TL;DR

With the continued prosperity of the cryptocurrency trading market, on-chain transaction processing capabilities and capacity expansion have become the key to technology exploration in the industry. In Ethereums expansion plan, the community gradually chose a roadmap centered on Layer 2. At that time, Layer 2 projects were under pressure from high Calldata costs and had to focus on DA expansion in order to further reduce costs and increase efficiency. Against this background, proposals such as Danksharding and EIP-4844 have emerged one after another, dedicated to using new storage mechanisms to make Rollup cheaper and more efficient when publishing data on the Ethereum mainnet. At the same time, a series of AltDA projects such as Celestia, EigenDA, and Avail have also begun to emerge, providing the entire industry with alternative block space solutions through independent consensus and data encoding technologies.

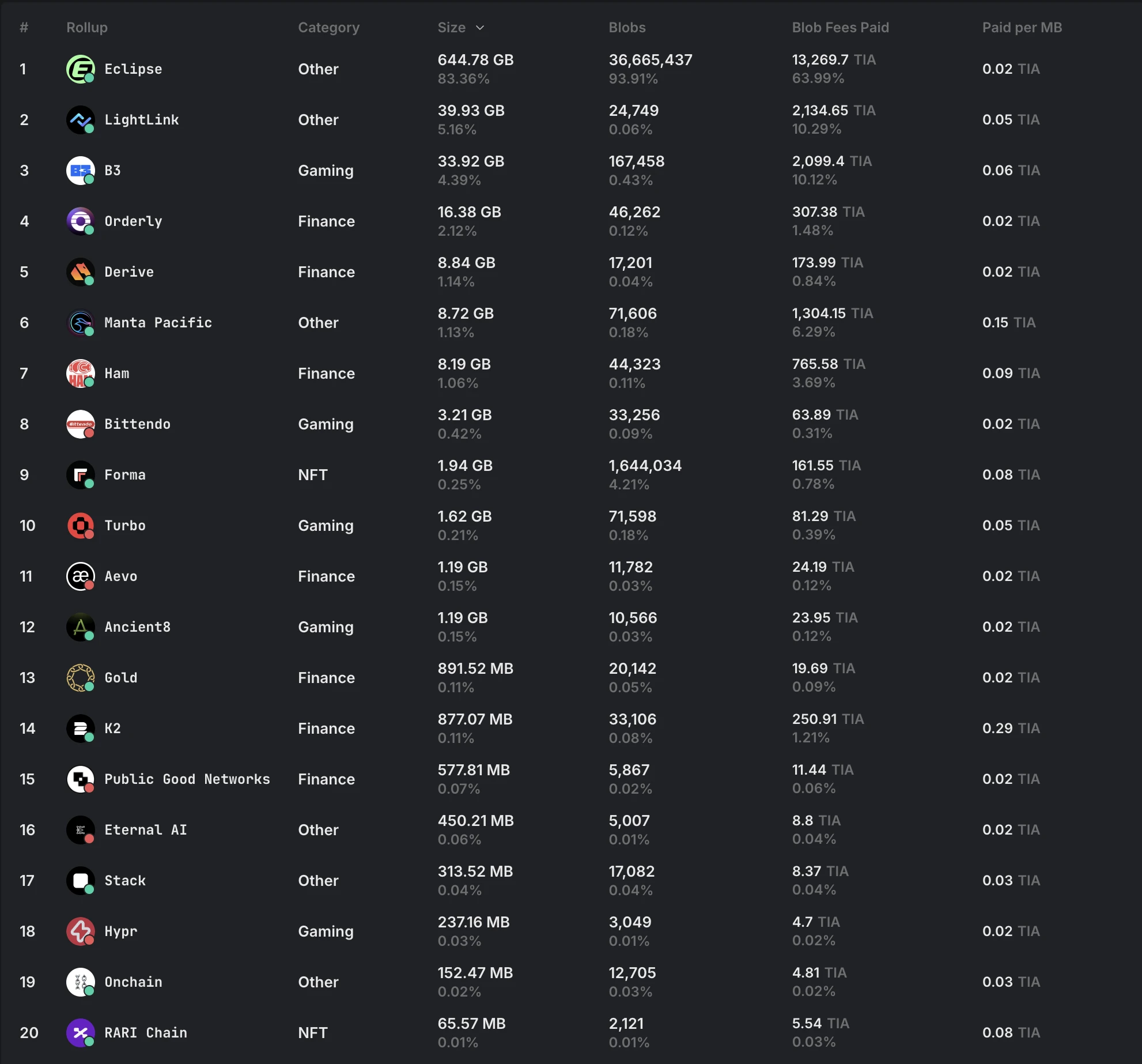

Although the AltDA project has shown potential in terms of block space price and scalability, the current market demand for massive data on-chain is still insufficient. For many Rollups, paying a portion of the DA fee on the Ethereum mainnet (for example, the DA cost of Base is even less than 5%) is not as important as obtaining the legitimacy, liquidity and ecological grafting capabilities brought by Ethereum. Take Celestia as an example. It currently relies mainly on its only major customer, Eclipse, which accounts for about 85% of the Blob upload volume, making Celestia appear quite single in terms of user structure. At the same time, since Celestia went online, the total revenue of the protocol has been only more than 100,000 US dollars. Such profitability is difficult to support the long-term operation of the project, not to mention continuing to invest a lot of resources to attract more potential users or accelerate the construction of the ecosystem. Other DA projects have almost become ghost chains under the attack of EigenDA.

By analyzing the real source of DA demand and the current difficulties it faces, we found that the consumption of block space by traditional financial or lightweight applications is relatively limited, and Ethereum DA only accounts for a very small part of its cost. In addition, as Ethereum DA continues to expand and ZK compression efficiency improves, this will further strengthen Ethereums dominance in the DA field and weaken the demand for AltDA. We have also rethought its user profile and believe that data-intensive applications such as AI, games, and social networking are likely to trigger explosive demand for DA, truly testing the high throughput and low-cost potential of the blockchains DA layer. Therefore, DA projects should explore more about the development of full-chain applications and the network effects they bring, similar to DeFi financial Lego.

