Original | Odaily Planet Daily ( @OdailyChina )

Author: CryptoLeo ( @LeoAndCrypto )

In general, the development of Ethereum L2 in 2024 is not very smooth. From the Starknet (STRK) at the beginning of the year to the ZKsync (ZK) airdrop in the middle of the year, it has brought a small climax to Ethereum L2 in terms of reputation, but it is ultimately not as good as the dumping and walking away of the users after receiving the airdrop.

For a long time after the airdrop, the on-chain data and token price trends on Zksync and Starknet were not satisfactory, and even similar data such as Only a few addresses have funds cross-bridged to Zksync on a certain day appeared many times. Of course, the decline in transaction and TVL data after the airdrop is understandable. After all, most users contribute data just to get the airdrop, but for the L2 Four Heavenly Kings level projects with huge financing, high expectations and new technologies, it is considered a high start and a low end.

During this period, Mantle Network, as a less high-profile L2, achieved a curve overtaking with its high TVL. Mantle Network is a modular Layer 2 Rollups solution built on Ethereum, providing EVM compatibility, ultra-scalability, and low transaction fees, and has the security inherited from the Ethereum mainnet. Since the mainnet was launched in July 2023, its coin price has also risen from US$0.5 at the beginning of 2024 to US$1.4 at the end of the year. In the two crashes after 2025, most of the cottage fell by more than 50%, and the fluctuation range of MNT also remained at around 20%, and the coin price has been stable at around US$1.

Many people even wonder why its token MNT performs so well. Next, we will explain from several perspectives what the Mantle ecosystem has achieved in 2024 and how Mantle has become a dark horse among many L2 networks?

2024: Mantle Network’s breakthrough growth and ecological prosperity

Macro level: technology development, ecosystem growth and token data

First, let’s take a look at Mantle’s macro performance in 2024, including technology, ecology, and tokens:

Enhance user experience, Mantles technology development and upgrade

1. Major Events: Mainnet Upgrade. Mantle Network completed the upgrade of the mainnet v2 Tectonic in early 2024, optimized the gas fee (providing the lowest gas fee in Ethereum Layer 2) and improved interoperability with the OP Stack ecosystem. The enhanced features of Mantle v2 in this upgrade include:

- Support for EIP-1559, ensuring end users experience more consistent network fees, reduced price volatility, and potential fee savings over time;

- Remove redundant components, including the data transmission layer and Threshold signature scheme in Mantle v1, to improve the efficiency of the Mantle network;

- Predictable block time, enhanced node performance. Unlike v1, block generation in v2 is now independent of transactions and follows a fixed schedule, generating blocks every two seconds.

-Block status tagging, catching up with other technically advanced L2s, the upgrade includes the same block tags and header status as chains based on the OP stack;

-Migration of native tokens in L2. The flow of MNT tokens will no longer go through the ERC-20 contract. It will be the native token of Mantle, which will enhance the flow of MNT tokens.

- Meta-transactions, enhancing user experience and lowering the threshold for users to participate in Mantle;

-Fee optimization strategies that provide estimates of total transaction costs directly to users.

2. Technology Update: Mantle Network advances its technology roadmap and launches the first ZK Validity Rollup in partnership with Succinct SP 1. The modular design of Mantles OP Stack combined with the powerful functionality of SP 1 zkVM bridges the gap between user-friendly Optimistic rollup and complex zero-knowledge technology, promoting interoperability, flexibility, and standardization, allowing every user to explore and enhance its ecosystem more easily and securely.

Leading L2, Mantle’s Ecosystem Growth and Token-Related Data

Ecosystem growth: In addition to technological upgrades, the Mantle ecosystem is also growing rapidly in 2024. According to official website data, there are currently 260 ecological projects on the Mantle network, mostly DeFi, games and infrastructure projects, which also reflects the focus of Mantles ecology in 2024. In addition to the prosperous growth of the main network ecology, Mantles modular design and technological updates have also attracted more developers to participate. The test network incentive plan launched by Mantle last year attracted more than 5,000 developers worldwide to participate, deployed 12,000 smart contracts, and the average daily transaction volume of the test network exceeded 1 million.

