Original author: The Kaiko Research Team

Original translation: TechFlow

As North America quickly resolves tariff disputes, global markets are gradually returning to stability. Meanwhile, the United States is actively exploring the establishment of its own sovereign wealth fund, while cryptocurrency regulator David Sacks optimistically predicts that digital assets are about to usher in a golden age.

This week, we’ll take a deep dive into the following areas:

Coinbase’s Market Performance Before Earnings Release

USDC trading volume on Binance has grown significantly

Liquidity Trends in the Alternative Market

How Crypto Data Becomes a Key Tool for Predicting Financial Performance

Coinbase earnings preview: Market data provides early insights

Coinbase will release its fourth quarter 2024 earnings report this Thursday (February 13). Until then, we can get some initial clues about its performance by analyzing market data. Although analysts earnings expectations and outlooks have a direct impact on stock prices, crypto market data is often an important leading indicator of the health of exchanges.

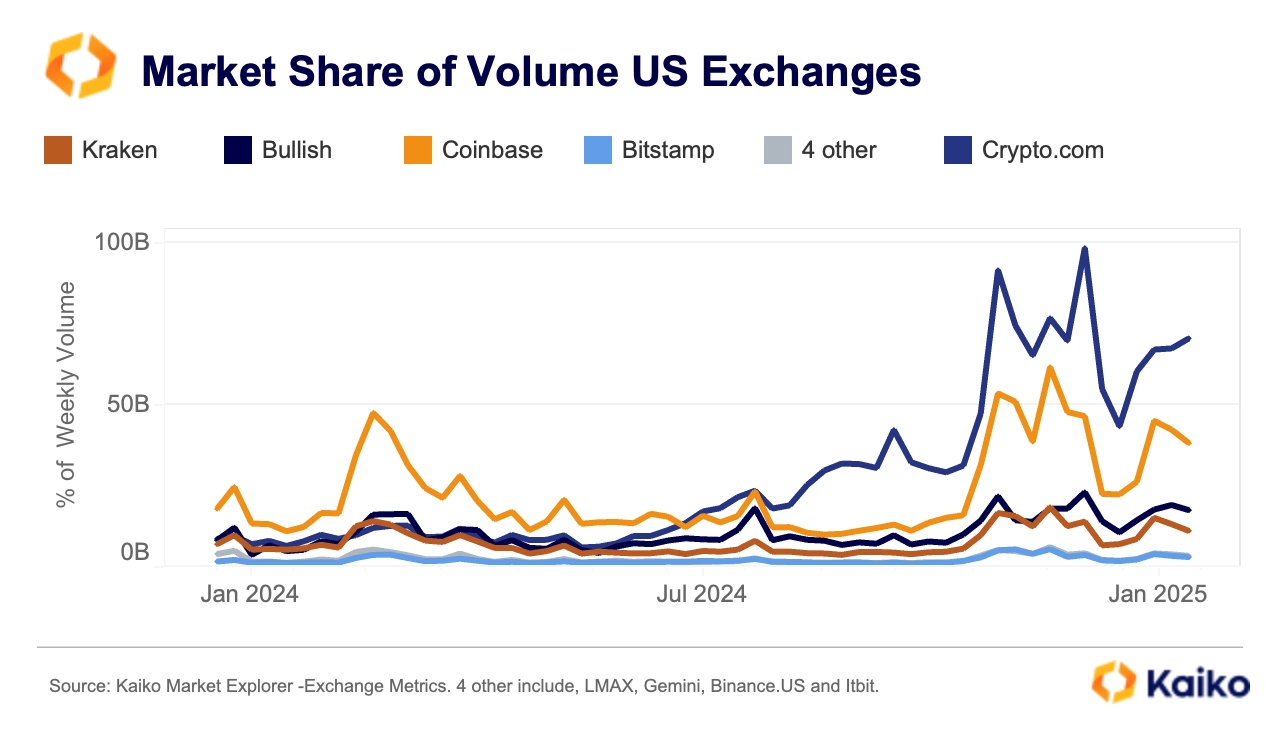

Data shows that Coinbases weekly trading volume climbed to its highest level in two years in the fourth quarter, a trend that suggests the platform has benefited greatly from the market rebound after the U.S. election.

In recent years, Coinbases revenue sources have gradually diversified, and its subscription and services business (including staking rewards, custody fees, and USDC interest) has significantly increased its share of total revenue.

However, trading revenue remains Coinbase’s core business. With the exception of one quarter in 2023, trading revenue has consistently accounted for more than 50% of total revenue.

