Original author: BitMEX

Hello everyone, and welcome to BitMEX Options Alpha. Today, we will explore a hybrid arbitrage strategy that combines a BitMEX call spread with a “no” position on Polymarket, asking the question “Will Bitcoin break $110,000 by the end of February?” The goal of this strategy is to capture potential gains if Bitcoin rises, while protecting against the risk of Bitcoin failing to hit $110,000 by hedging the risk with a Polymarket position. In this article, we will break down the trade structure, discuss several possible profit and loss scenarios, and highlight the key risks you need to consider and what to do about them. Let’s get started.

Transaction Overview

The transactions discussed in this article include:

1. Buy a Bitcoin Call Spread (a long position) on BitMEX.

2. Also buy a “No” position on Polymarket on the question “Will Bitcoin hit $110, 000 by February 28?”

Market Settings

As we approach the end of February, Bitcoin may or may not reach $110,000. Against this backdrop, an interesting arbitrage opportunity emerges: combining a BitMEX options position with a Polymarket hedge.

Polymarket allows users to bet on binary outcomes of events, such as whether Bitcoin will reach a certain price. This opens up the possibility of hedging Bitcoin positions using Polymarket, while also profiting from favorable price movements. By combining a BitMEX call spread with a “no” position on Polymarket (i.e., betting that Bitcoin will not hit $110,000 before the end of February), traders can balance risk and reward to maximize opportunities presented by Bitcoin’s volatility.

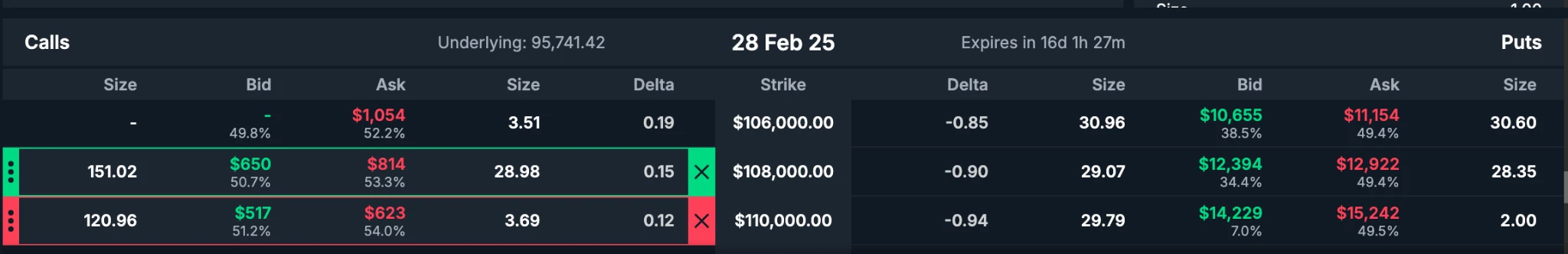

BitMEX options market (expiring on February 28)

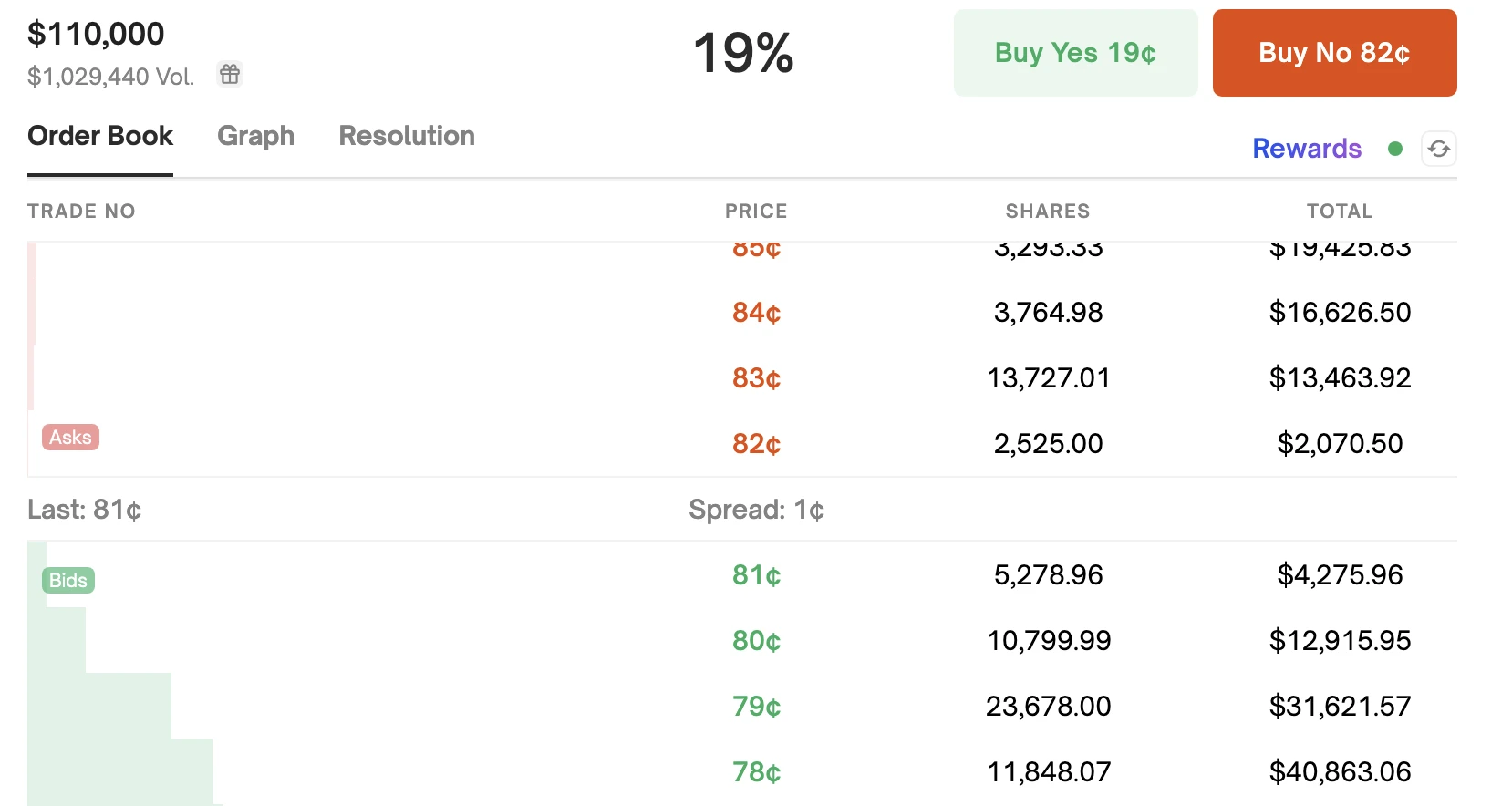

Polymarket

Transaction Structure

This strategy relies on two core components:

1. BitMEX Call Spread

2. Bitcoin “No” Position on Polymarket

BitMEX Call Spread (Feb 28 expiry)

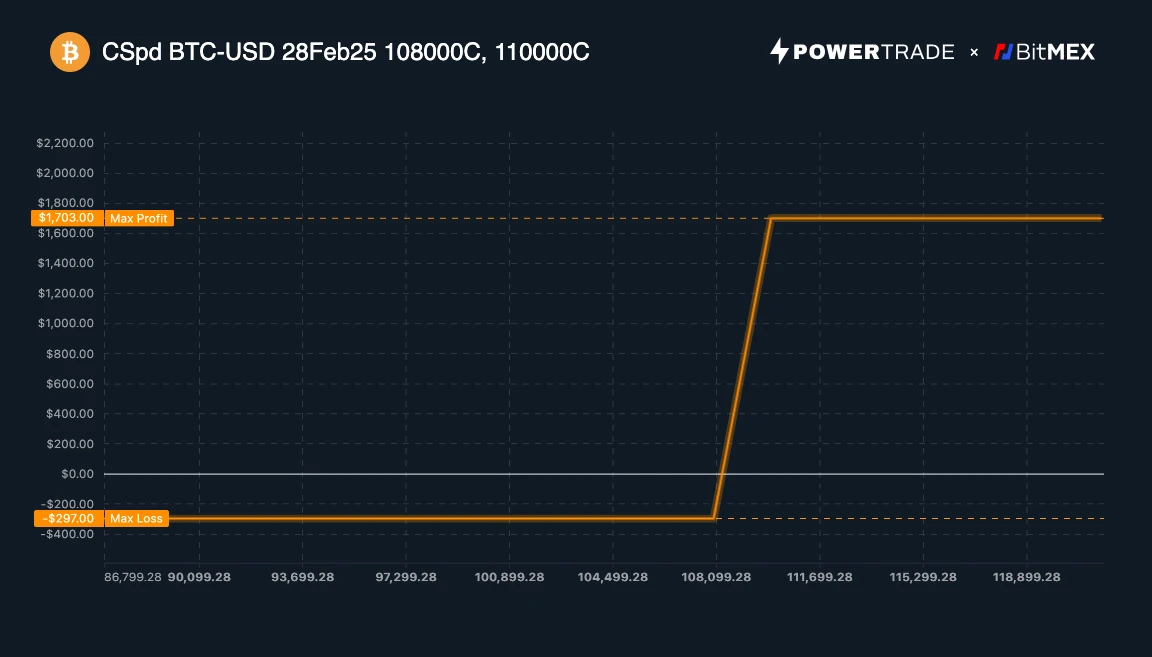

The position on BitMEX is a classic call spread designed to take advantage of gains in Bitcoin prices while limiting downside risk.

