Original author: Web3 farmer Frank

In the next 10 years, will the RWA narrative gradually enter the kingdom of freedom?

According to the data, the current total RWA market size exceeds US$15 billion, and BlackRock predicts that the potential growth space in the next seven years may be as high as more than 700 times. This is an incremental cake worth at least hundreds of billions of dollars. The only question is who will take up the banner and become the singularity that detonates this epic change.

Over the past decade, the entire crypto industry has witnessed every key node from the separation to the integration of traditional finance and DeFi, and witnessed Wall Street and mainstream TradFi players successively writing keywords such as tokenization into financial reports and making huge bets on RWA. Everyone has also increasingly clearly touched a powerful trend: the final battlefield of RWA is not at the protocol layer, but at the infrastructure layer.

Objectively speaking, what RWA needs is not just to move assets onto the chain, but to release their true value potential through liquidity reconstruction. This is why RWAfi will be the ultimate battlefield for the RWA narrative, and how to redefine the future of Crypto+RWA through the super linear growth function.

Why do we need RWA Hub?

If you want to truly understand and unleash the potential of RWAfi, you must first clarify a concept: RWA Hub.

As the RWAfi asset liquidity center initiated and actively built by Plume, RWA Hub is not only a technical solution, but also the core engine of an ecosystem, which determines whether RWA assets and applications can truly achieve exponential growth.

As we all know, when Wall Street investment banks began to discuss RWA tokenization, they faced three major obstacles: high compliance thresholds, fragmented liquidity, and lack of developer tools. This also explains why a large number of RWA projects are dormant as soon as they are put on the chain. After all, moving RWA to the chain is actually just the first step in tokenization, which is far from enough to unleash its true potential:

To further realize the release of on-chain value, more efficient technical underlying architecture, open infrastructure toolset and complete ecosystem collaboration are needed, which means that the industry needs a complete service framework around the entire life cycle of RWA assets, especially to introduce RWA assets into various on-chain DeFi scenarios safely and with low thresholds.

Only in this way can the stock dividends of traditional assets be thoroughly transformed into incremental value on the chain. Taking real estate tokenization as an example, a piece of real estate on the chain should not be just a static NFT, but should become an active cell of DeFi. For example, rental income is automatically distributed through smart contracts, mortgage loans do not require trust in intermediaries, and fragmented property rights transactions are completed instantly.

However, this kind of asset empowerment requires not only a protocol, but a complete public chain-level architecture that supports liquidity and composability.

