The currency price/TVL have both achieved a 500% increase, and the falsification track of fixed interest rates has come out of Pendle, an old tree blooming project.

Fixed rate? No, its actually a casino that rates! In this industry, gambling is always the most attractive.

This article uses actual calculation examples to give you an in-depth understanding of Pendle’s mechanism, and how interest-earning asset enthusiasts such as LSD / GLP can use it to make better profits, and look forward to interest rate swaps, an important derivatives track.

Pendle is an interest rate swap platform, in a nutshell

Disassemble the principal (PT) and interest (YT) of an interest-earning asset (SY) within a certain period of time

PT / YT is priced by the built-in AMM, the algorithm parameters determine the liquidity curve of the AMM, and the final pricing is done by the free market

That is to say, the conversion of SY to PT can lock the interest rate within a certain period of time, while YT is a gambling tool to increase leverage to bet on the rise of interest rates.

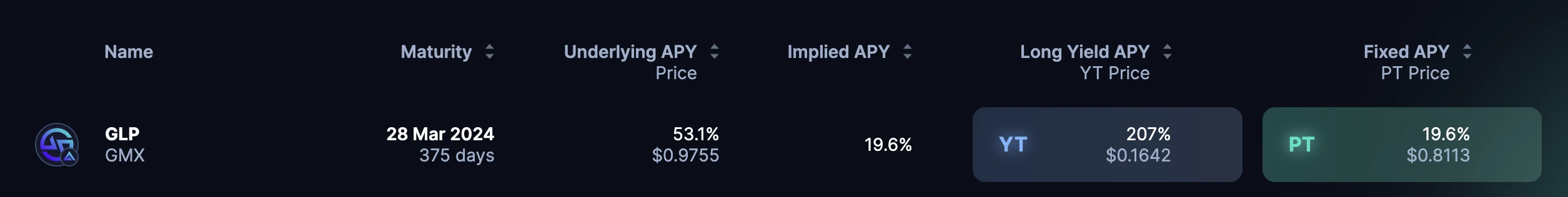

Taking GLP as an example, the current

GLP = $ 0.9755

YT = $ 0.1642

PT = $ 0.8113

Expiration time = 375 days

That is to say, the income of the 375-day GLP belongs to YT, and PT can get the GLP 1:1 after 375 days

Suppose you bought $0.9755/$0.8113 = 1.202 PT for 1 GLP.

Then after 375 days you will have 1.202 GLP

Converted to annualized income APY = 1.202 ^ ( 365/375)-1 = 19.6%

That is to say, no matter how much transaction fee share GLP actually gets in the next year or so, you can get 19.6% APY

This is the fixed rate function corresponding to PT

Suppose you spent 1 GLP to buy $0.9755/$0.1642 = 5.941 YT

What is your earnings after 375 days? It all depends on the actual earnings performance of GLP!

The so-called implied APY (Implied APY) = 19.6% means that the actual APY in the next 375 days of GLP = 19.6%

The gain for 1 YT is 1.196 ^( 375/365) -1 = 0.202 GLP

So 5.941 YT bought for 1 GLP ends up being 5.941* 0.202 = 1.200 GLP

Converted to APY, it is 1.2 ^ 365/375-1 = 19.6% (actually 19.4% on the left, with a slight error)

Assuming GLP Actual APY can sustain the current level of 53.1% for the next 375 days

Then spend 1 GLP to buy YT now, and after 375 days, you will get

5.941* ( 1.531 ^( 375/365) -1) = 3.261 GLP

Converted to APY is 3.261 ^ 365/375-1 = 207%

Yes, in this case, buying YT will make a lot of money

What if the actual APY of GLP is only 10%

5.941*( 1.1 ^( 375/365) -1) = 0.611 GLP

Yes, you will lose 0.4 GLP when you buy YT

To sum it up is:

SY actual interest rate = implied interest rate, YT income is the implied interest rate

SY actual interest rate > implied interest rate, YT is equivalent to several times leverage to earn excess interest rate

SY actual interest rate < implied interest rate, YT is equivalent to several times the leverage to lose the gap interest rate, and may even lose the principal

So how is YT/PT priced and traded?

