Original author: TechFlow

Welcome to another day of decline.

The crypto market was shrouded in dark clouds today, and the price of Bitcoin (BTC) came under pressure again, falling below $84,000 at one point, with a daily drop of nearly 3 points.

Amid the turmoil of internal and external troubles in the industry, negative news continued: practitioners resigned one after another, scandals broke out between project parties and market makers, KOLs openly fought over unfair distribution of benefits, and market trust almost collapsed.

The cold air began to spread to every leek again.

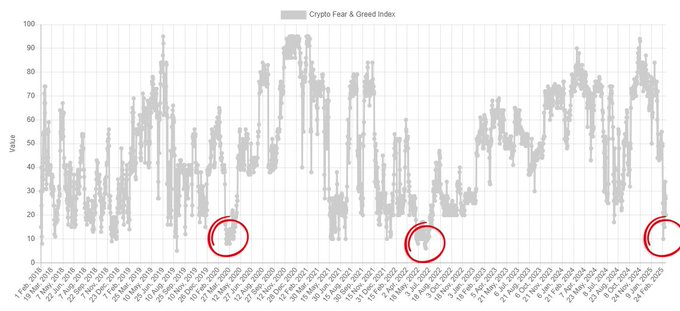

Data shows that the current level of fear in the market is exactly the same as the 2020 COVID crash and the 2022 market bottom. The fear index has reached 20, which is a state of extreme fear;

The United States’ recent announcement of a major policy to establish Bitcoin reserves has ignited the hopes of some investors.

As a bellwether of the crypto market, the price of BTC seems to have increased a lot compared to a few years ago, which is relatively more like a bull market; but if you look at the ups and downs in recent times, it feels like a bear market.

Now, is this the prelude to a bear market or the golden opportunity of a bull market?

What should we do in the face of drastic price fluctuations and uncertainty? Let’s listen to the views of domestic and foreign traders, KOLs and industry leaders, analyze market trends and see what they say.

Wait and see

What are you doing?

Im Waiting for Godot.

When will he come? I dont know. He told me he would come and asked me to wait for him here. ---Waiting for Godot

Samuel Becketts classic play Waiting for Godot tells the story of Vladimir and Estragons endless wait on a desolate roadside for Godot - a being who never shows up and is full of uncertainty.

For the leeks, this Godot is called BTC.

At a time when BTC prices are fluctuating wildly and fear is lingering, some people have chosen to wait and see.

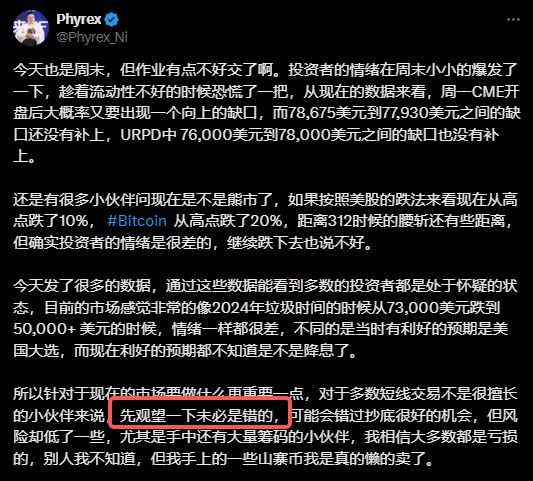

For example, Ni Da @Phyrex_Ni believes that everyone should remain patient, wait for market signals to arrive, and avoid blind actions.

In his latest analysis, he clearly pointed out that for ordinary investors who are not good at short-term trading, waiting and watching may be the safest choice. He believes that BTC is currently in a garbage time stage, similar to the downturn in 2024 when it fell from $73,000 to $50,000. The market sentiment is extremely low and there is a lack of clear positive drivers in the short term.

As for why to wait, the reason lies in the extreme uncertainty of the market.

Phyrex pointed out that the current BTC price has fallen below $84,000, investor sentiment has been repeatedly hit, the positive effect of the strategic reserve landing has faded, the expectations brought by the US election have turned into negatives, and macroeconomic data (such as CPI, PPI and the Fed dot plot) are still the dominant narrative. Coupled with the recent decline in US stocks and trade war (tariff) pressure, the crypto market may face further volatility, and the risk of rashly buying or adding positions is extremely high.

The data supports this view.

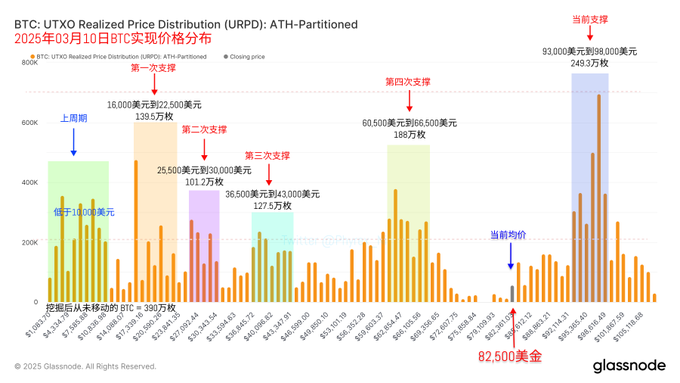

Unrealized profit distribution data shows that there is an unfilled price gap between $76,000 and $78,000, which may be a short-term support area; the dense chip zone support between $93,000 and $98,000 has failed.

