by Joven Wu , Principal of Investment at Ryze Labs

Fractal Bitcoin, which launched on September 9, 2024, may represent another blind spot between the Eastern and Western crypto markets. Although Fractal has captured a significant portion of Bitcoin’s hashrate within days of its launch, it remains a distant third in the global crypto space. Fractal is still relatively unknown to many in the community. This study aims to shed light on this innovative project that is quickly gaining traction in the Bitcoin ecosystem.

Key Points

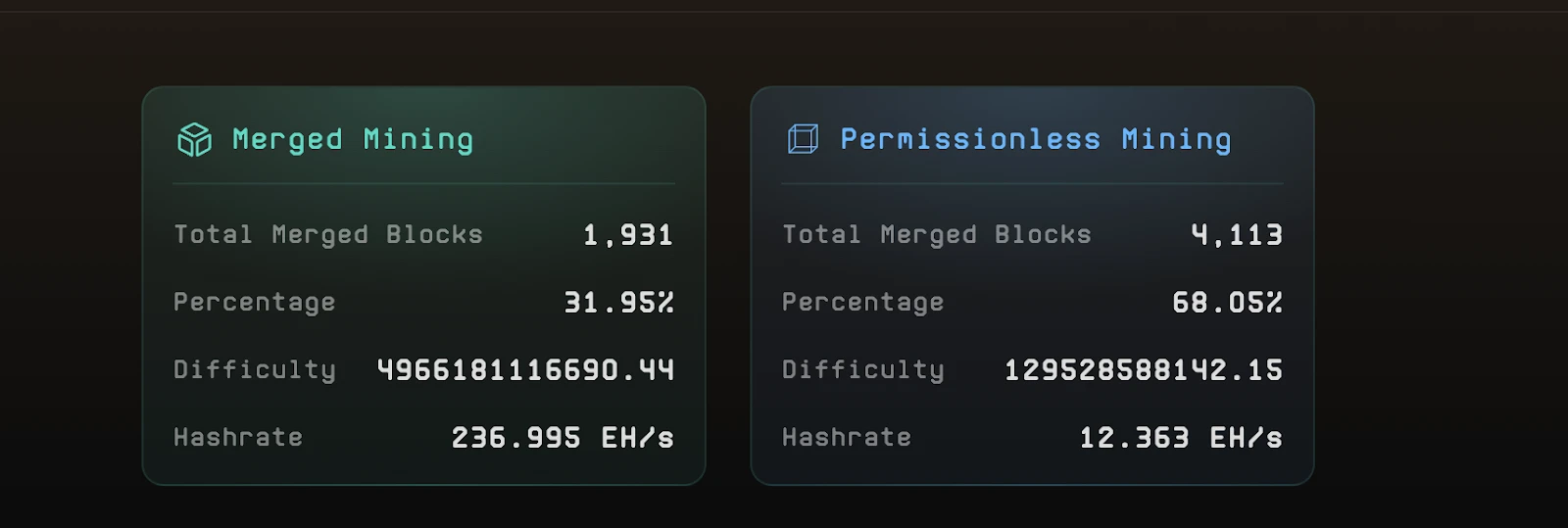

Innovative Mining Methods: Fractal introduces a hybrid mining model that combines merged mining and permissionless mining. This model provides a new perspective on PoW, proving that PoW is still viable even as the industry moves towards PoS. It is a robust approach to network security.

Bitcoin’s pilot network: Due to its compatibility with the Bitcoin mainnet, Fractal provides developers with a realistic testing environment, providing valuable user data and activity insights. The activation of OP_CAT on Fractal marks the beginning of many anticipated experiments, solidifying the Fractal’s role as a testing ground for potential Bitcoin upgrades and innovations.

Strong user base from day one: Through its partnerships with OKX and UniSat, Fractal has been able to attract Bitcoin’s most active users from the start. This early adoption helps Fractal avoid the “cold start” problem common with new platforms.

Grassroots and community-oriented: Fractal maintains a pragmatic, community-driven strategy that avoids excessive hype and institutional influence. This strategy of focusing on organic growth and engagement is at its core.

Ecosystem Integration: Fractal’s successful integration with key players in the Bitcoin ecosystem, including the BRC-20, Ordinals, and Runes communities, puts Fractal ahead of current Bitcoin trends.

1. Introduction

Fractal Bitcoin is the only Bitcoin scaling solution that uses the Bitcoin Core code itself to recursively scale to unlimited levels, built on the world’s most secure and widely held blockchain.

To fully understand Fractal’s innovation, it is necessary to understand the historical context of Bitcoin’s scaling discussions. In 2017, the Segregated Witness (SegWit) soft fork aimed to increase Bitcoin’s block capacity, followed by the controversial Bitcoin Cash hard fork. Forks have emerged as another method of scaling. Since 2018, more and more attention has turned to second-layer solutions such as the Lightning Network. In this ongoing exploration of Bitcoin scalability and functionality enhancements, In the process, Fractal stood out as a new approach that provided a unique perspective on these long-standing challenges.

As an important milestone, Fractals mainnet was officially launched at 00:00 UTC on September 9, 2024.

The launch was a significant success, demonstrating the strong appeal and technical robustness of the project. Within just 24 hours of the mainnet launch, Fractal’s joint mining accounted for more than 40% of Bitcoin’s total computing power, and Fractal Free mining on Fractal accounts for 2% of Bitcoin’s hashrate. To put this data in context, Fractal’s free mining hashrate is more than three times the total hashrate of Bitcoin Cash (BCH). This rapid adoption by miners , showing a high level of confidence in Fractal technology and its potential.

( snapshot taken at 10 pm HKT on Sep 10, 2024)

The project has attracted the participation of major players in the mining sector. Large mining pools such as F2Pool, Antpool and Spiderpool have already joined Fractal’s mining ecosystem. In addition, there are other well-known mining pools ready to participate, which shows that Fractal mining is Interest in the network is increasing and has the potential to expand further.

2. Core concepts and technologies

2.1 Native Bitcoin Extensions

As a native extension of Bitcoin, Fractal’s approach sets it apart from other scaling solutions. By leveraging Bitcoin’s existing codebase and making modifications to block production parameters, Fractal maintains full compatibility with the Bitcoin mainnet. Ensure seamless integration with existing infrastructure. This approach enables feature enhancements without affecting the core Bitcoin security model, striking a balance between innovation and maintaining Bitcoins fundamental principles.

2.2 Technical specifications

Fractal introduces several key technical innovations:

Block time: Fractal achieves a 30 second block time, which is a significant improvement over Bitcoin’s 10 minute block time. This faster block time allows transactions to be confirmed more quickly, greatly improving In addition, it significantly increases the overall throughput of the network, potentially supporting a wider range of complex applications that require high transaction volumes.

Mining mechanism: Fractal uses a unique hybrid mining method. Two out of every three blocks are permissionless mining, and one is merged mining with Bitcoin. This innovative mechanism allows individuals to Miners freely participate in two-thirds of the block production, encouraging decentralization. At the same time, it enhances security by leveraging Bitcoin’s strong computing power through joint mining of every third block. This balance This approach aims to maintain network security and decentralization and incentivize existing Bitcoin miners to support the Fractal network.

Scalability: Fractal’s architecture theoretically supports unlimited layers of improvements. Each Fractal layer provides 20 times the capacity of Bitcoin mainnet. This means that the base layer provides 20 times the capacity of Bitcoin, and the second layer will Providing 400 times the capacity. This exponential scalability model allows Fractal to address Bitcoin’s throughput limitations while maintaining base layer security properties.

Smart Contract Functionality: By implementing the OP_CAT opcode, Fractal enables Turing-complete smart contracts on a Bitcoin-based platform. OP_CAT is a simple connection operation that, combined with other opcodes, can implement complex smart contract logic. The functionality opens up possibilities for advanced DeFi protocols, complex NFT mechanisms, and other decentralized applications that were previously limited to the Ethereum platform.

Parallel execution: Fractal’s architecture allows different applications to run their own instances, so that specific optimizations do not affect the entire network. For example, a gaming platform can run on a specially optimized Fractal layer for high-frequency, low-value transactions. The DeFi protocol can use an independent layer of parameter tuning to perform financial operations.

Compatibility: Fractal maintains 100% compatibility with Bitcoin standards such as BRC-20 and Ordinals. This ensures that existing Bitcoin tokens and NFTs can operate seamlessly. In addition, users can use Fractal on both the Bitcoin mainnet and Using the same address across Fractals simplifies the user experience and reduces the risk of errors in address management.

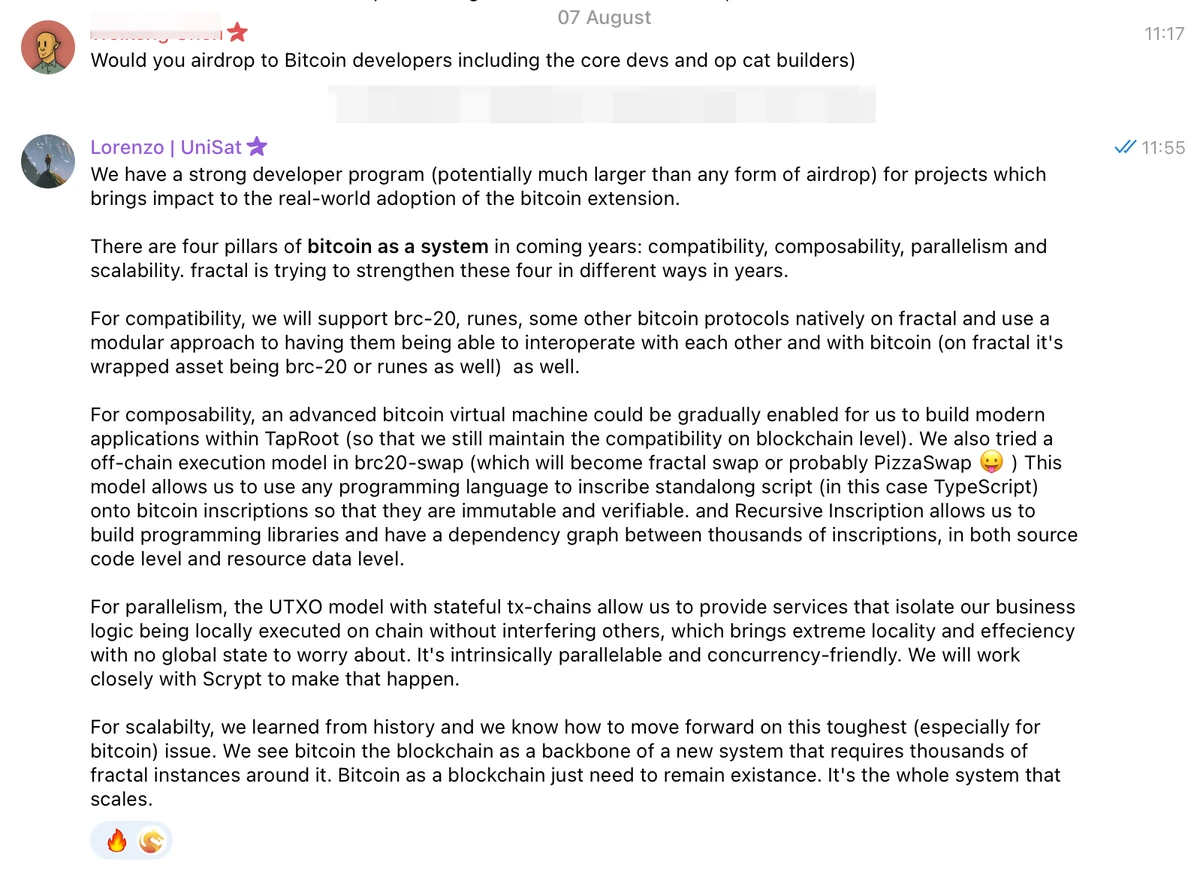

Lorenzo, founder of UniSat and core contributor to Fractal, outlined his vision in response to community questions.

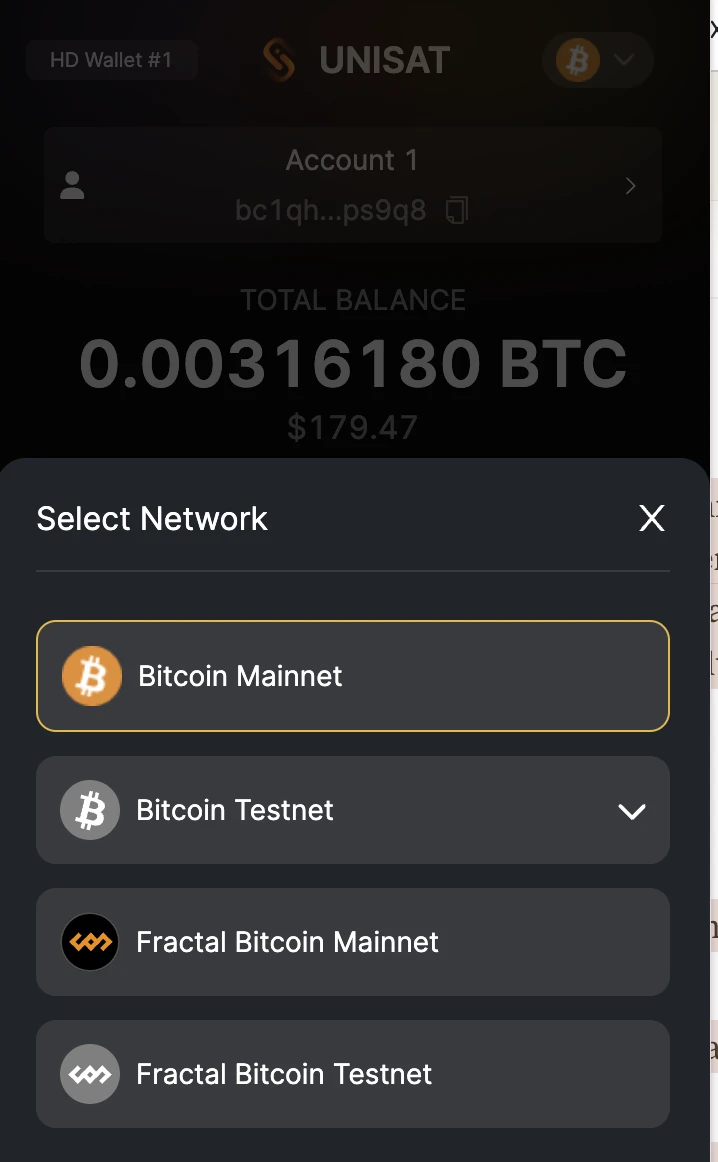

2.3 Unique User Experience

Unlike other Bitcoin Layer 2 solutions, the wallet address on Fractal is exactly the same as the mainnet address. This design provides convenience similar to Ethereum, where users can access different wallets by simply switching networks in UniSat or OKX wallets. Unlike other Bitcoin Layer 2 solutions that require a separate EVM wallet address, Fractal allows users to continue using the Bitcoin mainnet address in Layer 2 activities. As of now, major wallets such as OKX Wallet and UniSat Wallet serve Most active Bitcoin DeFi and collectibles users fully support Fractal Bitcoin.

3. Fractal’s position in the Bitcoin ecosystem

3.1 Comparison with other Bitcoin solutions

Fractal enters a competitive market for Bitcoin scaling solutions. Here’s how it compares to some of the main alternatives:

EVM-compatible Layer 2: Some projects attempt to create EVM-based second-layer solutions for Bitcoin. While these solutions are relatively easy to implement and launch, they face significant challenges in terms of acceptance by the Bitcoin community. Especially its core users and developers, often regard these EVM-compatible solutions as stitched. In contrast, Fractal takes a Bitcoin-native approach, aiming to expand Bitcoins capabilities without introducing external This approach may be more in line with the philosophy of Bitcoin purists and may lead to better integration and adoption within the existing Bitcoin ecosystem.

Bitcoin Cash (BCH): Bitcoin Cash emerged as a hard fork of Bitcoin, aiming to improve scalability through a larger block size. This approach led to divisions within the Bitcoin community and forced users to The BCH fork has sparked a lot of political debate, often overshadowing the technical discussions. In contrast, Fractal takes a fundamentally different approach. It does not create Instead of forcing users to choose a separate chain or a separate chain, Fractal embraces Bitcoin as the mainnet and seeks to scale it natively. Fractal’s architecture allows for the creation of multiple instances that scale together, potentially without sacrificing the security or decentralization of the base layer. Under the premise of providing unlimited scalability.

Lightning Network: Lightning Network excels in fast, low-cost payments and high privacy, but its smart contract functionality is limited and faces channel liquidity issues. In contrast, Fractal provides comprehensive smart contract support. , no channel management is required, providing a simpler user experience.

3.2 Marketing Strategy and Built-in User Base

Fractal stands out in the competitive Layer 2 space not only through technological innovation, but also through a strategic market approach and a strong built-in user base. Backed by UniSat, a leading Bitcoin wallet with approximately 1 million Bitcoins per user, Fractal is a leader in the Bitcoin industry. Weekly Active Users, which enables Fractal to reach an already engaged audience.

Many UniSat users already hold assets such as BRC 20 tokens and Runes in their wallets. These users naturally want a cheaper, faster, and more feature-rich trading environment. Fractal can directly meet this demand and provide improved trading experience while maintaining familiarity and compatibility with the Bitcoin ecosystem that these users are accustomed to.

This built-in user base gives Fractal a significant advantage over other Layer 2 solutions and new blockchain platforms, which often face the “cold start” problem of attracting an initial user base and building network effects from scratch. By leveraging UniSats existing user base, Fractal may be able to circumvent early adoption barriers.

In addition, Fractal’s strategy on growth metrics also distinguishes it from many other blockchain projects. While many Layer 2 solutions and new blockchains consider total locked value (TVL) as a core metric, Fractal plans to use the number of transactions as a core metric. This strategy is aligned with its native user base, which is likely to generate a large number of transactions naturally as they interact with existing assets on a more efficient platform.

By focusing on transaction volume rather than TVL, Fractal is able to demonstrate real usage and adoption, which may be more attractive to users and investors in the long run. This strategy also makes Fractal stand out from other projects that focus on TVL numbers. Stand out from the crowd.

4. Ecosystem Construction

Fractals ecosystem development strategy is committed to decentralization and community-driven growth. This section outlines Fractals strategy for building a strong and diverse ecosystem.

4.1 Decentralization Concept

At the core of the Fractal ecosystem is a firm commitment to decentralization. This philosophy is reflected in several key aspects:

Diverse cross-chain bridge solutions: Unlike some Layer 2 solutions that rely on a single official bridge, Fractal encourages multiple cross-chain bridge methods between the mainnet and its network. This approach reduces the risk of single point failure and promotes Cross-chain interactive innovation.

Open development environment: Fractal does not mandate a specific development framework or methodology, allowing developers to innovate freely within the ecosystem.

Community-driven governance: The direction of the ecosystem is primarily determined by community input and initiatives, rather than unilaterally by a central authority.

Distributed Infrastructure: Fractal promotes distributed infrastructure development and encourages multi-party participation in the construction of key components of the ecosystem.

4.2 Enabling users and developers

Fractal implemented a series of strategic initiatives to initiate user and developer engagement:

User Reward Program: After the mainnet launch, Fractal distributed 1 million FB tokens to more than 100,000 eligible addresses from OKX wallets and Unisat wallets, which established a broad FB token holder base. foundation, laying the foundation for increased participation in Fractal activities.

OKX Wallet Partnership: The successful partnership with OKX Wallet demonstrates Fractal’s ability to work with major players in the cryptocurrency space, significantly expanding its potential user base.

Developer Incentives: Through various funding programs and developer resources, Fractal incentivizes developers to contribute to the growth of the ecosystem.

4.3 Funding Plan and Project Evaluation

Fractal’s grant program aims to support and incentivize projects that contribute to the growth of the ecosystem and align with the philosophy of decentralization:

Retrospective Model: Fractal uses a retrospective funding approach, rewarding projects based on their actual impact rather than speculative commitments. This model encourages high-quality work and substantive results.

Evaluation Criteria: Projects will be evaluated on their contribution to the ecosystem, technological innovation, alignment with Fractal’s decentralization principles, and potential for long-term impact.

Diverse project types: The funding program supports a wide range of projects from core infrastructure development to application layer innovation, ensuring a well-rounded ecosystem.

4.4 Outstanding Funding Projects

Through Fractals grant program, several key projects have been supported:

sCrypt : Enhances Fractals scripting capabilities to implement complex smart contracts on the Bitcoin network.

F2 Pool : Serves as the primary mining pool, contributing to the security of Fractal and providing critical feedback on mining functionality.

Nubit : Developing a data availability (DA) layer to support scalable applications, including Ordinals and Layer 2 solutions.

DeTrading : Supports cross-chain atomic swaps without the need for a central authority or collateral, simplifying trustless trading on Fractal.

UniWorlds : Creating immersive environments on Fractal and developing community and gaming toolkits for building interoperable virtual worlds.

FractalEcosystem.io : A community-driven directory showcasing Fractal projects, enhancing transparency and discoverability of the ecosystem.

4.5 Future Prospects

Looking ahead, Fractal is poised to enable continued growth and innovation in the ecosystem:

Expanded Grant Program: The upcoming first quarter of the ex-post grant program (September 9 to October 9, 2024) will accelerate ecosystem development.

Community Engagement: The planned launch of community rewards and the establishment of a community committee in the fourth quarter of 2024 will deepen the direction of community engagement in the ecosystem.

Potential Use Cases: Fractal’s architecture supports a wide range of future applications, including advanced DeFi protocols, enhanced NFT capabilities, enterprise solutions, and decentralized identity systems.

Scalable Infrastructure: As the ecosystem grows, Fractal will continue to support the development of scalable infrastructure to accommodate growing network activity.

Cross-chain interoperability: Future development may focus on enhancing interoperability with other blockchain ecosystems, expanding Fractal’s impact and use.

5. Token Economics and Economic Model

Fractal has designed a comprehensive token economic model that aims to ensure long-term sustainability while maximizing value for the community and investors. This model incentivizes all participants in the ecosystem, from miners to developers, to work together to promote network growth and success.

5.1 Token Details

Name: FB (Fractal Bitcoin)

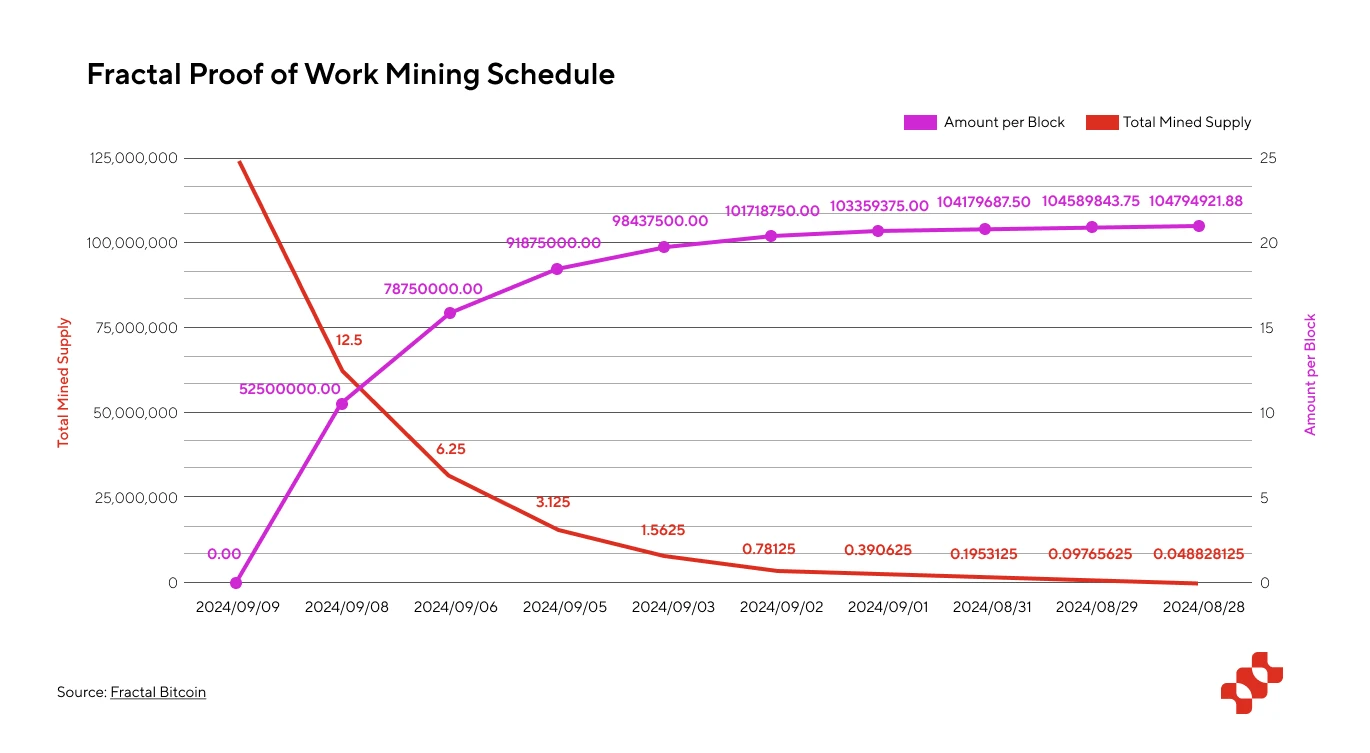

Maximum supply: 210 million

Total supply: 105, 153, 225.00000000 ( data source )

Circulating Supply: 1,213,225.00061300 ( data source )

Primary use: Transaction fees (within the Fractal ecosystem)

Secondary uses: Voting, applications

5.2 Token Allocation

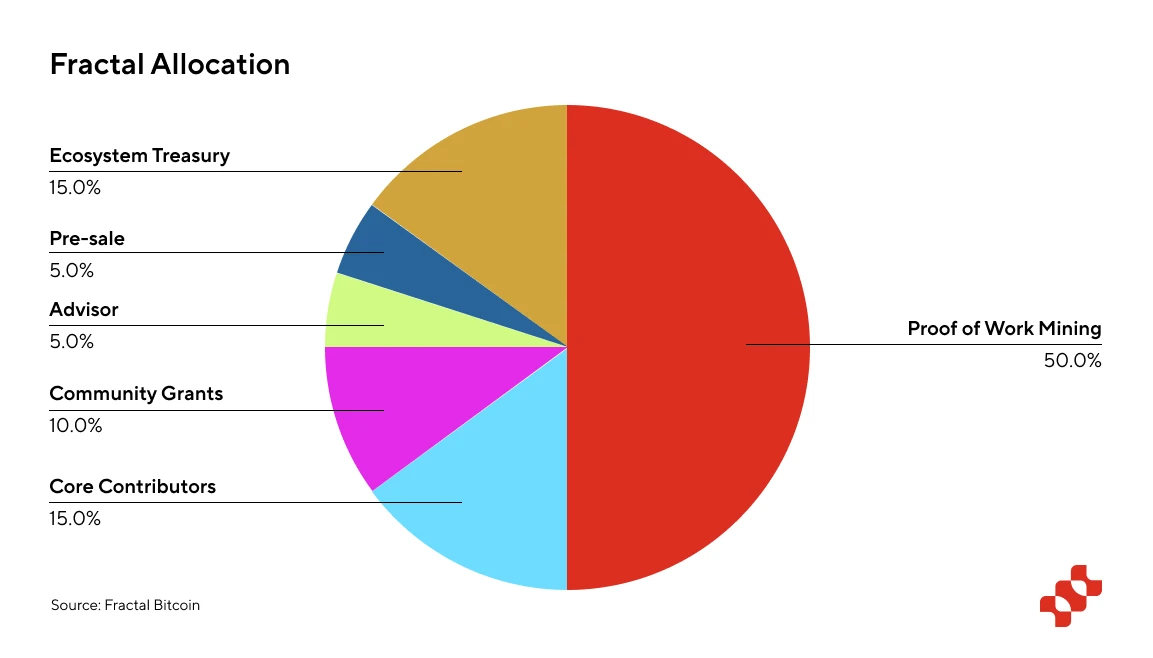

Fractals token distribution strategy is designed to promote network security, incentivize growth, and reward key contributors throughout the ecosystem. The specific distribution is as follows:

Proof of Work Mining (50%): 50% of the total supply is allocated to Proof of Work (PoW) mining. This significant allocation aligns Fractal closely with Bitcoin’s security model, ensuring network security and reliable blocks Production.

Ecosystem Reserve (15%): This portion is used to invest in the Fractal ecosystem, to support and fund projects that improve the ecosystem, and to fund continued core improvements to Fractal. A maximum of 15% of this pool can be used each year over a 10-year period. 10% .

Community Rewards (10%): Used to build partnerships and liquidity programs. These community-led initiatives are designed to increase network participation over time. Similar to the Ecosystem Reserve, this pool can use up to 10% of the , for a period of 10 years.

Pre-sale (5%): This portion is allocated to early investors to cover initial development and operating costs, as well as to conduct security audits. These tokens have a seven-month lockup period, after which they will be linearly released until twelve months Finish.

Advisor Pool (5%): Reserved for current and future advisors who will provide strategic advice and support for Fractals continued growth. Maximum of 20% per year for 5 years.

Core Contributors (15%): allocated to those who build and maintain Fractals core software. These tokens follow the same lock-up and release schedule as the pre-sale tokens.

5.3 Release and Lock-up Period

To ensure long-term commitment and alignment of interests:

Presale and Core Contributor tokens have a seven month lockup period, after which they are released linearly until the end of the twelve month period.

The maximum annual release rate of ecosystem reserve and community reward tokens is 10% within 10 years.

The maximum annual release rate of advisor tokens is 20% within 5 years.

5.4 Transparency and OP_CAT Governance Voting Mechanism

For full transparency, Fractal has published the official addresses for each token allocation category, which can be tracked when the mainnet goes live. This transparency allows the community to monitor the distribution and usage of tokens.

In addition, Fractal encourages all users to participate in the ongoing governance process and contribute to the development of the project. Proposals may include protocol upgrades, parameter adjustments, and allocation decisions for ecosystem reserves or community reward funds. This participatory approach is designed to ensure that Fractal is responsive to the community. needs and adapt to changing market conditions.

The Fractal team plans to adopt a governance voting mechanism based on OP_CAT. This innovative approach will be the first application in the Bitcoin space. By enabling OP_CAT, Fractal token holders will vote on proposals directly within the Fractal ecosystem.

6. Team and partners

6.1 Core Contributors

Fractal Bitcoin is built by an experienced team in the Bitcoin ecosystem:

UniSat: As a leading Bitcoin wallet with over 900,000 weekly active users, UniSat has extensive experience in cryptocurrency application interface design, implementation and support of Bitcoin standards such as BRC-20 and Ordinals, and secure management of high-value digital assets. Rich experience. Their participation increases the credibility of the project and provides a large potential user base for early adoption.

Block Space Force : Co-founders have successfully built and scaled world-class projects such as Coinbase, CoinMarketCap, and Cobo. They have decades of experience in USD A9 exits and investing in 100x projects and developing the worlds most used blockchain applications. experience, which demonstrates expertise in scaling blockchain projects from concept to mass adoption, navigating regulatory challenges in the cryptocurrency space, and managing investor relations.

6.2 Developer Platform Partnership

Fractal is backed by the Scrypt team, which is building a smart contract meta-protocol on Bitcoin using OP_CAT . This partnership could bring important synergies, including co-development of advanced smart contract standards, shared security audits, best practices, and more. Practice, cross-platform promotion and ecosystem building.

7. Challenges and risks

While Fractal presents an innovative approach to extending Bitcoin’s functionality, it also faces challenges that potential investors and users need to consider:

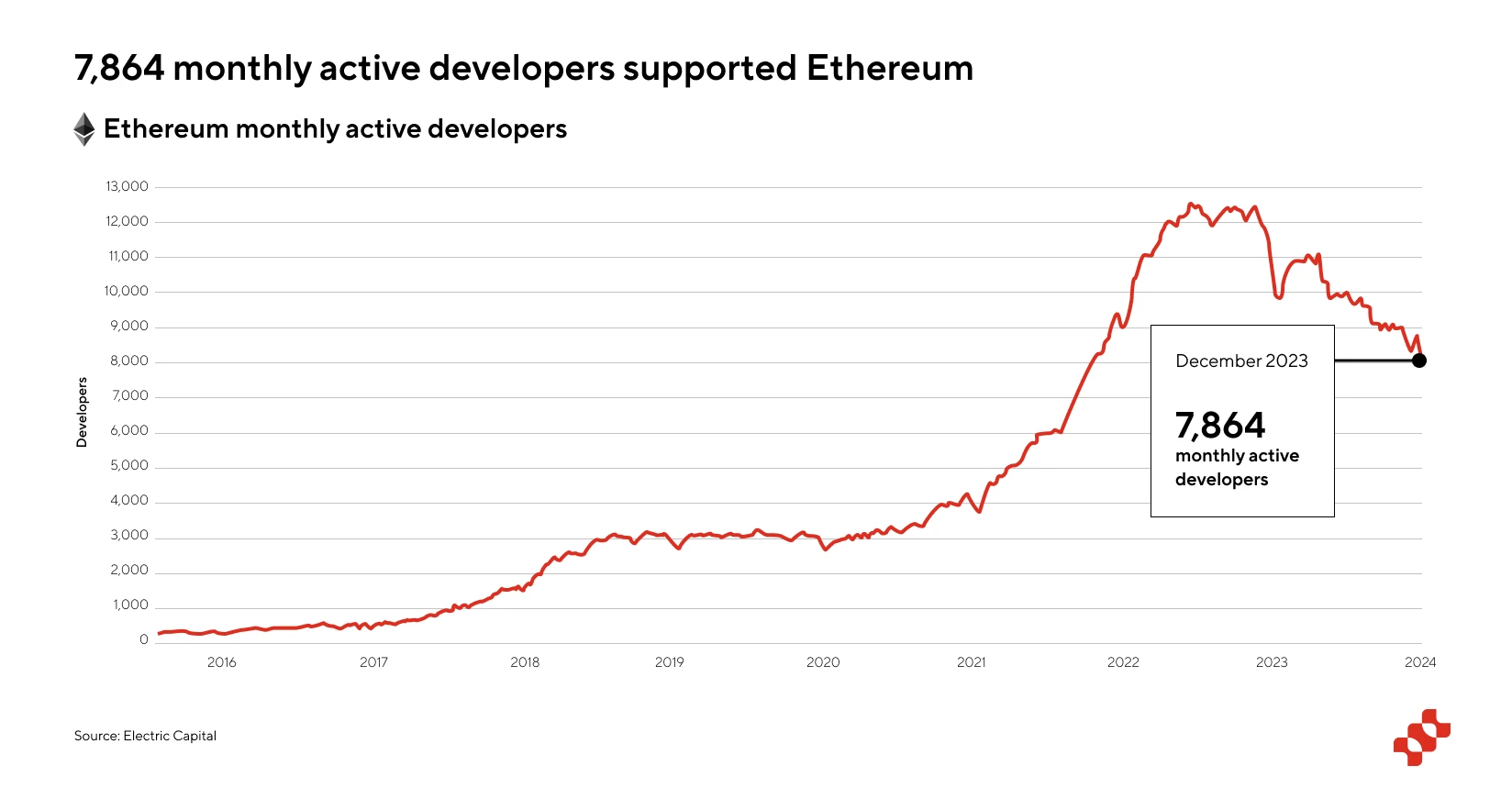

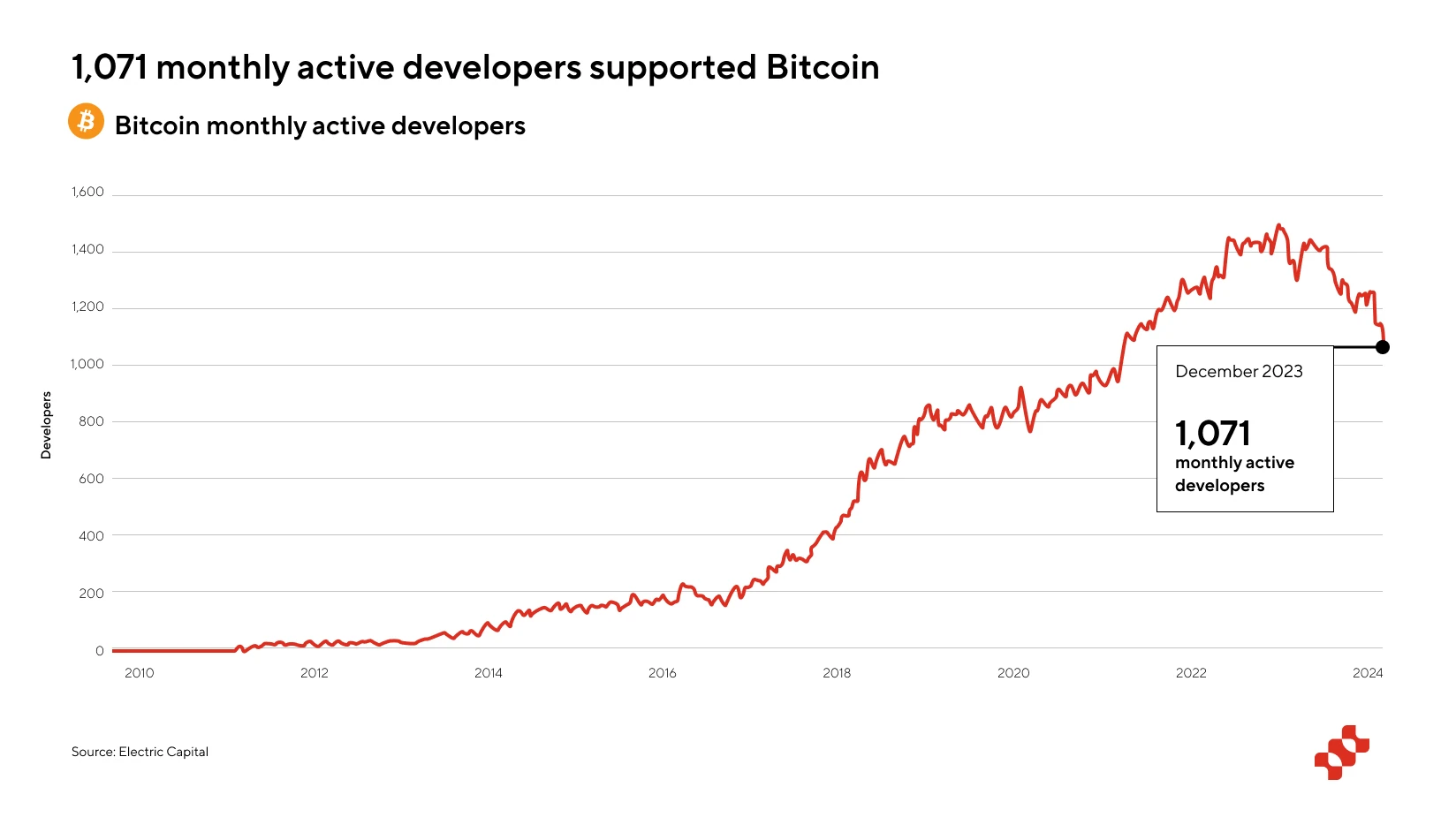

Programmability is the main challenge facing Fractal. Since it is 100% compatible with the Bitcoin mainnet, Fractal is programmed using Bitcoin Script, which may hinder the growth of the ecosystem. To better understand this issue According to Electric Capital’s developer report, Bitcoin has 1,071 monthly active developers, while Ethereum has 7,864 monthly active developers.

Bitcoin Script is not as well-known as popular languages like Rust or Solidity, and is more challenging to use, which may lead to a small number of developers. Fractal has a high coding threshold, and its functionality may not be as good as other blockchains, which may Slowing down the speed of ecosystem expansion. In addition, compared with other blockchain environments, the development tools, libraries, and frameworks of Bitcoin Script are relatively immature, which may further hinder the development and deployment of applications on Fractal.

Technical risks also pose significant challenges. Modifying Bitcoin’s core parameters and implementing new features such as OP_CAT inherently carries the risk of introducing vulnerabilities or unintended consequences. Managing recursive extensions and multiple levels of complexity adds to the technical challenges.

Adoption risk is another significant challenge. Fractal may face resistance from Bitcoin maximalists who believe that any modification or extension to Bitcoin is unnecessary or potentially harmful. Convincing users and developers to move away from established Layer 2 It may be difficult for other blockchain platforms to switch to Fractal, especially given the network effects of these existing solutions. In addition, despite Fractal compatibility, the Runes, Ordinals, and BRC-20 communities may be reluctant to adopt the same standards. These communities Already established ecosystems may not see enough incentive to migrate or expand to a new platform, even if it offers better performance. Fractal needs to clearly articulate its value proposition and potentially offer significant incentives to drive these users The challenge is not only to deliver a technological advantage, but also to overcome the inertia of the established community and their existing investments in the current platform.

To address these challenges, especially the issue of programmability, Fractal will likely need to invest significantly in developer education, create robust development tools, and possibly explore ways to make the development process more accessible without compromising its integration with Bitcoin Core. Easy to use method.

8. Conclusion

Fractal Bitcoin represents a groundbreaking approach to extending Bitcoin functionality. As the only Bitcoin scaling solution that leverages the Bitcoin Core code itself to recursively scale to infinite layers, Fractal offers a compelling alternative in the competitive Layer 2 solution market. Unique value proposition.

Fractals key benefits include:

Native Bitcoin Integration: Fractal maintains full compatibility with the Bitcoin mainnet, enabling seamless integration with existing infrastructure while enhancing its functionality.

Technological Innovation: With a 30-second block time, hybrid mining methods, and support for OP_CAT, Fractal significantly increases transaction speeds and enables complex smart contracts on a Bitcoin-based platform.

Built-in user base: Fractal has a significant advantage in overcoming the “cold start” problem. With the support of UniSat Wallet, Fractal has a solid foundation of over 1 million weekly active users, and through the Fractal Mainnet Launch Plan, 100,000 Active addresses holding FB tokens are the most engaged users in the Bitcoin ecosystem. In addition, the full integration of OKX wallet further expands Fractal’s potential user base in the OKX ecosystem.

Strong mining and network security: Get 30-40% of Bitcoin’s hashrate through joint mining and 1-2% of Bitcoin’s hashrate through free mining.

Ecosystem Development: Through strategic grant programs and community initiatives, Fractal is actively fostering a diverse ecosystem spanning DeFi, gaming, and core infrastructure development.

Unique user experience: Fractal’s approach allows users to use the same address between Bitcoin mainnet and Fractal, providing an Ethereum-like network switching experience.

A team with a long-term vision: Fractal’s core contributors have been building in the Bitcoin and crypto industry since 2013, which helps the team adopt a longer-term industry perspective and bring Fractal to a wider audience.

However, Fractal also faces some major challenges:

Programmability: Bitcoin Script may pose a barrier to developers more familiar with Solidity or Rust.

Technical Risks: There are inherent risks in modifying Bitcoin’s core parameters and implementing new features such as OP_CAT.

Adoption barriers: Convincing users and developers to switch from established solutions to Fractal can be challenging.

Despite the challenges, Fractal’s innovative approach, strong support, and early mining adoption show great potential. The project’s success in attracting major mining pools and rapidly growing hashrate after launch are particularly encouraging signs.

As the ecosystem continues to grow, Fractal is positioning itself as an innovative Bitcoin application platform in various fields, which may reshape the utility and adoption of Bitcoin. The planned implementation of the OP_CAT-based governance voting mechanism further demonstrates Fractal’s role in the Bitcoin ecosystem. Commitment to innovation within the system.

While the road ahead is filled with opportunities and challenges, Fractal Bitcoin represents a bold step forward in Bitcoin’s scaling journey. Its success could profoundly impact the future of Bitcoin and the blockchain ecosystem. As with any emerging technology, potential investors and users are eager to learn more about the technology. The project’s potential should be carefully weighed against its risks, and its technological development, ecosystem growth, and market adoption should be closely monitored.