Original author: Alex Liu, Foresight News

HAEADL is the token of Sui Ecosystem Liquidity Staking Protocol Haedal, which has been confirmed to be listed on Binance Alpha and Bybit spot. Haedal announced the completion of its seed round of financing in January, but the specific amount was not disclosed. Investors participating in this round of financing include Hashed, Comma 3 Ventures, OKX Ventures, Animoca Ventures, Sui Foundation, Flow Traders, Dewhales Capital, Cetus, Scallop, etc.

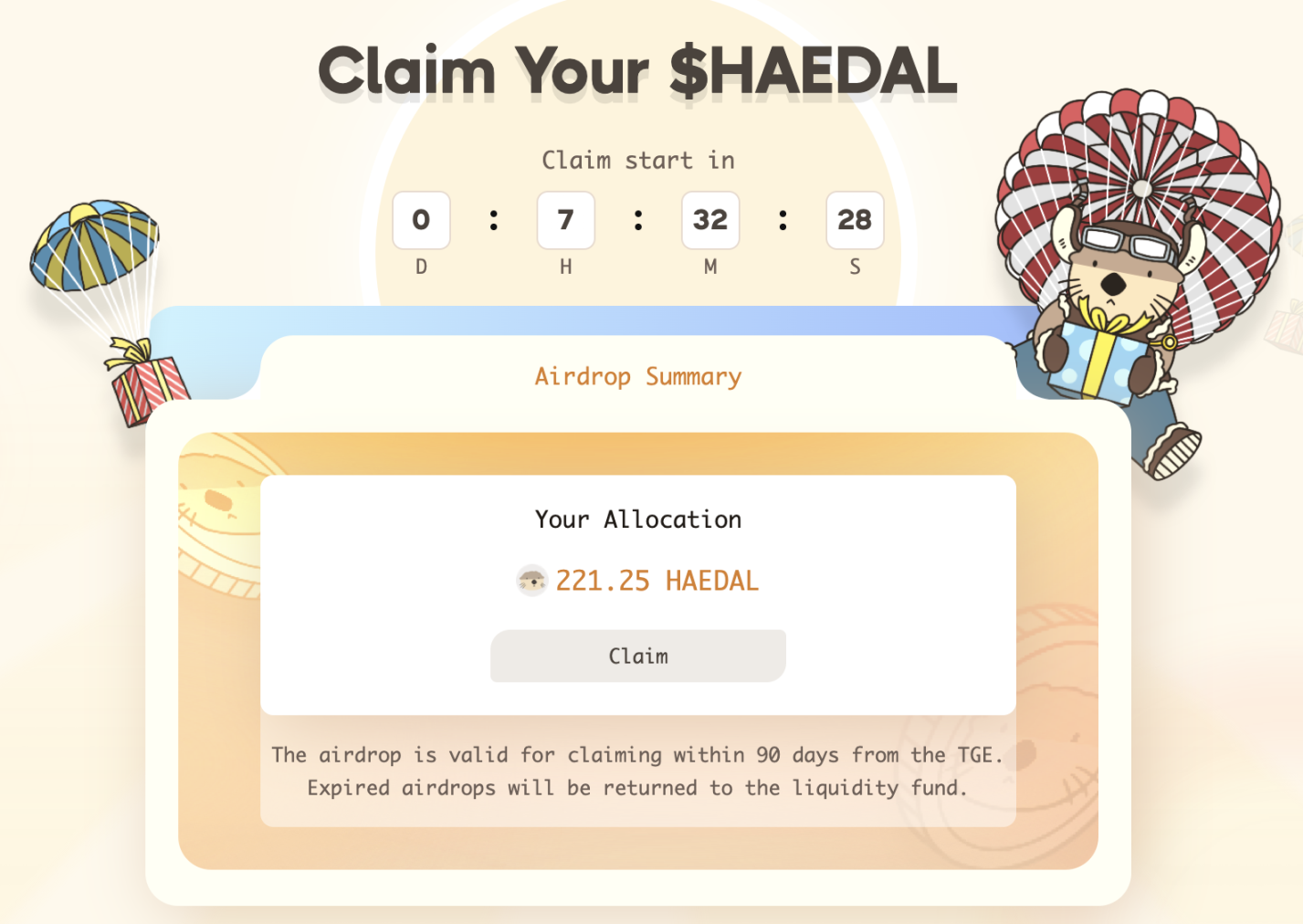

In addition, Haedal has opened the airdrop query interface and will start token claims at 20:00 today (April 29).

The author has accurately predicted the opening price of Sui Ecosystem WAL token in the article Is Sui Airdrop the Most Valuable? Comprehensive Prediction of WAL Token Value . This time, what is the reasonable price of HAEDAL?

First, let’s look at the token economics: the total number of HAEDAL is 1 billion, and the initial circulation accounts for 19.5% of the total supply. The total ecosystem incentive allocation is 55%, the liquidity fund accounts for 10%, investors account for 15%, and the team and consultants account for 20%.

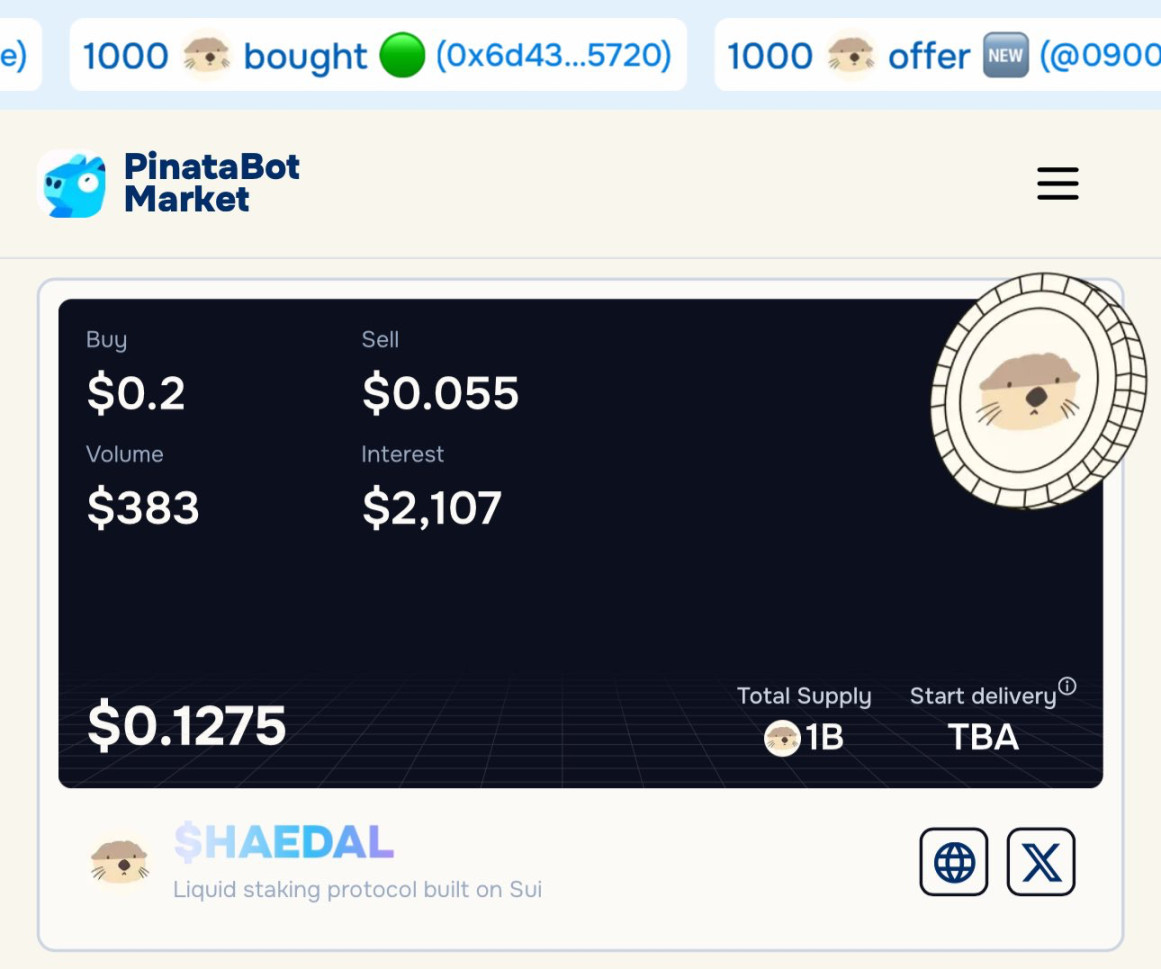

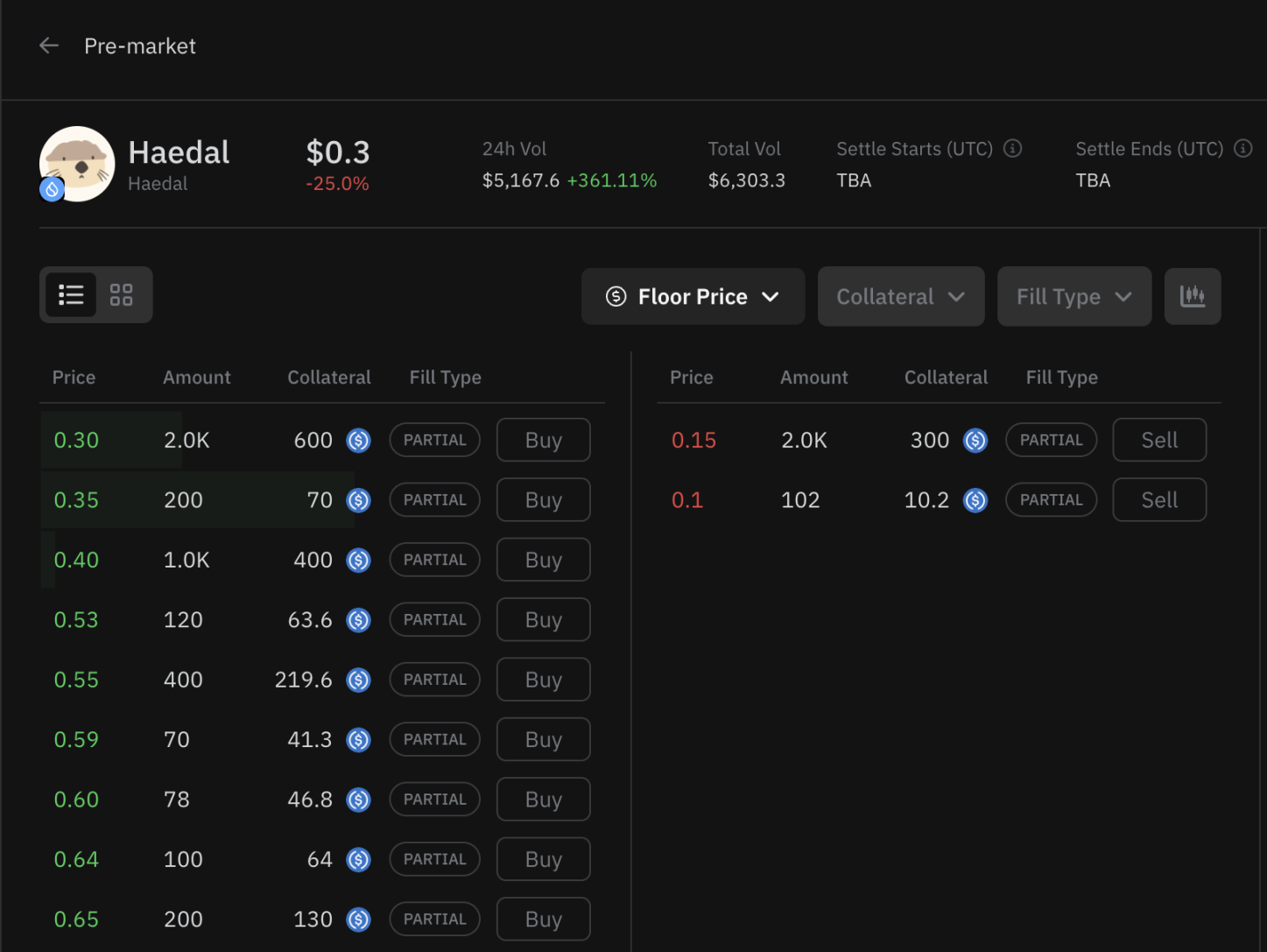

Pre-market price

Then look at the pre-market price. Currently, HAEDAL is quoted at 0.3 USDC on Whales.market and 0.1275 USDC on the pre-market PinataBot on Sui, corresponding to a fully tradable market value of $300 million and $127.5 million respectively.

The author believes that the prices on Whales.market are not reliable. In the quotation order book, the price of 0.3 USDC is the sellers order, while there are few buyer orders. The highest quotation of 0.15 USDC is only backed by a 300 USDC margin.

Observing the historical transactions on Whales.market at high prices, we can find that the total transaction volume is less than $1,000. Such a transaction volume is not enough to be an effective data reference, and it is more likely that the stakeholders have created high expectations at a low cost.

Comparison of projects on the same track

Back to rational analysis, how does the fundamentals of the Haedal protocol rank in the Sui ecosystem?

Sui Ecosystem Protocol TVL Ranking, data source: DeFiLlama

Haedal (LST) ranks fourth in TVL, behind Suilend (lending + AMM + LST), NAVI (lending + LST), and Cetus (AMM). It is worth noting that the TVL of Suilends liquidity pledge part (SpringSui) is also higher than Haedal, so Haedal is the fourth protocol in the Sui ecosystem and the second protocol in the LST track.

As the lending protocol with the highest TVL in the Sui ecosystem and the liquidity pledge LST protocol, the current FDV (full circulation market value) of the token SEND is only about 72 million US dollars. If the value of HAEDAL is higher than 0.1 US dollars, either HAEDAL is overvalued or SEND is undervalued.

in conclusion

Based on HAEDALs financing background, the high premium of the online platform, the current high attention, pre-market performance, and the actual market share of the Haedal protocol and the project fundamentals, I believe that HAEDAL has a small probability of opening above $0.1, but this will also be my selling range. In the short term, HAEDAL is likely to move towards $0.05 or even below.

The above is the author’s subjective analysis and does not constitute financial advice. Please DYOR (do your own research).