Written by: Steven, E2M Researcher (July 2024)

Daily Discussion

Peicai: Pay attention to the issuance of new assets. Brc-20 is a new asset issuance. Many people are optimistic about projects like Ethena. If you understand option tools, you can trade some linear income structures.

Dongzhen: The concept of points has existed for a long time. Bonds can be divided into principal and discount.

New Asset Issuance + Options

Pendle Yield trading was difficult before

Bonus, points, and meme can all become an interest rate trading platform, with the previous one giving incentives to new projects and maintaining its market share. I haven’t heard of any competitors yet.

Is the market big enough? Can it maintain its dominance, similar to (Derebit)

The demand is long-term.

Not only Crypto, RWA can be combined in reality

CM: Very good project. This round of old projects has found new narratives and reached new heights.

Points are not sustainable, but they have a great advantage in this round of the market. Many leading projects do this, and users pay for it. However, users are already resistant to point PUA. I don’t think it is a sustainable incentive. If points are no longer effective, can Pendle continue to do such a big thing?

1. Background

1.1 Why is it so popular?

Short-term speculation value

LRT Popularity

Points PMF (Product Market Fit) popularity

Binance Investment

Long-term investment value: The underlying assets of Defi yields are still crypto assets (mainstream assets, mid-stream assets, and long-tail assets). The volatility of these assets ultimately affects the yield fluctuations of the Defi protocol. For example, it is not uncommon for mining projects to have a 20% yield on the first day and 0.02% before the day after tomorrow. The friction cost and time cost of adjusting positions in the middle make the final profit, so fixed-rate products are gradually in demand.

1.2 Founding Team

Pendle was founded in 2021, with team members based in Singapore and Vietnam. [Image]

TN Lee (X: @tn_pendle): Co-Founder, was a member of the founding team and business manager of Kyber Network, and then went to RockMiner, a mining company that operates about 5 mining farms. In 2019, he founded Dana Labs, which mainly produces FPGA customized semiconductors. [Picture]

Vu Nguyen (X: @gabavineb): Co-Founder, formerly CTO of Digix DAO, specializes in RWA projects for tokenization of physical assets, and co-founded Pendle with TN Lee. [Image]

Long Vuong Hoang (X: @unclegrandpa 925): Engineering Director, obtained a bachelors degree in computer science from the National University of Singapore. He joined the National University of Singapore as a teaching assistant in January 2020, joined Jump Trading as a software engineering intern in May 2021, joined Pendle as a smart contract engineer in January 2021, and was promoted to engineering director in December 2022. [Picture]

Ken Chia (X: @imkenchia): Head of Institutional Relations. He holds a bachelors degree from Monash University. He was an investment banking intern at CIMB, the second largest bank in Malaysia, and later worked as an asset planning expert in a private investment bank at JPMorgan. In 2018, he joined Web3 and worked as COO at an exchange. In April 2023, he joined Pendle as Head of Institutional Relations, responsible for the institutional market - proprietary trading firms, cryptocurrency funds, DAO/protocol treasuries, and family offices.

An introduction from the founder of Pendle in an interview:

Information source: https://news.marsbit.co/20230527094059302139.html

The story behind Pendles creation

TN: Of course... Im TN. I entered the cryptocurrency industry relatively early, when I was still in school. As a research assistant to a professor, I was tasked with studying different business models of fintech companies. I personally think that the model of using Bitcoin as a remittance tool inspired me at the time. The result of this model is that the cost expenditure is lower when providing the same service compared to other models. This also made me very interested in blockchain technology and the entire cryptocurrency. As a result, I began to learn more about it. Later, it was 2014 and 2015, when Ethereum and its community were being hyped, because the whole concept of their desire to build a supercomputer and smart contracts excited me, and I thought it could create all kinds of possibilities. Then I went deeper into these, but for me personally, I am not a technical expert, but I wanted to get involved, so I started looking for ways to get involved. Then I helped set up the Ethereum Singapore community and gathered a lot of resources to share with community members.

