Author: Monchi | Editor: Monchi

1. Bitcoin market and mining data

From February 17 to February 23, 2025, the overall price of Bitcoin fluctuated widely, and the market experienced multiple breakthroughs and corrections at key technical levels, with intense long-short game in the short term. The specific trends are as follows:

On February 17, the price of Bitcoin fluctuated and consolidated below $97,000, and then pulled back under pressure; on February 18, market volatility intensified, the price dropped to $93,487, and market sentiment tended to be pessimistic; on February 19, after hitting the low point, the price rebounded and stabilized above $96,000, and market confidence recovered; on February 20, the bulls continued to exert their strength, pushing the price to break through the key resistance level to $97,893; on February 21, market sentiment warmed up, the price of Bitcoin broke through $98,000, and reached a high of $99,454, entering a high-level fluctuation stage; on February 22, the Bybit exchange was hacked, and market panic intensified, and the price plummeted from $98,619 to $95,012, but then rebounded; on February 23, the market continued to fluctuate and consolidate, and the price remained between $96,400 and $96,400. Overall, Bitcoin prices fluctuated sharply this week, and changes in market sentiment and macro news still have an important impact on short-term trends.

Bitcoin price trend (2025/02/17-2025/02/23)

Market dynamics and macro background

Fund Flow

In terms of capital flows, the inflows of Bitcoin and Ethereum have dropped significantly in the past month, from $45 billion to $30 billion, a drop of more than 30%. At the same time, the trading activities of Bitcoin whales have also decreased significantly, with no significant buying or selling behavior and a decrease in trading frequency. Despite the fluctuations in the price of Bitcoin between $90,000 and $105,000, the continued net outflow of exchanges is still ongoing, and the 30-day moving average shows that the net outflow of funds is greater than the inflow, which is regarded as a bullish signal. Historical data shows that when the inflow/outflow ratio of exchanges enters the high demand zone, Bitcoin tends to rise in the short term. Analysts point out that some of the outflows may be due to the regular asset transfers from centralized exchanges to custodial wallets such as ETFs, institutional investors and over-the-counter trading platforms.

However, the bearish turn of the inter-exchange flow index shows that market risk appetite is declining and investor sentiment is becoming cautious. This divergence signal may suggest that Bitcoin price volatility will increase in the short term, and investors need to pay close attention to future market changes.

In addition, the trading frequency of Bitcoin whales has dropped significantly, and there is no obvious buying or selling behavior, indicating a wait-and-see sentiment in the market. At the same time, K 33 Research pointed out that Bitcoin is currently in a state of low volatility, the overall market performance is sluggish, and risk aversion is significant. Traders should remain cautious until a clear direction signal appears.

Technical Analysis

From a technical perspective, Bitcoin has been range-bound between $93,000 and $99,500 this week, facing key support and resistance levels in the short term. Bitcoin is currently range-bound between $93,000 and $99,500, facing key support ($95,000) and resistance ($97,000) levels in the short term. A break above resistance could lead to further gains to $120,000, while a break below support could lead to a deeper correction. The 50-day moving average is around $96,000, forming short-term resistance, while the 200-day moving average is at $105,000, acting as a key long-term resistance level. The RSI is currently at 68, close to the overbought zone, suggesting that there could be pullback pressure in the short term. The MACD indicator is showing a bearish divergence signal, further increasing the risk of a pullback. In addition, slowing fund flows and an MVRV ratio of 1.5 suggest that the market is relatively healthy, but there is also a risk of overbought levels, and there could be large fluctuations in the short term.

Market sentiment

In the market sentiment from February 17 to February 23, 2025, Bitcoin and the overall crypto market showed a certain degree of caution, mainly affected by fund flows and technical indicators. According to CryptoFearGreedIndex data, the current market sentiment is in the neutral range, with an index of about 53, reflecting that investor sentiment is not biased towards extreme greed or fear, which usually indicates that the market is in a shock consolidation stage. According to IntoTheBlock data, the bullish market sentiment of Bitcoin is about 55%, lower than 60%-65% in previous weeks. This means that the confidence of market participants has weakened, especially when the price fluctuates greatly, the sentiment of investors may turn cautious. At the same time, data from Glassnode shows that the inflow of funds into Bitcoin has decreased compared with last week, indicating that the market activity has decreased in the short term and the willingness of funds to enter has weakened. Overall, although the market sentiment is relatively stable, investors are more cautious about price breakthroughs in the short term, and volatility is high.