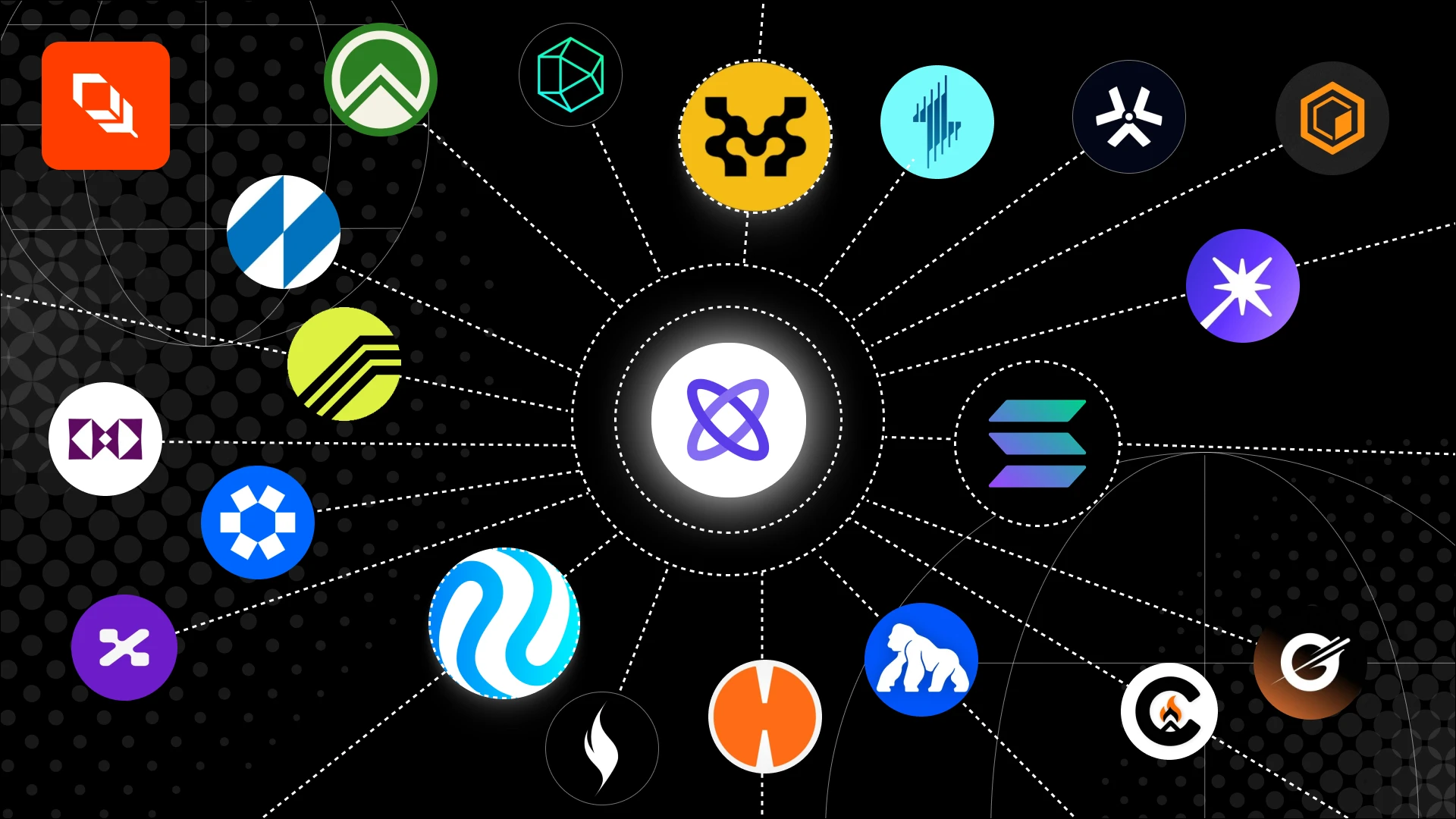

For this reason, Plume has launched a new approach with the RWA Hub as its starting point, aiming at both RWA on-chain and traditional Web2 mainstream institutions - by deploying the interoperability solution SkyLink in 18 blockchain networks such as Solana, Movement, Injective, Omni Network, etc., providing them with permissionless access to institutional-level RWA returns.

In this process, Plume acted as a bridge between Web2 and Web3, not only bringing new users and capital inflows to Web3, but also opening up a new growth logic: working with financial giants with massive user bases and huge amounts of traditional funds, obtaining the cooperation and support of these leading Web2 companies, and then directly helping them bridge billions of existing Web2 users and traditional funds into incremental Web3 users and Web3 New Money.

Interestingly, Ondo also recently announced that it would begin to deploy the RWA public chain, which also confirms the forward-looking nature of Plume’s RWAfi public chain from another dimension. However, compared with Ondo’s “WallStreet 2.0” route, I believe everyone will also find that Plume pays more attention to the concept of “Robinhood 2.0” - not just the inflow of institutional capital, but through the activation of underlying users, gradually guiding and attracting a wider range of institutions and retail users to join the new financial ecosystem.

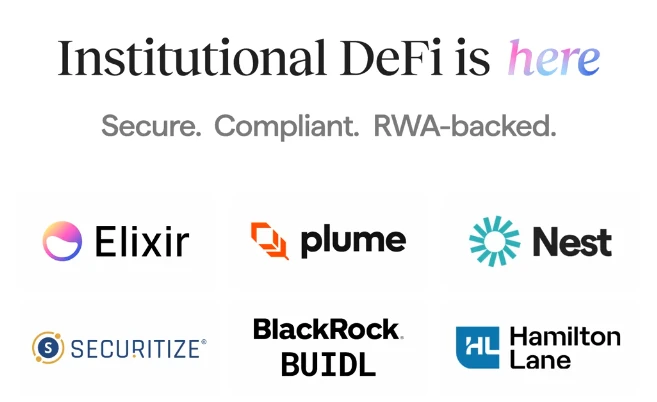

According to publicly disclosed information, Plume has also cooperated with Elixir to launch a new RWA institutional-level vault on Nest to connect the RWA assets of BlackRock (BUIDL) and Hamilton Lane (SCOPE), striving to expand from RWAfi infrastructure to the protocol layer deposited on the institutional-level asset chain:

