In 2024, the global economy showed resilience amid many challenges, with a growth rate of 3.2%. Inflation has fallen, and many central banks have started a cycle of interest rate cuts. However, elections in more than 70 countries around the world have led to greater divisions within governments and the rise of populism. Against the backdrop of easing inflation, most economies have shifted their policies, such as the Federal Reserves interest rate cut in September, Japans first interest rate hike, and Chinas strengthening of stimulus policies after September. Global stock markets have returned more than 20%, and bond markets have also grown. The global multi-asset portfolio has achieved a total return of 12.5% based on the performance of 16.5% in 2023.

I. Performance of major economies

1. United States

The US economy remains strong in 2024, with GDP growth of 2.7%, slowing inflation, cooling labor market, stagflation-like real estate market, good corporate earnings but significant industry differentiation, continued fiscal expansion, and loosening credit standards. In 2025, attention should be paid to Trump administration policies, geopolitical conflicts, overvalued asset prices, and government debt risks.

In 2024, the US economy will grow by 2.7%, mainly driven by household consumption, corporate investment, government spending and exports. Household consumption is expected to grow by 2.6% for the whole year, contributing 1.7 percentage points to GDP, supported by a solid job market, wage growth and low interest rates. Corporate investment is expected to grow by 3.7% for the whole year, supported by strong profits, AI technology revolution and fiscal subsidies. Government spending is expected to grow by 3.5% due to high fiscal deficits. Exports are expected to grow by 3.4% due to improved overseas demand and supply chains.

Growth is likely to slow over the next two years, facing high base effects, lagging monetary policy and Trumps policy uncertainty. Trumps tariff and immigration policies may slow the process of deflation, reduce the extent of interest rate cuts, support the strengthening of the US dollar, thereby prolonging the effect of restrictive monetary policy, hurting consumer demand and business confidence. In addition, economic weakness in non-US regions and trade wars may weaken the global economic outlook and drag down the US economy.

In terms of inflation, the core inflation rate has rebounded to 2%, commodity inflation has declined due to the recovery of supply chains and the return of demand to services, but service inflation has declined more slowly. It is expected that the PCE and core PCE inflation rates will drop to 2.2% and 2.3% in 2025 from 2.4% and 2.7% in 2024, and Trumps policies may increase the uncertainty of the inflation outlook.

The labor market is gradually cooling but still resilient, with non-farm payrolls slowing, the unemployment rate rising slightly to 4.2%, and wage growth falling to 3.9%. The labor market will continue to slow moderately in 2025, with new jobs mainly concentrated in healthcare, leisure and hospitality, and government departments.

The real estate market is in a stagflation-like state, with sluggish home sales, with new and existing home sales falling 1% and 2.5%, respectively. New home supply has improved, with more multi-family home completions, but single-family homes are still in short supply. Commercial real estate vacancy rates have risen, but returns have steadily increased. The real estate market may improve modestly in 2025, with new and existing home sales expected to increase by 7% and 4.5%, respectively, and house prices may continue to rise but at a smaller rate.

In terms of corporate earnings, 2024 will be strong but with significant differentiation among industries, with corporate profits increasing by 10.5% year-on-year. The profit growth rate of industries such as information services and machinery and equipment will exceed 17%, while the profits of industries such as energy and non-durable consumer goods will decline year-on-year. In 2025, the growth rate of corporate earnings may rebound slightly, and the markets consensus forecast for the EPS growth rate of the SP 500 index is as high as 15%, among which the EPS growth rate of industries such as information technology and healthcare is forecast to exceed 15%, while the EPS growth rate forecast of industries such as real estate, essential consumption and energy is relatively low.

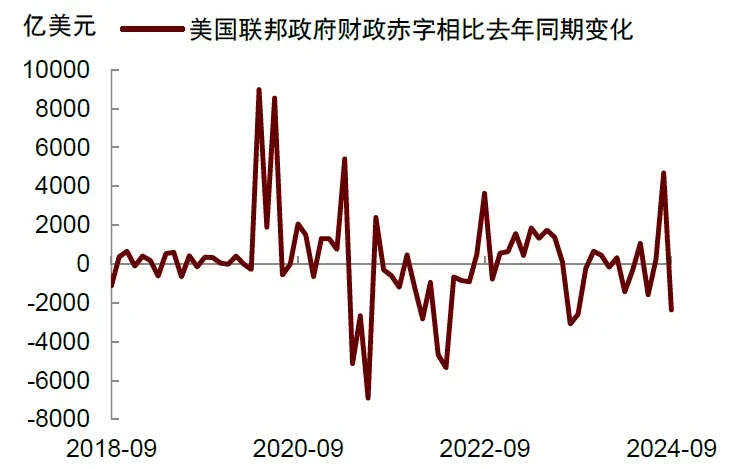

In terms of finance, the federal governments fiscal deficit in fiscal year 2024 is as high as 1.8 trillion US dollars, and the deficit rate is close to 7%. The student loan relief policy implemented by the Biden administration will help reduce the debt pressure of young people and release consumption potential. As concerns about economic recession ease, bank credit standards tend to be relaxed. If the Federal Reserve continues to cut interest rates, credit standards will be further relaxed, which will help reduce financing costs and promote credit expansion.

In terms of risks in 2025, the policies of the new US government are important variables. Trump may implement measures such as domestic tax cuts, foreign tariffs, expulsion of immigrants, and encouragement of fossil energy. These measures will keep the economy growing, but may also push up inflation. Geopolitical conflicts may cause oil prices to rise sharply, triggering stagflation. The prices of highly valued assets may fall sharply, weakening the wealth effect of American residents and causing consumers to cut spending. Concerns about US government debt may intensify, and US bond yields will rise, which will suppress the valuation of risky assets and be detrimental to US financial stability.

2. Japan

In 2024, the Japanese economy stagnated at the beginning of the year, but after the middle of the year, with the recovery of consumption and the growth of inbound demand, the overall recovery trend showed a weak trend. However, factors such as the depreciation of the yen, labor shortages and weak exports have led to a negative growth of 0.3% for the whole year. In the first quarter, GDP fell by 0.6% month-on-month and 2.2% year-on-year, but grew by 0.5% and 0.3% month-on-month in the second and third quarters respectively. The depreciation of the yen and the labor shortage have become the main obstacles to economic recovery.

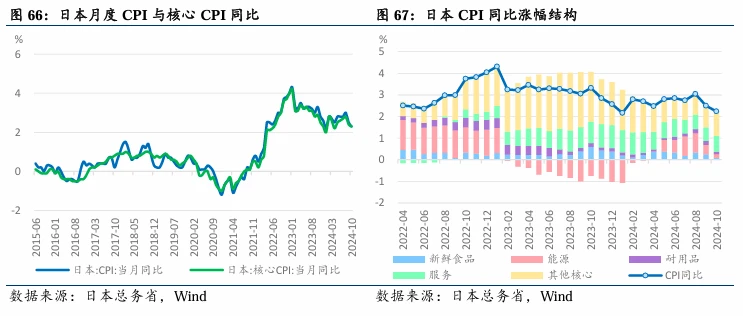

In terms of inflation, Japan has gradually escaped deflation, with the overall CPI and core CPI excluding fresh food exceeding 2% from January to October. The highest point in August was 3% and 2.8% year-on-year respectively. In October, Japans CPI and core CPI rose by 2.3% and 2.2% year-on-year. Many factors have jointly pushed Japan to gradually get rid of deflation, including wage growth. The wage increase in this years spring labor-management negotiations was 5.1% (the basic wage increase was 3.56%). As of October, the basic wage of workers increased by 2.7% year-on-year; price pass-through increased, with corporate prices increasing significantly from 2022 to 2023. Although the increase narrowed in 2024, it continued to rise. Service prices have also increased significantly since 2023 as wage increases accelerated; price expectations have risen. In the corporate price expectations of the Bank of Japans December survey, the overall price expectations will increase by 2.4% year-on-year in one year, 2.3% in three years, and 2.2% in five years, showing a stable upward trend.

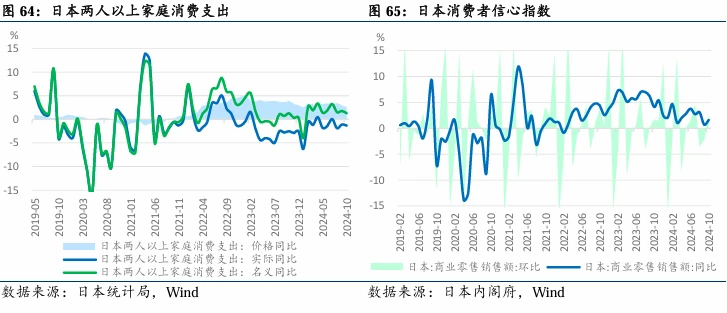

In terms of consumption, the year-on-year growth rate of residents actual consumption expenditure remained negative, the growth of household consumption lagged behind the increase in prices, the growth rate of the retail industry slowed down, and consumer confidence was at a low level.

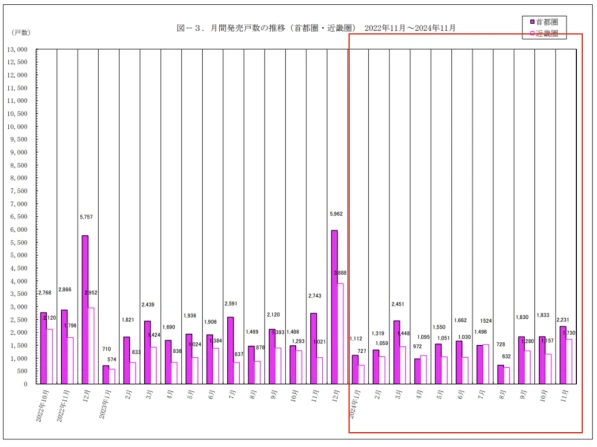

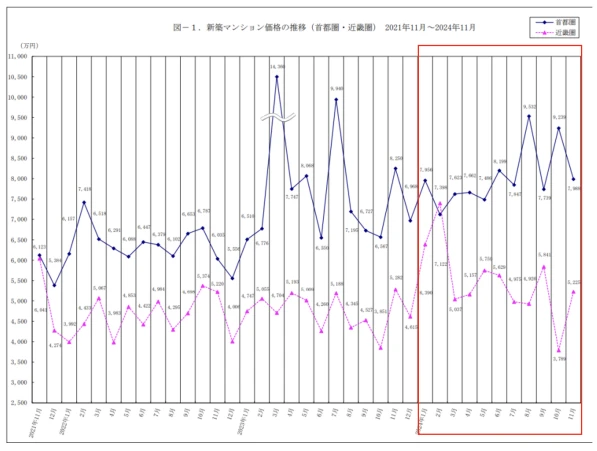

In terms of real estate, housing prices in the capital area maintained an upward trend. In November, the prices of new apartments fell by 5.2% and 3.2% year-on-year, but were still on an upward trend overall.

In terms of exports, Japans exports to major economies have all declined, with exports in the first 10 months down 1.8% year-on-year. Exports to Russia fell 27.9%, and exports to the United States, China, ASEAN, the European Union, South Korea and Oceania all declined, but exports to India and the Middle East increased. The decline in exports of traditional advantageous industries has led to a trade deficit.

In terms of exchange rate, the yen will depreciate overall in 2024, with the USD/JPY exchange rate reaching the 157 range. The yen rose to a record high of 161.9 in the first half of the year, but then began a second round of depreciation in October due to expectations of a rate cut by the Federal Reserve and the impact of Trumps deal.

3. Europe

Europes overall economic growth is weak, about 0.9% in 2024, and similar figures are expected in 2025. Germany is a relatively solid link in Europe, but its economy is shrinking, and it will continue to shrink from 2023 to 2024, with zero actual growth from before the pandemic to now. Germany is affected by the energy crisis, and its fiscal policy is conservative. The debt brake bill limits the fiscal deficit, and there are disagreements within the ruling party, which led to the dismissal of the finance minister. There will be early elections in February 2025. Germany has a prominent population problem, with a large number of people retiring at the peak of the population around 60 years old, a reduction in the labor force, rising wages but declining productivity, and difficult industrial transformation.

4. Other countries

Indias GDP growth rate is 7.0%, mainly driven by domestic demand growth; Russias growth rate is 3.6%, relying on energy prices and government stimulus under sanctions; the UKs growth rate is 1.1%, returning to a normal development model; South Koreas growth rate is 2.5%, mainly driven by exports. In 2025, attention should be paid to the sustainability of Indias domestic demand growth, especially whether government infrastructure investment can continue to promote economic development; Russia needs to pay attention to the impact of energy price fluctuations on the economy under the influence of sanctions; the UK needs to pay attention to the stability of economic recovery; South Korea needs to pay attention to the impact of changes in export markets on its economic growth.

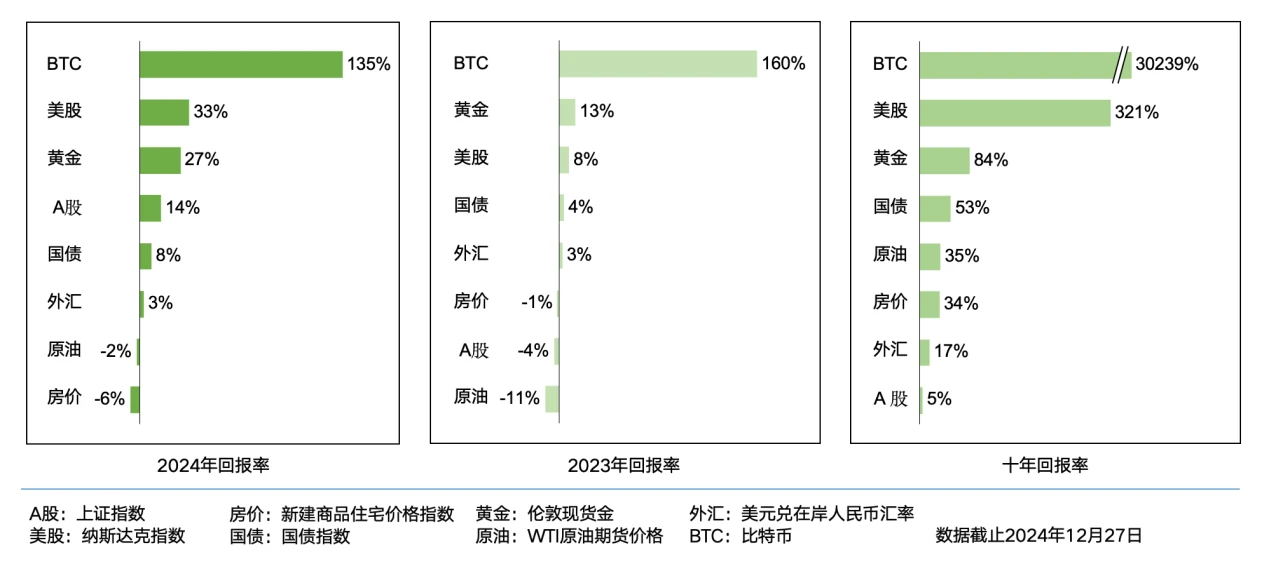

II. Return performance of various asset classes and the cryptocurrency industry in 2024

1. Stock Market

In 2024, global stock markets performed well, with returns exceeding 20%. This growth was mainly due to the resilience of the global economy, the decline in inflation, and the start of a cycle of interest rate cuts by central banks in many countries. Specifically:

US stocks: The SP 500 achieved significant growth in 2024, with a full-year return of nearly 27%, outperforming most years in the past 20 years. This growth was mainly due to strong corporate earnings, a low interest rate environment, and investors optimistic expectations for economic growth. In particular, technology stocks and growth stocks performed particularly well, driving the overall market up.

Stock Markets Emerging Market Stock Markets: Despite many uncertainties, emerging market stocks also performed well, with a full-year return of 18%. This growth was mainly due to the recovery of the Chinese economy, the strong growth of domestic demand in India, and economic reform measures in countries such as Brazil. In particular, the stock markets of China and India performed particularly well, attracting a large amount of international capital inflows.

European stocks: European stocks also achieved a 15% return in 2024. Despite relatively weak economic growth, policy adjustments and economic reform measures in major economies such as Germany and France provided support for the market. In addition, economic stability after Brexit also provided support for the recovery of European stocks.

2. Bond Market

The bond market also achieved solid growth in 2024, with a full-year return of 8%. This growth was mainly due to the interest rate cut cycle of global central banks, which reduced bond yields and increased bond prices. Specifically:

U.S. Treasury bonds: The U.S. Treasury bond market performed robustly, with the 10-year Treasury bond yield falling from 4.5% at the beginning of the year to 3.8% at the end of the year, driving up Treasury bond prices. The full-year return rate reached 10%, attracting a large amount of safe-haven funds.

European bonds: European bond markets also performed well, with the German 10-year bond yield falling from 2.5% at the beginning of the year to 2.0% at the end of the year, driving bond prices higher. The full-year return reached 9%, reflecting the markets cautious optimism about the European economic recovery.

Emerging Market Bonds: The emerging market bond market performed strongly, with a full-year return of 12%. This growth was mainly due to the recovery of the Chinese economy and economic reform measures in countries such as Brazil, which attracted a large amount of international capital inflows.

3. Real estate market

The real estate market will have a mixed performance in 2024, with an overall return rate of about 5%. Specifically:

US real estate: The US real estate market experienced a stagflation-like state in 2024, with sluggish home sales, and new and second-hand home sales fell by 1% and 2.5%, respectively. Despite this, house prices continued to rise in 2024, with an average annual increase of about 3%. In terms of commercial real estate, vacancy rates for offices and apartments increased, but returns remained at a high level.

China Real Estate: Chinas real estate market faces a major adjustment in 2024, with commercial housing sales area, new construction area and residential land transaction area falling by 51%, 69% and 68% respectively. Nevertheless, policy adjustments and improved market expectations brought some signs of recovery in the fourth quarter, and housing prices remained stable in first-tier cities and some second-tier cities.

Japanese real estate: House prices in the metropolitan area of Japan will maintain an upward trend in 2024. Although the sales of new and second-hand houses have declined, the average annual increase in house prices is about 2%. In terms of commercial real estate, the vacancy rate of offices and apartments has increased, but the return rate remains at a high level.

(IV) Commodity Market

The commodity market will perform steadily in 2024, with a full-year return of about 3%. Specifically:

Oil: Despite geopolitical conflicts, the oil market is relatively stable in 2024, with an average price of about $75 per barrel for the year and a return of about 2%. This price level reflects the markets cautious expectations for global economic growth.

Gold: The gold market performed strongly in 2024, with prices rising from $1,800 per ounce at the beginning of the year to $2,000 at the end of the year, with a return of about 11%. This growth was mainly due to the interest rate cut cycle of global central banks and investors demand for safe-haven assets.

Other metals: Base metals such as copper and aluminum will perform steadily in 2024, with a full-year return of about 3%. This growth is mainly due to the recovery of the Chinese economy and the growth of demand in emerging markets.

