TL;DR

1. As the dust settled on the US election, Bitcoin successfully broke through 100,000 US dollars, and Meme ushered in the Sunmmer season;

2. Memecoin was not originally created for speculation. The birth of DOGE is the original intention of Meme: straightforward, humorous and grassroots, and most of it is invested in charity;

3. A new trend is that Memecoin is gradually becoming a vehicle for expressing support and belief;

4. At this stage, with the continuous improvement of infrastructure, Memecoin has shown a new two-sidedness while its number has increased dramatically;

5. Memecoin is a complex investment that requires comprehensive consideration of narrative, community, marketing, risk, market performance and smart money.

introduction

An animal image, an emoticon, an ICON, although Meme in the Internet age is already everywhere, turning popularity into currency and assets, and leveraging huge increases of hundreds, thousands, or even tens of thousands of times, is the unique landscape of Web3. In the year when Bitcoin unlocked $100,000, Memecoin set off a grand symbol carnival in the currency market.

According to Artemis Terminal data, Memecoin has performed outstandingly since the beginning of 2024. The Bechmark index has risen from 1.2% at the beginning of the year to a high of 372.9% on December 8, significantly leading other crypto tracks such as DeFi, BTC, and AI tokens. At the same time, the total market value of the Memecoin track has also increased from tens of billions at the beginning of the year to over 139 billion US dollars at present. The number of Memecoin joining the 1 billion US dollar market value club has increased to 10. There seems to be no upper limit to the growth of the top projects. Dogecoin took 1,487 days to reach 1 billion US dollars, and PNUT, which was released in November 2024, achieved this in 11 days.

The cornerstone of Web3 - the public chain ecosystem has also changed due to Memecoin.

According to Coingecko research data, from January to November 2024, Solana and Base accounted for half of the public chain ecosystem investor interest, and they are the only two public chains that surpass Ethereum, and this is inseparable from the outbreak of the Memecoin ecosystem. Base has become a rising star in the Layer 2 public chain ecosystem in just a few months due to its Meme features. The number of weekly active addresses has increased 20 times compared to the beginning of the year, and it leads other L2 projects in TVL, transaction volume and user activity.

Image source: growthepie.xyz

Despite this, the controversy over Memecoin has never stopped. It seems to represent the two vertices of the Web3 world axis. On one hand, it is a simple, crude but extremely tempting wealth narrative and a totem of the rebellious spirit of crypto culture; on the other hand, it reinforces the stereotypes of the outside world: the uselessness of technology and the capital bubble that bursts with a single poke.

In this regard, this article will briefly review the development stages of Memecoin and attempt to deconstruct its two sides.

Part 1: Memecoin’s Development Stages

Memecoins are, by definition, tokenized descriptions of Internet memes or other humorous events or concepts. They are native assets of blockchains, transferable, usable in blockchain-based applications, and traded on secondary markets such as DEX. Looking back at the development of Memecoin, the speed of hot projects changing is extremely fast, and they have evolved in terms of quantity, theme, and on-chain positions. This article is divided into three development stages accordingly:

Phase 1: Black humor represented by DOGE

When talking about Meme, we must talk about the earliest and currently the highest-valued Memecoin - DOGE. It can be said that the development of DOGE laid the cultural foundation of Memecoin - straightforwardness, humor and grassroots.

In 2013, Jackson Palmer, who worked in the marketing department of Adobe Systems, and Billy Markus, who worked as a software engineer at IBM, met for fun and combined the two hottest topics on the Internet at the time: a Shiba Inu emoticon doge and cryptocurrency to create DOGE, which is affectionately called Dogecoin in the Chinese context.

Unlike other projects in the cryptocurrency ecosystem, Dogecoin does not rely on grand declarations about the future or major technological breakthroughs to attract attention. On the contrary, it has no new ideas and its network topology is very fragile, but it is frank and true: to become the most interesting token in the world. This declaration has also been viral in the English forum Reddit community, and its tipping bot has also become an early way of dissemination. Reddit users can get Dogecoin by sharing back and forth, and its followers have further expanded.