The $28 million institutional treasury currently online is just an experimental beginning - BlackRocks BUIDL scale has exceeded $460 million, and the scale of private equity assets managed by Hamilton Lane is as high as $119 billion. Plume unlocks these assets into on-chain liquidity in the form of deUSD through the Elixir stablecoin gateway. In essence, it opens up a gradual on-chain path for trillion-level RWA assets without impacting the original compliance framework.

In this context, users holding certificates such as BUIDL can not only participate in the staking and interest-earning of the Plume ecosystem, but can also use them as collateral to mint stablecoins in the DeFi protocol, thereby realizing the cycle of precipitation-activation-recreation, which is expected to promote the evolution of Plumes RWAfi treasury from a custody tool to an on-chain liquidity hub.

Essentially, this provides an excellent buffer zone for traditional financial giants to go on-chain. Its long-term value will be released exponentially with the trickle-down effect of institutional assets going on-chain, and is expected to make Plume a testing ground for the on-chain precipitation of trillion-dollar RWA assets. Therefore, this is not only a technological upgrade, but also a transfer of financial discourse power:

When the assets of Wall Street giants are reborn on the chain through Plume, the boundary between tradition and encryption will be completely dissolved, and the ultimate significance of Plume to RWAfi far exceeds the current narrative framework:

It is not only a liquidity infrastructure for existing DeFi players and RWA tokenization on the chain, but also a core pipeline that can attract new Web3 users and capital inflows, expanding the value of the RWAfi track to the entire Web3 world, and allowing the on-chain ecology to achieve qualitative changes in both capital and traffic dimensions.

From modular toolbox to community resonance: building a super linear growth function for RWA

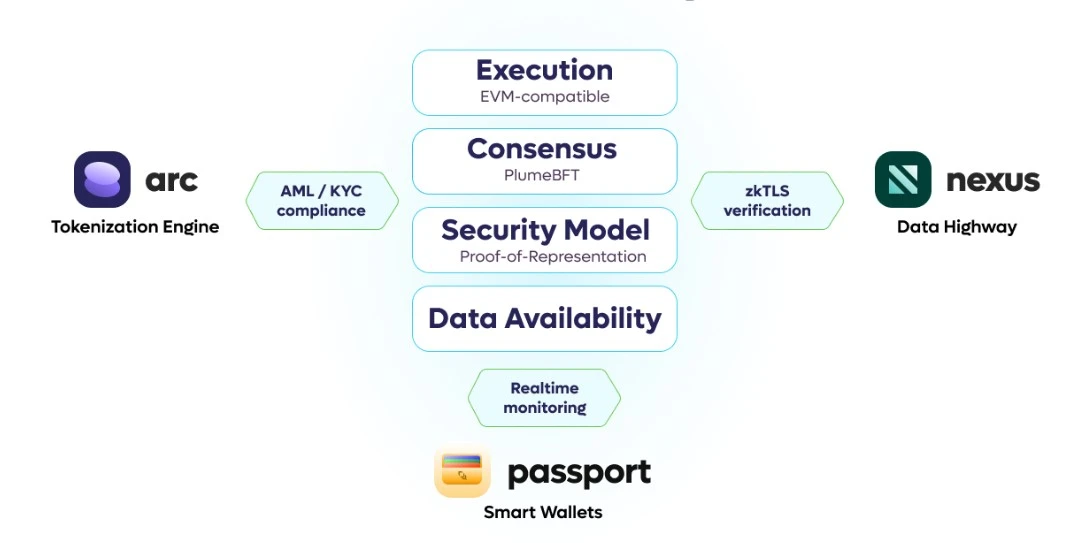

From the perspective of technical framework, Plume has created a set of out-of-the-box modular arsenal for developers. By integrating multiple modular key tools, it has built a complete RWA asset chain solution for developers:

Arc - Tokenization Engine: Arc simplifies the tokenization process by integrating compliance workflows and reducing barriers for asset issuers, providing an efficient path for bringing RWAs on-chain;

Passport - Smart Wallet: Passport allows users to store contract code directly in their externally owned accounts (EOAs). This native functionality supports RWAFI composability, yield management, and advanced account abstraction capabilities.

Nexus - Data Highway: Nexus uses cutting-edge technologies such as zkTLS to securely integrate real-world data into the blockchain, which not only improves the security and transparency of on-chain assets, but also unlocks new opportunities;

This is equivalent to implanting Compliance as a Service into the public chains genes - developers only need to focus on business innovation, and compliance, data, liquidity and other dirty work are automatically handled by the underlying Plume. It is this developer-friendly philosophy that has allowed Plume to quickly attract more than 180 ecological projects to settle in, covering a variety of scenarios from fund tokenization to RWA asset transactions.

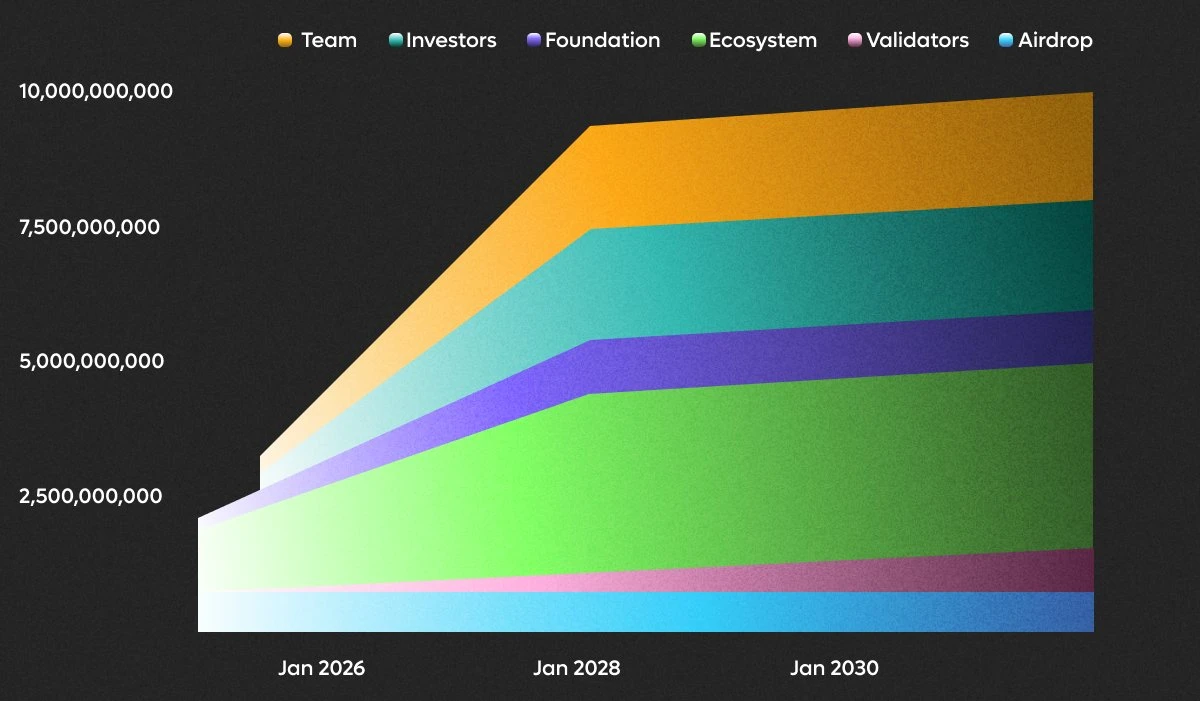

In addition, many people may have noticed that after the TGE not long ago, the initial circulation of PLUME tokens was only 20%, mainly community airdrops and early supporters shares. The remaining tokens will be gradually unlocked in the next 5 years.

On the one hand, this design is for the long-term security of market participants. On the other hand, it also meets the strategic needs of building the RWAfi ecosystem on the chain. The reason is very simple. By gradually unlocking tokens, token allocation is no longer a one-time reward, but a continuous ecological incentive tool. It can provide long-term incentives for ecological participants through staking, liquidity rewards and governance rights.

This is not only an incentive for existing users, but also an invitation to more potential users and developers, attracting more high-quality projects and users to join, which will help build a long-term RWAfi prosperous ecosystem.

Some people interpret this as a model of airdrop as a ticket to co-construction, which transforms users into co-builders of the ecosystem rather than passers-by, and breaks away from the traditional path of mainnet launch → ecosystem subsidy → token issuance, transforming TGE into an accelerator for ecosystem construction.

The public chain is not a pile of technologies, but the crystallization of community consensus. In the past year, Plume has cultivated more than 180 ecological projects and over 3.75 million real users on the test network, generating hundreds of millions of transactions, forming a moat that cannot be built quickly.

To some extent, Plume has long strategically regarded the community as its core competitiveness and built an ecosystem based on decentralization. Unlike Ondos traditional financial background and institution-led construction path, Plume relies on community power and user demand to drive the market, and is committed to breaking down the barriers between traditional finance and DeFi, making this market not only dependent on capital inflows from large institutions, but also establishing a self-growing network effect.

Therefore, more than 180 ecological projects and over 3.75 million real test network users have proved that its community-driven model has lasting vitality. In fact, relying solely on institutional capital inflows cannot provide long-term motivation for RWAs to go on-chain, because this is still a relatively closed model.

From this perspective, the final outcome of RWAfi is destined to belong to those architects who understand the rules of Wall Street and are well versed in the spirit of the crypto community. The growth of RWAfi will lead everyone to witness a historic turning point: traditional giants such as BlackRock will no longer be on the sidelines, but will actively participate in the construction of the on-chain ecosystem through Plume. Plumes previously accumulated community users and ecology will build a symbiotic network that the RWA protocol layer and other latecomer projects can never replicate.

In this model, asset flows and market formation are driven by the community rather than simply institutional capital. This market mechanism based on community and user needs gives Plume flexibility and sustainability that is different from traditional finance, enabling it to build a truly decentralized and vibrant financial ecosystem.

Because of this, Plume is not only a chain that meets the needs of institutions, but also a platform that is committed to breaking the old rules and giving every individual the right to participate and make decisions. In the future, RWAs on the chain will no longer be dominated by sellers, but a two-way flow and mutually reinforcing market.

Final game deduction: Where is the valuation anchor point of RWAfi and Plume?

Some people often discuss where the valuation anchor of RWAfi and Plume is. In fact, the answer may be unique: when traditional assets worth 10 trillion US dollars begin to migrate on the chain, the existing valuation framework will be completely invalid.

From the data perspective alone, there are also some simple control groups for reference:

If 5% of the $119 billion of private equity assets managed by Hamilton Lane alone were put on the chain through Plume, the on-chain deposited value would exceed the actual TVL of all RWAfi projects;

If BlackRocks prediction of a $10 trillion RWA market by 2030 comes true, Plumes valuation will reach $10 billion even if it only occupies 1‰ of the gateway share. If it can reach 1%, Plumes valuation will even reach $100 billion.

This is equivalent to completely opening up the valuation ceiling for Plume, an infrastructure hub, especially the potential to directly access trillions of dollars of traditional financial assets. Considering the potential market size of the RWAfi track, as the demand for tokenization of traditional assets increases, the ecological value of RWAfi will be further released.

More importantly, we are witnessing a historic turning point: BlackRocks BUIDL fund is converted into on-chain stablecoins through Plumes NEST vault, and traditional TradFi giants are beginning to evaluate Plumes compliance framework. This resonance between institutions and the community is building a super-linear growth function for RWAfi and Plume.

Therefore , Plumes sharpest edge does not lie in short-term prices, but rather in the technology and first-mover advantage of the subsequent RWAfi ecosystem construction - Plumes modular tools lower the development threshold and attract a large number of developers and institutional users.

Especially with the continuous expansion of the RWAfi ecosystem, each new project will bring synergistic gains to Plumes overall value network.

A great storm begins with a small ripple. Driven by the RWAfi narrative, RWA’s most exciting growth story has just begun.

When more and more RWA players follow Plumes footsteps, it is not just a simple zero-sum competition, but a signal of the rise of the RWA ecosystem. After all, the world of RWAfi does not need a lone hero, but an irreplaceable hub - a core engine that can connect traditional finance with the on-chain ecosystem and carry trillions of assets.