introduction

introduction

Traditional liquidity mining faces several major issues and challenges. First, the tokens rewarded by liquidity mining are often sold by farmers immediately after they are obtained, which causes the price of tokens to drop, thus harming the interests of token holders. Secondly, the reward mechanism will distort the interest rate and price of the agreement, crowding out real users, and reducing the actual use value of the agreement. In addition, the management mechanism of liquidity mining rewards is often opaque, the distribution and use of tokens are not clear, and the ownership is too concentrated. Finally, the reward mechanism may increase the security risk of the protocol, lead to the theft or loss of funds, and damage the reputation of the protocol.

The FOO (Fungible Ownership Optimization) model is a new token model that tries to solve these problems in multiple ways. First, it merges the roles of farmers and LPs so that they must hold tokens in order to receive rewards, thereby relieving the sales pressure of rewarded tokens. Second, it uses option tokens as reward tokens, enabling the protocol to collect cash and back the token price. Additionally, the FOO model uses LP tokens as proof of voting rights, enabling token holders to participate in governance and earn protocol benefits. Finally, the FOO model ensures high liquidity of tokens in the trading pool.

Start with Curves

Curve uses the Gauge system to incentivize liquidity

For every cycle, CRV tokens will be released as rewards

Reward tokens are distributed among different transaction pools

Among them, the voting right comes from the veCRV obtained by locking CRV tokens. The voting right is proportional to the locking time and the number of locking, and as the number of veCRV in the hands of farmers increases, the reward multiple of CRV they get will also increase, up to 2.5 times.

core mechanism

core mechanism

In the rest of this article, use LIT as the protocol token

Merging Farmer and LP identities

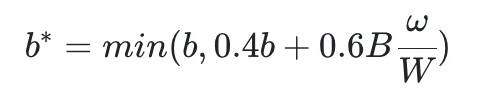

In Curve, the proportion of farmers getting token emissions is determined by the following formula,

in

in

b* is the weight of reward distribution

b is the liquidity it provides

B is the total liquidity of the trading pool

ω is the number of veTokens owned by the farmer

W is the total veToken supply

This means that if a farmer has no veToken, their liquidity share will be multiplied by 0.4 when determining how much they actually get rewarded, and when they have enough veToken, their weight will increase from 0.4 x to 1 x, reflected in the actual reward share earned is a 2.5 x increase.

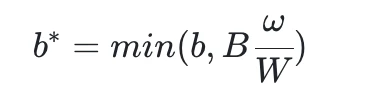

In the FOO model, the formula becomes of the form

This means that if a farmer has no veTokens, they receive 0 reward tokens, which forces farmers to become LIT holders, thereby dampening the sell-off every round of LIT release.

Option Tokens as Reward Tokens

In the FOO model, the call option of LIT is used as the reward token instead of directly using LIT as the reward. The benefit of this is that the protocol can amass substantial revenue regardless of market conditions and allow loyal holders to purchase protocol tokens at a discount.

For example, suppose the price of LIT is 100 $, and there is a call option token oLIT, which gives the holder the perpetual right to buy LIT at 90% of the market price. The protocol issues 1 oLIT to farmer Alice, who immediately exercises his option to buy 1 LIT for $90 and sell it on the DEX for $100. The profit and loss statistics are as follows:

Farmer Alice: + 10 $

Dex LP: + 1 LIT,-100 $

Agreement: -1 LIT, + 90 $

Compare this to regular liquidity mining where farmers pay no fees to the protocol:

Farmer Alice: + 100 $

Dex LP: + 1 LIT,-100 $

Agreement: -1 LIT

After comparison, it can be observed that the FOO model has the following characteristics compared with the conventional liquidity mining model:

Cash redistribution: using oLIT instead of LIT as a reward token effectively transfers cash proceeds from farmers to the protocol, and the LP of the token is not affected;

Use incentive efficiency to exchange protocol cash flow. In the FOO model, farmers get less incentives, but relatively, the protocol gets more powerful cash flow

Effectively stimulate the secondary market: Compared with the one-time issuance of tokens, the form of issuing options will reduce the pressure of secondary selling.

In FOO, the identity of farmer and LP coincide, and the profit and loss statistics become:

farmer-LP: + 1 LIT,-90 $

This means that when farmers are rewarded with oLIT, they have the right to buy tokens from the protocol at a discount and increase their ownership. Over time, protocol ownership will be optimized by transferring from non-liquidity holders to liquidity-providing farmers.

Summarize

The advantage of this model is that it can effectively suppress the arbitrage behavior of farmers, enhance the alignment of interests between farmers and token holders, provide stable liquidity and cash flow for the protocol, and promote the long-term development of the protocol. The disadvantage of this model is that it may reduce the incentive efficiency of the farmer, increase the complexity and risk of the farmer, and limit the freedom and flexibility of the farmer.

Disclaimer: This article is for research information only and does not constitute any investment advice or recommendation. The project mechanism introduced in this article only represents the authors personal opinion, and has no interest in the author of this article or this platform. Blockchain and digital currency investments are subject to various uncertainties such as extremely high market risk, policy risk, and technical risk. The price of tokens in the secondary market fluctuates violently. Investors should make cautious decisions and independently bear investment risks. The author of this article or this platform is not responsible for any losses caused by investors using the information provided in this article.