The first crypto-friendly Trump moved into the White House, and market sentiment was high. BTC prices fluctuated around $68,000, quickly broke through the $70,000 resistance level and reached a new high. The crypto market is volatile. How can investors seize the bull market opportunity to obtain long-term stable or even enhanced returns while effectively protecting the principal? Matrixport has dug deep into user needs and launched structured wealth management products suitable for various market conditions, different investment groups, and multiple investment needs. This article will review Matrixports structured wealth management products one by one to help investors quickly locate wealth management products that are suitable for them!

1. Shark Fin: Predict the price range of the underlying asset to obtain excess returns, and short-term volatility is preferred

Shark Fin is a structured financial product with cost protection and stable returns, designed to increase investors returns during market fluctuations. Investors who purchase this product have the opportunity to earn high returns of 100.75% (real-time data as of 2024-11-07, for reference only) while enjoying the basic annualized return. It is suitable for investors with low risk preferences who want to obtain enhanced returns.

Currently, Matrixport Shark Fin supports USDT, BTC, and ETH investments; and supports 7-day, 14-day, 30-day, and 90-day investment cycles.

Applicable scenarios

Shark Fin is suitable for low-risk users who want to obtain returns that exceed the market average. When the market fluctuates in the short term, investors who want to increase their returns during the fluctuation period can choose Shark Fin to judge the currency price range and gain enhanced returns. If the price of the underlying asset is within the underlying price range when the Shark Fin product expires, the user can obtain the increased return; if it exceeds the price range, the user will obtain the guaranteed return. It is suitable for investors with low risk tolerance who want to obtain enhanced returns during fluctuations.

Example

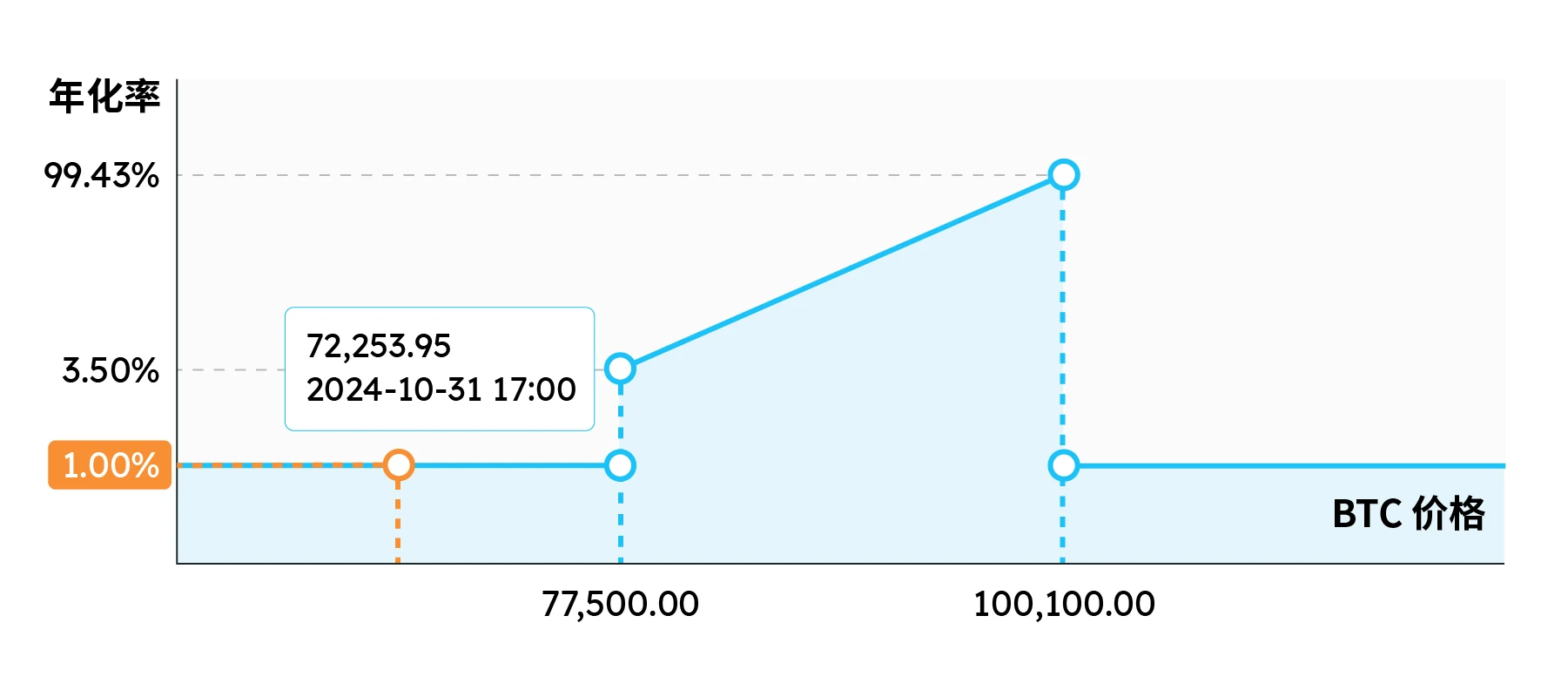

Assume that A believes that the price of BTC will fluctuate between $77,500 and $100,100 in the next few days, but will eventually stabilize at a price within this range. A holds 10,000 USDT and purchases the USDT-BTC bullish shark fin product.