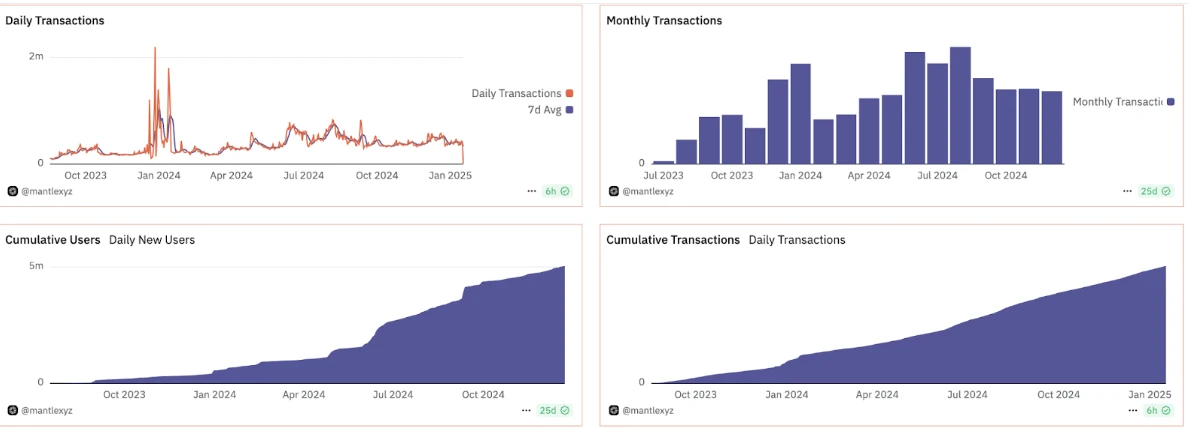

User growth: Dune data shows that the Mantle network user data has been growing since the beginning of 2024, reaching a peak in September, with the number of new users exceeding 200,000. The cumulative number of users on the chain increased from 550,000 in January to more than 5.02 million at the end of 2024; its cumulative network transaction volume also increased from US$35.77 million in January to US$183 million at the end of the year; its monthly transaction volume peaked in September at US$17.61 million.

Tokens and their TVL data: Mantles ecosystem witnessed significant user growth and total locked value (TVL) growth in 2024, reaching $240 million TVL, demonstrating its market position in Layer 2.