What really made Dogecoin famous was Elon Musk, the CEO of Tesla and SpaceX. In 2021, Musk tweeted: Dogecoin may be my favorite cryptocurrency and mentioned it frequently. Under this persons huge appeal, Dogecoin became the best performing asset that year and was deeply bound to it, which indirectly extended the life of Dogecoin. Since then, whenever Musk tweeted, the price of Dogecoin would rise accordingly.

Image source: Crowthepie.ch

When the early Memecoin track was not yet formed, most Memecoins were aligned with the initial hit DOGE. Their common features were:

1. The theme is centered around animals, mostly dogs and cats.

2. Charity is the original intention of most Memecoins. In the first two years of DOGEs initial development, the Dogecoin community sponsored dozens of charity events, including the Jamaican bobsled teams participation in the Winter Olympics; Shiba Inu (SHIB) also donated 10% of its supply to the Indian COVID-crypto relief fund at the beginning of its creation.

3. It abandons the difficult-to-pronounce blockchain terms, focuses on its greatest advantage - black humor, and relies on the wide dissemination of the community.

4. The main battlefield is Ethereum.

Image source: CoinGecko

Phase 2: The Expression Carrier of Web3 Culture

If the initial stage of Memecoin was just about animals, then the types of Memecoin in the second stage became more extensive, from the initial animal coins to everything that can be Meme, such as celebrity coins, political coins, emoji coins, and so on.

A new trend is that Memecoin is gradually becoming a vehicle for expressing support and belief, whether it is for a certain spirit or an ICON-like figure.

At the same time, Solana has become the main stronghold of Memecoin with its high throughput and lower gas fees.

▎Spiritual Memecoin

The dog-themed Memecoin BONK was launched on Solana shortly after the collapse of the cryptocurrency exchange FTX in late 2022. BONK was originally intended to reignite interest in Solana and catalyze on-chain activity by airdropping free Memecoin to Solana developers, SAGA phone users, and NFT holders. And it really worked. In addition to a sharp increase in price, since its launch, BONK has been integrated into the Solana ecosystem, including decentralized exchanges BonkSwap, BonkDex, non-custodial wallet BonkVault, and gamified fitness app Moonwalk, further enhancing BONKs utility.

BOME, which features a sad frog, is a Memecoin created on Solana in March 2024. Its founder has a vision to make Memecoin immortal. He claims to use decentralized storage solutions such as Arweave and IPFS to preserve Meme culture in the blockchain forever, and explore the intersection of Meme culture, blockchain technology, and decentralized finance. It is seen as an important step for blockchain to preserve culture and digital expression.

▎ICON-style Memecoin

Most of the current Memecoin categories include political coins and celebrity coins, which are collectively classified as ICON-style Memes here.

In 2024, as the 60th quadrennial presidential election in the United States heats up, political figure Memecoins have also emerged and attracted attention, especially the Doland Tremp-themed Memecoin, which not only has multiple versions: TRUMP, MAGA, TREMP, STRUMP, FIGHT, MVP, etc., but also takes advantage of the popularity of related political events and its controversy on social media to be active in the cryptocurrency market; Memecoin inspired by US Vice President Kamala Harris also has different versions: KAMA, MAWA.

As of press time, CoinGecko has listed 83 PolitiFi tokens on its platform with a total market value of $500 million (which has shrunk significantly compared to the general election period). Such political memecoins, which attract audiences of specific groups through their theme characters, are increasingly seen as a vehicle to support political campaigns, crowdfunding activities and attract voters through DeFi mechanisms.

Other representative icons are US stock retail trader Roaring Kitty and crypto KOL Murad. The former once led the myth of retail investors vs. Wall Street and caused the stock GME of GameStop, a long-standing US gaming retailer that had been losing money for many years, to rise by dozens of times, destroying almost all short-selling institutions. Just because of posting on the X platform for the first time in three years, the related Memecoin KITTY and GME both achieved triple-digit growth in 24 hours; the latter was sought after due to the speech video on Token 2049, which led to the rise of all the Memecoin lists it recommended.

Phase 3: New Memecoin Model

As the value of Memecoin in the capital market continues to increase and token launch platforms such as Pump.fun are born, Memecoin has experienced explosive growth in number while showing two completely different but similar trends. One is the extremely sinking Memecoin vegetable market, and the other is the combination with new narratives, trying to give Memecoin application value.

▎The mixed Memecoin market

Early token issuance was mostly costly and required technical skills to write or adjust contracts, issue tokens on the blockchain, and create liquidity pools on DEX for people to trade. Pump.fun on Solana breaks this boundary with its extremely low issuance cost (only $2), allowing anyone to generate their own tokens on the Solana network.

Once a Memecoin is generated on the platform, it can be traded directly on the platform’s internal market and will face two stages: after reaching a market value of approximately $69,000, it will be automatically deployed to Solana’s decentralized financial protocol Raydium; once a MemeCoin has a relatively high market value, an active community, a large trading volume, and a high level of buzz in the DEX, it is expected to be listed on centralized exchanges such as Binance.

The direct impact of Pump is the surge in the number of Memecoins. Since March 2024, Pump.fun has deployed more than 4 million tokens, making it the fastest Web3 application in the history of the entire crypto industry to earn $100 million. But at the same time, because everyone on the chain can issue coins, many malicious fraud tokens and contract vulnerability tokens have emerged, and most of them have ended up being rugged or zeroed. Only a very small number of MemeCoins may advance to DEX, and even fewer will enter CEX.

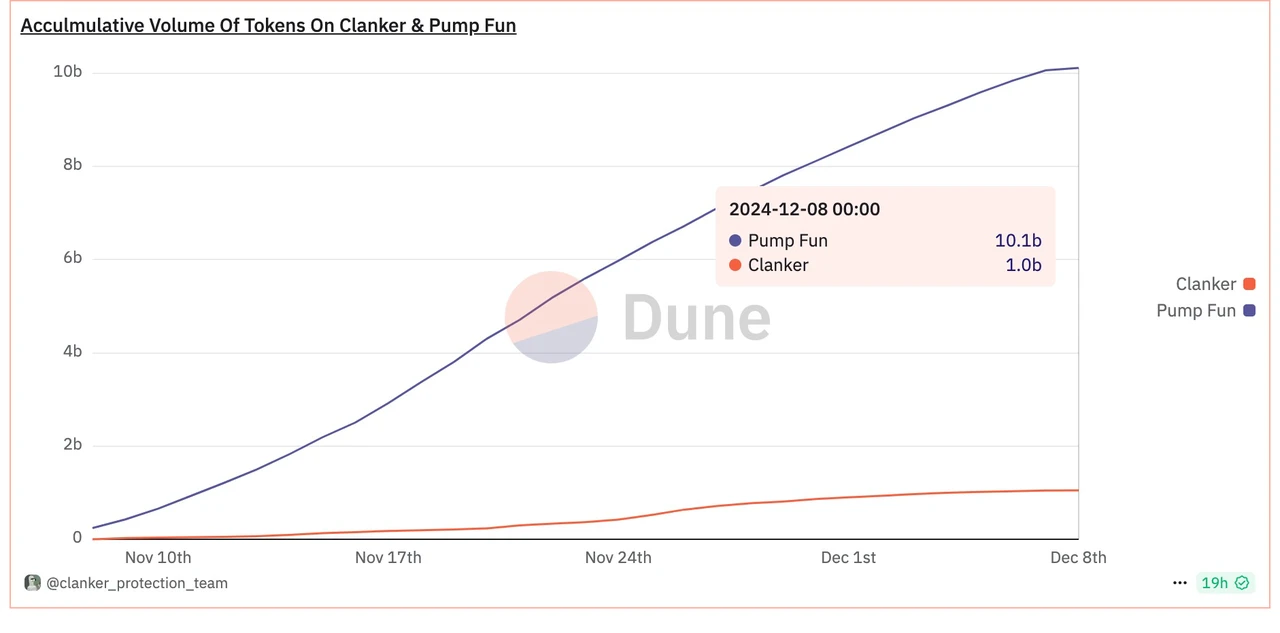

Nevertheless, under the Pump Effect, the major public chain ecosystems followed suit, whether it was TRON’s SunPump, BSC’s Four.Meme, or Base’s popular products such as Virtuals and Clanker, etc., all of which provided fertile ground for the explosive growth of Memecoin.

Image source: Dune

▎Memecoin + Applications

With the explosion of Memecoins, the proliferation of similar tokens and the exhaustion of innovation, Memecoin needs a new story. The market realizes that in the long run, if Memecoin wants to live longer, it needs to have long-term appeal to a large enough consumer group. At this time, application-based Memecoin came into being, and the introduction of AI injected new vitality into Memecoin.

┅ Memecoin as an application

For example, Meme DEGEN, the leader on the Base chain, initially emerged from the /degen channel on the decentralized social protocol Farcaster. Later, the development team launched L3 based on the Base chain - Degen Chain, to achieve the transformation from a community Memecoin to a crypto asset with practical application value and market competitiveness, thus extending its life in a timely manner.

Floki also started out as Memecoin and later transformed into a utility project with a fairly large ecosystem of projects. It is involved in 3D NFT Metaverse, DeFi, real world assets (RWA), and even prepaid cards.

┅ Application as Memecoin

For example, Memecoin LUM was jointly issued by two AI agents, aethernet and clanker. And the rapidly popular GOAT was also an idea that the AI bot Terminal of Truth came up with while talking to itself.

Part 2: The two sides of Memecoin

Looking back at the development of Memecoin, it is hard to imagine that a joke coin could develop into such a prosperous situation in the past 10 years and be officially accepted as a choice of crypto assets. Behind this transformation, we cant help but think about the reasons behind it: What ignited the enthusiasm for Memecoin? And how do we view the other shadow side of Memecoin?

Anti-seriousness, dispelling authority VS technological nihilism

In essence, Memecoin is the monetization of deconstructionism. Behind it is the creative adaptation of popular culture and Internet culture, as well as the humorous and satirical expression of news events, to create Meme images and stories with unique charm: dissolving authority, absurdity, and anti-seriousness, and attracting investors attention and participation through the markets frenzy.

The Memecoin craze in 2024 shifted the goal of eliminating authority from Web2 to Web3 and made it concrete.

VC Token, which was regarded as a blue chip in the last bull market cycle, has now lost its appeal to secondary market investors. The increase in market entry barriers has made the opportunity for retail investors to purchase pre-issued tokens close to 0. The current situation of high FDV (fully diluted value) and low circulation has also made valuation inversion and opening price is the peak the norm. Coupled with the fact that airdrop returns are lower than expected, retail investors are in urgent need of redistribution of power and wealth. The popularity of Memecoin is also seen as an expression of the communitys resistance to VC, that is, there is no dealer manipulating the odds, and all participants have a fair and equal opportunity to make a profit.

However, as Memecoin absorbs most of the traffic and funds, becoming a staple food instead of a side dish, Web3 is inevitably caught in the worry of technological nihilism. I am not against memes, but Memecoin is a bit weird now. Lets build real applications with blockchain. I believe this is not just the voice of Binance founder CZ.

Will the failure of the technical story and the erosion of the cake reduce the enthusiasm for technology construction and development of innovative use cases in the Web3 industry?