The product expires in 7 days, the annualized rate is 1% – 99.43%, and the pegged price is $ 77,500 – $ 100,100.

When the product expires, user A may face the following situations:

If the settlement price is $100,000 at maturity, the final profit = 189.92 USDT (10,000*99.03%*7/365). When $77,500 < settlement price < $100,100, investors will receive an APY of 1% – 99.43%. Within this price range, the closer the settlement price is to $100,100 (not equal to $100,100), the higher the profit will be.

If the settlement price is ≤ $77,500 or ≥ $100,100 at maturity, User A will receive 1% of the base APY, and the final profit = 1.91 USDT (10,000* 1% * 7 / 365)

2. Trend Intelligence: Predict the markets ups and downs to gain enhanced returns, and make more profits in one-way market

Trendy Profit is a cost-protected structured financial management. Users do not need to accurately predict the market, they can get high returns if they guess the direction correctly, and they can also get guaranteed returns if they guess the wrong direction. Currently, Matrixport Trendy Profit supports USDT, BTC, and ETH investments; it supports 7-day, 14-day, 30-day, and 90-day investment cycles.

Applicable scenarios

Trendy Smart Profit has more advantages in the unilateral market because it cancels the unilateral knock-out mechanism. Even if the market price continues to rise or fall unilaterally, the profit will not be reduced due to the knock-out. This design makes Trendy Smart Profit perform better in a strong unilateral market environment and can flexibly capture unilateral market trends. It is especially suitable for investors who have clear expectations for future trends.

Example

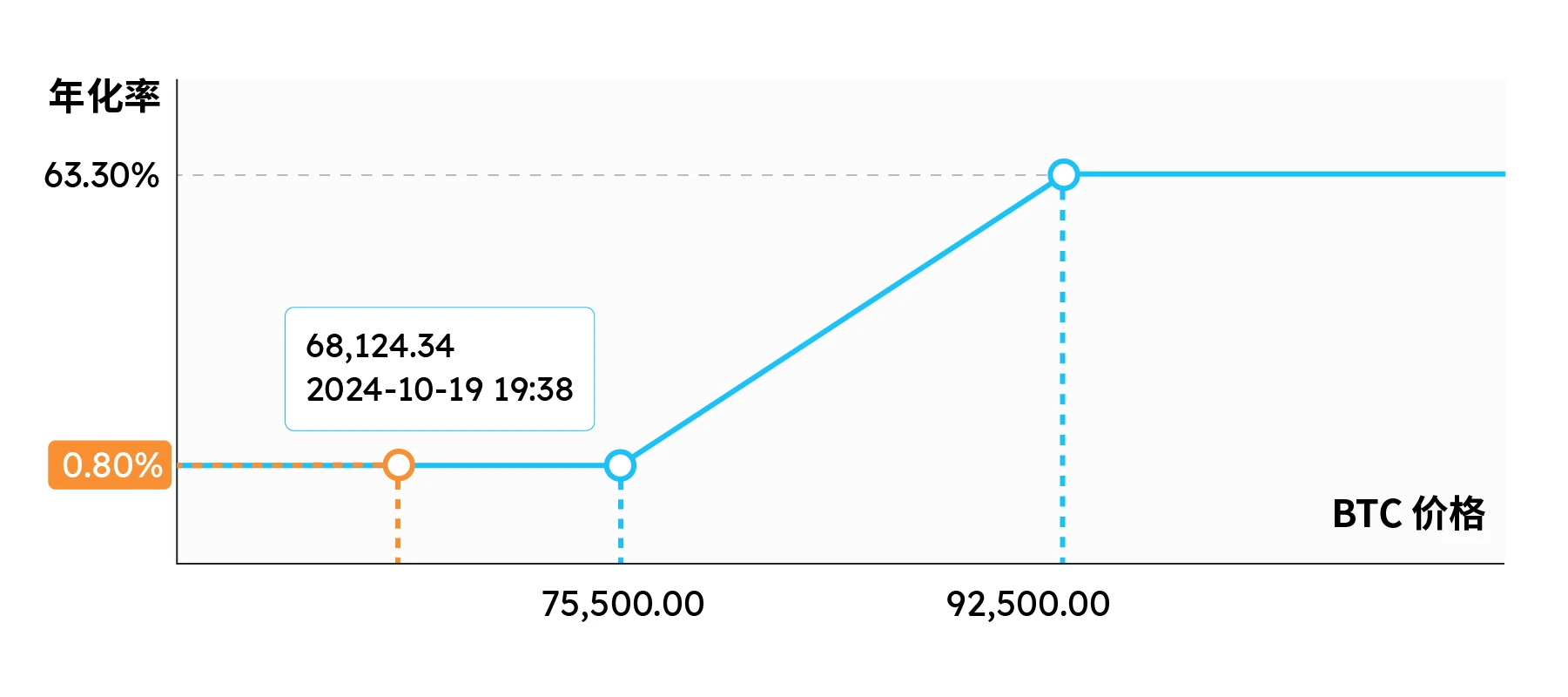

Assume that A believes that the price of BTC will continue to rise in the next few days, and that the rising range will be between $75,500 and $92,500. A uses 10,000 USDT to purchase the BTC bullish trend Zhiying product, which expires in 7 days and has an annualized rate of 0.8% to 63.3%, with a price range of $75,500 to $92,500.

When the product expires, user A may face the following situations:

If the settlement price after expiration is $100,000, which exceeds $92,500, the subscriber will enjoy the highest APY, i.e. 63.3%, regardless of the actual price. The final income = 121.37 USDT (10,000* 63.3% * 7 / 365);

If the settlement price after expiration is $80,000, between $75,500 – $92,500, A will enjoy enhanced APY in proportion to the difference between the BTC settlement price and $75,500. The final profit = 33.25 USDT (10,000* 17.34% * 7 / 365)

If the settlement price after expiration is $70,000 and falls below $75,500, A can enjoy the guaranteed 7-day 0.8% APY income, and the final income = 1.53 USDT (10,000* 0.8% * 7 / 365);

3. Snowball: Long-term volatile market, sustainable amplification and enhanced returns

As a classic structured product, Snowball can capture more profits in a volatile market. Snowball has a knock-in price and a knock-out price. As the name suggests, when the Snowball product purchased by investors fluctuates between these two prices, the profits will be like a snowball rolling in the snow, rolling more and more.

Matrixport’s “Snowball” product currently offers USDT bullish snowball, BTC bullish snowball, BTC bearish snowball, ETH bullish snowball, and ETH bearish snowball; investment supports 7-day, 14-day, 30-day, 90-day and 180-day investment cycles.

Applicable scenarios

Snowball is suitable for investors who have a certain risk tolerance and have clear expectations for market trends. When the market continues to fluctuate, Snowball can capture more profits. It is worth noting that Snowball will convert currencies when the underlying asset breaks through the protection price. Investors can flexibly settle according to actual conditions to avoid asset losses.