The history of DA usability

Ethereum expansion history, Source: GenesiSee

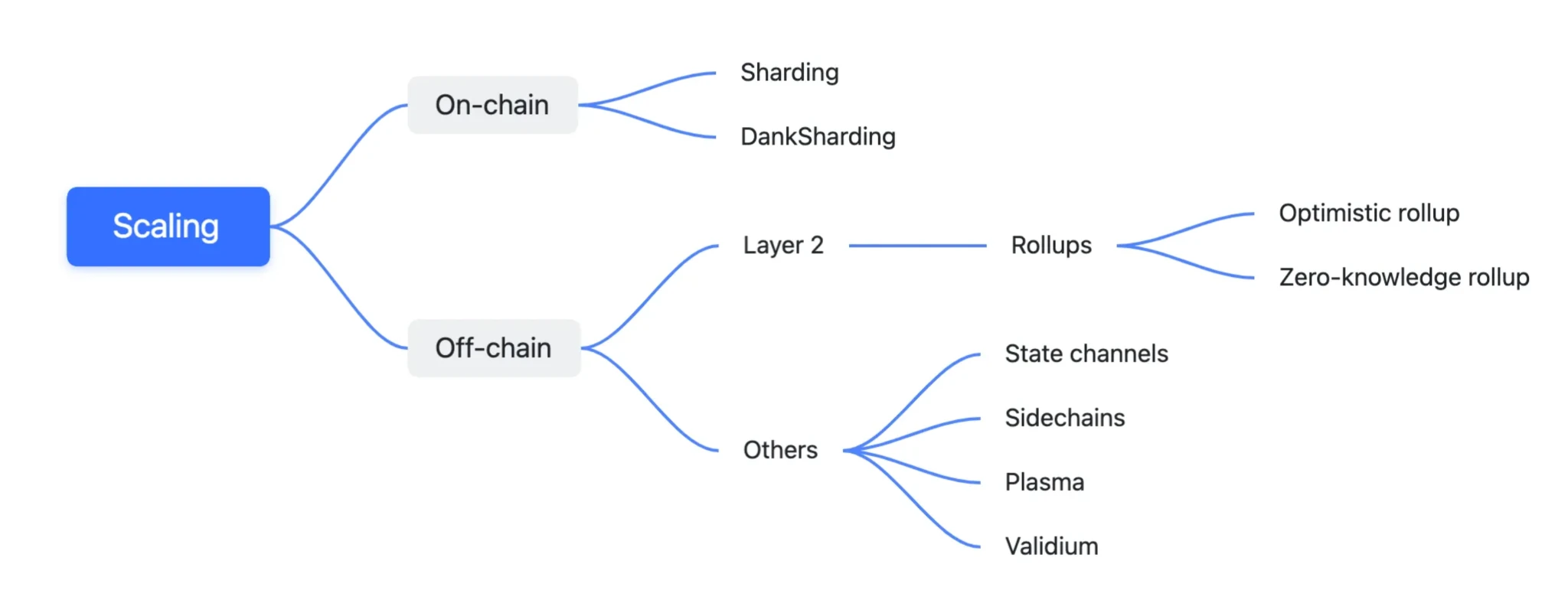

Scaling has always been an enduring topic. Ethereum has experienced the development of scaling technologies such as state channels, Plasma, ETH 2.0 Sharding, Shadow Chain (now Rollup), ZK, OP, and finally confirmed the scaling route centered on Layer 2. ZK Rollup is the main scaling technology of Ethereum. It packages the users transactions on Layer 2 and sends them to Calldata, which is the early data availability storage area. Data availability is not the same as data storage. Availability lies in its ability to be used to verify whether a transaction is legal. However, with the emergence of a large number of Layer 2 solutions, the high cost of Ethereum Calldata has gradually become apparent. Calldata is the parameter storage space for calling smart contract functions, which is not suitable for large-scale data availability storage in nature.

Therefore, Ethereum researcher Dankrad Feist proposed DankSharding. DankSharding splits the Ethereum architecture into multiple layers, one of which is the data availability layer (DA), and stores it in the form of blobs on Ethereum. It is also stipulated that it will be deleted on L1 after a period of time to avoid the problem of mainnet state expansion. The goal is to achieve DAS sampling and a mount capacity of up to 16 MB per slot.

In the early days, Dankrad Feist introduced Proto-Danksharding to quickly implement an early version of this vision, commonly known as EIP-4844 and Dencun upgrade. In the EIP-4844 specification, a Blob is 128 KB, and a block/slot can mount up to 6 Blobs, with a target of 3. If there are more than 3, a Gas Fee mechanism similar to EIP-1559 will be adopted.

For Layer 2, there are multiple daily operations, including execution costs (status updates and cross-chain costs between L1 and L2), DA costs (compressed data, state roots, and ZK proofs), and verification costs (ZK verification). Before the launch of EIP-4844, L1 costs accounted for 98% of the total cost of Layer 2, mainly because the storage cost of Calldata was too high.

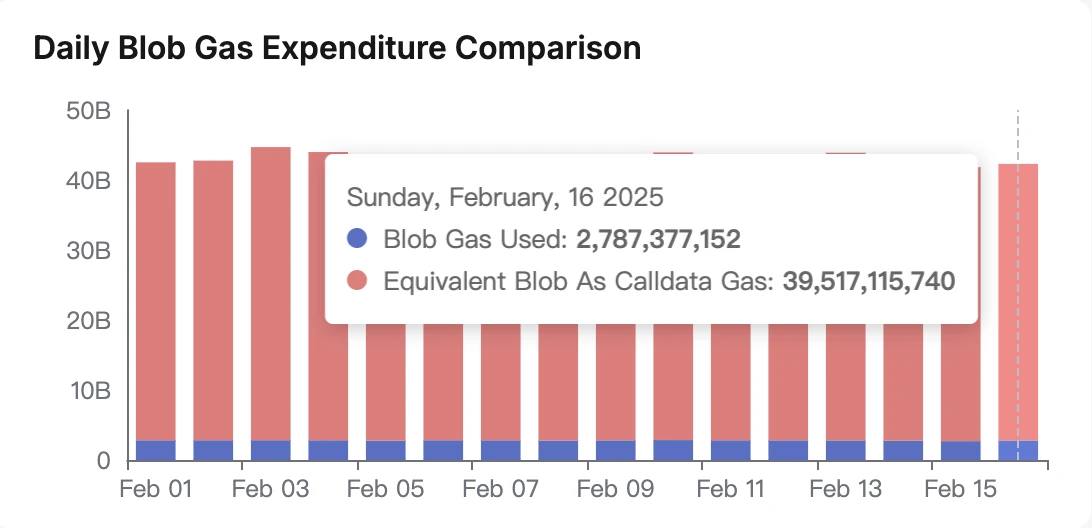

Daily Blob Saving, source: Blobscan

Since the Dencun upgrade, the cost of the DA layer has dropped by 92%. While Ethereum was exploring the Danksharding solution for expanding the DA layer, Celestia also launched its own third-party solution, and at the same time, brought the term modularity to the publics attention. During this period, the market began to criticize Ethereums roadmap, forming the following mainstream views:

Ethereum has decentralized the execution layer to Layer 2, and its vision of a world computer seems to have been strategically abandoned. Instead, it has embarked on the vision of the so-called world settlement layer, but this vision cannot be accepted by most people. Even when spot ETFs are conducting commercial promotions, ETF institutions do not know how to position Ethereum.

The Layer 2 architecture also has some inherent drawbacks that need to be addressed, and its overall liquidity is still not as good as that of the Monolithic Chain.

Celestias throughput and performance are a thousand times that of Ethereums data availability layer, and the most valuable asset is data availability. Celestia can capture more data assets.

The modularization of blockchain is a historical trend. A large number of modular projects have emerged, including modular execution, virtual machines, sequencers, data availability and other projects.

Ethereum’s advantage is mainly reflected in its legitimacy. For some projects, the cost of legitimacy is difficult to measure. They cannot be recognized by the Ethereum community, and the resulting reduction in users and reputation is often difficult to quantify. This is one of the reasons why many Internet groups jokingly call it the “Ethereum Cult.”

