1. Bitcoin market and mining data

From February 10 to February 16, 2025, the price trend of Bitcoin is as follows:

From February 10 to February 16, Bitcoin showed an overall volatile trend, with multiple highs and lows. The opening price on February 10 was $96,469, and it dropped to $94,896 during the session before rebounding to a high of $98,077. The upward trend continued on February 11, rising to a high of $98,442 before quickly falling back and dropping to $94,940 in the morning of the 12th, and the market entered an adjustment period. On February 12, the price fluctuated between $94,730 and $96,400, and fell to an intraday low of $94,737 in the evening. After opening on February 13, it quickly rose to $98,062, and then fell back to $95,865, with overall volatility narrowing. On February 14, the price fluctuated upward, rising from around $95,500, and broke through the intra-week high of $98,545 in the early morning of the 15th, and then fell back to $97,054. From February 15 to 16, the price fluctuated narrowly in the range of $97,000 to $98,000, and market liquidity stabilized. As of writing, the price of Bitcoin is $97,596. Overall, market sentiment is fluctuating, and in the short term it is still mainly range-bound. It is necessary to pay attention to subsequent changes in trading volume and breakthroughs in key resistance levels.

Bitcoin price trend (2025/02/10-2025/02/16)

Market dynamics and macro background

Fund Flow

From February 10 to February 16, 2025, the flow of funds in the Bitcoin market showed a trend of short-term adjustment and long-term bullishness. In terms of ETF funds, there was an outflow of $243 million on February 12, indicating that some institutions are taking profits, but institutions such as JPMorgan Chase are still optimistic about long-term allocation. Exchange Bitcoin holdings have declined. On February 12, mainstream exchanges had a net outflow of 12,000 BTC (about $1.15 billion), and a total outflow of 26,500 BTC in the past week, reflecting that investors prefer to hold for the long term (HODL). In the derivatives market, futures open interest (OI) fell 8% from February 10 to 12, but rebounded after February 13, indicating that leveraged funds are still in the game. Over-the-counter (OTC) market data shows that institutions are quietly increasing their holdings of Bitcoin. In addition, Bitcoin network activity has dropped significantly, with trading volume down about 55% from its peak, indicating that market activity has weakened. Overall, short-term volatility has increased, but long-term capital flows are still bullish. Overall, short-term market volatility has increased due to ETF fund outflows and macro data, but long-term capital flows are still bullish.

Technical Analysis

From February 10 to February 16, 2025, the price of Bitcoin maintained a volatile adjustment trend, gaining support near $95,000, but never broke through the strong resistance of the $98,000-100,000 range. In terms of technical indicators, the 50-day moving average ($96,800) provides support, while the 200-day moving average ($89,500) maintains a long-term upward trend, indicating that the bull market structure is still there. RSI remains between 53-58, market sentiment is neutral, and trading volume has dropped by about 12% from the previous period, indicating that short-term buying momentum has weakened. In addition, MACD formed a dead cross on February 12, and short-term adjustment pressure increased, but the momentum column began to shorten on February 14, which may be brewing a direction choice. Overall, Bitcoin will maintain range fluctuations in the short term. If it can break through $98,000, it is expected to challenge the $100,000 mark. On the contrary, if it falls below $95,000, we need to be alert to the risk of further pullback.

Market sentiment

From February 10 to February 16, 2025, the overall market sentiment was cautiously optimistic, but there were differences in the short term. The Fear Greed Index stabilized between 75-78, which is in the greed zone, indicating that the market is still bullish, but it has cooled down compared to the high of 85+ in early February. Social media and derivatives market data show that the BTC futures long-short ratio is between 1.12-1.18, indicating that the market is still biased towards bulls, but the bull advantage is gradually shrinking. In terms of CME Bitcoin futures positions, the proportion of long orders in institutional accounts fell from 62% on February 10 to 58% on February 15, indicating that some institutions reduced their positions at high levels to lock in profits. At the same time, the USDT premium index once fell to 0.98, indicating that short-term buying in the Asian market has slowed down, but there has been no obvious panic selling. Analysis agency BCA Research noted that the market is filled with excessive optimism, with more than 90% of Bitcoin holders in a profitable state, which is usually a sign of a market peak. Overall, market sentiment remains optimistic, but bullish momentum has weakened, and investors are more cautious about the resistance in the $98,000-100,000 range, causing Bitcoin prices to enter a period of consolidation.