Example

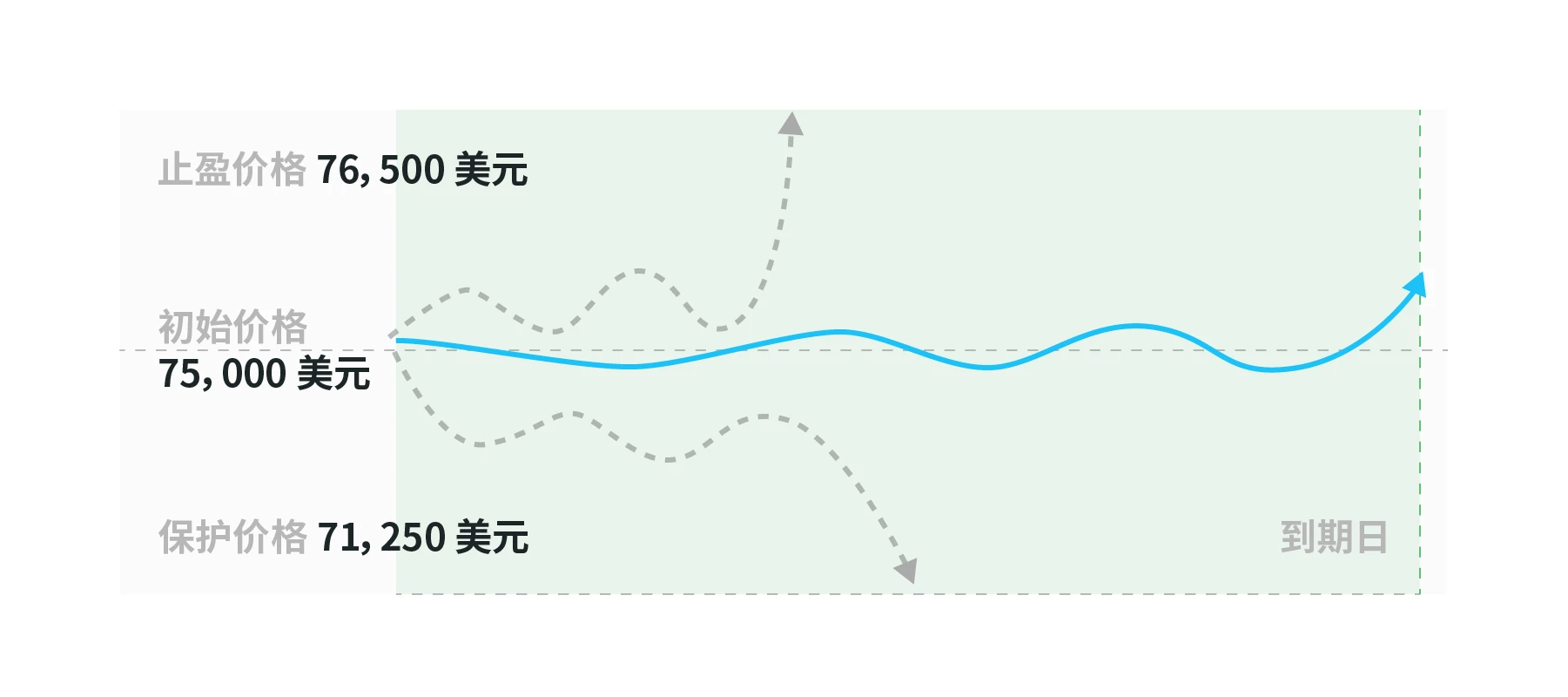

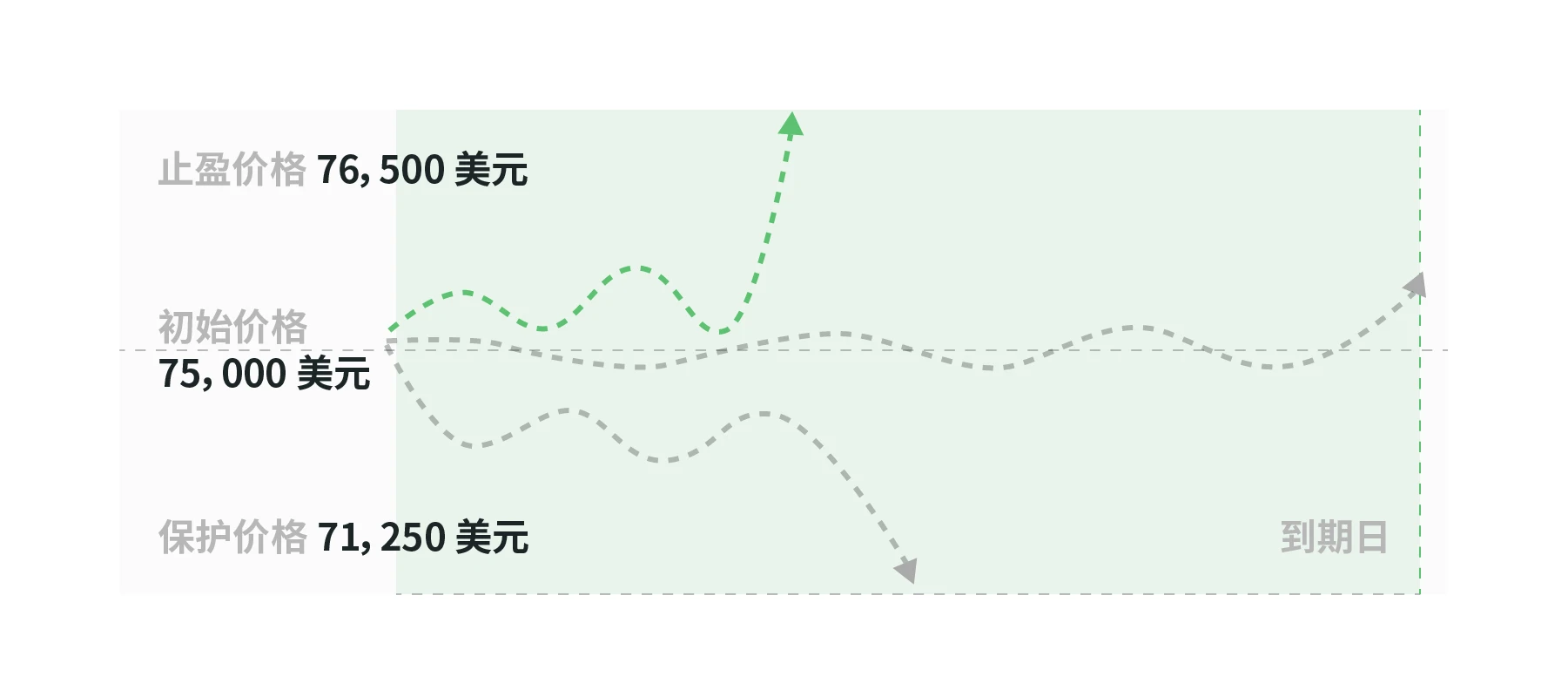

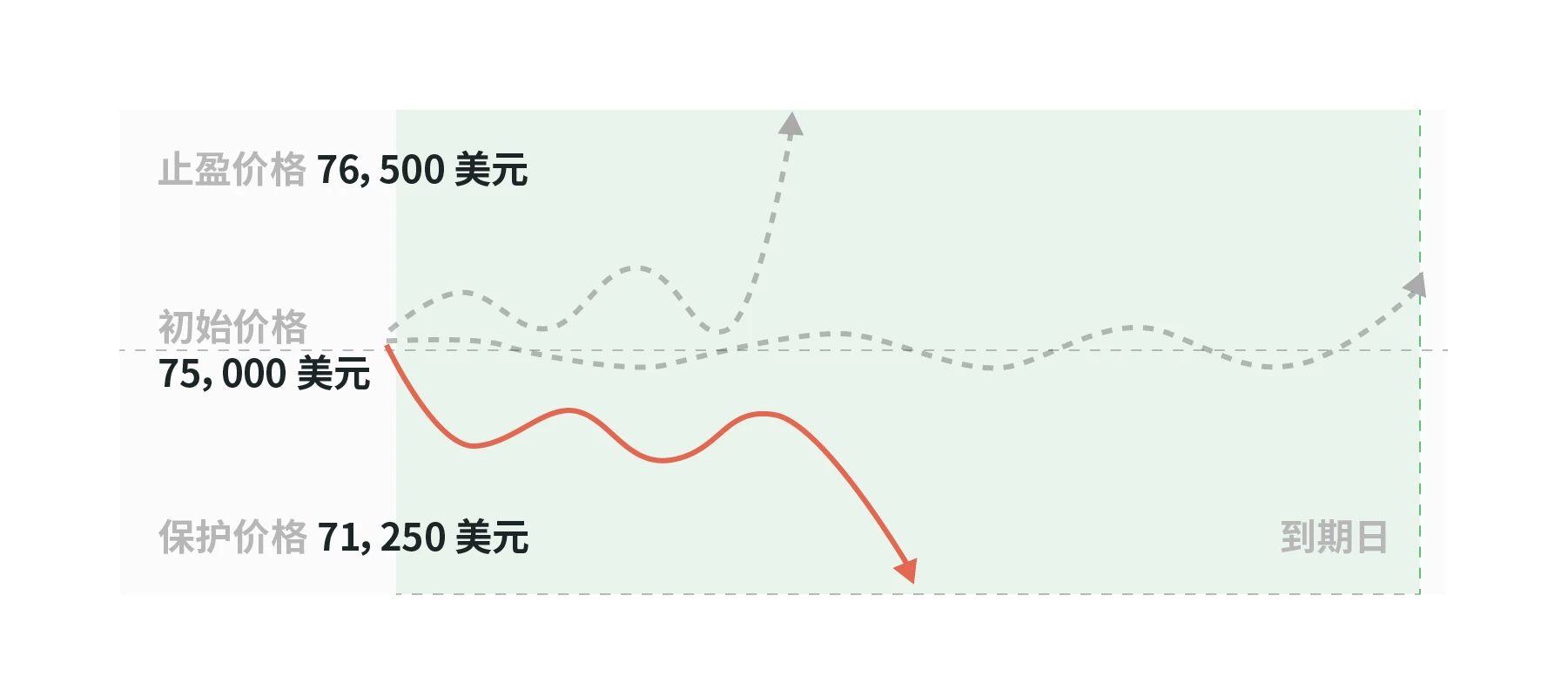

Assume that A believes that the price of BTC will fluctuate in the future, and there is a certain probability that it will rise during the fluctuation. A uses 10,000 USDT to purchase the BTC bullish Snowball product. The product expires in 7 days, the annualized rate is 92.59%, the current price of BTC is $75,000, the take-profit price is $76,500, and the protection price is $71,250.

When the product expires, user A may face the following situations:

If the BTC settlement price is $70,000 at expiration, $71,250 < settlement price < $76,500, and no knock-in or knock-out events occur, the product expires successfully and is settled in USDT, A can obtain a profit = 177.56 USDT (10,000* 92.59% * 7 / 365)

If the product is running, on the third day, the BTC observed price is $77,000, and the observed price is ≥ $76,500, triggering a knock-out event and taking profit in advance, the product will be settled in advance in the currency standard, and A can get a profit = 76.1 USDT (10,000* 92.59% * 3 / 365)

If the product is running, if the BTC observed price is $70,000 on the third day, and the observed price is ≤ $71,250, the knock-in event is triggered. The investors settlement assets will be converted into currencies and settled in BTC at a price of $70,000. In the end, A will receive a return of 0.104 BTC [(10,000*(1 + 92.59% * 3/365)]/70,000]

4. Dual Currency: Buy low and sell high, a short-term volatile market tool

Dual Currency Investment involves two currencies, and the investment directions are divided into sell high and buy low. Generally speaking, if you choose sell high, you need to use the corresponding currency to buy, and if you choose buy low, you need to use USDT/USDC to buy. However, there are exceptions, such as Matrixports ETH/BTC product, you need to invest in ETH if you choose sell high, and invest in BTC if you choose buy low.

Reasonable use of dual currencies can meet users needs for profit taking, bottom hunting, and currency hoarding. Dual Currency Investment is a non-principal-guaranteed but fixed-rate financial product. The rate of return of the product is clear and fixed at the time of purchase, but the settlement currency is uncertain. When the product expires, the settlement currency depends on the comparison between the settlement price and the linked price at expiration.

Matrixport’s “dual-currency investment” product supports 12 assets including BTC, ETH, ARB, BCH, BNB, ORDI, OP, etc.; the investment period is wide, supporting a wide range of investment cycles from 0.1 to 287 days.

Applicable scenarios

Choosing to sell high is equivalent to selling a call option, and choosing to buy low is equivalent to selling a put option. Dual Currency Investment is suitable for investors who have clear expectations for the current market trend to earn additional returns on the currency standard, and they can buy or sell when the linked price is reached without any transaction fees.

For example, if investors believe that the market will fluctuate in the future, they can choose a dual-currency product with a suitable period and the price will fluctuate between the upper and lower thresholds, then investors can obtain higher returns; if investors believe that the future will enter a stage of short-term decline and subsequent recovery, choosing a buy low product with a suitable period can not only buy at a lower price, but also obtain APY returns; if users believe that the market will rise and fall, choosing a sell high product has the opportunity to realize high-point profit.

Example

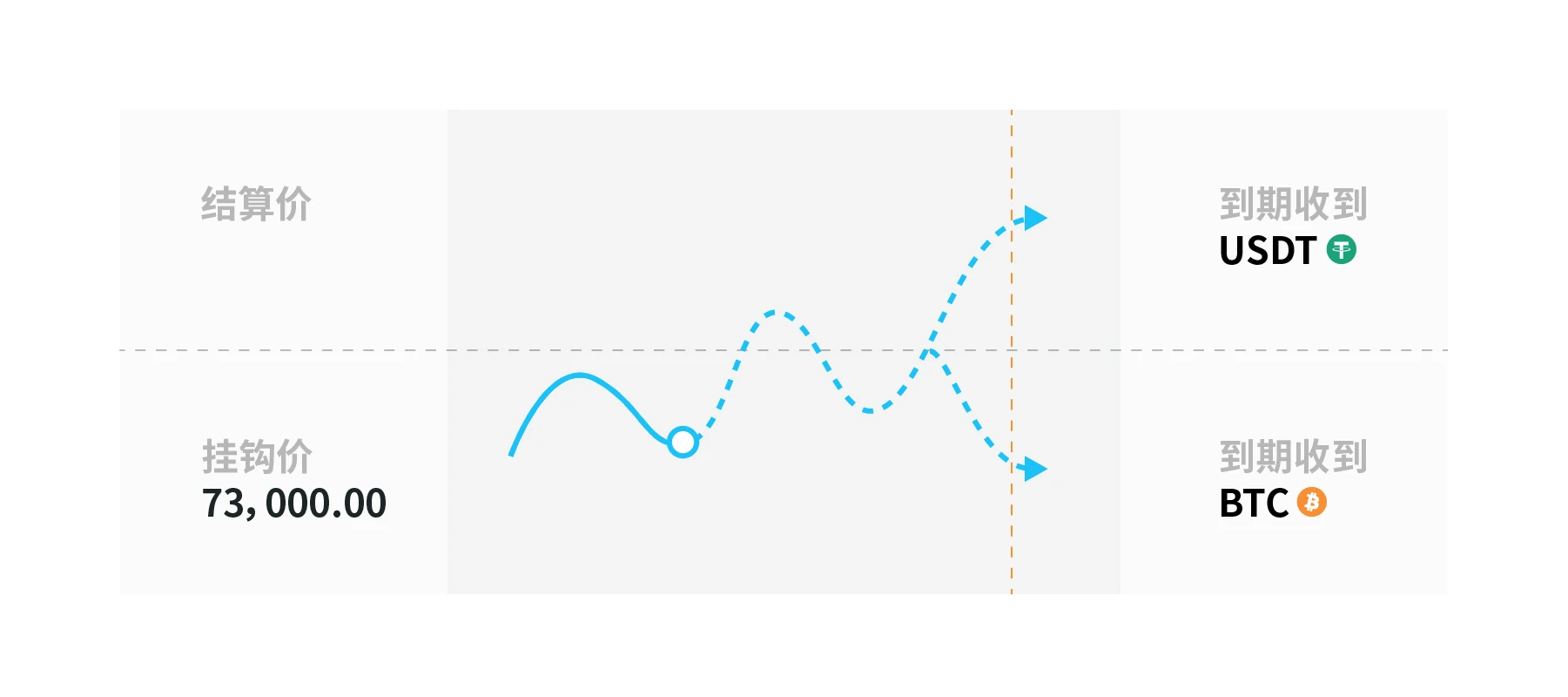

Assume that user A believes that the price of BTC may rise slightly in the short term, and hopes to earn additional currency-based income through dual-currency investment while selling BTC at a high point, but A is unwilling to pay any transaction fees. A can use 1 BTC to subscribe for a BTC dual-currency product, which expires in 15 days, has an annualized rate of 96%, and a pegged price of $73,000.

When the product expires, user A may face the following situations:

If the settlement price is $100,000 at maturity and the settlement price is ≥ $73,000, Dual Currency will sell the invested BTC principal and the BTC profit at $73,000 and settle the profit in USDT. As final profit = 2,880 USDT (1*73,000*96%*15/365)

If the settlement price is $70,000 at maturity, and the settlement price is less than $73,000, Dual Currency will settle the proceeds in the form of currency standard, and A will eventually receive = 1.039 BTC [1*(1+ 96% * 15 / 365)]

5. Seagull: Earn profits even in uncertain market conditions

Similar to the Seagull Option in traditional finance, Seagull is composed of three common option strategies with the same expiration date. In laymans terms, Seagull is a dual-currency product with a special structure and has a similar risk structure to dual-currency. However, in terms of income structure, Seagull solves the pain point of traditional dual-currency products that are prone to missing out on income in a unilateral market, and can amplify income in a unilateral market.

Matrixport’s “Seagull” product supports BTC, ETH, and USDT; the cycle span can meet the needs of different customers.

Applicable scenarios

Seagull has a wide range of usage scenarios, whether it is a volatile market, a sideways market or a unilateral rise. When users are uncertain about the future price trend, they can try Seagull to lock in the expiration income. As long as the price does not reach the conversion price at expiration, there will be no asset conversion. If the unilateral market continues in the future, users can obtain high enhanced income.