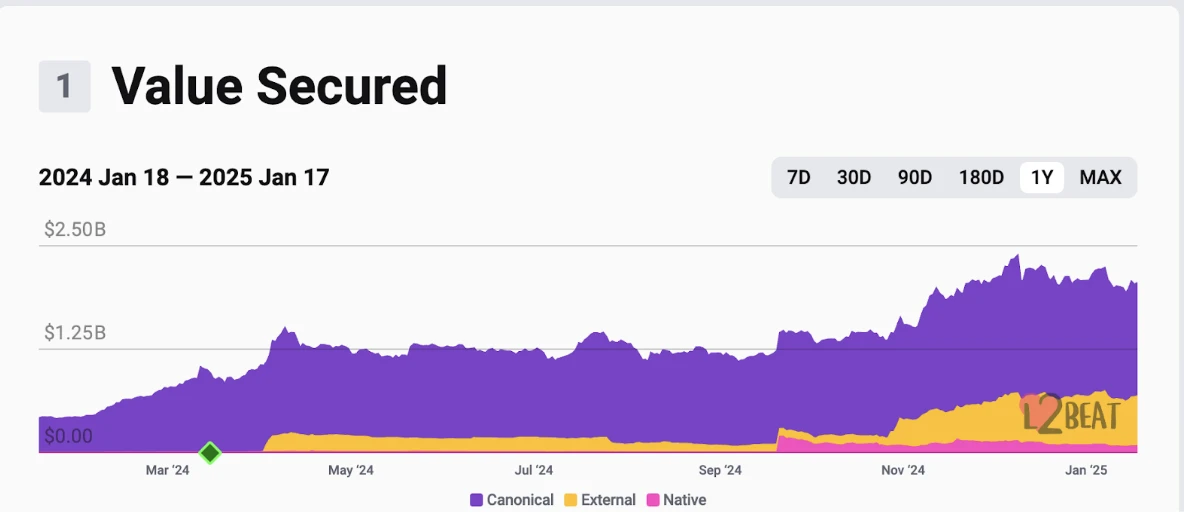

Token performance and TVL data: Mantles native token MNT has a strong upward momentum in 2024. Data shows that the price of MNT tokens has risen from US$0.58 at the beginning of the year to US$1.4 at the end of the year. L2 BEAT data shows that its network TVL has also risen from US$410 million at the beginning of the year to US$2.36 billion at the end of the year. The only project in the treasury that holds more than 1 billion mainstream assets and is supervised by token holders has made a profit of more than US$50 million this year. In addition to mainstream assets, the Mantle Treasury also holds tokens and equity including mETH, FBTC and Ethena. These mainstream assets have also become a stable reserve for Mantles token MNT.

Its native token MNT has a very pure token distribution and equity structure. In the future, no tokens will be unlocked in large quantities. Non-circulating MNT needs to establish a governance proposal and pass the Treasury vote before it can flow into the market. Currently, many L2 token projects are facing huge unlocking, which will affect their currency price trends.

Segmented sectors, the key tracks that Mantle is betting on in 2024

An important point that drives the growth of Mantle network data is that Mantle has seized the mainstream crypto narrative in 2024. The hottest narrative in the crypto industry in 2024 is staking. Ethereum re-staking top stream projects include EigenLayer, ether.fi, Swell, etc. The airdrop expectations and high returns and adoption have triggered a craze in the re-staking track. At that time, Mantle seized the opportunity of re-staking and became the first Layer 2 network to adopt EigenDA. EigenDA is a data availability solution that allows Mantle to submit only the necessary state roots to the Ethereum mainnet, and a large amount of transaction data is stored in EigenLayer.

Leveraging the staking track, mETH Protocol’s three-token model

In addition, Mantle also launched its flagship project mETH Protocol in 2024. mETH is an Ethereum liquidity staking and re-staking protocol. After the protocol was launched, it attracted a lot of attention and user participation. As of now, the TVL of the mETH protocol ranks fourth among all liquidity staking protocols. Data shows that the TVL of mETH has increased from US$363 million in January 2024 to a peak of over US$2 billion in March. In December 2024, the TVL of mETH was about US$1.85 billion, an increase of more than 5 times.

When talking about mETH Protocol, we have to talk about the three key tokens of the protocol: mETH, cmETH and COOK. The specific timeline of the three tokens is as follows:

On December 8, 2023, the protocol staking token mETH will be launched;

On October 29, 2024, the protocol governance token COOK was launched;

On October 30, 2024, the protocol’s re-staking token cmETH will be launched.

mETH is an interest-bearing ETH staking token that allows users to participate in staking without locking their ETH, and use mETH to conduct DeFi activities within the Mantle ecosystem, such as staking rewards, lending, etc. Currently, mETH can be used on 30+ DeFi protocols on Ethereum and Mantle networks, such as Pendle, Ethena, Compound, and Euler. mETH currently has an APY of 3.43%, with a total staking amount of over 450,000 ETH and a TVL of US$1.566 billion.

cmETH is the re-staking token of mETH, which can be used for re-staking in EigenLayer, Symbiotic, Karak and related re-staking protocols to obtain rewards. The token adopts the LayerZero OFT standard, which provides users with more convenience and benefits by achieving fast inter-chain bridging within a few minutes without slippage. The advantage of cmETH is that it can explore more income opportunities. Compared with ordinary LRT on the market, cmETH can cover multiple re-staking protocols through a single LRT without changing the ETH version. Holding cmETH can obtain: staking income, re-staking agreement income, AVS income, cooperation agreement income, governance token COOK income and potential airdrop expectations (such as EigenLayer airdrop). cmETH is also the best asset in LRT that can obtain multiple income.

