1. Bitcoin market and mining data

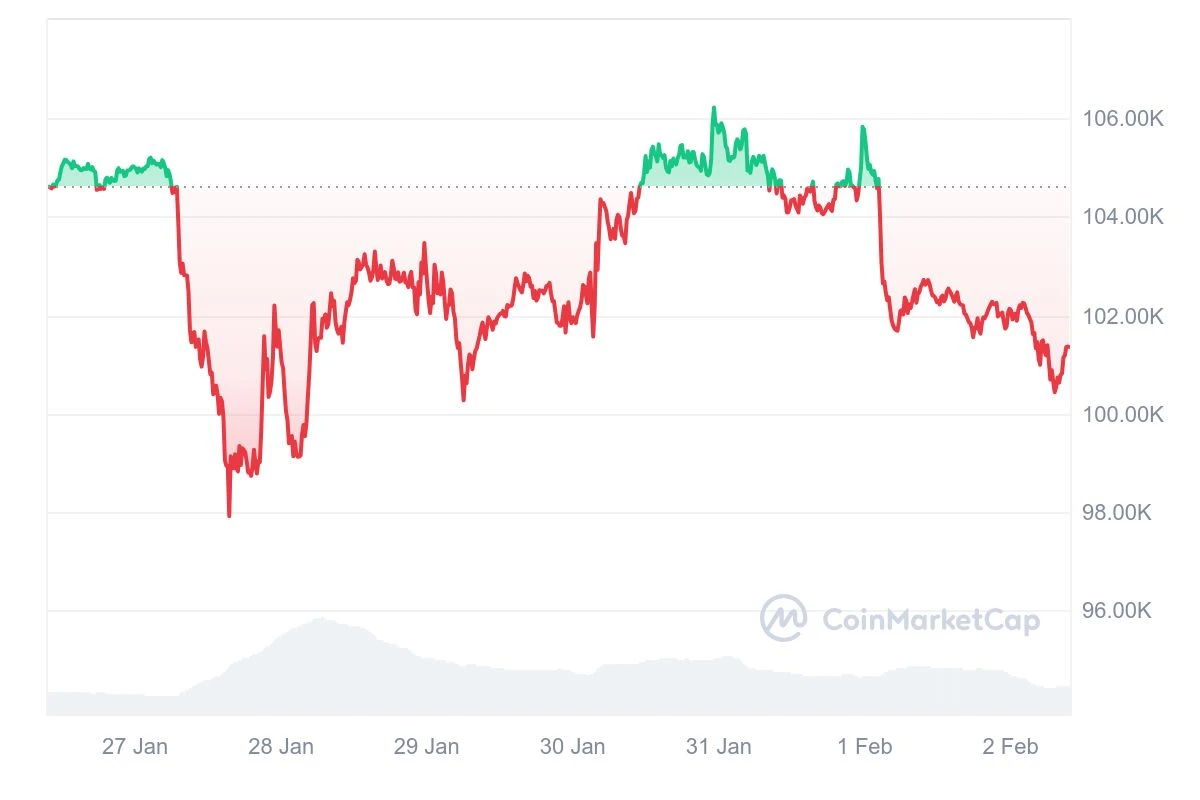

From January 27 to February 2, 2025, the price trend of Bitcoin showed significant volatility, and market sentiment repeatedly switched between long and short positions, as shown below:

This week, Bitcoin showed an overall trend of consolidation, rapid decline, rebound and then decline, and the market was fierce. The price fell below $100,000 and then rebounded quickly, forming key support at $104,000 and $102,000. On the evening of the 30th, it briefly broke through $106,100, but failed to stabilize, and then pulled back to around $102,000, and further fell to around $99,540. Overall, the market is still in a volatile pattern. Overall, the market is still in a volatile and weak pattern. In the short term, we need to focus on the upward resistance of $105,200 and the downward support of $98,000.

Bitcoin price trend (2025/01/27-2025/02/02)

Market dynamics and macro background

1. Capital flow: Institutional funds are cautious, and the markets short-term wait-and-see sentiment is increasing

This week, the flow of funds in the Bitcoin market showed a trend of differentiation, and the net inflow of exchanges increased, indicating that some investors chose to take profits, forming a certain selling pressure. In the derivatives market, the perpetual contract funding rate was negative, reflecting the strong short-term short-selling sentiment in the market, and leveraged funds were cautious about breaking through highs. At the same time, the continuous outflow of funds from Grayscale GBTC put downward pressure on the market, while the net inflow of spot Bitcoin ETFs slowed down, indicating that institutional funds failed to provide sufficient buying support, and the market as a whole showed a wait-and-see attitude.

