Original article by: Nicolai Søndergaard

Original translation: TechFlow

Key Takeaways

On-chain data shows that 86% of traders lost $251 million on $LIBRA, while the remaining profit earners made a total of $180 million;

Dave Portnoy lost millions on $LIBRA but later received a $5 million refund;

70% of wallets that traded $LIBRA between February 16th and 18th ended up with actual losses, many likely trying to profit from Javier Milei’s additional retweets;

Two wallets bought $LIBRA at 22:01 UTC on February 14 and sold it at 22:44 UTC, making a total profit of $5.4 million, of which wallet HyzGo 2 alone took $5.1 million;

introduction

On February 14, 2025, Argentine President Javier Milei publicly endorsed $LIBRA. The token was initially promoted on X as a tool to support small businesses and entrepreneurial projects in Argentina . Key project participants included Hayden Davis (self-proclaimed coordinator), Julian Peh (a member of Kip Protocol, referred to as the team by Hayden Davis), Mauricio Novelli, and Manuel Godoy (Tech Forum Argentina). In a short period of time, $LIBRAs valuation quickly soared to $4.5 billion.

$LIBRA was minted at 21:38 UTC on February 14. At 22:01 UTC, Milei posted a tweet, which attracted great attention from the market and attracted snipers to quickly intervene. By 22:44 UTC, the token price soared to a peak of $4.55, but then quickly plummeted.

$LIBRA’s collapse began when token liquidity was drained. Hayden Davis later dismissed it as “a meme,” in stark contrast to its initial positioning as a tool to support Argentina’s economy. Meanwhile, Milei deleted his support tweet, and the token price had fallen 80% from its peak. He later claimed that he did not understand the specifics of the project .

More controversially, Hayden Davis stated in an interview with Coffeezilla that Milei did not hold any financial interest in $LIBRA. However, as the token collapsed and Mileis support was withdrawn, investors began to question whether this was just a speculative insider operation.

On-chain data clearly shows that some insiders have unilaterally profited from ordinary investors through token trading.

Transaction Overview

Many traders have suffered heavy losses on the recently launched $LIBRA token. On February 14, the number of unique holders of $LIBRA was 50.7K, but as of writing (February 18), this number has dropped to 35.77K. So, which wallets are making profits on trading? Are they all snipers and insiders, or just very fast and skilled traders?