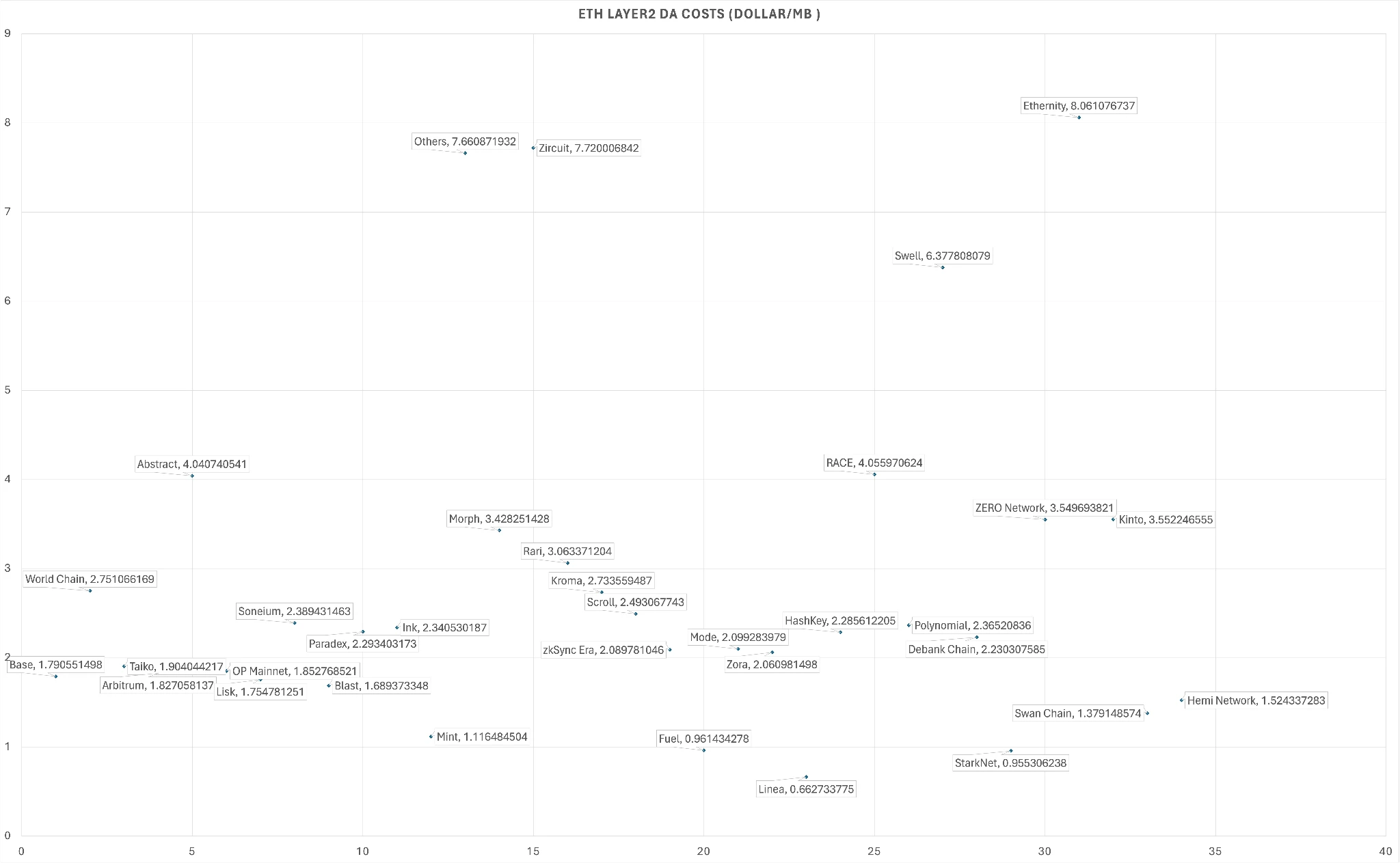

Layer 2 DA Costs(USD/MB)

Once Celestia was launched, it did significantly reduce the cost of DA. As shown in the above figure, after the Dencun upgrade, the cost of Ethereum DA per MB is generally concentrated between 0.6 and 4.0 USD/MB, among which Linea is as low as 0.66 USD/MB. We have not yet calculated the latest Unichain DA cost, and the current cost of using the OP chain is about 20 USD/MB.

DA Costs using Celestia, source: Celenium.io

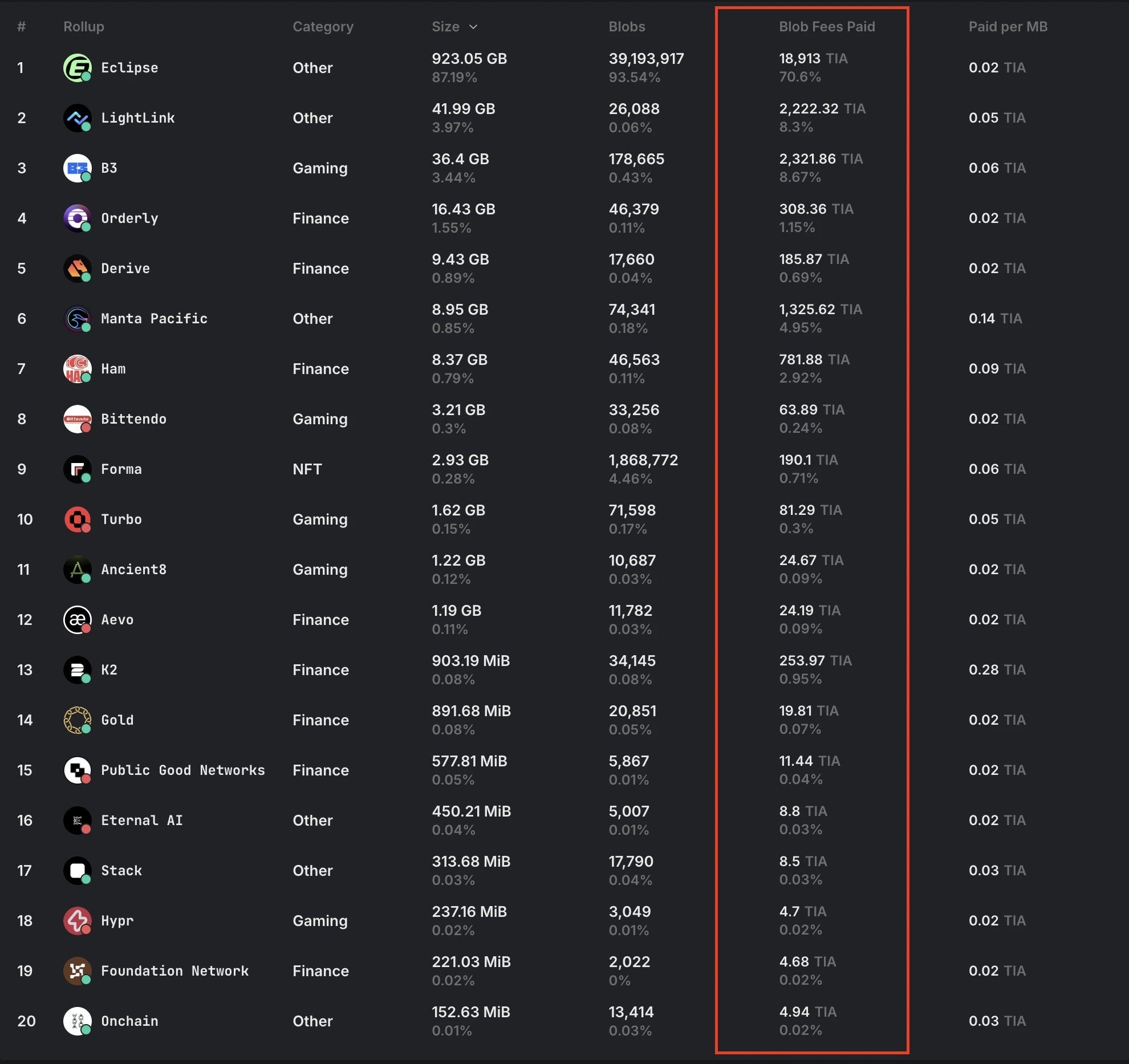

In contrast, Celestias DA cost is about 0.06-0.09 TIA/MB, which is 60%-90% lower than Ethereum. At the same time, Ethereums variance is much higher than Celestia, and the volatility of its block space sales price is significantly greater than Celestia. However, even though it actually saves so much cost for customers, Celestia, Avail and other data availability layers, or the block selling business, do not seem to have made substantial progress. In the ecological development of Celestia, Eclipse accounts for about 93.61% of the Blob submission data volume, and other projects such as Orderly, Lightlink and AEVO account for less than a fraction of it. The price of Avail and Celestia has also been in a sluggish state for a long time, and there was once news that the Celestia project party sold coins at a low price through OTC.

What happened to Celestia, which was once so popular? What problems is it facing? What is its current progress? Why is it difficult to advance the ecosystem? Why did the former modularization leader and Ethereum killer gradually disappear? This article hopes to explore the true value of the blockspace business model after two years of market precipitation and user education, after losing the halo of orthodoxy.

Analyzing the technical development of mainstream DA projects

The current mainstream DA projects include Celestia, EigenDA, Nuffle (NEAR DA), Avail, etc., as well as the relatively new Bitcoin DA Nubit and the AI-oriented 0G (Zero Gravity).

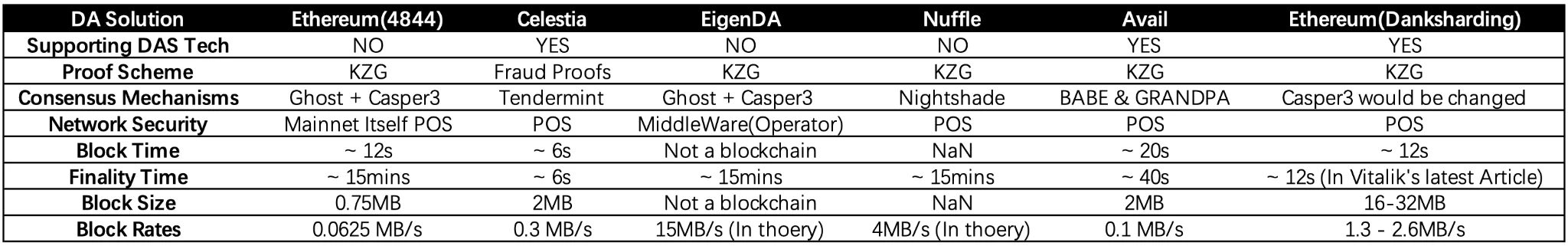

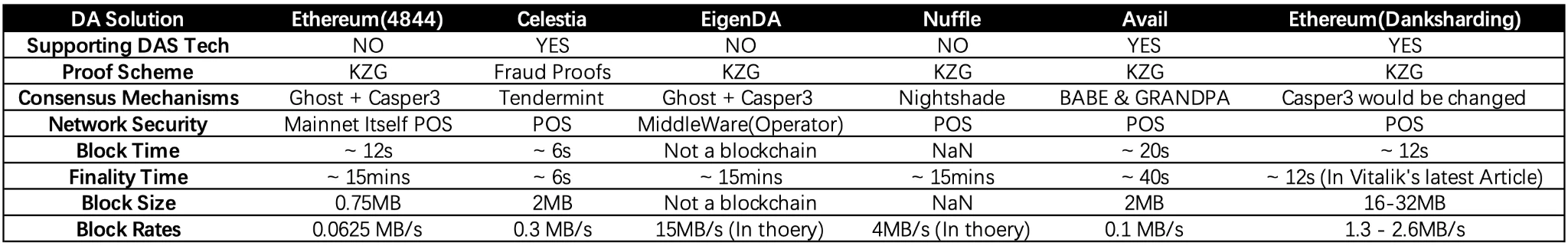

Comparison Chart

Most current DA technologies tend to adopt the same core technology - 2D Reed-Solomon erasure code + DAS (data sampling), which is also the direction of Ethereums future upgrades. 2D Reed-Solomon technology can ensure the recoverability of data during transmission through data redundancy, while DAS achieves high-confidence data availability verification with a small number of operations. Next, we will focus on Ethereum-EIP 4844, Celestia, EigenDA, Nuffle and Avail.

Ethereum EIP-4844

EIP-4844 is a transitional version before officially entering full sharding. Its core is to introduce a new blob-carrying transaction, which stores large blocks of data in the form of blobs in the consensus layer (Beacon Chain) rather than the execution layer, and deletes them from the execution node after about two to three weeks, thereby significantly reducing the cost of L2 writing data to L1. At present, EIP-4844 does not support DAS, but the future goal is to implement DAS. At the same time, it does not set up a dedicated Proof mechanism, because Blobs are directly mounted on the main network, and the consensus mechanism relies on Ethereums existing Ghost + Casper mechanism, so the block time still follows the 12-second rule of the Ethereum main network.

Currently, Blob uses the Gas Fee solution of EIP-1559 to control supply and demand, with a target of 3 blobs. A single block can mount up to 6 blobs, and the size of each blob is 128 KB. After Danksharding is fully implemented, the goal is to achieve a single slot processing 32 MB of data, and support cross-shard communication between data shards, while technically realizing 2D Reed-Solomon, DAS and KZG commitments.

Celestia

Celestia is the first independent L1 that focuses on the idea of modular blockchain, focusing on providing data availability and consensus services. It uses DAS combined with 2D Reed-Solomon erasure code and namespace Merkle tree (NMT) to split block data and encode it, and then verify it through random node sampling, achieving high-probability verification of complete data release with extremely small download volume.

Its consensus mechanism is mainly based on the Tendermint mechanism under the Cosmos architecture. The process includes a proposer proposing a new block, followed by two rounds of voting (Prevote and Precommit) by all nodes. When 2/3 of the nodes recognize the block, it is considered final. The block time is about 15 seconds, and the Finality time is also 15 seconds in theory in Celestia, but in actual operation, both can reach 6 seconds. Celestia adopts the Optimistic Proof architecture instead of the mainstream KZG, and only triggers interactive verification when fraud occurs.

In terms of block size, Celestias early single block size was 2 MB. After combining 2D Reed-Solomon and DAS technology, it effectively reduced the operating pressure of the nodes, thereby supporting the efficient operation of more light nodes.

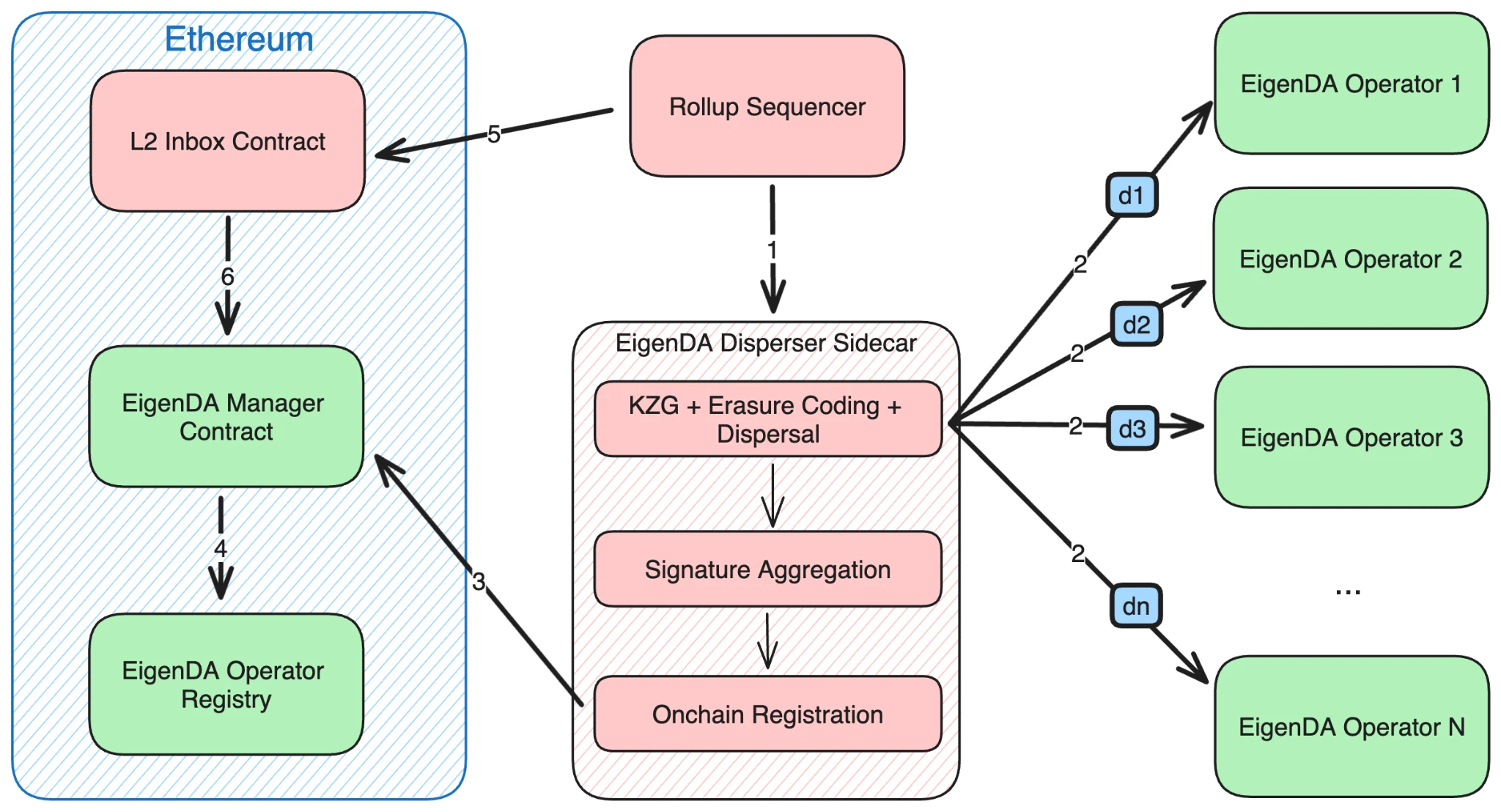

EigenDA

EigenLayer is a middleware that provides restaking infrastructure on Ethereum, allowing existing ETH validators to choose to join and provide additional services, one of which is EigenDA. EigenDA does not restart a new consensus network, but uses the Slashing mechanism to constrain nodes that provide data availability services. If the node fails to provide the published data to the outside world as required, the pledged ETH will be confiscated. Therefore, strictly speaking, EigenDA is more like a collection of multiple DA projects, which builds the operating specifications of these DA projects. Multiple DA projects can run in parallel and use xETH as re-collateral.

EigenDA Structure, source: EigenDA

Specifically, unlike the architecture of Celestia and Avail, on EigenDA, there is a role called Operator. These Operators need to pledge xETH on EigenLayer, which is equivalent to locking a margin. Each Operator stores part of the Blob, but the whole can form complete data after being pieced together, similar to data sharding. If an Operator commits fraud, it will be punished by economic Slash.

The role that directly interacts with Rollup on the C-side is Disperser, which is equivalent to the intermediary of Operator. Disperser will split the Blob of Rollup into multiple blocks and perform Reed-Solomon encoding (constructing redundant information to recover after data loss during transmission). Subsequently, Disperser verifies that these blocks come from a specific Blob through KZG commitment, and sends the blocks and corresponding proofs to Operators, while collecting their signatures. After collecting enough signatures (meeting the threshold), Disperser submits this signature aggregation to the Ethereum mainnet contract so that dishonest Operators can be punished if necessary.

The Retriever is responsible for retrieving the block data and piecing it together into a complete Blob. EigenLabs provides an official Retriever, but each Rollup project can also deploy it on its own.

EigenDA is not a blockchain because it does not have an independent consensus mechanism. Operators rely on EigenLayer for staking to implement a mechanism for malicious reduction.

Throughout the process, Ethereums role is to collect necessary information such as KZG commitments and signatures through on-chain contracts. Security is claimed to come from the Ethereum mainnet, but in fact it relies on the middleware Disperser, also known as DAC. The consensus mechanism depends on the Ethereum mainnet, and the final transaction certainty is consistent with the time of the Ethereum mainnet, about 2-3 epochs. It should be noted that the block time is not Ethereums 12 seconds per slot, because EigenDA can aggregate N blobs and submit them to a single slot at one time. In terms of block size, the official claims that the throughput can reach 15 MB/s.

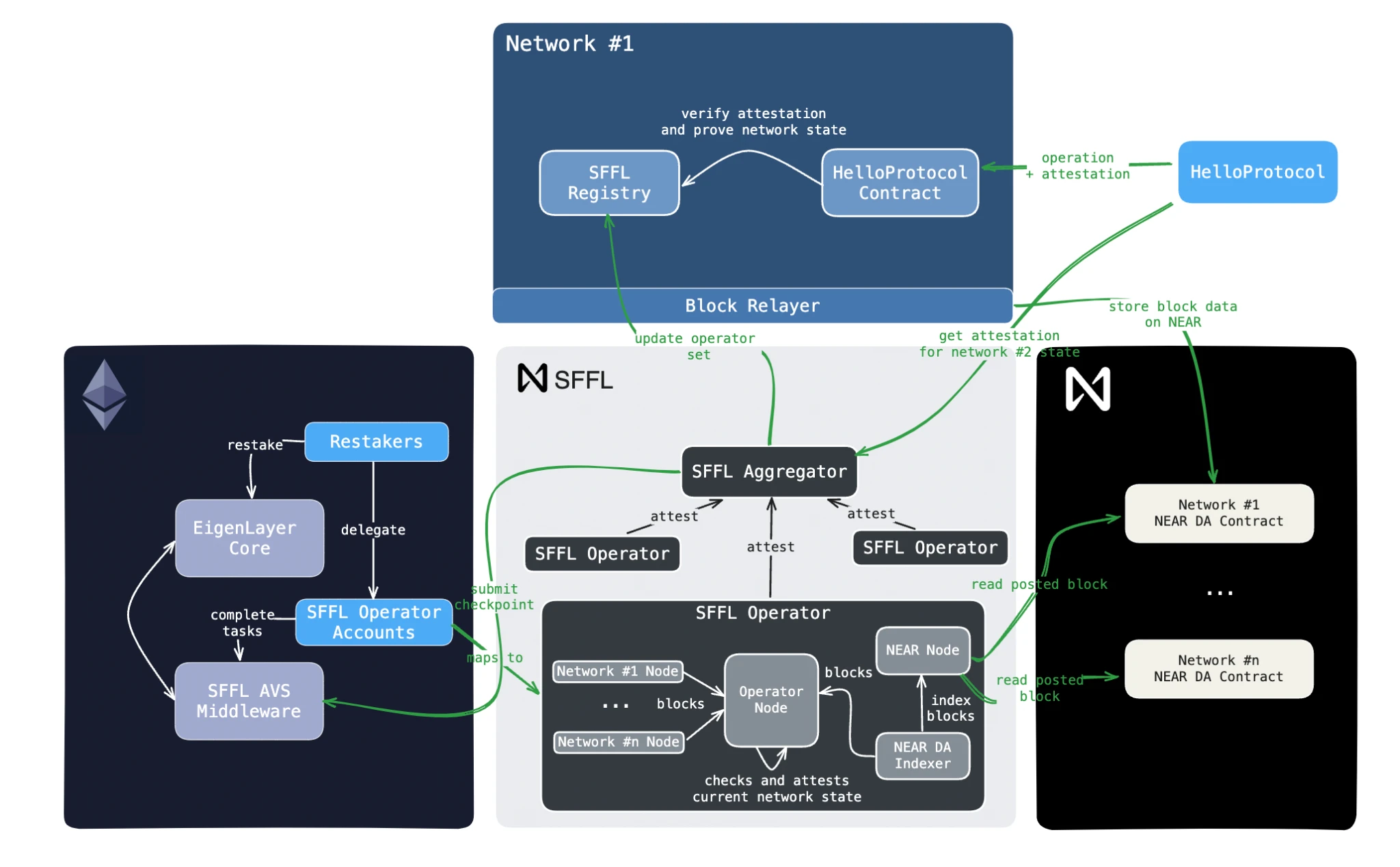

Nuffle

Nuffle is a project spun off from NEAR DA, one of the chain abstraction components incubated by the Near Foundation. Currently, the project has completed independent financing and received a $13 million seed round of financing led by Electric Capital. Although NEAR DA has not yet fully announced its specific design plan, according to the limited disclosure on the official website:

Nuffles DA layer may have adopted an architecture similar to NEARs execution sharding technology Nightshade. Nuffle applies Nightshade technology to data storage and implements state pruning, with a full data storage time of at least three days. Its specific implementation is still under construction, but official documents reveal that it may adopt the 2D Reed-Solomon + KZG scheme, but will not use DAS. The reason is that although DAS can achieve a 99% confidence level with a small number of verifications, there is still the possibility of malicious intent (0G also abandoned the DAS scheme last year).