2. Technical aspect: shock consolidation pattern, key support and resistance levels are tested alternately

Bitcoin maintained a consolidation pattern this week, testing the $102,000 and $104,000 support areas several times. The buying support was relatively strong, but it failed to break through effectively after rebounding above $105,200, indicating heavy selling pressure from above. From the technical indicators, the RSI (Relative Strength Index) fluctuated around 50, failing to provide a clear trend signal, and the volume failed to significantly increase when breaking through the key position, reflecting the lack of market momentum. Overall, the market is still in a consolidation phase. If $102,000 is lost, it may further pull back to $98,500, while a breakthrough of $105,200 may push the price up to the $106,500-$108,000 area.

3. Market sentiment: The long-short game intensifies, and short-term risk appetite declines

In terms of market sentiment, the Bitcoin Fear and Greed Index fell from the greed area to neutral this week, indicating that speculative sentiment has cooled down and investors confidence in the short-term market has weakened. At the same time, the on-chain activity has declined and the average daily trading volume has decreased, indicating that the market lacks strong new capital inflows in the short term. The implied volatility (IV) of the options market has risen slightly, reflecting that the markets expectations for future volatility have increased, but the overall risk appetite has declined, and investors are still in a cautious wait-and-see stage in the short term.

4. Industry news and macro background: policies and market dynamics affect market expectations

In terms of macroeconomic background, the Feds February FOMC meeting is approaching, the markets expectations for rate cuts have cooled, and the US dollar index remains high, which has put some pressure on risky assets such as Bitcoin. In addition, the capital inflow of spot Bitcoin ETFs has slowed down, the market liquidity support has weakened, and the short-term upward momentum is limited. Chinese AI startup DeepSeek released the open source multimodal artificial intelligence model Janus-Pro on January 28, which performed well in benchmark tests. Although such technological innovations are mainly concentrated in the field of AI, they may also indirectly affect investors interest in high-tech and digital assets, and thus affect the Bitcoin market.

In terms of the macro background, the markets expectations for the Feds rate cuts have cooled, and the US dollar index remains high, which puts some pressure on risky assets such as Bitcoin. In addition, the capital inflow of spot Bitcoin ETFs has slowed down, and the market liquidity support has weakened, limiting the short-term upward momentum of Bitcoin. On the other hand, major progress in the AI industry has triggered market risk aversion, especially the rise of the domestic AI model DeepSeek, which has impacted global technology stocks. Bitcoin has subsequently fallen below the $100,000 mark, setting a recent low. Overall, macroeconomic policies and the development of the technology industry are jointly shaping the short-term trend of the crypto market, and investors need to continue to pay attention to policy expectations and industry trends.