Macroeconomic Background

In late February 2025, the macroeconomic backdrop had a significant impact on the Bitcoin market. Fed Chairman Powell and other officials sent hawkish signals, clearly suggesting that high interest rates would be maintained, which directly suppressed the appetite for risky assets and exacerbated the volatility of the Bitcoin market. At the same time, China and Europe continued to grow at a weak pace, and the Peoples Bank of China did not loosen monetary policy, and global investors turned to low-risk strategies, further suppressing Bitcoins volatility. Although Bitcoin is known as digital gold, its safe-haven properties have weakened significantly this week, and price movements are more technically driven, reflecting market concerns about the long-term prospects of crypto assets. In addition, the Bybit exchange was hacked, triggering a crisis of confidence, and Bitcoin briefly fell below the key support level of $95,000, exposing the industrys security vulnerabilities and exacerbating short-term selling pressure, causing the market to enter a period of shock consolidation.

In terms of the crypto regulatory environment, in February 2025, many countries around the world accelerated the regulatory framework of the cryptocurrency industry, especially the digital asset regulation in the United States became the focus. The U.S. Securities and Exchange Commission (SEC) has recently stepped up its legal review of stablecoins and exchanges, and the EUs MiCA regulations are scheduled to be implemented in 2025, which is expected to have a profound impact on the markets regulatory environment. As the regulatory framework gradually becomes clear, market sentiment has shown a cautious attitude.

In terms of traditional markets, according to data from IntoTheBlock, on February 17, Bitcoins correlation with the SP 500 fell to zero, indicating that there is currently no correlation between the two, a phenomenon similar to when Bitcoin broke through $100,000 on November 5, 2024.

Hash rate changes:

Between February 17 and February 23, 2025, the Bitcoin network hash rate experienced significant fluctuations. On February 17, the hash rate fluctuated between 730 EH/s and 830 EH/s. On February 18, the hash rate first rose to 804.19 EH/s, then fell back to 739.60 EH/s, and quickly rebounded to 798.36 EH/s without significant fluctuations. On February 19, the hash rate rose to 847.11 EH/s, then slightly pulled back to 812.60 EH/s, and fell sharply that evening, reaching a low of 696.93 EH/s, and then remained near that level. On February 20, the hash rate continued the trend of the previous day and continued to remain near 700 EH/s. On February 21, the hash rate rebounded, first rising to 830.83 EH/s, then falling back to 828.61 EH/s, and finally falling further to 708.55 EH/s. On February 22, the hash rate rose again to 826.82 EH/s, and then fell back to 716.11 EH/s.

Hash rate fluctuations during this period reflect the strong volatility of the Bitcoin network, which may be affected by changes in miner participation, equipment adjustments or other market factors.

Bitcoin network hash rate data

Mining income:

According to the JPMorgan report, US-listed Bitcoin miners accounted for 29% of the global Bitcoin network computing power in February 2025, almost double the same period last year. Although the Bitcoin network computing power rose by 6% this month, miners daily average profit fell by 13% due to the decline in Bitcoin prices. The report also pointed out that the combined computing power of the 14 tracked Bitcoin mining companies increased by about 95% year-on-year to 244 EH/s, while the global network computing power increased by 45% year-on-year. However, due to the slight decline in Bitcoin prices, the economics of mining came under pressure, and the average daily profit of miners decreased to about $53,600, a decrease of 6% from January. It is worth noting that some mining companies such as IREN performed strongly, with its stock price rising by 27% in the first two weeks of February, while Greenidge Generation fell by 20%.