COOK is the governance token of the mETH protocol. COOK and MNT are complementary in the Mantle ecosystem. MNT provides a broad incentive and governance framework for the network, while COOK focuses on the specific governance and user incentive mechanism of the mETH Protocol. It gives holders the right to vote in the governance decisions of the mETH protocol, including decisions on the addition of new features, parameter adjustments, etc. COOK is distributed through various activities and reward mechanisms. For example, the Powder obtained in the Methamorphosis activity can be exchanged for COOK. Currently, there are nearly 30 channels that can use cmETH to do LP or deposit it in related lending protocols to obtain COOK.

Combined with the popularity of the staking track, the unique token model of the mETH protocol and the “kill two birds with one stone” strategic benefits have made it the best project to participate in this narrative.

Not just Ethereum, explore BTC’s higher DeFi returns

Although the development of Bitcoin ecology in 2024 is not as fast as that of Ethereum, it is also very lively. From the popularity of inscriptions, runes, NFTs at the beginning of the year and the emergence of BTC L2 and BTC pledge protocols, protocols such as Babylom and Solv have also attracted everyones attention to the Bitcoin ecology. Mantle invested in multiple Bitcoin ecological pledge protocols in 2024, which also shows that the network has always had plans to enter the BTC ecology.

Following the popularity of BTCFi, Mantle has long cooperated with BTCFi protocol Ignition (FBTC), which also means that in addition to exploring basic assets such as ETH, Mantle has also set its sights on the more ambitious BTC. FBTC is a 1:1 anchored full-chain BTC packaged version launched by Ignition, which aims to improve the accessibility and practicality of Bitcoin. Mantle and Antalpha Prime are early supporters of the project. Through the Mantle network, FBTC can be expanded to the Ethereum ecosystem. Mantles network characteristics also enable FBTC to obtain higher usage and revenue on its network.

Users can convert their BTC into FBTC through Ignition. On the Mantle network, FBTC can be used for staking. Staking FBTC can participate in the verification and governance process of the network, and users can receive income or rewards by participating in activities. FBTC can also be used as collateral or loan assets in some DeFi protocols on Mantle, or FBTC can be used to provide liquidity to the pool to receive rewards. In addition, FBTC can also participate in mining in the Mantle ecosystem DeFi protocol.

In terms of data, since FBTC was launched on Mantle and Ethereum networks in July, its TVL has grown from US$67 million to over US$1.4 billion. In terms of security, FBTC has received investment from Mirana, Ant Alpha, and Galaxy digital, three of the most influential financial companies in crypto, to jointly create a safe and reliable use of BTC assets in financial scenarios.

The BTCFi protocol launched at about the same time as FBTC, such as Corn (BTCN), has an ecosystem TVL of only $490 million. In contrast, Mantle uses data to bring users a better DeFi use case template for BTC, with high yield + security + good data panel.

Stronger network + high-quality team, Mantles game blueprint

In addition to its efforts in DeFi, Mantle Networks modular architecture gives it a unique advantage in gaming: it can achieve high throughput, provide the lowest transaction fees in L2, etc. Especially after the Mantle Network mainnet v2 Tectonic upgrade introduced meta transactions, users can more conveniently pay transaction fees in dApp.

In addition to its high-performance network, Mantle has also formed a strong web3 game team to support its game ecosystem. The team is composed of members with rich game development and operation experience, focusing on the token economy design, game design, gameplay development, user retention and operation management of blockchain games. In addition, the team members have experience in participating in Apple Arcade, League of Legends, Ragnarok and TapTap, which enables Mantle to have a strong ability to support game dApps on its platform. As of the time of posting, the Mantle ecosystem has launched 26 game dApps, and well-known blockchain games in the ecosystem include Catizen and MetaCene. With the help of game dApps, Mantle can achieve a more active game community and attract more users to participate in the blockchain game ecosystem.

Geezee, the head of Mantles game team, is also a leader who has a deep understanding of blockchain games. As a crypto OG, Geezee is well aware of the difference between blockchain games and DeFi. DeFi requires greater liquidity and a wider range of token transactions. A good blockchain game developer should not confuse game tokens with DeFi tokens. DeFi tokens pursue listing on CEX, obtaining high valuations and liquidity. Game tokens are just the opposite and need to deviate from market speculation. As a game developer, the source of income should be in-game consumption, not token sales. A large number of out-of-game transactions and flows of game tokens will deviate from the game itself, causing the valuation of tokens to be out of touch with their actual value, and the game will ultimately be unsustainable. High-performance network + high-quality team and leader enables Mantle to accurately bet on blockchain game projects and develop its game ecology.

Expanding outward, Mantle’s high-quality projects funded and supported in 2024

In general, in 2024, while Mantle is committed to staking, BTC, and blockchain game narratives, it is also inseparable from its ecological outward investment and funding. The two promote each other and make the Mantle ecosystem move forward steadily. In 2024, the Mantle Ecological Investment Fund was very active. According to statistics, a series of high-quality projects funded by Mantle EcoFund and Mantle Network in 2024 can be roughly summarized as follows:

Bitcoin ecology and pledge track: Renzo Protocol (January), Lombard (July), SatLayer (August), Pell Network (October), pumpBTC (October), Mezo (July), L2 (July)

Infrastructure: multi-chain wallet DreamOS (March), zero-knowledge startup Lagrange (May), points trading protocol Pichi Finance (August);

Stablecoin products: Stablecoin issuer Agora (April), stablecoin protocol Usual (April);

DEX: DEX aggregator ODOS (August);

Game and AI track: blockchain game MetaCene (March), blockchain game + AI agency protocol Blade Games (May), decentralized AI infrastructure Gaia (May), game platform B3 (July).

Overall, many of the projects that Mantle participated in investing in 2024 are leading projects in various fields. Many of these projects have close cooperation with Mantle, promoting the growth and innovation of the Mantle ecosystem, increasing its market share and application diversity in DeFi, chain games and other fields, and also promoting the growth of its ecological data and user ends.

Looking forward to 2025, we will continue to seize the hottest narratives and move forward on-chain and off-chain in parallel

In addition to the pledge track, the AI+Crypto narrative at the end of 2024 also promoted the further development of on-chain finance. The development of AI and crypto is interdependent, and breakthroughs in AI will bring breakthroughs in on-chain finance. As mentioned earlier, in addition to developing on-chain finance, Mantle is also increasing its resource investment in the field of AI, using artificial intelligence to achieve new changes in DeFi and bring more possibilities to on-chain finance. Not only developing on-chain finance, 2025 will also be a critical moment for the layout of RWA. Mantles integration with AUSD (Agoras US dollar stablecoin, backed by cash, US Treasury bills and overnight repurchase agreements) also marks a major achievement in its ecology—introducing a secure institutional-grade stablecoin to Mantle and expanding the scope of use of institutional-grade financial products. In addition, Mantles enhanced index fund institutional-level compliance product was launched in Q1, paving the way for the layout of the RWA track.

The inauguration of “Crypto President” Trump in 2025 will also promote the further development of cryptocurrencies. By then, value tokens will become the most promising investment targets. MNT’s “golden shovel” attribute also makes it the best choice among value tokens.

In 2025, Mantle will continue to focus on DeFi, BTC and AI. Whether it is for builders or users, everyone can find industry hot narratives and applications that are more suitable for them on Mantle.