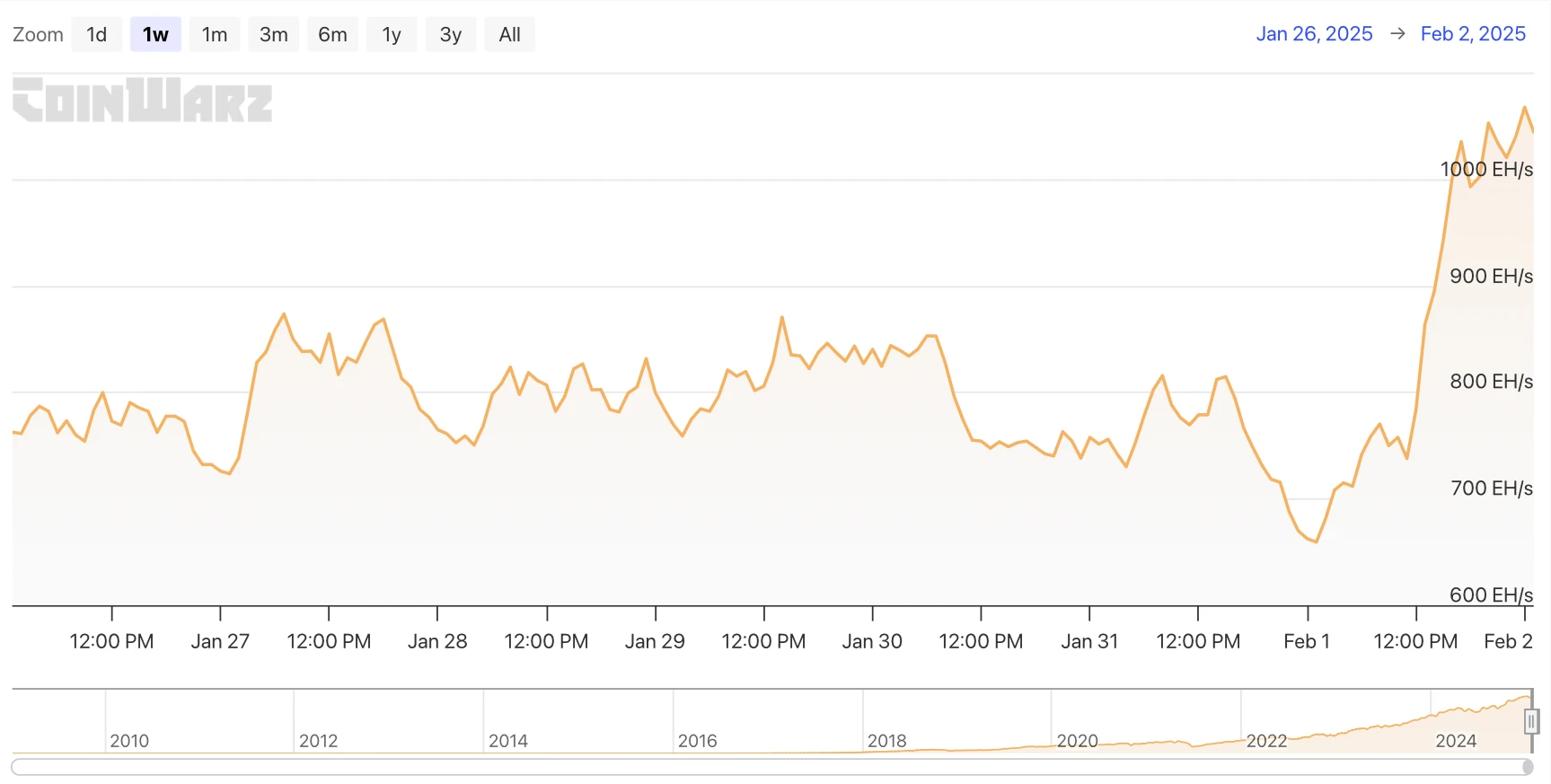

Hash rate changes:

From January 27 to February 2, 2025, the Bitcoin network hash rate experienced significant fluctuations, showing the dynamic adjustment of miners computing power and the impact of the market environment on mining activities. From January 27 to 28, the Bitcoin hash rate initially stabilized at around 775 EH/s, briefly dropped, and then quickly rebounded to 873.35 EH/s, then fell back to the 850 EH/s range, and further dropped to 752.36 EH/s in the evening. On the evening of January 28, the hash rate fluctuated around 800 EH/s. From January 29 to 30, the hash rate basically remained at the 800 EH/s level, and rose slightly on the evening of the 29th to 870.30 EH/s. On January 30, the hash rate remained around 835 EH/s, but dropped to 754.84 EH/s in the evening, showing some fluctuations in computing power. From January 31 to February 1, the hash rate continued to adjust. On January 31, it was relatively stable during the day, running around 750 EH/s, and rose to 815.35 EH/s in the evening. However, on February 1, the hash rate first dropped to 659.12 EH/s, and then quickly rebounded to 856.65 EH/s. On February 2, the hash rate quickly rose to 1034.99 EH/s, and then fluctuated to 1067.35 EH/s, indicating that the network computing power has changed dramatically in a short period of time.

