Original author:CapitalismLab

Original author:

$GMD1/ Several fund projects based on GLP have also been briefly reviewed. Let’s make a brief comment first, and write in-depth later when I have time:

@rage_tradeThe best model is given to this local dog team

$JONESRisk-on should talk about NAV instead of APR

@MugenFinanceHigh returns, high risks, high friction

2/ $GMDA plate with a bottom

The best model is given to this local dog team

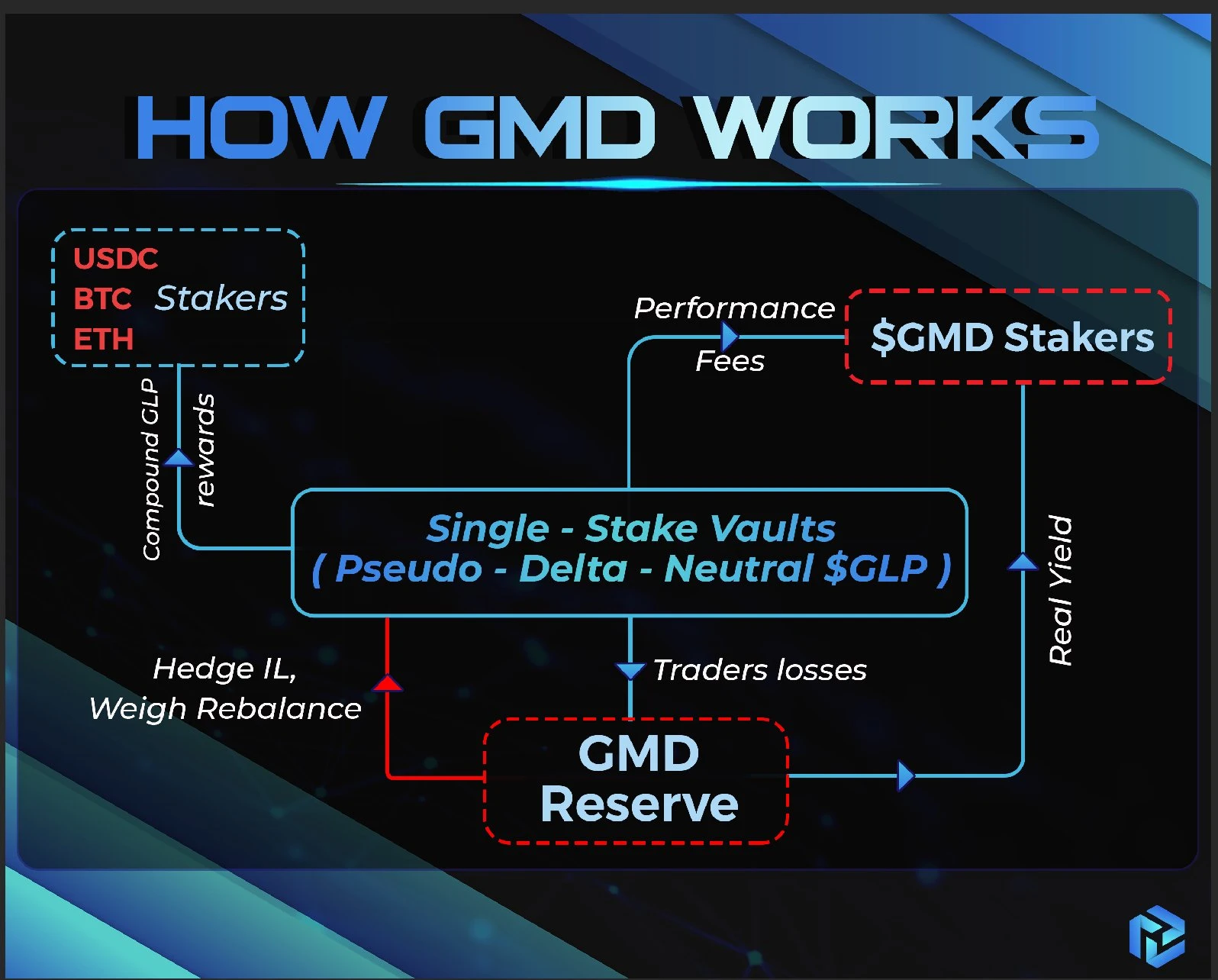

Summarize the model in one sentence: Raise BTC/ETH/USDC in proportion and deposit them in GLP, and then hedge Trader PnL by yourself

Why is it the best pattern?

