Original author: Daii (X: @yzdxs8 )

Today, the price of Bitcoin once again broke through the $90,000 mark, market sentiment was high, and social media was full of cheers of the bull is back. But for those investors who were still hesitant at $80,000 and missed the opportunity to get on board, this moment is more like an inner torture: Am I late again? Should I buy decisively during the pullback? Will I have another chance in the future?

This is exactly the key point we want to talk about: In an asset known for its violent fluctuations, is there really a value investment perspective? Can a strategy that seems to run counter to its high risk and high volatility attributes capture an asymmetric opportunity in this turbulent game?

Asymmetry in the investment world means that the potential gain is far greater than the potential loss, or vice versa. This doesn’t sound like a characteristic that Bitcoin would have. After all, most people’s impression of Bitcoin is that they either get rich overnight or lose everything.

However, it is precisely behind this polarized perception that lies an overlooked possibility - during the period of Bitcoins cyclical deep decline, the value investment methodology may be able to create an extremely attractive risk-return structure.

Looking back at the history of Bitcoin, it has plummeted by more than 80% or even 90% from its peak several times. At such moments, the market is shrouded in panic and despair, and the capitulation-style selling makes the price look like it has been beaten back to its original state. But for those investors who have a deep understanding of the long-term logic of Bitcoin: that is a typical asymmetry - using limited risks in exchange for huge potential returns.

This kind of opportunity is not readily available. It tests the investors cognitive level, emotional control and long-term willpower. This also leads to another more fundamental question: Do we have reason to believe that Bitcoin really has intrinsic value? And if it does, how can we quantify it, understand it, and formulate our investment strategy accordingly?

In the following content, we will officially embark on this journey of exploration: revealing the deep logic behind Bitcoin price fluctuations, clarifying how asymmetry shines when blood flows like a river, and thinking about how the principle of value investment can be reborn in this decentralized era.

However, there is one thing you should first understand: in Bitcoin investment, there is never a shortage of asymmetric opportunities, and there are many of them.

1. Bitcoin, why are there so many asymmetric opportunities?

If you check Twitter today, you will see the overwhelming Bitcoin bull market carnival. The price has once again reached the $90,000 mark, and many people are shouting on social media, as if the market will always belong only to prophets and lucky people.

But if you look back, you will find that the invitation to this feast had actually been sent out at the most desperate moment of the market, but many people did not have the courage to click on it.

1.1 Historical asymmetric opportunities

Bitcoin has never been a straight upward trajectory. Its growth history is a drama of extreme panic and irrational prosperity. Behind every deepest drop, there is an extremely attractive asymmetric opportunity - the maximum loss you can bear is limited, but the gains you get may be exponential.

Let’s travel through time and speak with data.

2011: -94%, from $33 to $2

That was the first time Bitcoin was widely seen, and the price soared from a few dollars to $33 in half a year. But soon, a crash followed. The price of Bitcoin plummeted to $2, a drop of 94%.

You can imagine the desperation: major geek forums were deserted, developers fled one after another, and even Bitcoin Core contributors posted messages doubting the projects prospects.

But if you just gambled once at that time and bought it with $1,000, a few years later when the BTC price exceeded $10,000, you would have $5 million in chips.

2013-2015: -86%, Mt. Gox crash

At the end of 2013, the price of Bitcoin exceeded $1,000 for the first time, attracting global attention. But the good times did not last long. At the beginning of 2014, the worlds largest Bitcoin exchange Mt.Gox announced its bankruptcy, and 850,000 Bitcoins disappeared from the chain.

Overnight, the media all said in one voice: Bitcoin is over. CNBC, BBC, and the New York Times all reported the Mt. Gox scandal on their front pages, and the price of BTC fell from $1,160 to $150, a drop of more than 86%.

But what happened next? By the end of 2017, the same Bitcoin was priced at $20,000.

2017-2018: -83%, ICO bubble burst

The picture above is a report from the New York Times on this crash. The text in the red box says that the investor lost 70% of the value of his position.

2017 was the first year of Bitcoin speculation, when it entered the public eye. A large number of ICO projects emerged, and white papers were filled with words such as disruption, reshaping, and decentralized future, and the entire market fell into a frenzy.

But when the tide receded, Bitcoin fell from its all-time high of nearly $20,000 to $3,200, a drop of more than 83%. That year, Wall Street analysts sneered, Blockchain is a joke; the SEC filed a large number of lawsuits; retail investors were liquidated and exited the market, and the forum was silent.

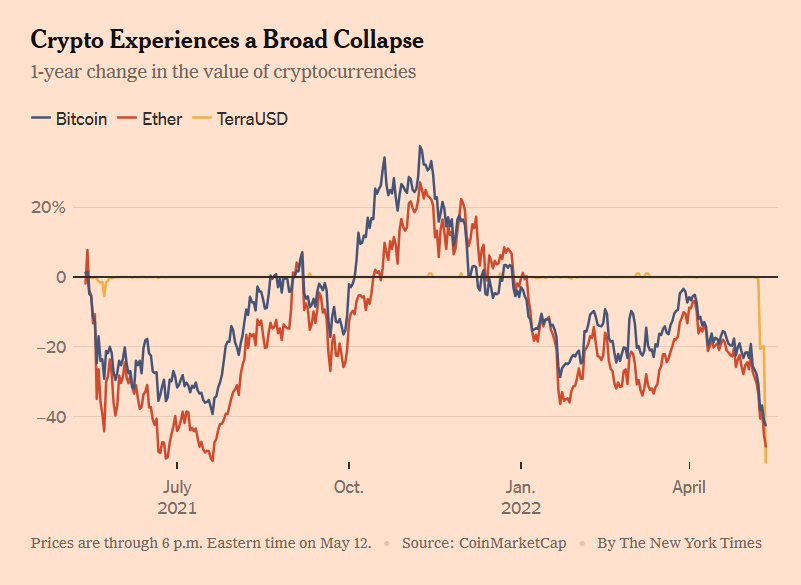

2021-2022: -77%, industry black swan series of explosions

In 2021, Bitcoin wrote a new myth: the price of a single coin exceeded US$69,000, and institutions, funds, countries, and retail investors flocked in.