Bitcoin network hash rate data

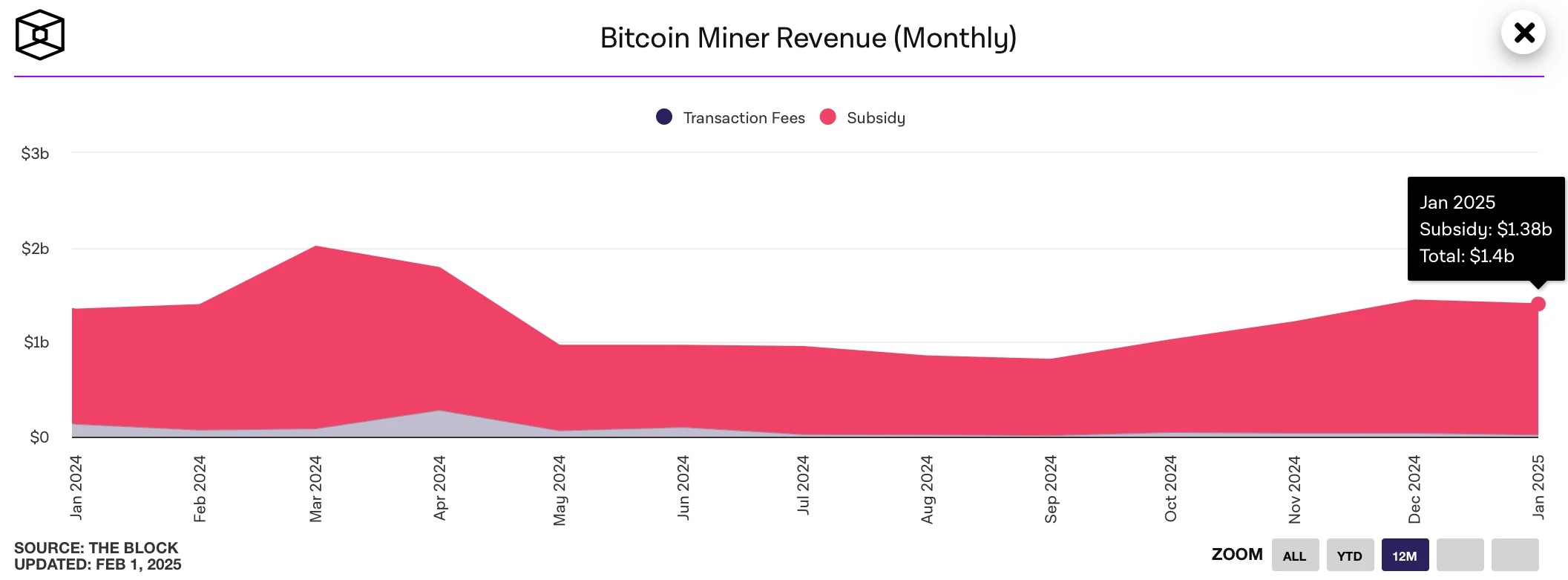

Mining income:

According to data from The Block, Bitcoin miners total revenue in January reached $1.38 billion. Although it was slightly lower than $1.44 billion in December 2024, it still maintained a high income level, showing the robustness of miners profitability. From January 27 to February 2, 2025, miners income was affected by Bitcoin price fluctuations and changes in block rewards. During this period, the price of Bitcoin once fell below $100,000 and then rebounded, while the hash rate experienced large fluctuations, reflecting the dual effects of miners computing power adjustments and changes in market sentiment. In addition, transaction fees also made a certain contribution to miners income during this cycle. As the degree of network congestion changed, miners income increased slightly in some periods. Overall, the profitability of Bitcoin miners remained at a high level this week, but in the future, we still need to pay attention to Bitcoin price trends and mining difficulty adjustments, which may affect miners long-term profitability.

Bitcoin Miner Income Data

Energy costs and mining efficiency:

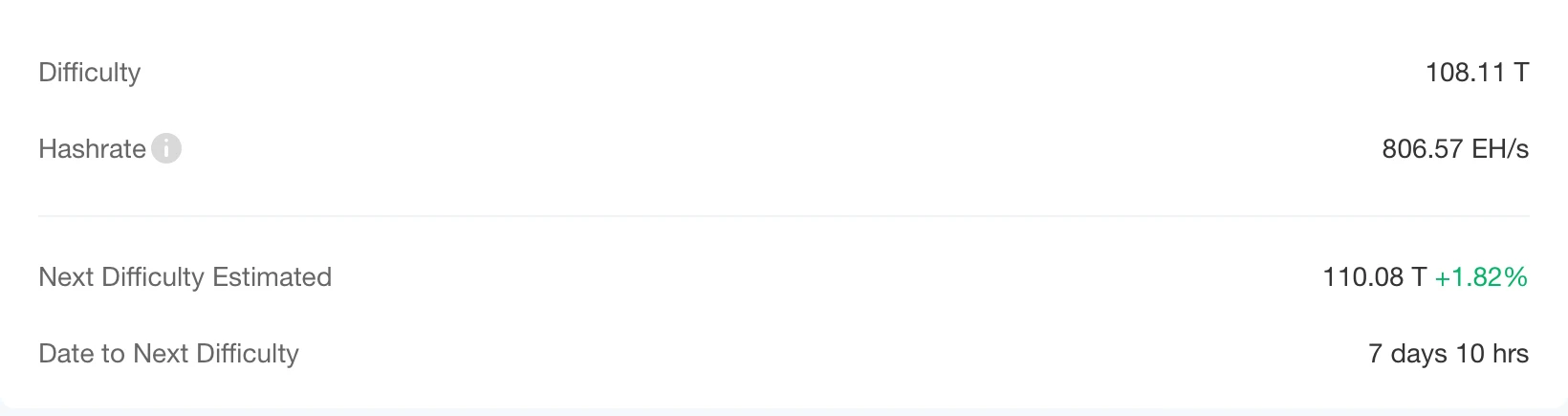

On January 27, 2025, the Bitcoin network completed a new round of difficulty adjustment at 11:22:53, with the difficulty value reduced by 2.12% to 108.11 T. This adjustment reduced the mining difficulty for miners and improved the overall mining efficiency. Currently, the average computing power of the Bitcoin network is 806.57 EH/s, and the next Bitcoin mining difficulty is expected to increase by 1.82% to 110.08 T on February 9. As the difficulty adjustment occurs, the operating efficiency of miners is also optimized, thereby affecting the overall energy consumption.

On February 1, due to the cold wave in the United States, the increase in electricity prices has led to the first reduction in the difficulty of Bitcoin mining since the end of September 2024. According to statistics from Luxor, a Bitcoin mining company, the United States accounts for 36% of the global Bitcoin computing power, of which Texas contributes nearly half. The polar cold wave in January increased the cost of electricity in the United States, and the profitability of mining companies was frustrated. As a result, the mining difficulty was reduced on January 27. In the previous six months, the mining difficulty had only dropped twice. Luxor expects that as the temperature warms up, the computing power will gradually return to stability. In addition, some US mining companies, such as Riot Platforms, are planning to shift part of their computing power to AI and high-performance computing businesses to reduce the risk of market volatility.

Bitcoin mining difficulty data

2. Policy and regulatory news

Several U.S. states are advancing Bitcoin reserve legislation, with Texas joining the push

Several states in the United States have promoted Bitcoin reserve legislation, Arizona has approved the bill, and Texas has joined the ranks. On January 27, the Arizona Senate Finance Committee approved a bill with a 5-2 vote to allow public funds to invest in Bitcoin and other digital assets. At the same time, South Dakota and Kentucky have also proposed similar legislation to promote the establishment of strategic Bitcoin reserves. In addition, on January 30, Texas Lieutenant Governor Dan Patrick announced that Bitcoin reserves would be included in the 2025 legislative priorities, further promoting the states Bitcoin Reserve Bill proposal. Texas joins at least five states that are promoting Bitcoin or cryptocurrency reserves, marking the United States continued progress in promoting the inclusion of digital assets in the public finance field.

El Salvador’s Congress has amended its Bitcoin laws to comply with IMF agreements

On January 30, the El Salvadorian Congress has quickly passed legislation to amend its Bitcoin law to comply with the International Monetary Fund (IMF) agreement. Elisa Rosales, a member of the ruling party, said the amendment aims to ensure the permanence of Bitcoin as legal tender while promoting its practical application.

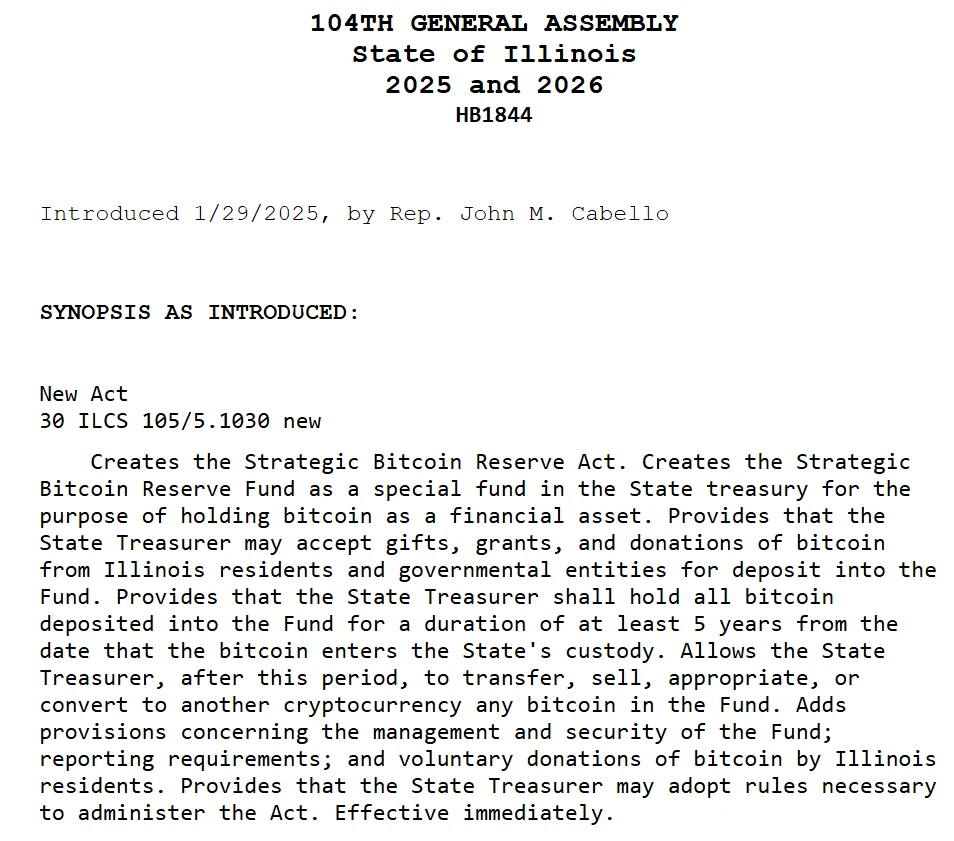

Illinois proposes Bitcoin reserve bill, requiring holding period of at least 5 years

On January 30, Illinois Congressman John Cabello proposed HB 1844, proposing to establish a strategic Bitcoin reserve fund in the state treasury.

The bill stipulates that Bitcoin must be held in state custody for at least five years before it can be transferred, sold or converted into other cryptocurrencies. The bill has now been submitted to the Rules Committee and is awaiting final approval from lawmakers.

Screenshot of HB 1844

Texas Lieutenant Governor Announces Bitcoin Reserve as 2025 Legislative Priority

On January 30, Texas Lieutenant Governor Dan Patrick announced the state’s legislative priorities for 2025, including a proposal to establish the Texas Bitcoin Reserve. Texas joins at least five states in the United States that are pushing for the establishment of Bitcoin (BTC) or cryptocurrency reserves, including Arizona and Utah, where strategic reserve bills have been passed in committee.

3. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

MicroStrategy increased its holdings of 10,107 bitcoins at an average price of approximately $105,596, bringing its total holdings to 471,107 BTC, with a purchase cost of approximately $30.4 billion and an average price of approximately $64,511. In addition, MicroStrategy filed a hybrid securities registration application and plans to use potential proceeds to further increase its holdings of bitcoin.

Metaplanet plans to raise about 116 billion yen (about $745 million) to buy Bitcoin, which will set a record for the largest Bitcoin fund raising in the history of Asian stock markets. At the same time, Metaplanet also announced its Bitcoin strategy, planning to hold 10,000 BTC by the end of 2025 and further increase its holdings to 21,000 BTC by the end of 2026.

Nuvve plans to use 30% of its idle funds to purchase Bitcoin to diversify its treasury assets and support Bitcoin payment options.

El Salvador currently holds 6,049.18 Bitcoins, or about $618 million.

BlackRocks IBIT Spot Bitcoin ETF holds 576,529.33 BTC, accounting for 2% of the total supply of Bitcoin, with a market value of over US$58.8 billion.

Worksport announced that it has completed its first purchase of Bitcoin and XRP and plans to continue to increase its holdings while adding cryptocurrency payment options to its official website.

Monochrome Spot Bitcoin ETF (IBTC) holds 305 BTC, with a market value exceeding US$50 million, approximately US$50.2765 million.

Thumzup Media Corporation released a shareholder letter disclosing that it holds 19.106 BTC and that the company will allocate up to 90% of its liquid assets to Bitcoin in accordance with the strategy approved by the board of directors.

Matador announced that he spent approximately $500,000 to increase his holdings by 3.38 bitcoins. His current holdings have reached nearly 65 BTC, and he plans to continue increasing his holdings of bitcoin.

Genius Group is seeking a rights issue of up to $55 million and additional loan financing to purchase BTC to replenish its Bitcoin reserves, with net proceeds from the rights issue expected to reach $33 million and additional loan financing of up to $22 million.

Trump: 100% support for the cryptocurrency industry and will push Bitcoin to a new height

On January 27, Bitcoin Magazine CEO David Bailey said on the X platform that US President Trump said in a conversation with him that he will 100% support the cryptocurrency industry and will push Bitcoin to a new height. David Bailey also thanked Trump for fulfilling his promise to the crypto industry in the post.

The author of Rich Dad Poor Dad: February will usher in the biggest stock market crash in history, and a large amount of funds may flow into Bitcoin, gold and silver

On January 27, Robert Kiyosaki, author of Rich Dad Poor Dad, reiterated on social media the prediction in his 2013 book that the biggest stock market crash in history will occur in February 2025. He said that this crash will cause a large amount of funds to flow from the stock and bond markets to Bitcoin, gold and silver.

He predicted that Bitcoin will see a significant growth and advised investors to invest in cryptocurrencies and precious metals as soon as possible. He stressed that even a small investment, such as one Satoshi, could bring huge returns. Kiyosaki saw the crash as an opportunity to discount assets, while reminding investors to stay away from fake assets.

Earlier news, the author of Rich Dad Poor Dad said that buying one satoshi of Bitcoin can make you rich.

Screenshot of social media post

Tesla reports $600 million gain on its Bitcoin holdings in Q4

On January 30, Tesla reported a $600 million gain on its Bitcoin holdings in the fourth quarter as it adopted new accounting rules that allow the company to value digital assets at market prices every quarter.

According to Arkham Intelligence, the electric car maker holds 11,509 BTC, which is worth $1.19 billion based on current market prices. However, Tesla did not disclose its Bitcoin holdings in its fourth quarter report for 2024, only mentioning a $600 million gain in digital assets at market prices.

10x Research: Bitcoin may face supply crunch, making it increasingly difficult to earn stable returns through altcoins

On January 30, 10x Research analyzed that Bitcoin may face a supply crunch, although the market still lacks key market structure data support. They pointed out that there are currently many positive signals in the market, including on-chain data, seasonal trends, breakthrough indicators, the Chinese New Year effect, neutral Federal Reserve policy, and a crypto-friendly president. However, these factors have not yet resonated with the market structure.

In addition, 10x Research also mentioned that it is becoming increasingly difficult to obtain stable returns through altcoins in the current bull market. Altcoins performed strongly only during the period from the US election on November 5 to the employment report on December 6/9, and then the hawkish stance of the Federal Reserve in mid-December put pressure on the market.