1. BTC/ETH/USD three single-currency stable income, single-currency income products have the widest audience, investors may not even understand what GLP is, and BTC income products are currently very scarce!Rage3/ High efficiency,

That U-based strategy needs to hedge half of the currency in GLP, while GMD is originally raised in proportion, and only needs to hedge the net position of the trader, and even does not need to hedge when the long-short balance is balanced.

Why the local dog style team? 1. The income sharing is opaque. At present, it basically depends on how much the LP will share according to the mood. 2. The hedging details are not transparent, anyway, it is hedging

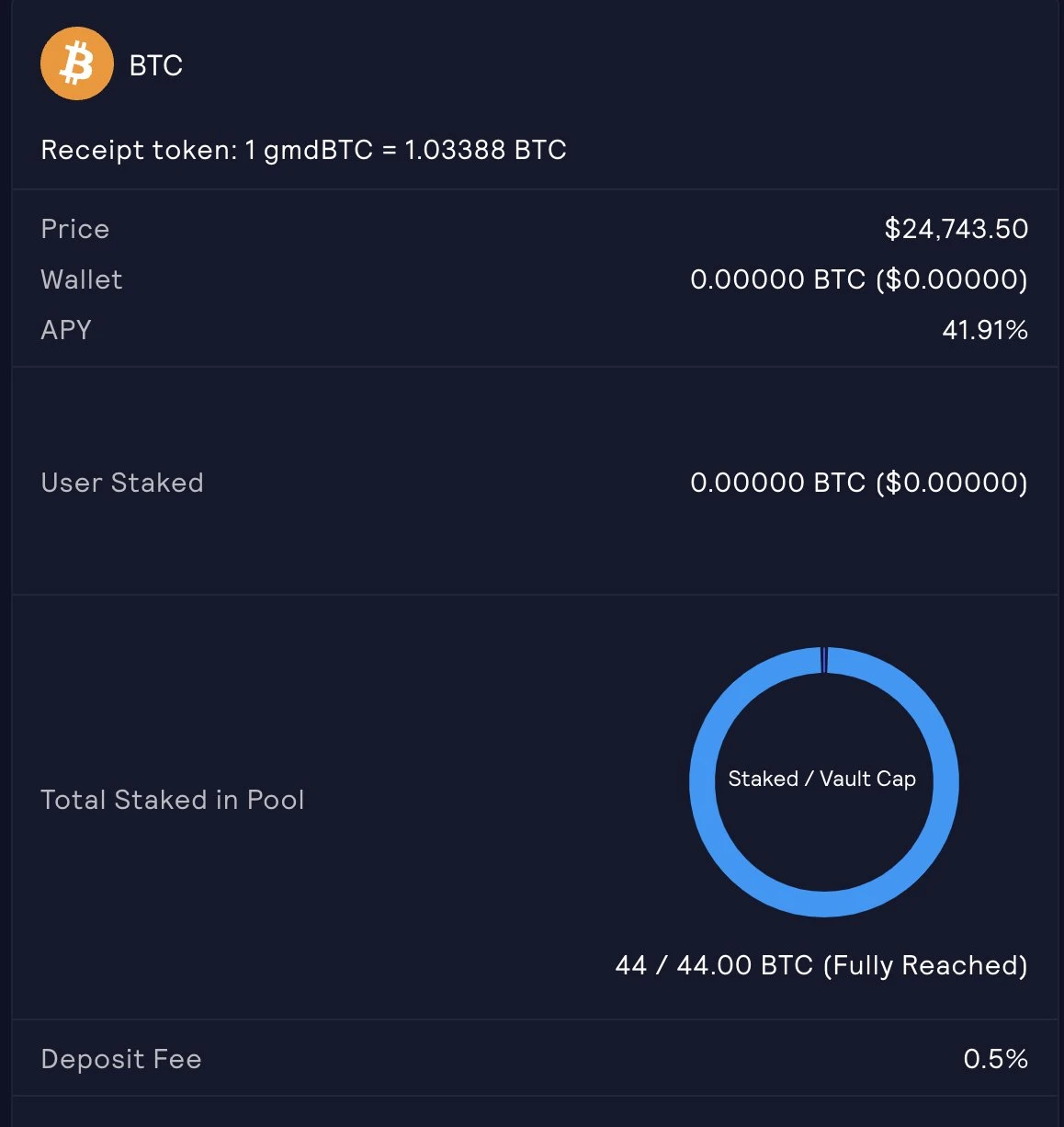

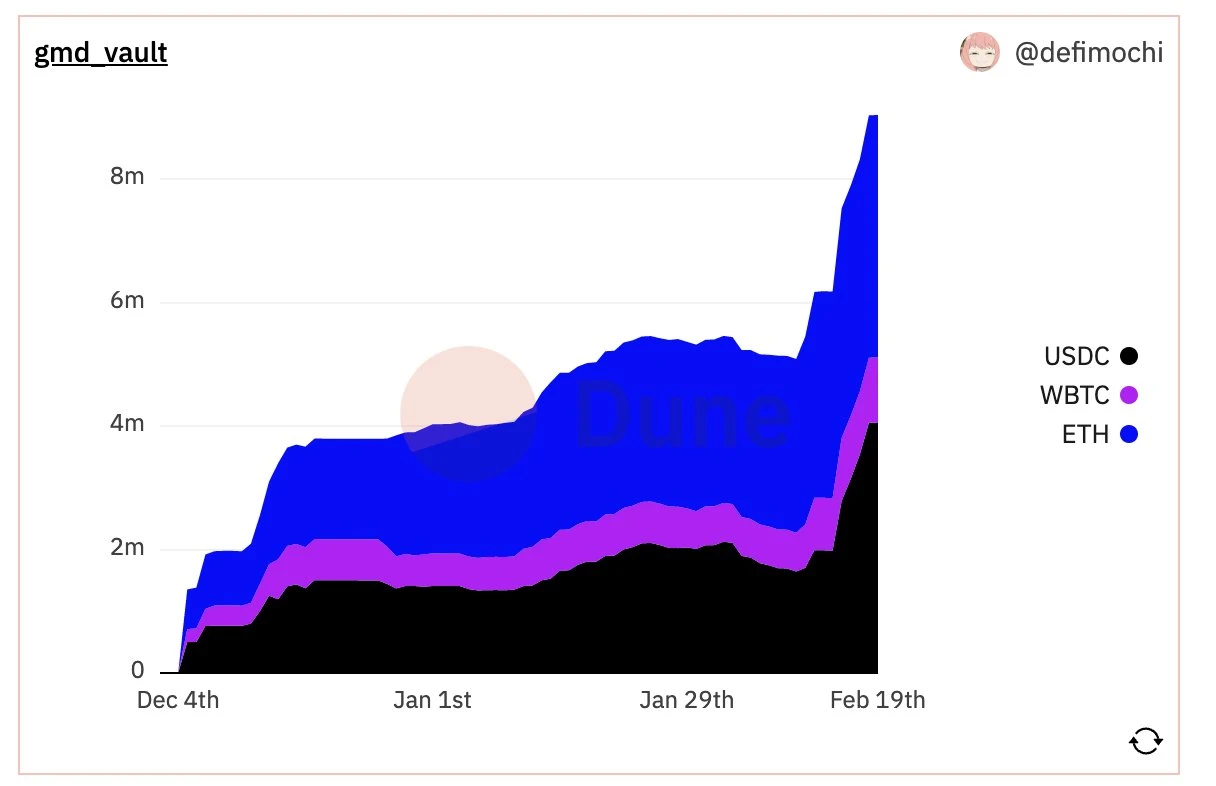

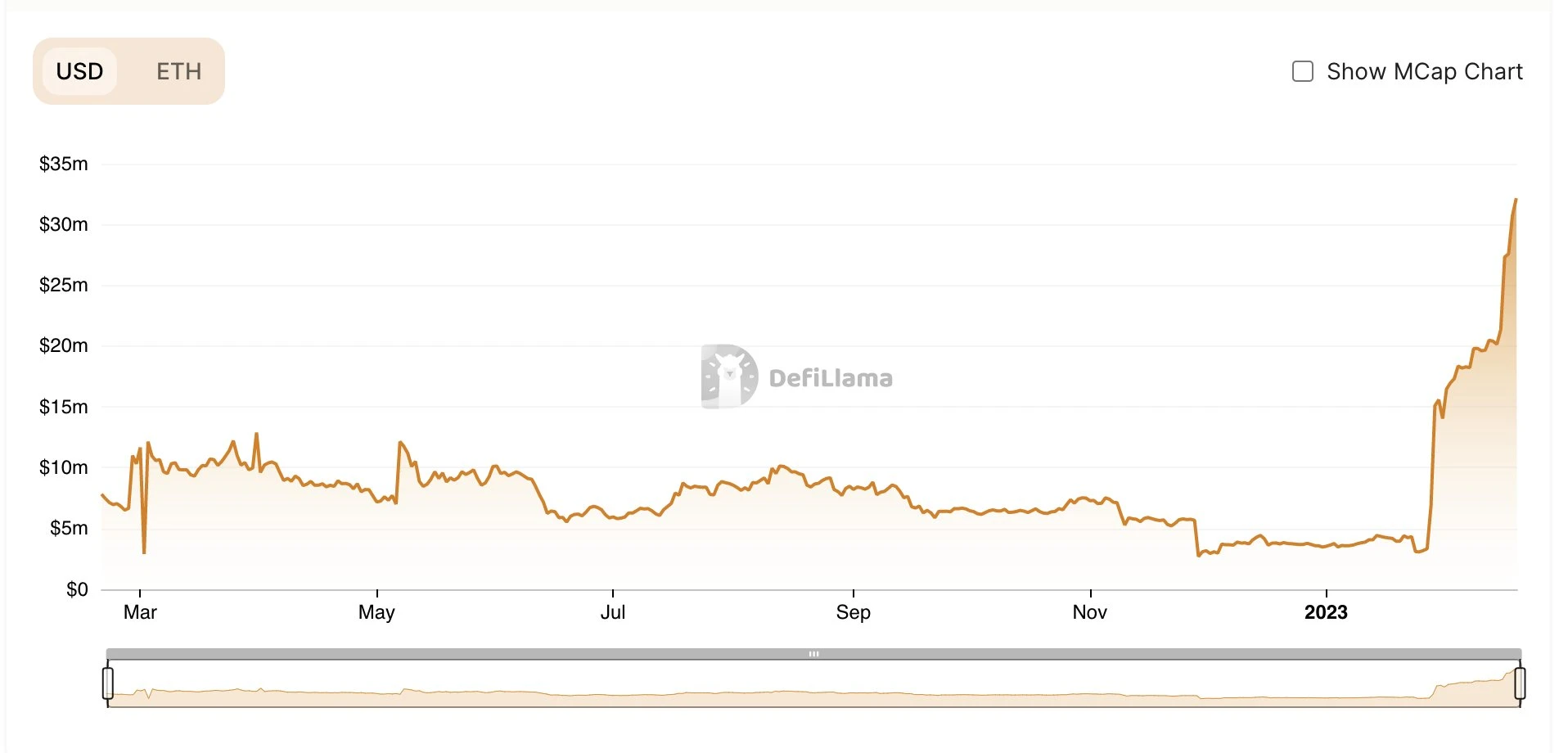

4/ Based on the above problems, 1. The product is selling well, and the quota will be full within a few days after basically releasing it once.