It is important to note that the cost of mining one Bitcoin varies depending on a variety of factors, including electricity costs, mining machine efficiency, mining difficulty, and regional differences. As of February 23, 2025, the total cost of mining each Bitcoin is approximately $96,414.03. Given the volatility of Bitcoin prices, miners profitability may be affected.

Overall, although Bitcoin mining revenue remains stable, miners profitability is under the dual pressure of falling Bitcoin prices and rising mining difficulty. Mining companies need to pay attention to market dynamics and optimize their operating strategies to cope with industry challenges.

Energy costs and mining efficiency:

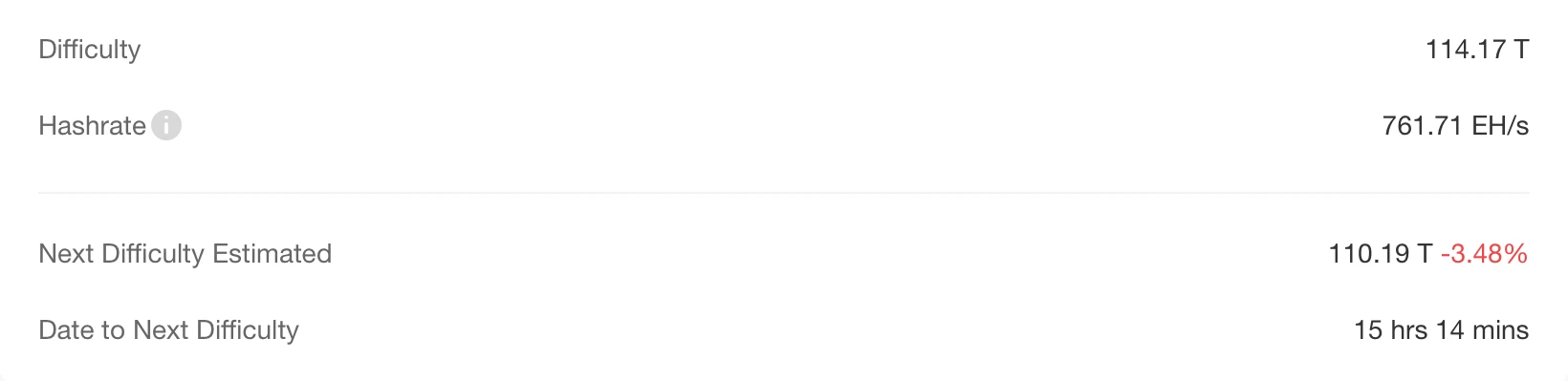

According to CloverPool data, as of February 23, 2025, the total network computing power is about 761.71 EH/s, and the total network mining difficulty is 114.17 T. It is expected that the next Bitcoin mining difficulty will be reduced by 3.48% in 15 hours to 110.19 T.

According to the VanEck report, Bitcoin mining companies are accelerating their transformation to artificial intelligence (AI) and high-performance computing (HPC) businesses due to unstable transaction fee income. The report pointed out that although network congestion may lead to short-term fee increases, there is uncertainty about long-term on-chain revenue growth. It is expected that Bitcoin mining companies will allocate 20-30% of their power capacity to AI and HPC businesses in the future to diversify their revenue sources.

To support this transformation, miners are expanding power capacity to accommodate AI and HPC workloads and leveraging existing power infrastructure to improve profits. Bitcoin mining power expansion is expected to reach 20.4 GW by 2027, and the power demand of artificial intelligence will further affect the allocation of power resources.

Bitcoin mining difficulty data

2. Policy and regulatory news

Montana Strategic Bitcoin Reserve Legislation Passes Committee and Heads to a House Vote

On February 20, according to market news, the strategic Bitcoin reserve legislation in Montana, USA has passed the committee review and is about to enter the House of Representatives voting stage.

As previously reported, on February 9, Montana House Bill No. 429 will authorize the state treasurer to invest up to $50 million from the general fund in digital assets with a market value of more than $750 billion, namely Bitcoin, by July 15, 2025. These investments must be held by a qualified custodian or made through a trading platform trading fund.

