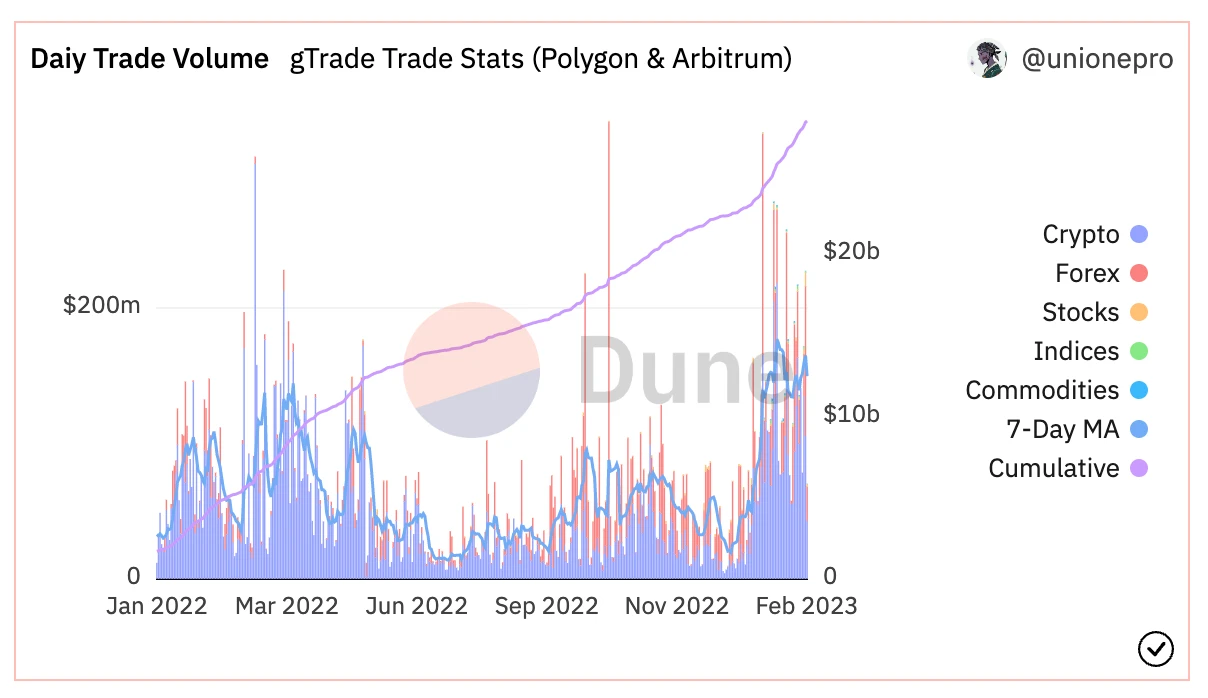

The new versions of GMX and SNX Perp both draw on a project - GNS. GNS has increased by more than 10 times since the Luna crisis last year, and its transaction volume and fee income have also hit new highs. This is inseparable from its continuous innovation in mechanism. This article will give you a detailed introduction to the mechanism, development history and competitive advantages of GNS. It can be said that if you understand GNS, you can see through many DEX PERPs at a glance.

first level title

Mechanism of GNS

If you lack a basic understanding of GNS, it is simply a decentralized perpetual contract platform:

Oracle pricing, LP and Trader betting

LP is a pure stable currency that supports foreign exchange/stock/cryptocurrency transactions

Two-way funding rate, one party pays the other party the same as CEX Perp

On the other hand, you can read what I wrote beforeGNS Chinese Encyclopedia, content other than LP (DAI Vault) is still meaningful.