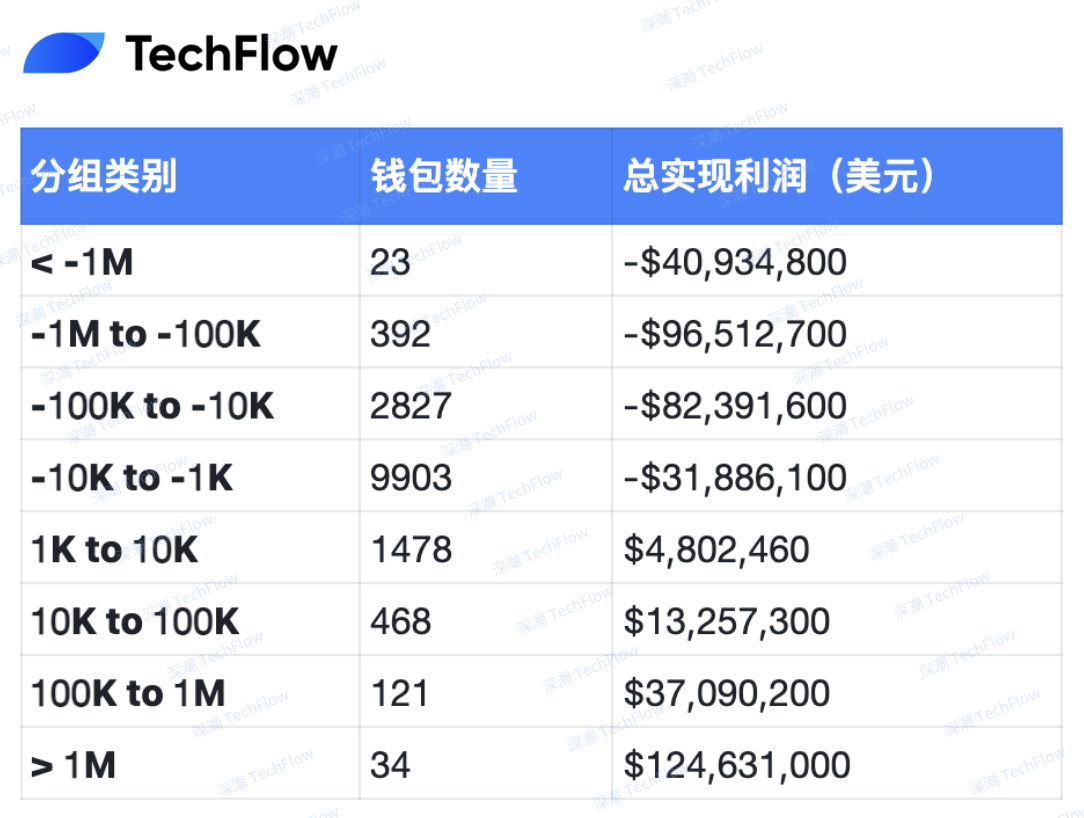

Among all wallets with absolute gains or losses exceeding $1,000, there are 15,431 addresses. Among them, 86.07% of the addresses have realized a total loss of $251 million, which fully reflects the severity of the losses in $LIBRA trading. On the other hand, there are only 2,101 profitable wallets, with a total of about $180 million in gains.

Among them, 57 wallets quickly entered the market for trading, and 37 realized profits of more than $1,000. This suggests that some early entrants may be simple automated robots rather than large players deploying huge amounts of money. Among these wallets, two wallets bought around 22:01 UTC on February 14 and completed the sale at 22:44 UTC, making a total profit of $5.4 million. Among them, wallet HyzGo 2 alone accounted for $5.1 million.

Original image from Nicolai Søndergaard , compiled by TechFlow

Note: Nansen’s profit and loss (PL) data is based on the trading records of tokens on decentralized exchanges (DEXs) and the estimated results of the inflow and outflow periods of related wallet funds, so there may be some errors.