Another key data insight is that the BTC turnover rate has been low in the last 24 hours, so the price drop is not due to a large number of users dumping the coins.

Considering the above and other factors, it is attractive to buy at the bottom now, but the risks and rewards need to be carefully weighed.

Gold Pit Bullish

There will always be bloody chips being sold out during a decline, and optimists will also believe that the current BTC is at a stage low and it is worth adding positions or even buying at the bottom.

@neso: The current price is a golden pit

Well-known KOL @neso clearly pointed out in his analysis that the current price of BTC is in a golden pit, which is an excellent opportunity for long-term investors.

Both the U.S. stock market and the crypto market are experiencing a wave of hot money withdrawal. This wave of hot money may have flowed into hot assets such as Nvidia and BTC due to Trumps inauguration. After Trump took office, the market began to withdraw due to policy uncertainty, resulting in a retracement of nearly 30%. But for crypto, it is actually in the best policy environment since its birth. The current retracement is obviously a disaster for innocent people. In the long run, it is a golden pit.

This view is not without reason.

The United States’ recent announcement of the establishment of a Bitcoin reserve, the White House Crypto Summit, and the SEC’s withdrawal of the SAB 121 accounting rule mark the best policy environment in the crypto industry’s history.

Although in the short term, the market feels that these policies are not stimulating enough, if you think back to the hard days of the crypto industry, things are much better now.

The introduction of more policies may provide a solid foundation for the long-term rise of BTC.

In addition, BTC’s 30% retracement was described as “affecting everyone”, mainly due to the drag of US stocks and macroeconomic factors (such as trade wars and monetary policy tightening), rather than fundamental problems in the crypto industry itself. Historical data (such as the bottom of the bear market in 2022 and the rebound after the 2020 COVID-19 crash) show that similar retracements are often long-term buying opportunities.

@Trader_S 18: 81,000 open long

Trader @Trader_S 18 took a more direct approach, posting on X based on recent market trends:

Based on the judgment that the recent market will fluctuate widely between 80,000 and 100,000, I entered at more than 81,200 in the morning.

He believes that the recent price of BTC has formed a wide range of fluctuations between $80,000 and $100,000. The current price has fallen back to $81,200, close to the lower limit, with a high risk-return ratio, making it suitable for long positions.

According to the four-hour candlestick chart and trading volume data, there may be support around $81,000, providing technical basis for short-term long orders.

Of course, the traders long strategy may be suitable for experienced short-term traders. The entry point of $81,200 is indeed close to technical support, but the risks are also obvious: if the market continues to fall to the $76,000-78,000 area, the stop loss may be triggered.

For ordinary players who are buying at the bottom at the current price, I hope this is not a game of waiting to cut their longs.

75000 Shot Party

In addition, there is a view that around 75,000 will be a key price area for BTC and needs to be closely monitored.

Arthur Hayes: 70,000 -75,000 The market may change dramatically

According to his post and related trend data, the price of Bitcoin has fallen from its highs in March 2025, falling below $81,000 and may further test $78,000 or even $75,000.

Hayes’ analysis suggests that if Bitcoin prices fall to the $70,000-$75,000 range, the market could experience dramatic price volatility due to the large amount of open interest in options concentrated in this range.

Here Hayes refers to the fact that in the Bitcoin options market, there is a large amount of open interest (OI) with strike prices concentrated in the range of $70,000 to $75,000. This means that many traders or investors have purchased Bitcoin call options (Call Options) or put options (Put Options) with strike prices set in this price range.

These open options contracts could trigger significant trading activity when the Bitcoin price approaches or enters the $70,000-$75,000 range. If options approach expiration and Bitcoin price approaches these strike prices, holders may choose to exercise their options (buy or sell Bitcoin), or market participants may hedge their risk by closing their positions.

This could lead to large price swings (dramatic increases or decreases) in Bitcoin prices.

A large amount of OI concentrated in a certain price range means that the market may face liquidity pressure. If many traders try to buy or sell Bitcoin at the same time to hedge or close options, it may cause rapid price fluctuations or even a squeeze phenomenon.

As such, Hayes’ warning suggests that investors may need to prepare for wild price swings and consider whether to “buy the dip” or wait for a more stable price range.

Eugene Ng Ah Sio: Wait until 75,000

Trader Eugene Ng Ah Sio said in the TG group that he is not in a rush to participate in the trade at the current price. Eugene reiterated that as mentioned before, the $75,000 price level is the only level that he is interested in at the moment.

Here are some Bullish indicators

And if you just need some psychological massage or encouragement, you might want to take a look at these Bullish indicators.

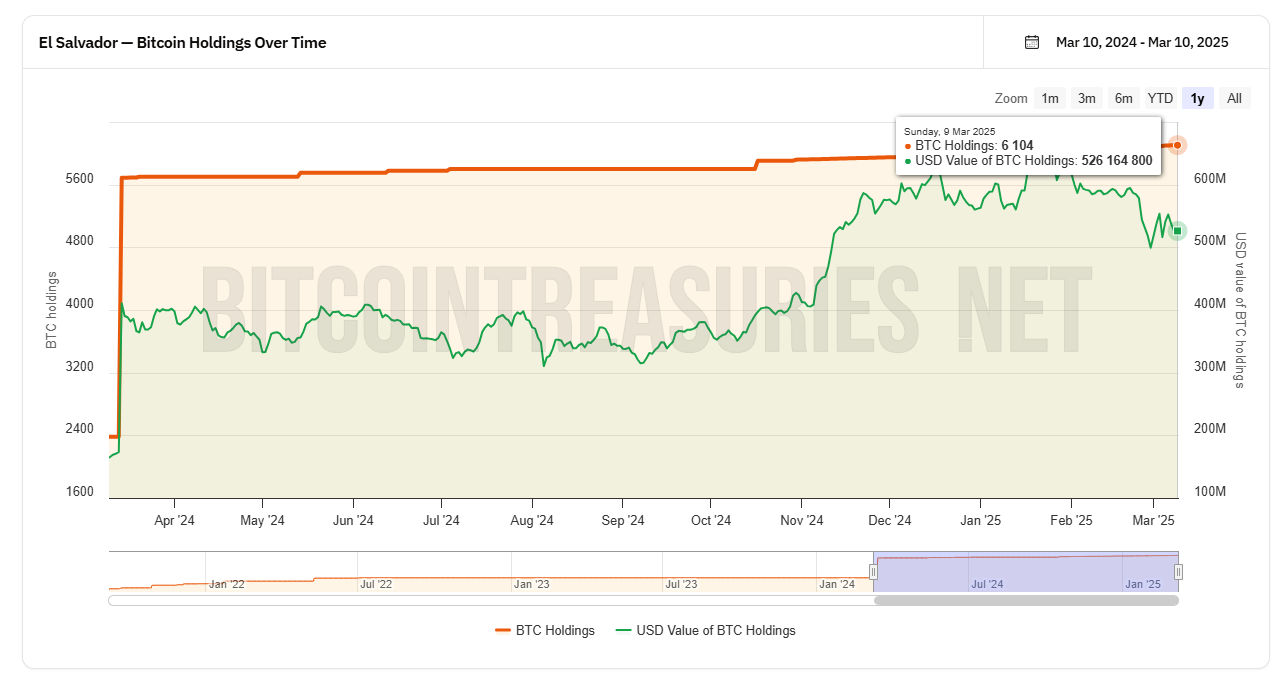

First, that country, El Salvador, added another 5 #BTC today, and now has a total holding of 6,111 BTC; the chart shows that El Salvador is obviously a firm DCA (constant investment) player, buying not much each time, but always buying.

Needless to say, another die-hard bull micro-strategy has increased its BTC holdings several times from the end of last year to the beginning of this year.

Its CEO Michael Saylor was recently photographed holding his head in frustration while attending a relevant meeting held by Trump. Perhaps he is the one who hopes that BTC will continue to rise.

But don’t worry, data shows that MicroStrategy’s average holding cost is around 66,000, and it has not yet lost money to the cost line.

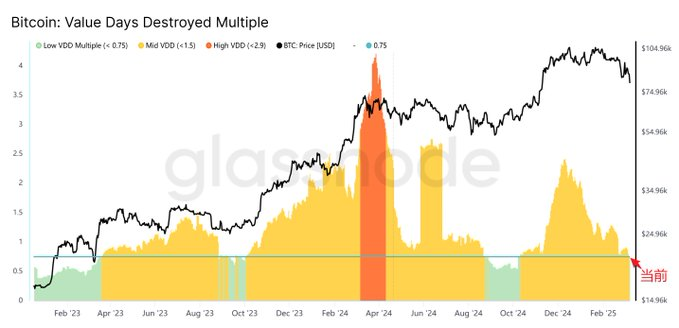

In addition, according to on-chain data analysis, the current BTC VDD Multiple has entered the bottom range, close to the historical low (such as below -2.9). This is similar to the bottom of the 2022 bear market and the market low after the 2020 COVID-19 crash, indicating that the market is in a state of extreme fear and low liquidity.

Combined with the recent BTC price drop of about 20% from $90,000 to below $84,000, and the lack of a significant increase in exchange trading volume, the VDD indicator shows that investors are reluctant to sell and chips are concentrated, which may trigger a rebound in the short term.

The VDD Multiple is a ratio that is calculated by dividing the short-term (usually 30-day) average VDD by the long-term (usually 365-day) average VDD. This ratio reflects the recent spending velocity compared to the annual average spending velocity and is used to identify cyclical highs and lows in the Bitcoin market.

Finally, in the kangaroo characteristics of the volatile market, the views of the above schools can only be used as a reference. The editor still believes that caution is the key to success, and it is better to miss out than to lose the principal.

The price may still be there, but the position must not be lost.