Macroeconomic Background

From February 10 to February 16, 2025, the price of Bitcoin was greatly affected by macroeconomic and market events. The US CPI for January, released on February 13, rose by 3.1% year-on-year (higher than the expected 2.9%), which led to a cooling of the markets expectations for the Feds interest rate cut in March. The 10-year US Treasury yield broke through 4.3%, the US dollar index (DXY) rose to 105.2, and Bitcoin fell back to $96,200 in the short term. At the same time, the daily inflow of funds into Bitcoin spot ETFs fell to $120 million, a significant decrease from $380 million in early February, and institutional funds were cautious. On February 14, Federal Reserve Chairman Powell emphasized that the decline in inflation requires more confirmation, which strengthened the markets expectations for a rate cut in June, but Bitcoin still failed to break through $100,000. On February 12, the escalation of geopolitical tensions in the Middle East and risk aversion pushed Bitcoin to $98,700, but rising U.S. bond yields limited gains. Overall, Bitcoin is under pressure from CPI data, the Feds stance, and slowing ETF inflows in the short term, but geopolitical tensions provide some support, and market sentiment tends to be cautious and wait-and-see.

Hash rate changes

From February 10 to February 16, 2025, the hash rate of the Bitcoin network experienced significant fluctuations, showing an overall trend of first correction, then repair. On February 10, the hash rate fluctuated slightly downward from 877.93 EH/s the previous day, reaching a minimum of 737.95 EH/s, and then quickly rebounded to 825.44 EH/s. On February 11, the hash rate showed a trend of decline-rebound-fall again, briefly rebounding from 714.28 EH/s to 780.39 EH/s, but then further dropped to this weeks lowest point of 680.48 EH/s.

Since February 12, the hash rate has entered the repair phase, and the overall trend has fluctuated upward. On February 13, the hash rate once climbed to 916.93 EH/s, and then fell back to 826.70 EH/s. From February 14 to 15, the hash rate continued to grow, climbing from 826.70 EH/s to 922.34 EH/s, and after a brief correction to around 860 EH/s, it fluctuated upward again to 962.04 EH/s, showing strong recovery momentum. On February 16, the hash rate broke through 972.18 EH/s, and as of the time of writing, it fell slightly to 913.51 EH/s.

Overall, the hash rate fluctuated violently this week. Short-term declines and recovery may be affected by factors such as miners income adjustments, changes in mining difficulty, and market liquidity. Future trends still need to be closely monitored to assess the sustainability of computing power recovery and its potential market impact.

Bitcoin network hash rate data

Mining income

From February 10 to February 16, 2025, the mining income of Bitcoin miners was affected by the fluctuation of hash rate, the increase of mining difficulty and the change of Bitcoin price. On February 9, the seven-day moving average hash rate of the Bitcoin network reached 809 EH/s, and rose by about 5% in the subsequent difficulty adjustment, resulting in a decrease in mining income per unit of computing power. According to YCharts data, the total daily income of miners fell to $43.52 million on February 10, down 10.48% from the previous day and down 7.3% year-on-year. At the same time, the price of Bitcoin fluctuated between $96,103 and $97,648.59 during this period. Although it was still higher than the average mining cost of miners (about $26,000 to $28,000), the increase in difficulty and rising energy costs led to further compression of profit margins. Overall, miners’ income is under pressure this week. In the future, we need to pay attention to the trend of the Bitcoin market and the impact of the next difficulty adjustment on mining income.

