Author: Monkey | Editor Monkey

1. Bitcoin Market and Mining Data

From December 22 to December 29, 2024, the price trend of Bitcoin showed a certain volatility. The main changes during this period are as follows:

December 22-December 23: Prices continued to fall, market sentiment was bearish

On December 22, the opening price was $97,281.6 and the closing price was about $95,183.8, a decrease of -2.13%. The trend on December 23 continued the downward trend, opening at $95,184.8 and closing at about $94,852.1, a decrease of -0.35%. In two days, Bitcoin has fallen by -2.48%, indicating that the market sentiment is bearish and investors confidence in the market has declined.

December 24-December 25: Price rebound, short-term upside

On December 24, Bitcoin rebounded, opening at $94,852.8, reaching a high of $99,446.6, and finally closing at $98,668.1, up +4.02%, the largest single-day gain this week. After that, on December 25, the price continued to rise slightly, opening at $98,661.9 and closing at about $99,391.3, up +0.73%. The rise during this period shows that market sentiment has warmed up and investors have regained confidence.

December 26-December 29: Price decline, small fluctuations Starting from December 26, the price of Bitcoin experienced a sharp correction. The opening price on December 26 was $99,389.4, and the closing price was about $95,777.7, a decrease of -3.64%. After that, the price continued to decline slightly. From December 27 to 29, the price gradually fell, with a decrease of -1.57% on December 27 and a closing price of about $95,076.7 on December 29, a decrease of -0.22%. Despite the large correction, the price fluctuations on the weekend were relatively stable.

Bitcoin price trend (2024/12/22-2024/12/29)

Influencing factors

1. Macroeconomic environment:

Federal Reserve policy expectations: The market expects the Federal Reserve to slow down the pace of interest rate cuts, which has weakened the markets demand for risky assets and curbed the continued rise in Bitcoin prices.

USD Index Fluctuations: The dollar strengthened during the period, increasing investors’ preference for safe-haven assets and outflows from the cryptocurrency market.

2. Market sentiment and trading behavior:

Increased volatility during Christmas: Between December 24 (Christmas Eve) and 25 (Christmas Day), Bitcoin rebounded driven by retail funds and short-term sentiment was optimistic.

Short-term profit-taking: The pullback on December 26 (-3.64%) reflected that some investors chose to take profits after the rebound, leading to increased selling pressure.

3. Technical factors:

Effect of psychological barrier: Bitcoin has tried to break through the $100,000 mark many times but failed, and technical resistance is obvious.

Support Level Test: The intraday low of $92,543.2 is close to the strong support area below, triggering buying and preventing the price from falling further.

4. Policy expectations:

The market is divided on the news of the US governments strategic Bitcoin reserve plan in 2025, and short-term hype sentiment has weakened.

Hashrate Changes

The Bitcoin network’s hash rate experienced notable fluctuations between December 22 and December 29:

From December 22 to 23, 2024, the hash rate of the Bitcoin network continued to remain at a high level. From December 23 to 25, 2024, the hash rate of the Bitcoin network decreased compared to the previous two days, and the hash rate of the Bitcoin network remained around 750 EH/s. Starting from December 27, the hash rate rose slightly to above 800 EH/s, reaching a maximum of 876.85 EH/s. On December 28, the hash rate stabilized at around 800 EH/s.

Overall, Bitcoin’s hash rate continued to remain at higher levels this week.

Bitcoin network hash rate data

Bitcoin’s hash rate has a certain correlation with Bitcoin’s price fluctuations (as shown in the aforementioned price analysis), which shows the sensitivity and response mechanism of miners’ behavior to market dynamics.

Mining income

According to Blockchain.com, miners earned about $42 million on December 22, and at the peak in April 2024, daily revenue exceeded $100 million. During this period, the price of Bitcoin fluctuated between about $92,650 and $99,700. The fluctuation of Bitcoin prices directly affects the income of miners.