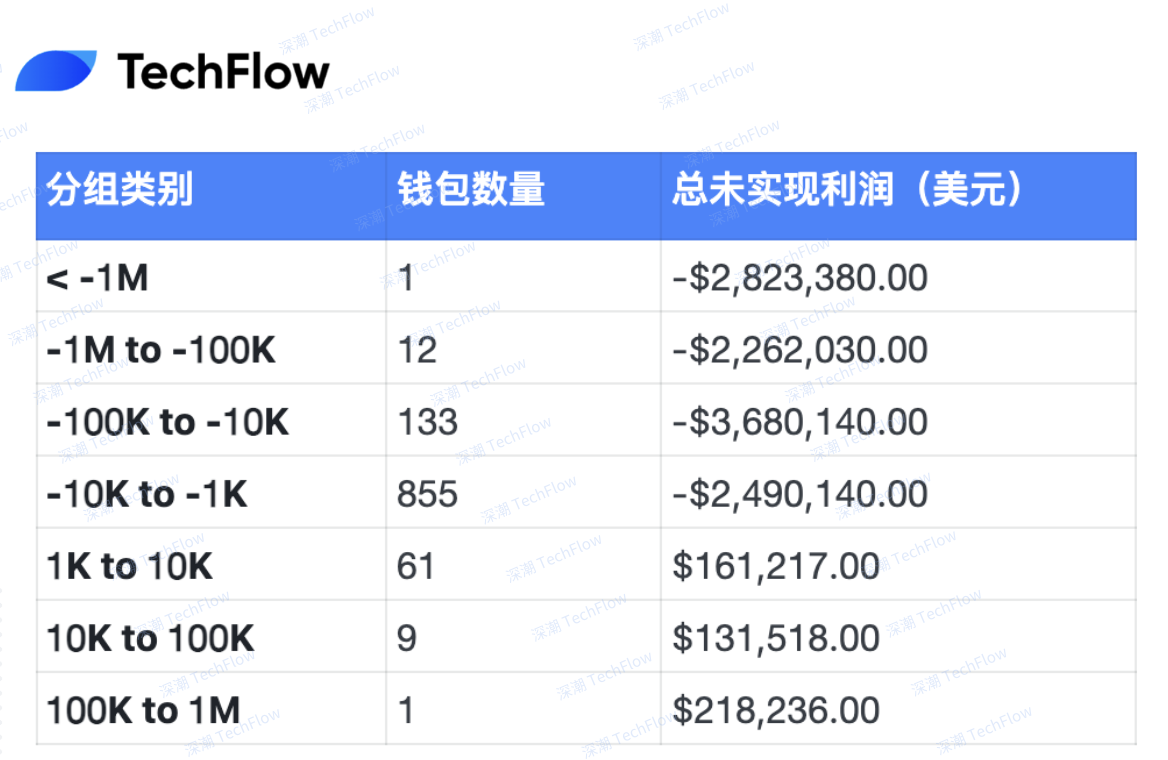

There are still some wallets holding unrealized gains or losses. As of 8:00 AM UTC on February 18, 2025, there are 1,001 wallets still holding the token, with a total unrealized loss of approximately $11 million. In addition, there are 71 wallets that are still profitable, but their total gains have shrunk significantly, leaving only about $540,000.

Original image from Nicolai Søndergaard , compiled by TechFlow

Who’s Still Trading $LIBRA?

Despite the peak and crash in $LIBRA’s price on February 14 and 15, surprisingly, some wallets continue to trade the token. As of February 16, a total of 1,990 wallets traded or held $LIBRA. So why is this data worth paying attention to?

On February 17, Argentine President Javier Milei retweeted a tweet mentioning that it was not easy for retail investors to buy $LIBRA. This tweet briefly pushed the token price up, but it is still far below its previous highs. From the low point on February 17, the price of $LIBRA once rose by more than 125% due to Mileis tweet. However, within the next 24 hours, the price fell back to the level before the rise.