Energy costs and mining efficiency

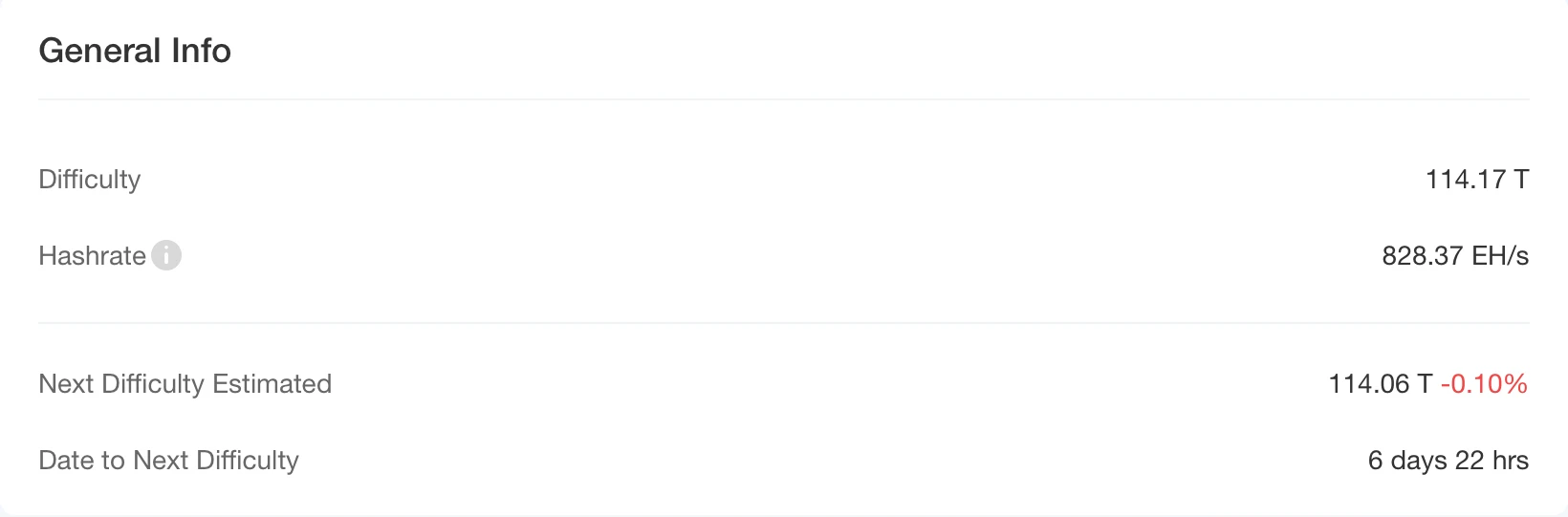

According to CloverPool data, as of February 16, 2025, the total network computing power is about 823.37 EH/s, and the total network mining difficulty is 114.17 T. It is expected that the next Bitcoin mining difficulty will be reduced by 0.10% in 6 days, to 114.06 T.

According to Cointelegraph, the average transaction confirmation time of the Bitcoin network in 2025 has reached 19 minutes, a record high. This phenomenon is mainly affected by network congestion, block size restrictions and dynamic changes in handling fees. The extension of confirmation time directly pushes up the energy costs of miners, because mining machines need to run for a long time to compete for new blocks, and the block output per unit time decreases, resulting in a decrease in mining efficiency. At the same time, the increase in transaction fees prompts miners to prioritize packaging high-fee transactions to make up for the loss of revenue, but if the increase in handling fees is not enough to cover the additional energy consumption, the overall profitability will still be compressed. In addition, with the intensification of computing power competition, some miners may adjust their operating strategies or upgrade more efficient mining equipment due to rising electricity costs to optimize computing power utilization. In the long run, this trend may drive the Bitcoin network to develop more efficient mining equipment and second-layer expansion solutions to cope with the cost pressure caused by main network congestion.

Bitcoin mining difficulty data

2. Policy and regulatory news

Overview of Bitcoin Legislation Progress in US States

Currently, 21 states in the United States have proposed bills related to the Strategic Bitcoin Reserve (SBR). The following is the legislative progress of major states:

Texas: The state has resubmitted the Strategic Bitcoin Reserve Act, which, if passed, would allow the state government to invest in Bitcoin or crypto assets with a market value of at least $500 billion, with no purchase cap. The bill has been submitted to the Senate Finance Committee for review and is listed as one of the Senates top 40 priority bills for 2025.

North Carolina: Proposed a strategic bitcoin reserve bill, potentially becoming the first U.S. state to officially purchase bitcoin.

Florida: Florida House members have filed the state’s second Bitcoin Reserve bill, proposing to allow 10% of state funds to be invested in Bitcoin.

Oklahoma: The state’s bitcoin reserve bill has passed committee and is heading to a full house vote.

Utah: The fastest progress, Utahs Bitcoin Reserve Act has passed the House Economic Development Committee and is currently awaiting Senate review. If passed, it will take effect as early as May 7 this year.

Georgia: On February 14, Georgia introduced a bill that would allow the state treasurer to invest in Bitcoin.

West Virginia: On February 15, West Virginia Senator Chris Rose submitted a bill proposing to allow the state treasury to invest up to 10% of its funds in Bitcoin or precious metals to hedge against inflation risks. The bill stipulates that the state treasury can invest in digital assets with a market value of more than $750 billion, and currently only Bitcoin meets the criteria. Assets can be held on-chain or invested through ETFs.

Former Thai Prime Minister Proposes Developing Phuket into a Bitcoin Sandbox Zone

On February 11, according to Bitcoin News, former Thai Prime Minister Thaksin Shinawatra proposed to develop Phuket into a Bitcoin sandbox area, allowing foreign tourists to use Bitcoin to pay for real estate and tourism-related expenses without being restricted by cash.

3. Mining News

An independent miner received a Bitcoin block reward worth $300,000

On February 11, an independent Bitcoin miner won the jackpot and successfully mined a block, receiving a reward of 3.125 Bitcoins, worth more than $300,000. According to data from the Bitcoin block browser Mempool.space, the 883,181 block mined on February 10 contained 3071 transactions, with a total reward of 3.15 Bitcoins, and the miner information was displayed as unknown.

Bitcoin miner Marshall Long said in a Feb. 10 X-Platform post that the miner was using an implementation of CKPOOL, but “does not appear to be directly from CKPOOL.” He speculated that the lucky miner may have used Bitaxe.

Related images

An explosion in a Malaysian city revealed an illegal Bitcoin mining operation

On February 13, according to Decrypt, an explosion occurred in Bandar Puncak Alam, Malaysia, and an illegal Bitcoin mining activity was discovered. This is another case of cryptocurrency-related electricity theft in the country.

At 11:41 a.m. on Tuesday, smoke and flames came out of the house, and local residents called for help. After the fire was extinguished at 4:45 p.m., investigators discovered a complex illegal device: nine Bitcoin mining machines, blowers and a D-link router, all connected to an unauthorized power source.

While Bitcoin mining itself is not illegal in Malaysia, tampering with electricity supply lines is a crime under Section 37 of the Electricity Supply Act, punishable by a fine of up to 100,000 Malaysian ringgit ($23,700) and up to five years in prison.

4. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

El Salvador: This week, it increased its holdings by 17 BTC, and its current total holdings reached 6,072.18 BTC. The national Bitcoin strategy continues to advance. El Salvador’s current Bitcoin holdings are equivalent to approximately US$592 million.

Metaplanet: Unrealized gains on Bitcoin holdings reached $35 million, and plans to increase holdings to 21,000 BTC by 2026, and expand holdings through bond financing and other means. Metaplanet announced the issuance of 4 billion yen in ordinary bonds to purchase more Bitcoin, further increasing its Bitcoin investment strategy.

HOLO: Plans to raise $200 million to invest in Bitcoin and related derivatives to enhance capital reserves.

Japanese gaming company Gumi: Plans to purchase $66 million worth of Bitcoin and earn additional income through the Babylon staking protocol.

KULR: Increased holdings of BTC by $10 million at an average price of $1,039.05, and total holdings increased to 610 BTC.

MicroStrategy: Financial operations in 2024 accumulated 18,527 BTC, bringing approximately US$1.8 billion in profits to shareholders.

Goldman Sachs: Bitcoin ETF holdings increased to $1.5 billion in Q4 2024, increasing BlackRock IBIT by 88% and Fidelity BTC Fund by 105%. According to the latest disclosure, Goldman Sachs currently only holds $3.6 million worth of Grayscale Bitcoin Trust Fund GBTC.

National Bank of Canada: Purchased $2 million worth of Bitcoin ETF, institutional investors continue to increase their investment in the Bitcoin market.

