1. Bitcoin market and mining data

From January 20 to January 26, the price trend of Bitcoin showed a certain volatility. The main changes during this period are as follows:

This week, the price trend of Bitcoin showed a pattern of rising high and then falling back, entering a period of shock consolidation. The previous rise was mainly driven by favorable policies and institutional buying, but after facing profit-taking pressure at high levels, market sentiment has become cautious. In the short term, the price of BTC may continue to fluctuate around the range of US$104,000 to US$107,000, and attention should be paid to changes in trading volume and policy news. If it can break through the resistance of US$107,000, it is expected to hit US$110,000; but if it falls below the support of US$104,000, it may test US$102,000 or even lower.

Bitcoin price trend (2025/01/20-2025/01/26)

Market dynamics and macro background

1. Fund Flow:

According to Glassnode data, the net outflow of Bitcoin from exchanges has decreased significantly in the past 7 days, indicating that investors confidence in the subsequent rise has been shaken. This trend in capital flows echoes the price adjustment, reflecting the weakening of market sentiment. As the price of Bitcoin has pulled back, investors have chosen to keep their funds on exchanges in the face of uncertainty, perhaps out of a cautious wait-and-see attitude towards further market fluctuations, or in preparation for trading when prices fall further. This change in capital flows is consistent with the adjustment of Bitcoin prices, indicating that market uncertainty and cautious sentiment have increased in the short term.

2. Technical pressure:

Technical analysis shows that Bitcoin broke through the historical high of $108,000 in the previous week, but then encountered strong selling pressure near $110,000, failing to effectively break through this psychological barrier, forming a short-term top, indicating that the selling pressure above the market is large. At present, the price of Bitcoin is hovering around $105,000, and the important support level is at the integer mark of $100,000. If the price falls below this area, it may further test the support of $98,000 (the low point of the previous consolidation range). In terms of technical indicators, RSI fell from the overbought zone (>70) to the 55-60 range, indicating that the bullish force has declined, but has not yet fully entered the oversold zone, suggesting that prices may continue to adjust. The Bollinger Bands show that the price has fallen from the upper track to near the middle track, and the fluctuation range has gradually narrowed, reflecting that the short-term market has entered a shock consolidation stage.

3. Changes in market sentiment:

On January 26, the price stabilized at around $105,000 and did not fluctuate further. After the price stabilized, market sentiment entered a neutral phase. Investors were no longer eager to chase ups and downs, and market sentiment was in a balanced state. At this time, the market was waiting for further macroeconomic data and technical signals, and investors generally took a wait-and-see attitude. Trading volume declined, and market sentiment was at a more cautious neutral level.

4. Industry News:

First, President Trump fulfilled his campaign promise and pardoned Silk Road founder Ross Ulbricht, an event that has attracted widespread attention in the cryptocurrency community. At the same time, the inflow of funds to Bitcoin ETFs has increased significantly, with $802.6 million in funds inflow on Tuesday alone, and the total assets of Bitcoin ETFs have exceeded $1.75 billion. In addition, BlackRock CEO Larry Fink predicted that with the participation of more institutional investors, the price of Bitcoin may reach $700,000 in the future. The above factors have jointly promoted the activity of the Bitcoin market and have had an important impact on price trends.

Hash rate changes

From January 20 to January 26, 2025, the hash rate of the Bitcoin network experienced significant fluctuations, showing a complex ups and downs. On January 20, the hash rate dropped rapidly from 877.89 EH/s to 727.81 EH/s; on January 21, it remained around 825 EH/s, and fell back to 730.09 EH/s in the evening. On January 22, the hash rate fluctuated in the range of 730-800 EH/s, which was relatively stable; on January 23, it rose significantly to 887.71 EH/s, and then broke through the highest value of 920.41 EH/s this week, but quickly fell back to 733.88 EH/s. From January 24 to 25, the hash rate fluctuated around 740 EH/s. It briefly reached a small peak of 787.45 EH/s on the evening of January 24, and then fell back to 688.53 EH/s. On January 26, the hash rate fluctuated around 710 EH/s and climbed to 786.71 EH/s in the morning. The overall volatility of the hash rate this week may be related to factors such as market sentiment, miner behavior, and network difficulty adjustment.

Bitcoin network hash rate data

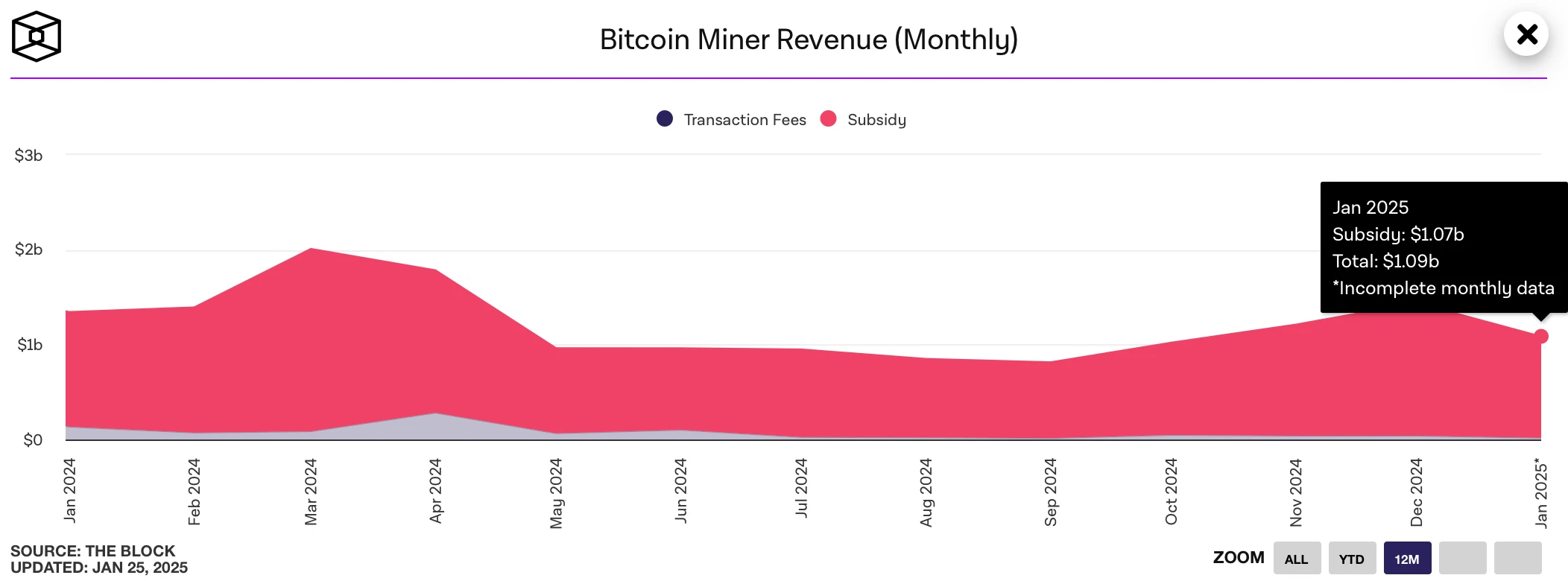

Mining income

According to data from The Block, as of January 26, 2025, Bitcoin miners total revenue in January has reached $1.07 B, a slight decrease from $1.44 B in December 2024. This decline is closely related to the recent sharp fluctuations in the hash rate of the Bitcoin network, which has affected the overall profitability of miners. In addition, adjustments to the difficulty of network mining and market fluctuations also put some pressure on miners income. At present, income mainly comes from block subsidies, and transaction fees account for a relatively small proportion, but if the network activity increases, fee income is expected to provide support. Overall, despite the decline in income, the miner ecosystem remains stable, and future earnings will depend on changes in hash rate, market trends, and network activity levels.

It is worth noting that the latest research report from global financial services company Canaccord Genuity further demonstrates the profitability prospects of the mining industry. According to the report, the main cost of Bitcoin mining in 2025 is expected to be in the range of about $26,000-28,000 per Bitcoin, while the current Bitcoin trading price is about $105,000, indicating that mining activities still have considerable profit margins. In addition, the report pointed out that the large-scale power supply of mining companies is attracting the attention of artificial intelligence data center hosting business, which provides miners with diversified sources of income. At the same time, many large listed mining companies have enhanced their competitiveness and network computing power share by upgrading mining equipment. This trend is expected to further consolidate the stability and profitability of the industry in the future.