5/ @rage_tradeSo this mode seems to be the best, but... PS: GMDs own strategy is actually a copy from Umamis second-phase space.Risk-on should talk about NAV instead of APR rage_trade I have analyzed it a long time ago, seetweet below

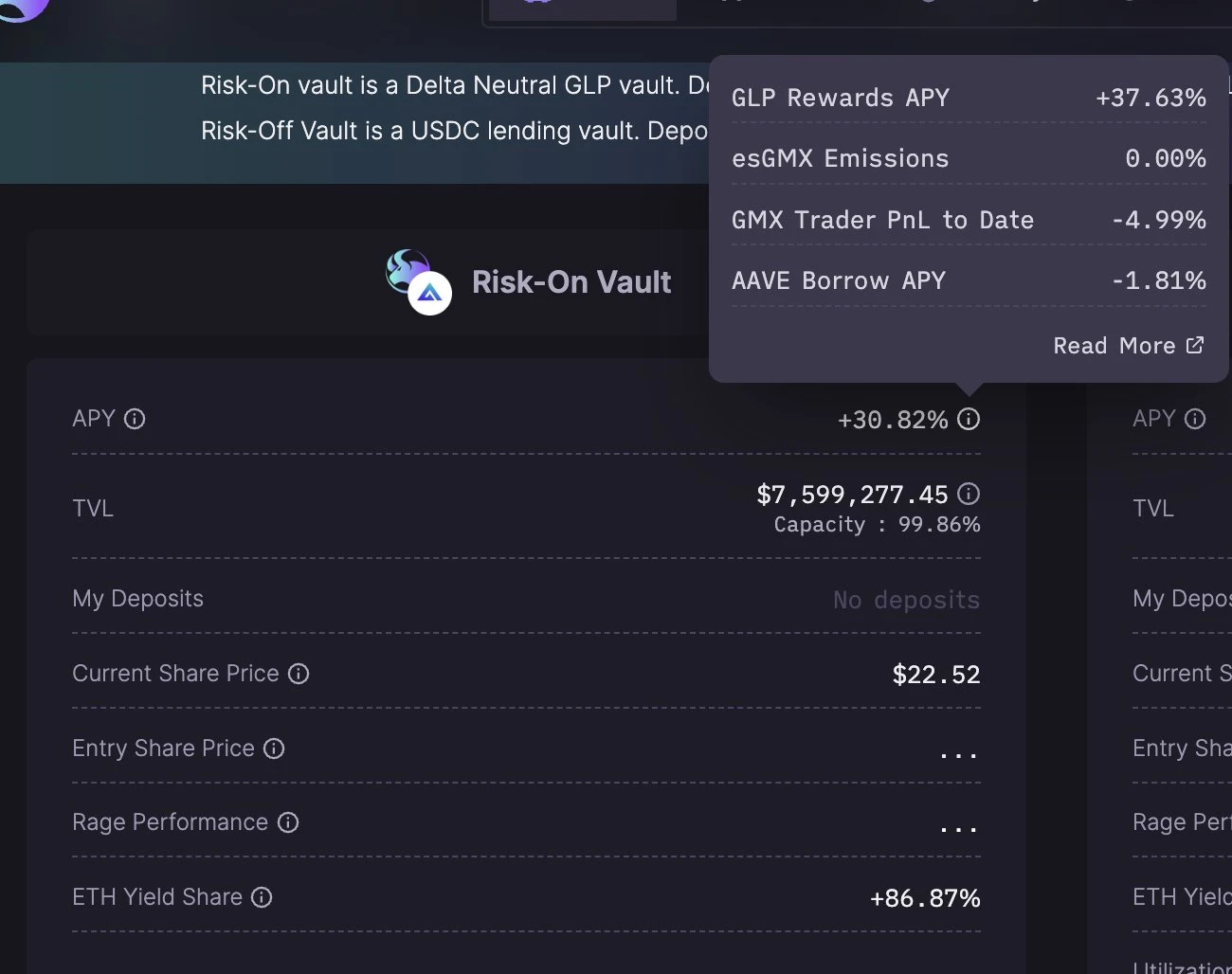

To put it simply, risk-off vault lends money to risk-on to short BTC/ETH to hedge the BTC/ETH part of GLP, and realize U-based income-generating products

6/ First of all, as mentioned above, the hedging scale requirement is too large and the efficiency is slightly low. Secondly, there is no hedging trader pnl, so full hedging has not been achieved. However, risk-on is actually packaged into an APR model, and the part of trader-pnl is also included. You must know that there are times when trader is profitable. At this time, an APR of -XX% may be directly produced, which is harmful to the users psychology. The impact is too great.

8/ $Jones7/ At that time, the team was showing off the profits in the first period. I saw that most of them came from trader pnl and felt bad. Sure enough, I often heard people saying that rage was losing money or something. If risk-on is packaged as a net worth product, it is normal for the net worth to fluctuate a little. Generally speaking, the rage team has done a relatively formal job in terms of transparency, but what about this model.

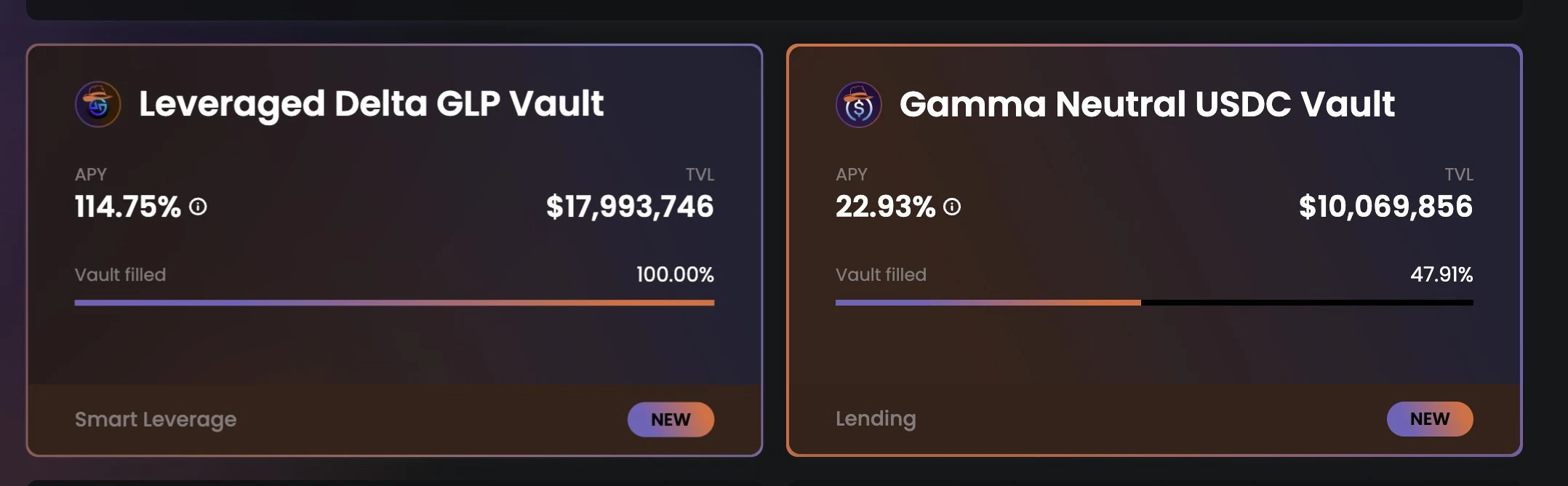

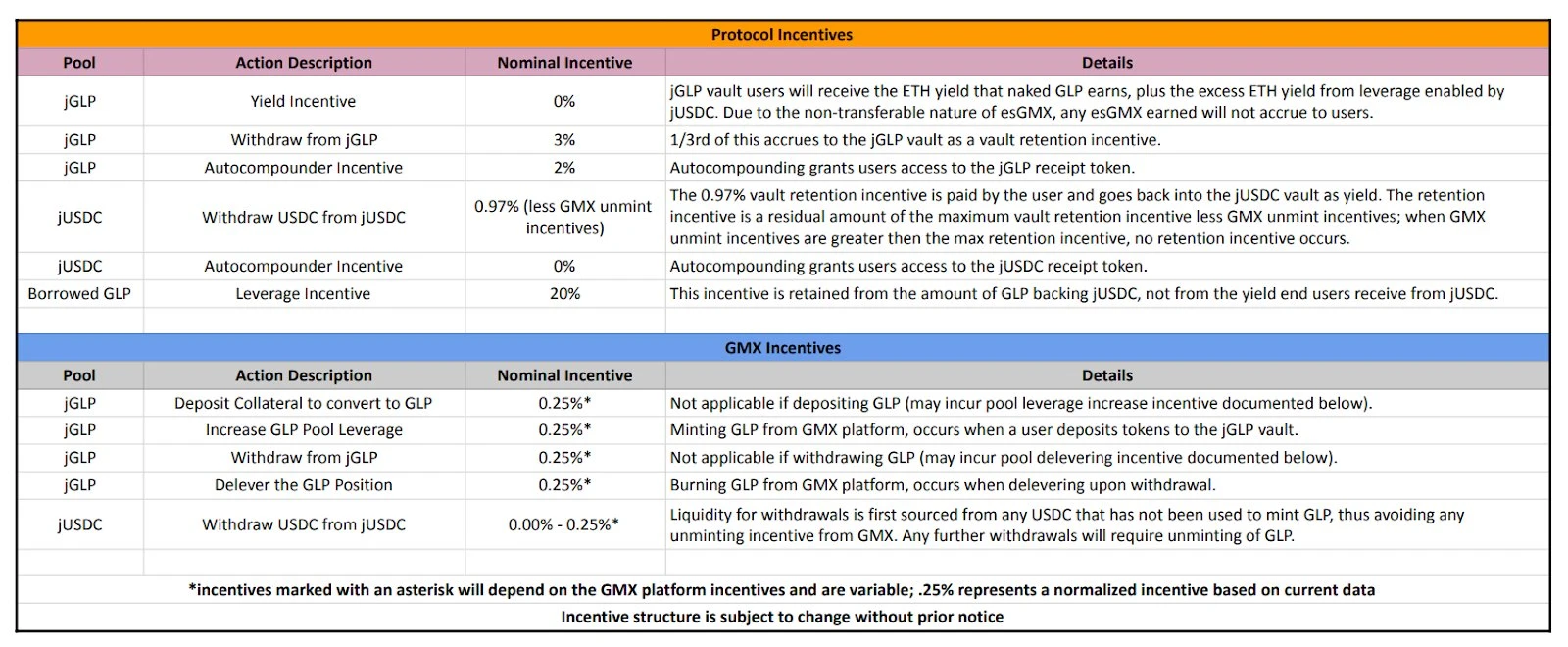

High-risk, high-yield, high-friction logic is simple. Mortgage GLP, borrow USDC to buy more GLP to increase leverage, and then sell two products a. jGLP: GLP with several times leverage b. jUSDC: The pool that lends money to jGLP to increase leverage is as follows Figure, the income can be said to be quite generous

10 / @MugenFinance9/ The product is basically sold out quickly every issue, which brings jones TVL back to life, but there are two problems - GLP has a 0.2% entry and exit fee, which leads to JGLPs entry and exit friction costs. If you lose, then here is the loss several times

The content of the plate with a bottom is like the title. It is better to look at the nature of this plate

11/ Generally speaking, the growth potential of this area is still good. The two better products, GMD and Jones, sold out quickly after the quota was released. However, there are not too many barriers and moats in this area now, and new projects are relatively easy to enter.