It is important to note that subscription and service revenues are closely tied to the overall activity of the crypto market and do not serve as a risk diversifier. Therefore, in the event of low trading activity or falling market prices, subscription and service revenues will also be significantly affected.

For example, in the third quarter of 2024, Coinbase’s blockchain reward revenuefell 16% due to falling ETH and SOL prices.

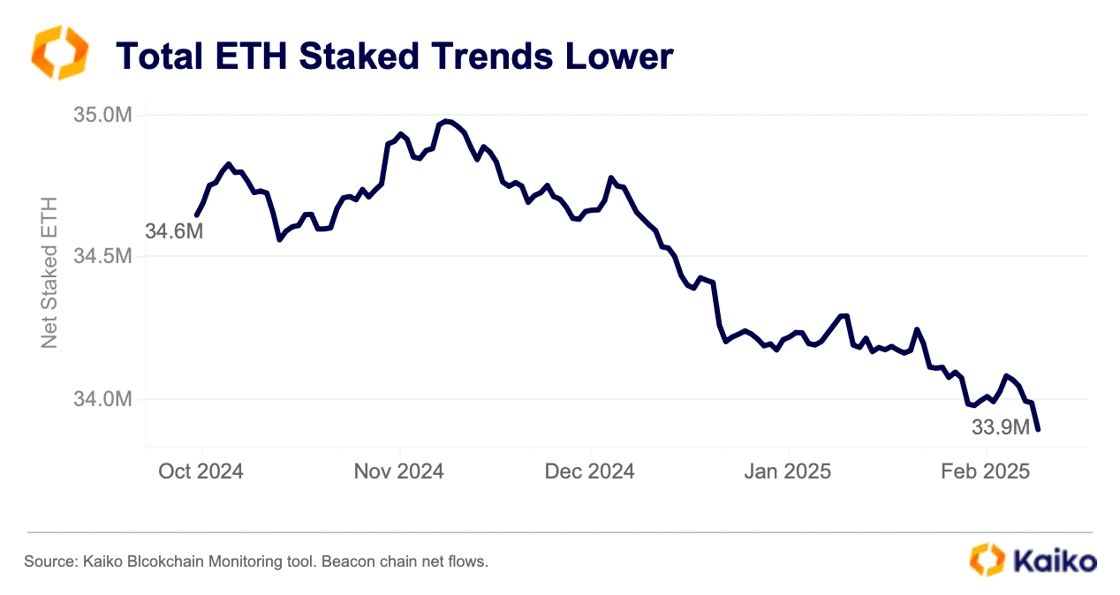

Kaikos blockchain monitoring tool shows that the net flow on the Ethereum beacon chain declined in the fourth quarter of 2024. As the second largest ETH staking entity after Lido, Coinbase is one of the main contributors to this downward trend. Data shows that in the past six months, Coinbases share of the staking market has fallen by 3.8%, with a net outflow of 1.29 million ETH in the same period.

This trend shows that although Coinbase still occupies an important position in the staking field, its market share is gradually being eroded by other competitors. This may have an adverse impact on its long-term revenue growth and competitiveness.

Although the price increase of ETH and SOL during the quarter alleviated the impact of the reduction in staking to some extent, the overall data still shows that Coinbases blockchain reward revenue may have declined in the fourth quarter. Especially in the ETH staking market, Coinbases market share fell by 3.8%, which had a direct impact on its staking-related revenue.

Coinbases commercial agreement with Circle enables it to receive a steady stream of revenue from USDC-related revenue. Notably, Circles new partnership with Binance and record USDC trading volumes may have offset the decline in staking revenue to some extent. This provides Coinbase with an additional revenue buffer, especially as staking and trading revenues come under pressure.