Trump: The Biden administration’s war on Bitcoin and cryptocurrency has ended

On February 20, US President Trump said that I have signed an executive order to make the United States a leader in artificial intelligence and end the Biden administration’s war on Bitcoin and cryptocurrency, marking the advent of a new era of digital assets.

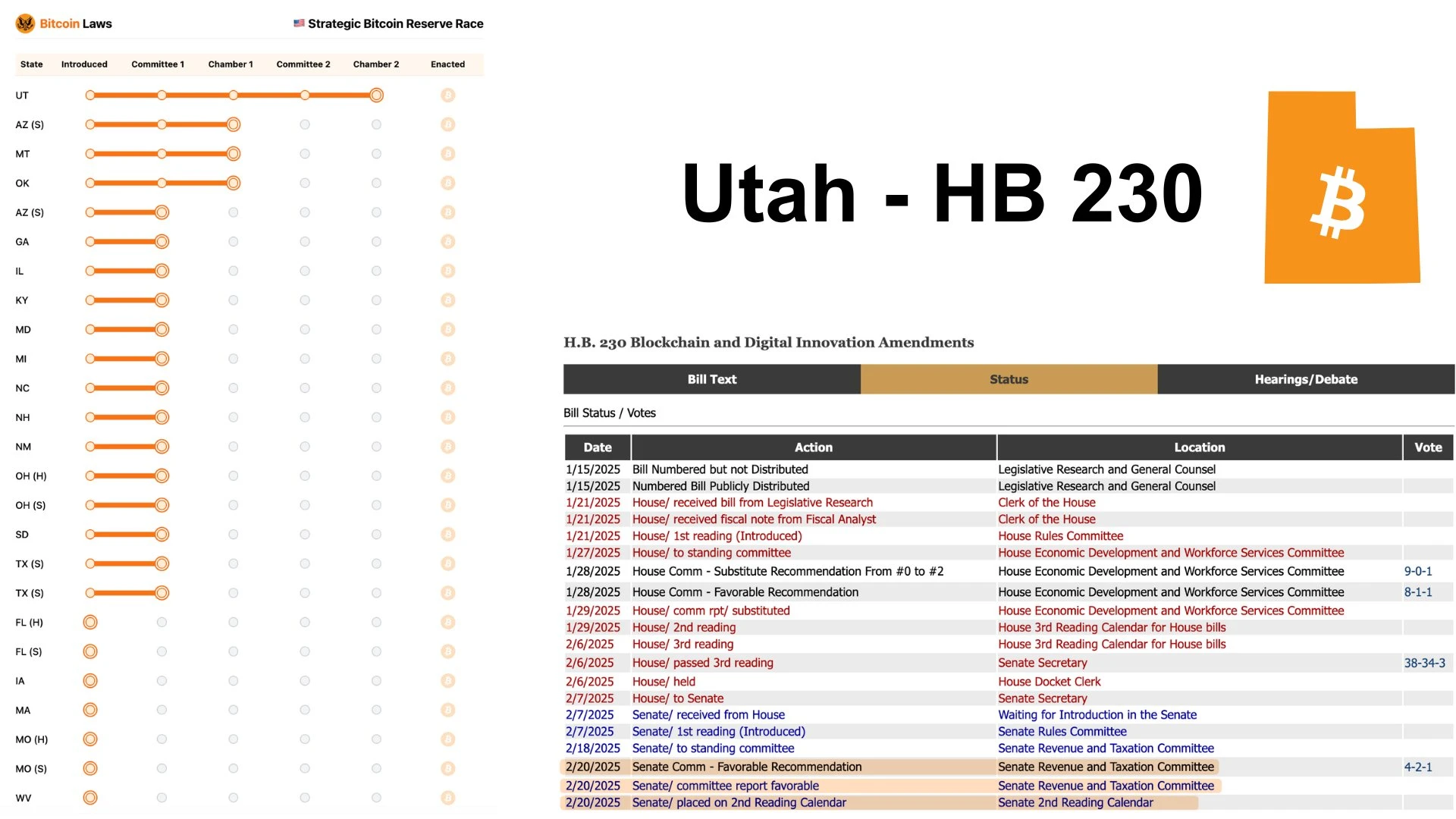

Utah Bitcoin Reserve Bill Passes Senate Tax Committee

On February 21, according to Cointelegraph, Utahs HB 230 Blockchain and Digital Innovation Amendment was passed by the state Senate Taxation Committee with a 4-2-1 vote on February 20. The bill will enter the Senates second and third reading procedures.