Source: $LIBRA price surge on February 17th

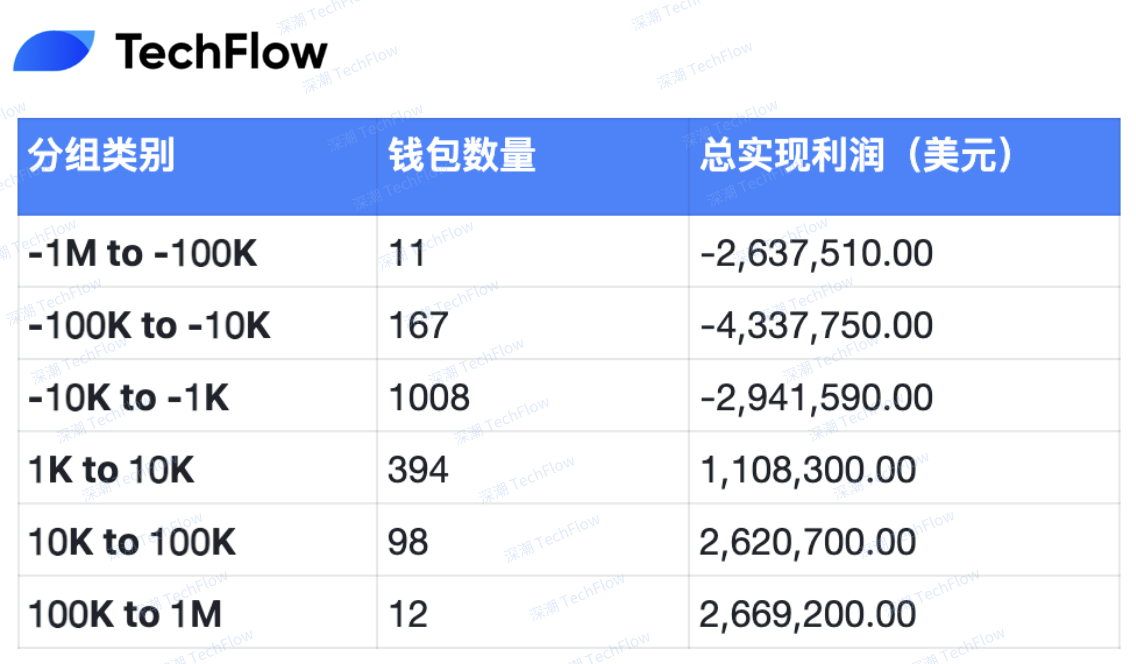

However, regardless of when investors entered the market, most wallets ultimately failed to avoid losses. From February 16 to February 18 at 11:00 AM UTC, 70% of wallets ended up with actual losses. This may reflect the high volatility of the market and the disadvantages of retail investors in operation.

Original image from Nicolai Søndergaard , compiled by TechFlow

However, the situation is quite different in the unrealized part: unrealized losses are $4.57 million higher than unrealized gains, which highlights the obvious asymmetry between unrealized losses and gains. This also means that there may be more potential losses that have not yet been recognized, further exacerbating the overall loss trend.

Original image from Nicolai Søndergaard , compiled by TechFlow

On-chain analysis

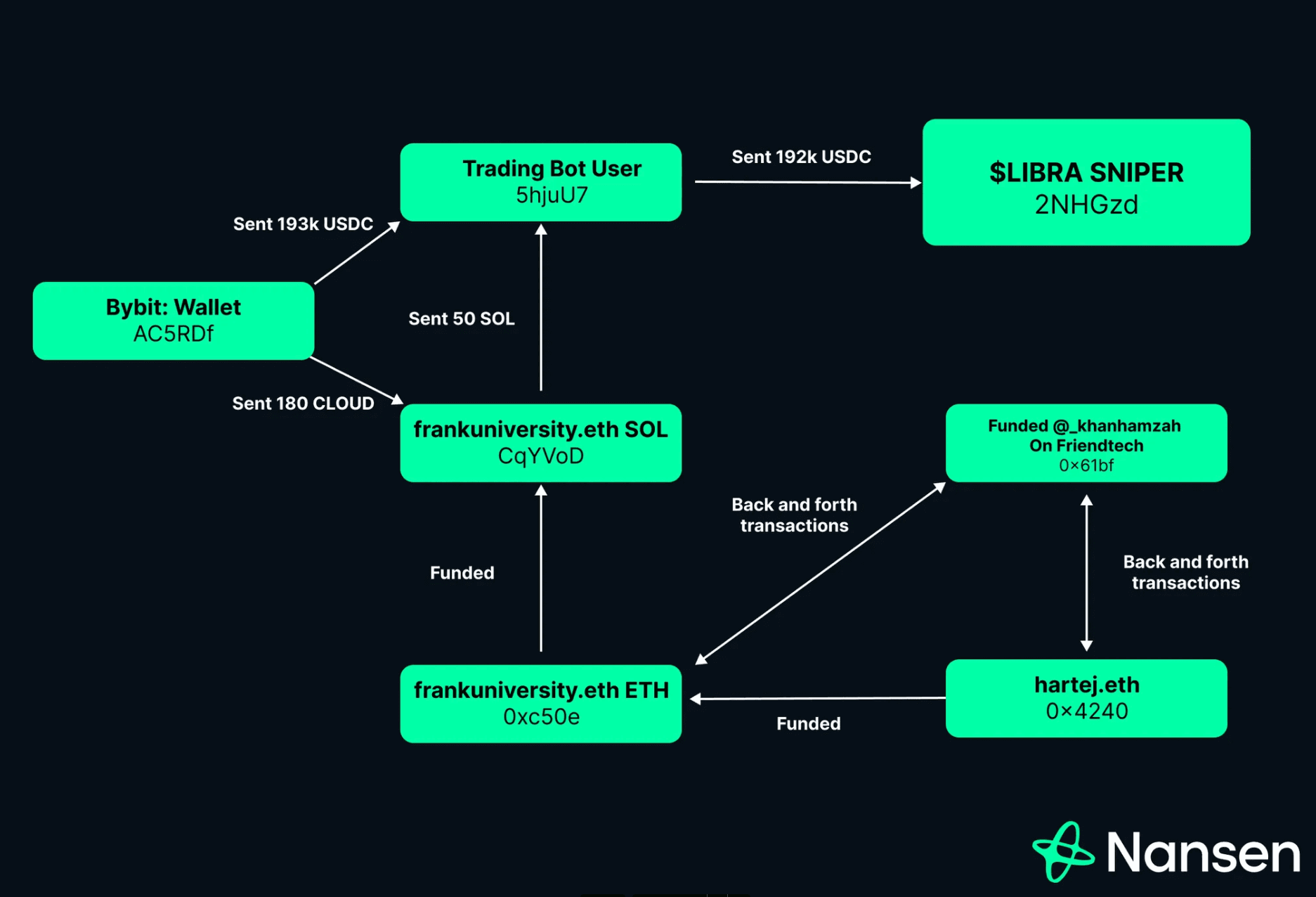

One of the most successful “snipers” in $LIBRA trading realized a profit of $6.5 million. This investor’s wallet was funded by a Bybit wallet and another external wallet. The user of this external wallet is a trading bot user (such as using GMGN or BULLX bots) and is associated with some well-known wallets such as Frankuniversity.eth , extending to hartej.eth , and a wallet that funds _khanhamzah on the Friendtech platform.

Although the existing data is not sufficient to confirm whether these wallets belong to the same person, on-chain data suggests that there is a certain connection between them. For example, 5hjuU 7 and Frankuniversity.eth both interacted with the same Bybit hot wallet within a few days.

Source: 2 NHGzd Sniper Relations

However, not all snipers were able to make a profit. An investor named XRfKhaCA lost $407,000. He bought at a cost of $6.5 million, but eventually sold for only $6.1 million. It is worth noting that XRfKhaCA is associated with another wallet called dysphoria.sol. dysphoria.sol made about $341,000 on $LIBRA, and coincidentally made $11.6 million and $655,000 in transactions on $TRUMP and $MELANIA, respectively. This may indicate that the wallet holds inside information or has close ties with insiders. In addition, dysphoria.sol also received funds from blader.eth on Ethereum on January 4, allegedly as part of compensation for wallets that lost money in the $ZERO project.

On February 18, dysphoria.sol also traded $GREED, one of the new tokens launched by Dave Portnoy, although the profit was relatively small, only about $7,000, as the token price plummeted by more than 90% in a short period of time.

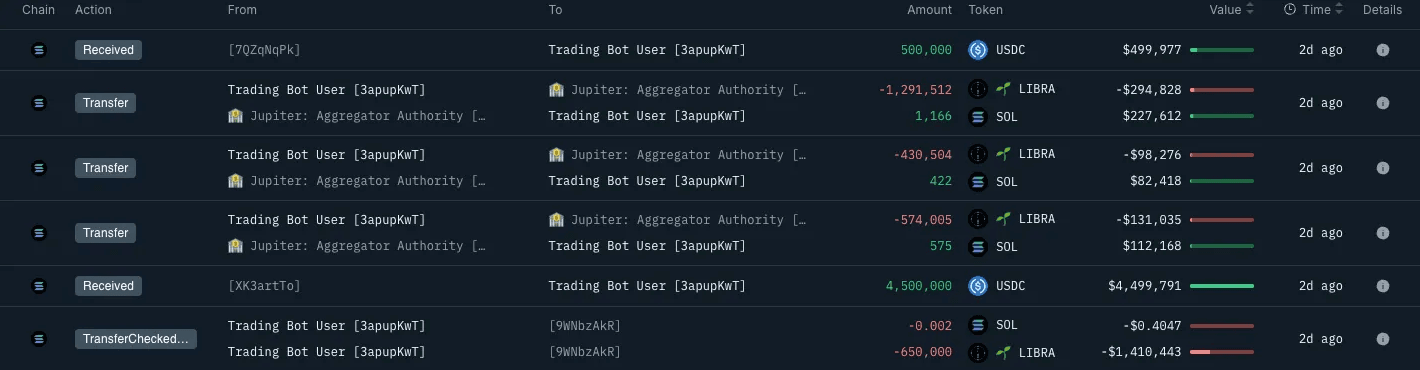

The largest single wallet winner realized a profit of approximately $25 million, but is this actually the case? An investor named 8bZsrR exchanged 1.7 million USDC for 12.3 million $LIBRA on 14 February 2025 at 22:01:00 +UTC, and subsequently transferred these tokens to seven other wallets. According to our model, the tokens transferred out of the wallet are considered selling points, which constitutes a profit estimate of $25 million. However, this is not a complete picture. Further analysis is needed to analyze the trading behavior of these tokens after they were transferred to the seven wallets. These wallets sold off their holdings at different time periods, and some of them appear to have sold at a loss compared to the price at which the tokens were fully exited when transferred.

Across all transactions, the “worst” 15 addresses have seen losses totaling $33.7 million, with one wallet still holding 57% of its initial balance. The largest single actual loss came from Dave Portnoy’s wallet, which was worth $6.3 million.

According to an interview with Coffeezilla on its alternate channel Voidzilla, some key figures in the project seem to have known about the existence of $LIBRA. So, can this be verified by on-chain data?

Take Dave Portnoy, for example, who publicly admitted that he knew about $LIBRA before the token was launched, but chose not to take immediate action, and instead invested just 10 minutes after the Token Generation Event (TGE), resulting in a loss of millions of dollars. However, according to the on-chain USDC inflow records, he was later refunded $5 million. This refund has been confirmed off-chain by Hayden Davis and Dave Portnoy himself, adding more complexity to the dispute.

Source: Dave Portnoy’s USDC refund history after $LIBRA loss

David Hayes and Kelsier have publicly admitted that they were involved in sniping tokens that they helped launch, including $LIBRA and $MELANIA. This behavior lends credence to the allegations that insiders bought $TRUMP tokens in advance. The information was allegedly shared at a crypto party in Washington, D.C. However, this claim has not been confirmed and is only speculation, as David Hayes said he heard it from others and has no direct evidence. Nonetheless, as BubbleMaps reveals, insiders may also be active in transactions on multiple other tokens, with activity from some associated addresses visible from on-chain data.

Reputational damage

When a scandal breaks, companies often face an immediate reputational crisis. Meteora is a prime example. With Ben Chow’s resignation, public scrutiny of the company has intensified, and social media has magnified these issues.