Nuffle DA + NFFL Structure, source: Nuffle

It is worth noting that Nuffle also introduced a new protocol called NFFL (Nuffle Fast Finality Layer, formerly known as SFFL). This protocol relies on EigenLayer to provide encryption security. The architecture contains two off-chain roles, Operator and Aggregator. Its workflow is as follows:

Rollup publishes its own block data to Nuffle DA.

The Operator obtains data from Nuffle DA and verifies whether it is consistent with the original data of Rollup.

After verification, the Operator signs the state root and submits it to the Aggregator.

Aggregator generates a unified proof and submits it to the NFFL contract on Ethereum.

After verification, the status proof is synchronized back to each Rollup network to achieve fast settlement.

At the same time, NFFL is a middleware registered on EigenLayer. Operators are responsible for signing the validity of Blob data, and these Operators also run AVS nodes, so they are also threatened by confiscation under the POS mechanism. The reason why Nuffle designs such a complex architecture is that the Nightshade technology based on NEAR can provide extremely high Blob throughput, and the introduction of NFFL as a means of fast settlement makes Rollup mainly rely on the xETH re-staking security of EigenLayer, thereby improving throughput at the DA layer. Since the final settlement occurs on Ethereum, its Finality time is still about 15 minutes.

Avail

Avail was originally incubated by Polygon as one of its scalability solutions, and was later split from Polygon. Avail uses the BABE and GRANDPA consensus mechanisms inherited from the Polkadot SDK (Substrate). Similar to Celestia, Avail also uses 2D Reed-Solomon encoding + KZG commitment + DAS to ensure that data is not intentionally hidden or tampered with.

BABE is the validator election rule of Polkadot, which is similar to the form of lottery drawing. For example, each slot generates a random number, and each node holds a fixed number. If the nodes number is less than the random number, it can participate in the block generation of the slot. Each slot is fixed, Polkadot is set to 6 seconds, and Avail chose 20 seconds. The problem is that there are often multiple nodes that meet the conditions at the same time, thus forming multiple forked chains. GRANDPA is used to determine which forked chain becomes the final chain. Its essence is a voting mechanism. Multiple validators participate in Byzantine voting. As long as 2/3 of the validators recognize a forked chain, the forked chain is regarded as the final chain. The biggest problem is that it usually takes multiple rounds of voting, so each 20-second slot may require multiple slots to finally confirm the validity of the transaction.

Currently, the block size of Avail is 2 MB, the block time is 20 seconds, and the final confirmation time is 40 seconds, which means that an additional slot is consumed in addition to the original slot for validator voting.

Comparison Chart

The above is our summary chart based on the five DA projects and the future Ethereum DA expansion goals. EigenDA achieves higher throughput by completely relying on the staking security of EigenLayer and abandoning the public chain architecture to turn to AVS. Nuffle adopts a dual security architecture that relies on Ethereum and its own DA. At the same time, it is also one of the Eigenlayer AVS ecosystems on the Ethereum side, and combined with the NEAR Nightshade sharding expansion solution, it brings relatively outstanding performance.

In the future, Danksharding aims to expand Blobs to 16-32 MB, thereby achieving a 20-40 times capacity increase. In terms of technology stack, most projects plan to adopt KZG and DAS, but some projects are gradually abandoning the DAS solution, believing that it may lead to longer settlement time. Ethereum and other projects prefer to verify the validity of blocks through DAS technology to introduce more light nodes, thereby achieving a certain degree of node decentralization. This reflects different value propositions.

Return to the source of value: AltDAs cost, ecology and business model

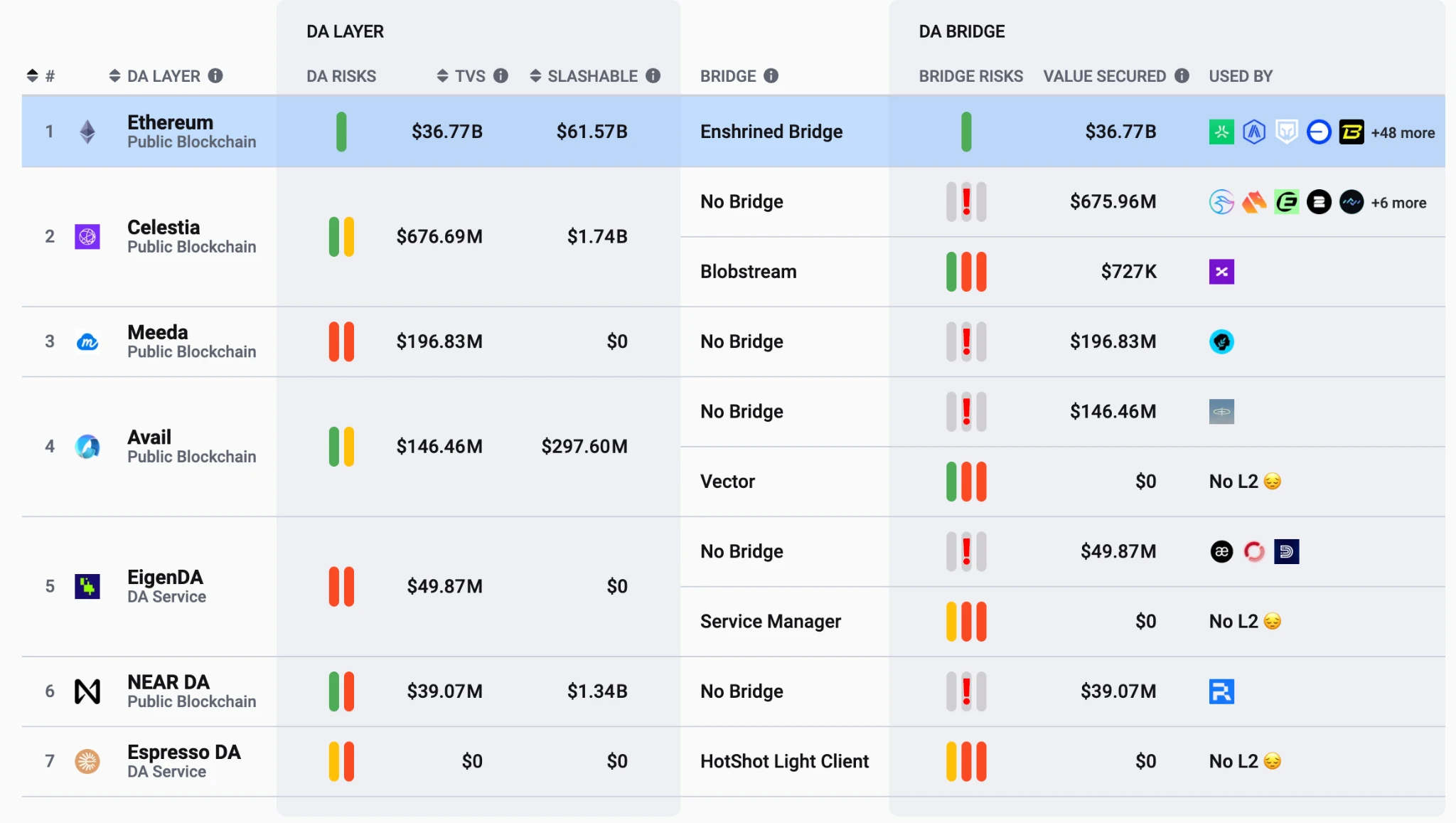

Data Availability Ecosystems, source: L 2b eat

AltDAs main business model is to sell block space, and its business model is mainly ToB, so it is crucial to convince major customers to adopt AltDA solutions. At present, the AltDA ecosystem is as shown in the figure above. Except for the earliest Celestia ecosystem, which has Eclipse, a project that occupies 96% of the Blob share, the rest of the projects have not achieved significant development.

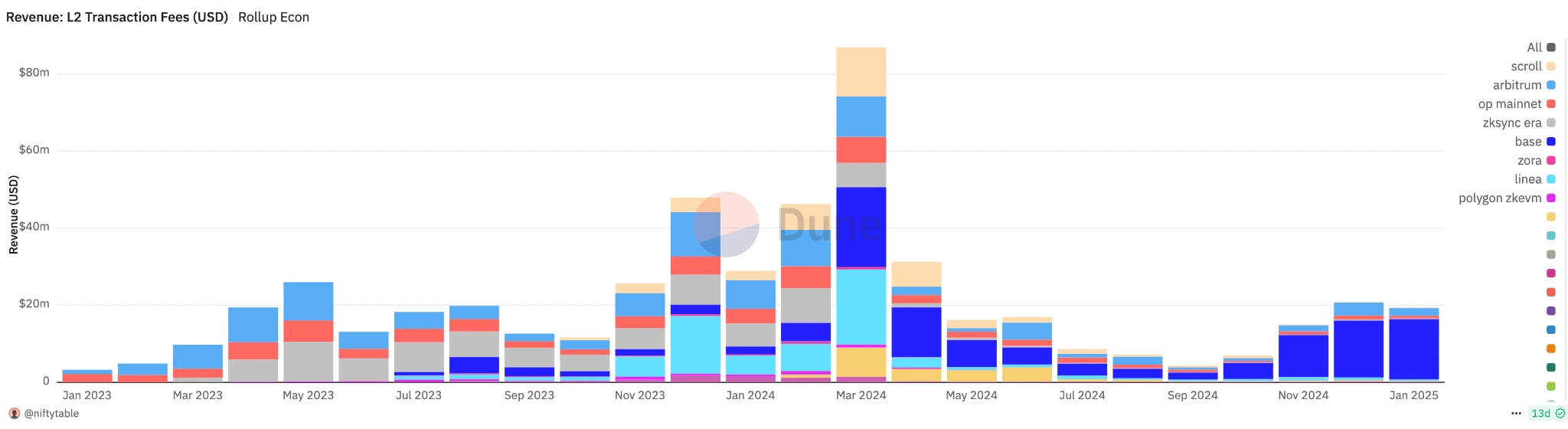

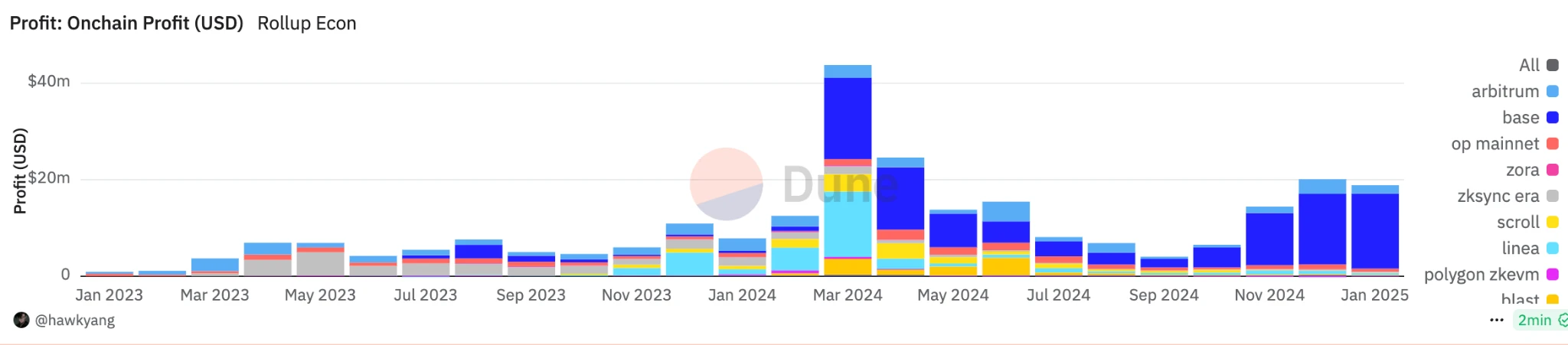

Layer 2 Revenue of USD

Layer 2 Profit of USD

At present, the entire industry, whether it is Rollup or public chain, is far from talking about profits and revenues. The current profits of Layer 2 (without deducting the costs of the team, sorter, network development, etc.) mainly come from the fees obtained by the Sequencer, minus the Blob and execution fees on Layer 1. At present, the Base chain occupies most of the market share, with total revenue of US$16.6 million and profit of US$15.54 million in January, and the actual Layer 1 cost is only about US$1.06 million; Arbitrum, with a cost of US$238,700 and a profit of US$1.77 million in January. Since the Dencun upgrade, the cost of Blobs on the Ethereum mainnet has been negligible compared to the actual team, marketing and development costs.

This is why, even if AltDA reduces the cost of DA by another 60%-90%, most project parties are still unwilling to migrate to AltDA, because the absolute value of the cost reduction is far less than the benefits brought by legitimacy and liquidity on Ethereum. At the same time, Eclipse is also considering migrating from Celestia to EigenDA after EigenDA goes online. We believe that the main consideration is that EigenDA has a closer interest relationship with Ethereum and stronger legitimacy, and EigenDAs current expansion effect is also the best.

Celestia Revenue, source: Celenium.io

Eclipse, which accounts for 87% of Blob uploads, contributed a total of 18,913 TIAs of revenue to Celestia, equivalent to about $100,000. This is an extremely unhealthy business model. The low Blob cost is far from covering Celestias own off-chain operating costs, and it is too dependent on a single customer. And this is Celestia, which already has a certain ecosystem, not to mention Avail, which is almost like a ghost chain.

In general, Ethereums DA currently meets the needs of the entire relatively sluggish ecosystem, and the subsequent Blob expansion is still in progress. At present, the cost of Blob is low enough, and it is the Sequencer that really needs to reduce the Gas fee. This is the main reason why AltDA cannot effectively acquire customers. Because when Layer 2 is selected, unlike in the past, DA cost is actually no longer a core consideration. This also reflects a fact - the speed of infrastructure construction is much faster than the speed of application development. Applications cannot effectively promote the growth of demand for block space, and naturally it is difficult to promote the development of AltDA.

AltDA’s Dilemma: Cost Reduction and Efficiency Improvement Are Not a Solution to Sluggish Demand

Celestias seem to be caught in a dilemma: Ethereum DA is sufficient to meet current needs, DA has become a negligible cost in projects such as Layer 2, and the cost of migrating out of the Ethereum ecosystem and the loss of legitimacy may be far higher than the small amount of expenses saved by DA.