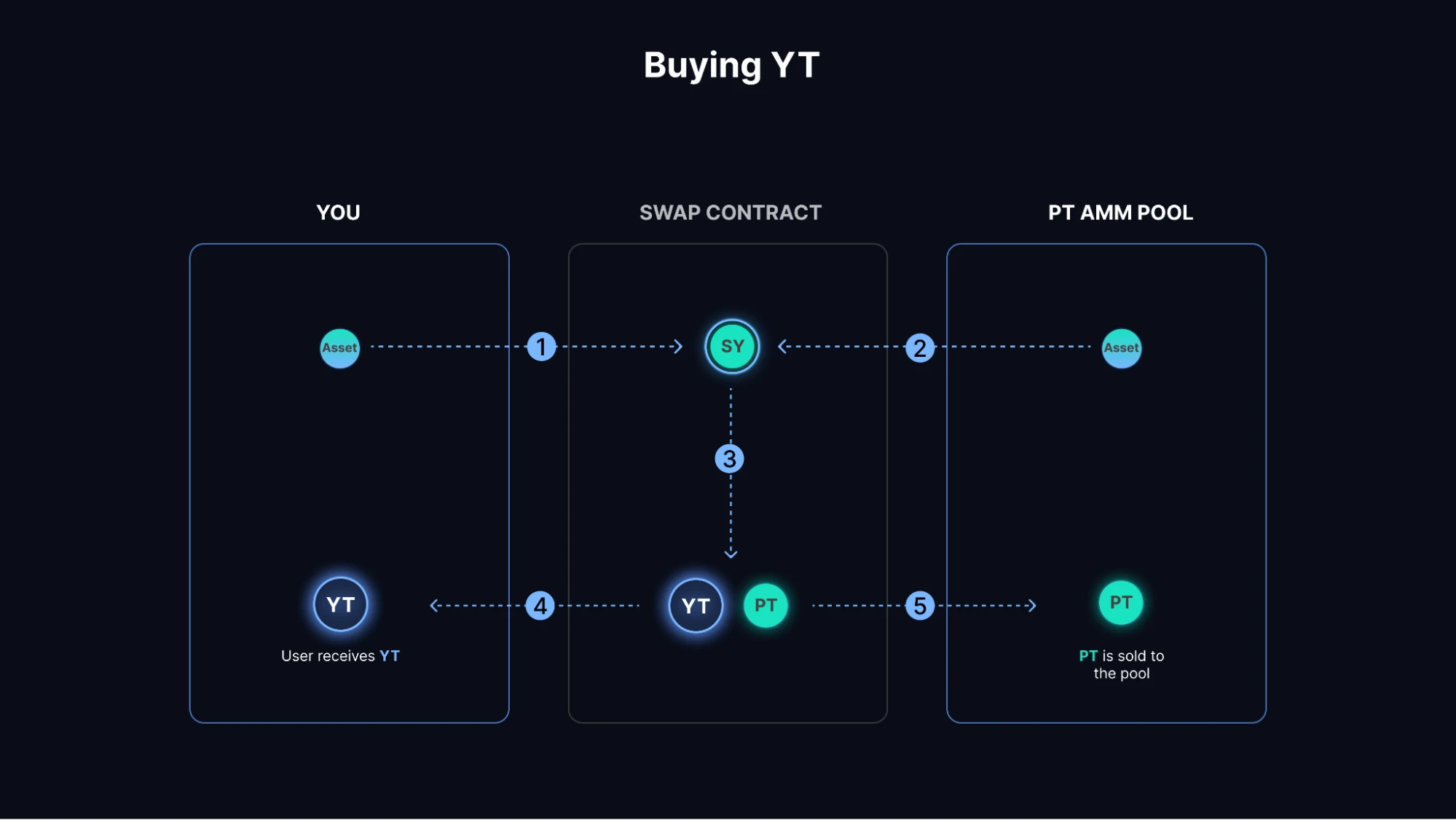

Pendle has a built-in PT/SY AMM, which allows external participants to provide liquidity, and users can trade PT through this AMM transaction. And trading YT is more complicated:

User executes a trade to buy X YT for 1 SY

The Pendle contract is to withdraw (X-1) SY from AMM

Pendle merges two SY and splits X SY = X PT + X YT

X YT is sent to the user, and X PT is returned to AMM. Since X PT = (X-1) SY = X SY- X YT, the total assets of the pool will not change

The process for the user to sell YT is reversed, see the picture below

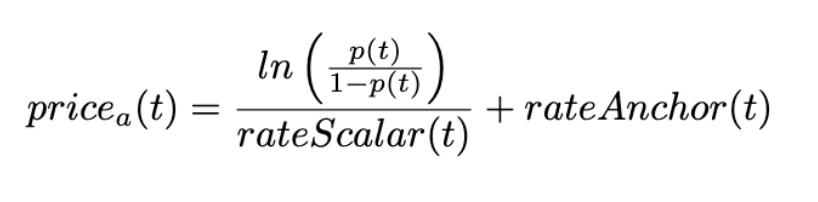

So how is Pendles AMM priced? Its AMM is borrowed from Notional, and the formula is complicated. Miaowaseed will help you refine the core concept:

The longer the time to maturity, the wider the liquidity distribution. The shorter the time to maturity, the more concentrated the liquidity.

The liquidity concentration point is at the current actual APY position of SY. Whats the meaning? For example, the liquidity of Curve V1 is concentrated at a 1:1 position.

When the PT ratio fluctuates in the range of 10% -90%, the interest rate fluctuates in the [0, Max] range, MAX is the set parameter, and the estimated maximum APY

The reason for this design is probably because

The implied interest rate formed by the transaction should be around the actual interest rate, so it can be concentrated here

The longer the maturity date, the greater the uncertainty of future interest rate expectations, so the liquidity distribution is wider to facilitate transactions with greater deviations

Through these designs, Pendle has realized a market-based interest rate transaction with a fair experience, serving two waves of customers with fixed interest rates and betting expectations.

Most of the products that failed in the fixed-rate market in the past did not take into account certainty + gambling. Pendle has done a good job, and LSD/Perp DEX has brought a large amount of interest-earning assets. Pendle once again seized the opportunity to enter the upward range.

After talking about the mechanism, it can be seen that Pendle’s products still have merits, but the value capture ability of its tokens is still relatively low

Its core capture mode is

PT/YT transaction fee, 0.1% up and down dynamically adjusted with time, 80% belongs to vePENDLE, 20% belongs to LP

Interest on YT, 3% vested in vePENDLE

ve-tokenomics , vote to decide which pool to reward

The average daily transaction volume in the past 7 days is about 1 M, and the annualized transaction fee income is: 1 M* 52* 0.001* 0.8 = 40 k

The current 34 M TVL, the main assets include both low-interest assets such as LSD and high-interest assets such as GLP, with a gross estimated average interest rate of 10%

The annualized interest income is 34 M 0.10.03 = 100 k

The total income is 140k, which is relatively small, even if it is doubled by 10 times, it cannot be considered too much. So in the future, we need to pay attention to whether its bribe can develop. After all, LSD is also a big bribe, and if it can develop, it will also have good benefits.

The interest rate swap market plays an important role in traditional finance, especially for institutions. However, these beautiful imaginations were not supported by actual data and performance in the last round of DeFi development. The fixed interest rate track is a well-known Falsification track.

With the rise of Real Yield, interest-bearing assets have become more sustainable. If the experience and mechanism are further optimized, maybe the old tree will bloom. Pendle is an example

tweetstweets。