Hive Digital: By the end of 2024, Bitcoin holdings increased to 2,805 BTC, a year-on-year increase of 263%, and Bitcoin mining profits were significant.

SBC Medical: Plans to buy $6.7 million worth of Bitcoin as part of long-term asset allocation to cope with inflation.

Bank of Montreal (BMO) of Canada: Spent $150 million to purchase Bitcoin ETF, of which $139 million was invested in BlackRock iShares BTC ETF.

Tether: Holding $7.8 billion in Bitcoin and $5.3 billion in precious metals, strategy advisors believe this may be one of the best commodity hedge transactions in history.

Family Office Avenir Group: Holds $599 million in BlackRocks Bitcoin ETF.

Abu Dhabi Sovereign Wealth Fund: Increased holdings of Bitcoin ETF by US$436 million in Q1.

National Bank of Canada: It has recently shown a bearish attitude towards Bitcoin and has applied to exercise put options to sell BlackRock iShares Bitcoin Trust ETF holdings worth more than US$1.3 million.

Wisconsin Investment Committee: Increased its holdings in BlackRock IBIT to 6 million shares, with a market value of over $340 million based on the current price of $56.10 per share.

Millennium Management: holds $2.6 billion in Bitcoin ETF and $182 million in Ethereum ETF.

David Sacks: Bitcoin is backed by mathematics, not government

On February 10, according to Cointelegraph, Trump’s encryption and AI consultant David Sacks recently said: “Bitcoin provides a different type of currency that is not backed by the government, but by mathematics.”

Viewpoint: Bitcoin continues to fluctuate below $100,000, and the market gradually turns pessimistic

On February 10, Greeks.live macro researcher Adam wrote that there are many important macro events this week. The Federal Reserve and US economic data will be more prominent this week. The semi-annual monetary policy and CPI data are worthy of attention.

The new EU regulations require crypto exchanges to comply with travel rule guidelines and strengthen anti-money laundering measures. Exchanges such as Deribit need to improve KYC before they can be used normally.

The EU Crypto-Assets Markets Act (MiCA) has come into full effect, and compliant exchanges such as Kraken have gradually removed stablecoins such as USDT from their shelves in Europe. The crypto market continues to be sluggish, with Bitcoin continuing to fluctuate below $100,000. Altcoins have generally fallen sharply in the past month, and the markets wealth-creating effect has become relatively weak, and the markets enthusiasm has gradually turned into pessimism.

In terms of options, the full-term IV continues to decline, the monthly at-the-money IV has fallen below 50%, and the quarterly at-the-money IV is below 55%, and the market game is not fierce. Recently, there have been many transactions of large call options, mainly by large investors adjusting their positions.

Polymarket predicts that the probability of the United States establishing a national Bitcoin reserve in 2025 is 41%.

On February 11, Polymarket predicted that the probability of the United States establishing a national Bitcoin reserve in 2025 was 41%. Previously, it rose to 65% on January 17. As of press time, the cumulative transaction volume of this prediction reached 722,000 US dollars.