Energy costs and mining efficiency

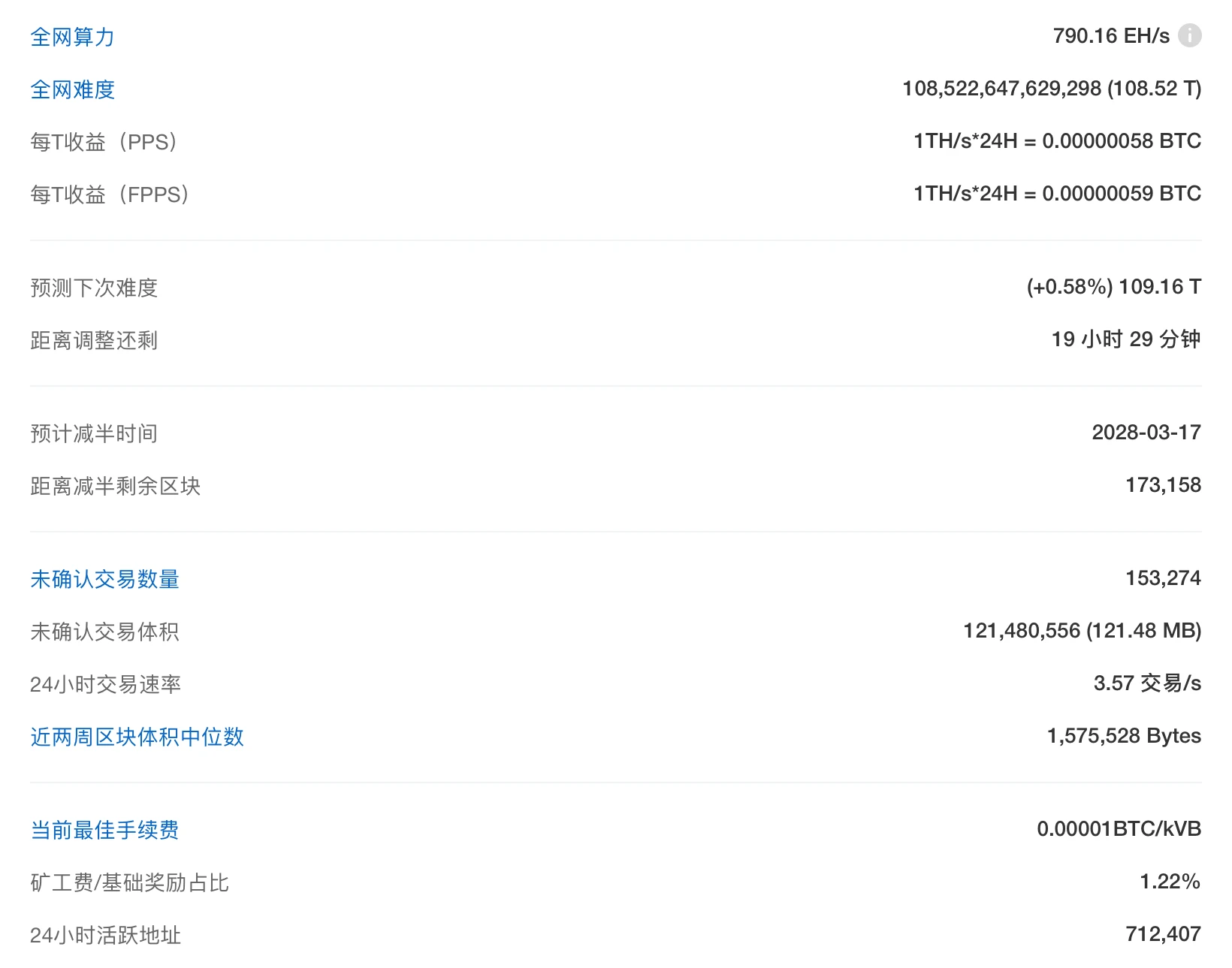

From December 22 to 28, the difficulty of Bitcoin mining remained at a relatively high level of 108.52 T. At the time of writing, the total network computing power was 790.16 EH/s.

In the first half of 2024, miners enjoyed the best economic benefits of the past two years. Driven by the rise in Bitcoin prices, the hash price averaged $0.094/TH in the first quarter of 2024. However, with Bitcoins fourth halving in April 2024, the block reward was reduced from 6.25 Bitcoin to 3.125 Bitcoin, and miners income was affected. Nevertheless, miners responded to these challenges by improving mining efficiency and adopting new generation mining machines.

Bitcoin miners income is affected by Bitcoin price fluctuations and network difficulty. Energy costs remain an important factor affecting miners profitability. Miners respond to these challenges by improving mining efficiency and adopting new technologies to maintain profitability.

Bitcoin mining difficulty data

II. Policy and Regulation

El Salvador strengthens support for Bitcoin: Buying Bitcoin in violation of IMF agreement

On December 23, the Salvadoran government has made it clear that it will continue to promote Bitcoin as part of its economic strategy, even though the country has signed an agreement with the International Monetary Fund to gradually end its Bitcoin business.

