Original author: Jake

Original translation: TechFlow

In the first three months of 2025, U.S. crypto policy has evolved faster than in the previous three years.

Cant keep up? I compiled them all into one comprehensive report.

Note: The following is a condensed summary of the report. For the full report, please visit here

Lawmakers in 26 U.S. states have introduced bills that would create state-level Bitcoin or digital asset reserves.

44 states have proposed broader legislation covering digital asset regulation, consumer protection, legal recognition, and the integration of blockchain in government services.

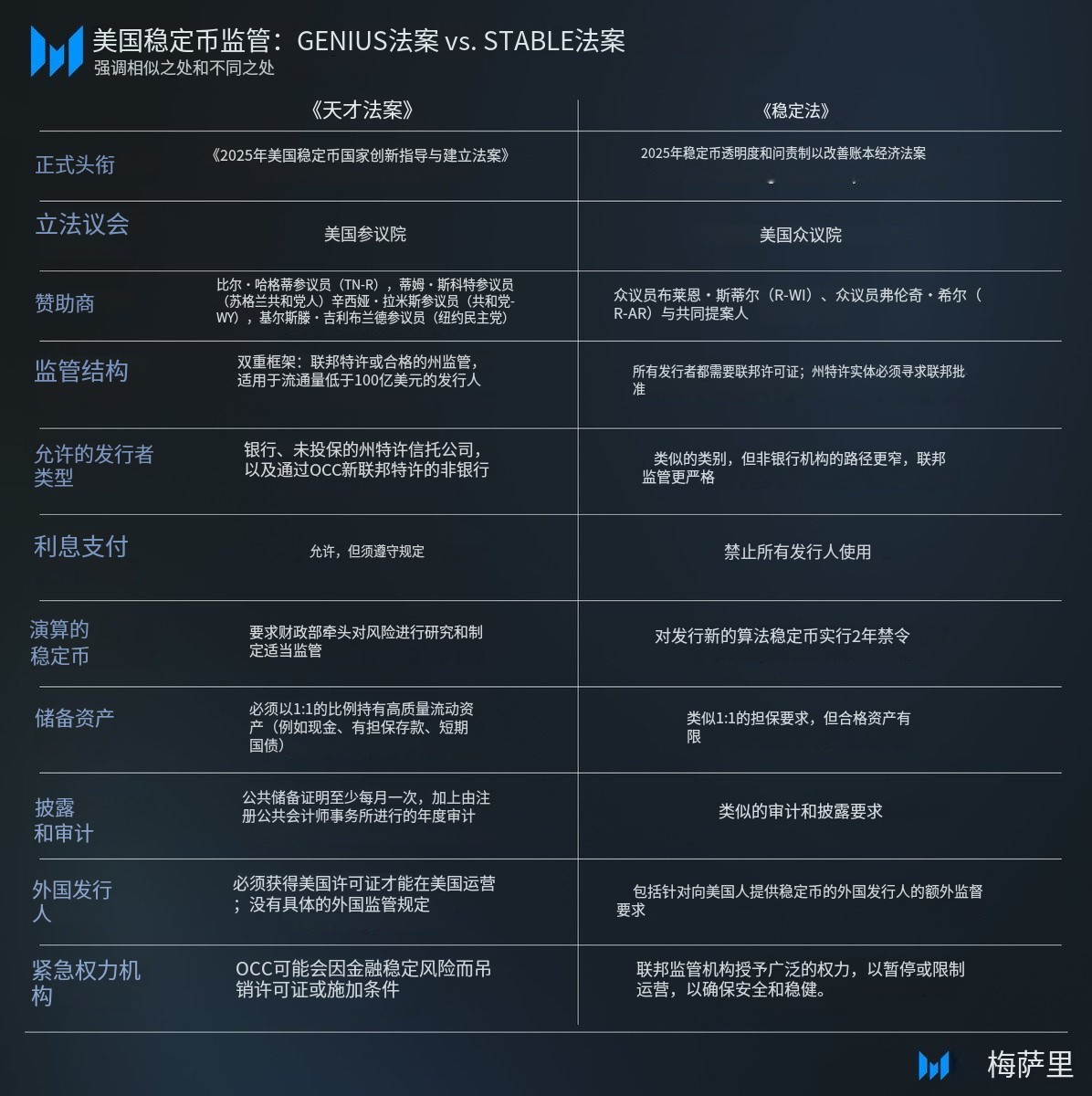

Two stablecoin bills have advanced in Congress: the GENIUS Act in the Senate and the STABLE Act in the House.

The similarities and differences between the two bills are shown in the figure below.

(TechFlow Note: The image content is AI translated)

Since February, the SEC has suspended or dismissed several cases against the following companies:

Binance, Coinbase, OpenSea, Robinhood, Uniswap, Gemini, Justin Sun, Consensys, Kraken, Yuga Labs, DRW, Ripple, Immutable and Crypto.com.

The SEC withdrew SAB 121 and clarified that proof-of-work mining and certain fiat-backed stablecoins do not fall under securities laws.

The U.S. Department of Justice disbanded its crypto enforcement unit, reinforcing a broader shift away from punitive regulation and toward regulatory clarity.

A full federal regulatory proposal is due by the end of July 2025 (180 days after Trump’s January 23 executive order). The proposal will include a national framework for stablecoins, exchange regulation, and market structure.

In full professional reporting , I analyze every post-election executive action, regulatory update, and legislative development in detail.