At that time, not a lot of people knew a lot about crypto at the beginning, so the community was relatively small, but it opened a door for me and allowed me to meet Roy... He is the founder of Kyber Network. He was still in college doing his PhD at the time, so we met and became friends very quickly. When he first started Kyber Network, he asked me if I wanted to join him as one of the founding team and be in charge of the business department, and I agreed. I think this was one of the most important decisions for me, in my personal experience, because this decision made me learn a lot and became more professional in the crypto field. So I started working at Kyber Network in 2017 and worked until 2019. Then, in 2019, I felt that it was time for me to take a step forward because I wanted to understand the entire crypto industry from all sides.

So I left and with a few other people, who are now part of the founding team of Pendle, we formed a new platform to explore vertical products in different crypto industries. The first product we built was mining software that optimized FPGAs for mining privacy coins. The product itself worked, but the scale was not large enough and our profits were too small, so we stopped doing this.

And in general, from 2019 to 2020, our financing was not smooth, but it was also a good time, although it was difficult, because I think in those two years, I and other founders were closely connected, and we were motivated to create a product that was both practical and far-reaching for the community. I think this ambition made us progress quickly. In 2020, we mined a lot of FoodCoins, and it was the DeFi summer in August/September 2020. Then, many of these FoodCoins had an annualized yield of 10,000%-20,000%. Just as we were enjoying this considerable annualized yield, we also deeply realized that this number was only temporary because we could not lock in the annualized yield we desired. This also made us start thinking about a solution to serve our need for certainty and predictable results, so this was the motivation for thinking about fixed-rate products in the first place. At that time, I was also thinking that if funds continued to flow into the cryptocurrency circle, then naturally there would be an exposure to fixed-rate products, because you can look at the number of fixed-rate products to know that it is one of the most important components of any financial industry. You dont have to look too far ahead, just look at the near future... I think a lot of people value certainty and want to know what their income is. I think the demand is natural, so this is how we envision Pendle.

In simple terms, Pendle is a place for tokenization and yield trading. First, there is a fixed interest rate, where users can deposit assets and withdraw more assets after maturity. On the other hand, there are traders who prefer the returns of high-risk speculation.

1.3 Financing

The investment institutions are mainly well-known Asia-Pacific institutions.

Data source: https://www.rootdata.com/zh/Projects/detail/Pendle?k=ODc0

2. Pendle composition

2.1 PT, YT, ST

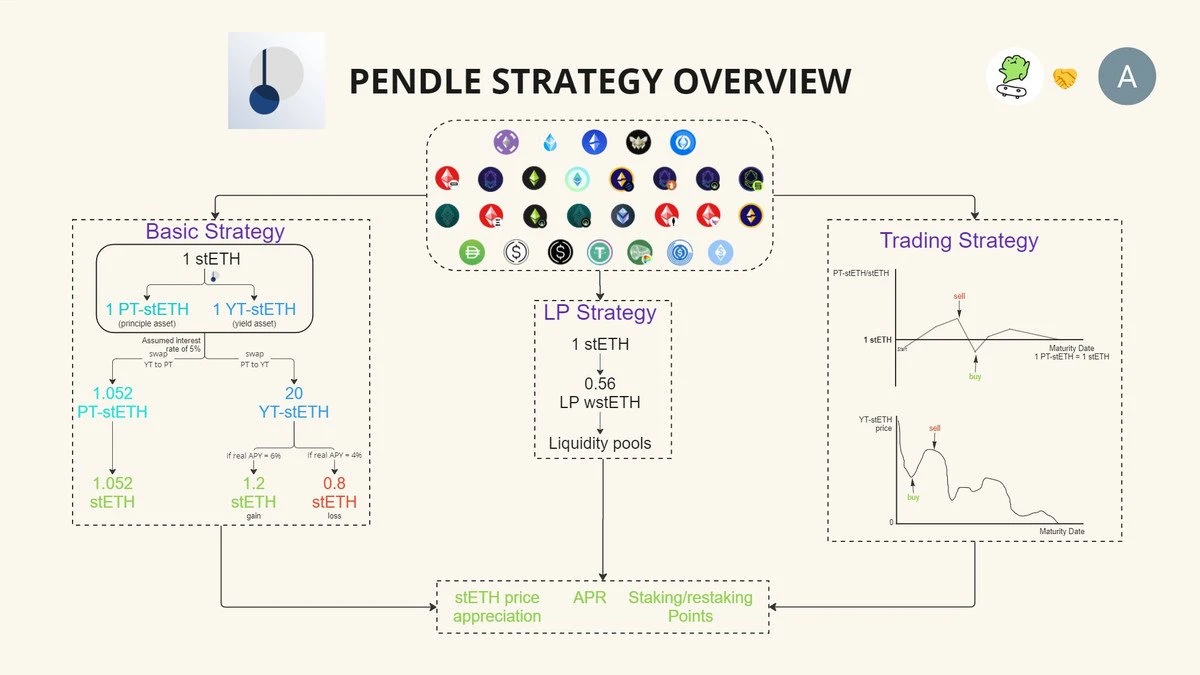

Simple thinking logic:

PT is about locking in profits for investors;

YT For investors, they will think about future returns based on history and make decisions.

Pricipal Token Principal

PT is a component of the principal that is split from the underlying interest-bearing tokens. Holding PT means that you have the ownership of the principal and can redeem it after maturity. For example, if you own 1 PT-stETH that expires in 1 year, you will be able to redeem stETH worth 1 ETH in 1 year.

PT can be traded at any time before expiry.

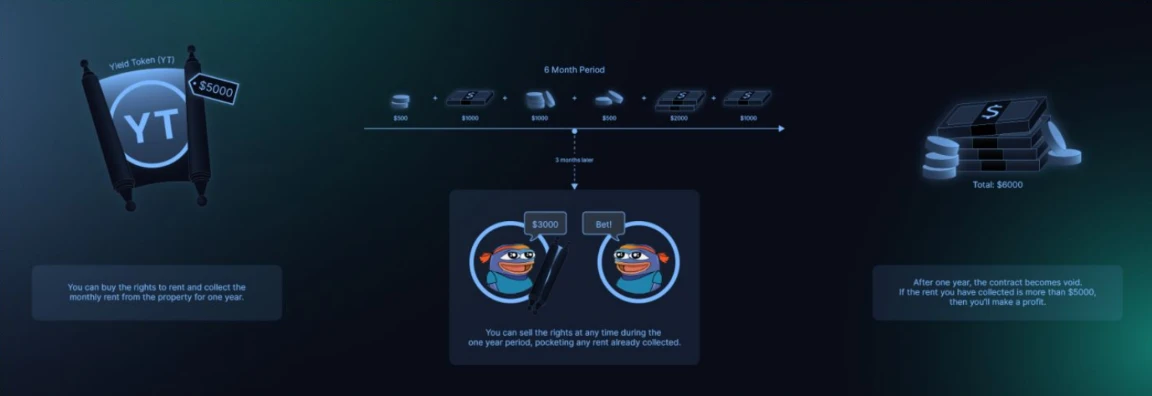

Yield Token

YT is a component of the income derived from the underlying interest-bearing tokens. Holding YT means that you own all the real-time income generated by the underlying assets, and you can manually collect the accumulated income on the Pendle panel at any time.

If you own 1 YT-stETH and stETH has an average yield of 5%, you will have accumulated 0.05 stETH at the end of one year.

YT can be traded at any time before expiry.

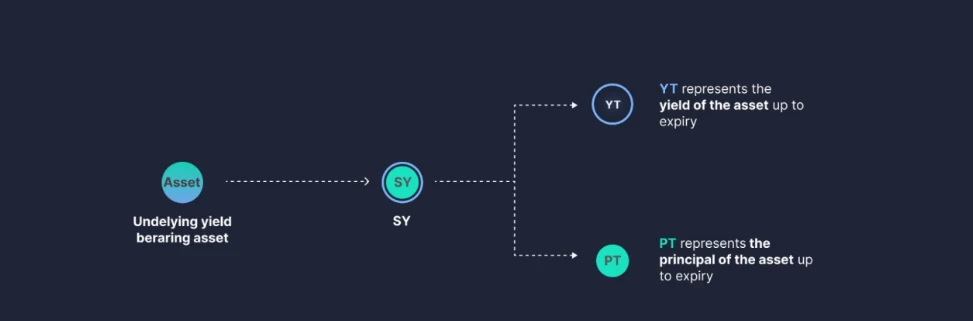

Standard Yield — EIP-5115

SY is a token standard (EIP-5115) written by the Pendle team. It was proposed in May 2022 that it can wrap any interest-bearing token and provide a standardized interface for interacting with the yield-generating mechanism of any interest-bearing token. SY is a purely technical component and users will not interact directly with SY.

More information: https://eips.ethereum.org/EIPS/eip-5115

Token standard for encapsulating interest-bearing tokens, all SY have the same mechanism

PT and YT are minted from SY, and Pendles AMM pool conducts transactions between PT and SY.

Pendle can automatically convert interest-bearing tokens to SY and vice versa

For example, stETH, cDAI, and yvUSDC can be packaged into SY-stETH, SY-cDAI, and SY-yvUSDC, thereby standardizing their yield generation mechanisms for Pendle system support.

Pendle-Arbitrium takes eETH as an example

Minting wETH: Users first wrap ETH into wETH and obtain ERC-20 standard tokens.

WETH converted to weETH: Users convert wETH to weETH and earn interest through etherfi.

Transfer weETH to Pendle Router V3: User sends weETH to the Pendle Router V3 contract address.

Pendle Router V3 separates earnings: After receiving weETH, Pendle Router V3 divides it into two parts: SY-weETH and YT-weETH. SY-weETH represents the underlying assets, and YT-weETH represents future earnings.

2.2 Processing asset classes

Underlying assets: the principal of interest-bearing assets, without yield

For example, ETH or DAI

Interest-bearing assets: also called underlying assets, are assets with yields obtained by investing the underlying assets in other DeFi protocols.

Rebase class: The number of tokens will change automatically, and the income will be reflected through the change in the number of tokens. The exchange rate between the interest-bearing asset token and the underlying asset token is always 1:1, such as stETH, aToken

Accumulate class: The number of tokens will not change, and the income is reflected through the increase in the intrinsic value of the token. The exchange rate between the interest-bearing asset token and the underlying asset token will increase as the income accumulates, such as wstETH and cToken.

Distribute class: The number of tokens will not change, and the benefits are reflected through additional distributions, which require users to manually claim, such as the liquidity incentive part of GLP and LP tokens.

2.3 Pendle Exclusive AMM——PT-SY Single Pool + Flash Swap

Due to the different attributes of its own assets, Pendles AMM curve is different from Curve, Uniswap, etc.

Characteristics of PT and YT assets

Interest rates fluctuate within a range

Approaching Maturity, the fluctuations are getting smaller and smaller

PT and YT return to a fixed value after expiration

YT income can be withdrawn at any time, and the income after expiration is 0

Corresponding characteristics

AMM Liquidity Concentration

AMM can reflect the gradual decrease in volatility and the gradual concentration over time

AMM price changes over time

The price of YT represents the future return pricing of the asset

The price evaluation of YT is more influenced by the market, with large fluctuations, strong uncertainty, and complex pricing. Therefore, YT is directly abandoned and YT-SY is used as a single-pair liquidity pool. The pool that originally required 3 token pairings has become a single-pair pool.

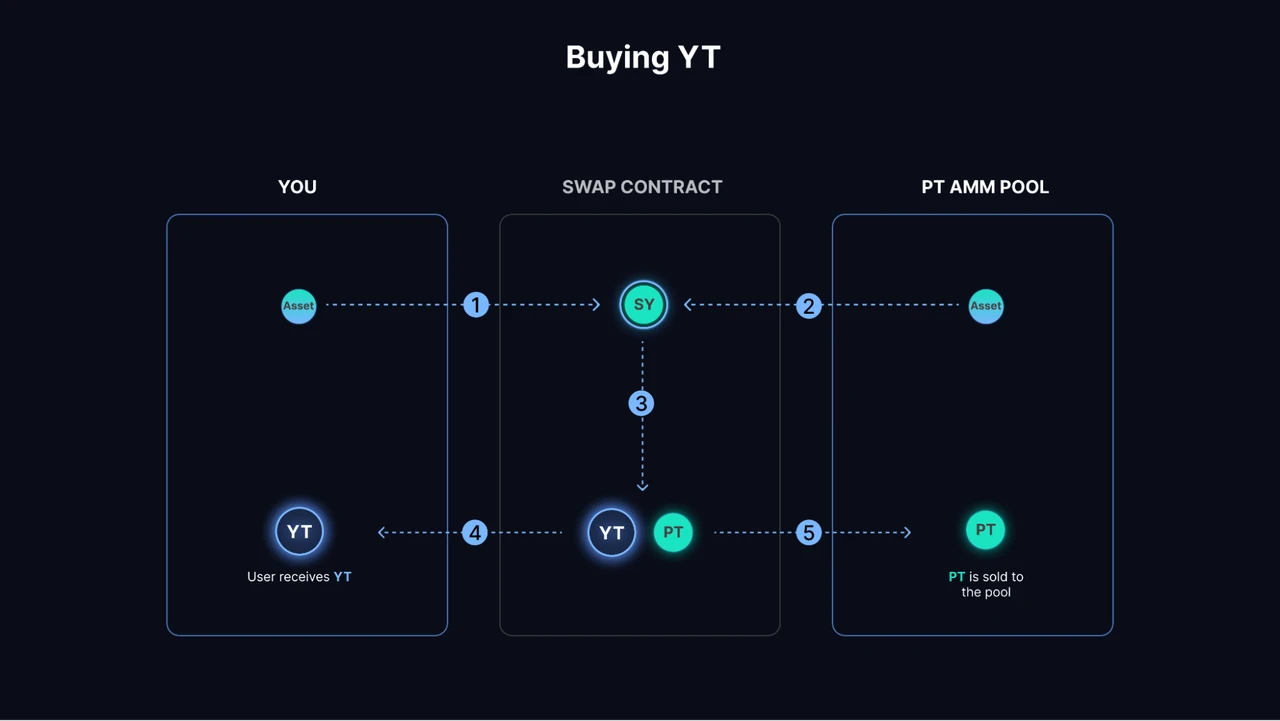

Buy YT:

1. The buyer sends the assets to the SWAP contract

2. The contract extracts more SY from the AMM pool

3. Mint PT and YT from all SY until YT matches the buyers needs

4. Send YT to the buyer

5. PT is sold to obtain SY to return the amount in step 2

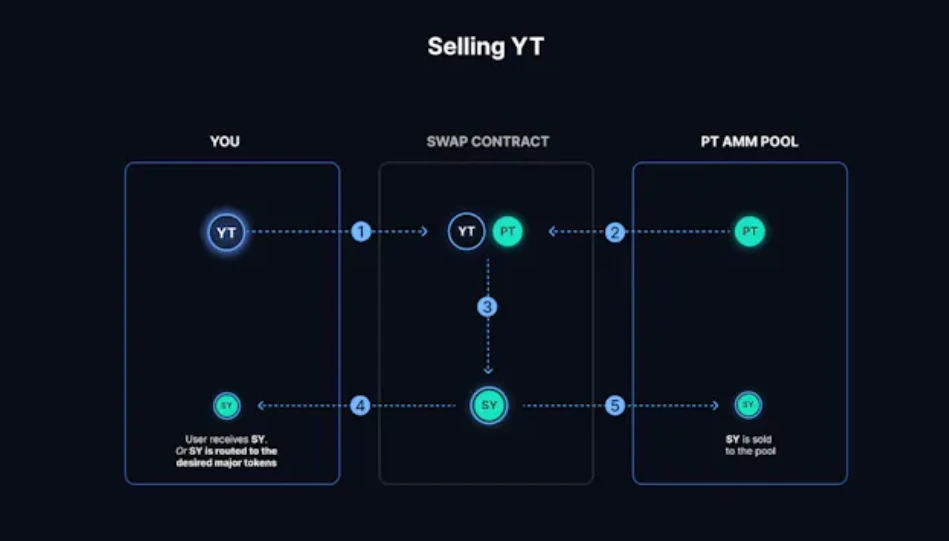

Selling YT:

1. The seller sends YT to the SWAP contract

2. The contract borrows an equal amount of PT from the pool

3. YT and PT are used to exchange for SY

4.SY is sent to the seller (or routed to any major token, such as ETH, USDC, wBTC, etc.)

5. Part of SY is sold to the PT pool to return the amount in step 2

2.4 Points Market

Driven by the EigenLayer hype, it brought positive upward momentum to the $PENDLE token price.

Through a custom integration of LRT, Pendle allows Principal Token to lock in base ETH revenue, EigenLayer airdrops, and any airdrops associated with the Restaking protocol that issues LRT. This creates an annual yield of more than 30% for Principal Token buyers.

On the other hand, due to the way LRT is integrated into Pendle, Yield Token allows for a form of “leveraged point farming.” Through the swap function in Pendle, we can exchange 1 eETH for 9.6 YT eETH, which will accumulate EigenLayer and Ether.fi points, just like holding 9.6 eETH.

In fact, for eETH, Yield Token buyers can also get 2x Ether.fi points, which is actually leveraged airdrop farming.

Given that Yield Tokens will trend towards zero as expiration approaches, Yield Token buyers are betting that the value of the EigenLayer and Ether.fi (or Kelp in rsETH) airdrops will be greater than the ETH spent to purchase the Yield Tokens.

Buying Yield Token means more people share the risk and provide more income to the protocol. Therefore, the project has the motivation to provide more points to users who buy Yield Token.

Data source: https://app.pendle.finance/trade/markets/0x6c269dfc142259c52773430b3c78503cc994a93e/swap?view=ytpy=outputchain=ethereum】

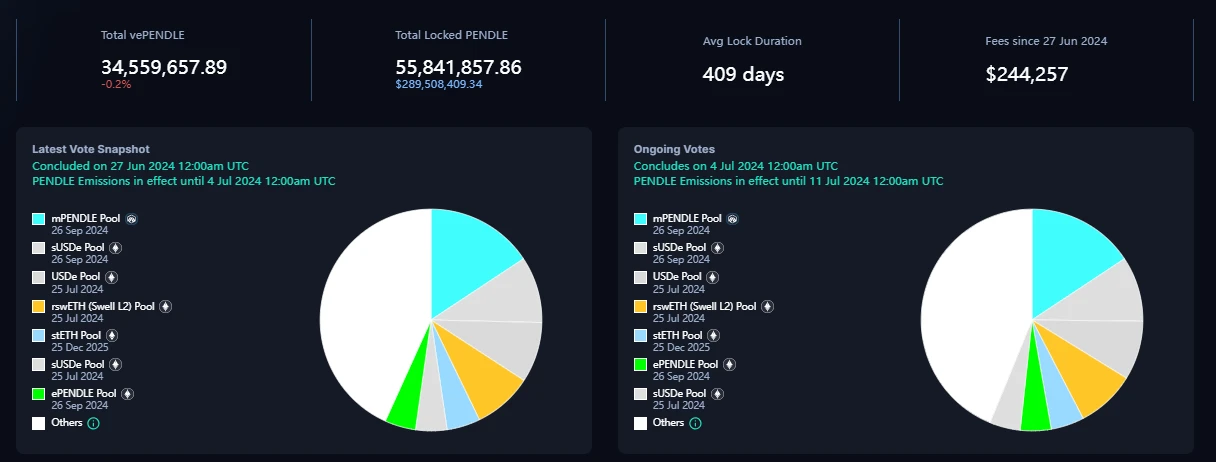

3. Token Economics — VePendle

In terms of token value capture, Pendle imitates Curve and uses the VeToken model.

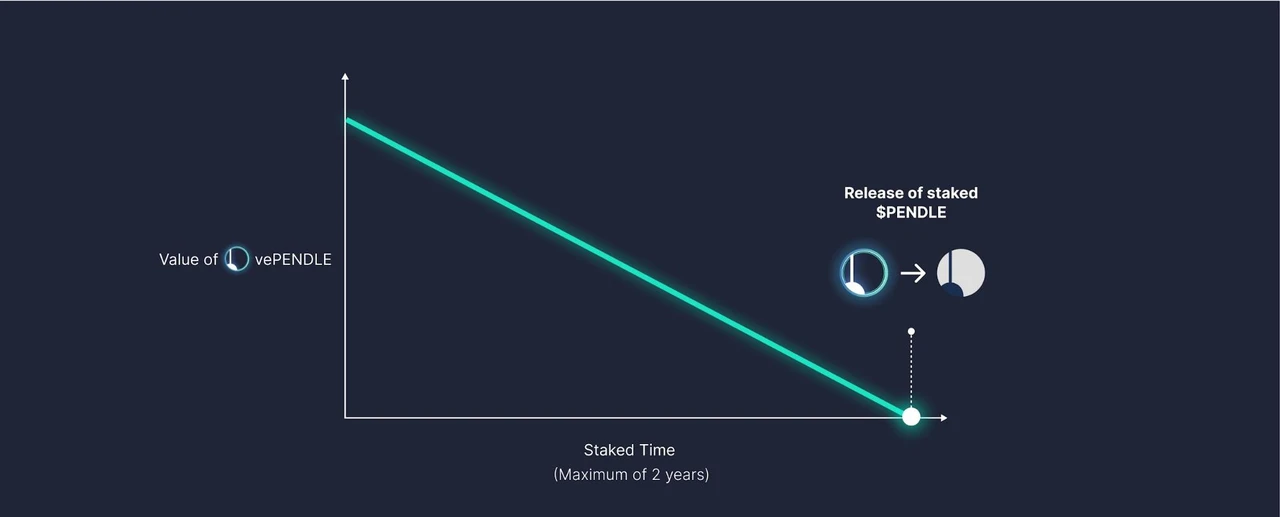

Pendle token holders can stake their tokens to get vePendle. The longer the stake is, the more vePendle they get. Curve has a 4-year term, while Pendle has a 2-year term.

Equity: Holding vePendle can obtain the income share of the protocol, vote to decide the allocation of weekly liquidity incentives, and enhance the income of being an LP

Utility with vePENDLE

Vote to inject $PENDLE incentives into the pool

Vote to earn voter APY (80% of the transaction fee of the voted pool)

Get Base APY

Increase LP rewards (up to 250%)

mPendle currently has the largest share. The mPENDLE pool is deployed by Penpie (governance yield aggregator) to the yield platform Pendle Finance. mPENDLE stands for Magpie PENDLE and is the liquid version of vePENDLE.

Data source: https://app.pendle.finance/vependle/stats

4. Token Distribution

PENDLE allocations as of October 2022.

Data source: https://docs.pendle.finance/cn/ProtocolMechanics/Mechanisms/Tokenomics

Team tokens will remain locked until April 2023. After that, any increase in circulating supply will come from incentives and ecosystem construction.

In October 2022, weekly issuance will be 667,705 and will decrease by 1.1% per week from then on, in a deflationary model until April 2026. The current token economy will eventually reach a terminal inflation rate of 2% per year (for ongoing incentives).

As the industry matures, governance mechanisms can propose the best changes based on the development of the ecosystem.

5. Data

TVL

The current TVL is $4.017b, the highest is $7.014b, and the Eigenlayer token price is halved after it was issued.

Data source: https://defillama.com/protocol/pendle#information

Pools — TVL Sorting

Data source: https://app.pendle.finance/trade/pools

Pools — APY Ranking

Data source: https://app.pendle.finance/trade/pools

Appendix - Glossary

Yield-Bearing Token

Interest-bearing tokens are a general term for any token that can generate income. For example, stETH, GLP, gDAI, and even liquidity tokens like Aura rETH-WETH.

SY = Standardized Yield

SY is a token standard (EIP-5115) written by the Pendle team that wraps any interest-bearing token and provides a standardized interface for interacting with the yield-generating mechanism of any interest-bearing token. SY is a purely technical component and users will not interact with SY directly.

PT = Principal Token

PT is a component of the principal that is split from the underlying interest-bearing tokens. Holding PT means that you have the ownership of the principal and can redeem it after maturity. For example, if you own 1 PT-stETH that expires in 1 year, you will be able to redeem stETH worth 1 ETH in 1 year.

PT can be traded at any time before expiry.

YT = Yield Token

YT is a component of the income derived from the underlying interest-bearing tokens. Holding YT means that you own all the real-time income generated by the underlying assets, and you can manually collect the accumulated income on the Pendle panel at any time.

If you own 1 YT-stETH and stETH has an average yield of 5%, you will have accumulated 0.05 stETH at the end of one year.

YT can be traded at any time before expiry.

Maturity

On the maturity date, PT can be fully redeemed and its underlying assets can be received, while YT stops earning income. The same asset can have multiple maturity dates, and each maturity date has an independent market. Therefore, the implied yield of the same asset on different maturity dates may also be different.

Underlying APY

The underlying annualized rate of return, or “underlying APY” for short, represents the 7-day moving average rate of return of the underlying asset. This method provides a more accurate indication of the underlying rate of return over a period of time, helping traders better assess the average underlying APY in the future.

Implied APY

Implied annualized rate of return, or implied APY for short, is the markets consensus on the future APY of an asset. This value is calculated based on the YT and PT price ratio, as shown below.

When used together with the underlying APY, the implied APY can be used to assess the relative valuation of assets like YT and PT at current prices, helping traders develop their trading strategies.

The implied yield value is equal to the Fixed Income APY value.

Fixed APY

Fixed income APY is the guaranteed income you will get if you hold PT until maturity. This value is equal to the implied APY value.

Long Yield APY

Also translated as Long APY Yield or Long APY Yield, it is the estimated return (annualized) based on purchasing YT at the current price and assuming that the underlying APY remains unchanged.

This value can be negative - indicating that the total value of all future returns calculated at the current underlying APY is less than the current cost of purchasing YT.

About E2M Research

From the Earth to the Moon E 2 M Research focuses on research and learning in the fields of investment and digital currency.

Article collection: https://mirror.xyz/0x80894DE3D9110De7fd55885C83DeB3622503D13B

Follow us on Twitter: https://twitter.com/E2mResearch ️

Audio podcast: https://e2m-research.castos.com/

Xiaoyuzhou link: https://www.xiaoyuzhoufm.com/podcast/6499969a932f350aae20ec6d

DC Link: https://discord.gg/WSQBFmP772