Bitcoin Miner Income Data

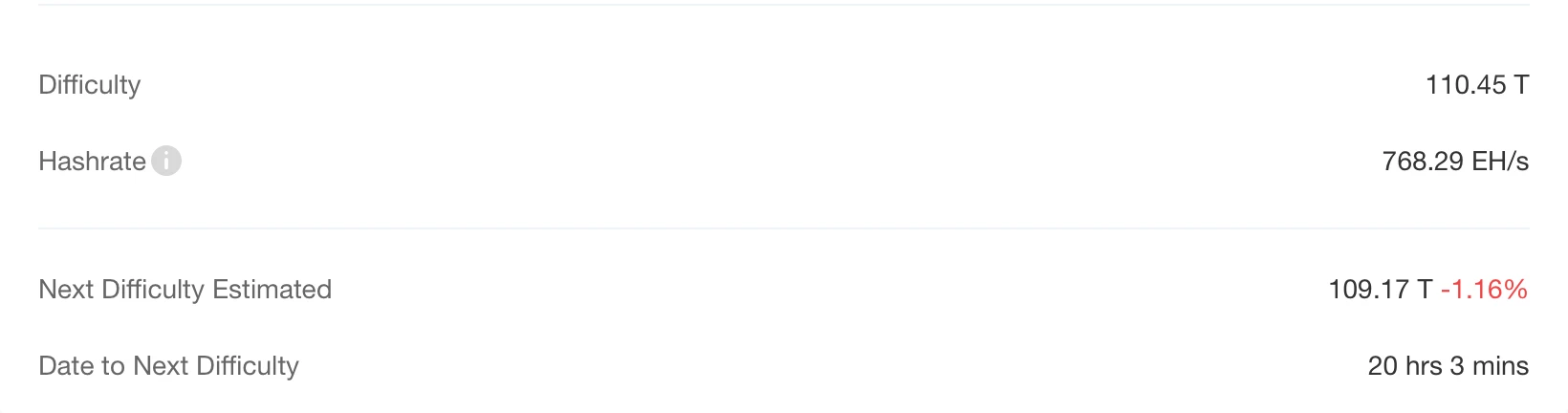

Energy costs and mining efficiency

According to CloverPool data, as of January 26, 2025, the total network hashrate is about 768.29 EH/s, and the total network mining difficulty is 110.45 T. It is expected that the next Bitcoin mining difficulty will be reduced by 1.16% on January 27, to 109.17 T. This is a rare difficulty reduction in the Bitcoin network in recent years, mainly due to the recent global cold wave that caused some mines to be temporarily closed, thereby exacerbating the overall hashrate fluctuations.

It is worth noting that since August 2024, the difficulty of Bitcoin mining has shown a significant upward trend, with a quarterly increase of 24%. This trend shows that more miners have joined the market and deployed more efficient mining machines, which has not only improved network security but also intensified competition among miners. In this context, energy cost optimization and mining efficiency improvement are particularly important.

In addition, Bitcoin mining is having a positive impact on regional energy management. According to reports, Bitcoin mining has saved Texas about $18 billion in costs by replacing expensive gas-fired peak-shaving power plants. At the same time, miners balance the load on the power grid by flexibly adjusting energy consumption during peak electricity consumption, thereby significantly improving the stability of the power grid. This operating model demonstrates the potential of Bitcoin mining in optimizing energy use and supporting power grid operation.

Overall, whether it is the fluctuation of computing power, the adjustment of difficulty, or the innovation of energy management, it shows that the Bitcoin mining industry is in a stage of continuous optimization and development. In the future, with the deployment of more efficient mining machines and the widespread use of clean energy, Bitcoin mining will further balance cost, efficiency and sustainability.

Bitcoin mining difficulty data

2. Policy and regulatory news

Utah Rep. Jordan Teuscher Introduces Strategic Bitcoin Reserve Legislation

On January 20, U.S. Congressman Jordan Teuscher of Utah proposed strategic Bitcoin reserve legislation.

Tweet screenshot

Utah proposes bill to allow 10% of state funds to be invested in cryptocurrencies such as Bitcoin

On January 22, according to BitcoinNews, the U.S. state of Utah proposed a new bill that would allow the state government to allocate 10% of its funds to Bitcoin and other cryptocurrency investments.

