0. Executive Summary

0.1 TL;DR

The Pendle project itself is well-built, with transparent data and reasonable token distribution. The team has excellent resume and technical capabilities, and the core members are long-term stable and have the ability to independently advance complex systems. In terms of token structure, although the tokens of the team and the foundation have all been unlocked, the overall selling rhythm is rational and restrained, showing good long-termism. Pendle has performed well in trustworthiness and medium- and long-term delivery capabilities and is a typical hardcore DeFi project.

From the perspective of products and technology, Pendles core mechanism (PT + YT split) builds a new on-chain interest rate logic. The AMM design has a high degree of financial engineering understanding and successfully commercializes the trading of income rights. At the same time, the introduction of innovative superpositions such as points and airdrop rights makes it both profitable and game-like. Pendle far exceeds similar projects in product engineering and mechanism design capabilities and is a protocol with a deep moat.

From the product roadmap, Pendles development path is clear and stable. In 2023-2024, it will complete the transformation from LRT-driven to interest-bearing stablecoin-dominated market. In 2025, it will clearly propose to expand to funding rates, non-EVM ecology, etc., and continue to extend its life cycle. From this point of view, Pendle has strong strategic execution and clear direction. It is one of the few DeFi projects that can self-find the second growth curve.

From the perspective of the economic model, Pendle adopts the veToken architecture to achieve a closed loop of token value: lock up positions to participate in governance, obtain profit sharing, and increase LP income. The main income comes from YT income fees and PT transaction fees, and there is no official commission, all of which is returned to the community. However, the valuation under the fee is somewhat overestimated, which also reflects the markets high expectations for its future.

From the perspective of market potential, the on-chain interest rate market where Pendle is located is far from being fully developed. The potential market includes: stablecoin interest rate spreads, LRT, RWA, and funding rates, with a scale of potentially hundreds of billions of dollars. Currently, Pendle has dominated the Ethereum ecosystem and is expanding to Solana, TON, Hyperliquid, etc. As a protocol-level platform at the critical point of the on-chain interest rate market, Pendle has extremely high long-term growth potential, but its development is still highly dependent on the continued expansion of the overall scale of interest rate products.

0.2 Narrative and Investment

The interest rate market infrastructure created by Pendle is highly forward-looking, building a standard layer for fixed income and income rights transactions on the chain, and successfully taking on multiple rounds of market themes such as LRT, stablecoins, and airdrop point markets. Its business direction is highly consistent with trends, its governance mechanism is sound, and its closed-loop income structure is clear. From this point of view, Pendle has a clear narrative anchor and valuation expectations, and has typical strong narrative + elastic fundamentals project characteristics, which is suitable for medium- and long-term allocation.

● Short term: As the stablecoin track ushers in its “second spring”, PayFi and airdrop narratives continue to ferment, and Pendle is expected to gain market game space; but it should be noted that the current on-chain data is showing a downward trend, which may put certain pressure on the short-term currency price.

● Medium term: With the launch of Boros and access to the funding rate market, a new customer base will be activated and a new narrative stage will be ushered in.

● Long term: Pendle is expected to become the “structural core facility” of the on-chain interest rate market, playing a role similar to the interest rate swap platform in TradFi. It faces a huge market space and has the potential for continued expansion and growth.

For long-term investors:

Although Pendle may have a certain short-term premium at the current stage, from a long-term perspective, its brand recognition, diversity of user structure, risk resistance and potential growth space in market share all have significant advantages. The project has clear medium- and long-term growth potential and is suitable for gradually building positions through fixed investment. It is recommended to start planning immediately.

Short and medium term players:

Due to the short-term market volatility and the fact that swap fees are currently experiencing a slow weekly decline, we recommend closely monitoring:

1. Will the stablecoin market usher in a second wave of market conditions? Recently, many stablecoin projects have received financing support, which is expected to boost the track’s activity again in the short term. As one of the main receiving platforms, Pendle may benefit from this round of capital and user inflows.

2. Whether new user groups emerge: From the early LRT to the current stablecoin users, Pendles core appeal lies in its ability to trade assets related to interest rates. If it can cover new scenarios such as PayFi or add new ecological user groups, it will become a key node to promote mid-term growth.

1. Basic Overview

1.1 Project Introduction

Pendle Finance is a decentralized interest rate trading protocol built on the Ethereum ecosystem, with the vision of becoming the infrastructure of the on-chain interest rate market. Pendle has created a native on-chain income rights market, opening up a new track for fixed income and income derivatives in DeFi, and is known as the Uniswap of the interest rate market in DeFi.

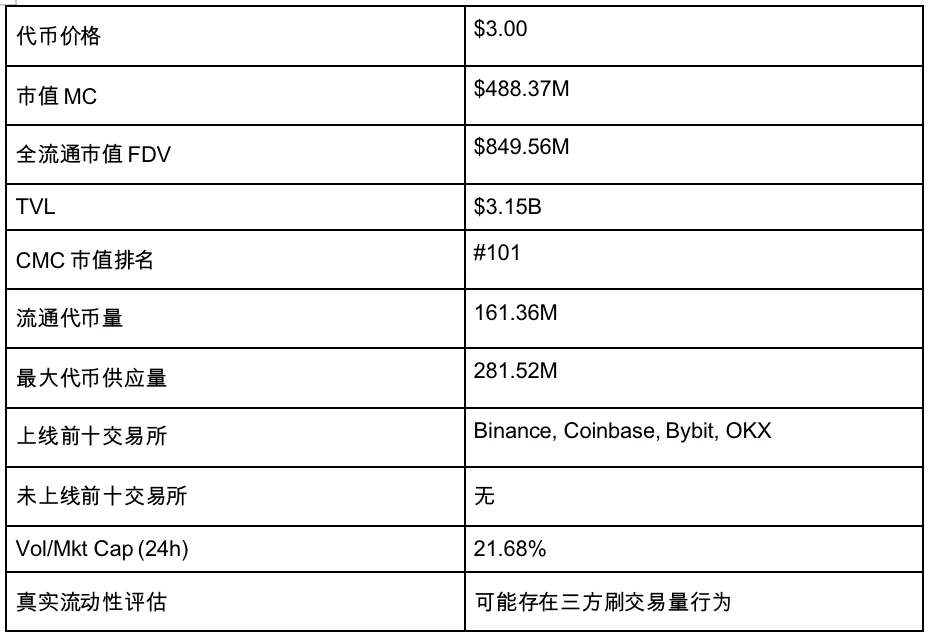

1.2 Basic Information

1.3 Team and Background Check

Pendle was founded in 2021. Its team members are based in Singapore and Vietnam. There are currently about 30 people registered on LinkedIn, with an average tenure of about 2.1 years, and a relatively stable management team.

TN Lee (X: @tn_pendle): Co-Founder, was a founding team member and business leader at Kyber Network, and later joined RockMiner, a mining company that operates about 5 mining farms. In 2019, he founded Dana Labs, which mainly produces FPGA customized semiconductors.

Vu Nguyen (X: @gabavineb): Co-Founder, formerly CTO of Digix DAO, specializing in the tokenized RWA project of physical assets, and later co-founded Pendle with TN Lee.

Long Vuong Hoang (X: @unclegrandp a9 25): Engineering Director, holds a Bachelor of Computer Science degree from the National University of Singapore. He joined the National University of Singapore as a teaching assistant in January 2020, joined Jump Trading as a software engineering intern in May 2021, joined Pendle as a smart contract engineer in January 2021, and was promoted to Engineering Director in December 2022.

Ken Chia (X: @imkenchia): Head of Institutional Relations, holds a bachelors degree from Monash University. He worked as an investment banking intern at CIMB, the second largest bank in Malaysia, and later worked as an asset planning expert at JPMorgan Chases private investment bank. He joined Web3 in 2018 and worked as a COO at an exchange. In April 2023, he joined Pendle as head of institutions, responsible for the institutional market - proprietary trading companies, cryptocurrency funds, DAO/protocol treasuries, and family offices.

Daniel Anthony Wong: Head of Growth. He holds a Bachelor of Electronics and Electrical Engineering degree from Nanyang Technological University. He joined Pendle right after graduation and has been with the company for about four years.

1.4 Funding/Financing

2. Products and technologies

2.1 Background

The DeFi world lacks a native interest rate market, and traditional interest rate tools cannot be replicated on the chain. Pendle has opened up a fixed income track on the chain through the mechanism of income rights separation. Pendles core vision: to transform all income-bearing assets into tradable income products, and realize the commercialization of fixed income, interest rate speculation and income finance.

2.2 Core Product Introduction

Pendle positions itself as an interest rate swap market. It is a decentralized yield trading protocol built on Ethereum that allows users to split, price, trade and combine future yield cash flows.

Its core function is to split profitable assets (such as interest-bearing stablecoins, staked tokens, etc.) into two tradable components: principal (PT, Principal Token) and income rights (YT, Yield Token), thereby forming an interest rate swap market.

This mechanism provides DeFi with unprecedented flexibility, allowing users to manage interest rate risks, lock in fixed returns, or speculate on future yield trends, just like in traditional financial markets.

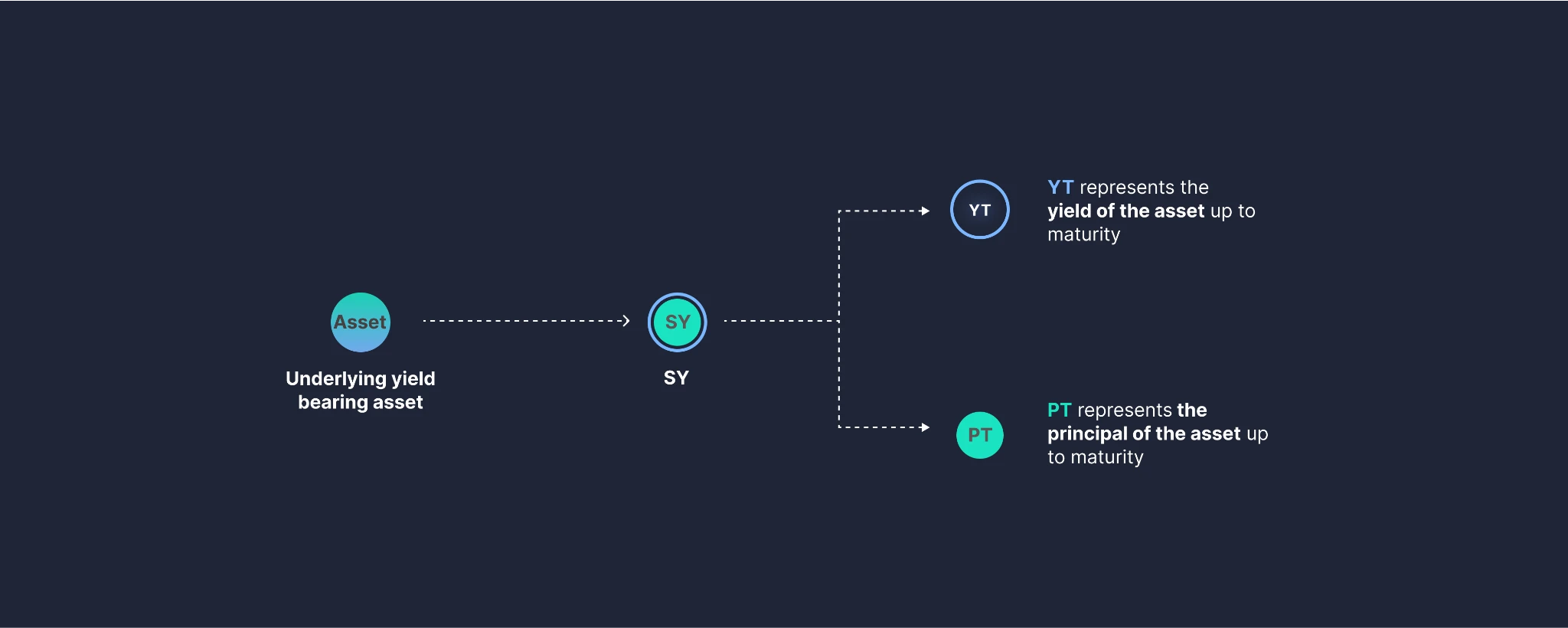

Pendle mechanism, source: Pendle

Pendle supports a variety of assets with income through a universal income asset interface (Standardized Yield, SY). After entering Pendle, these assets are broken down into:

● PT (Principal Token): only represents the principal rights and can be redeemed at 1:1 upon maturity;

● YT (Yield Token): represents the right to future income, and its price depends on future interest rate expectations.