We want to revisit a question: Compared with general-purpose Rollup and other Layer 2, what is the real customer profile of DA? Our conclusion is that the customer group facing DA should be non-general-purpose, vector data-driven applications.

AI data is a typical vector data, and applications such as games, social networking, and music also belong to this category. First of all, we recognize the core idea behind the DA business model - the DA layer is where the most valuable assets are deposited. However, the data on the Ethereum mainnet is still dominated by financial or lightweight applications, and the actual contribution of general-purpose Rollup to DA is minimal. On the contrary, if vector data is put on the chain, its data volume will be extremely large, and the demand for DA will show exponential growth. This is also one of the reasons why Lens Protocol chose to build its own public chain, because in the face of huge on-chain social data, the existing DA solutions are far from sufficient to support its needs.

In the future, if SocialFis business model can be successfully implemented, the social and gaming fields will bring real and huge market demand for DA projects, which is the key to resolving AltDAs dilemma.

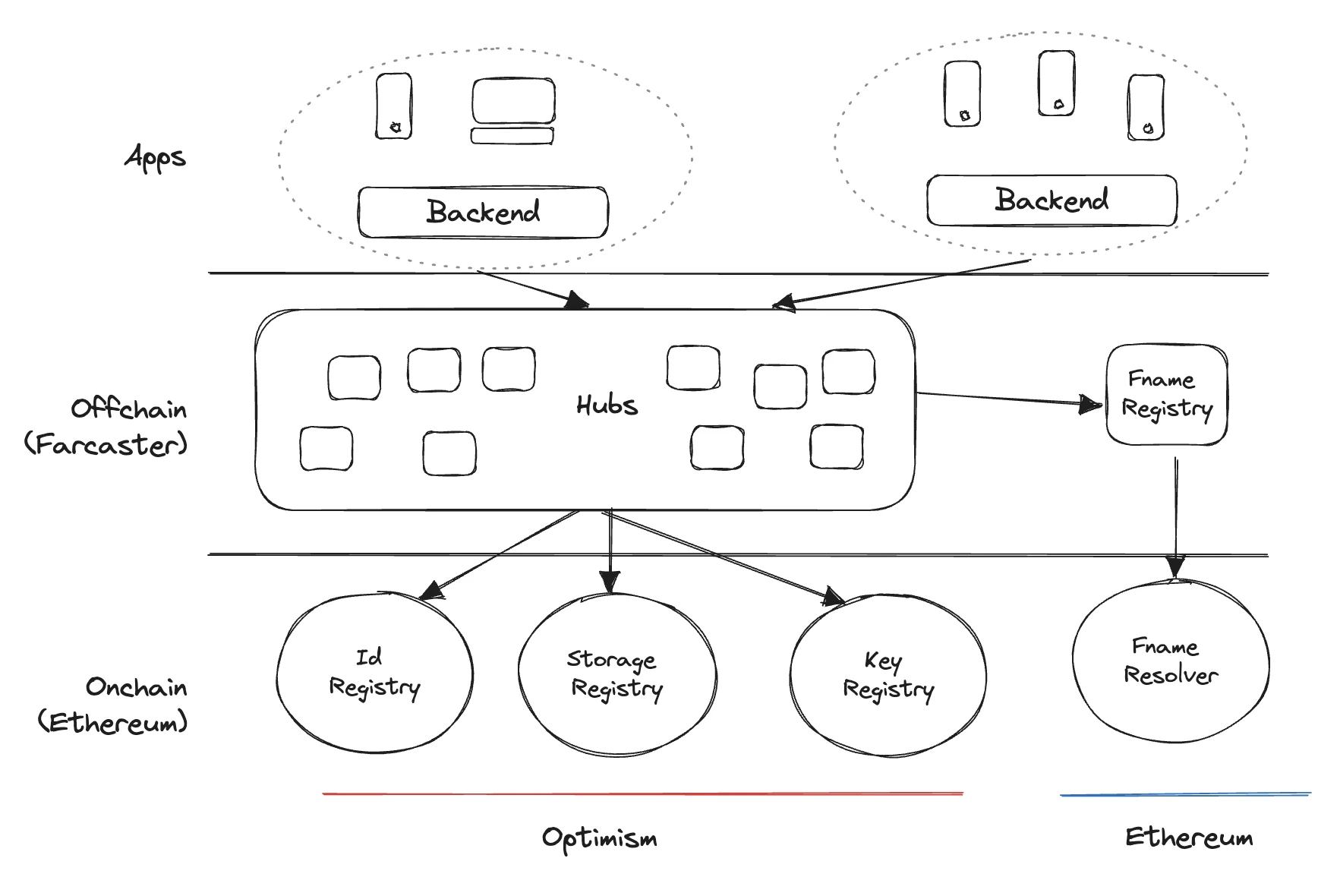

Farcaster Structure, source: Farcaster

Farcasters architecture also uses a partial data index on-chain approach when processing data, but the data is not fully on-chain in essence, which still leads to the problem that the data cannot be fully reconstructed on-chain. In the vision of Web3, in an ecosystem similar to financial Lego, social data should have sufficient credibility and portability, but current social applications are still insufficient in terms of openness. The DA project needs to vigorously promote full data on-chain, especially in the social and gaming fields. Because even after compression and on-chain, the demand for DA is still limited and far from enough to support the long-term development of DA.

We can see that the actual supply of DA layer projects far exceeds the market demand. Under the current almost zero real market demand, the valuation of all DA projects is seriously overestimated. Although DA is one of the real needs of Layer 2, under the competition of Ethereum native DA, AltDA has almost no market space. This is also one of the reasons why Celestia is rumored to sell coins OTC to cash out - so far, the on-chain revenue of the project since its establishment is only hundreds of thousands of dollars, and it is conceivable how difficult it is to turn the tide.

0G is also aware of the dilemma of the DA layer. Its improvements are mainly aimed at data-intensive applications, especially AI scenarios. It builds an execution layer for parallel processing of AI calculations, while saving vector data through the data storage layer. Officials claim that it supports up to 50GB/s throughput (while the fastest EigenDA only claims to be up to 15MB/s). This direction actually constitutes a certain competitive relationship with Filecoin/FVM and Arweave/AO. 0G believes that its main advantages lie in higher throughput and execution speed, and can support massive amounts of structured data.

Future Development

AltDA seems to be stuck in a dilemma that is theoretically valid but lacks demand in actual business operations. The development of AltDA began when Ethereum was still in the Calldata era, when DA expansion was a must. However, Ethereums current DA is sufficient to meet existing needs, and the factors limiting the development of Layer 2 are no longer just low DA fees, but more liquidity fragmentation, finality and other issues. The Gas fees paid by users are not directly caused by Ethereum, but are driven by the profit orientation of Rollup, especially the revenue growth of the Base chain, which has brought significant support to the stock price of its parent company Coinbase. DA fees account for only a very small part of the Rollup cost. It is difficult for Rollup projects to give up the added value of liquidity spillover, orthodoxy and other added values brought by the Ethereum ecosystem for this insignificant savings.

Looking ahead, with the booming development of on-chain applications and the continuous emergence of Layer 2 public chains, the demand for DA will undoubtedly rise further. However, with the continuous expansion of Ethereum DA and the gradual maturity of ZK compression technology, these technological advances will further compress the market space of AltDA. Therefore, DA has reached a critical moment when it has to transform. DA projects need to more actively explore the development of full-chain applications, especially in data-intensive scenarios such as AI, games, social networking, etc., build their own ecological barriers, and cultivate real and sustainable market demand.

References

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web 3.0 era. Gate Ventures works with global industry leaders to empower teams and startups with innovative thinking and capabilities to redefine social and financial interaction models.

Official website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures