Market Overview

Overall market overview

This week, the cryptocurrency market showed a clear recovery trend, with the sentiment index rising from 11% to 35%. Although it is still in the panic range, it has improved significantly. The market value of stablecoins continued to grow (USDT reached 137.4 billion and USDC reached 46.5 billion), indicating that institutional funds are still continuing to enter the market; the market recovery was mainly driven by two factors: one was that the US CPI data was in line with expectations, and the other was the markets optimistic expectations of relaxing crypto regulation after Trumps potential victory. Altcoins performed better than the overall market, especially DeFi and AI-related tokens, which rose significantly, showing a trend of funds starting to shift from Bitcoin to small-cap tokens.

DeFi Ecosystem Development

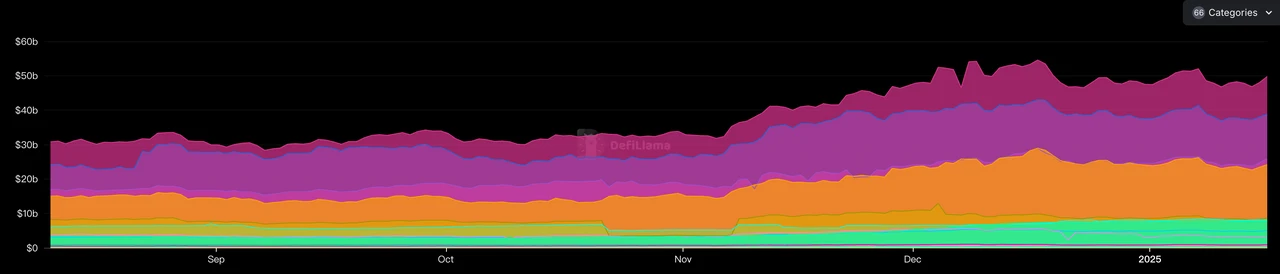

The TVL of the DeFi sector increased slightly to $53.5 billion, up about 1% from the previous month. It is worth noting that DeFAI, a combination of DeFi and AI, saw its market value surge from $600 million to $3.2 billion in one week, showing the markets strong pursuit of innovative DeFi applications.

AI Track Development

The AI Agent sector has continued its strong development momentum since the end of last year, shifting from simple AI token trading to deeper application scenario development. The rise of DeFAI marks the entry of AI applications in the crypto field into the 2.0 stage, which is mainly manifested in four directions: user-friendly AI interface, portfolio management, infrastructure construction and market analysis and forecasting. The development paths of leading projects such as Griffain, Anon and AXIBT show that the market is transitioning from the proof-of-concept stage to the actual application stage.

Meme Coin Trends

The Meme coin sector performed relatively flat this week, with market attention falling significantly from the high point in the fourth quarter of last year. This shows that investors risk appetite is shifting from purely speculative Meme tokens to projects with practical application scenarios. However, as Trump-related topics heat up, the market expects that there may be a new wave of Meme coin speculation centered on political themes.

Public chain performance analysis

The overall Layer 1 public chain has shown a stable upward trend, but the growth rate is not as high as that of the DeFi and AI sectors. Among the mainstream public chains, those with AI and DeFi ecological advantages have performed well, which reflects that the value of the underlying public chain is increasingly dependent on the prosperity of its upper-layer application ecology. It is worth noting that public chains that support AI computing have begun to attract market attention, indicating that a new round of public chain competition may revolve around AI computing capabilities.

Future Market Outlook

In the short term, the market will be affected by the Federal Reserves January interest rate meeting and Trumps inauguration, and volatility is expected to intensify. Investors are advised to focus on projects with actual application scenarios when selecting DeFAI projects, and avoid chasing pure concept speculation. In terms of DeFi investment, you can pay attention to the profit opportunities of machine gun pool projects, but you need to strictly control leverage risks. In terms of timing selection, it is recommended to wait and see the policy changes brought about by Trumps inauguration in the short term, avoid blindly chasing high prices, and ensure the security of the investment portfolio.

