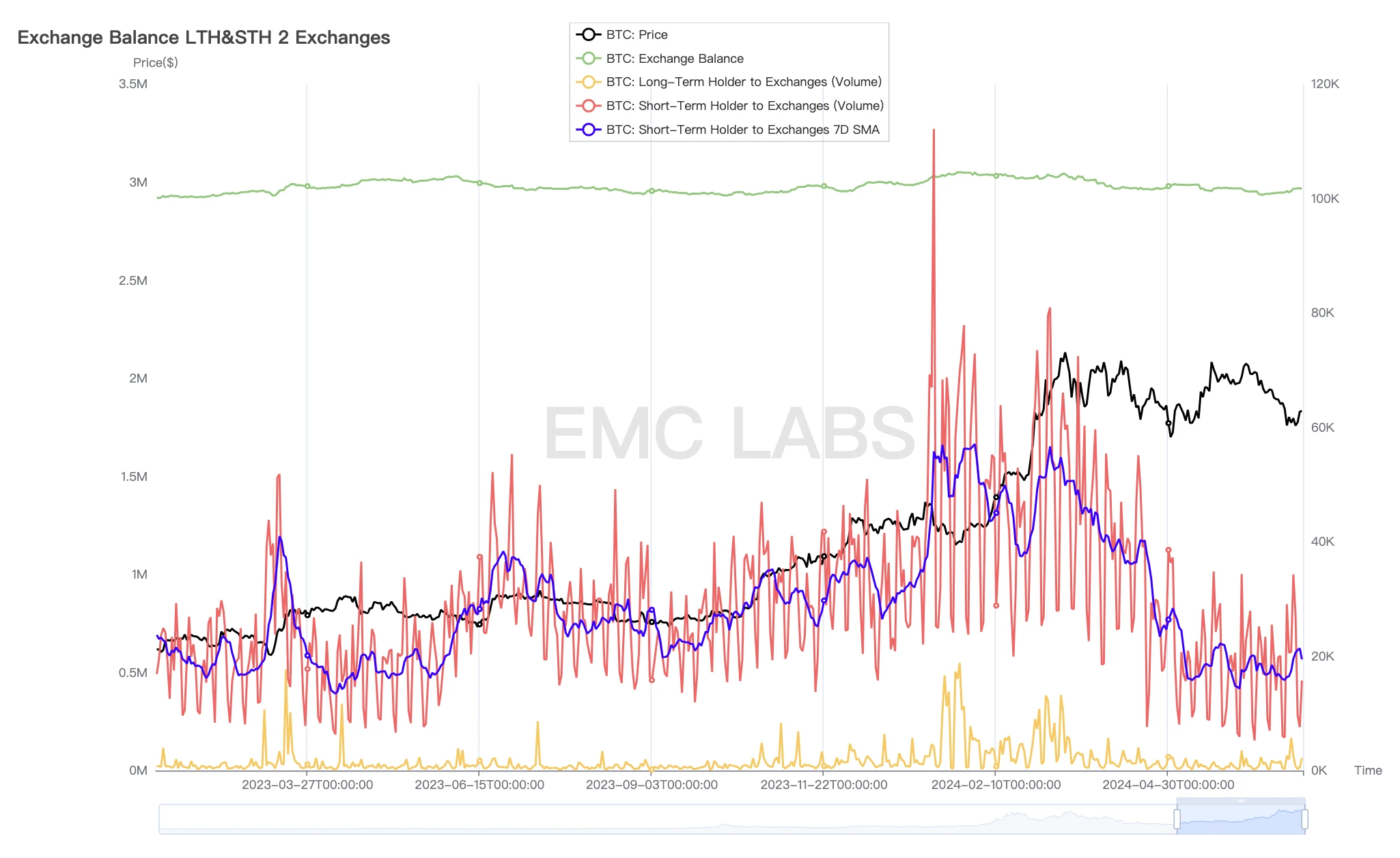

Statistics of long-term and short-term investors selling BTC

Although the stablecoin channel alone had net inflows of more than 8.9 billion and 7 billion US dollars in March and April respectively, the massive sell-off consumed all the buying power, and the BTC price stopped at US$73,000.

2024.05 ~ 06: BTC price entered a new high consolidation area after March. The previous large-scale clearing caused the markets long enthusiasm to be completely extinguished. Under the pressure of high interest rates of the US dollar, the capital inflow of the stablecoin channel and the fiat channel shrank rapidly to 341 million US dollars and 856 million US dollars in May and June. BTC built a new high and then consolidation box at 58,000 ~ 73,000 US dollars, waiting for new funds to enter the market.

Monthly changes in the supply of major stablecoins (EMC Labs chart)

A bull market is a process in which new funds pour in under an optimistic backdrop, revaluations push up asset prices, and long-term holders sell to lock in profits after prices rise. In the course of a bull market, sell-offs often occur in several waves, and the one that happened not long ago is just the first wave. The next sell-off will occur again after higher prices are realized.

Statistics of capital inflows and outflows of 11 BTC ETFs in June (Chart by EMC Labs)

Since its approval in January, BTC ETF has been regarded as an important channel for new capital inflows in the crypto asset market. Since January, a total of $13.882 billion has flowed into the entire channel, but since March, the scale of inflows has been gradually declining as the BTC price stopped at $73,000. In June, the inflow of funds in the ETF channel was $641 million, which is quite close to the $856 million of the stablecoin channel. In the May report , we proposed that ETF channel funds are expected to become an independent force for pricing BTC. With the growth of scale and the gradual independence of decision-making will, the funds in this channel are expected to take on this important task. Its scale and behavior deserve continued attention, but it is not yet up to the task.

Market supply

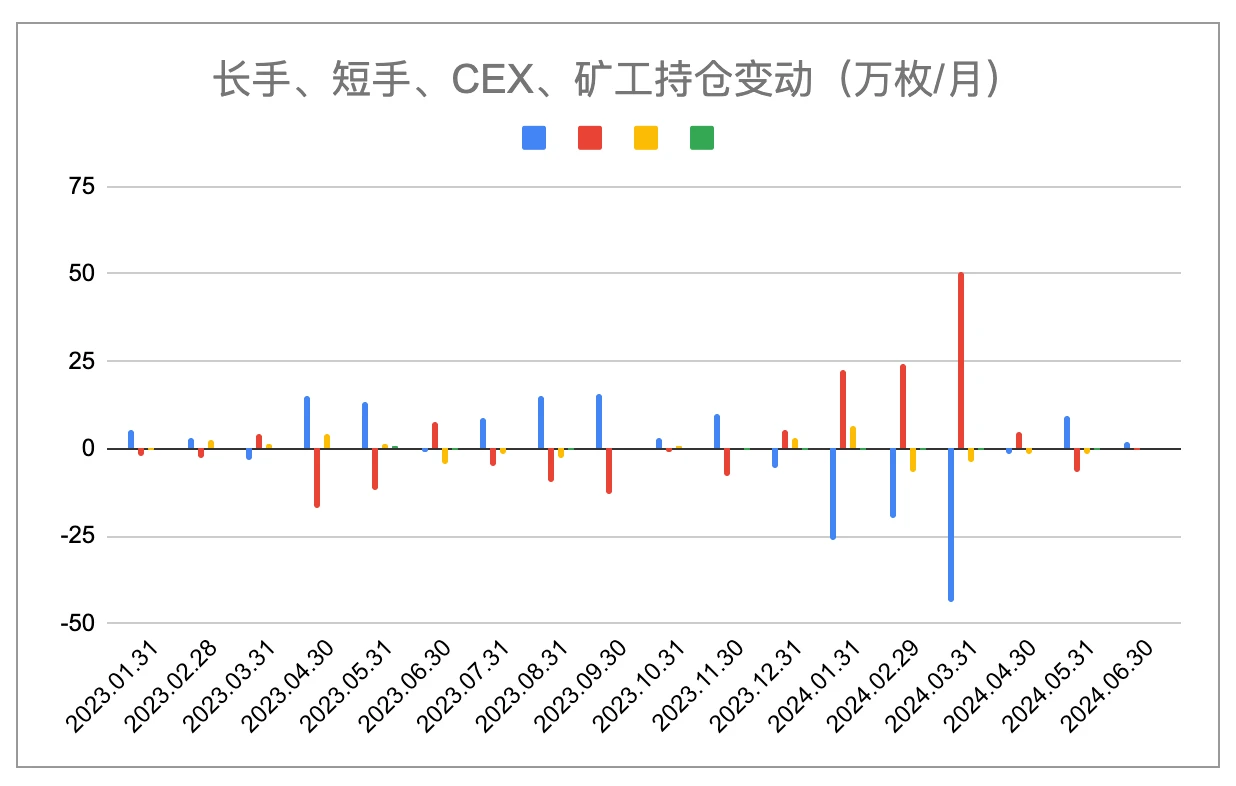

In a bull market, long-term investors and short-term investors use different valuation systems for BTC targets. After the price rises, BTC flows from long-term investors to short-term investors, and the value is transferred accordingly. Based on this, two phenomena are bound to occur in a bull market: capital inflow and BTC holder group transfer. The two phenomena influence each other and jointly shape the market trend. In the previous section, we analyzed the capital inflow situation. In this section, we focus on the changes in the BTC holder group. Analyzing the positions of long-term investors, short-term investors, exchanges, and miners since last year, we found that in the first 11 months of 2023, long-term investors were increasing their positions, while short-handed investors were reducing their positions. The turning point occurred in December, when the BTC price approached the previous high, and the long-term investor group began to distribute chips, while the short-handed group began to increase its holdings. With the BTC price hitting a record high in March, this chip exchange game reached its peak. After that, prices began to collapse, and the scale of long-term investors selling in April quickly shrank. In May and June, this selling completely ended, and long-term investors began to increase their holdings again.

Analysis of changes in holdings of long-term investors, short-term investors, exchanges and miners (Chart by EMC Labs)

From March to May, the exchange of chips by all parties in the market around the previous high price of BTC at $69,000 was one of the main activities in the market cycle. Its occurrence means the first stage of the bull market is underway. The chips held by low-frequency traders (long-term investors) flow into the hands of high-frequency traders (short-term investors), and the market liquidity suddenly overflows. New funds are consumed by hard selling, prices fall, speculation cools down, and the market returns to the stage of hesitation after the passion. Will the bull market come to an abrupt end? We will turn our attention to the previous rounds of bull markets.

BTC distribution statistics for long-term investors