According to the bill, to become a reserve asset, the average market value of a digital asset must reach $500 billion or more in the previous calendar year. Currently, only Bitcoin meets this requirement. The bill also authorizes the state treasurer to participate in the cryptocurrency pledge business, and the state treasury can invest no more than 5% of digital assets in five state-level accounts, including the general budget fund, the income tax fund budget, and the state disaster recovery account.

Earlier news, the Utah Bitcoin Reserve Act was passed by the House of Representatives and entered the Senate Taxation Committee for deliberation.

Related images

Russia’s Supreme Court Pushes to Classify Cryptocurrency as Property in Criminal Cases

On February 22, News.bitcoin quoted TASS as saying that the Russian Supreme Court is promoting the classification of cryptocurrencies as property in criminal cases, aiming to strengthen the ability of law enforcement to track, freeze and confiscate illegal digital assets. The Supreme Court is participating in the drafting of a legislative initiative aimed at treating digital currencies as property in criminal proceedings, a move that could strengthen the ability of law enforcement to deal with crypto-related crimes.

This is not the first time that Russia’s Supreme Court has addressed cryptocurrency in legal proceedings. In 2019, the court ruled that exchanging Bitcoin for rubles constitutes money laundering if the digital currency was obtained through illegal activities, especially in cases involving drug trafficking. The court’s ruling further indicated that cryptocurrencies may fall under the jurisdiction of existing anti-money laundering laws. Additionally, in 2021, the court ruled that WMZ, the electronic currency used in the Webmoney Transfer system, was legally recognized as an object of civil rights, setting a precedent for Russia’s legal treatment of digital assets. These early rulings indicate that the Supreme Court is working to incorporate cryptocurrencies into the country’s judicial framework.

3. Mining News

Report: Bitcoin mining creates 31,000 jobs in the United States and contributes more than $4 billion in economic output

On February 17, according to the latest research report from Perryman Group, the Bitcoin mining industry has directly created more than 31,000 jobs in the United States and indirectly promoted employment growth through related industries. The industry contributes more than $4.1 billion to the U.S. economy each year and accounts for about 40% of the global Bitcoin hash rate.

The report pointed out that Bitcoin mining activities in the United States are mainly concentrated in 12 states, of which Texas benefits the most, with an annual economic activity of $1.7 billion and more than 12,200 jobs. The mining industries in Georgia and New York bring economic contributions of $316.8 million and $225.9 million respectively. In addition, Bitcoin mining also plays a role in stabilizing the load of the power grid and supporting local energy infrastructure. The study was commissioned by the Texas Blockchain Committee and the Digital Chamber of Commerce.

SECs lawsuit against Bitcoin miner Geosyn is temporarily on hold as the US federal government files fraud charges

On February 17, the U.S. Securities and Exchange Commission (SEC) has suspended the fraud lawsuit against the crypto mining company Geosyn Mining and its executives after U.S. federal prosecutors filed similar charges against the companys CEO and two former executives. In a document filed with the Texas federal court on February 14, the agency agreed to suspend the execution of the case it filed in April 2024 after Geosyn CEO Caleb Joseph Ward and the companys former operations director Jeremy George McNutt surrendered to the authorities and appeared in court the day before.

Trump has promised to ease regulatory enforcement on the crypto industry, and the SEC set up a crypto task force last month to engage with the industry and suspended some crypto-related lawsuits. However, the SEC said in a filing on the same day that neither the SECs crypto task force nor the current administrations position on the crypto industry should have any impact on this case because the case is not related to crypto regulation and does not accuse the two of selling cryptocurrencies.

Earlier in April 2024, the US SEC sued Bitcoin miner Geosyn, accusing its founder of defrauding $5.6 million.

4. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

Michael Saylor: Strategy founder Michael Saylor revealed that he does not hold any other cryptocurrencies besides Bitcoin, and his personal Bitcoin holdings exceed 17,732. He also said that he has increased his holdings in the past few years but did not disclose the specific amount.

Hong Kong HK Asia Holdings: After the company purchased 1 bitcoin, its stock price rose 93% in a single day, approaching its historical high.

Bitcoin ETF institutional holdings: As of the end of 2024, institutional investors held 25.4% of the total assets of spot Bitcoin ETFs, reaching US$26.8 billion, and BlackRock IBIT holdings increased significantly.

Government of El Salvador: Since December 2024, the country has accelerated its Bitcoin purchases, increasing its holdings by an average of about 1.6 BTC per day. Its current holdings total 6,081 coins, with a total market value of approximately US$579.9 million.

Semler Scientific: Q4 net profit surged to $29.2 million, or $3.64 per share, due to a $28.85 million increase in the revaluation of Bitcoin assets.

Bank of New York Mellon: Disclosed that it holds more than $13 million in Bitcoin ETFs, including the WisdomTree Bitcoin Fund (BTCW) and BlackRock iShares Bitcoin Trust (IBIT).

Japans Metaplanet: The company holds 0.01% of the total Bitcoin supply.

South Africas Altvest Capital: Plans to raise $10 million to purchase Bitcoin, becoming the first listed company in Africa to use Bitcoin as a treasury reserve.

Australia Monochrome ETF: As of February 20, it held 319 BTC with a total market value of approximately US$48.704 million.

Nano Labs: Announced that it increased its holdings of Bitcoin to 400, with a total value of approximately US$40 million, and raised US$5.9 million in financing through private equity transactions.

MultiCorp International: Plans to invest $25 million in Bitcoin as part of its asset allocation using a leveraged buyout structure.

Bitwise Chief Investment Officer: This year will be a watershed year for Bitcoin adoption

On February 17, Bitwise Chief Investment Officer Matt Hougan published an article on X saying that this year we will see more funds flow into ETFs. In addition, companies, countries, wealth management companies and traditional financial institutions will also increase their holdings of Bitcoin.

On the other hand, regulators create productive transparency; the world (geopolitics, monetary policy, etc.) is increasingly in an environment that drives demand for Bitcoin. “This will be a watershed year.”

Related images

The number of Americans holding Bitcoin has surpassed the number of Americans with student loans

On February 17, according to Cointelegraph data, the number of Bitcoin holders in the United States (about 50 million) has exceeded the number of Americans with student loans (about 43 million).

Bernstein: The United States may promote the national reserve of Bitcoin, and institutional funds will accelerate the bull market

On February 18, according to CoinDesk and Decrypt, investment bank Bernstein pointed out in its latest research report that the US cryptocurrency working group is promoting the establishment of a national Bitcoin reserve, a move that may trigger a global competition among sovereign countries to include Bitcoin in their reserve assets. The report explores key issues in the establishment of reserves, including the determination of the purchasing entity, the source of funds (or through the issuance of bonds or the sale of gold), and the possibility of including approximately $20 billion in Bitcoin seized by the government in the reserve.

Meanwhile, Bernstein analysts said the Bitcoin bull run will continue as institutional money continues to flow in. Banks, institutional investors, companies and sovereign states (directly or through sovereign funds) are working together to push Bitcoin to become a challenger to gold. The Abu Dhabi Sovereign Wealth Fund has purchased Bitcoin through ETFs, and top institutions such as Jane Street Group, Citadel Advisors, and Morgan Stanley have also invested hundreds of millions of dollars in Bitcoin ETFs. Bernstein advises investors to prepare for a new round of gains in Bitcoin and related stocks, and maintains its forecast of a Bitcoin target price of $200,000 by the end of 2025.

Strategy announces $2 billion convertible senior notes offering to support purchase of more Bitcoin

On February 19, Strategy (MSTR.O) announced that it plans to privately issue its 0% convertible senior notes due in 2030 to qualified institutional buyers, with a total principal amount of US$2 billion. Strategy also expects to grant purchase rights to the initial purchasers of the notes, which will be settled within five business days (including the day) from the date of the initial issuance of the notes, with a total principal amount of up to US$300 million. Strategy intends to use the net proceeds from this offering for general corporate purposes, including the acquisition of Bitcoin and as working capital.

Google is exploring using Google Sign-In to log into Bitcoin wallets

On February 19, Kyle Song, Web3 expert at Google Cloud Asia Pacific, revealed in his speech at the Hong Kong Bitcoin Technology Carnival that Google is committed to making Bitcoin wallets as user-friendly as Web2 applications. Googles vision is to enable users to log in to Bitcoin wallets using their existing Google accounts. The purpose of this goal is to make Bitcoin closer to mainstream users.

Song said the launch of a spot Bitcoin ETF in 2024 opens up a more convenient path for large Web2 companies such as Google to enter the Bitcoin industry. The tech giant has been working with companies and developers in the Bitcoin space since last year. We are exploring ways to lower the barrier to entry so that Web2 users can easily use Bitcoin, Song said. Speaking about bridging the technological gap between traditional finance and blockchain-based finance, Song noted that Google is focusing on improving security. We are also working on solutions to address the trust issues between on-chain systems and off-chain systems, Song said. Google is particularly considering how to use advanced cryptographic techniques such as zero-knowledge proofs (ZKP) to improve reliability.

Related images

Institutional Bitcoin spot ETF holdings in Q4 2024 increased by more than 200% compared to Q3

On February 20, according to data from 13 F documents submitted by institutions to the U.S. Securities and Exchange Commission (SEC), large institutions such as pension funds or hedge funds tripled the size of spot Bitcoin ETFs held in the fourth quarter of 2024.

As of Q4 2024, institutional investors hold $38.7 billion worth of spot Bitcoin ETFs. This figure is more than three times that of Q3, when the reported holdings were only $12.4 billion.

Among them, the Wisconsin Investment Commission increased its holdings of BlackRock iShares Bitcoin Trust (IBIT) to just over 6 million shares. Billionaire hedge fund investor Paul Tudor also nearly doubled his holdings in IBIT from 4,428,230 shares to 8,048,552 shares.

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said IBIT currently has 1,100 institutional holders who report their holdings through 13 F filings. Most newly launched ETFs typically have fewer than 10 institutional holders.