Stacey Herbert, director of the El Salvador Bitcoin Office, clarified that even after the agreement, the country will continue to purchase Bitcoin at an accelerated pace as part of its strategic Bitcoin reserve strategy. Herbert also explained on social media that Bitcoin will remain legal tender and the government will continue to sponsor several cryptocurrency-focused educational programs.

Russia bans crypto mining in 10 regions for 6 years

On December 24, according to the Russian news agency TASS, from January 1, 2025, 10 regions of Russia (Dagestan, Ingushetia, Kabardino-Balkaria, Karachay-Cherkessia, North Ossetia, Chechnya, Donetsk and Luhansk Peoples Republics, Zaporizhia and Kherson) will completely ban cryptocurrency mining for six years. The ban will last until March 15, 2031.

Russian lawmakers also approved seasonal restrictions in major cryptocurrency mining regions to prevent power outages. These restrictions are in line with Russia’s cryptocurrency mining laws signed by the president in August and October 2024.

Italy’s Central Bank Designates Bitcoin P2P Services as “Crime as a Service”

On December 24, Bitcoin Magazine published an article on the X platform, revealing that the Italian central bank has identified Bitcoin P2P services as crime as a service because they are suspected of being used for money laundering activities.

Japanese Prime Minister: There is not enough information to consider Bitcoin as a strategic reserve

On December 27, Japanese Prime Minister Shigeru Ishiba said that the government currently lacks sufficient information to consider Bitcoin as a strategic reserve. At the same time, the United States and Brazil are exploring similar initiatives.

Chinas State Administration of Foreign Exchange issues reporting measures for high-risk transactions such as illegal cross-border financial activities involving virtual currencies

On December 27, according to the announcement of the State Administration of Foreign Exchange of China, the Measures for the Administration of Bank Foreign Exchange Risk Transaction Reports (Trial) has been issued and will be implemented from now on. The Measures is a supporting document for the Measures for the Administration of Bank Foreign Exchange Business (Trial), which aims to strengthen the foreign exchange risk management of banks and conduct early identification, early warning and early disposal of high-risk transactions such as suspected false trade, underground banks, and illegal cross-border financial activities of virtual currencies.

The main contents include: clarifying the reporting responsibilities of banks for foreign exchange risk transactions, requiring the establishment of a monitoring system and the submission of reports; stipulating the scope of information reporting, including activities suspected of illegal and irregular cross-border capital flows; clarifying the content of the report, such as basic information and measures to be taken; and strengthening internal management measures, including internal control systems and data confidentiality management.

3. Mining News

Only 7 of the 25 listed mining companies will achieve positive returns by the end of 2024

As of December 24, Bitcoin is up 113% in 2024. According to data from the Hash Rate Index and Google Finance, most listed mining companies are in a downward trend at the end of 2024, with a drop of up to 84%. Of the 25 listed mining companies in the index, only 7 have achieved positive returns. As of press time, Bitdeer (BTDR) is up 167%, Cipher (CIFR) is up 33%, Hut 8 (HUT) is up 91%, Iris Energy (IREN) is up 72%, Northern Data (NB 2) is up 58%, Core Scientific (CORZQ) is up 327%, and TeraWulf (WULF) is up 169%.

On the other hand, Argo Blockchain (ARB) fell 84%, followed by Sphere 3D (ANY) with a 69% drop, (to name a few). Bitcoin miners have accumulated revenues of over $71 billion. According to Blockchain.com, miners earned $42 million on December 22, compared to a peak of over $100 million in April.

Kyrgyzstans crypto mining tax revenue to drop 50% in 2024

On December 27, according to a budget document released by the Ministry of Economy and Finance of Kyrgyzstan, the tax contribution of crypto mining in 2024 is 46.6 million soms (about 535,000 US dollars), down more than 50% from 93.7 million soms (more than 1 million US dollars) in 2023. The country imposes a mining tax rate of 10% of the electricity bill on crypto miners, including value-added tax and sales tax. Although Kyrgyzstan is regarded as an ideal place for mining with its abundant undeveloped renewable energy, the decline in tax revenue may be related to the reduction in mining activities. According to data from the International Energy Agency, 30% of the countrys energy supply comes from hydropower, but only 10% of its hydropower potential has been developed.

Bitcoin mining uses more than 56% of clean energy

On December 29, according to Woocharts data, the proportion of clean or sustainable energy used in mining is currently 56.76%. BTCs use of clean energy has been growing steadily since April 2021. The platform uses the Cambridge Center for Alternative Finances definition of sustainability in its calculations to measure its use of clean energy. The relevant indicators depend on the proportion of crypto mining operations from energy sources such as wind, solar, hydropower and even nuclear power.

4. Bitcoin News

US Senator Cynthia Loomis Proposes Allowing the Federal Reserve to Hold Bitcoin

On December 23, U.S. Senator Cynthia Loomis of Wyoming recently mentioned the possibility of turning Bitcoin into a reserve asset and proposed how to implement the plan, including involving the Federal Reserve.

Loomis said she wants to give the Fed the ability to buy and hold BTC as part of a larger strategic Bitcoin reserve to deal with the national debt problem. I want to give it to them. I want our federal government to have a strategic Bitcoin reserve to help support the dollar as the worlds reserve currency.

MicroStrategy Bitcoin purchases exceed 2021 bull run levels

On December 23, according to the Saylortracker page, MicroStrategy purchased 27,200 BTC at about $74,000 per coin on November 10, 2024. MicroStrategy purchased another 51,780 BTC on November 17, and then purchased 55,500 BTC at about $97,000 per coin on November 24, setting a record for the largest BTC purchase ever.

During the 2020-2021 bull run, MicroStrategys largest acquisition was 29,646 Bitcoins on December 21, 2020, when Bitcoin was trading around $21,000.

MicroStrategy acquires 5,262 BTC for approximately $561 million

On December 23, MicroStrategy announced that it had acquired 5,262 BTC for approximately US$561 million, at a price of approximately US$106,662 per Bitcoin, and achieved a BTC return of 47.4% so far in the quarter and a BTC return of 73.7% so far this year.

As of December 22, 2024, MicroStrategy holds 444,262 BTC at a price of approximately $62,257 per Bitcoin, valued at approximately $27.7 billion.

Matador Technologies, a U.S. stock, plans to allocate the first $4.5 million of funds into Bitcoin in December and add Bitcoin to its balance sheet.

La Rosa Holdings, a publicly traded real estate brokerage, now accepts Bitcoin as a payment method

On December 24, La Rosa Holdings, a listed real estate brokerage company, announced that it would accept Bitcoin as a payment method.

Russian Finance Minister: Russia is using Bitcoin in foreign trade

On December 25, the Russian Finance Minister said that Russia is using Bitcoin in foreign trade.

Russian Finance Minister: Russian Companies Are Currently Using BTC for International Trade

On December 26, Russian Finance Minister Anton Siluanov said that Russian companies are currently using BTC for international trade, and Putin also supports this move. As China and Turkey face secondary sanctions from the United States, Moscow is considering using cryptocurrency as a solution. Putin unabashedly accused the United States of politicizing the dollar and insisted that Bitcoin cannot be stopped.

CryptoQuant analyst: BTC Kimchi premium reaches a local high, indicating strong demand from Korean investors

On December 26, CryptoQuant analyst Joo Hyun Ryu wrote that during the recent market downturn, speculative short-term holders exposure to Bitcoin increased, especially driven by demand from South Korea. The Kimchi Premium, which measures the price gap between South Korean exchanges and other exchanges, reached a local high of 5.12, indicating strong local demand. The rise in buying interest among South Korean investors suggests that the region is optimistic about the prospects for Bitcoin, despite mixed signals from global markets.

Earlier news, South Korean cryptocurrency investors exceeded 15 million in November. According to data submitted by the Bank of Korea, as of the end of November, a total of 15.59 million South Koreans had accounts in the countrys five major cryptocurrency exchanges (Upbit, Bithumb, Coinone, Korbit and GOPAX).

Cardone Capital Launches Fund Combining Real Estate Investments with Bitcoin Purchases

On December 27, Cardone Capital, a real estate investment company that manages $4.9 billion in assets, announced the launch of the 10X Space Coast Bitcoin Fund, which combines institutional-grade real estate with Bitcoin purchases. The fund size is $87.5 million.

CryptoQuant founder: Trumps Bitcoin policy depends on the economic status of the United States

On December 29, CryptoQuant CEO and founder Ki Young Ju said that President-elect Donald Trump’s Bitcoin policy may depend on the global investment community’s view of the U.S. economy and the strength of the U.S. dollar.

Ju believes that when investors believe that the US economic hegemony is threatened, the prices of value-storing assets such as gold and BTC will soar. However, investors continue to express confidence in the US economy and regard the US dollar as a safe haven currency. This dominant position makes it unlikely that the Trump administration will adopt a strategic reserve of Bitcoin to protect the dominance of the US dollar and may cause the president-elect to backtrack on policies supporting Bitcoin.