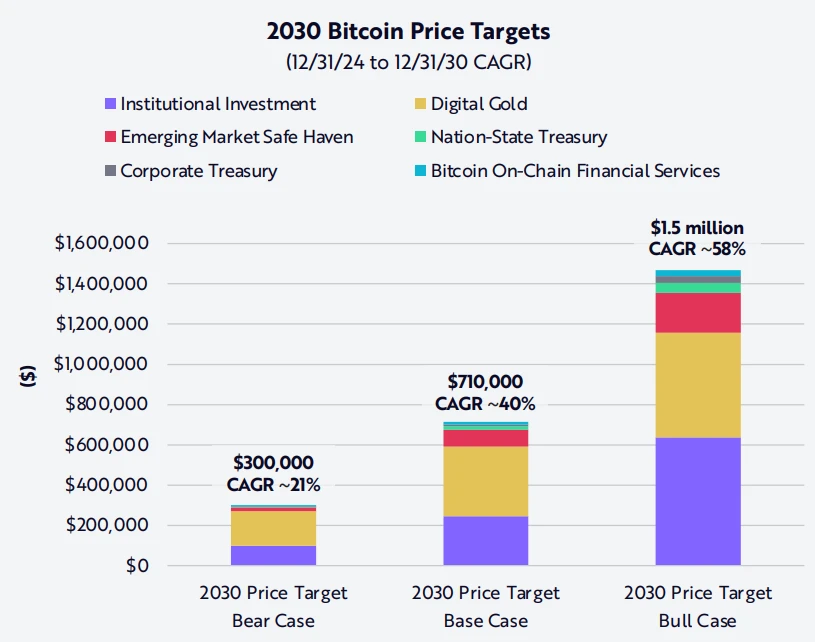

Cathie Wood: Bitcoin price is expected to reach $1.5 million by 2030

On February 12, Bitcoin has been trading below the key $100,000 level since February 4 as global trade war concerns weighed on investor sentiment after the United States and China announced new import tariffs. Despite the temporary downturn in the market, according to Cathie Wood, CEO and chief investment officer of ARK Invest, the chances of Bitcoin breaking through $1.5 million per coin have increased.

Related images

VanEck analyst: Bitcoin reserve bills in 20 states will bring in $23 billion in incremental funds

On February 12, Matthew Sigel, head of digital asset research at VanEck, posted on social media that the agency analyzed Bitcoin reserve bills issued by 20 states. If enacted, they could drive $23 billion in funds to buy, independent of any pension fund allocations, and more funds could come in if lawmakers move forward.

Analysis: Bitcoin bull run may not be over yet, 200-week moving average trend shows bullish signal

On February 14, according to TradingView data, Bitcoin (BTC)s 200-week simple moving average (SMA) is currently $44,200. Although it has reached an all-time high, it is still far below the 2021 bull market peak of $69,000. Historical data shows that the bull market usually ends when the 200-week moving average rises to the high point of the previous bull market. For example, the 2021 bull market ended when the 200-week moving average reached the 2017 high of $19,000, while the 2017 bull market ended when the moving average reached the 2013 high of $1,200.

The current BTC price fluctuates between $90,000 and $110,000, and if the historical trend continues, this range may break out with a bullish trend. In addition, Deribit options market data also supports this view. According to Amberdata, call options with a term of three months or longer are more expensive than put options, reflecting the markets expectation of rising prices. The current market price is $96,700, and the most popular option is a call option with a strike price of $120,000, with a notional open interest of more than $1.8 billion.

Bitwise European Research Director: Bitcoin and gold are expected to benefit from the weakening of the US dollar and the reduction of US debt holdings by central banks

On February 14, Andre Dragosch, head of European research at Bitwise, said that Bitcoin and gold are gaining market attention as the macroeconomic environment suggests a possible shift in the dominance of the U.S. dollar.

As the largest overseas holders of U.S. debt, China and Japan are reducing their holdings of U.S. Treasuries, raising concerns about the long-term demand for U.S. government bonds. Dragosch revealed that some overseas central banks have asked Bitwise about the possibility of shifting some of their U.S. debt investments to spot Bitcoin ETFs, and the Czech National Bank is also considering similar measures.

CZ: Fed Chairman Powells view on Bitcoin is improving step by step

On February 15, Federal Reserve Chairman Powell said that Bitcoin is digital gold. Bitcoin has not replaced the US dollar yet, but it is a strong competitor to gold. In response, Binance co-founder CZ said that Powells views on Bitcoin are improving step by step.

Related images

Former CFTC Chairman: Bitcoins scarcity leads to its rapid appreciation

On February 16, according to Cointelegraph, Chris Giancarlo, former chairman of the U.S. Commodity Futures Trading Commission (CFTC), said: Bitcoins design has determined its scarcity. You can never have more than a certain amount of Bitcoin. Bitcoin is appreciating rapidly.

The total holdings of the US spot Bitcoin ETF on the chain exceeded 1.2 million BTC

On February 16, according to Dune data, the total on-chain holdings of the U.S. spot Bitcoin ETF have exceeded 1.2 million BTC, and now reach about 1.205 million BTC, accounting for 6.08% of the current BTC supply, and the on-chain holding value has reached about US$117.7 billion.