In addition, Memecoin eliminates the authority of the dealer and invisibly strengthens the authority of KOL opinion leaders. Under the psychological expectation that there is no dealer controlling the market, does it also weaken the image of the underwater cable group?

Low cost and high return VS capital bubble

The enthusiasm for Memecoin is largely derived from the wealth narrative of rapid doubling, 100-fold, and 1,000-fold myths. For example, GMGN data on November 24 showed that a smart money invested 1 SOL to buy memecoin Mustard early on, and has now made a floating profit of 4,424 times. With the lowest investment cost, becoming the protagonist of the next story of getting rich quickly is the biggest attraction of Memecoin. It is like a new type of encrypted lottery ticket, conquering cities and castles in a bull market with abundant funds - a period when Fomo mentality is greater than narrative.

But the other side of the wealth myth is the sobering reality that most Memecoins failed to maintain their initial momentum, leaving behind only a series of dashed hopes. Research from ChainPlay shows that 97% of Memecoins have died, and the average lifespan of a Memecoin is 1 year, which is one-third of the lifespan of an ordinary crypto project; in addition, malicious activities have seriously affected the Memecoin market, with more than half of Memecoins (55.24%) considered malicious, and nearly one-third of investors (28%) reported losses due to scam Memecoins.

Attention Economy VS Out of Control and Transience

The essence of Memecoin is based on attention, and attention consists of:

1. Symbolic communication form: The symbolic content form itself gives it a prominent communication advantage. An online emoticon package, a well-known animal or anime character is obviously a labor-saving medium that can establish a connection with the audience and promote natural participation. The live broadcast function once launched by Pump.fun on Solana is a maximum display of the attention economy. Through live broadcast, token issuers can show their creativity or behavior in real time, attract the attention of the audience, and promote token transactions.

2. Community-driven communication media: The dissemination of Memecoin is driven by the community. This decentralized communication method is both efficient and highly penetrating, such as reddit forums, 4chan, Twitter, and TG groups.

However, at the same time, attention is extremely unstable. The rapid shift of market attention also means that the value of Memecoin may collapse in an instant. The average life cycle of many new projects is short and the success rate is extremely low. In addition, some Memecoins, such as politicians’ Memecoins, are time-sensitive. Once the event is over, the news value decreases and the popularity ends.

Similarly, when there is no limit to hype and people do whatever it takes to get attention, the bottom line will become blurred or even disappear. When Pump.fun live streamers began to compete for more extreme behaviors, from self-mutilation and suicide to animal abuse, and even performances imitating Nazis, the closure of the live broadcast function and the short life of the related Memecoin were foreseeable.

Part.3 How to identify high-quality Memecoin or shitcoin?

Although most Memecoins have a short lifespan and a high failure rate, they still attract a large number of investors due to their potential for quick profits, and detailed investigation is particularly important. It should be noted that the author is not an expert, but based on public research conclusions and community wisdom, the following three factors of concern are summarized in order to provide some reference value for readers to exclude shitcoins.

1. Narrative

For a Memecoin to become popular, there needs to be a supporting narrative that goes viral, such as a news event, political theme, watchable story, or ICON character.

When the old narrative is saturated, it is also important to judge whether the new narrative has enough humor or irony and whether it can lead the trend.

2. Community

It is important to check the real activity of the Memecoin team on social platforms, such as Twitter, Telegram, Reddit, Discord, etc. Memecoin relies heavily on the power of social media and online communities. The more attention it receives, the more likely it is to attract new investors. A meme that is easy to spread and has a good conversion effect can attract a lot of attention in a short period of time.

It is also critical to assess the potential of the community. Crypto KOL Murad proposed the concept of cult Meme, emphasizing that the ultimate form of Meme is the next religion, so you need to hang out in their social space to see how big the cult, passion and religious atmosphere of that community is.

3. Marketing

Marketing capability is different from community building. Marketing capability represents the subsequent development capability of Memecoin. It is reflected in the publicity strength of the crypto KOL matrix, the discussion trend on Twitter, the number of transmissions on Telegram, etc., which can all be queried through relevant tools. For example, Twitter Premium can understand the number of related posts by searching keywords and judge whether the overall trend is rising or falling.

Celebrity effect: If relevant celebrities such as Vitalik, Musk, and top KOLs are linked to it, the dissemination potential will be greater and it is expected to attract more attention and funds. It should be noted that the endorsement effect of crypto KOLs is limited and should not be followed blindly.

4. Risk review

Checking whether LP tokens have been destroyed can ensure that project developers cannot withdraw liquidity and abscond with the funds (rug pull).

Check whether the developer has given up the ownership of the smart contract. This is reflected in whether the Memecoin developer has transferred the ownership of the smart contract to an empty address. The abandonment of ownership means that the developer can no longer modify the supply of tokens or manipulate the code, which can ensure that the risk of malicious changes and harming investors is reduced.

5. Market performance

Expected market value: The estimate of narrative value determines the expected profit margin. If the current market value of memecoin is far from the market value of narrative value, then there is still room for obtaining alpha. The estimated value needs to be combined with the three points mentioned above: narrative, community and marketing.

Liquidity: High liquidity allows investors to enter and exit quickly without significantly affecting prices, which is reflected in the depth and trading volume of Dex. It should be noted that trading volume and depth can also be faked, which can be compared with the degree of matching with FDV.

Chip distribution: Use tools such as Dexscreen to check the proportion of topholders. Chips should not be concentrated in the hands of a few people. Ideally, in addition to excluding addresses that provide liquidity (Binance, Raydium, etc.), the top 10 holders should hold a maximum of 20%-30%.

Trends: Watch price action and market volatility closely as they are a barometer of Memecoin risk and timing.

6. Smart Money

By using Memecoin on-chain data analysis platforms such as GMGX, or trading robots to track the actions of “smart money”, insights into market trends can hopefully increase the chances of successful trading.

It should be noted that not all smart money wallets are reliable. Some Memecoins rely specifically on smart money buying signals to rug retail investors.

In summary, the following principles should be followed when investing:

Mastering the use of technical tools will achieve twice the result with half the effort, such as trading platforms, on-chain browsers, on-chain data analysis tools, and trading robots;

Only invest what you can afford to lose and set a stop loss;

Put your eggs in multiple baskets and allocate assets according to your risk appetite.

Conclusion

Soviet thinker Bakhtin once drew inspiration from the Western carnival and proposed one of the crystallizations of his thought - carnival theory. Its broad and inclusive explanatory power can completely break through the limitations of time and space and be derived to Memecoin. In his theory, the spiritual core of liberation and freedom is emphasized, and the core is the universality and mockery of the sacred, that is, everyone is an active participant. In the carnival, people elect the king in a joking way, de-crowned and crowned him.

Similarly, Memecoin is like a carnival ritual in the crypto world. Born out of jokes, it disenchanted the awkward blockchain terms, pulled VC down from the altar, and became one of the forces that cannot be ignored in the crypto world with an overwhelming momentum. The founder of DOGE once mocked the bubble market of cryptocurrency with his playful indifference, but he did not expect to open up one of the largest bubble markets in cryptocurrency from then on. Isnt it an interesting thing?

In the second half of 2024, we see the potential of combining Memecoin with the Web3 ecosystem. The arrival of AI technology and the innovation of Web3 narratives have given Memecoin a new coat. We expect Meme to be more rebellious and no longer be satisfied with short-term speculative positioning, and digital games in the asset market, bringing a new look to Web3.

*All content on the Coinspire platform is for reference only and does not constitute an offer or recommendation of any investment strategy. Any personal decision made based on the content of this article is the responsibility of the investor, and Coinspire is not responsible for any gains or losses arising therefrom. Investment is risky, so make decisions carefully!