Related Reading:

Related Reading:Rumors, Problems, and the Future of GMX

GNS has three mechanisms to control risks on the transaction side and the LP side, the core of which is:

Asset spot liquidity determines the slippage of on-site transactions and prevents price manipulation

Asset price volatility and long-short ratio determine the cost of continuing to hold positions, and deal with unilateral market conditions

Net worth model plus liquidity adjustment and cash flow cycle to build a stable LP

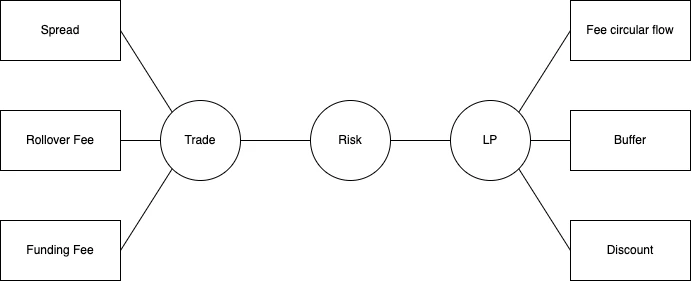

GNS uses the triple mechanism of Spread, Rollover Fee, and Funding Fee to carry out risk control on the transaction side.

Spread: Additional opening costs, the larger the opening position, the less liquid the assets, the higher the cost. It is used to prevent price attacks and facilitate the listing of small currencies.

Rollover Fee: Priced by spot volatility, used to control traders leverage and risk

Funding Fee: The price is determined by the difference between long and short positions and the spot volatility. When long/short > 1, the long pays the short, and vice versa. It is used to balance the long-short ratio and avoid excessive unilateral exposure.

For details, see:gTrade v 6.1: In-depth

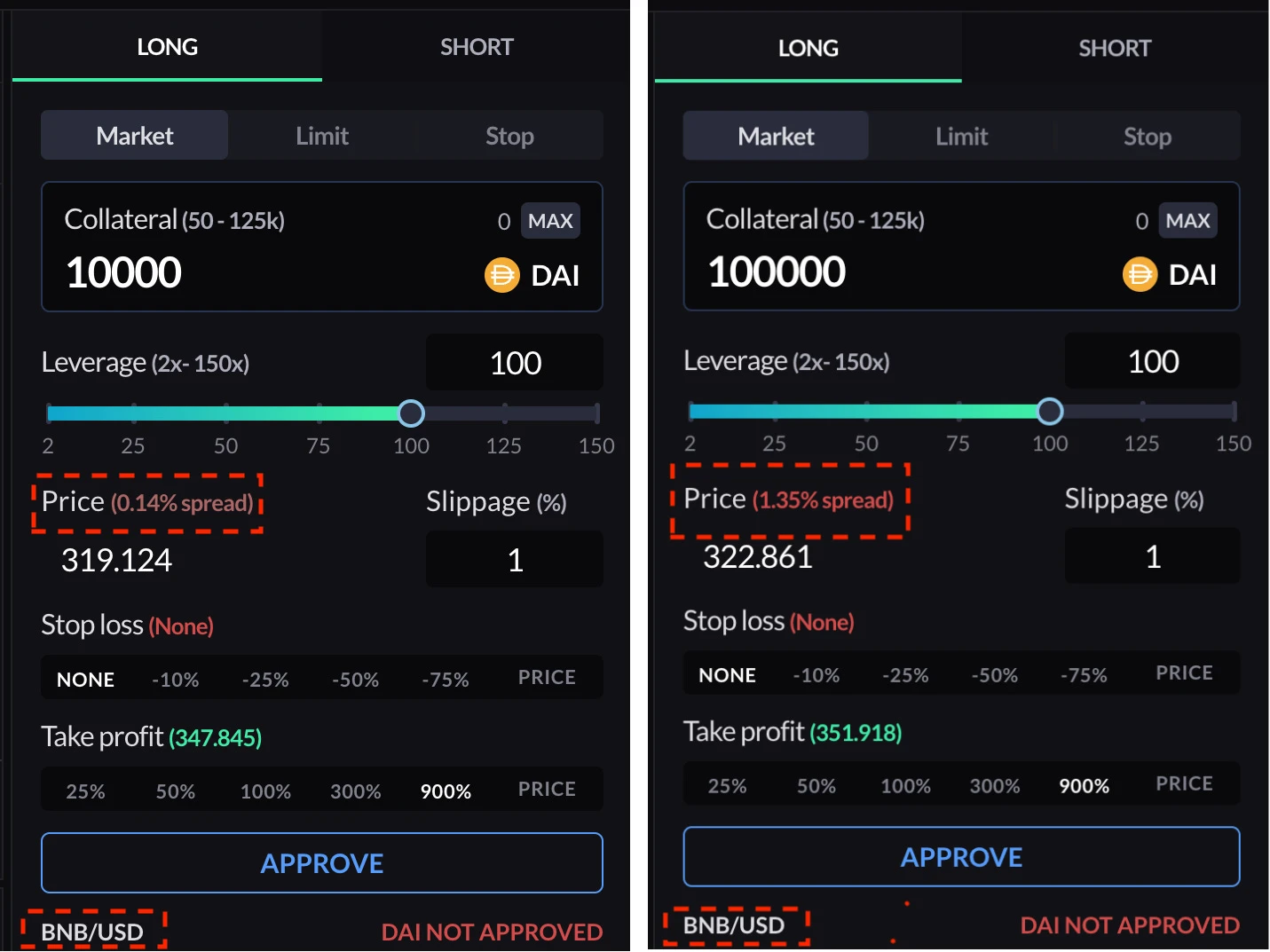

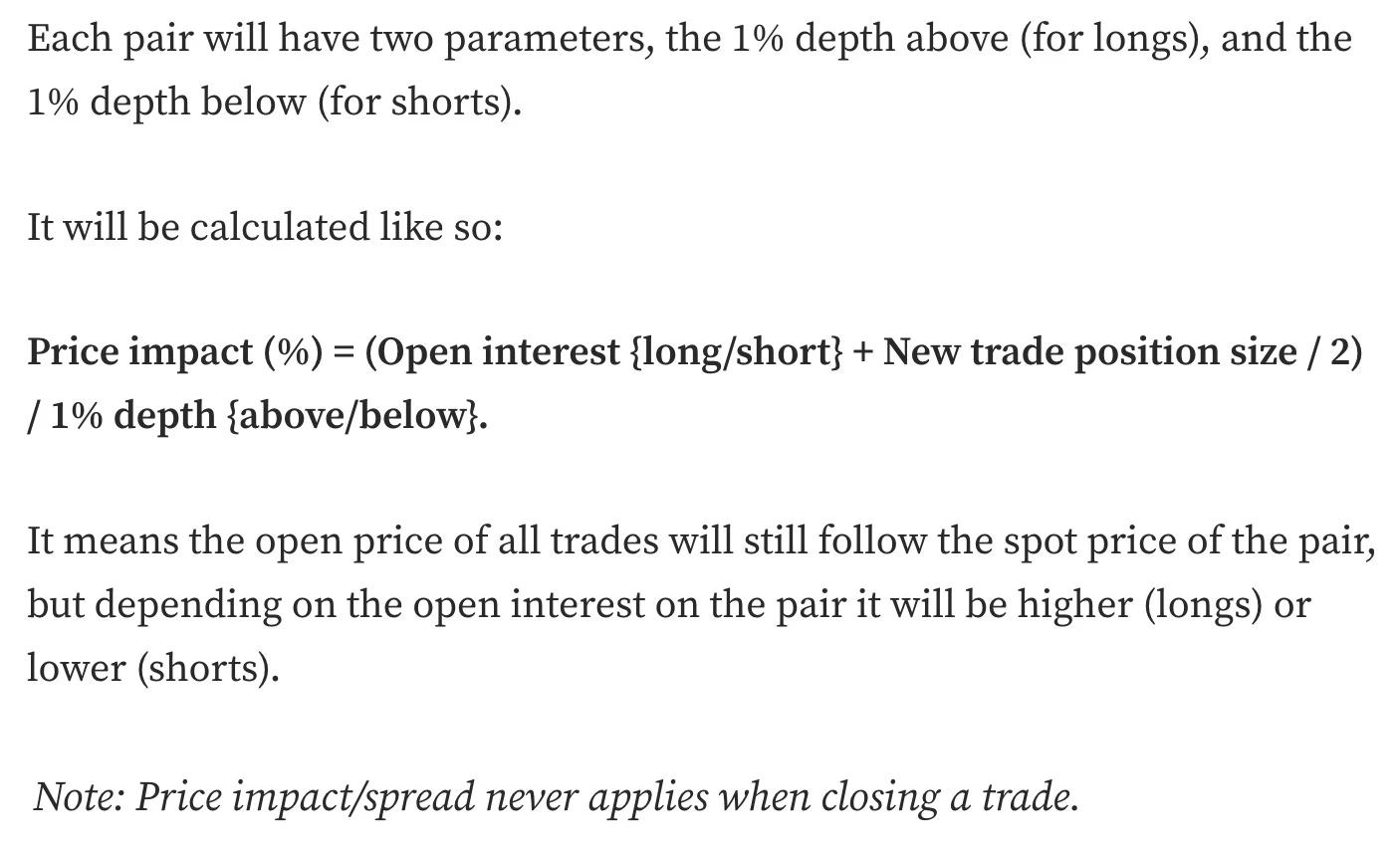

Spread is the extra slippage that needs to be paid when opening a position. For oracle pricing, its slippage should be dynamically adjusted according to the depth of the transaction pair from the oracle source (CEX), so that the cost of manipulating prices outside the market is always higher than the profit on the market. Therefore, Spread is positively related to the scale of opening positions and the impact of on-market OI, and negatively related to the depth of off-market spot. See the formula below

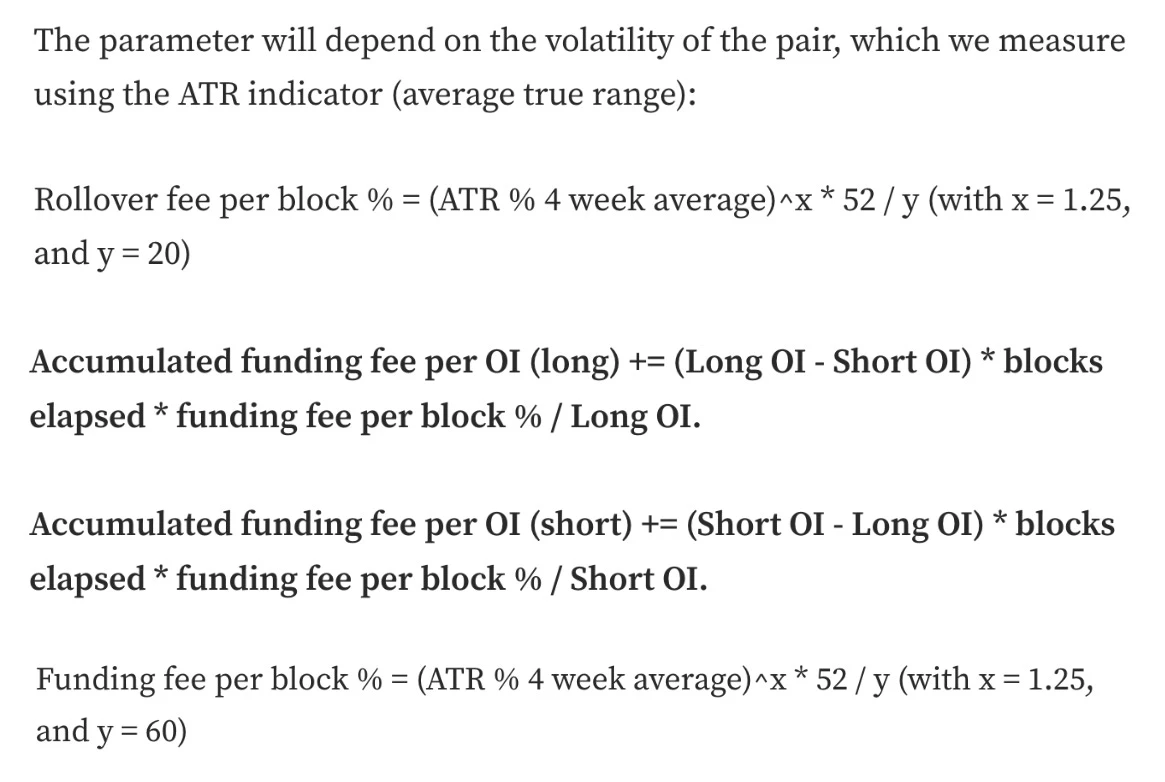

Rollover Fee / Funding Fee is calculated based on recent volatility. Rollover Fee is paid for both long and short positions, while Fung Fee is determined by the long-short ratio and paid by one party to the other. See the figure below for the specific formula. In the violent bull market, the increase in volatility and the long-short ratio will cause the fees paid by multiple parties to rise rapidly, so as to cover the losses of the counterparty and control the long-short ratio. Of course, these have also caused high transaction costs, so in cryptocurrency, an asset class that can be used as Index Asset LP, the volume will be inferior to GMX. For stocks/forex, which do not have assets on the chain, it is extremely advantageous.

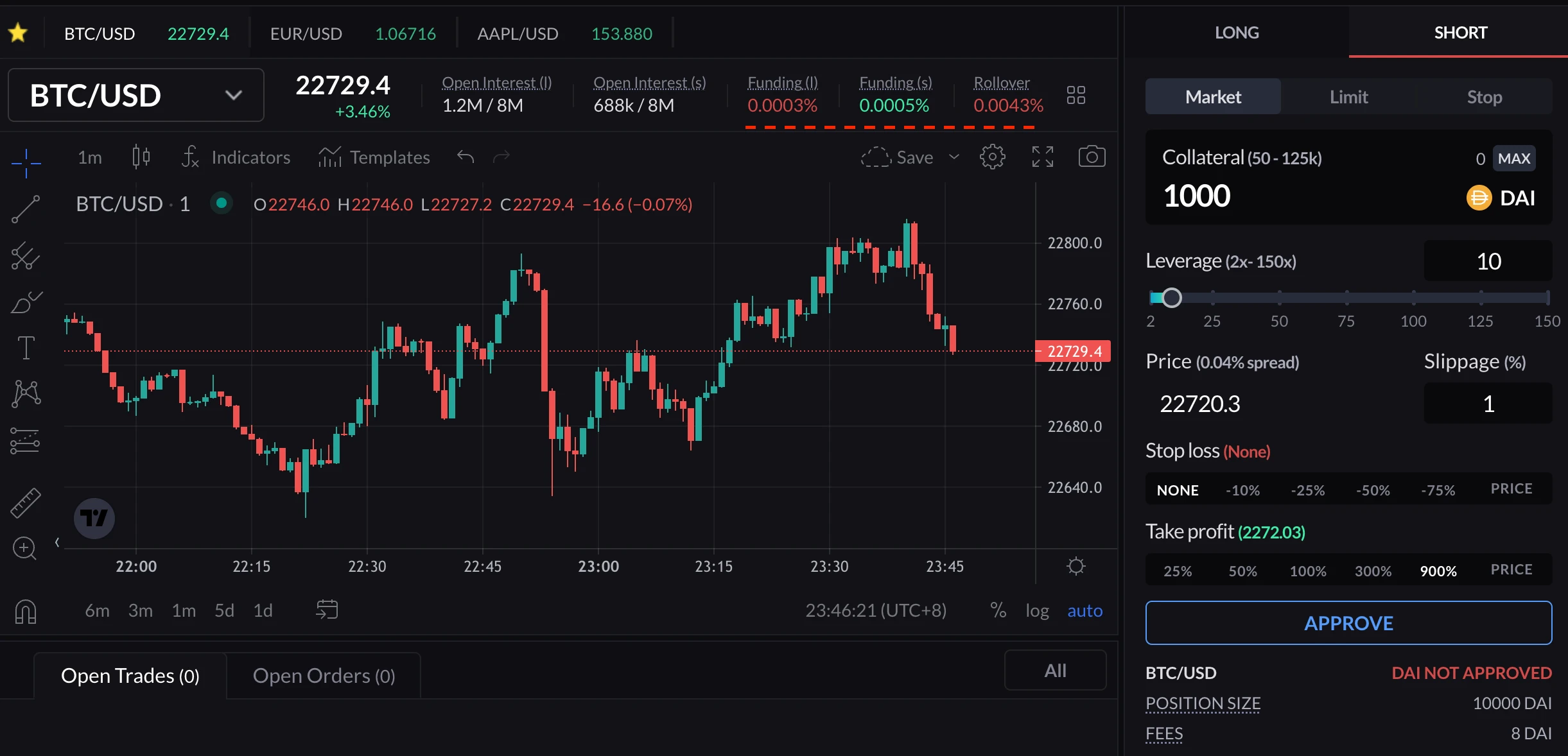

The so-called Rollover Fee is only applied to the collateral, that is, you use $1k to open a $10k position, and you only receive interest based on your $1k, while the Funding Fee is applied to the position, and you receive 41% based on $10k. For example, in the picture below, $1 k open short $10 k BTC, Funding Fee (s) = -0.0005% , Rollover Fee = 0.0043% . Then the final Fee that needs to be paid = ($ 1 k * 0.0043% - $ 10 k 0.0005% )/$ 10 k = -0.00007% , that is, you can still earn interest when you open short positions at this time.

LP side - gDAI also has a triple mechanism to make it run robustly:

Net value products similar to GLP, without capital protection

Fee income/Trader PL creates a layer of buffer for gDAI to avoid price drop

Incentivize long-term lock-up funds, dynamically adjust the time of entry and exit, and avoid liquidity problems in extreme situations

The advantage of the so-called net value products is that all pledgers are treated fairly, and extreme situations are shared. The old LP model is so-called capital preservation, but under the deficit, the last one who runs away will not get a penny. Yes, it is the same as FTX, so it is easier to panic at a critical moment.

The most difficult thing to understand here is the heavy mechanism of Buffer. Part of the GNS fee income will be paid to users by Mint’s new GNS, while the DAI originally used as income will enter gDAI to form the over-collateralized Buffer. Trader’s profit and loss will be in the over-collateralized Under certain circumstances, it will also enter the Buffer, which makes gDAI not guaranteed capital in name, but in fact the price will not drop most of the time, which shows that it is well aware of the publics loss aversion psychology.

At the same time, in the case of over-collateralization, GNS takes part of the profits brought by Traders losses to repurchase GNS, and keeps the over-collateralization rate fluctuating within a safe range. In this way, in the long run, GNS will not be in a state of massive additional issuance.

Long-term lockup of LP will give it a certain discount, and the source of funds for the discount is also paid from this Buffer. The so-called dynamic adjustment means that the lower the over-collateralization rate, the slower the withdrawal, which increases the ability to resist risks. Although it is a bit strange to do so, the rules are open and transparent in advance.

Yes, you may not understand the above paragraphs, this is normal, otherwise how can I call it the most sophisticated and complex in history. If you really want to understand, you can read the original introduction of gDAI firstIntroducing gToken Vaults.first level title

Development History

In the crash brought about by Luna, GNSs LP once fell into a deficit deadlock, and was forced to sell GNS for DAI to make up for the gap.Later, GNS was improved in many ways, and it performed well in the panic caused by FTX.

first level title

Competitive Advantage

The core advantage is that through its complex risk control mechanism, it provides a foreign exchange/stock derivatives trading place with qualified experience. The trading experience on these assets is the best, so that its products can stand on its own. On the other hand, the two-way funding rate has allowed it to achieve differentiated competition with GMX, and it has also successfully acquired some customers in terms of cryptocurrencies. This is inseparable from the excellence of the GNS team, which is the most valuable asset of this growing project.

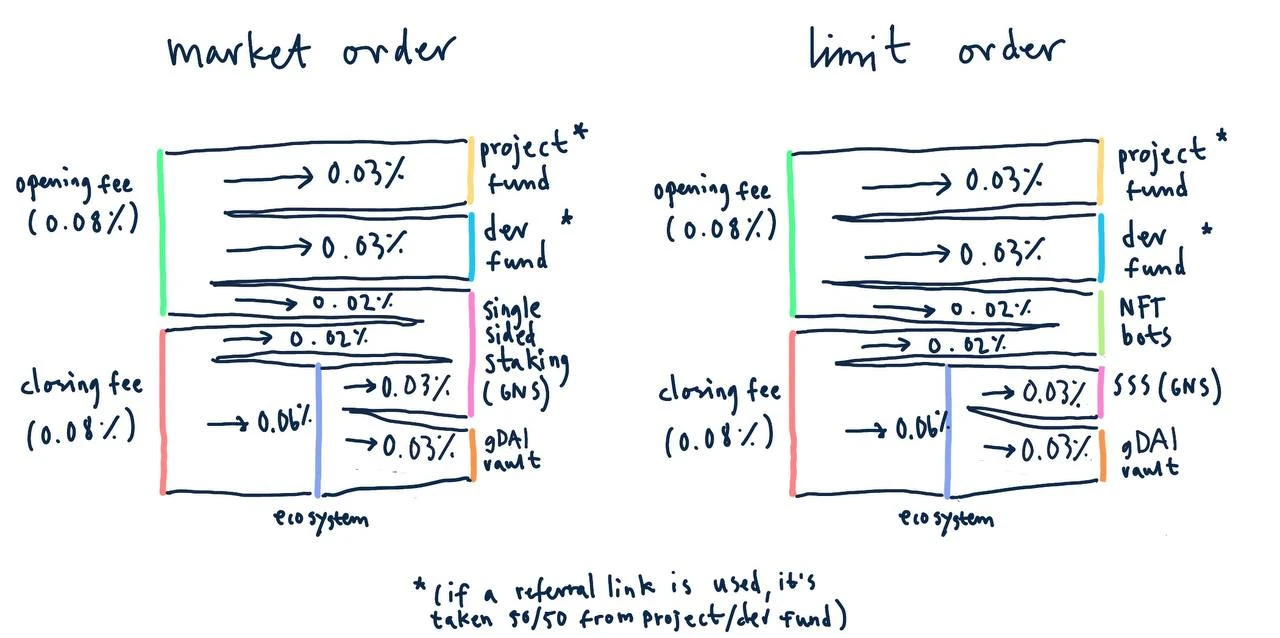

The details of GNS fees are as shown in the figure below. Considering that market orders account for about 70%, the GNS Staking share is about 0.07/0.16 x 70% + 0.03/0.16 x 70% = 36.25%, and the gDAI share is about 0.03/0.16 = 18.75 % . The part of the limit order paid to the NFT Bots (execution robot) is the part that entered the gDAI Buffer in the previous tweet.

Yes, GNS pays an unusually low percentage of revenue to LPs, so why is it able to do this?

In order to avoid Fork, GNS has been audited but not yet fully open source

As mentioned in the previous tweet, its mechanism is extremely complicated, it is very difficult to copy, and it is easy to overturn if it is not copied

LPs that are not fully collateralized allow them to operate with high capital efficiency

Summarize

Summarize

Original link