Original author: Michael Saylor

Original translation: Felix, PANews

Microsoft plans to vote on a proposal to evaluate investment in Bitcoin at its annual meeting on December 10. If the proposal is passed, Microsoft will become the largest publicly traded crypto investment company, surpassing MicroStrategy and Tesla. When the vote began, Michael Saylor gave a 3-minute speech at the Microsoft board of directors, explaining why Bitcoin should be adopted. In the speech, Michael Saylor proposed that Bitcoin represents digital capital, is the core opportunity of the next wave of technological innovation, and represents the greatest digital transformation in the 21st century. He suggested that Microsoft adopt Bitcoin as a core corporate strategy. The following is a part of the essence of the PPT used in the speech:

Here are seven next-generation technology trends that Microsoft can’t afford to miss:

PC

Graphical User Interface

internet

Mobile computing

cloud computing

AI

Digital Capital

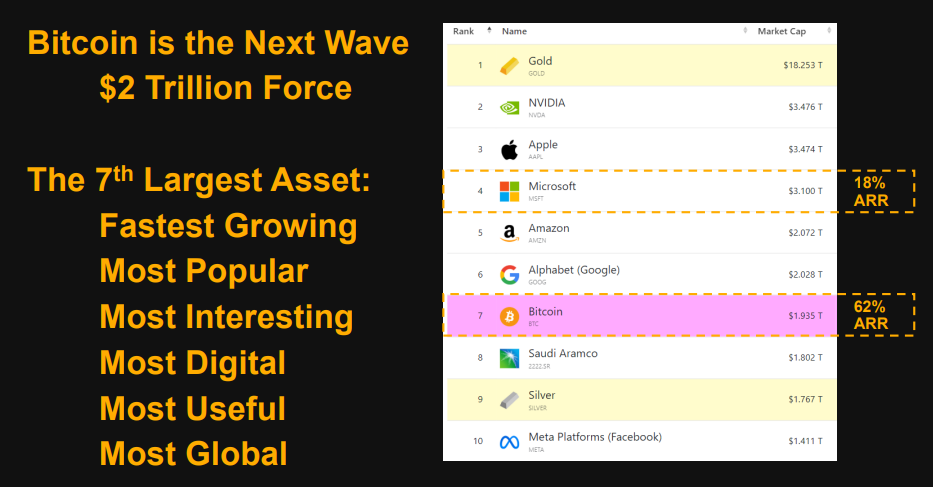

The biggest digital transformation in the 21st century is the transformation of capital, and Bitcoin is digital capital. Bitcoin is currently the seventh largest asset in the world, with the fastest growth, most popular, most interesting, most digital, most useful, and most global. In addition, Microsofts current ARR (annual recurring revenue) is 18%, while Bitcoins ARR is 62%.

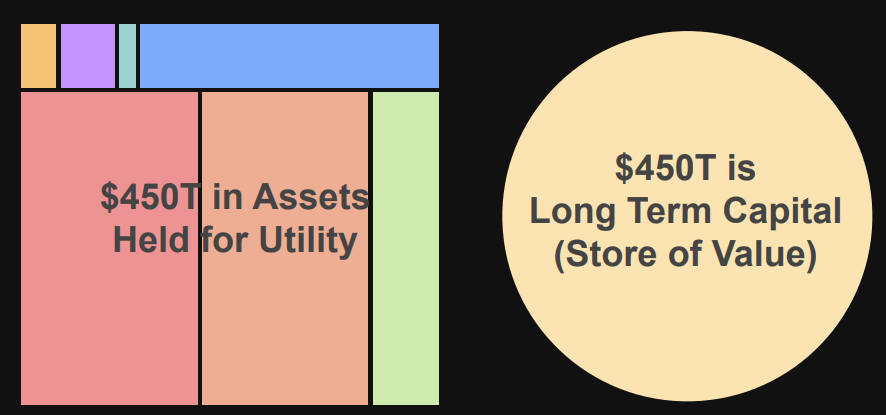

Currently, global wealth is distributed among various assets. In the current global asset market of about 900 trillion US dollars, the market value of Bitcoin is about 2 trillion US dollars.

Global wealth is distributed between assets that provide utility and other assets that preserve capital. Of this, $450 trillion is long-term capital (store of value). However, more than $10 trillion of assets are lost each year due to risk factors such as regulation, taxation, competition, obsolescence, economic and political chaos, and crime.

Digital capital is economically and technologically superior to physical capital, and long-term capital is being transformed into digital capital (Bitcoin). Bitcoin offers advantages similar to owning a building, but without the obvious, fixed liabilities of an asset. For example: no taxes, no need to consider traffic, tenants, torts, weather factors, building corrosion, and regulators. In contrast, Bitcoin is intangible, indestructible, permanent, teleportable, programmable, divisible, convertible, and configurable.

It can be said that Bitcoin is a revolutionary advancement in capital preservation.

original

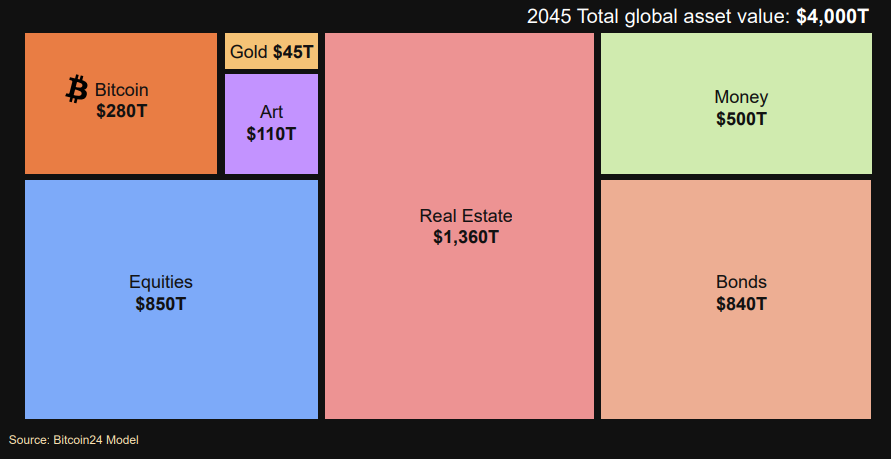

Additionally, Bitcoin’s market capitalization is expected to grow from the current $2 trillion to $280 trillion by 2045, surpassing traditional assets such as bonds and gold.

At the same time, Bitcoin is secured by digital, political and economic forces. The current Bitcoin network computing power exceeds 750 Exahash, there are 622 million crypto users, and 400 million Bitcoin holders.

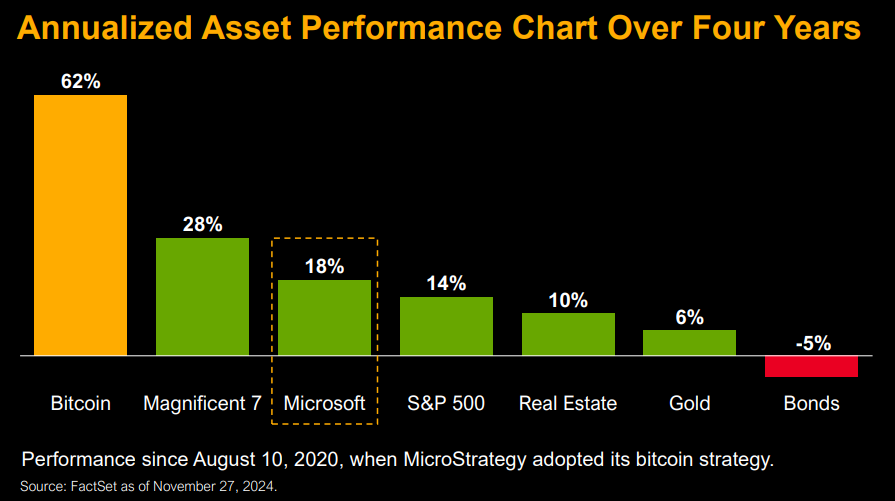

Based on a four-year annual asset performance chart, Bitcoin is the best performing non-correlated asset on corporate balance sheets.

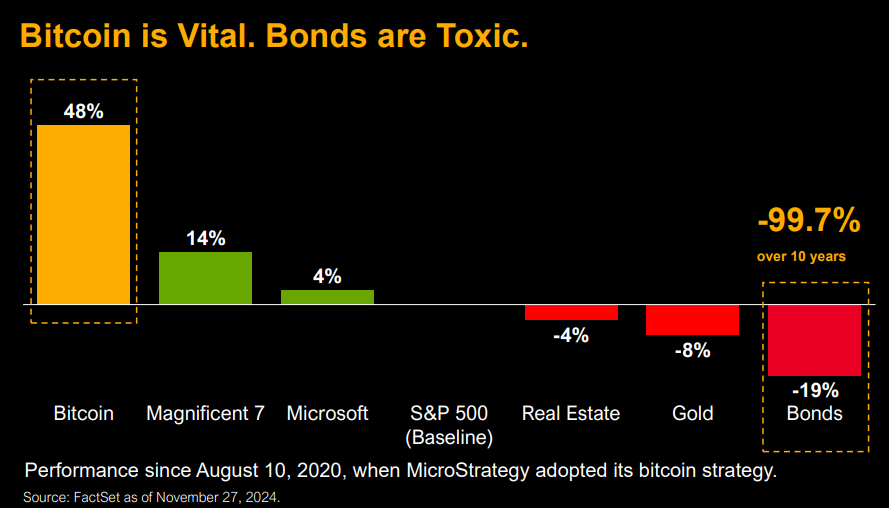

MicroStrategy Bitcoin strategy performance since August 10, 2020

Bitcoin’s annual performance is 10 times higher than Microsoft’s, while bonds are performing even worse.

MicroStrategy Bitcoin strategy performance since August 10, 2020

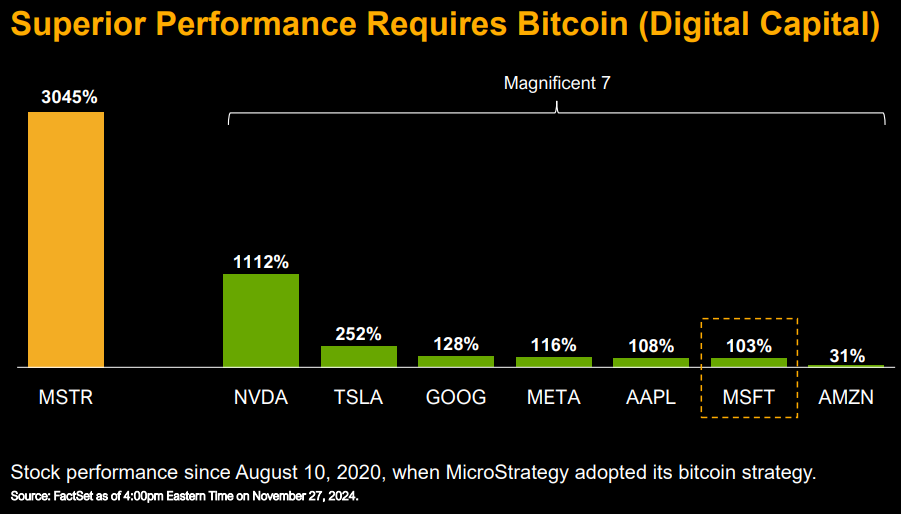

The outstanding performance of corporate stocks is inseparable from Bitcoin (Digital Capital). Since MicroStrategy adopted the Bitcoin strategy on August 10, 2020, MicroStrategys stock price has risen by 3045%, while Microsofts (MSFT) stock price has only risen by 103%.

MicroStrategy Bitcoin strategy performance since August 10, 2020

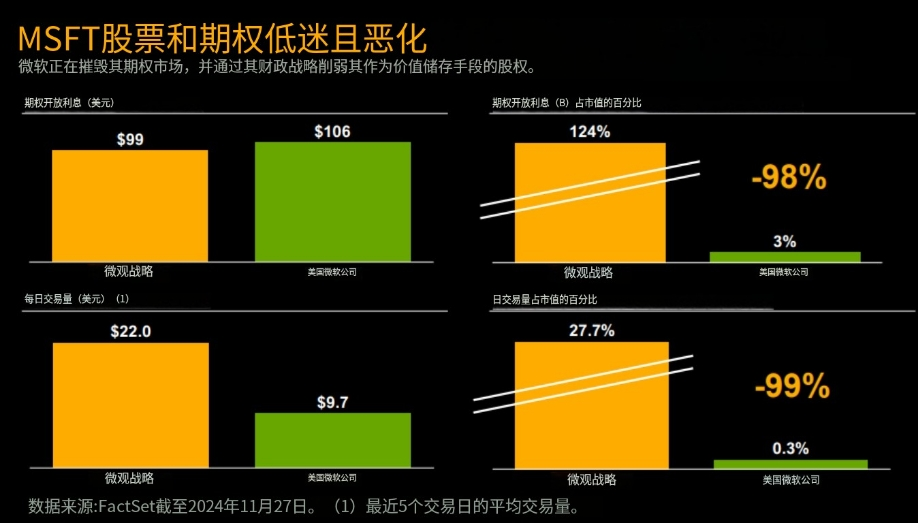

Additionally, MSFT (Microsoft) stock and options are weak and deteriorating (Microsoft is cutting into the options market and stock as a store of value through its financial strategy).

Today, Bitcoin has become an institutional asset and has now become a viable alternative to public company bonds. The number of public entities holding Bitcoin has surged:

In addition, a wave of political support for Bitcoin is surging, with endorsements from the government, Wall Street and many well-known politicians, including the White House, the Senate, the House of Representatives and Wall Street, including Donald Trump, JD Vance, Robert Kennedy, Howard Lutnick and Musk. At the same time, support for the US strategic Bitcoin reserves is also surging, with Trump once saying: Never sell your Bitcoin.

2025 will be the first year of a full cryptocurrency renaissance. It is expected that:

Wall Street adopts ETFs

FASB Fair Value Accounting

There are more than 250 cryptocurrency supporters in Congress

Bitcoin Strategic Reserve Act

Repeal of SAB 121

Ending the legal war on cryptocurrencies

Digital Asset Framework

In this case, Microsoft has to make a choice:

Holding on to the past: Traditional financial strategies based on Treasury bonds, buybacks, and dividends

Embracing the Future: Innovative Financial Strategies Based on Bitcoin as a Digital Capital Asset

Backsliding: $100 billion in buybacks per year increases investor risk and slows growth

Progress: Investing $100 billion per year, reducing investor risk and accelerating growth

Microsoft has repurchased $200 billion of capital in five years.

Buybacks and dividends amplify Microsofts risk factors, and Bitcoin is the best way to get out of this vicious cycle. As an asset, Bitcoin has no counterparty risk of competitors, countries, companies, creditors, culture or currency. It is recommended that Microsoft seize this opportunity of the times and take a leading position in global digital financial innovation.