In addition, Pendle has built an automated market-making system to make the PT and YT markets liquid and composable, and introduced a pool structure with low transaction slippage and strong mining incentives to attract long-term capital and DeFi professional users.

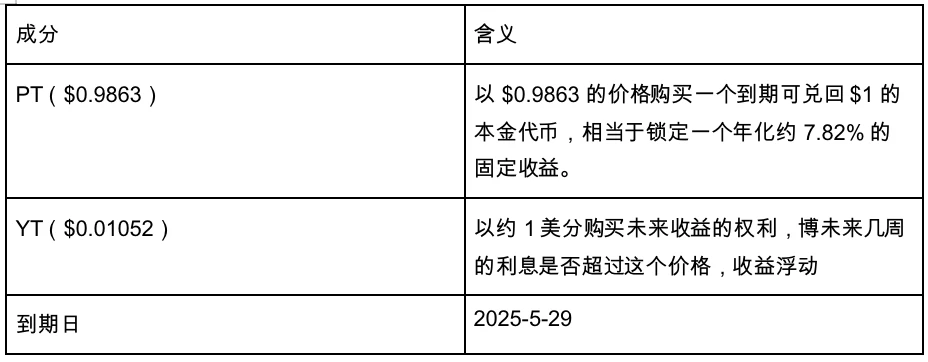

For example: sUSDe 2025-05-29 expiration pool

● Buy PT or sell YT to lock in future profits. If you hold sUSDe encapsulated by Pendle (i.e. converted from USDe), you can split sUSDe into YT and PT through AMM. You can choose to sell YT (that is, the right to 7.82% of future profits) to lock in your 7.82% profit in advance; or you can directly buy PT at a discount in the market and redeem it at 1:1 after maturity, which is also a way to lock in 7.82% profit.

● Buy YT and bet on future yield increases. If you believe that future on-chain market conditions or other factors will cause the yield of USDe to rise, then you can buy YT currently priced at low interest rates to take advantage of the possibility that future YT returns will exceed the yield at the time of purchase.

The buying and selling of PT/YT mainly relies on Pendle Finances automatic market maker (AMM), which is the core component of the protocol and the main source of profit, and is designed for trading principal tokens (PT) and yield tokens (YT). Unlike traditional constant product formulas (such as Uniswaps AMM), Pendles AMM takes into account the impact of time on asset value and can dynamically adjust its curve over time to reflect the accumulation of earnings and changes in PT price ranges.

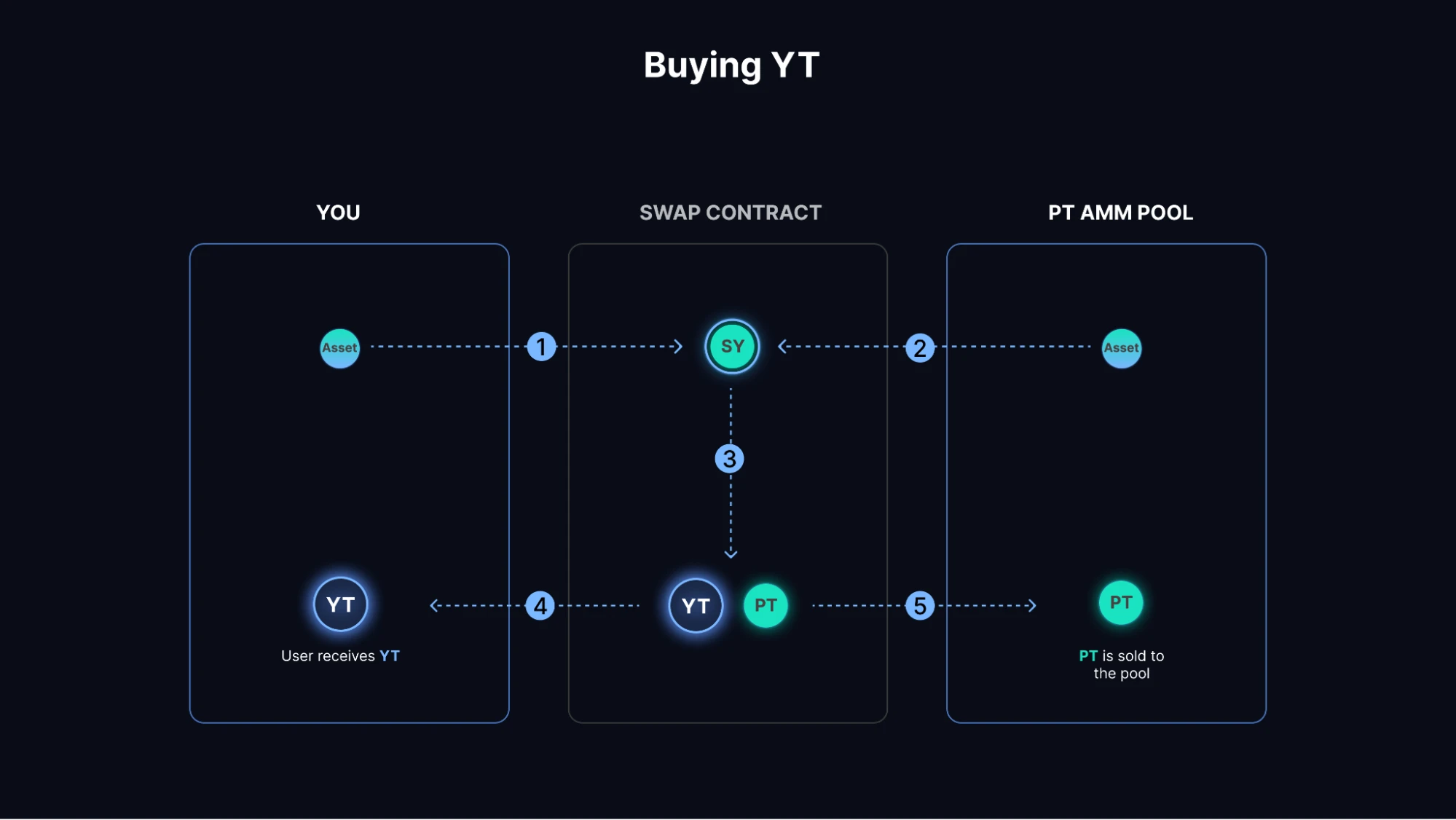

Its core components are: virtual AMM of PT and SY. This design allows users to directly use SY to purchase PT, thereby locking in future earnings, and also to buy and sell YT (earnings token) through the “Flash Swap” mechanism.

The specific transaction process is as follows (the user holds USDC but wants to buy USDe’s YT):

After the Swap contract receives USDC, it will use USDC to purchase the corresponding SY asset in the virtual AMM pool, which is sUSDe. Subsequently, sUSDe will be split into YT and PT assets by the Mint contract. YT assets are sent to the users address, while PT assets are sold in the AMM Pool. In this way, the user obtains the limited income rights and point rights (Ethena Points) of the Ethena USDe asset.

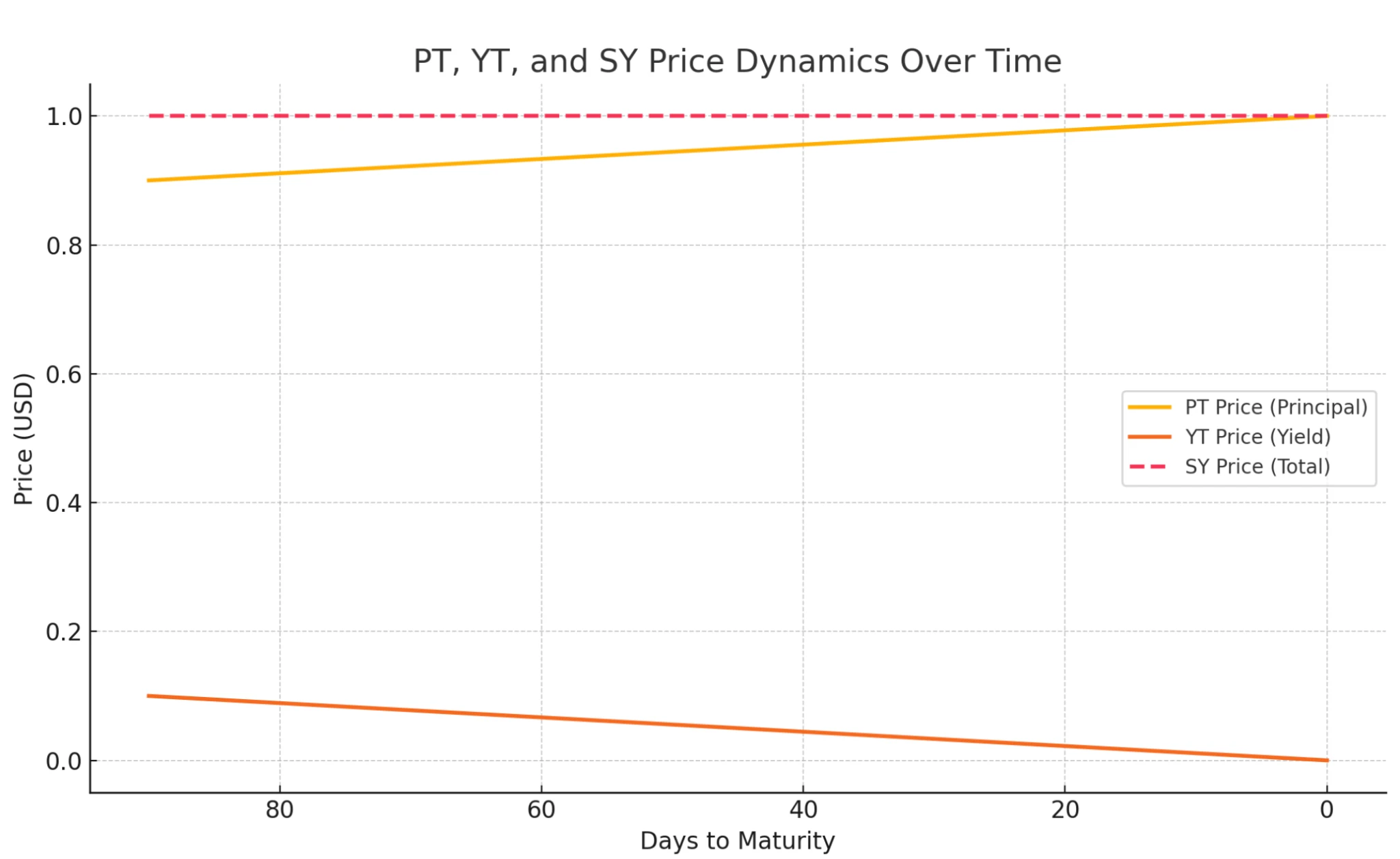

PT (Principal Token) + YT (Yield Token) = Current value of SY

This is the core algorithm of the AMM mechanism, which means that there is a direct correlation between the PT price and the YT price. If the market sells off PT, then YT will tend to rise, offsetting the price drop caused by the PT sell-off, and ultimately achieving an asset value that is always equal to SY. Therefore, even if there are only PT and SY in the pool, the price of YT can be derived without building two AMM pools.

PT YT and SY correlation

On the other hand, taking sUSDC as an example, assuming the expiration date is 90 days, as the expiration date approaches, the income will gradually approach 0, then the price of YT will gradually return to zero, and PT will gradually approach 1. We can understand YT as the right to capital gains within a certain period of time.

Pendle derivative gameplay: Combined with the point mechanism of the current airdrop market. For example, projects such as Ethena, EigenLayer, Renzo, KelpDAO, etc. will issue points to users who hold tokens (such as sUSDe, ezETH, rsETH) or pledge. These points mean future token airdrop shares. You can sell the right to future point income, or lend assets to earn point income, and others pay the interest. The logic of this gameplay is the same as YT (capital income rights), except that the subject matter is points instead of interest.

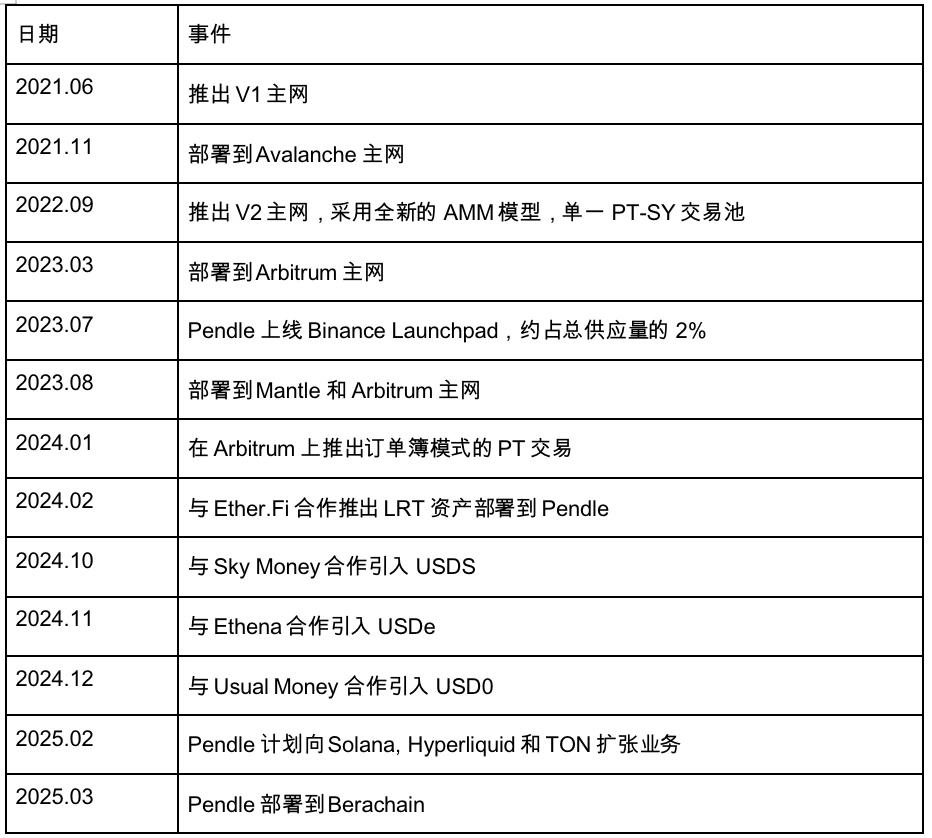

3. Project Development History

3.1 Past

3.2 Now

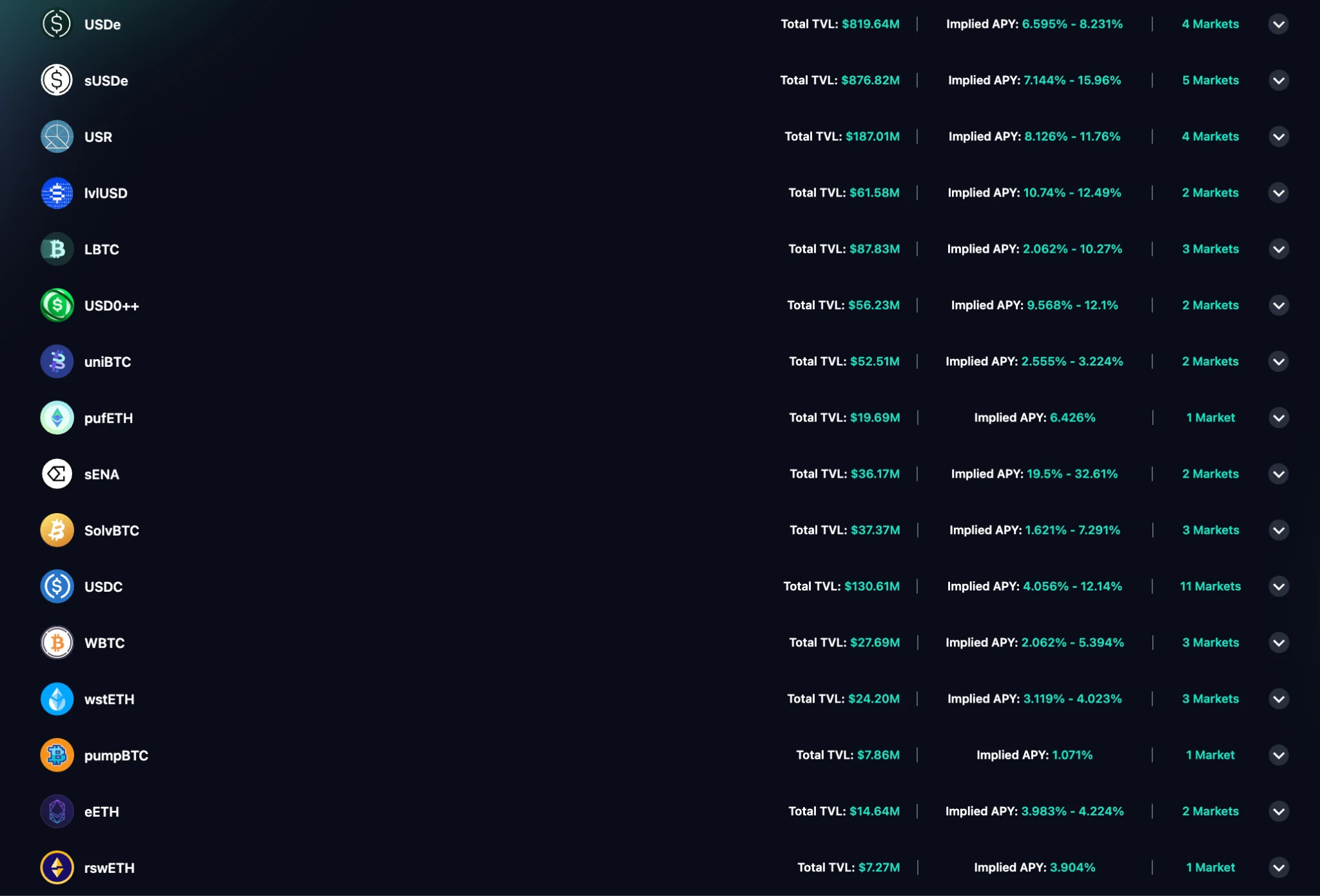

3.2.1 Ecological Development

Last year, its ecosystem was mainly based on LRT. With the end of the EigenLayer airdrop, the LRT track began to decline, and Pendles TVL, coin price, and ecological activity also declined significantly. After matching the growth trend of stablecoins, it ushered in growth again. The following are its main stablecoin ecological cooperation projects:

The landscape of ecosystem, source: Pendle

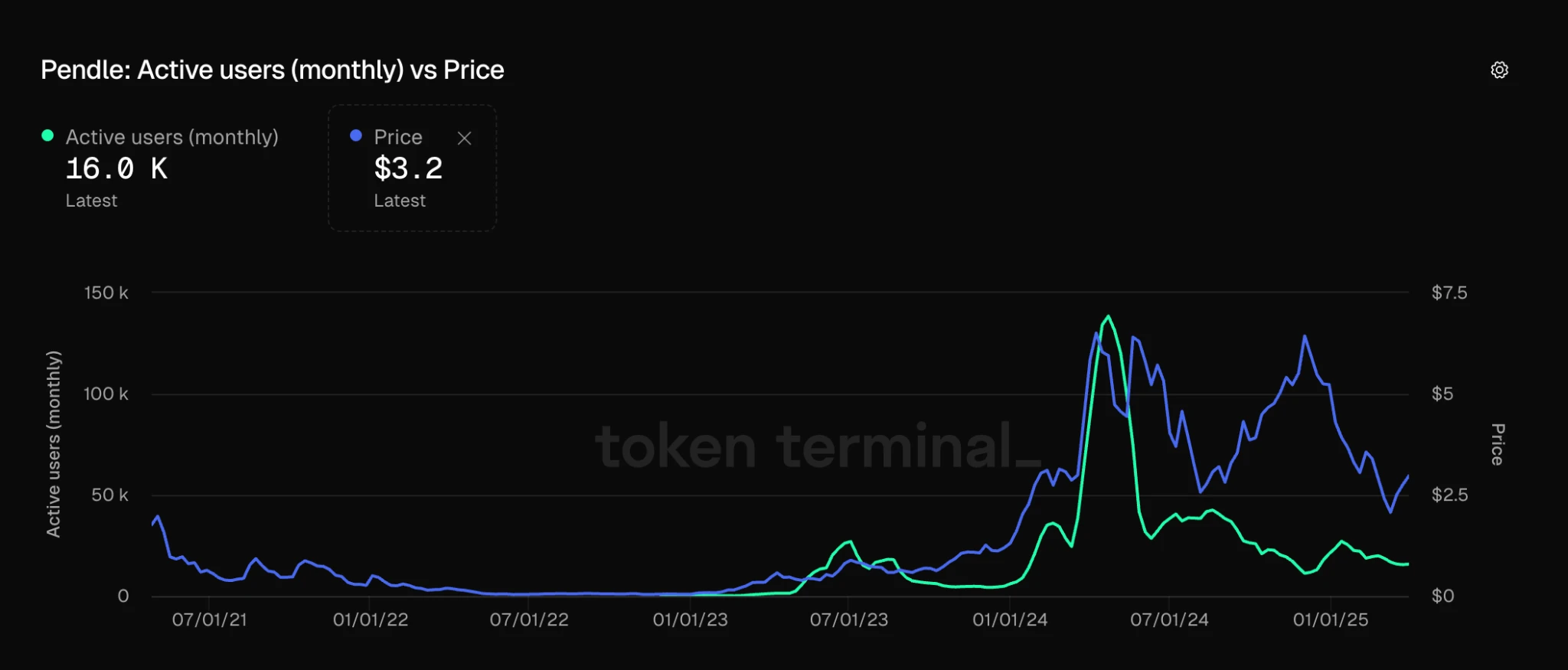

Active Users, source: Tokenterminal

In the past month, Pendles monthly active users were around 16K, and the number of active users showed a downward trend.

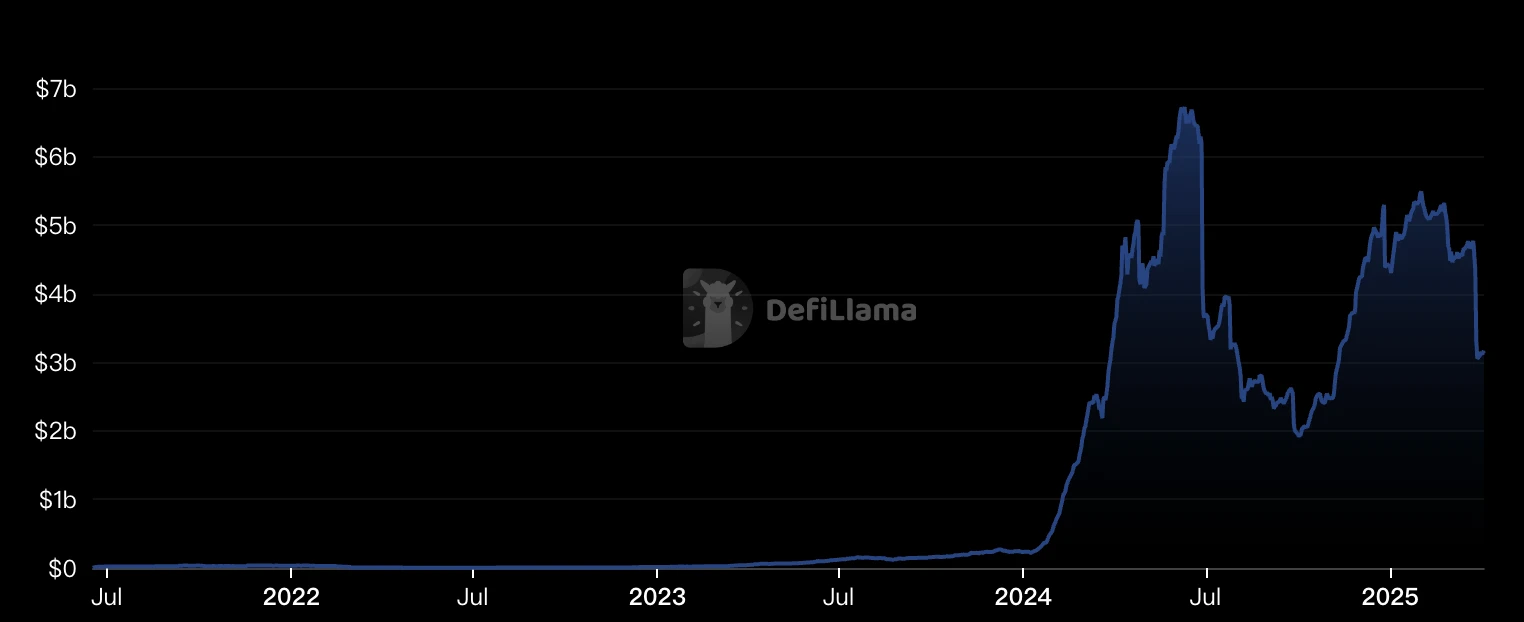

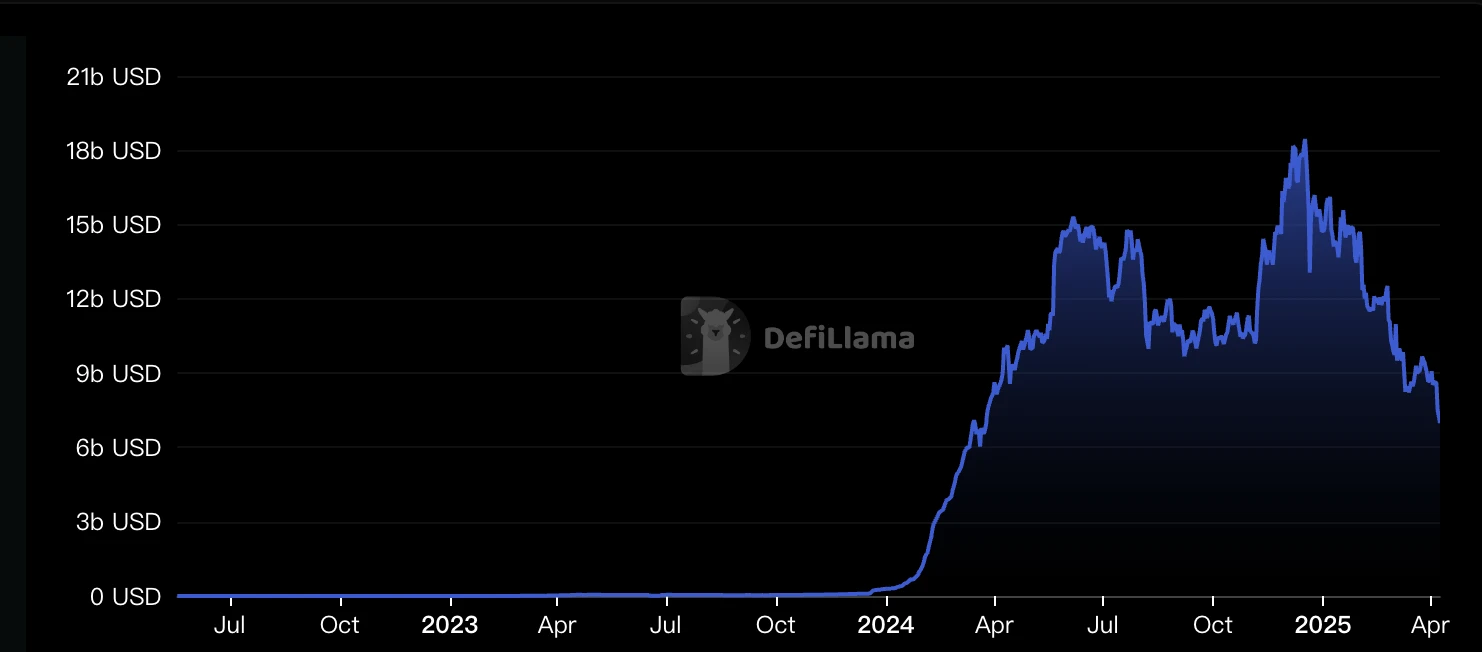

TVL, source: Defillama

DeFi products have been greatly affected by market fluctuations recently, so the TVL U-based calculation has declined sharply, from 4.8 billion at the beginning of the year to 3.1 billion now, a drop of 35%.

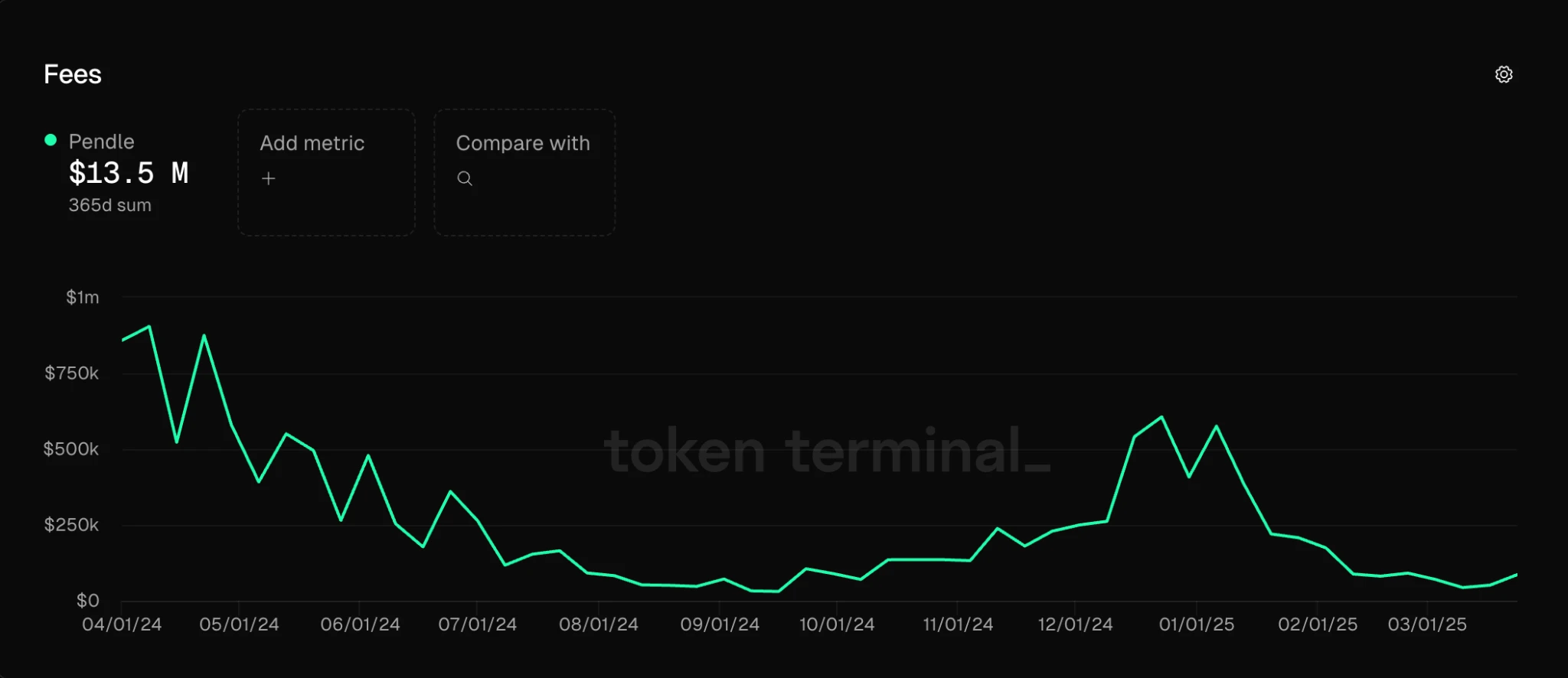

Fees and Revenue, source: Defillama

Pendles fee income has been around $1 million in the last two months.

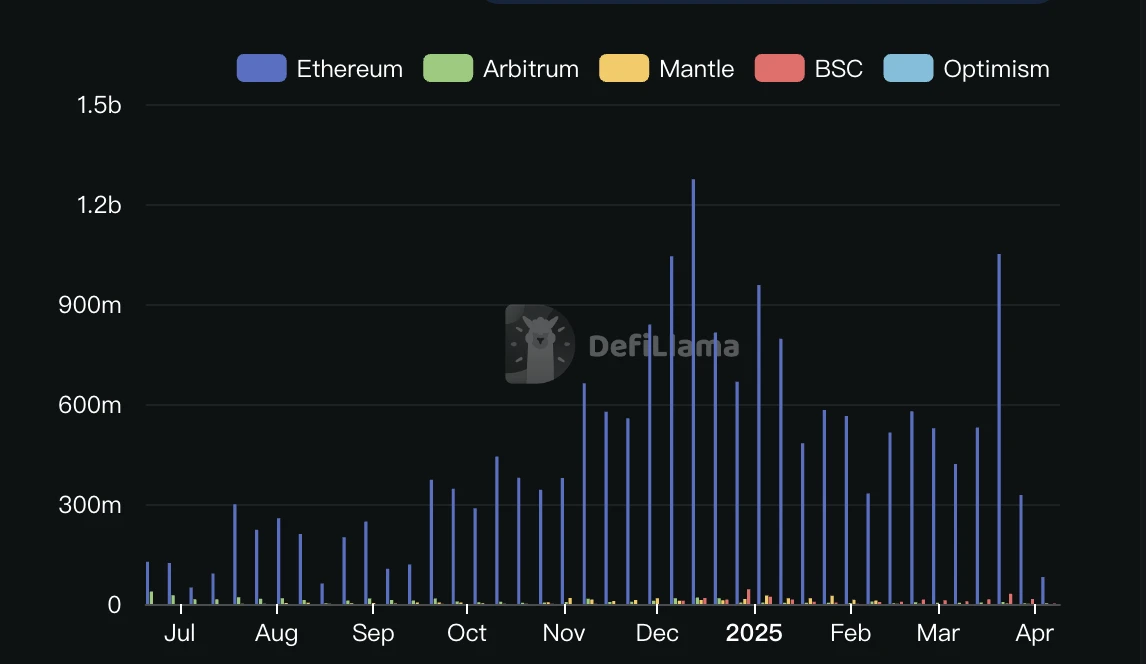

DEX Trading Volume, source: Defillama

Although DEX trading volume rebounded in mid-March, it maintained a downward trend overall, reflecting the continued sluggishness of the overall Ethereum chain. In March, Pendle DEXs trading volume was $2.75 billion, with an average daily volume of $100 million, which was only comparable to Hyperliquids daily spot trading volume. During the same period, Uniswaps daily trading volume was $1.7 billion.

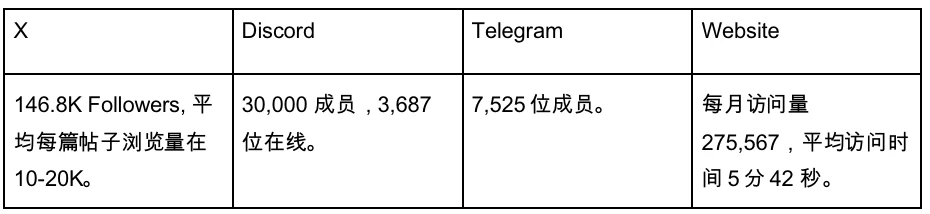

3.2.2 Social Media

Overall, Pendle has a stable community foundation and good market attention.

3.3 Future

According to the article Pendle 2025: Zenith published by the Pendle team on February 4, 2025, Pendles main plans for 2025 include the following three aspects:

Pendle V2 Improvements: We plan to improve protocol performance and user experience in the following ways:

● Increased openness: Provide functionality in the user interface that allows users to create their own yield markets, thereby enabling community-driven growth.

● Dynamic fee adjustment: Implement a dynamic fee rebalancing mechanism to ensure a balance of interests between liquidity providers, users, and protocols.

vePENDLE Improvements: Expand vePENDLEs functionality, allow all users to participate in voting, and optimize the protocol benefits for vePENDLE holders.

Establish Citadels: Aims to expand Pendles influence, including:

● PT supporting non-EVM ecosystems: Expand fixed income products to non-EVM chains such as Solana and TON to attract new user groups.

● PT for traditional finance: Develop compliant products to provide institutional investors with access to crypto fixed income products.

● PT for Islamic funds: Create financial products that comply with Sharia law and enter the Islamic financial market.

Introducing Boros: a new platform designed to support any type of yield trading, with an initial focus on funding rates in crypto markets.

4. Economic Model

4.1 Initial Token Distribution

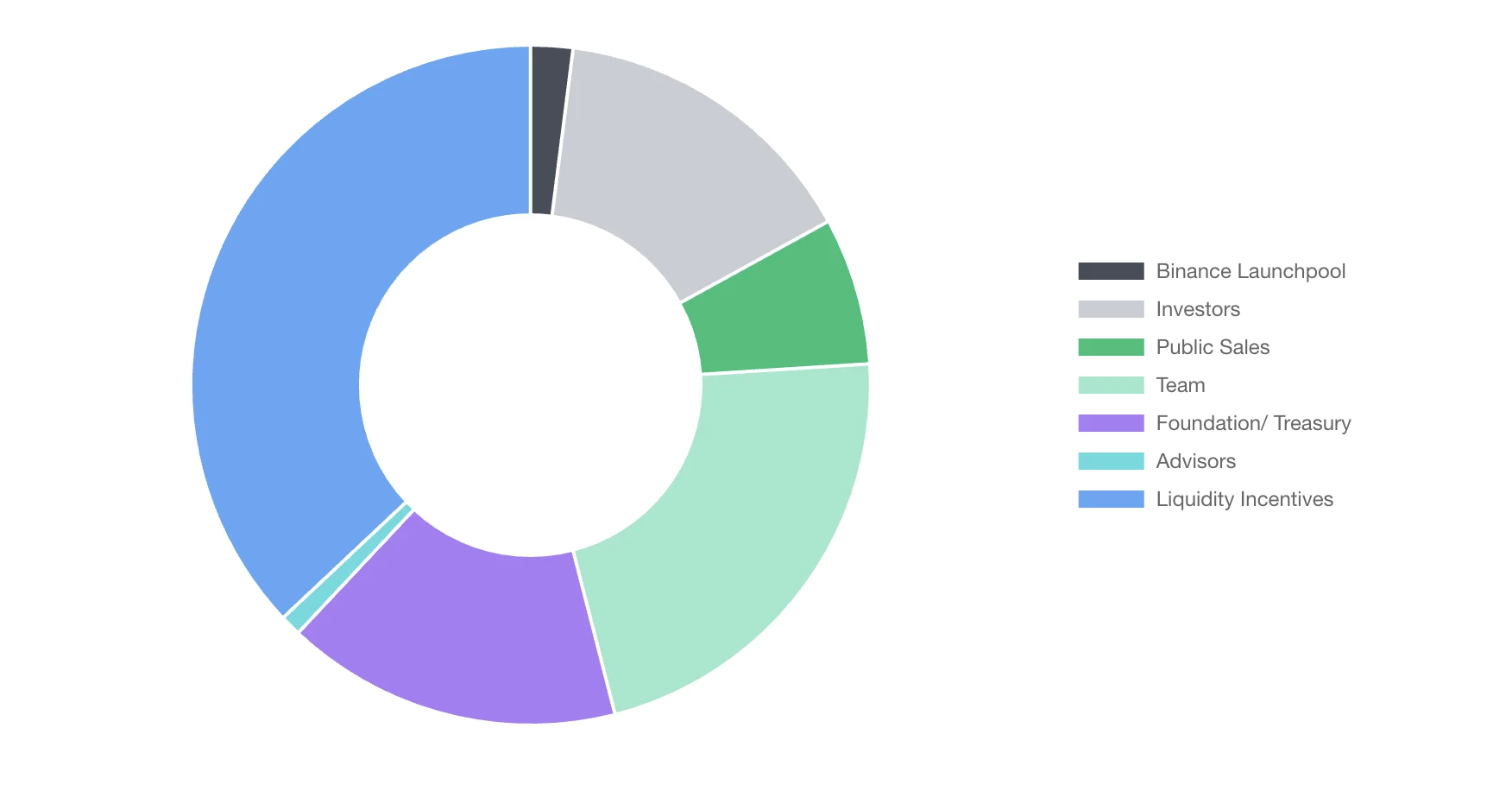

Token Distribution, source: Binance

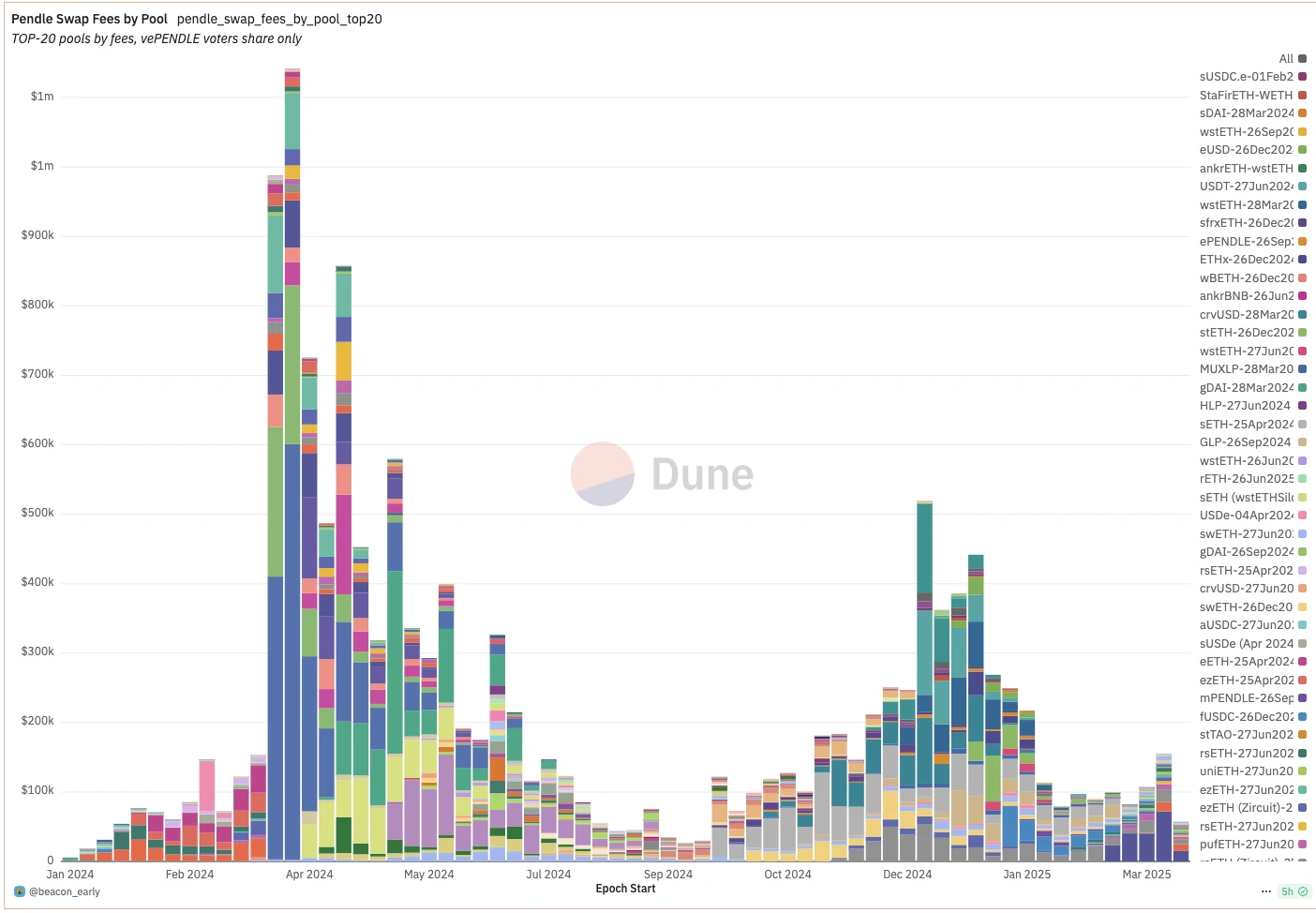

This chart is based on the token distribution of Binance Launchpad in July 2023. Liquidity incentives account for 37%, which is distributed by the team; the foundation and treasury account for 16%, the team accounts for 22%, investors account for 15%, public offerings account for 7%, and Binance Launchpad accounts for 2%. As of September 2024, all investor and team tokens are fully vested.

4.3 Token Usage

Pendle tokens can be converted to vPendle to enjoy:

1. Vote to decide which funding pools to introduce $PENDLE incentives into. Voting rights are related to the amount and duration of Pendle staked.

2. If you participate in the voting of the pool, you will receive 80% of the pool swap fee.

3. Collect 3% of the income generated by YT and give it to all vPendle holders.

The 3% interest collected from YT and the PT rewards that mature make up the vePENDLE base APY, which, together with active voting, builds up the total rewards.

In general, in terms of token empowerment, all functions of the Pendle protocol are basically related to vPendle.

4.2 Analysis of Coin Holding Addresses

On-chain Pendle holdings, source: Nansen

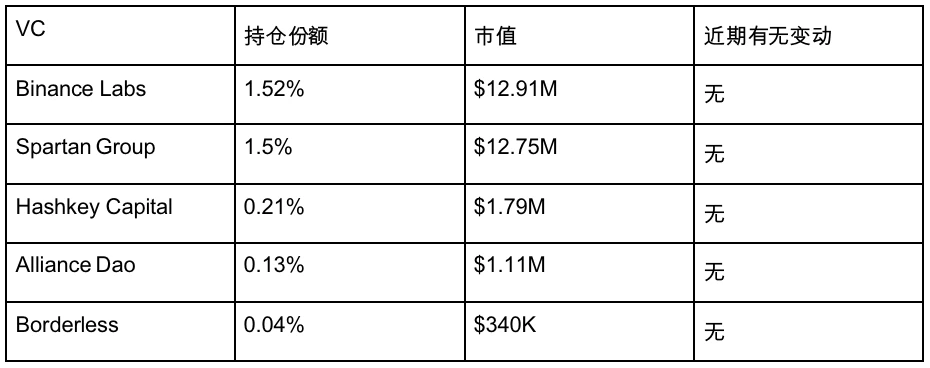

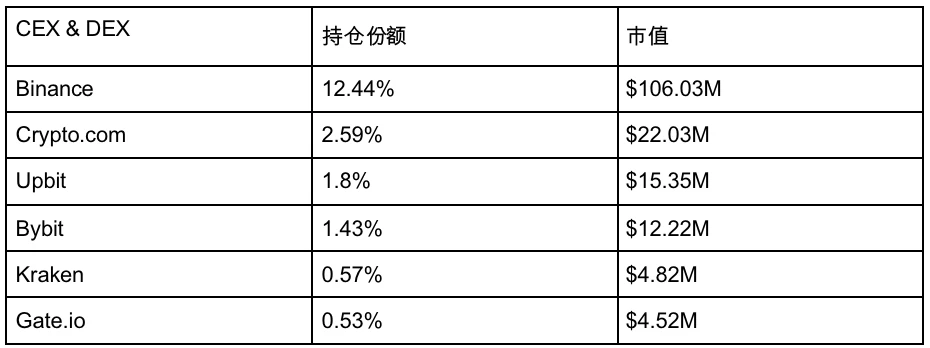

According to the data available on the chain, Pendle’s main VC holdings are as follows:

The positions of major exchanges are as follows:

Binance has accumulated a large number of Pendle tokens, including Binance Labs, which together account for 14% of the total supply. However, since only 50% of the total supply is currently in circulation, this part of the holdings actually accounts for 24% of the markets circulating chips, and has the ability to significantly affect market prices.

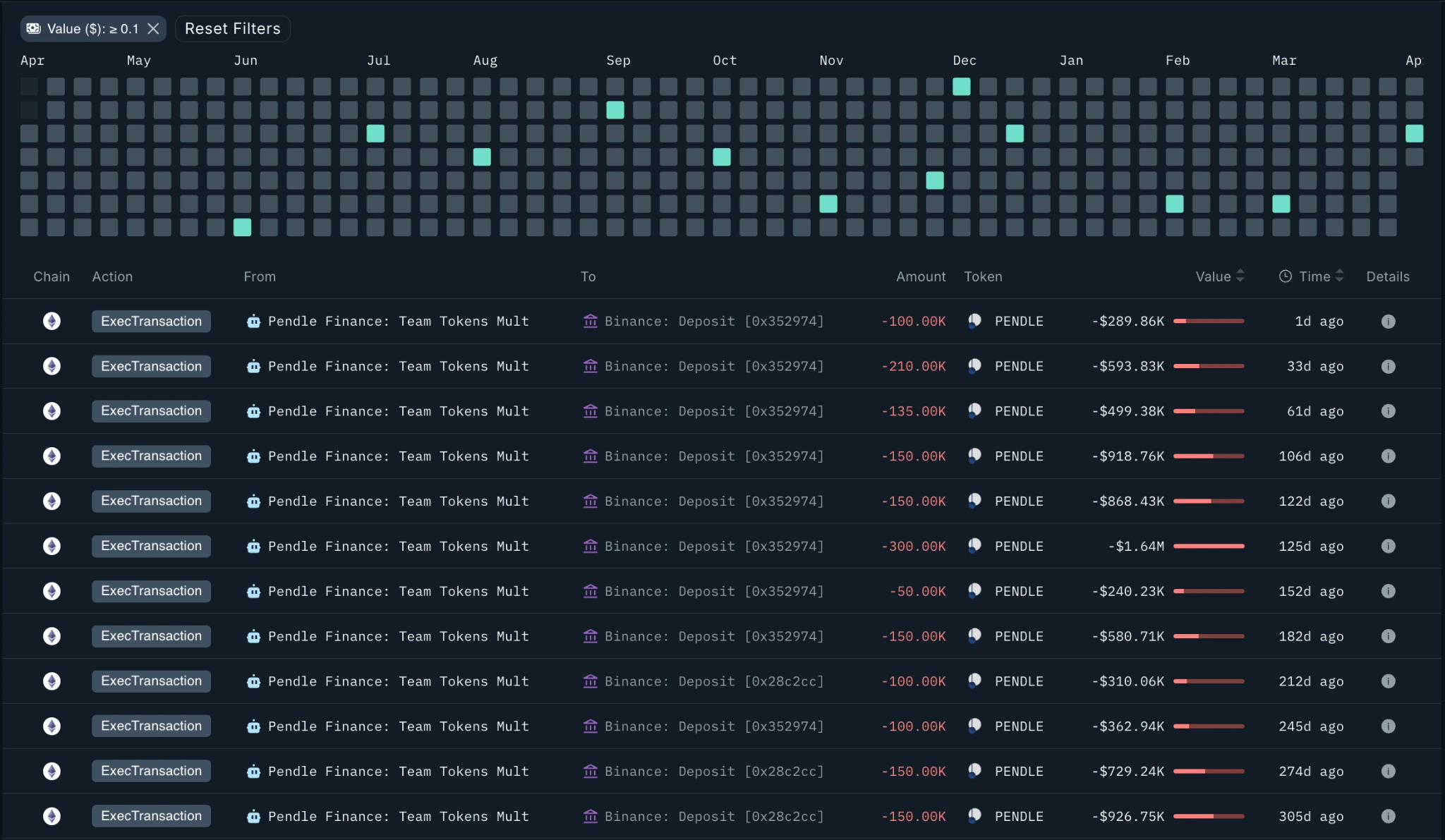

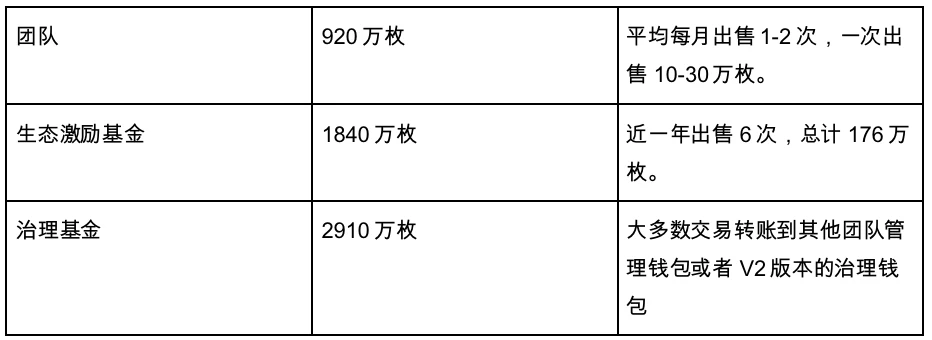

Currently, the team (not Foundation Treasury) still holds 9.2 million tokens, worth about $27.6 million. This part is classified as non-circulating tokens by the team, but it is actually fully unlocked. The team sells tokens infrequently, selling 1-2 times a month on average, with 100,000-300,000 tokens sold each time, which is about $300,000-900,000 at the current price.

The Ecosystem Incentive Fund has been sold 6 times in the past year, with a total of 3.36 million tokens sold and 1.6 million tokens received.

In general, the token quotas of both the team and the ecological incentive fund are maintained at a high level, the sale of tokens is relatively restrained, and the sustainability is strong.

4.4 Token Market Value Circulation

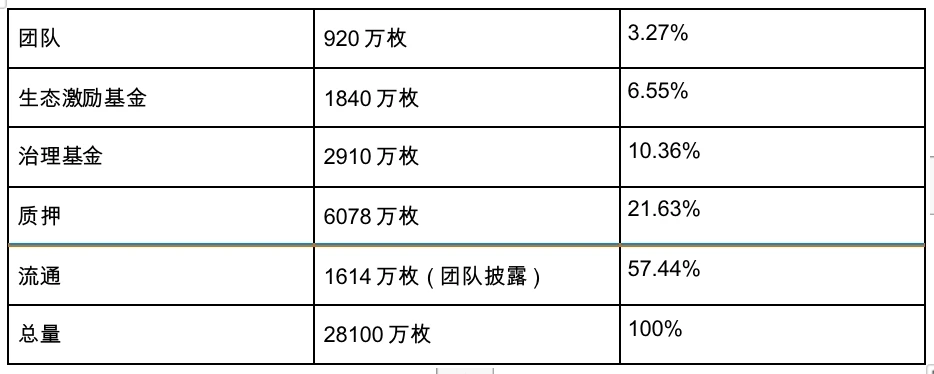

Here is our recalculated token distribution:

The basic data is correct. It is worth noting that the Pendle team clearly stated in the official document that although the team reserve, ecological incentive and governance fund have all been unlocked, they are not included in the circulating chips.

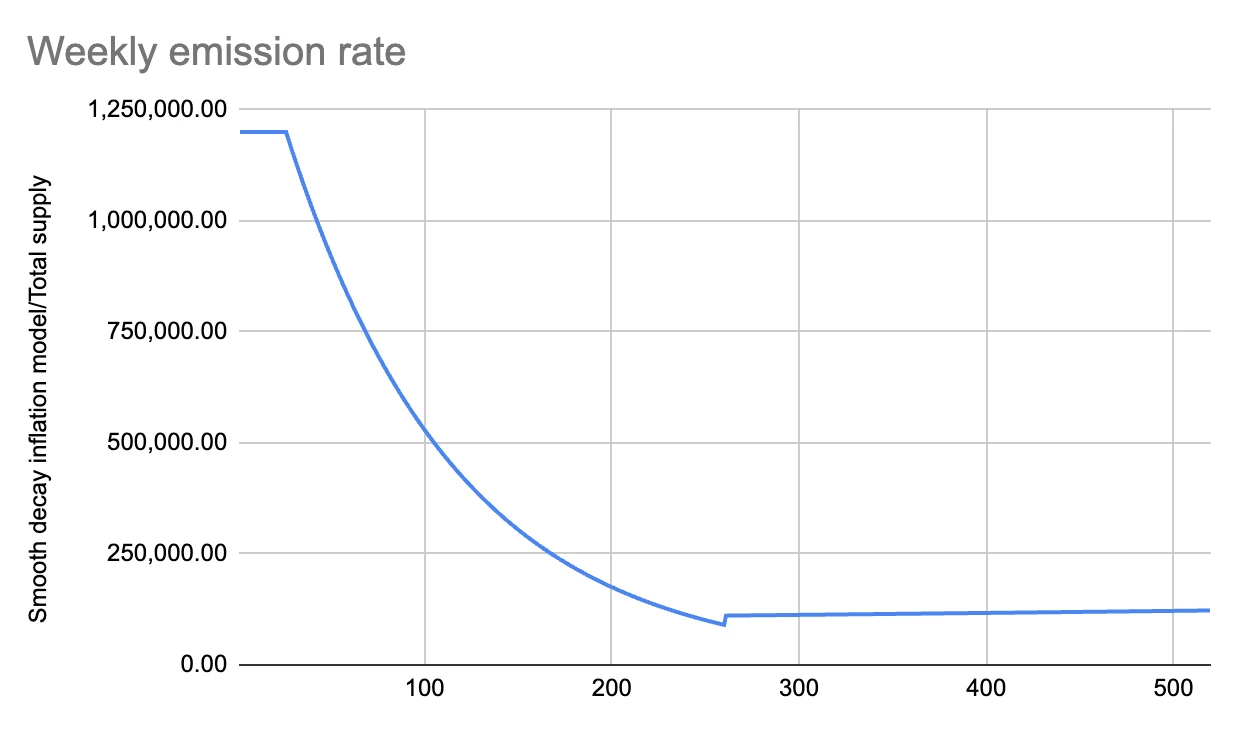

Token Inflation, source: Pendle

As of September 2024, the weekly emission is 216,076, decreasing by 1.1% per week until April 2026. At that time, Pendles inflation model will switch to a final inflation rate of 2% per year to provide ecological incentives. By calculation, a total of 7,119,017 PENDLE will be emitted in 2025, with an average annual inflation rate of 2.2%. In 2026, it will be infinitely close to 2%. The inflation rate is relatively healthy.

5. Market Potential

5.1 Available Market

Pendle has impressive data at first glance, but after in-depth research, we found that, similar to other dividend-paying products, Pendles dividend capacity is not enough to support its FDV (Fully Diluted Valuation) of up to $900 million. We believe that Pendles current valuation premium mainly comes from its huge market potential and its unique position as a pioneer in the on-chain interest rate market.

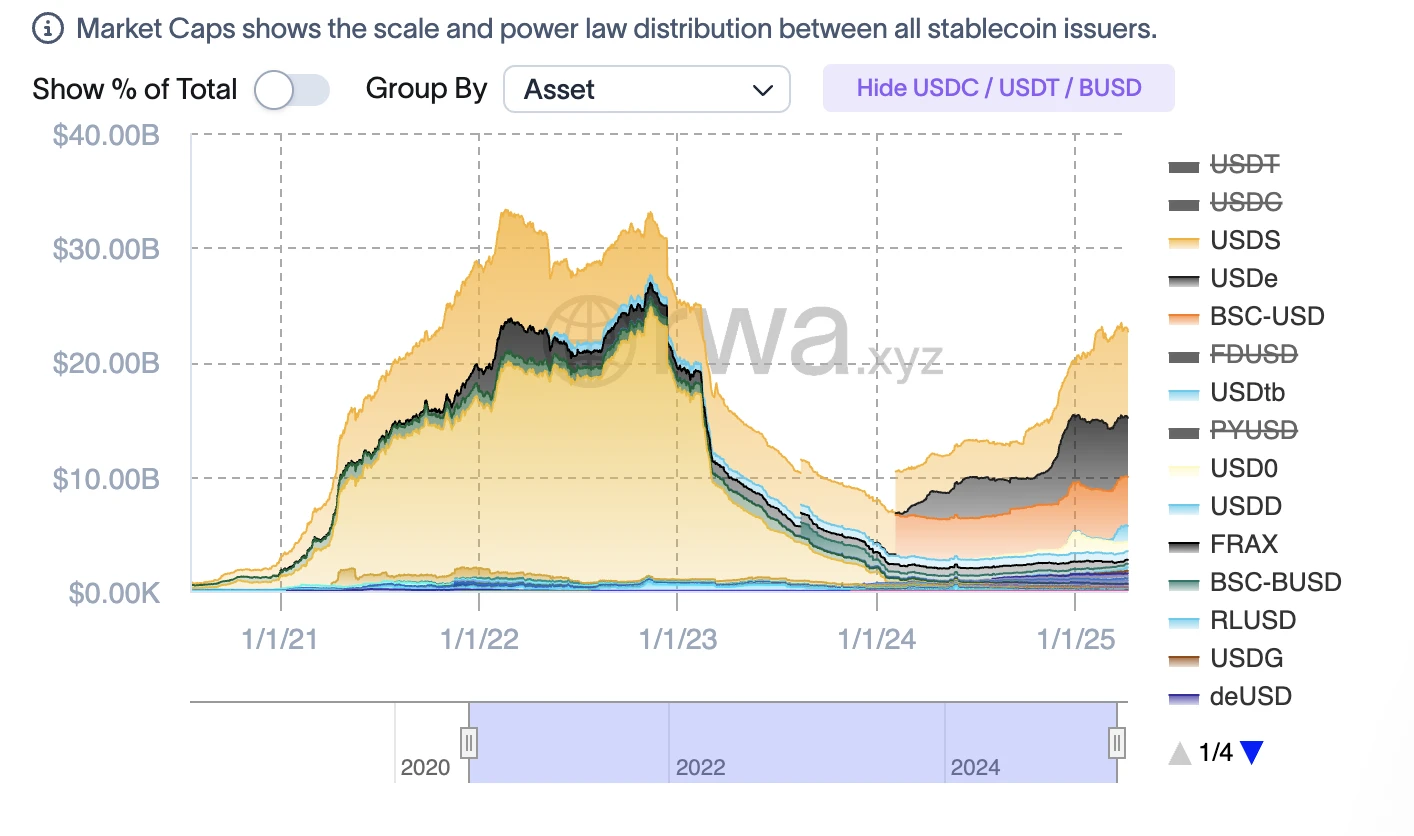

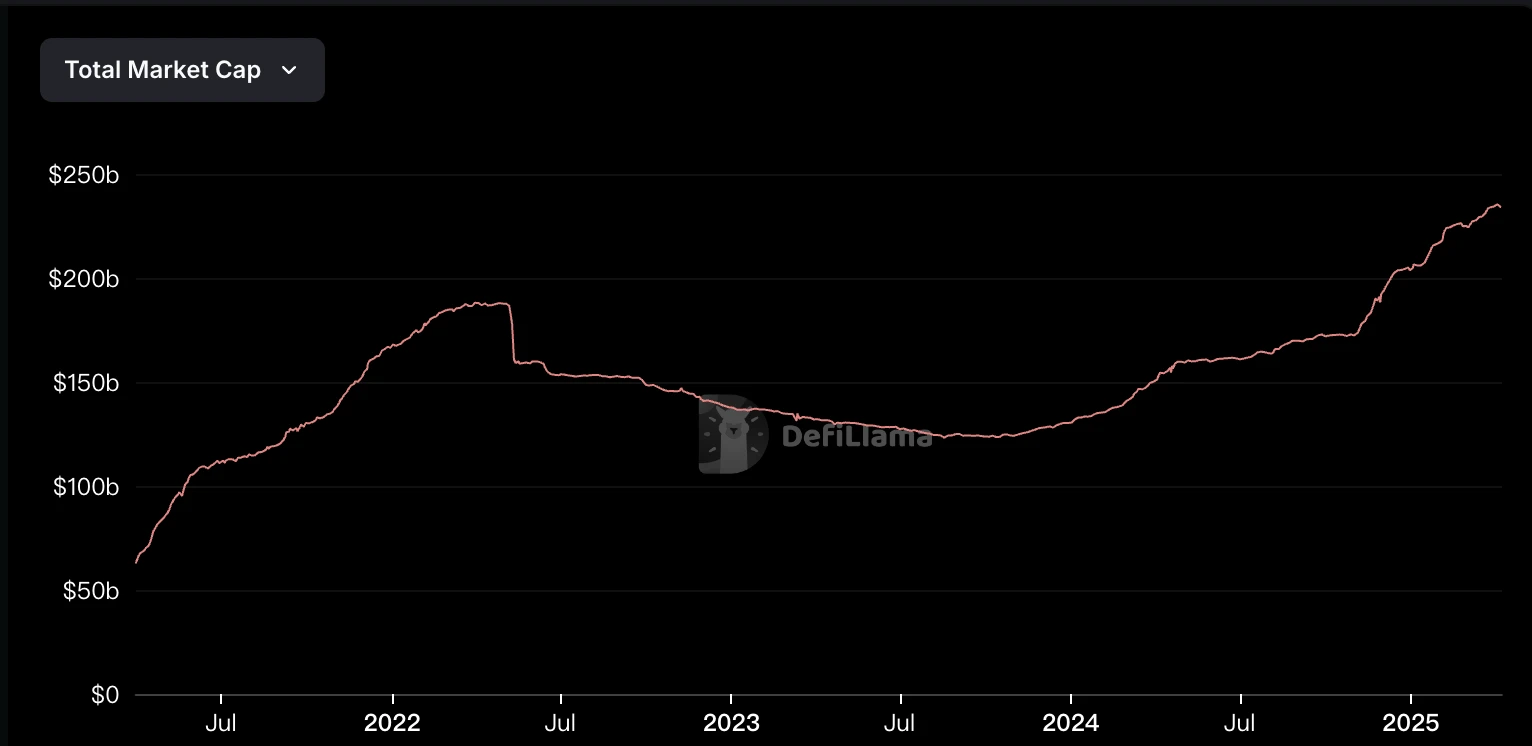

The market cap of Stablecoins, source: RWA.xyz

The arrival of the stablecoin market is also closely related to the price performance of the cryptocurrency market itself. In the last round of BTC entering a bear market, it was approximately from January 2022 to January 2023. This period was also the stage when the stablecoin track was active, and retail investors were more inclined to pursue the interest rate returns of stablecoins. From experience, the stablecoin market usually lasts about a year. Combined with the financing situation in the primary market, the CAP project on MegaEth and the M^0 project on the Ethereum mainnet have just completed financing. Most of these projects will give priority to cooperating with Pendle.

Currently, about 80% of Pendles business is still concentrated on the Ethereum mainnet. According to its 2025 roadmap, the team has clearly planned to expand to multiple chains, including Solana, Hyperliquid and Ton. We believe that given Pendles unique brand influence in the on-chain interest rate market, it is likely to dominate the market share of these three chains in the interest rate track.

At the same time, all future dividend-based gameplay/tracks will generate demand for Pendle-type products. For example, Pendles Swap fee income, which used to be dominated by LRT, is now driven by high-interest stablecoins. This shows that its business model does not rely on a single customer group, but has high flexibility and long-term operating potential.

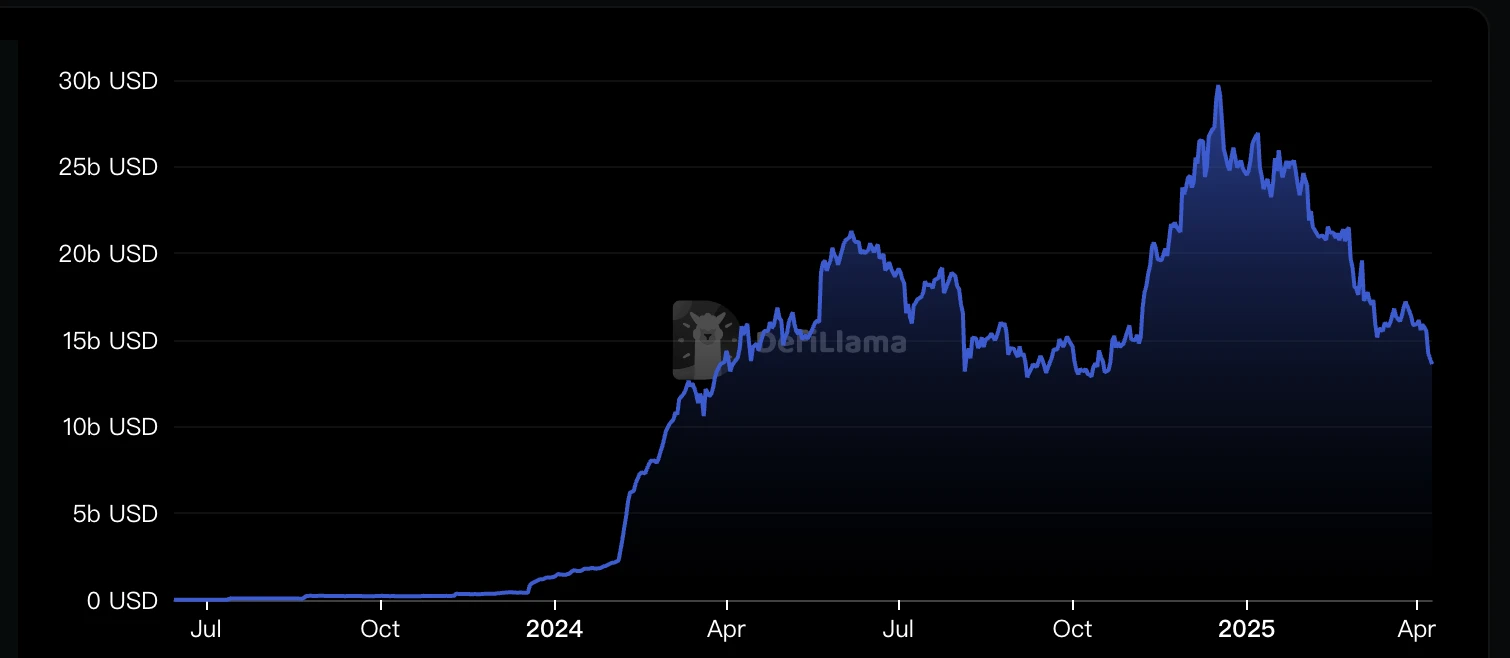

Liquid Staking Market, source: Defillama

Liquid Restaking Market, source: Defillama

Stablecoins Market, source: Defillama

Liquid Staking ($15 billion) + Liquid Restaking ($7 billion) + Stablecoin ($233.5 billion) market, currently totaling about $255 billion in available market share. Solana, Hyperliquid, and Ton Chain are still in the development stage, and the demand for interest rate swaps for stablecoins is just beginning.

At the same time, Pendle also plans to develop interest rate products compatible with traditional finance, and will launch interest rate swap tools for perpetual contract funding rates in 2025. It is worth noting that the transaction volume of the contract market is usually dozens of times that of the spot market, which will further expand its potential market.

In summary, the interest rate swap track that Pendle has entered not only has huge application prospects and real market demand, but also, with the increasing integration of traditional finance and DeFi, Pendle will rely on its first-mover advantage and is expected to occupy a dominant position in this track for a long time.

5.2 Business Model and Revenue

The growth of handling fees is divided into swap fees and YT, and most of it comes from swap fees. It is worth noting that unlike the familiar model of Uniswap, which charges a fixed fee (such as 0.3%) based on transaction volume, Pendle does not charge fees based on transaction volume, but charges based on the proportion of future income represented by PT. This means that even if the transaction volume of a transaction is high, if the PT being traded is about to expire and the corresponding remaining income is already very low (the value of YT is close to zero at this time), then the actual Swap Fee generated will also be very limited.

6. Investment

6.1 Profitability and Valuation

Pendle Fees, source: Pendle

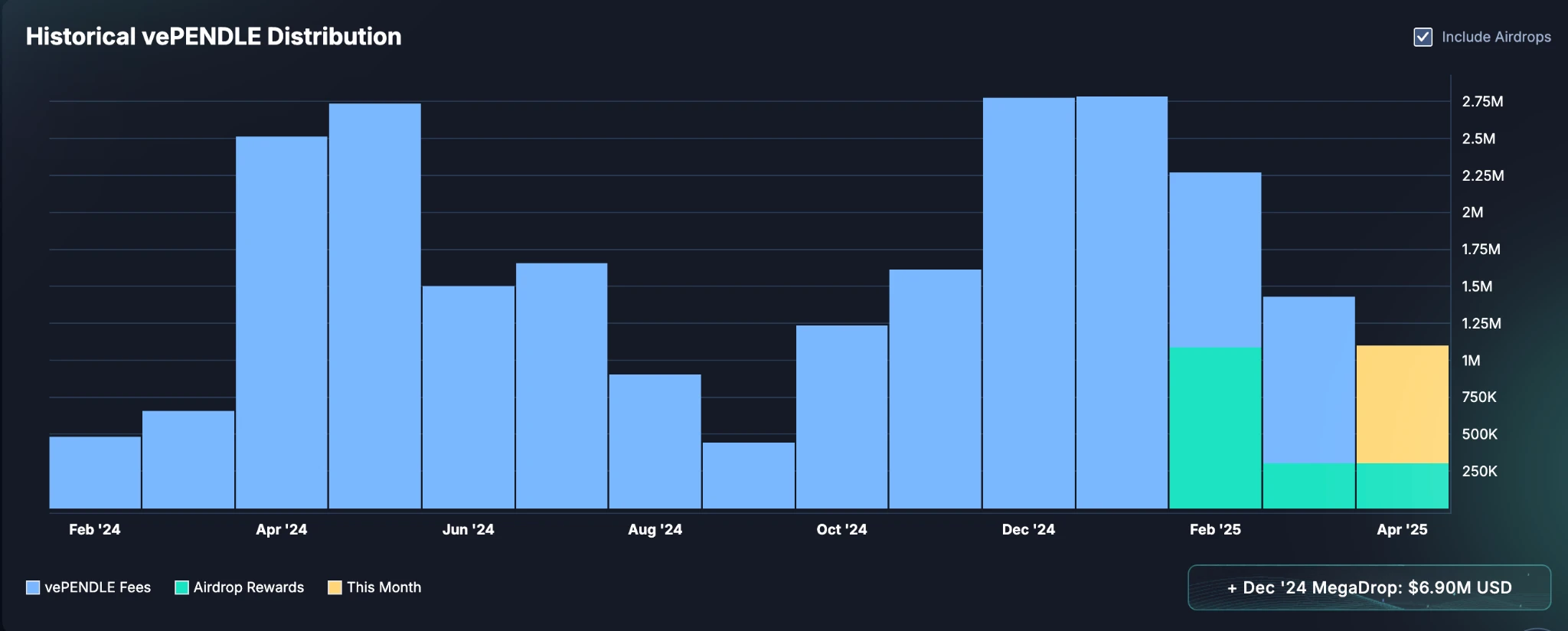

In the past year, Pendles swap fees revenue was $13.5 million, all of which was given to vPendle holders. However, since the protocol itself does not charge fees, and vPendle has other fees of about $24 million, we will value Pendle tokens based on vPendles final cash income.

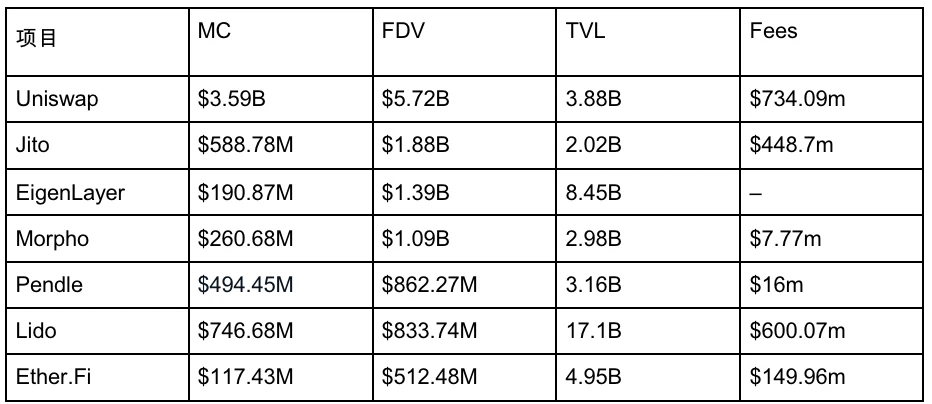

vPendle Holder Dividend, source: Pendle

In the above picture, the blue part is the total fee received by vePendle, the green part includes the airdrop reward, and the yellow part represents the real-time profit sharing for that month. The current number of locked PENDLE is 60.78M, accounting for about 21% of the total number of Pendles, and the average lock-up period is 388 days.

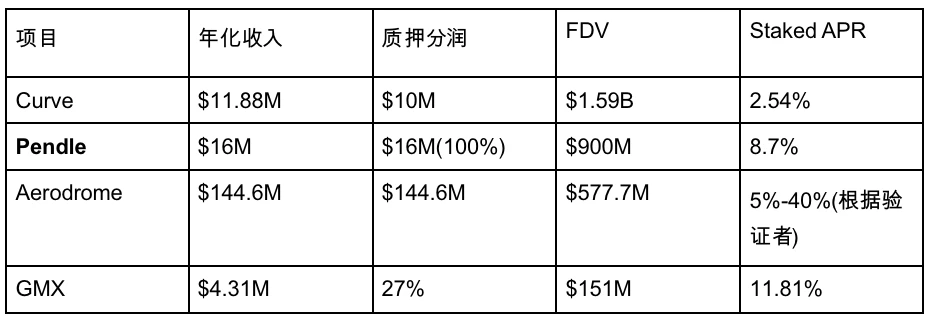

Regarding the choice of project valuation, since vPENDLE is a purely dividend-based project, we mainly compare it with projects that provide token incentives. For example, Unsiwap and Lido have not enabled the fee conversion function, so they are not included in the comparison range.

In comparison, Pendles Staked APR is not particularly outstanding. From this point of view, the market has a certain premium for Pendle. The following is mainly a horizontal comparison of the TVL and market value ratio of some typical projects.

Comparison of typical project data

As shown in the figure above, we found that the FDV/MC and TVL of a project are not proportional. The main reason is that FDV only represents the assets managed by the project and cannot be converted into actual future income. Therefore, TVL valuation is actually no longer effective, and the market is more rational and sophisticated in pricing projects.

In general, from the perspective of fee income, Pendle has a certain premium. From the perspective of TVL, the market has shifted from TVL valuation, quietly shifting from the past TVL-only theory to a more rational and refined one. The variance between TVL and FDV is large, and it is no longer suitable for valuation.

6.2 Window Period

The above chart is calculated by month, so the peak is ignored, and it also includes non-fee income, mainly airdrop income. If we only look at the fee and calculate it by week, it will be as shown in the following figure:

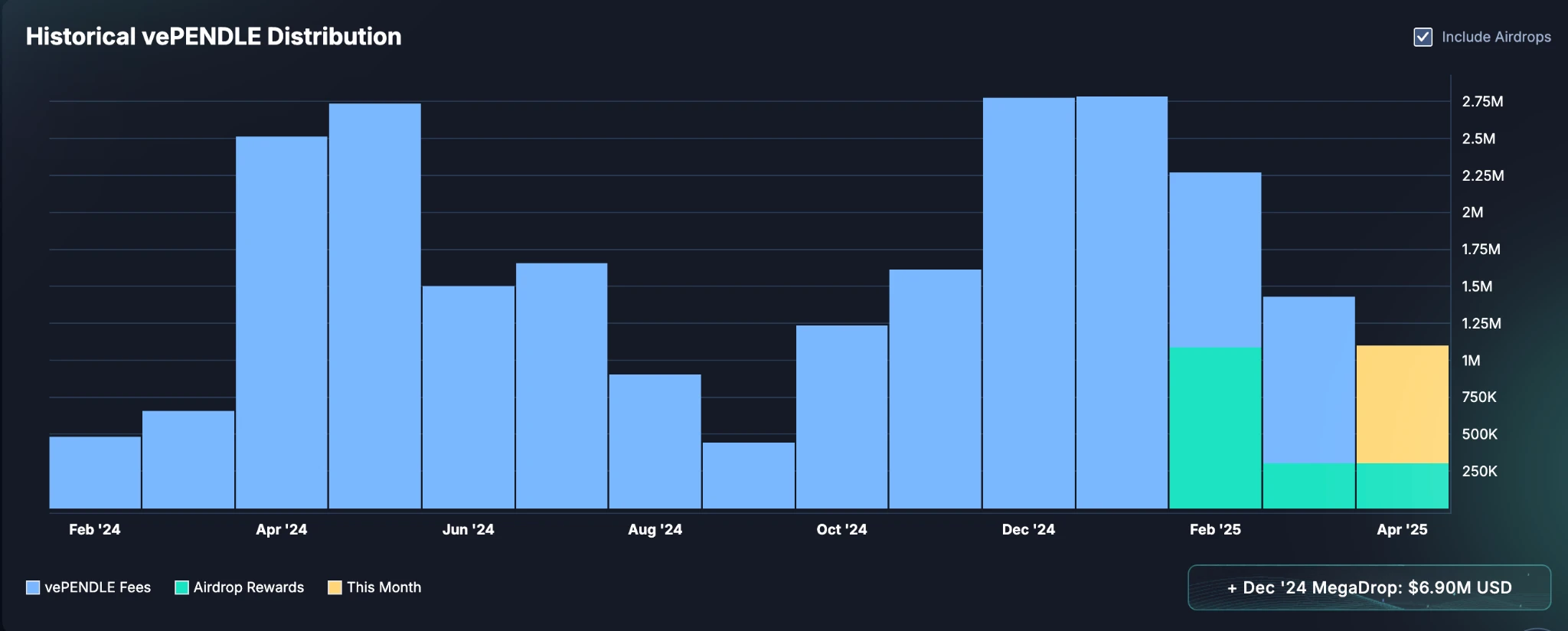

Pendle swap fees, source: Dune

We have observed that Pendle’s Swap Fees are highly correlated with the price trend of the coin, and there is a significant linkage between the two: the top of the handling fee is often the top of the coin price twice. The top of the handling fee is also the top of the coin price.

Pendle swap fees used to be highly correlated with LRT Token, mainly due to the popularity of the LRT track led by EigenLayer at the time, and the strong demand for the points market and YT transactions. From June to October 2024, the Pendle ecosystem gradually cooled down as the LRT track cooled down. However, after December 2024, as the market gradually entered a bear market, retail investors demand for interest-bearing stablecoins began to increase, and the Pendle Swap market also reflected the dominance of stablecoins.

Pendle Price, source: CMC

The end of the LRT ecosystem is also the bottom of the coin price and the bottom of the handling fee. The turning point is that a new track for interest-bearing stablecoins has been found. As the interest-bearing stablecoin ecosystem reaches its climax in September 2024, the coin price will also reach its climax. We believe that the stablecoin market will continue. Especially under the influence of factors such as the warming of the PayFi narrative, the downward trend of the overall yield of Altcoins, and the increase in external risks, retail investors demand for stable returns on the chain will continue to grow, further driving the market popularity of interest-bearing stablecoins.

In general, the stablecoin market is expected to continue until the whole year of 2025, which is a common feature in past cycles. From a fundamental perspective, it is currently facing a decline in transaction fees in terms of data. At the same time, from the perspective of transaction fee valuation, there is also a premium, which is the main risk point for a short-term decline in token prices.

6.3 Trading strategies

Long-term investors: For projects that may have a partial premium in the short term, but have very good brands, diverse customer groups, resilience to risks, and potential growth in market share in the long term, we recommend immediate participation in the form of fixed investment. Fixed investment can help balance the risks of FOMO and short-term business decline.

Short- and medium-term participants: Due to the short-term market volatility and the fact that Pnedle’s swap fees are highly correlated with the coin price, and the fact that swap fees are currently experiencing a slow weekly decline, we recommend that you closely monitor:

1. Will there be a second wave of stablecoin market? Given that there are multiple financings for current stablecoin projects, it is very likely that there will be a second wave of stablecoin market in the short term.

2. Will there be new customer groups? In the past, it was LRT, and now it is stablecoins, which are all related to interest rates. This is a mid-term turning point, and it also means that a track is hot, which is more obvious when observed.

6.4 Risk Warning

1. Smart contract risk: Although Pendle has been running for three years without major security incidents and has passed multiple audits (such as Spearbit and ChainSecurity), as a highly complex DeFi protocol, there is still a potential risk of contract vulnerabilities. Some contracts have a pause function (such as the SY contract), which can suspend operations in an emergency to protect user assets.

2. Underlying asset risk: The value of PT comes from the stability of its underlying assets. For example, if an asset such as stETH or sUSDe decouples from its price, it will affect the final value of PT. Insufficient liquidity, centralization risk or governance failure of the corresponding assets will also be transmitted to the Pendle protocol.

3. Price risk outside the scope of AMM: Pendles AMM is built for PT/SY and has a fixed maximum supported yield range. When the actual yield exceeds this range, the transaction price of PT may move out of the range, causing the AMM to be unable to provide valid quotes and can only rely on the order book, resulting in a significant drop in liquidity. If PT is used for mortgage lending, it may lead to overvaluation, arbitrage opportunities, or liquidation failures.

7. References

1. Pendle PT Risk Framework, chaos labs

2. Pendle v2 Mechanism Risk Assessment, chaos labs

3. Pendle 2025: Zenith, pendle

4. Pendle Me Softly: Unraveling the Complexities of Yield Tokenization, Alexander Abramovich

Disclaimer:

This content does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decision. Please note that Gate.io and/or Gate Ventures may restrict or prohibit all or part of the Services from restricted regions. Please read their applicable user agreements for more information.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web 3.0 era. Gate Ventures works with global industry leaders to empower teams and startups with innovative thinking and capabilities to redefine social and financial interaction models.

Official website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures