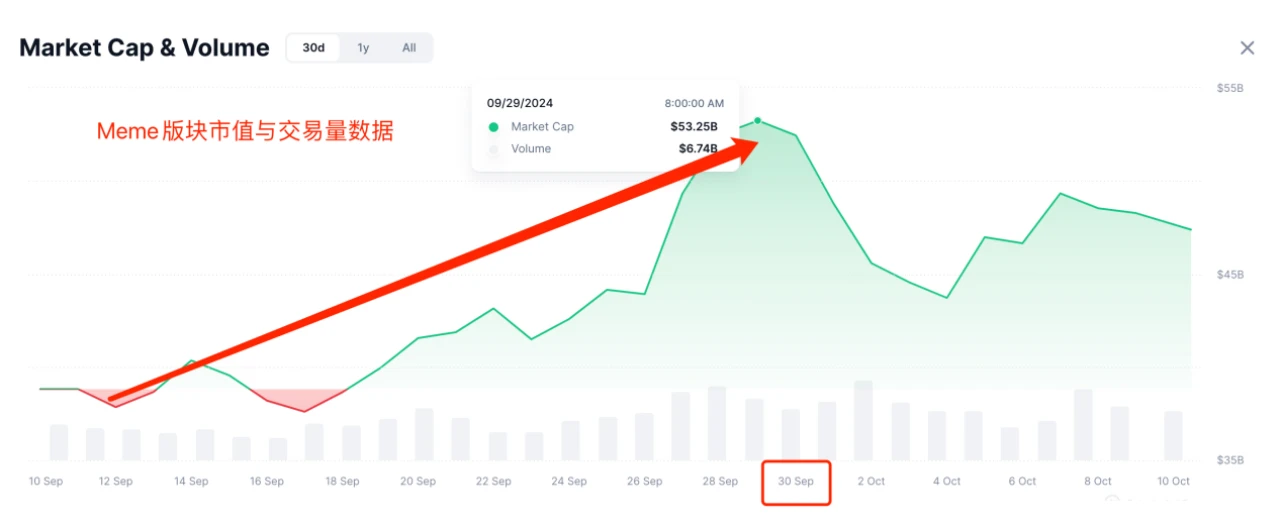

The interest rate cuts by the Federal Reserve and the Peoples Bank of China have injected new impetus into the global financial market, driving a strong rebound in the stock and bond markets in the United States and China. This positive signal of monetary policy has not only boosted the traditional financial market, but also triggered a chain reaction in the crypto market. In September, the total market value of the global crypto market rose by 8%, among which the performance of the meme sector was particularly eye-catching, with the highest market value increase exceeding 52%. In this meme boom, SunDog, a star project of the TRON ecosystem, has become the focus of global investors with its strong market performance and unique application scenarios, and has quickly become one of the top projects in the meme track.

As a representative meme project in the TRON ecosystem, SunDog has extremely high market potential. Since its launch, SunDog has shown strong growth in terms of market performance, community size, on-chain liquidity, and the distribution of coin holding addresses. Especially in the context of meme assets being highly dependent on community consensus and market popularity, SunDogs community support and practical application scenarios have brought it unique advantages.

In order to better analyze SunDog’s potential and competitive advantages in this round of meme craze, we compare and analyze SunDog with meme projects recently launched on major exchanges such as Binance and OKX from the following key dimensions.

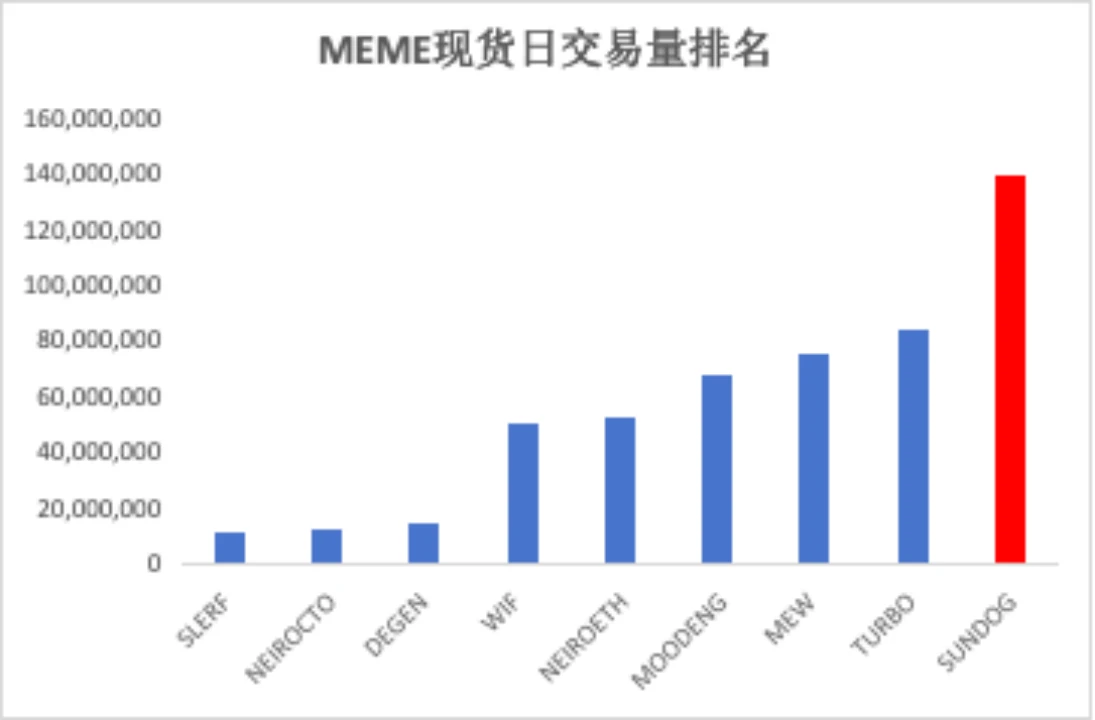

Trading volume comparison: SunDog performs well

In the meme market, trading volume is an important indicator of a projects popularity. According to CoinGecko data, by comparing the meme coins recently launched on Binance and OKX, we can see that SunDogs trading volume has surpassed most of its competitors before it was launched on these platforms. Even during the period of fierce competition for meme coins, SunDog still maintained a trading activity far exceeding that of other currencies.

(Note: Since listing on OKX or Binance will have a significant impact on trading volume, some currencies use the trading volume of the first 30 days before listing)

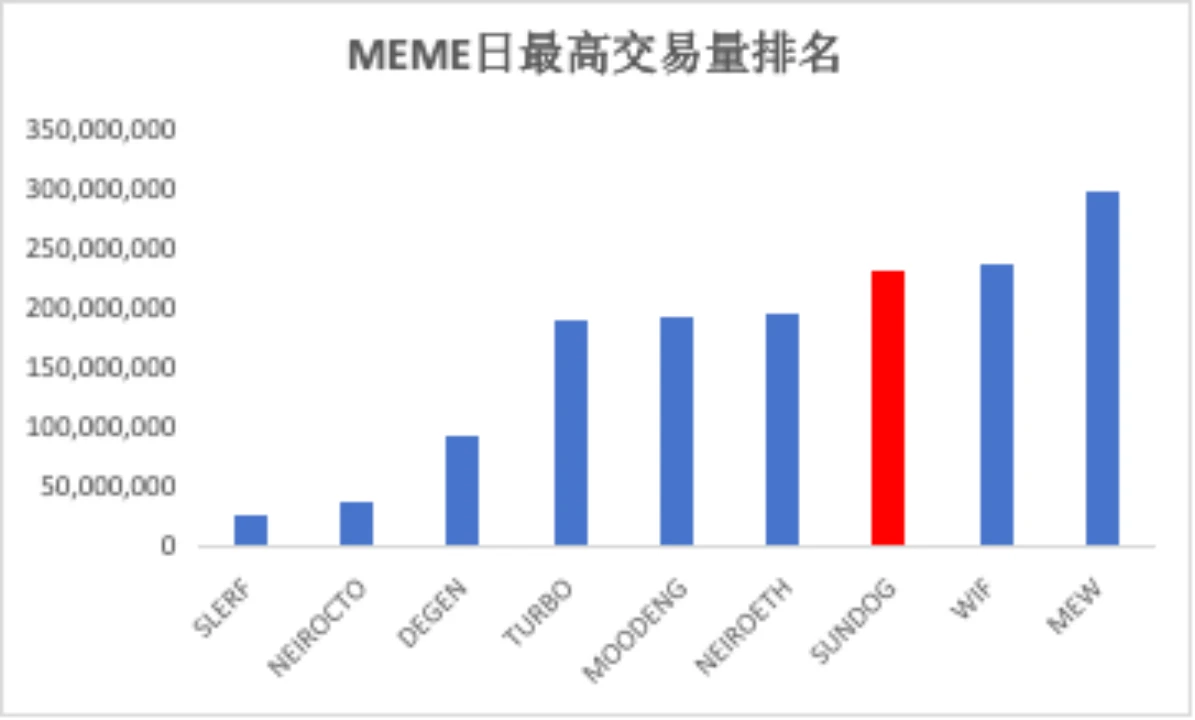

Without considering the impact of listing on OKX or Binance, SunDogs trading volume is much higher than other tokens under the same conditions. If we look at the highest daily trading volume, the results are as follows.

(Ranking by highest daily trading volume in the past 30 days)

SunDog ranks third in terms of the highest daily trading volume, not far behind the first place, while the average trading volume data is more convincing. SunDog is currently listed on 17 exchanges, and its trading volume performance is excellent without relying on the influence of OKX and Binance.

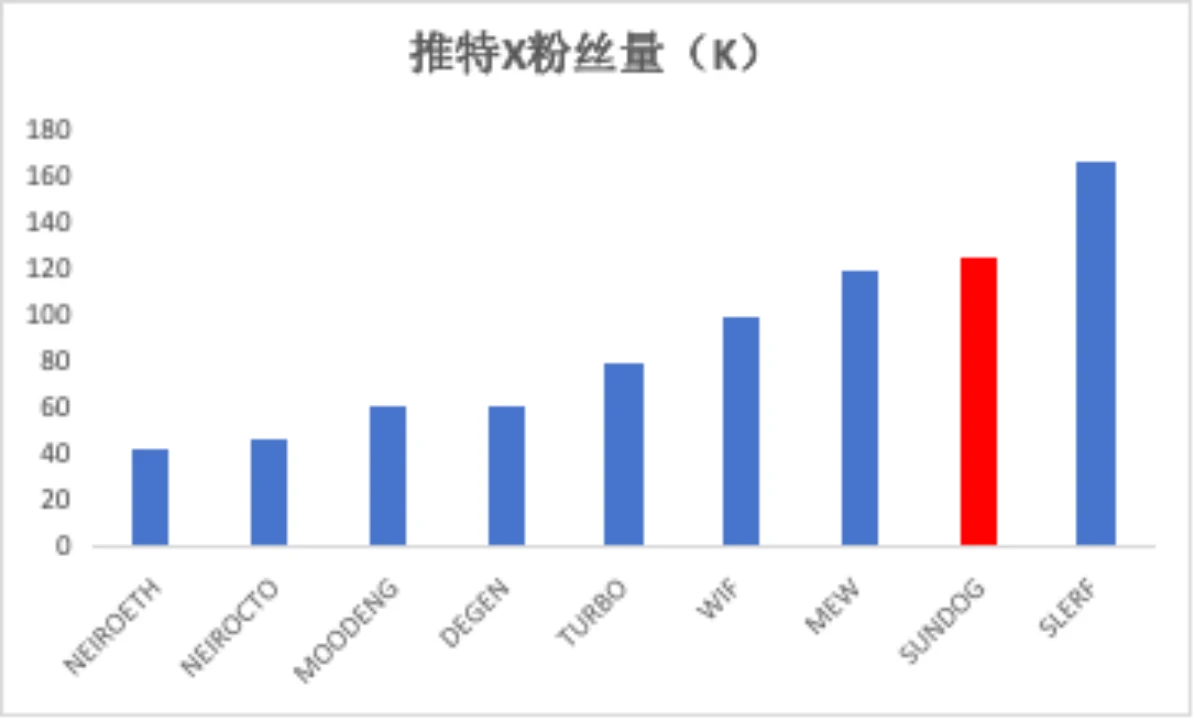

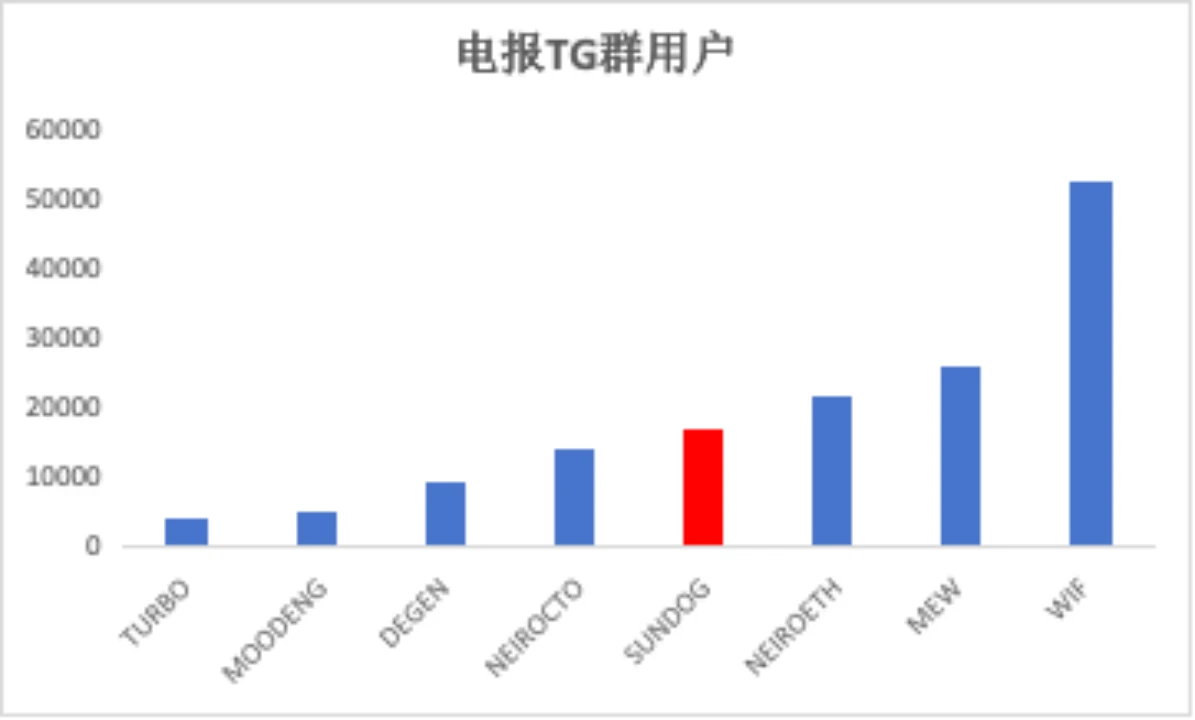

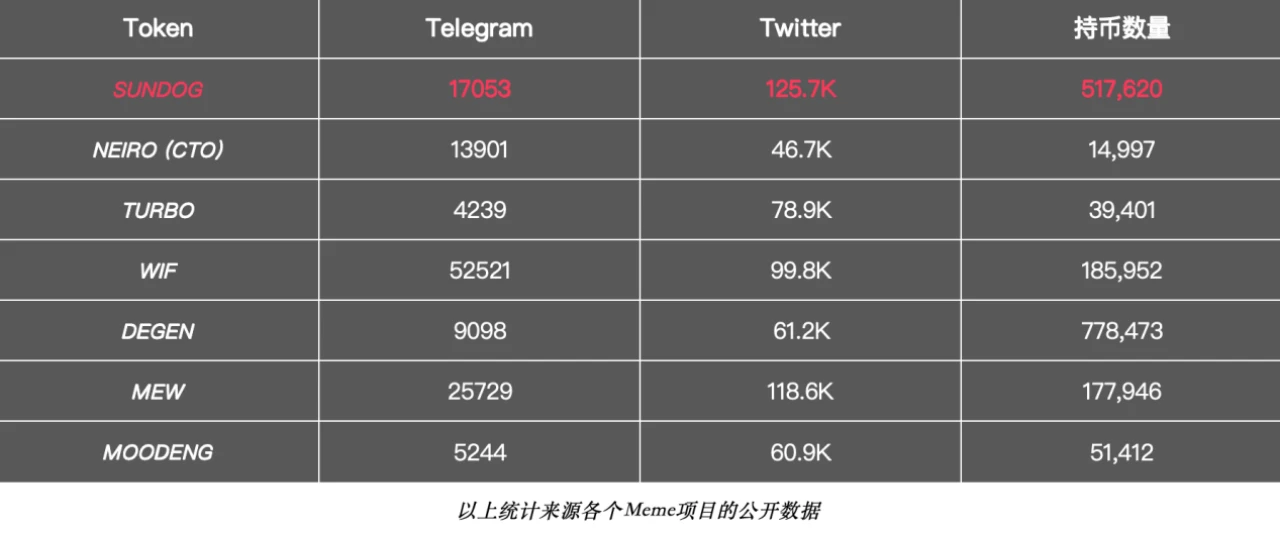

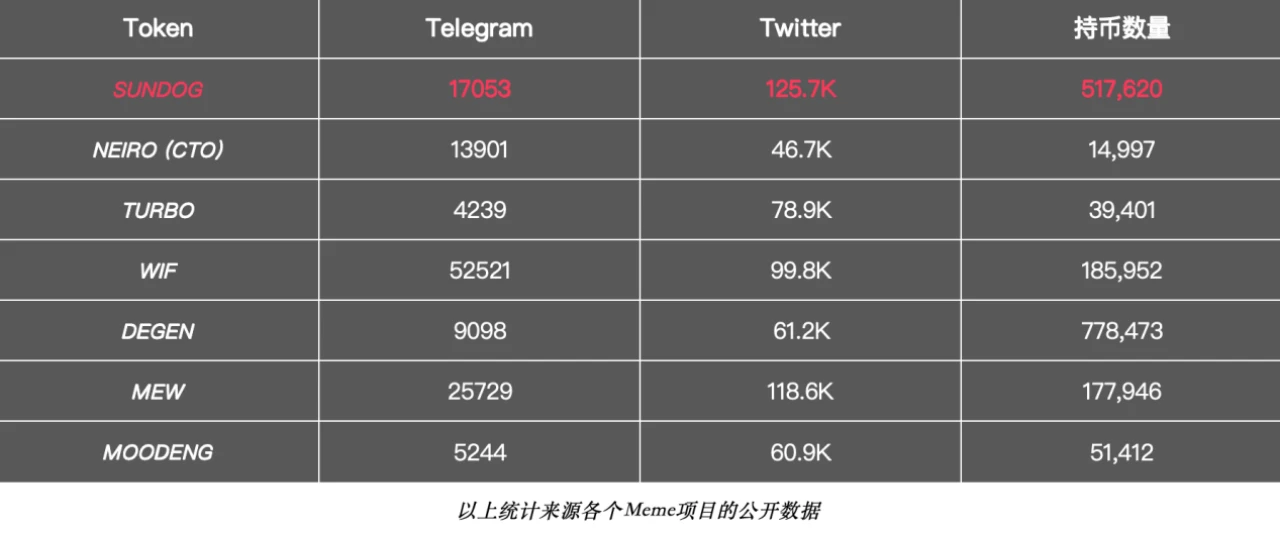

Community size comparison: Sundog shows strong community foundation

Community power is at the core of a memes success, and SunDog is not far behind in this regard. According to social media data, SunDogs official account on Twitter has 125,000 followers. Although Slerf has more followers, SunDogs number of followers is growing faster.

In addition to the social media influence of Twitter, SunDog has also significantly increased its activity in the Telegram community. Its Telegram main group has more than 17,000 members and more than 2,500 daily active users, demonstrating strong community cohesion and user engagement.

(SunDog’s official Twitter account ranks second with 125,000 followers, while Slerf, which ranks first, was founded five months earlier than Sundog.)

(Although SunDog ranks fourth, the first three were established earlier than SunDog, and WIF will not be established until 2023.)

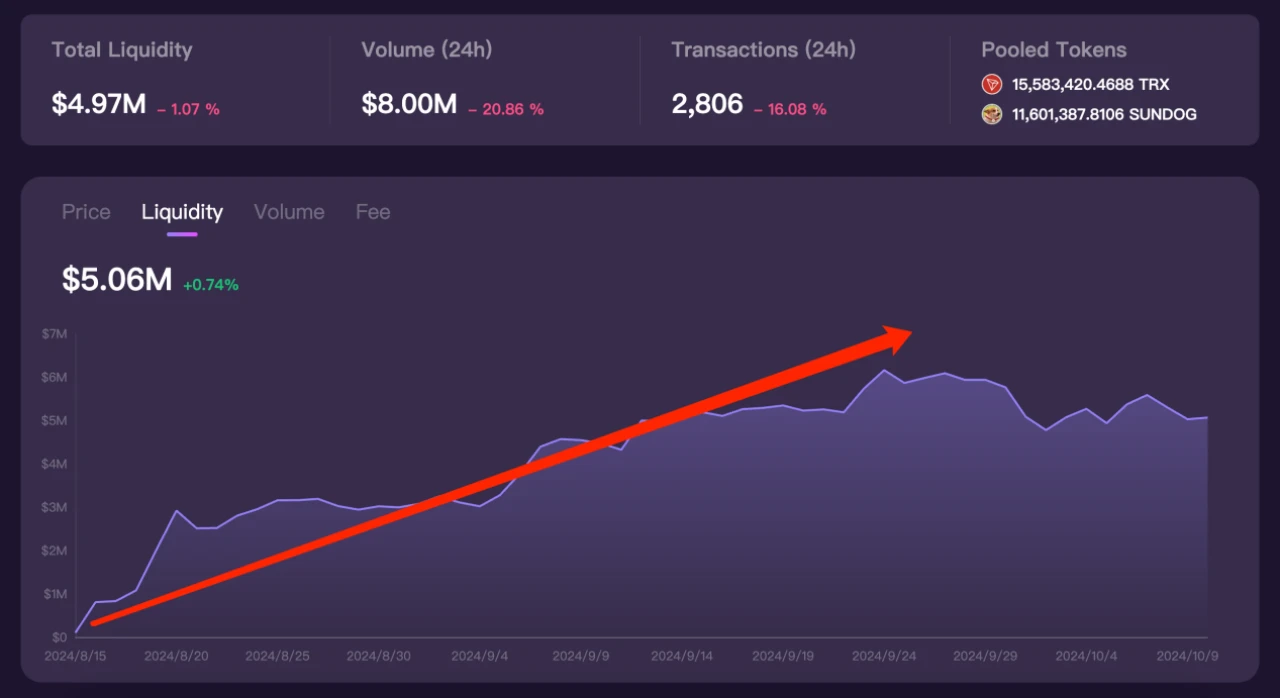

On-chain liquidity: SunDog’s market resilience and healthy development

SunDog not only performs well in terms of trading volume and community size, but also has healthy liquidity and coin distribution. The liquidity value of the largest liquidity pool TRX/SUNDOG on DEX is maintained at $5 million, which gives SunDog a more stable market foundation and better price stability on the chain.

By comparing the number of addresses holding coins, it is not difficult to see that SunDog has a broad user base. Although the number of SunDog coins held is not the highest, it is second only to DEGEN. Compared with other popular meme coins, SunDogs coin distribution is healthier, the project is more resilient, can withstand more risks, and the entire market state is more dynamic. A dynamic market can attract more traffic and funds to join.

SunDog’s application scenarios: from meme to actual value

Unlike traditional meme projects that simply rely on market hype and social media popularity, SunDog has added practical application scenarios on this basis. SunDog launched its native trading robot, SunBot, only 7 days after its launch. SunBot can generate about $100,000 in transaction fees per day, and the official promise is to use all revenue to repurchase and destroy SunDog tokens. This not only increases the market demand for tokens, but also brings substantial benefits to holders. On the same track, projects such as Slerf, Neiro, and Moodeng are only meme coins used for community and entertainment, and have no actual project application scenarios. In this regard, SunDog has left them far behind.

In addition, SunBot has repurchased and destroyed all the SunDog tokens with the proceeds in September, and the repurchase and destruction in October is still ongoing. This move by SunDog clearly conveys to the market the firm determination and confidence of the project party in the development of the project, which will create more value and development opportunities for investors and users.

Celebrity effect: SunDog breaks through the circle again

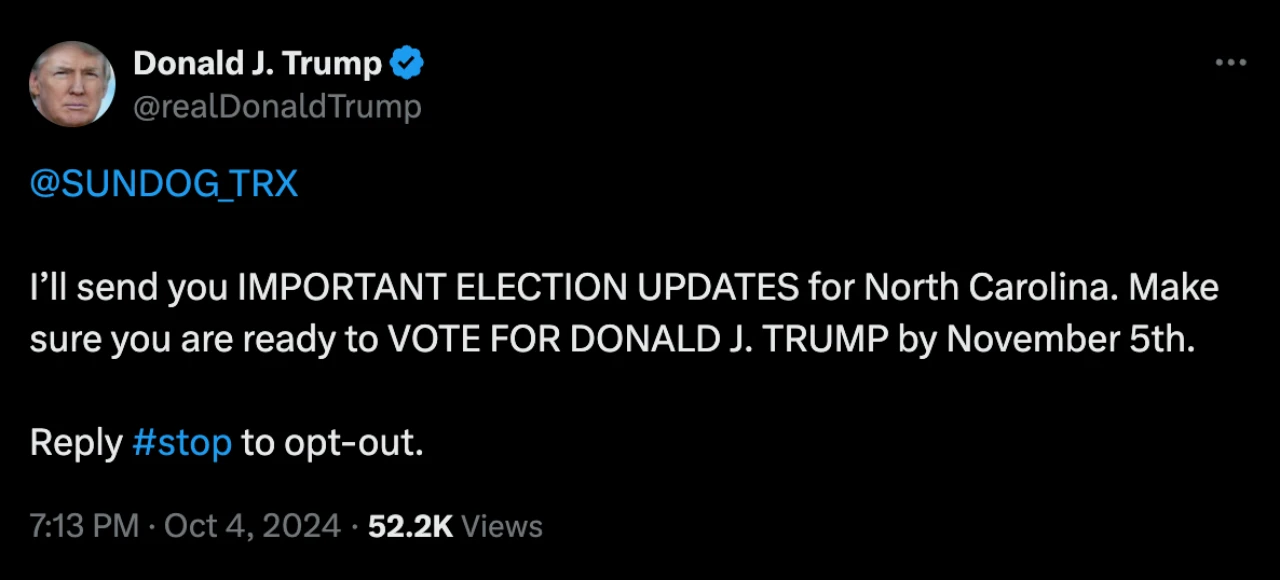

SunDogs market popularity comes not only from the inherent strength of its projects, but also from the celebrity effect, which has brought it more exposure and attention. Just a few days ago, Trump posted a message to interact with SunDog, which brought it super high exposure and topic discussion.

(Source: https://x.com/realDonaldTrump/status/1842161227910262886 )

On October 8, Ty Dolla $ign (@tydollasign), a famous American rapper, completed a highly watched transaction on SunSwap V3. He exchanged more than 3.2 million TRX worth US$500,000 for more than 1.66 million SunDogs, and posted a message to support SunDog and expressed his appreciation for its development potential.

Unexpectedly, Ty Dolla $ign mistakenly sent all these tokens to the wrong contract address and destroyed them all. In response, Justin Sun quickly responded and posted a message saying that he would support Ty Dolla $igns mistake. He gave Ty Dolla $ign TRX worth $500,000 and encouraged him to continue to buy SunDog. Currently, Ty Dolla $ign has used this TRX to repurchase SunDog.

Conclusion

SunDog is rapidly emerging as a leader in the meme track with its outstanding market performance, balanced distribution of holdings and practical application scenarios. With the strong support of the TRON ecosystem, SunDog not only has a deep community foundation, but also is expected to become a meme project that top trading platforms focus on as its market influence continues to increase.