Original author: Web3 farmer Frank

From a data perspective alone, the RWA narrative is definitely the clearest Alpha direction for Blockchain+ in the next 10 years.

Statistics from the RWA research platform rwa.xyz show that the current total RWA market size exceeds US$15 billion. Fidelity predicts that this figure will double to US$30 billion by 2025, while BlackRocks outlook is more optimistic, predicting that the market value of tokenized assets will reach US$10 trillion by 2030.

In other words, in the next seven years, the potential growth space of RWA narrative may be as high as 700 times or more! However, there is actually a core question hidden behind this: who will really capture the incremental value of this epic narrative?

Source: rwa.xyz

This should also be the next hundred billion dollar question for the entire RWA track, and the answer may be hidden in the infrastructure surrounding the RWAfi public chain.

RWAfi, RWAs historic shuttle

In essence, moving real-world assets (RWA) to the chain is actually just the first step in tokenization, which is far from enough to unleash its true potential. To further realize the release of on-chain value, more efficient technical underlying architecture, open infrastructure toolset and complete ecosystem collaboration are needed.

To put it bluntly, the on-chainization of RWA requires not only technological breakthroughs, but also a complete service framework around the entire life cycle of RWA assets, especially the safe and low-threshold introduction of RWA assets into diversified on-chain DeFi scenarios, and the complete transformation of the stock dividends of traditional assets into on-chain incremental value.

This is exactly what RWAfi means. Under the framework of tokenization, RWA not only greatly improves its own liquidity, but also can obtain DeFi income through operations such as lending and staking, introduces real income asset support to DeFi, and enhances the value foundation of the Crypto market.

Vitalik Buterin once proposed an interesting metaphor, that is, each blockchain network has a unique soul. For example, some networks are deeply involved in a certain segment of DeFi, some focus on NFT and DAO ecology, and some are committed to incubating ZK applications, etc.

However, when we turn our attention to the RWA ecosystem, we will find an intriguing current situation: although RWA is popular, there are very few RWAfi public chains that specialize in real-world asset management and on-chain circulation. Even Ethereum, Avalanche, etc., which have a deep layout in the RWA direction, are not originally designed to carry trillions of dollars of real-world assets.

The reason is simple. The core mission of RWAfi is to allow real-world assets to flow freely on the chain. Therefore, compared with on-chain applications such as DeFi, in addition to dealing with the complexity of traditional on-chain applications such as DeFi, the more challenging thing is how to make RWA truly active on the chain:

On the one hand, putting the ownership of real-world assets on the chain involves a complex asset tokenization process and collaboration among multiple parties. It is necessary to solve problems such as security compliance, liquidity, cross-chain interoperability, and a developer-friendly technical environment, so as to achieve efficient liquidity and transparency of on-chain assets.

On the other hand, it is not enough to just complete tokenization. After on-chain, there is also empowerment, that is, the real value of RWA is reflected in how to build a transparent, efficient and liquid on-chain financial market through blockchain technology. Therefore, it is necessary to realize in-depth DeFi protocol integration, profit distribution, and risk management in the future, so as to give RWA liquidity, composability and interoperability similar to crypto assets.

Taking real estate as an example, after tokenization and chain-linking, it is no longer a static asset in the traditional sense and can participate in a variety of DeFi scenarios, such as transparent distribution of rental income through smart contracts, or using it as collateral for on-chain financing. This empowerment puts forward higher technical and ecological requirements, while also breaking the inherent limitations of RWA as a real asset, injecting it with higher-dimensional composability and application potential.

Therefore, perhaps many people do not realize that RWAfi is not just a technical solution, it essentially creates a new asset class with native real-income attributes - by introducing real-world assets, capital and cash flows, it injects native real-income attributes into the blockchain ecosystem.

In this context, although many blockchain networks have begun to explore the RWA field, most of them remain on the surface and lack full-chain technical support and ecological layout. After all, the success of RWAfi lies not only in its completion of asset tokenization, but also in its ability to provide a full set of solutions from development to operation:

Developers and users need a development resource environment that is easier to use, a more efficient and scalable infrastructure, and a more secure and compliant underlying environment. Therefore, the core demand of the future RWA incremental market of hundreds of billions or even trillions of dollars is obvious - a dedicated RWA public chain.

It can meet the diverse needs of both institutional users and crypto-native users. In this vision, the RWAfi public chain not only empowers RWA assets, but is also likely to become the core capturer of incremental value in the RWA ecosystem. By becoming a hub for liquidity and value settlement, all DeFi operations around RWA tokenized assets (such as Farm and mortgage interactions) can gather value through the RWAfi public chain, further promoting the incremental expansion of the RWA track.

In short, the L1 public chain dedicated to RWA is only a means, not an end . The players who can ultimately capture the incremental value of the RWA track will most likely be those solution providers who can cover the entire chain from on-chain infrastructure to ecological empowerment. They can enable the entire RWA process from chaining to empowerment to run smoothly and efficiently.

Therefore, from this perspective, the golden age of RWA dedicated chains has arrived.

A new interpretation of one-stop RWA dedicated chain from Plume

For RWAfi, there is another natural advantage:

No matter which track or product under the RWA narrative finally comes out, as long as the overall market size continues to grow, the RWAfi public chain platform, which directly provides the most basic support in the form of infrastructure, can enter the future market of up to hundreds of billions or even trillions of dollars and capture the incremental value behind it.

After all, RWA has gradually become the main driving force for the increase in on-chain digital assets, allowing Web3 to effectively reach the huge asset pool of traditional markets - such as the global bond market ($133 trillion) and the gold market ($13.5 trillion).

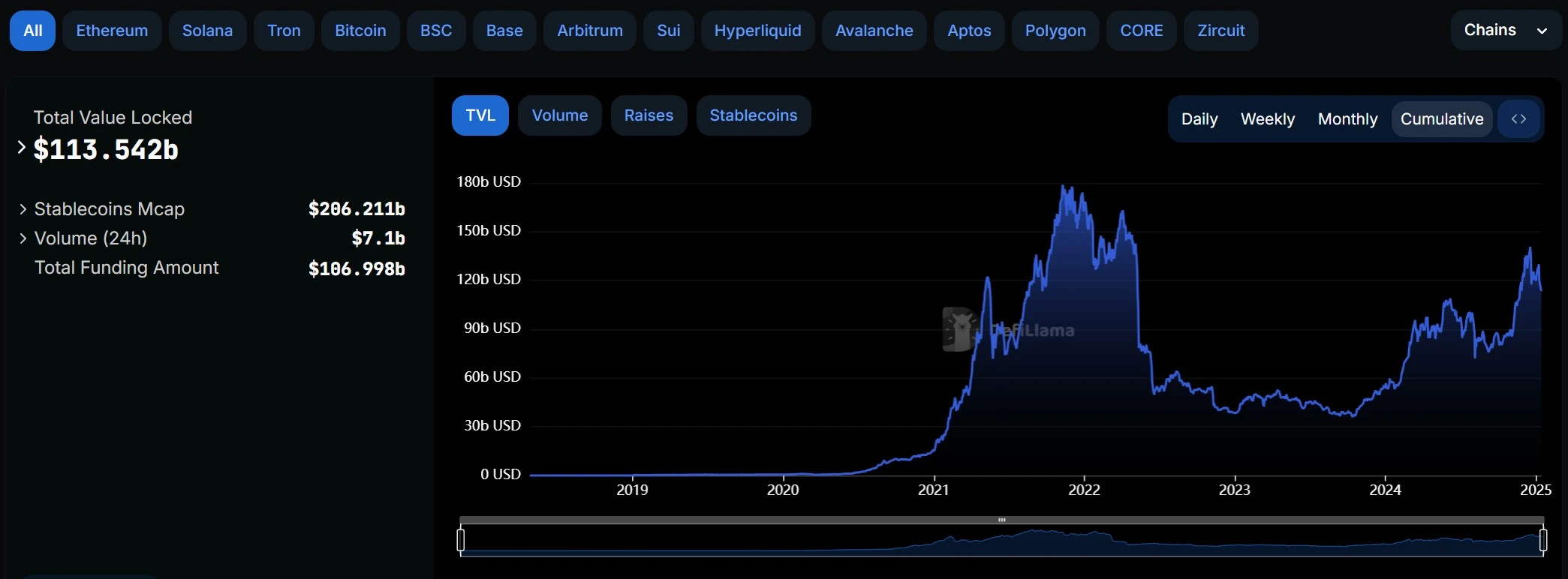

You should know that since Compound ignited the DeFi summer in 2020, the size of digital assets in the entire on-chain world has ushered in considerable development. Even though it is still facing a sharp pullback compared to US$180 billion in November 2021, as of January 13, 2025, the on-chain TVL is still as high as US$113.5 billion.

Source: DeFiLlama

However, compared with the trillions of dollars of tokenizable RWA assets (bonds, gold, stocks, real estate, etc.), this volume is still insignificant. Therefore, RWA tokenization will undoubtedly bring a new incremental momentum to the on-chain world and expand unprecedented incremental market space on the chain.

Currently, there are very few L1 public chains that are positioned around RWAfi. Plume, which recently completed a new round of financing of US$20 million, is almost the only RWAfi public chain in the strict sense. This can also be regarded as a benchmark financing event in the RWAfi field so far.

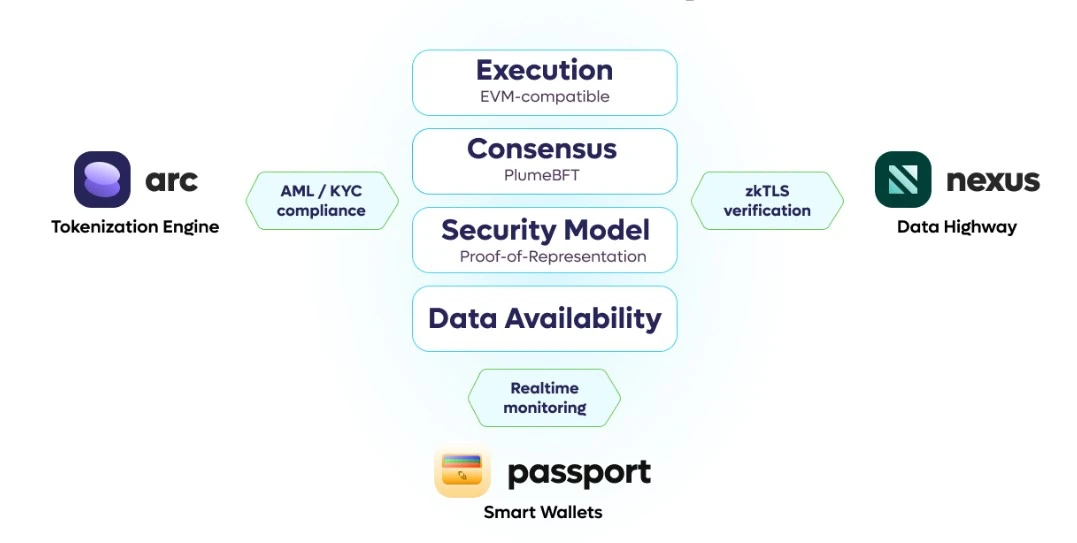

The most notable feature of Plume is its modular design. Through a one-stop solution, it systematically solves the tokenization, compliance, liquidity and interoperability issues of RWA, providing developers and institutions with a complete solution covering the entire life cycle of RWA tokenization.

This systematic model is worthy of attention. After all, for a public chain, it doesn’t matter how “high-end” the technology is. Whether it can attract developers and users to choose you and settle down is the core competitiveness. Especially for products like RWA that involve high complexity on and off the chain, if you only provide fragmented services in a certain link, developers and institutional users will not pay for it.

The advantage of Plume is that it integrates multiple modular key tools to build a complete RWA asset on-chain solution for developers. This toolset not only lowers the technical threshold, but also directly incorporates compliant suppliers into the platforms upstream supply chain system in a compliance as a service model, ensuring that tokenized assets meet regulatory requirements from the source:

Arc - Tokenization Engine: Arc simplifies the tokenization process by integrating compliance workflows and reducing barriers for asset issuers, providing an efficient path for bringing RWAs on-chain;

Passport - Smart Wallet: Passport allows users to store contract code directly in their externally owned accounts (EOAs). This native functionality supports RWAfi composability, yield management, and advanced account abstraction capabilities.

Nexus - Data Highway: Nexus uses cutting-edge technologies such as zkTLS to securely integrate real-world data into the blockchain, which not only improves the security and transparency of on-chain assets, but also unlocks new opportunities;

Through these modular tools, Plume not only empowers developers, but also greatly lowers the threshold for traditional financial institutions to enter Web3 - developers can lower the technical threshold through modular tools and quickly deploy complex RWA solutions; the Compliance as a Service model can also help traditional institutions solve compliance pain points while providing efficient technical support.

This means that Web2 giants such as UBS and Blackstone Group that want to enter Web3 can directly embed RWA tokenization services into existing products through the one-stop RWA asset tokenization service provided by Plume, and quickly achieve product iteration and market expansion.

This not only allows institutions to easily tokenize assets and introduce them into the blockchain ecosystem, but also retains the smooth user experience of Web2, giving users asset autonomy and Web3 attributes.

From a more macro perspective, in the Web2 world where private traffic is king, whoever can grab enough private traffic can maximize the profits. This has led to the formation of a fat application and thin protocol in Web2. Super apps such as WeChat, Alipay, and Meituan are becoming increasingly large, locking in users through a closed ecosystem.

In Web3, the product logic has clearly reversed - products in the form of underlying components or middleware are becoming more and more popular, and can be inserted in the form of building blocks or used as underlying infrastructure to obtain maximum aggregation benefits. Plumes modular infrastructure perfectly fits this Web3 product logic. It provides traditional financial institutions and Web2 giants with lightweight RWA integration tools, enabling them to quickly implement Web3.

This is where Plumes appeal lies. For the RWAfi track, future competition is not just a contest of technical capabilities, but whether it is possible to design an efficient and friendly ecological support system around developers and users. This model of connecting on-chain innovation with off-chain assets will become a real watershed in the development of the RWA track.

RWAfi’s only way forward: a two-way link between institutions and DeFi’s “circle of friends”

For Web3, increment is the eternal theme - whether it is the injection of incremental funds or the expansion of incremental users.

The core charm of RWAfi lies precisely in its natural two-way connection attribute: on the one hand, it links new and old players in Web3, and on the other hand, it connects with the huge amount of deposited assets in traditional finance. This can not only provide new asset categories and income opportunities for crypto-native users, but also open up a path for traditional financial giants to deeply integrate with the on-chain DeFi world, thereby achieving a superposition effect of 1+1>2.

Taking Plume as an example, it has currently built a two-pronged ecological network with institutional partners as the core and DeFi partners as the extension:

Institutional partners: responsible for providing compliance, trust foundation and high-quality assets, and are the trusted core of the RWAfi ecosystem;

DeFi partners: provide on-chain users with a flexible and high-yield asset participation method, further enhancing the liquidity and composability of RWA;

If you look closely, you will find that Plumes institutional circle of friends mainly focuses on traditional asset tokenization, compliance and asset management, so that RWA can obtain higher liquidity and transparency through Plumes on-chain infrastructure, paving the way for the deep integration of traditional financial giants and RWAfi, for example:

Anchorage Digital Bank: Provides compliant custody services for Plume on-chain assets, allowing institutional clients to directly access on-chain RWA earnings;

DeFiMaseer: An institutional partner focused on tokenizing the carbon market, putting $200 million of carbon emission quotas on-chain to optimize the efficiency and accessibility of the regulatory market;

DigiFT + UBS: Collaborate to launch uMint to promote the tokenization of on-chain financial assets;

Dinari Global + Blackstone: Bring Blackstone’s ETFs to the chain to provide higher liquidity for institutional assets;

Elixir + Blackstone: Support Elixir to build more asset circulation infrastructure on the chain;

NestCredit + MountainUSDM + m0 Foundation + Anemoy Capital/Centrifuge: Build a multi-party cooperation network to promote the sustainable development of diversified assets on the chain.

Pistachiofi: Introducing on-chain Real Yield services to LATAM and APAC, expanding regional market coverage;

Busha: Provide real on-chain benefits to the African market and expand the boundaries of global financial services;

Cultured RWA: Exploring the on-chain potential of the RWA speculative ecosystem;

Google Cloud: Using AI to provide RWA pricing services, making on-chain asset pricing smarter and more efficient;

The DeFi protocols that have achieved deep integration or cooperation with Plume mainly use Plume to convert the stock dividends of traditional assets into incremental value on the chain, such as providing diversified participation opportunities for on-chain users through liquidity support, yield optimization and new scenario exploration:

Ondo Finance: The leading protocol for tokenized U.S. Treasury bonds (USDY), injecting trusted asset liquidity into Plumes RWA ecosystem;

Anzen finance: Supports USDz’s on-chain stable asset innovation and optimizes the tokenization experience of USD-related assets;

Royco (Berachain): Provides a transparent yield liquidity market built specifically for DApps and expands to the RWAfi ecosystem through cooperation with Plume;

Bouncebit: As a partner of CeDeFi portal, it helps users access reliable institutional-grade yield products through its platform and strengthens RWAfis influence in the CeDeFi field;

Midas: A DeFi project focused on high-yield, institutional-grade assets, providing Plume users with more on-chain income options;

PinLink: DeFi infrastructure provider, working with Plume to introduce fragmented DePIN assets and revenue opportunities to enhance ecosystem liquidity;

Avalon Finance: Plume’s BTCfi liquidity layer partner, focusing on BTC lending and circulation in the RWAfi environment, further expanding the application scenarios of on-chain assets;

Objectively speaking, the Plume team has a technology + market gene in its background - its members include Degen players from Web3 giants such as Coinbase, BNB Chain, and Galaxy Digital, as well as veterans from traditional finance and technology industries such as Robinhood, JPMorgan Chase, and Google. This enables them to better start from the complex needs of the traditional financial market and combine the unique advantages of blockchain technology to create a modular, compliance-friendly infrastructure.

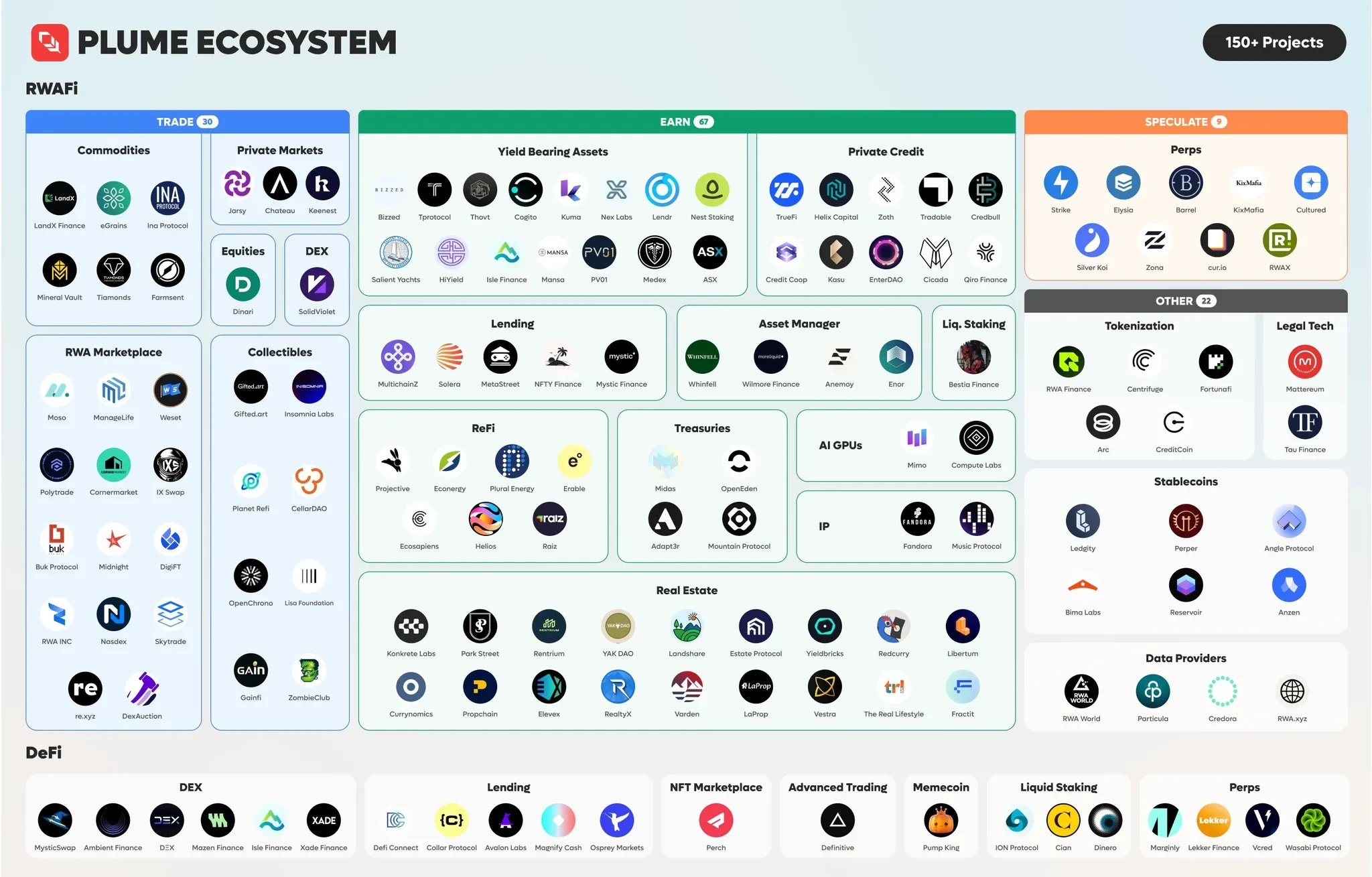

In general, Plume has already built two huge and expanding ecosystems, namely, new and old participants in Web3 (covering the on-chain and Token fields) and traditional financial giants (involving the off-chain and RWA fields). It has accumulated more than 180 applications and protocols, and the test network has attracted more than 3.75 million users and generated hundreds of millions of transactions, with remarkable results.

The dual-wheel-driven cooperative network has also formed an ecological layout jointly promoted by new and old players in Web3 (on-chain, DeFi protocol) and traditional financial giants (off-chain, RWA). Plume has become an indispensable infrastructure role between the two, and is expected to become a rigid demand among rigid demands as the RWAfi ecosystem continues to be built.

This further strengthens Plumes unique positioning as a dedicated RWAfi full-chain infrastructure, which can directly capture the core value generated by RWA assets in tokenization, liquidity integration and on-chain operations - from asset minting to deep integration of DeFi scenarios, it can provide complete technical and ecological support, and truly realize the seamless transformation of traditional asset value to on-chain increments.

From this perspective, this full life cycle empowerment is the unique competitive advantage of RWAfi dedicated chains such as Plume. RWAfi public chains not only serve institutions and developers, but also directly face all RWA users, capturing the participation value of end users, thereby sharing the dividends of the large-scale growth of the entire pan-RWA ecosystem and becoming the core engine driving the expansion of the trillion-dollar market.

Interestingly, as a track closely related to regulation, Plume actually has a potential policy benefit that is easily overlooked: Plumes investor Katie Haun, formerly an assistant prosecutor and digital currency coordinator at the U.S. Department of Justice, a former partner of a16z, and a member of the Coinbase board of directors, can be said to be one of the few critical few in the Crypto industry who deeply understands the far-reaching impact of U.S. regulation on the blockchain industry.

This also means that her investment source background makes Plume closer to the center of regulatory policy, which is undoubtedly a positive signal for Plume. As the US regulatory framework gradually improves, especially after January 20, a series of crypto-friendly people took office in the Trump cabinet, Plume is expected to become the RWAfi project closest to the US regulatory core, thereby directly reaping the greatest policy support and market dividends.

Conclusion

A strong storm starts with a small ripple. The logic of the market has always been subtle and the value discovery of all narratives has its own internal development logic.

It can be said that RWAfi is one of the few narrative directions that can build a bridge between the on-chain and off-chain. Its potential comes from the innovation of Web3 and also benefits from the stock dividends of huge assets in traditional finance.

The value of the RWAfi public chain is self-evident - as the infrastructure that can truly upgrade RWA tokenization to the RWA Asset Internet, it provides a practical answer to the $100 billion growth of the RWA narrative.

As for whether leading players like Plume that focus on both on-chain (DeFi) and off-chain (traditional financial institutions) can stand out in the future, it depends on whether it can continue to attract developers, consolidate the ecosystem, and allow the on-chain and off-chain integration of RWA to truly prosper. After all, it is a blue ocean that no one has occupied, and the opportunity has just begun, and everything is unknown.