Original author: Weilin, PANews

AAVE, which has always been popular in the community, has recently aroused unprecedented doubts from the community.

Aave Labs recently launched a new program called Horizon, which plans to develop products that enable institutional adoption of decentralized finance through real-world assets (RWA), namely an RWA product that allows institutions to use tokenized money market funds (MMFs) as collateral to borrow USDC and GHO on a large scale. Aave Labs hopes to further bridge the gap between traditional finance and DeFi through this product.

However, within a few days of the proposal being released, the community expressed strong opposition to the Horizon plan, especially questioning the potential issuance of new tokens and Horizons profit distribution mechanism.

Temperature Assessment awaits community approval, Horizons profit distribution and new token distribution become the focus of controversy

According to the Temp Check proposal, Aave Labs said that the demand for tokenized real-world assets (RWA) is rising due to tokenizations ability to increase liquidity, reduce costs, and enable programmable transactions around the clock - making traditional assets more accessible on-chain. Tokenized U.S. Treasuries grew 408% year-on-year to $4 billion, and institutional adoption accelerated in the process, with on-chain RWAs expected to reach $16 trillion in the next 10 years. To meet this growth demand, Horizon, a project initiated by Aave Labs, proposed to launch an RWA product that would run as a licensed instance of the Aave protocol. Horizon will allow institutions to use tokenized money market funds (MMFs) as collateral to borrow USDC and GHO at scale, unlocking stablecoin liquidity and expanding institutional access to DeFi.

Upon approval by Aave DAO, Horizon’s RWA product will be launched as a licensed instance of Aave V3, and will migrate to a custom Aave V4 deployment when possible. To support long-term alignment with Aave DAO, Horizon will implement a structured profit-sharing mechanism, allocating 50% of revenue to Aave DAO in the first year, and driving ecosystem growth through strategic incentives.

According to Aave Labs, Horizon will have several key design components, including a permissioned RWA token supply and withdrawal mechanism, permissionless USDC and GHO supply functions, stablecoin lending for qualified users, exclusive GHO facilitators, support for on-demand GHO minting, a permissioned liquidation process, integration with ERC-20 tokens in the RWA whitelist (allowlisted), and asset-level permission control managed by the RWA issuer.

Aave Labs said that Horizon will implement a structured profit-sharing mechanism. Specifically, 50% of the profits will be distributed to Aave DAO in the first year, 30% in the second year, 15% in the third year, and 10% in the fourth year and beyond.

In addition, if Horizon issues tokens, 15% will be allocated to Aave DAO as follows:

10% allocated to Aave DAO Treasury

3% reserved for Aave ecosystem incentives

2% distributed to Staked Aave (stkAAVE) holders in the form of airdrops

In terms of operational support, Aave DAO and its service providers will oversee the operational functions of the Horizon RWA product. At the same time, Horizon will retain independence and be responsible for configuring the instance and guiding the strategic direction of the product, including adapting to market changes, meeting institutional needs, and expanding to new networks.

Strong community reaction: Profit distribution ratio is only 10% after 4 years, and the use case of new tokens is unclear

However, the launch of the Horizon plan did not receive general support from the community, but instead triggered fierce opposition. EzR 3a L, an independent representative of Aave DAO, said, I think this decline rate (the distribution ratio of profit sharing) is too aggressive and does not even follow the guidelines here. Because we can all agree that the first and second years may be the market launch stage, so the income will not be too high, unless Aave Labs promises to provide liquidity support in advance, and such a promise, if any, should be shared with the DAO in order to estimate potential income. Otherwise, I think the real substantial income may not appear until the third year and beyond, and the profit sharing ratio has been reduced to 10% by then, which confuses me.

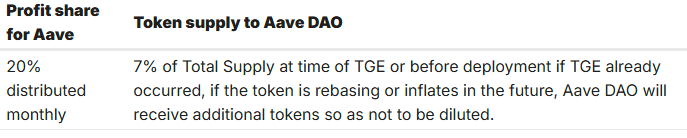

Guidelines mentioned by EzR 3a L: Aave profit share: 20% distributed monthly; Aave DAO token supply: 7% of total supply distributed at TGE (Token Generation Event) or before deployment (if TGE has already occurred). If the token is rebased or inflated in the future, Aave DAO will receive additional tokens to avoid dilution.

EzR 3a L said, Next is the token allocation alignment, which is the part that I am most confused about. Is it (the new token) for independent governance? Is decentralized governance really necessary for a permissioned market that is only accessible to qualified institutions? Is it for investors in Aave/Avara to be compensated? Because VCs usually expect this arrangement if profits cannot be shared in other ways. Is it a way for Aave Labs/Avara to generate profits? Because it may include a profit sharing mechanism as one of the features?

In addition, he asked, how will the minting process of GHO work? Will the core instance of Aave mint GHO first and then lend it to the instance, or can the instance mint GHO directly and thus obtain the income brought by GHO lending? Finally, Aave DAO and its service providers will oversee the operational functions of Horizons RWA product. What does this mean? Under the V3 version, what parts of the instance will the DAO control? But once the V4 version is launched, will the DAO no longer have anything to do with it?

EzR 3a L said that what is more worrying is that the Aave token seems to be abandoned while another product based entirely on the Aave codebase (the development of which was funded by the DAO through multiple funding proposals, with $12 million spent on version 4 alone last year) is launched.

“It looks like AaveLabs and Avara are looking for ways to monetize this product, which is totally fine. I’ve been supporting this since the Ethlend days. It will definitely take a lot of resources to get large institutions on-chain. But there could be other better ways to do this that are consistent with the community and the DAO. For example, Horizon could pay fees in USDC and GHO and have the DAO keep those fees, while perhaps having some degree of restrictions on Horizon’s governance due to legal issues.”

EzR 3a L believes that if we do this, we can create a super DApp - Aave, and split it into two branches:

Aave Market: Facing the on-chain DeFi ecosystem and on-chain government bonds

Horizon Market: For institutions that want to be fully compliant and legally on-chain

Meanwhile, other community members have criticized the issuance of new tokens. gregrwalsh said: I dont really like the proposed token issuance method. I dont understand why the Aave token should be diluted. If a new token is needed for some reason, it should be kept at a 1:1 relationship with the Aave token, and holders should receive a corresponding distribution based on the proportion. In addition, the revenue share of the Aave DAO is also declining. This is obviously planned to operate as a new entity. I dont agree with this proposal. ParkerB 123 said: In my opinion, there is no reason to issue a new token. If it is for governance purposes, then $AAVE itself should be used as the governance token. After all, this is an initiative of AAVE Labs.

L1 D investment partner 0x LouisT was even more scathing, noting that launching a new token for a new business line is a scam. Did Amazon spin off AWS into a new company? Did Apple launch a separate stock for AirPods? Apparently not. Investors support the protocol both for its current business and its future potential. Splitting the token is the exact opposite - a huge red flag. The market will punish it. If we want cryptocurrencies to be taken seriously, projects need to start operating like serious businesses.

Aave founder Stani responded: DAO consensus will be respected

After the incident fermented for several days, Aaves founder and CEO Stani Kulechov (@StaniKulechov) responded on March 16: The overall consensus of Aave DAO is that there is no interest in other tokens. This consensus will be respected, and Aave DAO is a real DAO. Once a suitable method is found, RWA exploration will continue.

“It is now clear that the DAO has reached consensus that even if the token could accelerate Aave’s revenue growth by bootstrapping liquidity, it will not generate widespread interest. Our team does not intend to stick with the proposal, especially since this is the least exciting part of the temperature check, and I believe there are other ways to find how to bootstrap liquidity and revenue streams through centralized businesses and products that are interested in using the Aave tech stack.”

Stani further noted that RWA is an extremely important revenue exposure for Aave DAO and as mentioned before, should not be ignored, so we will revise the proposal to take feedback into account. We must remember that Aave DAO is a real DAO, any preliminary discussions and consensus reached must be respected, and our team has no interest in promoting anything that the DAO does not deem appropriate. This is why the smart money is betting on $AAVE.

Crypto researcher @0x Coumarin said that in fact, AAVEs Horizon proposal can be completely split into more detailed sub-proposals. The demands of DAO are actually very simple: 1. No new tokens, the money to attract liquidity can be provided by AAVE DAO; 2. The proportion of protocol income given to AAVE DAO needs to be increased. It is a general trend for DeFi protocols to move closer to institutions. The launch of Horizon can increase AAVE DAOs income, just more or less. In addition, Horizon will support $GHO as the main lent stablecoin, which can increase the market size and income of AAVE stablecoin business.

The communitys concerns are understandable. If new tokens are allowed to be issued and the profit sharing ratio is reduced, then from the perspective of making money, the team will definitely focus more on the construction of Horizon. Horizon itself is also a product for institutions, and does not need the expected growth of new tokens through points activities. The analogy of $AERO to $VELO does not apply here.

The distribution details of the new tokens are also very strange. Only 15% will be allocated to Aave DAO, 10% will enter the Aave DAO fund pool, 3% will be reserved for Aave ecosystem incentives, and 2% will be airdropped to Staked Aave (stkAAVE) holders. It is reasonable to speculate that AAVE Labs will receive a large amount of token-based income from the remaining 85%, which is why the community believes that the team is starting a new project to make money. In summary, the launch of Horizon is a good thing. It depends on how the community and the team can reach an agreement on the distribution of benefits.