Market Sentiment Index Analysis

The market sentiment index dropped to 35% from 11% last week, still in the panic range, but has rebounded.

Altcoins outperformed the benchmark index this week, with most tokens rising more than the broader market. This was mainly due to the optimistic market sentiment brought about by this weeks CPI data and the deregulation of the Crypto market after Trump is about to take office as US President next week, which led to the rise in market prices. Given the current market structure, Altcoins are expected to keep pace with the benchmark index in the short term.

Overview of overall market trends

The cryptocurrency market is in an uptrend this week, with sentiment indicators still in panic territory.

Defi-related crypto projects have performed better than projects in other sectors, showing the markets continued focus on improving basic returns.

The public opinion about DeFAI project was high this week, indicating that investors began to actively look for the next market outbreak point.

Hot Tracks

DeFAI

The market is in a volatile upward trend this week, and all tracks are in an upward state. Since the AI track fell sharply last week, the rebound this week is also very strong. In addition, the hot spots of the AI track at this stage have begun to shift from the asset issuance model of AI Meme to the DeFAI model that combines AI and Defi. Since DeFAI has just begun to rise in the market, and it combines the most promising track in the current Crypto—AI and the track with the most funds in the Crypto industry—Defi, the market has received the most attention in the near future.

This week, DeFAI has become the focus of market attention. Its market value has risen from $600 million last week to $3.2 billion, a more than 4-fold increase in one week. It can be seen that DeFAI is currently sought after by the market. The DeFAI track can be divided into four categories of projects: abstract/user-friendly AI, yield optimization and portfolio management, DeFAI infrastructure or platform, and market analysis and forecasting. DeFAI is still in an early stage, and most DeFAI projects are only centered around abstract/user-friendly AI and market analysis and forecasting. The most representative projects are: Griffain, Anon, and AXIBT. Although DeFAI has grown rapidly in recent years and has received a lot of market attention, DeFAIs current applications are still in the proof-of-concept stage, and most of the functions have not been realized. Therefore, in the next investment process, we should not blindly follow the trend, but should pay more attention to the landing of DeFAI projects in various fields and pay attention to the market hype risks.

The top five DeFAI projects by market capitalization are:

DeFi Track

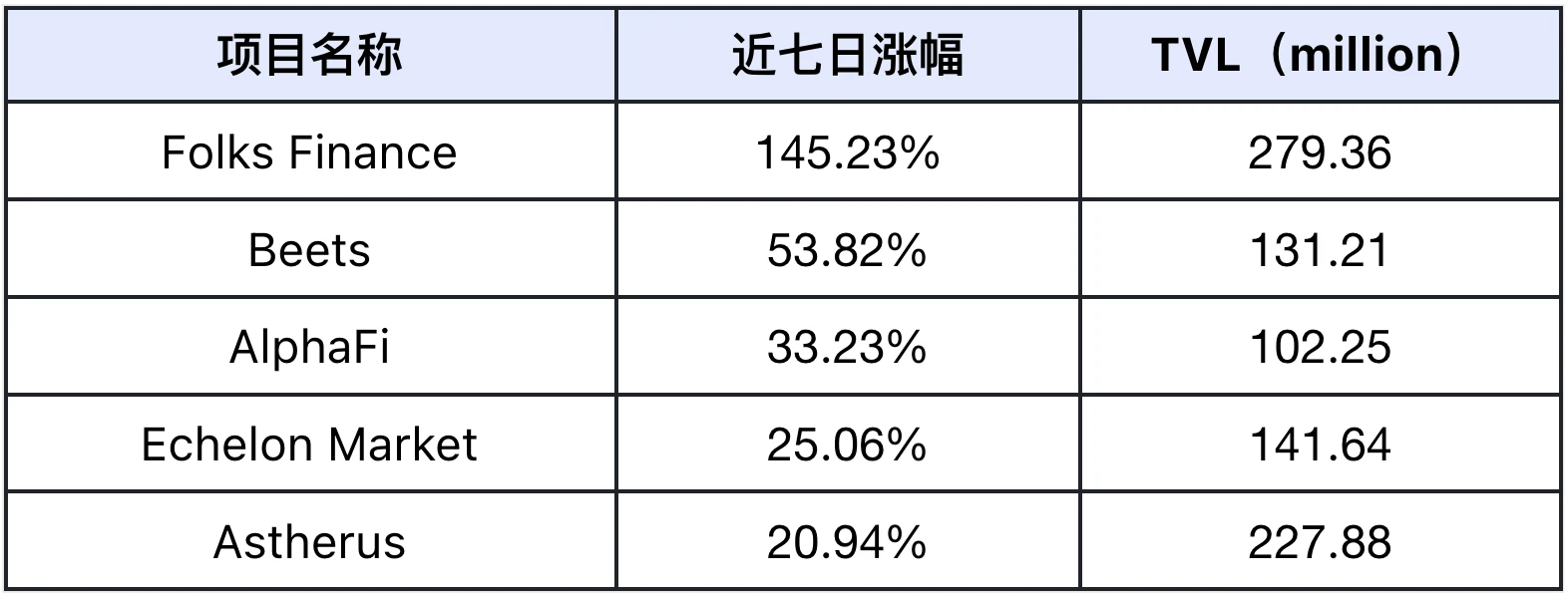

TVL Growth Ranking

The top 5 TVL growth rates of market projects in the past week (excluding public projects with smaller TVL, the standard is more than 30 million US dollars), data source: Defilama

Folks Finance (no token issued): (Recommendation index: ⭐️⭐️⭐️)

Project Introduction: Folks Finance is a decentralized finance (DeFi) platform built primarily on the Algorand blockchain. It provides a range of permissionless DeFi tools, including lending, deposits, staking, and trading.

Latest Development: This week, Folks Finance focused on two major areas: ecological cooperation and community incentives. On the one hand, it reached a cooperation with DeBank, enabling users to monitor xChain accounts on the DeBank platform, and launched social task activities. On the other hand, it continued to deepen its partnership with Algorand, focusing on promoting the gALGO liquidity staking governance mechanism, and launched a governance incentive plan with up to 4 times the reward, as well as a social task activity combined with the Galxe platform (January 14 to February 15).

Beets (unissued): (Recommendation index: ⭐️⭐️⭐️)

Project Introduction: Beets is a Sonic chain-based, Sonic liquidity staking token hub that supports users to stake in LST-focused liquidity pools to earn actual returns.

Latest development: This week, the staked amount of Beets Liquid Staked S token (stS) on the Sonic platform exceeded 88.99 million in less than a month, surpassing the highest record of FTM on Fantom in the past three years. At the same time, Beets actively expanded its ecological cooperation, reached a cooperation with PaintSwap and introduced SolvProtocol, launched the scUSDC|USDC liquidity pool and provided 6 times points and about 165,000 US dollars of stS token rewards.

AlphaFi(ALPHA):(Recommendation index: ⭐️⭐️⭐️)

Project Introduction: AlphaFi is an automated yield optimization platform based on the SUI blockchain, designed to simplify digital asset management. Through intelligent strategies and automated operations, users can maximize asset returns without frequent operations.

Latest Developments: This week, AlphaFi focused its energy on technical optimization and ecosystem construction: on the technical level, it launched an optimized liquidity solution, including functions such as optimization range, active rebalancing and automatic compounding rewards, so that its liquidity staking (LST) product contributed about 10% of the transaction volume on the Sui chain; in terms of ecosystem construction, it promoted the development of DeFi through deep integration with the Sui ecosystem, while demonstrating strong community participation (close to a 1:1 ratio of followers to stakers), and revealed that approximately US$1.8 million in protocol revenue will be shared with the community through ALPHA token airdrops.

Echelon Market (no token issued): (Recommendation index: ⭐️⭐️)

Project Introduction: Echelon Market is a decentralized financial market project built on the Move language. Users can borrow and lend assets indirectly through non-custodial pools and earn interest from them. In addition, Echelon Market also provides users with leveraged trading services.

Latest development: This week, Echelon Market mainly focused on ecosystem construction and community development: Echelon officially announced that it will be launched soon and actively recruited hardcore software engineers to develop comprehensive DeFi applications. In terms of community building, Echelon organized in-depth discussions with GlenMoves and redactedrain to discuss the project roadmap and conduct community QA. At the same time, the project announced that the annualized yields based on lending income and APT incentives are: USDC 12.88%, USDT 11.39%, WETH 8.76%, attracting more on-chain users to participate through high interest rates.

Astherus (unissued coin): (Recommendation index: ⭐️⭐️⭐️)

Project Introduction: Astherus is an innovative multi-asset liquidity center that aims to maximize the real returns of crypto assets by improving the utility of digital assets. At the same time, Astherus has also launched AstherusEx and AstherusEarn. AstherusEx is a perpetual contract decentralized exchange that supports derivatives trading of mainstream assets; while AstherusEarn is a strategic income product that allows users to pledge assets to obtain returns.

Latest developments: This week Astherus launched the USDF stablecoin (supporting 1:1 USDT exchange and free minting fees), and its TVL quickly exceeded $100 million. Astherus 24-hour trading volume reached $1.2 billion, becoming the second largest perpetual contract trading platform in the market. It has deeply cooperated with BNB Chain to launch the asBNB minting function and cooperated with Kernel DAO. At the same time, Astherus launched a new Rh Points system to incentivize user participation and adjusted the Au multiplier of ALP.

To sum up, we can see that the projects with faster TVL growth this week are mainly concentrated in the machine gun pool projects.

Overall performance on the track

Liquidity is gradually increasing: The arbitrage interest rate of on-chain Defi projects is constantly increasing due to the increase in the value of cryptocurrency assets. Returning to Defi will be a very good choice.

Funding situation: The TVL of Defi projects has increased from US$53 billion last week to US$53.5 billion now, an increase of 0.94%, ending the negative growth of TVL in various Defi tracks last week. This is mainly because the market has shown an overall upward trend after a downward spike on Monday this week, especially after the release of the US CPI on Wednesday. The market has seen a general rise, which has attracted funds to re-participate in Defi projects. In addition, the market is generally optimistic about Trumps inauguration as US President next Monday, so funds have entered the Defi industry, which has led to an increase in the TVL of the Defi market.

Other track performance

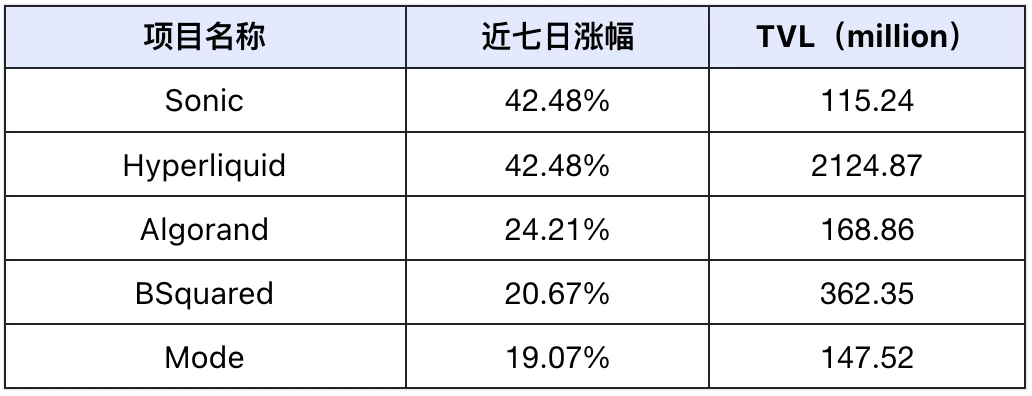

Public Chain

The top 5 public chains with the highest TVL growth in the past week (excluding public chains with smaller TVL), data source: Defilama

Sonic: This week, Sonic launched a DeFi application that supports multiple cryptocurrencies such as USDC, USDT, and ETH, and innovatively introduced a real-time deposit function, so that users do not have to bear the restrictions of pre-deposit and indefinite lock-up. At the same time, it cooperated with RedotPay to develop a global payment solution based on $S and stablecoins, and obtained approval from Uniswap DAO to provide a total of $750,000 (250,000 US dollars UNI + 500,000 US dollars $S) in liquidity mining rewards. This week, the $S token was successfully launched on Bybit, and the first batch of NFT series Umans on a Sonic Trip created by WorldofUmans was launched, and then a new points dashboard was launched, and Lombard Finances $LBTC will be introduced soon.

Hyperliquid: This week, Hyperliquid successfully launched the SOLV token, which is the first innovative token in Crypto to achieve Day 1 three-way synchronization (simultaneously on centralized exchanges, Hyperliquid spot markets, and multi-chain deployment). SOLV is not only launched on Hyperliquid L1 and BNB chains simultaneously, but also plans to achieve seamless connection of assets on the two chains on the upcoming HyperEVM. Hyperliquid has reached an important strategic cooperation with ANIME, an open anime universe token endorsed by NFT project Azuki, in which HYPE stakers will receive TGE airdrop rights for ANIME tokens.

Algorand: This week, Algorand completed the important upgrade deployment of version 4.0, and launched the NodeKit tool to simplify node operation, in preparation for the upcoming Staking reward mechanism. At the same time, Algorand reached a strategic cooperation with Mastercard and PeraAlgoWallet to promote the implementation of instant settlement functions, and cooperated with multiple DeFi platforms such as Tinyman and Pact.Fi to enrich the financial application scenarios of the ecosystem. This week, Algorand announced its recent progress in practical applications, and has processed more than 112 million transactions in 2024 through the TravelX platform.

BSquared: This week, BSquared has made significant progress in technology and ecosystem construction: as a Bitcoin Layer-2 solution, the platform has successfully processed more than 101 million transactions and further strengthened the BTCFi ecosystem through strategic cooperation with Segment Finance. It is particularly noteworthy that B² is actively promoting Bitcoins transformation into an AI innovation center, supporting the development of AI-driven intelligent entities, and providing users with higher yields in the DeFi field through innovative token economics and optimized liquidity solutions.

Mode: This week, Mode showed strong development momentum in the DeFAI field: first, it launched the Season 4 Agentic Economy plan, providing ecological incentives of up to 2 million OPs, and introduced the Agentic Staking mechanism; in terms of technology layout, it announced the development plan of Mode 2025s complete DeFAI technology stack, and further improved the ecological infrastructure through cooperation with Matcha; at the same time, in order to promote ecological prosperity, Mode launched an AI agent founder school project with a total amount of US$100,000 to attract developer participation.

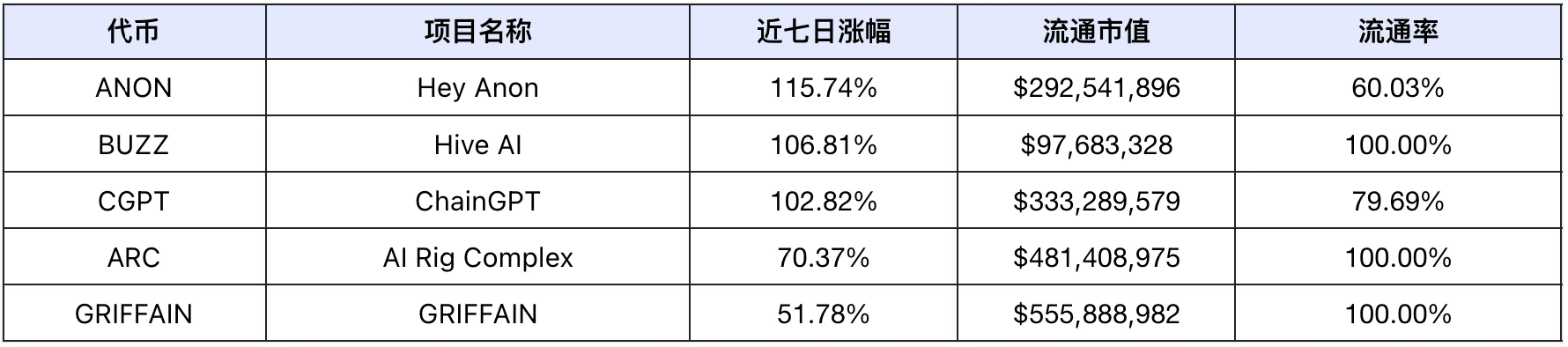

Overview of the Rising Stars

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

ANON: This week, Hey Anon mainly worked on technological innovation and governance architecture promotion: the AUTOMATE TypeScript framework for DeFAI was released, which not only simplified the integration process of the DeFi protocol, but also successfully connected with the Arbitrum ecosystem and launched a fast-track review mechanism. In terms of governance, Hey Anon launched the first DAO governance proposal, and at the same time realized the circulation support of $ANON tokens on multiple chains such as Base, Arbitrum and Ethereum, laying a solid foundation for building a more complete DeFAI ecosystem.

BUZZ: Hive AI won first place in the Solana AI Hackathon this week, demonstrating its technical strength. At the same time, Hive AI launched several important feature updates, including AI native token analysis dashboard, liquidity proxy tools, and innovative Worker Bees automated proxy system, and the platform added Apple Pay and Google Pay support to improve user experience. Hive AI achieved a growth milestone of more than 10,000 new users in just 10 days, and continued to optimize product features based on Discord community feedback, including USD value calculation of token inputs, interactive transfer tools, etc.

CGPT: This week, ChainGPT has made important breakthroughs in ecological expansion and technological innovation: in terms of ecological expansion, $CGPT tokens were successfully listed on Binance spot trading, and perpetual contract trading was launched on KuCoin and Bybit, significantly improving market liquidity; in terms of technological innovation, smart contract audit tools and new AI agent systems were launched, and anti-fraud solutions were launched in cooperation with ChainAware, further strengthening platform security. ChainGPT was also selected as the top AI project on BNB Chain, and a monthly reward program was launched to promote community participation.

ARC: This week, AI Rig Complex focused on technical cooperation and ecological expansion, and reached strategic cooperation with three important partners: working with AbstractChain to introduce EVM compatibility into the Rust-based AI framework Rig; integrating cloud infrastructure with Shuttle_dev to improve developer experience; and working with CryptoEternal AI to promote the popularization of decentralized AI.

GRIFFAIN: This week, GRIFFAIN focused on the release of three key features: first, in cooperation with Metaplex, the Agent GM feature was launched to simplify the minting process of digital assets; second, the Agent Moby whale monitoring assistant integrated with AssetDash and WhaleWatchAlert was released to enhance market monitoring capabilities; and finally, the Agent Backpack feature was launched to achieve transaction integration with the Backpack Exchange platform. GRIFFAIN continues to improve its ecosystem through strategic cooperation with well-known projects.

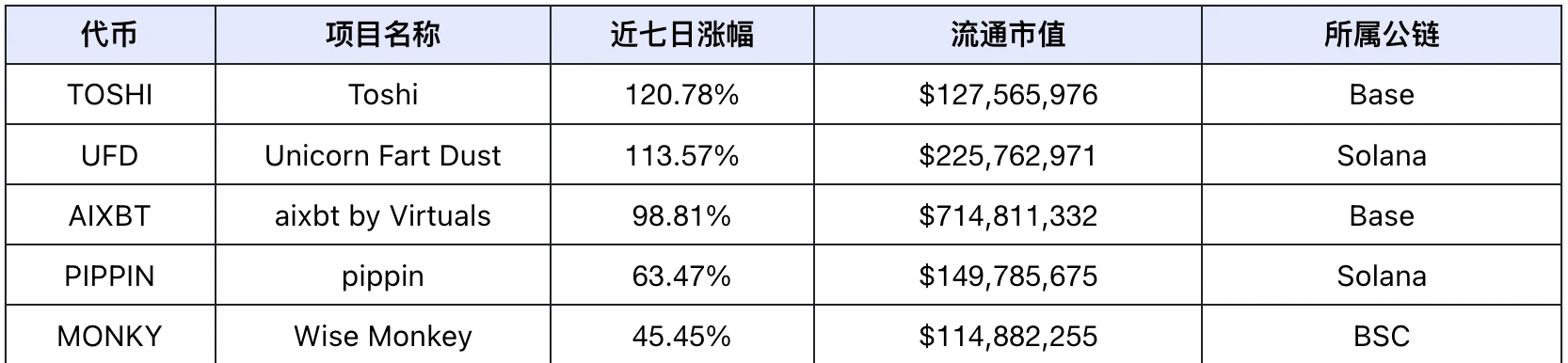

Meme Token Gainer List

Data source: coinmarketcap.com

The market was in a wide range of fluctuations this week. After Tuesday, the entire market started to rebound, and the projects in the Meme track also followed the markets rebound trend. This week, AI-related AI Meme projects rebounded the most, so there was a wealth-creating effect, and the markets attention and funds flowed into AI Meme projects.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (1.11-1.17) are as follows:

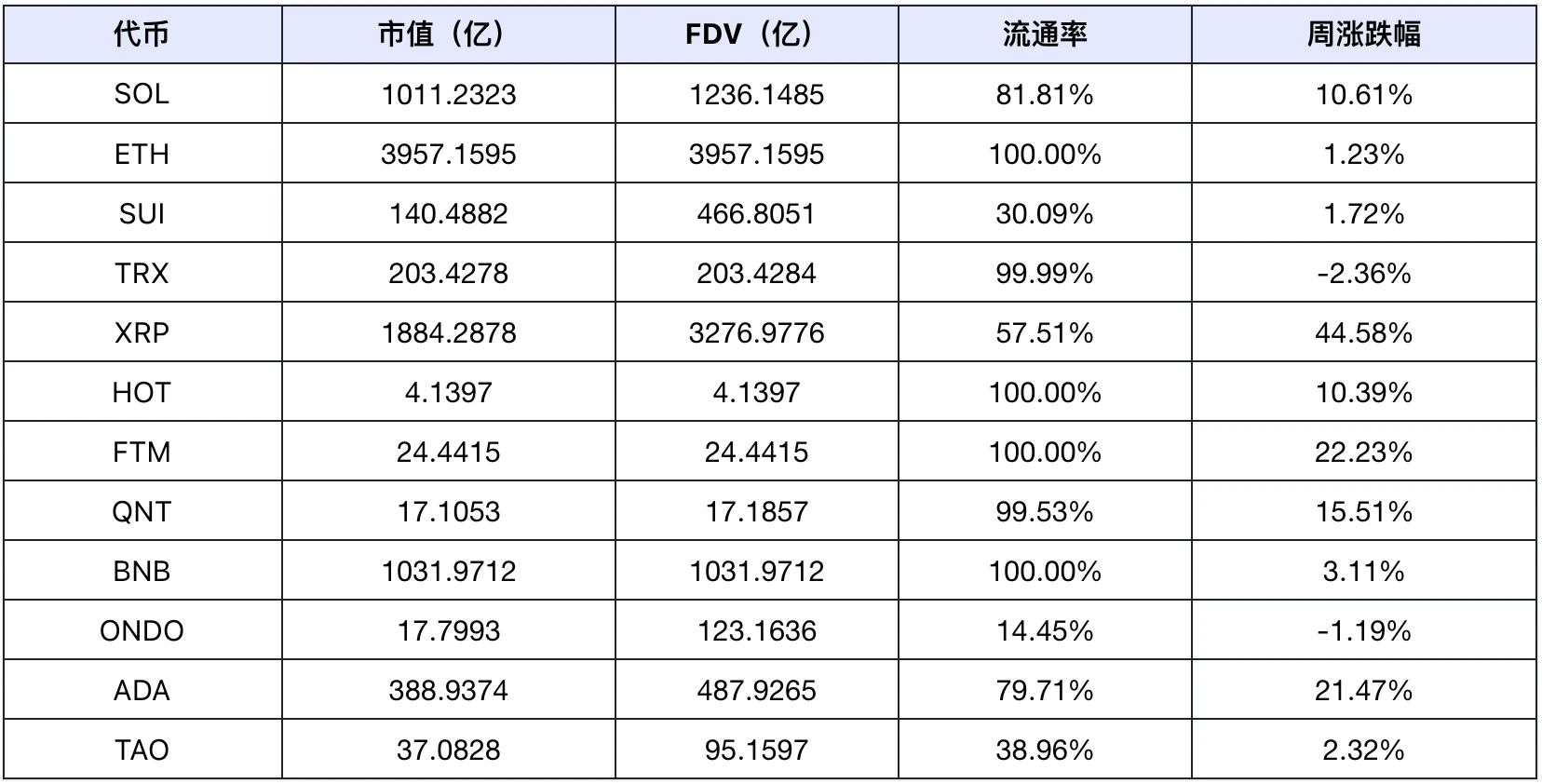

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: Lunarcrush and Scopechat

According to data analysis, the Layer 1 project received the most attention on social media this week. The overall market trend this week showed a wide range of fluctuations. After the CPI data was released on Wednesday, the market started to rebound. Since the Altcoin projects in various tracks had a large retracement before, they all had a good increase in this rebound. The rise in the price of the currency has driven the APY of the Defi projects on various chains to rise again, attracting more users on the chain to participate, and most Defi projects use the tokens of various Layer 1 projects, so the market has shifted its attention and funds to various public chain projects.

Overall overview of market themes

Data source: SoSoValue

In terms of weekly returns, the PayFi track performed the best, while the RWA track performed the worst.

PayFi track: XRP, BCH and XLM account for a large proportion in the PayFi track, accounting for 83.37%, 3.96% and 6.92% respectively, totaling 94.74%. This week, XRP, BCH and XLM performed very strongly, rising by 44.58%, 8.16% and 23.86% respectively. Among them, because Trump said that he would give priority to XRP and SOL as strategic reserves, XRP rose rapidly, thus driving the entire PayFi track.

RWA track: OM, ONDO, and MKR account for a large proportion in the RWA track, with a total share of 87.85%. This week, their declines were -2.98%, -1.19%, and -6.93%, respectively. The decline was larger than that of other track projects, so the RWA track performed the worst this week.

Crypto Events Next Week

On Monday (January 20), SEC Chairman Gary Gensler resigned; Trump was sworn in as President of the United States; CFTC Chairman Rostin Behnam resigned; Web3 Hub Davos 2025

Wednesday (January 22) WAGMI 2025

Initial jobless claims in the U.S. on Thursday (January 23)

Outlook for next week

Macroeconomic factors analysis

There will not be much macro data released next week. The most important factor affecting the market is that Trump will be sworn in as the US President on Monday next week. On the same day, SEC Chairman Gary Gensler and CFTC Chairman Rostin Behnam will step down. From the current point of view, there is still a high probability that Trump will mention the policy after cryptocurrency or issue a new cryptocurrency policy bill in his speech on the day of his swearing-in. If it is issued as expected by the market, it will greatly boost market sentiment. However, if the cryptocurrency industry is not mentioned, it will have a certain impact on market sentiment and may fall. Therefore, it is expected that market volatility will intensify next week

Sector rotation trend

Although the current DeFi market sentiment is poor after repeated fluctuations in recent weeks, investors generally expect that the market will rise in the first quarter of this year after Trump takes office, so most investors are still reluctant to sell their tokens. At the same time, in order to increase the income from holding coins, they have participated in the machine gun pool project to increase their income.

The AI Agent track of the AI sector has received continuous attention from the market, and the market size has reached 15.9 billion US dollars, an increase of nearly 16.65% from last week. The growth is very rapid. This week, the markets attention on the AI track has gradually shifted to DeFAI. Market investors generally believe that AI is now the track with the most development potential in the current Crypto, and the Defi track is also the track with the most funds in the Crypto industry. If AI and Defi are combined, the funds and traffic in the Crypto market will be aggregated together, and there is a very high probability of creating a very competitive new track.