But just one year later, BTC fell to $15,500. The collapse of Luna, the liquidation of Three Arrows Capital, the collapse of FTX... the successive black swans acted like dominoes, destroying the confidence of the entire crypto market. The Fear and Greed Index once fell to 6 (extreme fear range), and the on-chain activity was close to freezing.

The above picture comes from a report in the New York Times on May 12, 2022. It shows that the prices of Bitcoin and Ethereum plummeted along with UST. Now we know that Galaxy Digital’s “credit” for Luna’s high shipments is actually behind the UST plunge.

But once again, at the end of 2023, Bitcoin quietly rose back to $40,000; after the ETF was approved in 2024, it soared all the way to todays $90,000.

1.2 Where does Bitcoin’s asymmetric opportunity come from?

We have seen that Bitcoin has achieved amazing rebounds many times in history when it seemed to be in a state of disaster. So the question is - why is this happening? Why does this high-risk asset, which has been ridiculed by countless people as passing the parcel, rise again and again after collapse? More importantly, why can it provide such asymmetric investment opportunities for patient and knowledgeable investors?

The answer lies in three core mechanisms:

Mechanism 1: Deep cycle + extreme emotions create pricing deviations

Bitcoin is the only free market in the world that operates 24/7. There is no circuit breaker mechanism, no market maker protection, and no Fed backstop. This means that it is more likely to amplify human emotional fluctuations than any other asset.

In a bull market, FOMO (fear of missing out) dominates the market, retail investors frantically chase the rise, narratives soar, and valuations are seriously overdrawn;

In a bear market, FUD (fear, uncertainty, and doubt) fills the entire Internet, the sounds of selling at a loss are heard one after another, and prices are trampled into the dust.

This cycle of sentiment amplification has caused Bitcoin to frequently enter a state where prices seriously deviate from their true value. This is exactly the breeding ground for value investors to look for asymmetric opportunities.

To sum it up in one sentence: the market is a voting machine in the short term and a weighing machine in the long term. The asymmetric opportunities of Bitcoin appear precisely when the weighing machine has not yet been turned on.

Mechanism 2: Price fluctuations are huge, but the probability of death is extremely low

If Bitcoin really could “return to zero at any time” as the media claims, then of course there would be no point in investing in it. But the reality is that it “survived” every crisis and became stronger than the last one.

In 2011, after the price collapsed to $2, the Bitcoin network continued to operate normally and transactions continued as usual.

After the collapse of Mt. Gox in 2014, new exchanges quickly filled the gap and the number of users continued to grow.

After the FTX explosion in 2022, the Bitcoin blockchain continued to produce blocks steadily every 10 minutes.

Bitcoins underlying network has almost no history of downtime, and the system is far more robust than most people realize.

That is to say, even if the price is cut in half and cut in half again, as long as Bitcoins technical foundation and network effects are still there, it has no real risk of returning to zero. So we get a very attractive structure: the short-term decline is limited, but the long-term rise is open.

This is asymmetry.

Mechanism 3: Value anchoring exists but is ignored, leading to “oversell”

Many people believe that Bitcoin has no intrinsic value and therefore has no bottom to fall. This view ignores several key facts:

Bitcoin has programmatic scarcity (21 million coins, halving mechanism);

It has the most powerful POW network in the world, and the cost is calculable;

The network effect is strong, the number of users has exceeded 50 million, and the transaction volume and hash rate have hit new highs;

Mainstream institutions and countries recognize its reserve asset attributes (ETFs, national fiat currencies, company balance sheets);

This is also the most controversial issue, that is, whether Bitcoin has intrinsic value. I will elaborate on this in detail later.

1.3 Will Bitcoin return to zero?

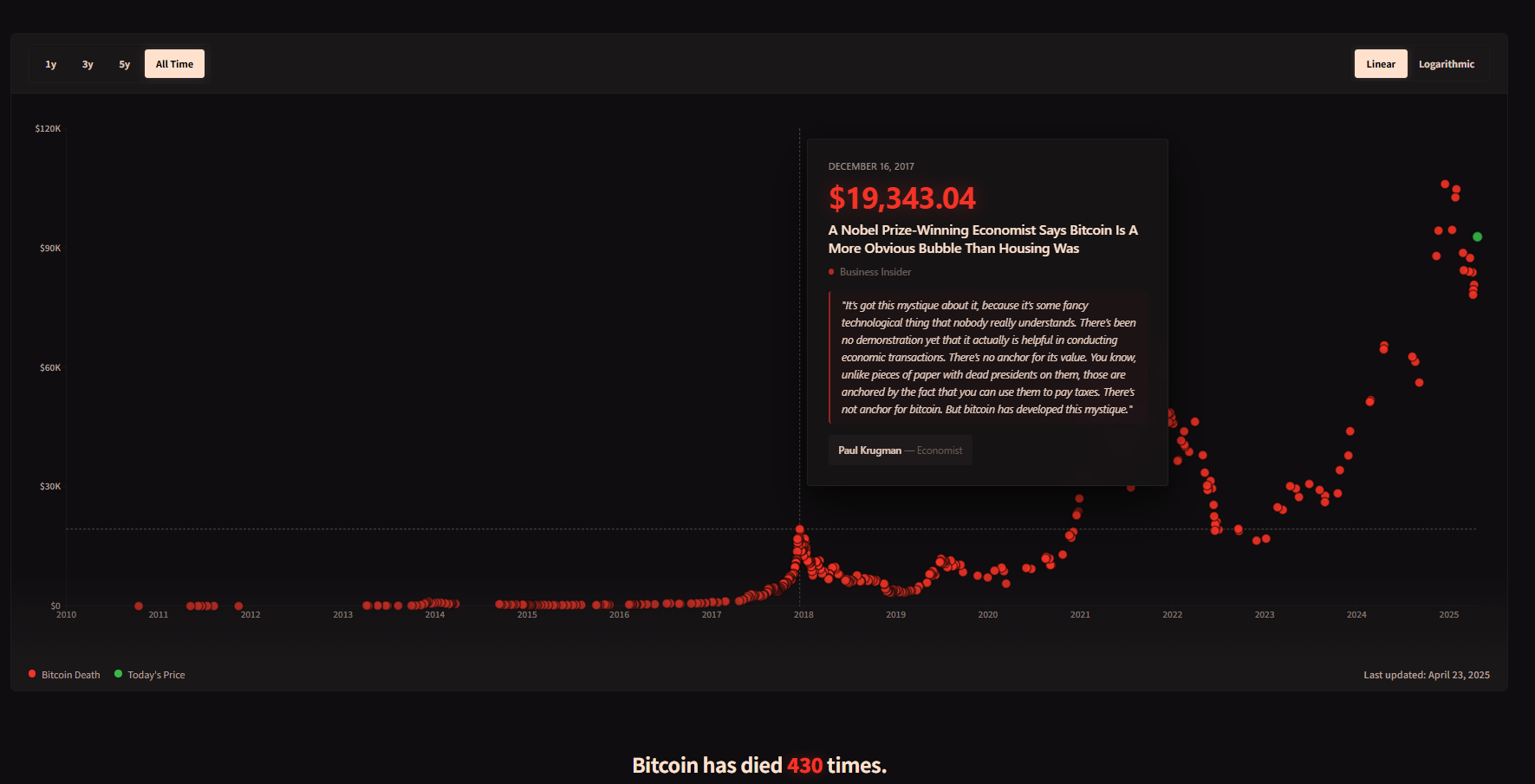

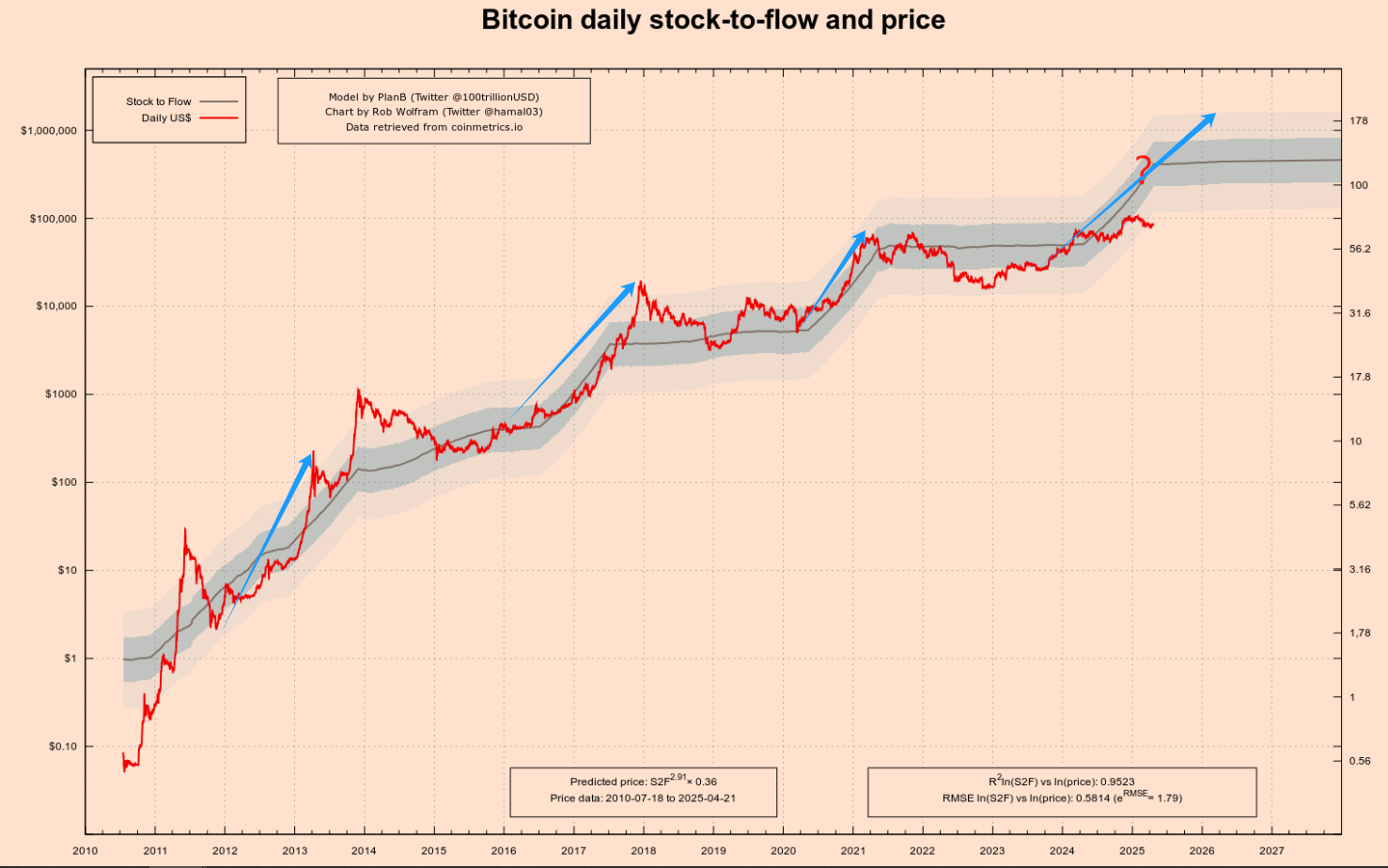

It is possible, but the probability is extremely low. This website records 430 incidents in which Bitcoin was declared dead.

However, there is a line of small print below the number of death announcements that tells everyone: If you bought $100 every time someone announced the death of Bitcoin, you would now have more than $96.8 million, as shown in the figure below.

You have to know that the underlying system of Bitcoin has been running stably for more than ten years, and has almost never been interrupted. Whether it is the collapse of Mt.Gox, the collapse of Luna, or the explosion of FTX, its blockchain has always continued to produce a block of land every 10 minutes. Such technical resilience provides it with a strong bottom line for survival.

Now you should understand that Bitcoin is not a illogical speculation. On the contrary, its asymmetry is so prominent because its long-term value logic is real, but it is often seriously underestimated by market sentiment.

This brings us to the next question we must explore - can Bitcoin, which has no cash flow, no board of directors, and no factory, really be considered a value investment?

2. Can Bitcoin also be used for value investing?

Bitcoin is always soaring and plummeting, and people are swinging between extreme greed and extreme fear. Is such an asset really suitable for value investment?

On one side is the Graham and Buffett-style margin of safety and discounted cash flow, and on the other side is a digital commodity without a board of directors, dividends, profits, or even a corporate entity. In the traditional value investment framework, Bitcoin seems to have nowhere to go.

But the key question is - how do you define value?

If we broaden our horizons from traditional financial reports and dividends and return to the core essence of value investing——

Buy at a price below intrinsic value and hold until the value returns.

Then, Bitcoin may not only be suitable for value investing, but may even embody the original meaning of the word value more purely than many stocks.

Benjamin Graham, the founder of value investing, once said: The essence of investment is not what you buy, but whether the price you buy it at is lower than its value. The picture above is an imaginary picture created by AI. Graham looks at Bitcoin with a puzzled look on his face.

In other words, value investing is not limited to stocks, companies or traditional assets. As long as something has intrinsic value and its market price is periodically lower than this value, it can become a target of value investing.

But this also brings up a more critical question: If we cannot use traditional price-to-earnings ratio and price-to-book ratio to estimate the value of Bitcoin, then where does its intrinsic value come from?

Although Bitcoin does not have financial statements like a company, it is by no means nothing. It has a complete set of value systems that can be analyzed, modeled, and quantified. Although these value signals are not concentrated in a quarterly report like stocks, they are equally real and even more stable.

Below, I will mainly analyze the source of Bitcoins intrinsic value from the two dimensions of supply and demand.

2.1 Supply side: scarcity, hard-coded deflation model (Stock-to-Flow)

The most fundamental value pillar of Bitcoin is its verifiable scarcity.

Total limit: 21 million pieces, no additional issuance;

Halving every four years: Each halving reduces the annual supply by 50%, and it is expected that all issuance will be completed in 2140;

After the halving in 2024, the annual new supply of Bitcoin will drop to an inflation rate of less than 1%, making it more scarce than gold.

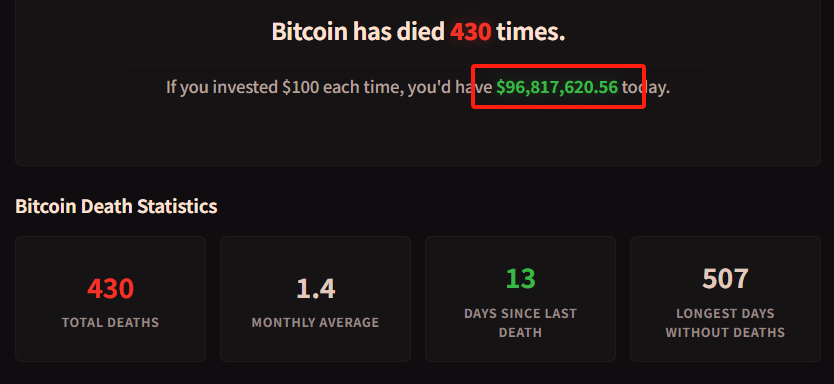

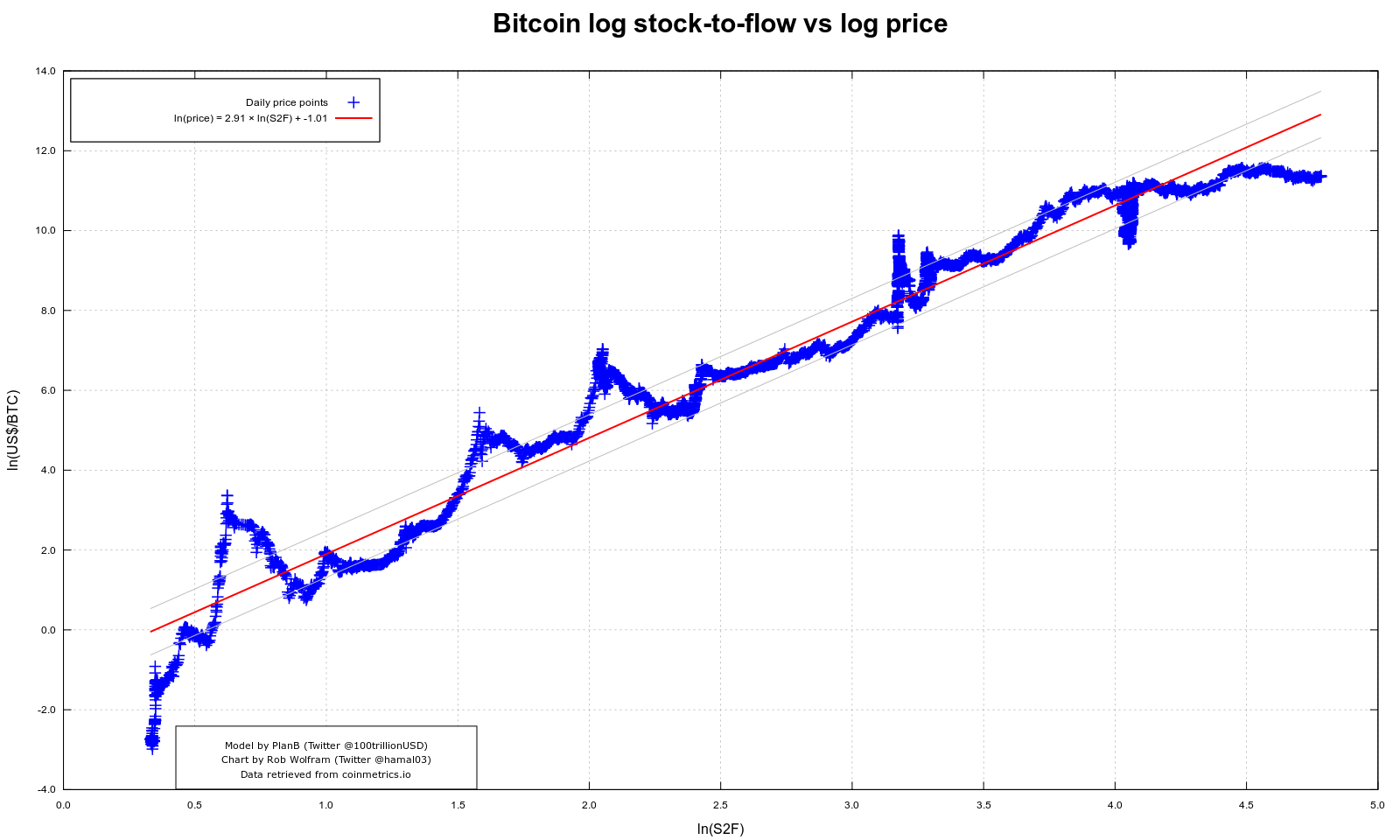

The S2F model (inventory/annual supply) proposed by analyst PlanB has accurately captured the medium- and long-term upward trend of Bitcoin after halving many times. After the three rounds of halving in 2012, 2016, and 2020, prices have increased several times within 12-18 months, as shown in the first three blue arrows in the figure below.

After the first halving in 2012, the price of Bitcoin rose from about $12 to over $1,000 in a year.

After the second halving in 2016, the price soared from around $600 to nearly $20,000 in about 18 months.

After the third halving in 2020, the price also rose from around US$8,000 to US$69,000 in about 18 months.

You may have noticed that I put a big question mark on the fourth blue arrow. This is the fourth halving. Will the previous upward trend continue? My answer is yes, but the amplitude may be further reduced.

You need to note that the left vertical axis of the above chart showing the price of Bitcoin is a logarithmic scale, and the height from 1 to 10 is the same as the height from 10 to 100. This helps us see the early trends of Bitcoin.

Let me focus on this model. This model draws on the valuation methods of precious metals such as gold and silver. Its core logic is:

Stock: refers to the total amount of assets that currently exist.

Flow: refers to the amount of new supply each year.

S 2 F ratio = stock / flow

The higher the S2F ratio of an asset, the smaller its annual new supply is relative to the existing stock, the scarcer the asset is, and theoretically the higher its value is.

Gold has an extremely high S2F ratio (around 60), which is one of the important foundations of its use as a means of storing value. Bitcoins S2F ratio continues to increase with each halving. For example, after the third halving in May 2020, Bitcoins S2F ratio increased to about 56, which is very close to the level of gold. After the fourth halving in April 2024, its S2F ratio doubled to more than 100, making it surpass gold in terms of scarcity. See the coordinates to the right of the question mark in the above figure.

One of the most popular graphs in the cryptocurrency world is the Bitcoin S2F model fitting graph, as shown below. It is not only known for its visual simplicity and intuition, but also because of the logic behind it, it once became one of the most powerful proofs of Bitcoins long-term price increase.

In the above figure, the horizontal axis is the natural logarithm of S2F, and the vertical axis is the natural logarithm of Bitcoin price. In this log-log space, we see an almost straight red regression line that crosses all halving cycles in Bitcoin history, showing an amazing fitting effect.

This chart tries to tell everyone that every time Bitcoin enters a new halving cycle, the new output in circulation is cut in half, the S2F ratio rises accordingly, and the long-term price predicted by the model also rises simultaneously. This model has accurately predicted the first three times, but whether it will be accurate for the fourth time is still unknown.

However, any model has its limitations, and S2F is no exception. It focuses entirely on the supply side: halving, total volume cap, and mining speed, but completely ignores changes in demand. This was still true in the early days when there were fewer Bitcoin users and demand had not yet taken shape. But after entering 2020, the market structure, capital volume, and institutional participation have grown rapidly, and the power to determine prices has increasingly shifted to the demand side - that is, adoption, market expectations, macro liquidity, regulatory policies, and even social media sentiment.

Obviously, a single S2F model cannot convince you or me. We also need a demand-side model.

2.2 Demand side: network effect, Metcalfes Law

If the S2F model locks the supply gate of Bitcoin, then the network effect is the demand pump that determines how high the water level can rise. The most intuitive measurement is the expansion rate of on-chain activity and coin holders: by the end of 2024, the number of non-zero balance addresses has exceeded 50 million, and in February this year, the number of daily active addresses returned to ≈ 910,000, a new high in nearly three months.

Using Metcalfes Law to roughly calculate - Network Value ≈ k × N² - when the number of active users doubles, the theoretical network value can expand to four times the original value. This is exactly the underlying driving force behind the repeated step-by-step increase in Bitcoin prices over the past decade. The above picture is also an AI-generated imaginary picture, in which Mr. Metcalfe looks at Bitcoin with great joy.

Three major indicators on the demand side

Active addresses: measure the actual usage popularity in a short period of time;

Non-zero balance addresses: a long-term penetration indicator; the compound growth rate over the past seven years has been about 12%/year - even if the price has been halved, the number of coin holders is still rising.

Value-bearing layer: The Lightning Network channel capacity and the number of off-chain payments continue to reach new highs, providing a closed loop for existing currency holdings → actual payments.

This N² drive + network stickiness demand model has two meanings:

Positive cycle: more users → deeper transactions → richer ecosystem → increased value; this explains why prices will jump nonlinearly whenever ETFs, cross-border settlements or emerging market payments bring in incremental users.

Negative cycle risk: If there is global regulatory pressure, technological substitution (such as CBDC, Layer-2 payment methods) or macro liquidity depletion, activity and new users may fall simultaneously, causing valuation and N² to shrink together - this is a demand gap scenario that S2F cannot capture.

Therefore, only by connecting the S2F on the supply side with the network effect on the demand side can a more complete valuation framework be formed: when S2F points to long-term scarcity and active addresses and non-zero balances still maintain an upward slope, the demand-supply mismatch will amplify the asymmetry; conversely, once the activity continues to decline, even if the scarcity remains unchanged, it may trigger a simultaneous decline in price and value.

In other words, scarcity prevents Bitcoin from depreciating, and network effects allow it to appreciate.

It is particularly worth mentioning that Bitcoin was once regarded as a geeks toy or the epitome of a bubble. But today, its value narrative has quietly changed.

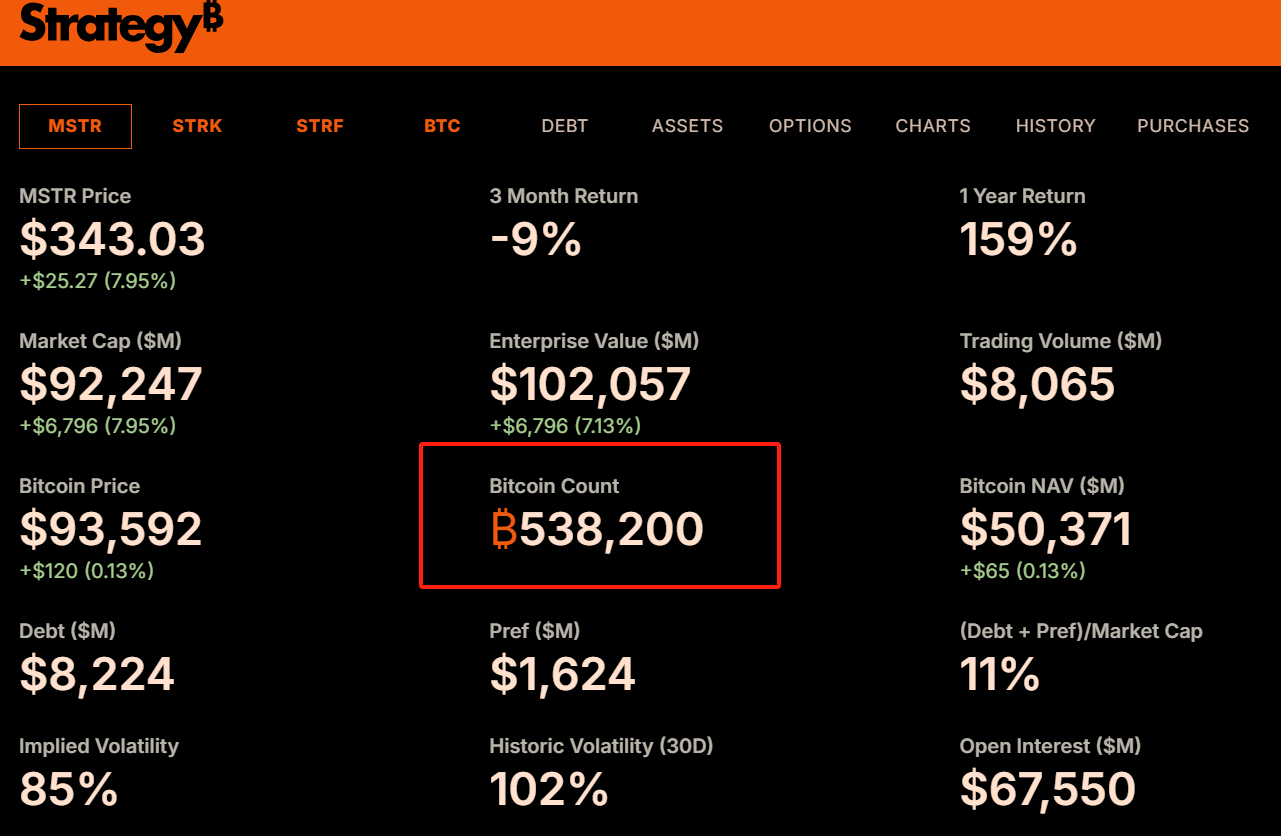

Since 2020, MicroStrategy has included Bitcoin in its balance sheet and now owns 538,000 Bitcoins, as shown above. I have previously detailed Strategys transformation in the article Bitcoin Dividends.

Subsequently, top global asset management institutions such as BlackRock and Fidelity also launched Bitcoin spot ETFs, bringing in billions of dollars of incremental funds. Morgan Stanley and Goldman Sachs began to provide BTC investment services to high-net-worth clients, and even countries like El Salvador listed it as legal tender. These changes are not only an embrace at the capital level, but also an endorsement of legitimacy and institutional consensus.

2.3 Summary

In the world of Bitcoin valuation, supply and demand are never isolated variables, but rather a double helix that constitutes asymmetric opportunities.

On the one hand, the S2F model starts from programmed deflation and uses mathematical formulas to describe the pull of scarcity on long-term prices;

On the other hand, network effects are based on on-chain data and user growth, demonstrating the real demand basis for Bitcoin as a digital network.

In such a structure, the mismatch between price and value becomes increasingly clear - this is exactly the moment that value investors are looking forward to: when sentiment is low and prices are lower than those shown in the comprehensive valuation model, the asymmetric window of opportunity quietly opens. This also leads to the question we really need to discuss: Is the essence of value investing to look for such asymmetric opportunities that are underestimated by sentiment and corrected by time?

3. The essence of value investing is to find asymmetry?

The core of value investing has never been just buying cheap things, but is based on a more fundamental logical basis: looking for asymmetric structures with limited risks and huge potential returns in the mismatch between price and value.

This is the essential difference between value investing and trend investing, momentum trading, and technical gaming.

Trend investing relies on market inertia, speculative trading bets on short-term fluctuations, while value investing is to calm down and evaluate the long-term value of assets when market sentiment deviates from rational judgment, and decisively buy when the price is significantly lower than the value, waiting for the market to return to rationality. The reason why this approach works is that it establishes a natural asymmetric structure behind it: the worst result you endure is a controllable loss, while the best result you get is often far beyond expectations.

If we carefully examine the logic of value investing, we will find that it is not a specific operational method, but a structural thinking based on probability and imbalance.

The reason why investors analyze the “margin of safety” is to assess the downside potential in the worst-case scenario;

The reason for studying intrinsic value is to clarify the possibility and space for the target price to return;

The reason why we need to hold on patiently is because the returns from asymmetric structures often take time to materialize.

All of this is not about pursuing perfect predictive ability, but about building a betting structure in a series of uncertainties - when you make the right judgment, the gain is far greater than the loss when you make the wrong judgment. This is the essence of asymmetric investment.

Many people misunderstand value investing as conservative, slow, and low-volatility, but it is actually the opposite. Real value investing does not mean low return, low risk, it means using controllable risks in exchange for highly asymmetric return space. Whether it is early shareholders who invested in Amazon or long-termists who quietly bought Bitcoin in the bear market, they are essentially doing the same thing: when most people underestimate the future of an asset and the price is pushed to an extreme range due to emotions, policies or misunderstandings, they are quietly making arrangements.

From this perspective:

Value investing is not some old strategy of buy cheap and hold on to dividends from the past, but the common language of all investors who truly pursue an asymmetric return structure.

It emphasizes not only cognitive ability, but also emotional control, risk awareness and belief in time. It does not require you to be smarter than others, but only requires you to stay calm when others are crazy and dare to bet when others are running away.

Therefore, understanding the deep relationship between value investing and asymmetry also helps us understand why Bitcoin, despite its different form from traditional assets, can be embraced by serious value investing methods. Its volatility is not an enemy, but a gift; its panic is not a risk, but a pricing error; its asymmetry is a rare asset revaluation opportunity of the times. And true value investors are waiting for the next such opportunity, quietly deploying their forces in the deep and quiet waters.

4. How to use asymmetry to invest in Bitcoin?

After understanding the source of Bitcoins intrinsic value and realizing that market fluctuations can create opportunities where prices are lower than value, the next question is: As ordinary investors, how can we practice value investing in Bitcoin?

It should be emphasized here that value investing is not about bottom fishing, that is, trying to buy at the lowest price, which is an extremely difficult or even impossible task. The core of value investing is to start buying in batches and in a disciplined manner when the price enters the value area that you judge to be obviously underestimated, and hold it patiently, waiting for the value to return and grow.

For a highly volatile asset like Bitcoin, here are some simple and practical value investing strategies:

4.1 Dollar-Cost Averaging (DCA)

This is the most basic strategy that works best for most people. DCA means investing a fixed amount of money into Bitcoin at fixed intervals (e.g., weekly, monthly), regardless of whether the price is high or low at the time.

Advantages:

Spread the cost: Buy smaller quantities when the price is high and buy larger quantities when the price is low. In the long run, your average holding cost will be lower than the market average price during a continuous rise.

Overcome emotions: DCA is a disciplined investment approach that helps you avoid the impulse to chase ups and downs due to short-term market fluctuations. You only need to execute according to the plan without worrying about subjective judgment and timing.

Simple and easy: It does not require complex analysis and frequent operations, and is suitable for investors who do not have much time and energy to study the market.

Regarding DCA, I have explained it in detail in Bitcoin: The Ultimate Safe-haven Plan for Long-termists. If you still have questions, I suggest you read it carefully.

4.2 Dynamic Adjustment Based on Market Sentiment Indicators: Fear Greed Index

On the basis of DCA, if you want to slightly improve the efficiency of investment, you can introduce market sentiment indicators as auxiliary judgment. Among them, the Crypto Fear Greed Index is a widely watched indicator.

The index combines market volatility, trading volume, social media sentiment, market dominance, survey data and other factors to measure the overall sentiment of the current market with a value of 0-100:

0-25: Extreme Fear

25-45: Fear

45-55: Neutral

55-75: Greed

75-100: Extreme Greed

The reverse thinking of value investing tells us, Be greedy when others are fearful, and be fearful when others are greedy. Therefore, we can incorporate the fear and greed index into the DCA strategy:

Basic fixed investment: Maintain the regular monthly/weekly fixed investment plan unchanged.

Add more when in fear: When the index enters the extreme fear zone (for example, below 20 or 15), it means that market sentiment is extremely pessimistic and prices may be seriously undervalued. At this time, you can add an additional investment in addition to the regular investment.

Be cautious when greedy/reduce positions (optional): When the index enters the extremely greedy range (for example, above 80 or 85), it means that market sentiment is overheated and risks are accumulating. At this time, you can choose to suspend fixed investment, or even consider selling part of the profit in batches to lock in profits.

4.3 Important Notes

Never invest more money than you can afford to lose. Bitcoin is still a high-risk asset, and its price may go to zero (although this possibility is decreasing as it develops, but the theoretical risk always exists). Allocate assets reasonably, and the proportion of Bitcoin in your total portfolio should match your risk tolerance. However, Bitcoin is also the cryptocurrency with the lowest risk, so it should dominate all your crypto assets. My asset portfolio is - Bitcoin: Ethereum: Others = 5: 3: 2.

Using DCA or a dynamic DCA strategy combined with sentiment indicators is essentially practicing the core principles of value investing: acknowledging that the market cannot be predicted, taking advantage of the irrational fluctuations of the market, and accumulating assets in a disciplined manner in areas where prices may be lower than intrinsic value. Remember: investing should not be the most important thing in your life, and you dont have to lose sleep over it.

Conclusion

Bitcoin is not a gambling table for you to escape reality, it is a footnote for you to re-understand reality.

In this world full of uncertainty, we often mistakenly think that safety means stability, risk aversion, and staying away from volatility. But true safety is never about avoiding risks, but about understanding and managing risks - and being able to see the cornerstone of value buried under the sand when everyone else turns around and flees.

This is the true essence of value investing: looking for asymmetric structures created by cognition in the midst of emotional dislocation; and quietly buying chips that have been forgotten by the market but will eventually return at the deepest bottom of the cycle.

Bitcoin, as a financial species that has scarcity written into its algorithm, value evolved in the network, and is repeatedly reborn in panic, is the purest manifestation of this asymmetry. Its price may never be stable, but its logic is consistent: scarcity is the lower limit, the network is the upper limit, volatility is opportunity, and time is leverage.

You can never accurately buy the bottom of Bitcoin, but you can go through one cycle after another and continue to buy the value misunderstood by the market at a reasonable price. Its not because you have magical judgment, but because you have a higher-level way of thinking - you believe that the best bet is to put the chips on the side of time when others turn around and leave.

So remember this sentence:

Those who bet at the deepest level of irrationality are often the most rational people; and time is the most faithful fulfiller of asymmetry.

This game will always belong to those who understand the order behind the fluctuations and the logic behind the collapse. Because they know: the world does not reward emotions, but rewards cognition. And cognition will eventually be proven by time.