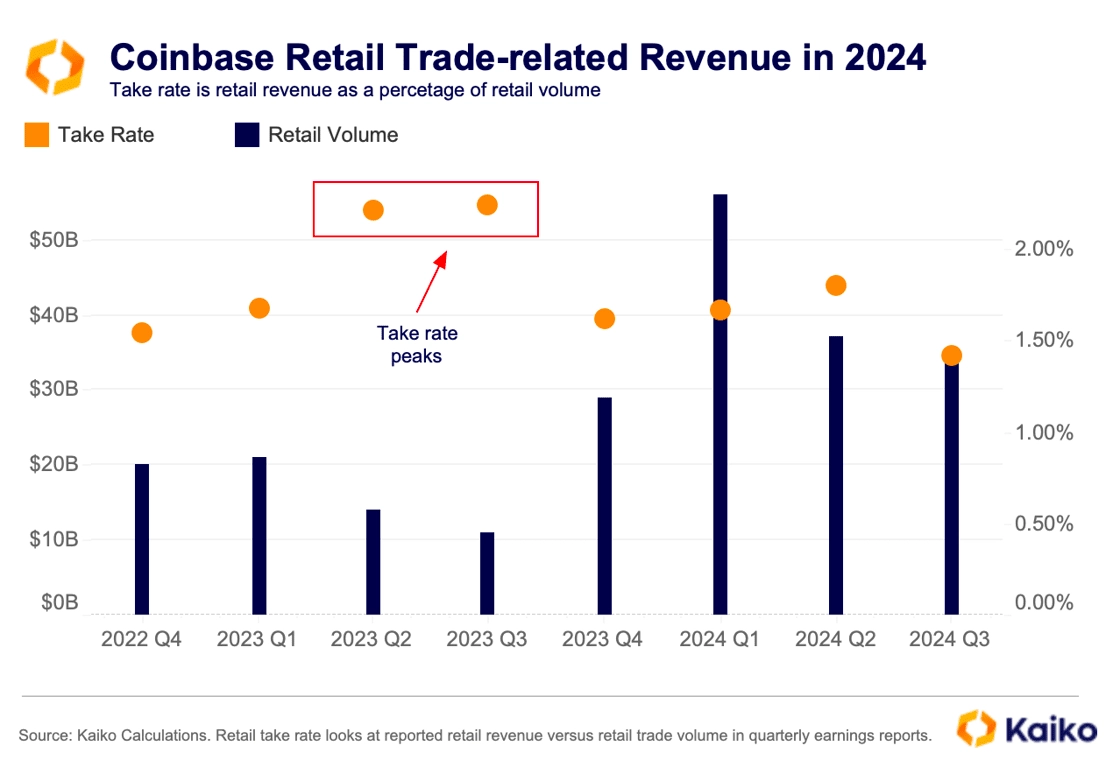

Retail traders, who pay the highest transaction fees, have seen their share of trading volume drop significantly from 40% in 2021 to 18% currently. Despite growth in Coinbases subscription businesses, such as blockchain rewards and custody services, the loss of retail traders has put significant pressure on its trading revenue.

Since its peak in mid-2023, Coinbase’s “take rate” — the proportion of revenue it takes from retail traders — has fallen to its lowest level since the Terra Luna crash in the first half of 2022.

The decline in revenue comes at a time of intensifying competition in the U.S. market, with some platforms slashing transaction fees to attract users, further increasing pressure on platforms like Coinbase.

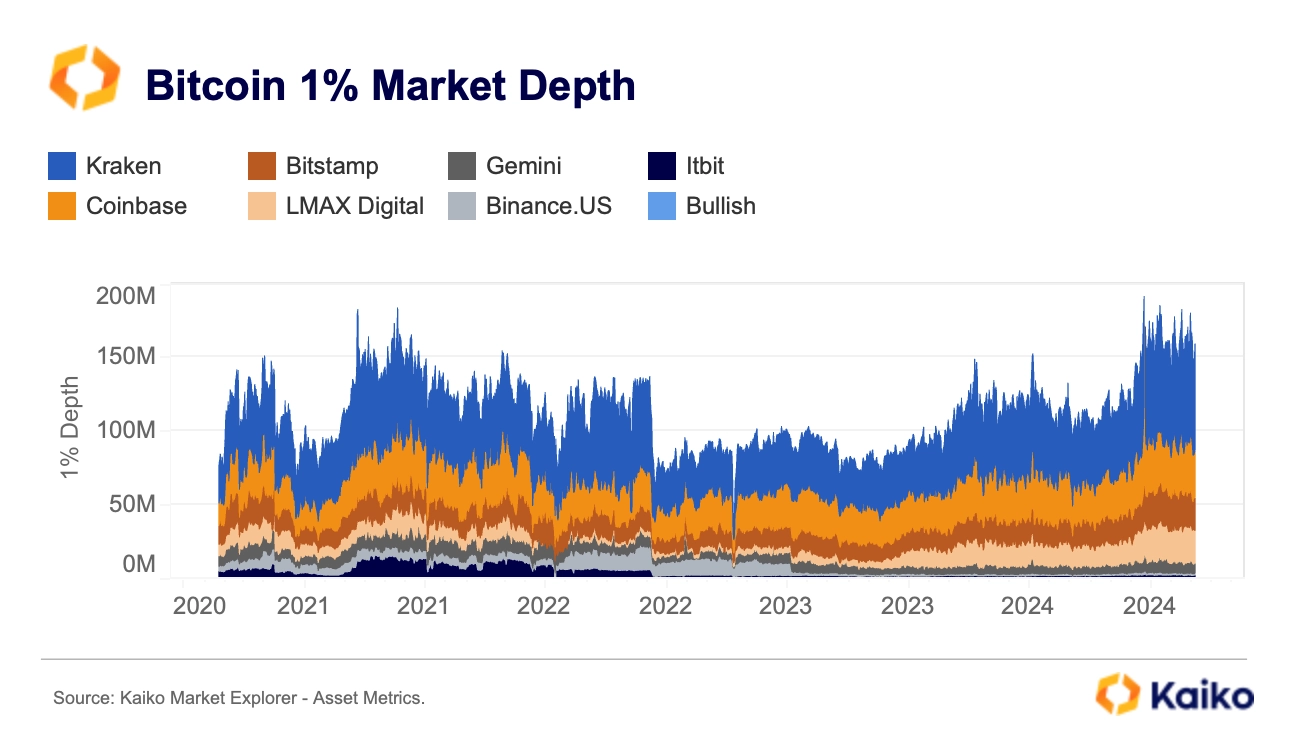

While Coinbase remains one of the most liquid exchanges in the U.S. and its fee structure (which favors market makers over takers) has remained relatively stable, the decline in retail traders has undoubtedly increased pressure on this revenue source.

In addition, although Coinbase continues to enrich its product categories and gain more benefits in cross-product synergies, its listing activities for new assets have slowed down significantly due to the strict regulatory environment in the United States.

The chart below shows that the number of active trading pairs for both Binance.US and Coinbase has dropped significantly since the SEC filed a lawsuit against them in June 2023. However, if the regulatory environment improves in the future, Coinbase may re-accelerate its listing pace, which may also enhance its attractiveness to retail traders.

Data Points

USDC trading volume hits all-time high: Binance’s dominance

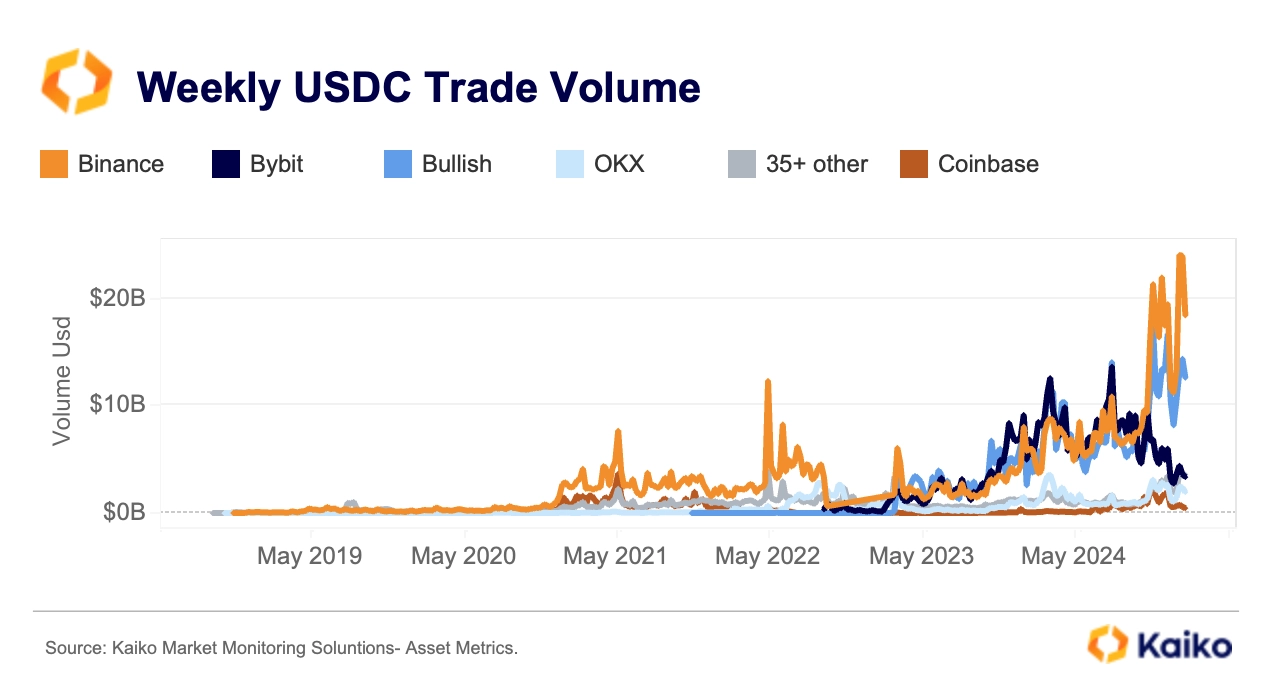

Binance has now become the worlds largest USDC trading market, with weekly trading volume reaching $24 billion in January 2025, accounting for 49% of the total global USDC trading volume. This is the highest market share since September 2022. This significant growth is due to Binances strategic cooperation agreement with Circle in late 2024, which aims to promote wider adoption of USDC.

In contrast, Bybit’s market share has dropped significantly, from 38% in October 2023 to 8% currently.

At the same time, the Bullish platform has risen rapidly and has become one of Binances main competitors with a 32% market share.

This change in the market landscape is also reflected in the increased competition among stablecoins. Data shows that the proportion of newly listed USDT quoted trading pairs has dropped from 77% in 2023 to below 63% in 2024, and so far in 2025, this proportion has further dropped to 50%.

It is worth noting that trading pairs backed by EUR are gradually gaining traction in the market. This may indicate that the EU market is experiencing a recovery with the implementation of MiCA regulations in 2024. For a more detailed analysis of EUR market trends, please refer to our latest research report .

Shanzhai Liquidity: Centralization Trend and the Rise of Small Tokens

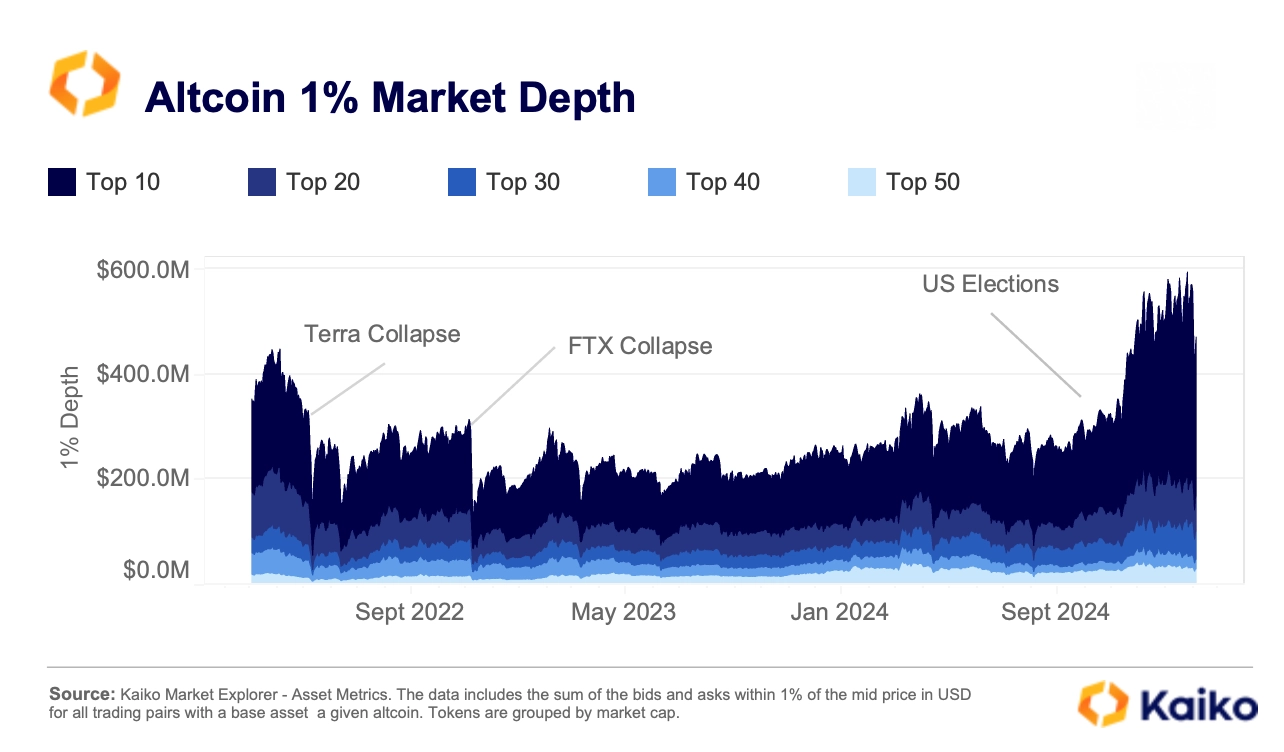

The outlook and sentiment towards altcoins has clearly improved since the U.S. election. This positive sentiment has driven a large number of new altcoin ETF applications, as well as a surge in trading activity.