As indicated by the green box in the above figure, we have observed in the past three bull markets that long-term investors will conduct two rounds of large-scale selling to lock in profits after taking advantage of the price increase. The first wave of selling will press the pause button on the price increase, and the second wave of selling will destroy the market. The first wave of selling in history lasted for 3 months, 9 months and 4 months respectively in chronological order. This round from December to March last year is also 4 months, the same as the previous cycle. According to historical laws, after the first wave of selling, the long-hand group returns to the accumulation state and waits for the price to rise. As shown in the red box in the above figure, when the price continues to hit a record high, it returns to the state of reducing holdings and sells ruthlessly. This way of selling in batches to lock in profits is in line with the behavior pattern of long-term investors and the law of market movement. Therefore, we believe that this selling law is still applicable to the current crypto asset market. Based on this, EMC Labs judged that the recent sell-off was only the first wave of sell-offs in the bull market. As long-term investors return to the accumulation state, the market selling pressure will decrease, and the market will continue to rise after funds return to flow in. At that time, the market will usher in the second and most lucrative stage of the bull market. The end of the high interest rate environment of the US dollar is likely to occur in the second half of this year. Therefore, although the market confidence is low and the trading volume is light, we are still optimistic that BTC is likely to start the market early in the fall.

Conclusion

Market movement is a process of interaction between internal and external factors. In the first half of 2024, long-term investors in the market carried out the first wave of selling, locking in tens of billions of dollars in profits, and have now returned to accumulation. After the approval of 11 BTC spot ETFs in the United States, nearly $14 billion flowed into the ETF channel, with 240,000 new BTC holdings, and the cumulative holdings reached 860,000, totaling $53.1 billion. Considering that this record was achieved in an environment of high US dollar interest rates, such market performance is already very outstanding.

The US dollar has not yet started to cut interest rates, and the funding pressure in the global capital market has reached unprecedented levels.

The first phase of the bull market is coming to an end, and the second phase has not yet begun. We believe that the variables are likely to occur in the fall.

The biggest risks are the Federal Reserves unexpected rate hike and increased selling of U.S. debt, the issuance of Mt.Gox BTC, and the U.S. governments selling of its BTC holdings.

Now should be the most depressing and painful moment before the heavy rain.

EMC LabsEMC Labs was founded in April 2023 by crypto-asset investors and data scientists. With industry research and data mining as its core competitiveness, it is committed to becoming the worlds leading crypto-asset research institution. 14 original content WeChat account

EMC Labs was founded by crypto asset investors and data scientists in April 2023. It focuses on blockchain industry research and Crypto secondary market investment, takes industry foresight, insight and data mining as its core competitiveness, and is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets to bring benefits to mankind.

For more information, please visit: https://www.emc.fund