3. Mining News

Siberian Power to Prosecute 400 “Illegal” Crypto Miners

On January 21, according to Tim Alper, Siberian power company Irkutsk Energosbyt plans to file lawsuits against about 400 illegal cryptocurrency miners who are accused of stealing $6.3 million worth of electricity from the power grid. The company said that these miners illegally used electricity for crypto mining, especially installing high-energy mining equipment in garages, private homes, apartment balconies and garden plots, which increased the load on household power grids and could cause accidents.

As of January 1, 2025, courts have supported 1, 348 cases against power companies, and 104 miners have chosen to settle out of court to pay their electricity bills. Irkutsk Energosbyt said it would continue its legal action.

If mining power is transferred to AI in the long term, the risk of Bitcoin centralization will increase

On January 24, Bitfinex released an analysis report stating that the symbiotic potential between Bitcoin mining and artificial intelligence infrastructure cannot be ignored. Artificial intelligence operations require a lot of energy and professional facilities, and Bitcoin miners already have these facilities. They can reduce the scale of Bitcoin mining during peak AI operations or high energy demand, and increase the scale of mining when energy is more abundant. This dynamic can improve the economic efficiency of mining operations while maintaining sufficient hash power for the Bitcoin network.

Whether this shift will be a boon or a detriment to the Bitcoin network depends on how diversified the miners become and the industry’s ability to maintain network security amidst the changing dynamics. If executed strategically, the combination of AI and Bitcoin mining can foster innovation and efficiency without compromising Bitcoin’s decentralized nature.

However, if a large amount of hash power is permanently transferred, the Bitcoin network may face greater centralization risks. Choosing AI over other digital assets also aligns with the broader strategic goals of many mining companies. The growth trajectory of the AI industry is expected to achieve long-term scalability and align with emerging technology trends from automation to advanced data analytics.

4. Bitcoin related news

This week, global companies and countries continue to increase their holdings of Bitcoin

El Salvador: 12 new bitcoins were added, bringing the total holdings to 6047.18, worth approximately US$631 million.

MicroStrategy: Increased its holdings by 14,600 bitcoins in January, bringing its total holdings to 461,000 bitcoins, accounting for 2.2% of the Bitcoin supply.

Genius Group: Increased its holdings of Bitcoin by $5 million, with a total holding of 420 coins, worth approximately $40 million.

KULR Technology Group: Increased its holdings of Bitcoin by $8 million, with a total holding of 510 coins, a total investment of $50 million, and a return of 127% this year.

Critical Metal Corp: Plans to allocate US$100 million to purchase Bitcoin, with a total capital pool of US$500 million. The timing and scale of the increase are to be determined.

Australian Monochrome ETF: As of January 22, it held 295 bitcoins with a market value of approximately US$49.7196 million.

Fathom Holdings: Will purchase up to $500,000 worth of Bitcoin or Bitcoin ETFs within two weeks.

Semler Scientific (Holdings): As of January 17, it held 2,321 bitcoins with a total purchase price of $191.9 million and an average purchase price of $82,689 per bitcoin.

Semler Scientific (Funding): Increased funding to $85 million to purchase additional Bitcoin.

Thumzup: The board of directors authorized 90% of the companys remaining cash to be held in Bitcoin.

OKG Research: The U.S. public and private sectors hold about 10% of the world’s Bitcoin

On January 20, according to OKG Research, the US public and private sectors currently hold about 10% of the worlds Bitcoin, of which the private sector accounts for about 9%. Although the US government has not directly included Bitcoin in its strategic reserves, the deep involvement of private companies such as Tesla and MicroStrategy has gradually attracted attention to Bitcoins potential as an alternative reserve asset.

Compared with the United States share of gold (23% of the world) and oil (15% of the world) reserves, Bitcoins status is attracting the attention of global markets against the backdrop of increasing fiscal deficits and debt pressures.

Polymarket predicts 58% chance Trump will create Bitcoin reserves within 100 days of taking office

On January 20, according to Polymarket data, the probability of yes on the platform regarding whether Trump will create Bitcoin reserves within 100 days of taking office has surged to 58%, while the probability of yes in the same period yesterday was only 43%.

In addition, the market expects that there is a 42% probability that Trump will sign more than 40 executive orders on the first day; Kalshi implies that the market expects Trump to sign 40.4 executive orders on the first day of his inauguration. Among them, immigration, tariffs, diplomacy, and energy are expected to be the areas where Trumps policies will be launched intensively on the day of his inauguration.

In addition, the market generally expects that Trumps presidential executive power will be greatly strengthened in his second term. Kalshi shows that the market expects that the probability of Trump declaring a national emergency within the first 100 days of his new policy is 77%.

WisdomTree Report: Bitcoin is no longer a niche investment as institutional adoption rises

On January 21, according to CoinDesk, the 2025 Crypto Trends Report released by WisdomTree pointed out that Bitcoin is no longer a niche investment, and institutional adoption is growing rapidly. The report shows that multi-asset portfolios that allocate Bitcoin continue to outperform unallocated portfolios. WisdomTree expects Bitcoin adoption to continue to rise in 2025 due to increased customer demand. The launch of the US spot Bitcoin ETF has promoted the mainstreaming of cryptocurrencies, and more countries may approve altcoin trading products (ETPs) including SOL and XRP in the future. The report also mentioned Ethereums important position in the fields of DeFi, NFT and Web3, but its scalability issues remain to be resolved. Stablecoins and asset tokenization are expected to grow significantly, further promoting the application of blockchain technology in the global financial system.

Analysis: If Bitcoin follows cycles, prices could exceed $1 million by the end of the year

On January 21, CoinDesk analyst James Van Straten wrote that if Bitcoin continues to follow the 2017 cycle, it may exceed $1 million by the end of the year. Currently, the price of Bitcoin has risen by about 550% from the low point of the cycle, which is consistent with previous cycles.

The analysis of the four-year cycle has received much attention in discussions about Bitcoin. This cycle revolves around the Bitcoin halving mechanism, which reduces the supply every four years. Usually, the price of Bitcoin rises sharply in the year after each halving, and the current cycle continues to show similar trends to the previous two cycles.

As of now, the price of Bitcoin is up about 550% from the cycle low of $15,500 when FTX crashed. Data shows that in the current cycle, Bitcoins performance is similar to the 2015 to 2018 cycle: After the cycle low on January 14, 2015, Bitcoin (blue line) also rose by about 550% at that time.

If Bitcoin continues to follow the 2015-2018 cycle trend, its price could rise by about 1,100% from the cycle low to $186,000 by the end of the first quarter of 2025. The peak of this cycle could occur in October this year, with an increase of 11,000%, pushing the price to about $1.7 million.

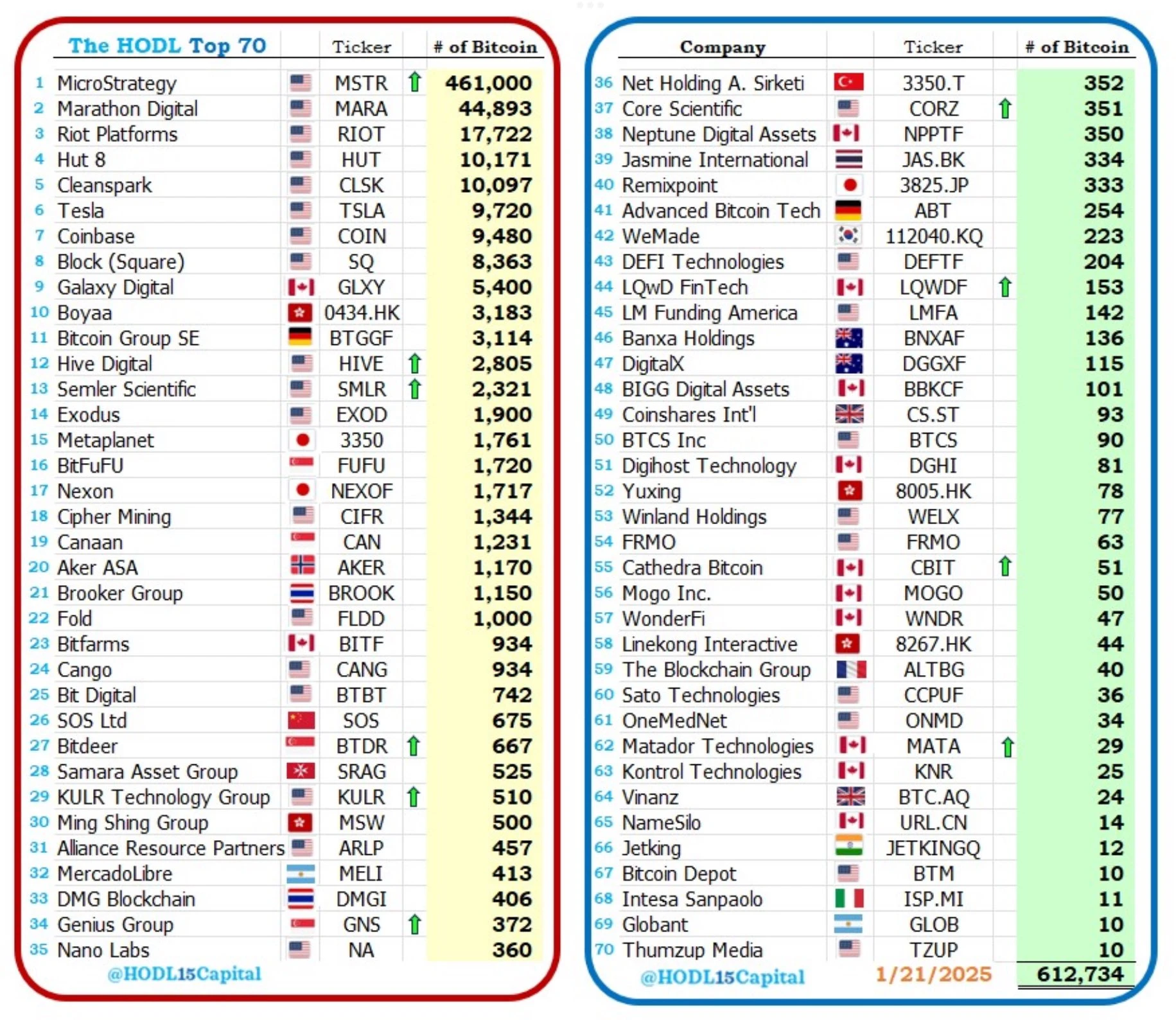

Data: 70 listed companies hold more than 612,000 bitcoins, worth more than $61.2 billion

On January 21, according to the latest statistics released by HOD L1 5 Capital, the top 70 listed companies that hold Bitcoin on their corporate balance sheets currently hold a total of 612,734 Bitcoins.

Data chart of Bitcoin holdings of 70 listed companies

12 U.S. states are actively promoting strategic bitcoin reserve bills

On January 22, Cointelegraph disclosed that 12 states in the United States are actively promoting the Strategic Bitcoin Reserve Act. Including:

Florida, Alabama, New Hampshire;

Pennsylvania, Ohio, North Dakota;

Oklahoma, Texas, Wyoming;

Massachusetts, Utah, Arizona.

Standard Chartered Bank: Institutional capital inflows are expected to push Bitcoin to $200,000 this year

On January 23, according to a report from Standard Chartered Bank, more funds are expected to flow into the Bitcoin field from institutions than last year. In particular, the participation of pension funds is expected to push Bitcoin to US$200,000 this year.

The report reads: “If the positive action is carried out as we expect, we think institutional flows will continue. We expect institutional inflows into BTC in 2025 to exceed 2024 levels, with new capital likely coming from long funds classified as ‘pension funds.’ The dominance of institutional inflows into ETFs is likely to support the performance of BTC and ETH; we expect their prices to reach $200,000 and $10,000, respectively, by the end of 2025.”

CZ: The US strategic Bitcoin reserve plan has been basically confirmed

On January 24, CZ posted a comment on the X platform, U.S. Senator Cynthia Lummis serves as the chair of the U.S. Senate Banking Digital Assets Subcommittee, saying: The U.S. strategic Bitcoin reserves have been basically confirmed. Cryptocurrency is once again advancing at the speed of encryption.

US Bitcoin spot ETFs saw net inflows of $517 million

On January 25, according to FarsideInvestors, the US Bitcoin spot ETF had a net inflow of US$517 million yesterday, including: BlackRock IBIT: + US$155.7 million

Fidelity FBTC: +$186.1 million

BitwiseBITB: -$8.6 million

ARKB: +$168.7 million

WtreeBTCW: +$2.8 million

Grayscale Mini BTC: +$13 million

Coinbase CEO: Bitcoin is a better form of money than gold

On January 26, Coinbase CEO Brian Armstrong said that Bitcoin is a better form of currency than gold.