Data shows that daily altcoin liquidity metrics (measured by 1% market depth of the top 50 tokens) has almost doubled since September 2023 to $960 million.

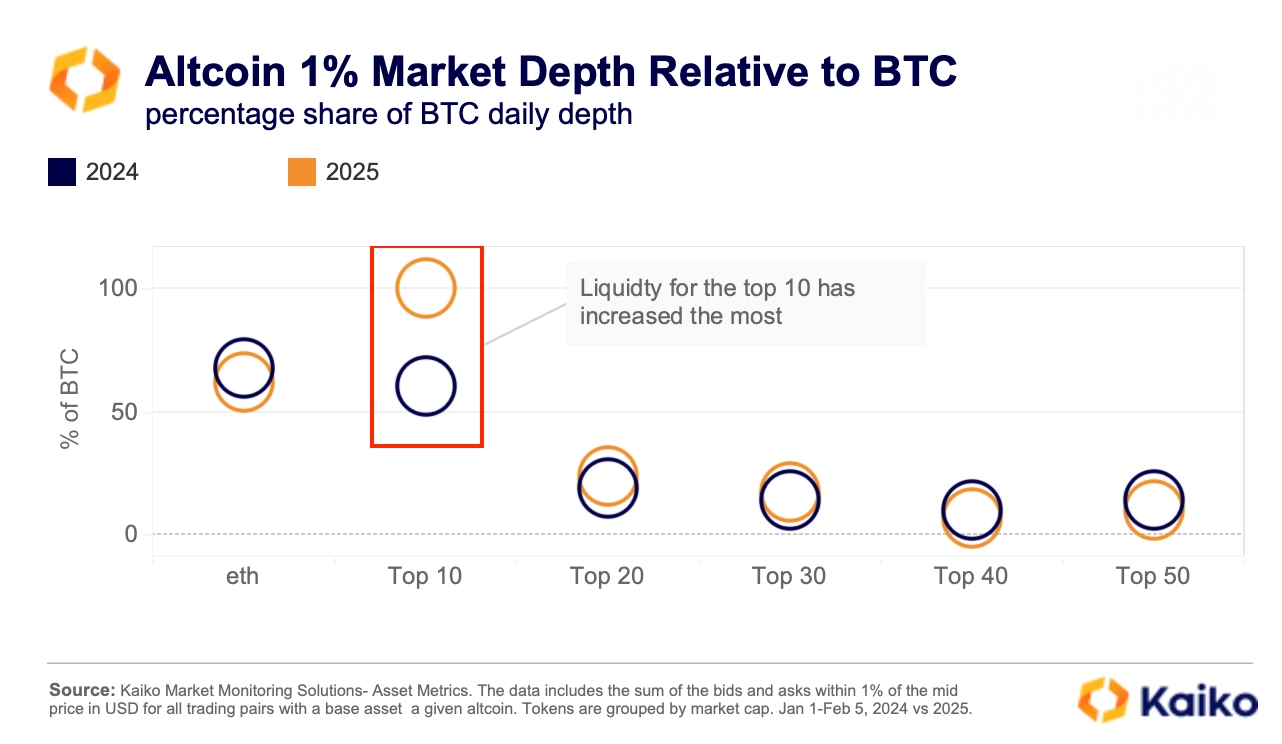

However, liquidity distribution is not evenly distributed and is still highly concentrated in the top 10 altcoins, which account for 64% of the total market depth. In contrast, the liquidity share of mid-cap tokens (ranked 20-30) has declined, while small-cap tokens (ranked 50) have shown unexpected growth, with their liquidity share even exceeding that of the higher-cap group (ranked 40).

However, market liquidity remains highly concentrated, with the top 10 altcoins accounting for 64% of the total market depth. In contrast, mid-cap tokens (ranked 20-30) have seen a decrease in market share, while small-cap tokens (ranked top 50) have unexpectedly grown, with their liquidity share even exceeding that of the larger group of tokens (ranked top 40).