Buy 1 $108,000 call option (expiring on February 28)

Sell 1 $110,000 call option (expiring on February 28)

The structure provides limited risk and unlimited upside (up to $1,700) if the price of Bitcoin exceeds the higher strike price.

Polymarket Hedging (“No” Position)

On Polymarket, there is a binary options market where users can speculate on the likelihood of certain events occurring. For this strategy, the questions involved in trading are:

Will Bitcoin hit $110, 000 by February 28?

The position at this point would be a “No” contract, a bet that Bitcoin would not hit $110, 000 before the end of February.

Buy a No contract at 82¢ (example)

Cost: $250, $1 denomination

If Bitcoin does not hit $110,000, expect to make a profit of about $300

If Bitcoin hits or exceeds $110,000, expect a loss of $1,350

The hedge provided protection when Bitcoin hit $110,000, helping to offset some of the losses on the BitMEX position.

Profit and Loss Analysis

Understanding the potential outcomes of this strategy is critical to making an informed decision. Let’s look at four different scenarios:

Scenario 1: Bitcoin closes below $108,000

BitMEX: -$297 (maximum loss)

Polymarket: +$300 (if Bitcoin does not hit $110,000)

Net Profit: +$3

In this case, Bitcoin failed to hit $110,000 at expiration and the Polymarket position made a profit of $300. However, the BitMEX call spread incurred a maximum loss of $297. The end result was a slim net profit of $3.

Scenario 2: Bitcoin closes between $108,000 and $110,000

BitMEX: Profit = (Bitcoin price - 108,000) - $297

For example, at $109,000, the profit is $703

Polymarket: +$300 (if Bitcoin does not hit $110,000)

Net Profit: $703 (BitMEX profit) + $300 (Polymarket) = $1,003

This is the ideal scenario, where if Bitcoin closes near $110,000, the BitMEX position provides a solid gain while the Polymarket hedge adds $300, for a final total profit of $1,003.

Scenario 3: Bitcoin closes above $110,000

BitMEX: + $1,700 (max profit)

Polymarket: -$1,350 (if Bitcoin hits $110,000)

Net Profit: $350

If Bitcoin exceeds $110,000, the BitMEX call spread is maximized to $1,700, but the Polymarket hedge results in a loss of $1,350. The final net profit is $350.

Scenario 4: Bitcoin briefly hits $110,000 but closes below $110,000

BitMEX: Losses if price falls below $110,000

For example, at $108,000, a loss of $297

Polymarket: -$1,350 (as Bitcoin briefly hits $110,000)

Net loss: -$1,647

In this less-than-ideal scenario, Bitcoin briefly touched $110,000 but closed below that level. In this scenario, both the BitMEX call spread and the Polymarket hedge incurred losses, ultimately resulting in a net loss of $1,647.

Risks and Considerations

While this strategy offers an attractive risk/reward structure, there are several risks to be aware of:

1. Time risk:

There is a 21-hour settlement gap between BitMEX (08:00 UTC on February 28) and Polymarket (23:59 ET on February 28). This time window could cause Bitcoin to make unexpected moves, rendering the hedge ineffective.

2. Market liquidity and price fluctuations:

During periods of high volatility, options may have wider bid-ask spreads. Polymarkets may have limited depth and larger orders may drive market prices. Be aware of slippage and transaction fees.

Summarize

This Bitcoin arbitrage strategy offers traders an opportunity to capture upside potential through Bitcoin volatility while also providing a hedge against key price levels. By combining the BitMEX Call Spread with the No position on Polymarket, you can construct a trading strategy that works well in different market conditions, whether Bitcoin is rising or moving sideways.

However, it is important to keep a close eye on key risks, including the 21-hour settlement gap and the possibility that Bitcoin hits and reverses at a key price point. By implementing proper risk management techniques, careful timing and liquidity, traders can maximize potential profits while minimizing exposure to significant losses.

In summary, this strategy offers a balanced risk-reward structure with clear risk control and clear upside potential for traders looking to capitalize on Bitcoin price volatility.