5. Crypto Industry

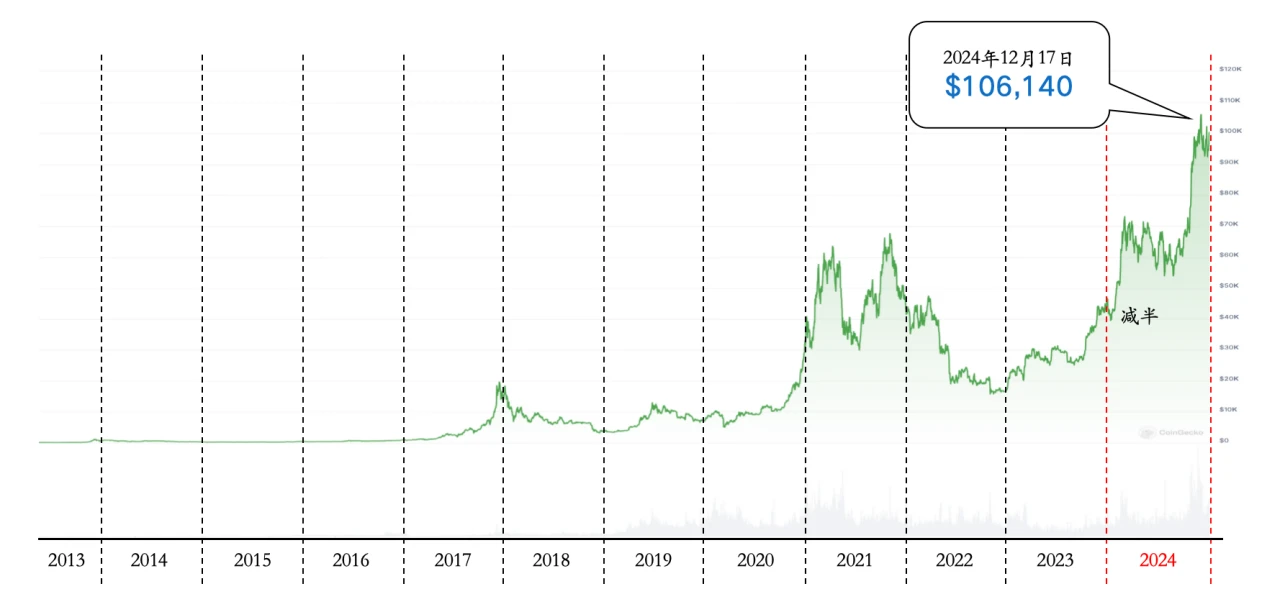

2024 is a year of transformation and recovery for the cryptocurrency industry. After the bear market in 2023, the industry gradually regained confidence, the pace of innovation accelerated, and institutional participation increased significantly. The launch of the Bitcoin ETF, major changes in the policy environment, policy expectations brought about by Trumps election, and the resurgence of Solana and others have become key factors in promoting the development of the industry.

The price of Bitcoin (BTC) has risen from about $40,000 at the beginning of the year to more than $100,000 in December, an increase of more than 150%. The launch of Bitcoin ETFs and massive buying by institutional investors are the main factors driving its price increase. Many other cryptocurrencies have also performed well, for example, Memecoin and AI+Crypto have performed well in this cycle.

In terms of user growth, the number of cryptocurrency users continues to grow, especially in emerging markets. The widespread adoption of stablecoins has become an important factor in driving user growth. Many users in emerging markets have bypassed the traditional banking system through stablecoins, achieving more efficient and low-cost financial transactions.

Conclusion

In 2024, the global economy maintained relatively stable growth amidst many challenges, while the cryptocurrency industry ushered in new development opportunities driven by improved policy environment, technological innovation and application expansion. The market performance of mainstream cryptocurrencies such as Bitcoin is strong, and the rise of emerging blockchains has also injected new vitality into the industry. With the influx of institutional investors and the continued growth in the number of users, the cryptocurrency industry is gradually maturing and is expected to play a more important role in the global economy in the future.