Example

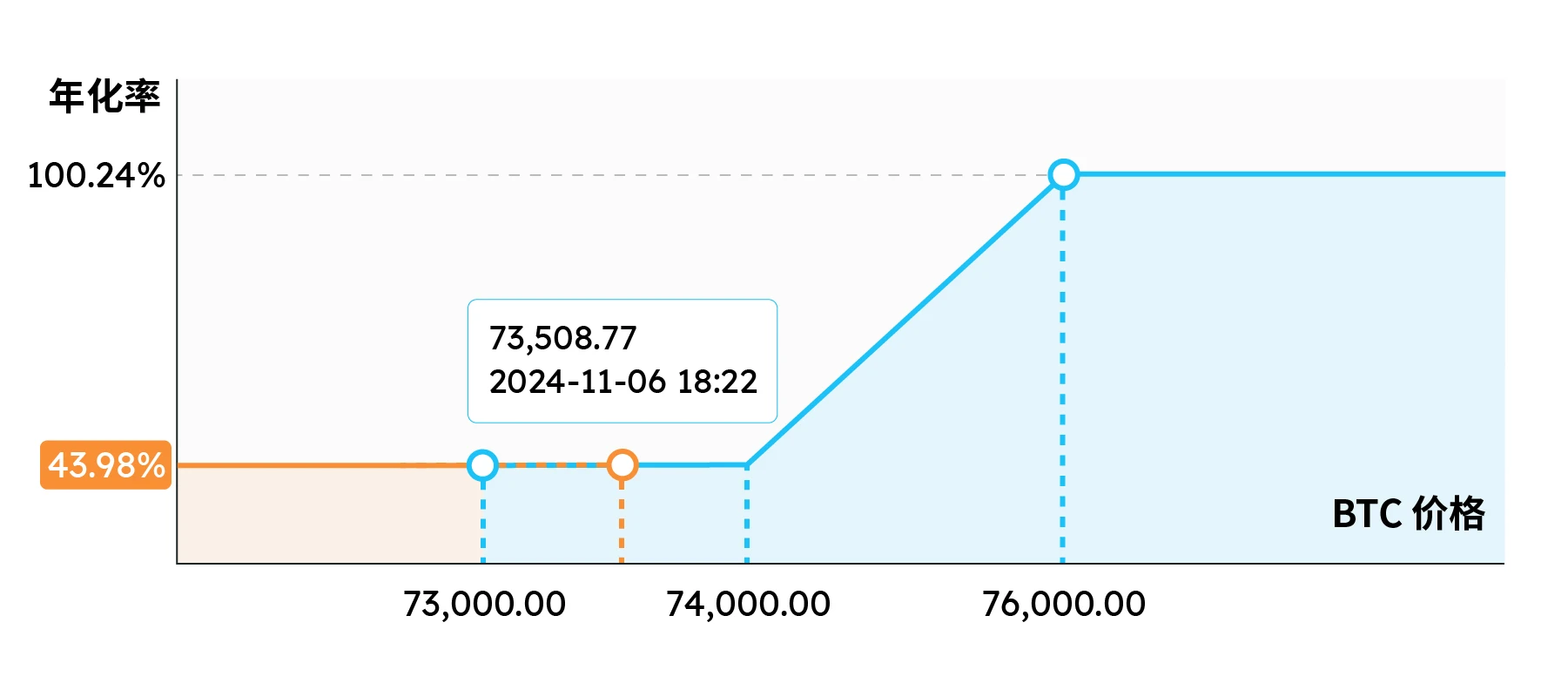

Assume that A believes that the price of BTC will fluctuate and rise in the future, and hopes to earn additional currency-based income. A uses 10,000 USDT to purchase BTC bullish Seagull products. The product expires in 15 days, with an annualized yield of 43.98% ~ 100.24%, a conversion price of $ 73,000, a base price of $ 74,000, and a maximum price of $ 76,000.

When the product expires, user A may face the following situations:

If the settlement price is $100,000 at maturity and the settlement price is ≥ $76,000, the maximum APY will be 100.24%. As final return = 411.94 USDT (10,000* 100.24% * 15 / 365)

If the settlement price is $75,000 at maturity, when $74,000 < settlement price < $76,000, the return will be between the base 43.98% APY and the maximum 100.24% APY. As final return = 296.25 USDT

If the settlement price is $73,500 at maturity, when $73,000 < settlement price ≤ $74,000, the basic 43.98% APY will be obtained. As final income = 180.73 USDT (10,000* 43.98% * 15 / 365)

If the settlement price is $70,000 at maturity, and the settlement price is ≤ $73,000, the user will receive an annualized return of 43.98% and buy BTC at $73,000. In the end, A will receive = 0.1394 BTC [10,000 *(1 + 43.98% * 15 / 365)] / 73,000

6. Installment Purchase: Buy first and pay later, lock crypto assets in installments

Installment Purchase is a crypto derivative of the traditional financial product Installment Payment Warrant, which is the first launch of Matrixport in the industry. Investors can use the installment payment method to lock in the potential returns of crypto assets in advance and improve the utilization rate of funds. Currently, the installment purchase supports a maximum leverage of 10 times, and there is no need to add margin to avoid liquidation.

Matrixport’s “Installment Purchase” product supports BTC, ETH, USDT, and supports a wide range of investment cycles from 0 to 365 days.

Applicable scenarios

Installment purchase is suitable for investors who want to maintain long-term exposure to cryptocurrencies such as BTC. Investors only need to make a low down payment to purchase cryptocurrencies such as BTC through installment payments, and enjoy the potential rising returns of holding the underlying assets in advance, while maintaining long-term market exposure. At maturity, investors can choose to pay the balance and take physical delivery to obtain cryptocurrencies such as BTC; or they can choose not to pay the balance and use cash settlement or automatic renewal.

Revenue Mechanism

Assume that user A wants to buy BTC, but is worried about the large price fluctuations after holding the spot and causing financial losses. The user can use installment purchase to lock in a certain amount of BTC future income by paying a certain percentage of the down payment.

If the real-time price of BTC is $75,961, A purchases an investment with an investment period of 84 days, a down payment of $14,941, a balance of $68,000, and an expiration date of January 31, 2025.

After the product expires, User A can choose the following methods to settle. When the product expires, User A can choose to pay or not pay:

Pay the final payment of $68,000 and receive 1 BTC. Since the down payment and final payment amounts are fixed, investors will be able to gain benefits from the difference in BTC prices during the holding period;

If you do not want to pay the balance immediately, you can choose to use the current maturity settlement price as the down payment for the next installment purchase product and automatically renew the investment to maintain market exposure.

Not paying the $68,000 balance and settling the installment product with the cash value of 1 BTC at maturity.

The cash value settlement formula is as follows:

Cash value = Max {0, [(settlement price - balance) / settlement price] * purchase quantity}

Note: The minimum cash value is 0, which means that even if the price of the underlying asset drops sharply, the investor’s maximum loss is only the down payment, and there will be no negative cash value.

The above content does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy to residents of the Hong Kong Special Administrative Region, the United States, Singapore, and other countries or regions where such offers or solicitations may be prohibited by law. Digital asset trading may be extremely risky and volatile. Investment decisions should be made after careful consideration of personal circumstances and consultation with financial professionals. Matrixport is not responsible for any investment decisions based on the information provided in this content.