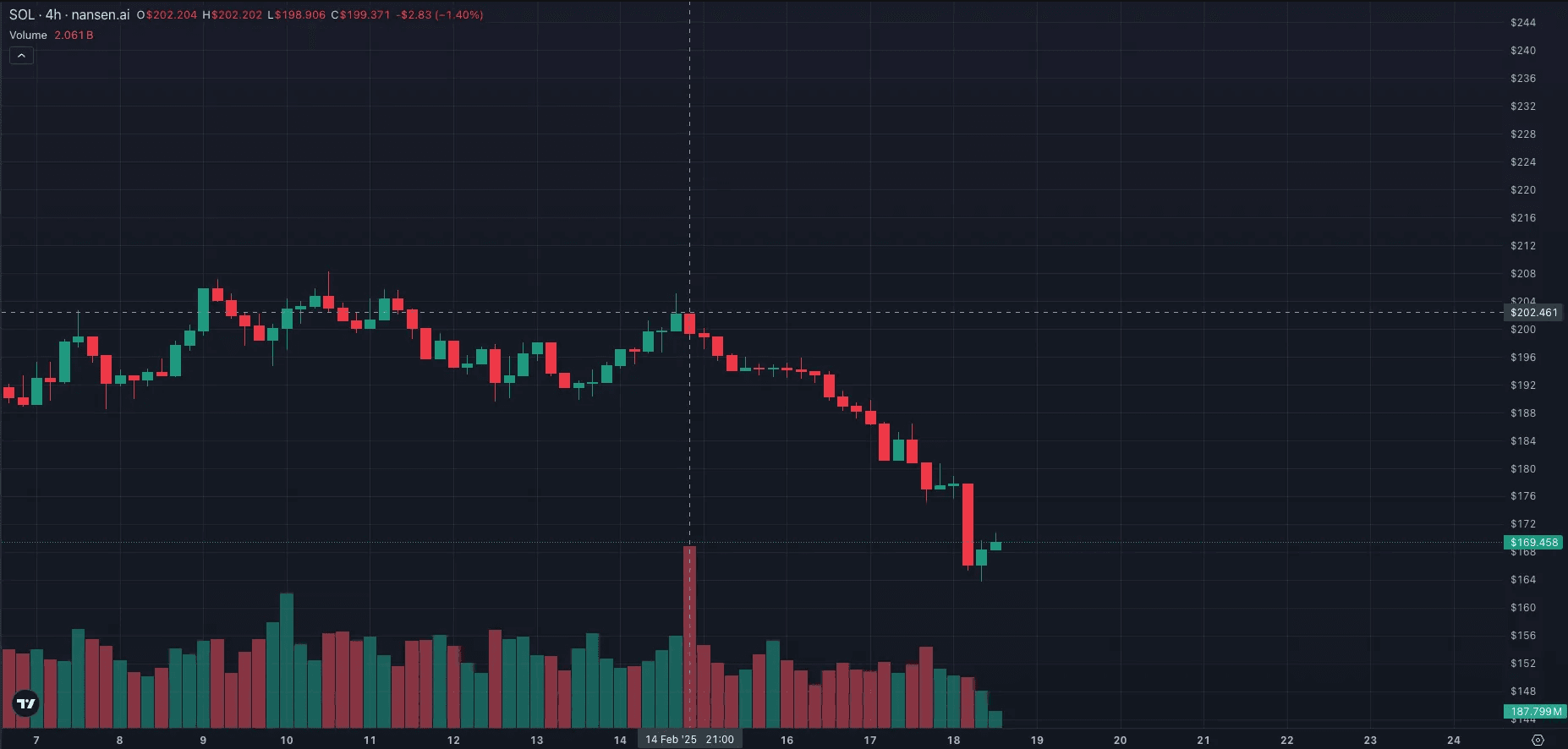

Meanwhile, when the $LIBRA incident occurred, the price of Solana (SOL) began to fall on February 14, and has fallen by about 16% so far. Although Solana only serves as the underlying infrastructure and does not directly participate in token transactions, its ecosystem has still been affected. According to DefiLlama data, Solanas liquidity has dropped sharply from $12.1 billion to $8.29 billion. This phenomenon may be related to investors uncertainty about the future issuance and trading of Meme, which has led to the gradual withdrawal of funds from the Solana ecosystem.

Source: $SOL Price decline since February 14th

in conclusion

Although $LIBRA initially received a public endorsement from the President and boasted a $4.5 billion valuation, it all quickly fell apart: insiders quickly took profits, retail investors suffered heavy losses, and key backers distanced themselves from the project.

The on-chain data clearly reveals this process: a few wallets have made millions of dollars in profits, while most ordinary traders are in deep losses. This phenomenon is not new, and the mechanisms behind it include early entry, sniping transactions, and exit liquidity provided by subsequent investors. The real damage lies in the loss of trust and the markets aversion to such viral tokens - these tokens often collapse quickly before most people fully understand them.

Even the Solana ecosystem has been affected, with a surge in liquidity outflows, indicating that the impact of these events has gone beyond a single token. Based on the current situation, the crypto market seems to be tired of this cycle: from exaggerated promises to rapid price increases, and then to even faster capital withdrawals.

As to whether the $LIBRA event merely brought a necessary cooling down of the overheated market, a healthy adjustment, or whether it will have a more profound impact on the market, especially in the context of the US narrative of promoting cryptocurrency adoption through the launch of Memes by the President and the First Lady, it will take time to observe.