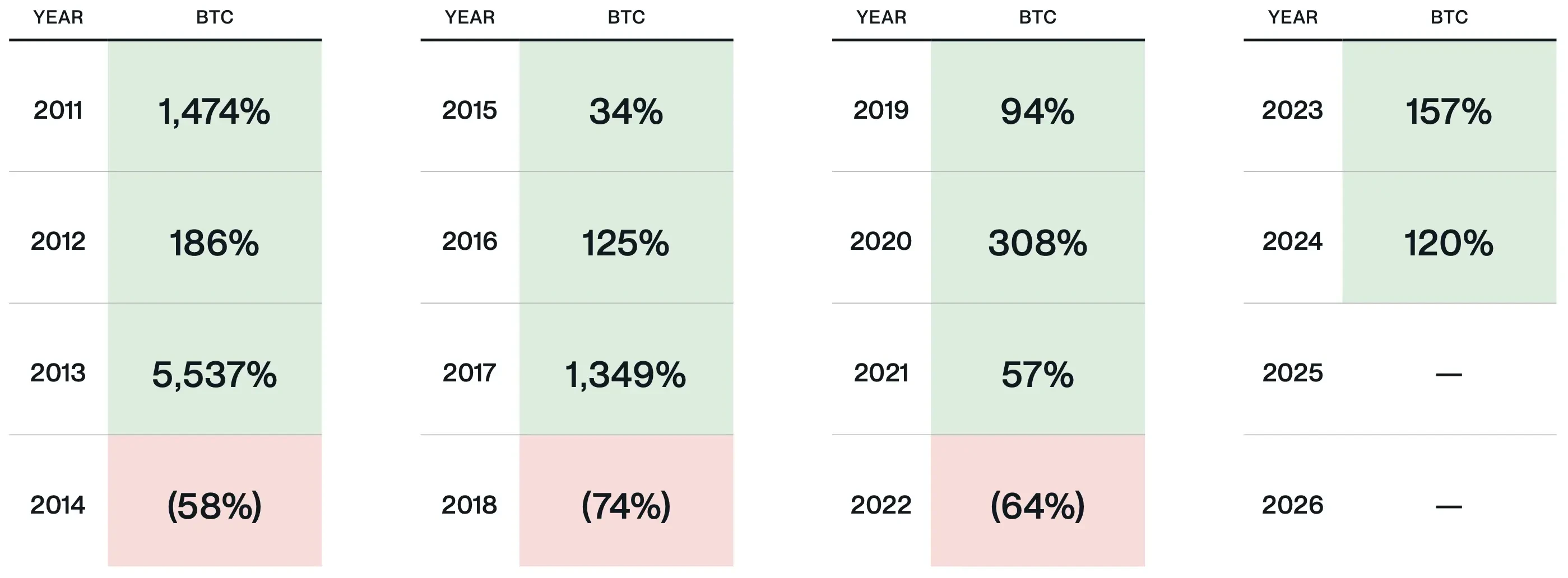

Bitwise: Trumps cryptocurrency order could disrupt Bitcoins 4-year cycle

On January 30, Bitwise investment director Matt Hougan said that cryptocurrencies will not completely overcome the four-year cycle, but he said that market corrections will be shorter and shallower than before. The cryptocurrency executive order recently issued by US President Donald Trump may break the four-year boom and bust cycle that the cryptocurrency market has experienced in the past decade.

In a Jan. 29 note, Hougan said Trump’s sweeping order issued on Jan. 23, along with the changes at the SEC, has brought about “the full mainstreaming of cryptocurrencies,” with banks and Wall Street able to “enter the space aggressively.”

He added that cryptocurrency exchange-traded funds are “big enough” to bring in billions of dollars from new investors, but said he believed Trump’s executive order to explore the creation of a digital asset reserve and draft a regulatory framework “will bring in trillions of dollars.”

Four-year cycle pictures

Standard Chartered Bank: The emergence of DeepSeek AI may be beneficial to risk assets such as Bitcoin

On January 30, Standard Chartered Bank analyst Geoffrey Kendrick said that the emergence of DeepSeek AI may be beneficial to risky assets such as Bitcoin, because DeepSeeks low-cost characteristics will help reduce inflation, and non-AI-related assets such as Bitcoin may benefit from this.

Although most analysts expect the Fed to keep interest rates unchanged, some believe there may be a slightly dovish surprise, which may ease DeepSeeks short-term impact on Bitcoin prices. Kendrick expects Bitcoin to rebound in the next few days, but the specific trend still depends on the policy stance of Fed Chairman Powell. He believes that if the Feds attitude is neutral, the price of Bitcoin may return to $105,000.

Czech central bank plans to vote on $7 billion Bitcoin reserve proposal, finance minister warns of BTC volatility risk

On January 30, the Czech National Bank (CNB) will vote today on a $7 billion Bitcoin reserve proposal, but Czech Finance Minister Zbynek Stanjura warned of Bitcoins high volatility and believed that it did not meet the requirements of central bank stability.

CNB President Michl plans to propose investing up to 5% of reserves in Bitcoin, noting that market interest in Bitcoin has continued to grow since institutions such as BlackRock launched BTC spot ETFs. However, he also acknowledged BTCs high volatility and said that its potential role in central bank reserves still needs to be further evaluated.

If the proposal is approved, CNB may hold at least $7 billion in Bitcoin, part of its total reserves of $146 billion. The proposal has received some support in the local Czech industry. Trezor analyst Lucien Bourdon said that the Czech Republic has long been a frontier country for Bitcoin innovation, including the worlds first mining pool, hardware wallet and large-scale Bitcoin conference.

Analyst: Bitcoin is expected to hit a new high by the end of this quarter

On February 1, Pav Hundal, chief analyst at Swyftx, said that the current short-selling atmosphere has become very tense, and the macro environment favorable to cryptocurrencies indicates that Bitcoin is expected to hit a new high by the end of this quarter.

BitMEX co-founder Arthur Hayes previously predicted that Bitcoin could fall back to the $70,000 to $75,000 range, which would trigger a “mini financial crisis” if it were to happen. However, Dr. Sean Dawson, head of research at Derive, recently said that there is less than a 10% chance that Bitcoin will fall to the $75,000 level in the first quarter.