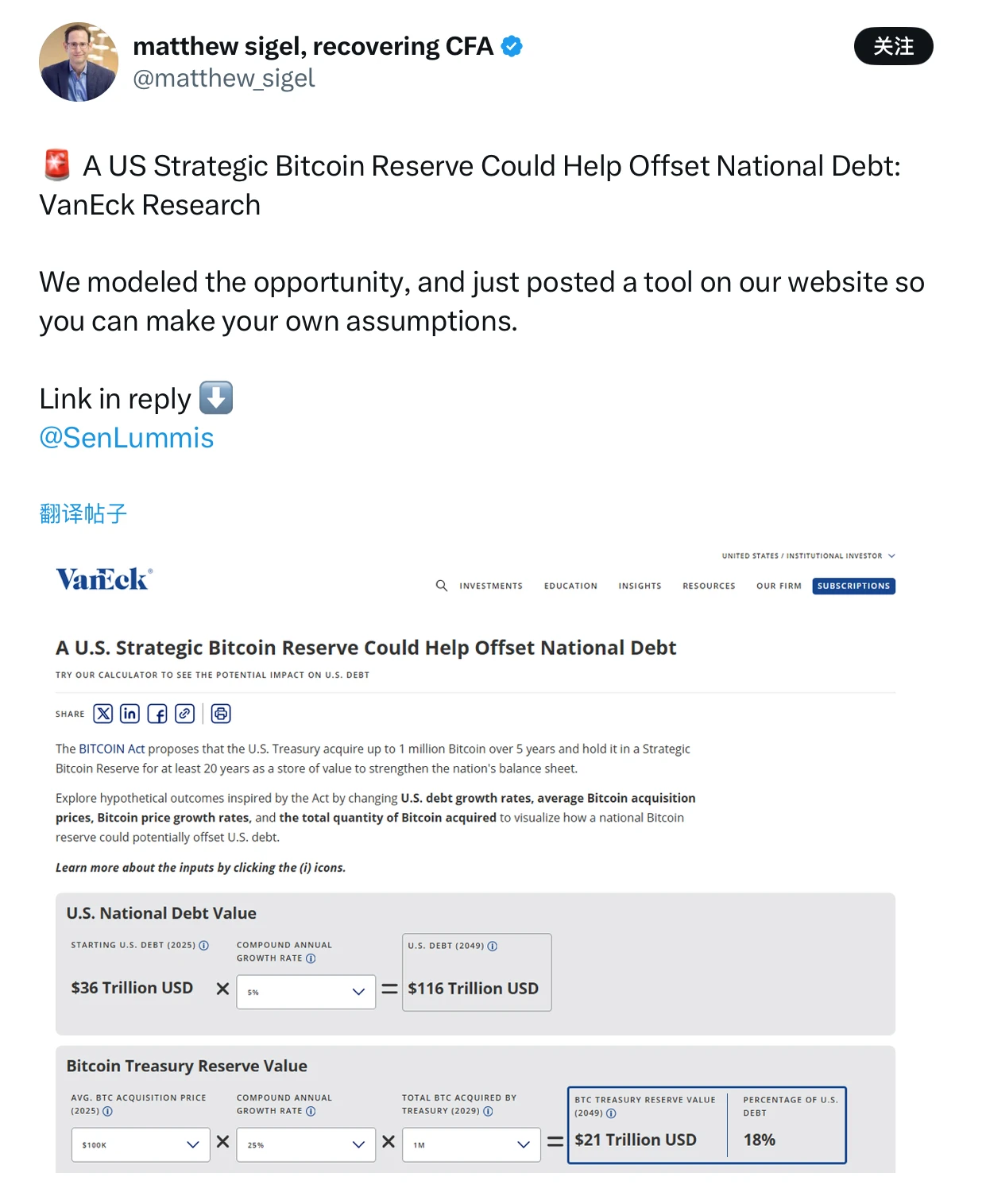

VanEck: US strategic Bitcoin reserves may offset $21 trillion in national debt, modeling tool released

On February 21, VanEcks latest research showed that by 2029, if the United States establishes a strategic Bitcoin reserve and holds BTC worth $1 million, the total value may offset approximately $21 trillion in national debt.

Matthew Sigel, head of digital asset research at VanEck Research, posted on the X platform that the agency has modeled the impact of the US strategic Bitcoin reserves on the national debt and published relevant tools on the website. In response, Cynthia Lummis, chair of the US Senate Banking Digital Assets Subcommittee, said that the tool is very interesting and worth promoting, and believes that Bitcoin can be used as a potential solution to reduce the national debt problem.

Related images

Bybit suffered a $1.5 billion hack, the market was hit but Bitcoin reserves remained stable

On the evening of February 21, the cryptocurrency trading platform Bybit was hacked, and about 400,000 Ethereum (ETH) and stETH were transferred to unknown addresses, with a total loss of more than $1.5 billion, becoming the largest cryptocurrency theft to date. Bybit CEO Ben Zhou said that the hacker forged the user interface to induce the signer of the multi-signature cold wallet to authorize malicious transactions, thereby gaining control of the wallet.

Despite the heavy losses, Bybit has ensured the safety of user assets and the platform operation has not been affected. According to CryptoQuant data, after the incident, Bybits Bitcoin reserves decreased by about 2,000, but it still holds about 68,000 BTC, and the reserves are stable without abnormal fluctuations. In the market, this incident has attracted widespread attention, and the price of Bitcoin has fallen below $95,000 for a short time, and market sentiment has been impacted. At present, Bybit is working with blockchain security experts to conduct an in-depth investigation of the attack, and has received support from peer companies such as Bitget and Binance.

As of February 23, deposits and withdrawals on Bybit have fully returned to normal levels, as confirmed by on-chain data.