1. Overview

The Chicago Mercantile Exchange (CME) will launch futures contracts for the exchange rate between Ethereum and Bitcoin on July 31. Investors will be able to trade the ETH/BTC exchange rate. Giovanni Vicioso, CME's Global Head of Cryptocurrency Products, said, "This product allows investors to capture exposure to ETH and BTC risk in a single trade without having to take a directional view." He noted that ETH/BTC complements the existing BTC/USD+ and ETH/USD crypto trading pairs.

Blockchain validator and staking service provider Everstake announced the upcoming release of a new testnet called Holešky. Their team participated in a coordination call for the Holešky testnet release. Holešky will replace Goerli as the testnet for staking, infrastructure, and protocol development. Additionally, decentralized applications (DApps), smart contracts, and other Ethereum Virtual Machine (EVM) functionalities can be tested on the Sepolia testnet. To replace Goerli before the end of this year, the Ethereum team proposes to launch Holešky no later than September, with the Genesis event tentatively scheduled for September 15, 2023, 14:00 GMT.

In the secondary market, the short-term price of ETH is likely to continue consolidating, with support at $1900 and resistance at $1950.

2. Secondary Market

1. Spot Market

According to OKX market data, the price of ETH fell to $1816 last week, rebounded to a high of $1946, and closed the week at $1918, representing a 1.6% increase compared to the previous week.

ETH daily chart, from OKX

The daily chart shows that the price is currently consolidating around $1940, with support at $1900. If it falls below, it may further decline to $1850; the resistance above is $1950.

2. Network Operation

Etherscan data shows that the Ethereum network produced 49,842 blocks in the past week, which is basically the same as the previous week; the number of weekly active addresses is 2,851,805, a decrease of 2.7% compared to the previous week; block reward income is 4,427 ETH, a 24% increase compared to the previous week; the weekly ETH burn volume reached 15,258, an increase of 16.6% compared to the previous week.

3. Major Changes

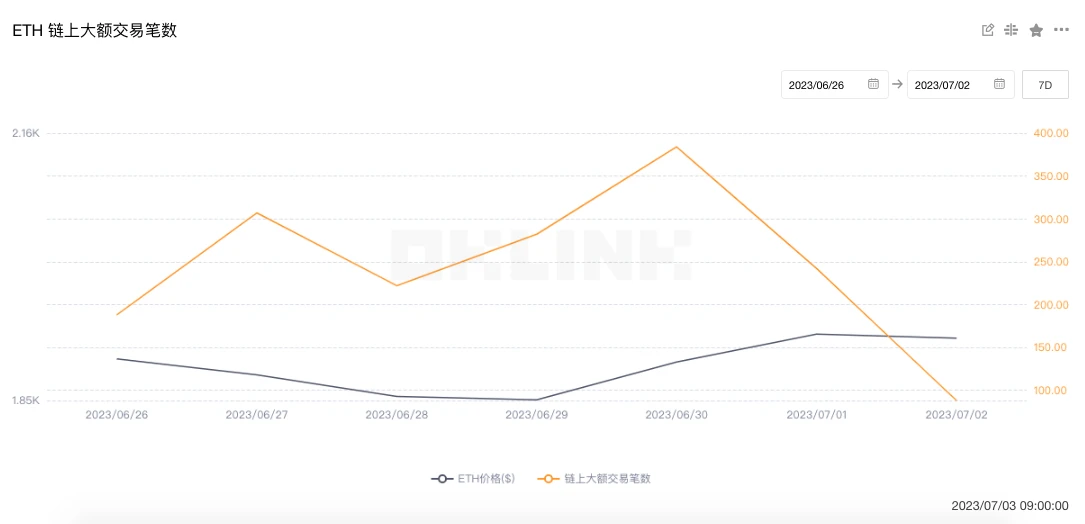

OKLink data shows that the number of on-chain large transactions reached 1,713 last week, a 12.5% decrease compared to the previous week (1,959), indicating a significant decrease in whale trading activity.

4. Rich List Addresses

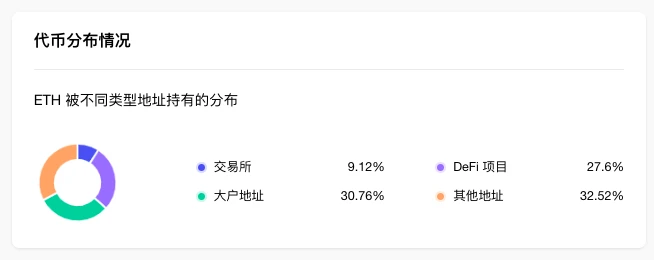

OKLink Data shows that from the distribution of ETH holding addresses, exchanges account for 9.12%, unchanged from last week; DeFi projects account for 27.6%, up 0.34% compared to the previous period; large addresses (excluding exchanges and DeFi projects) account for 30.76%, down 0.27% compared to the previous period; other addresses account for 32.52%, down 0.07% compared to the previous period.

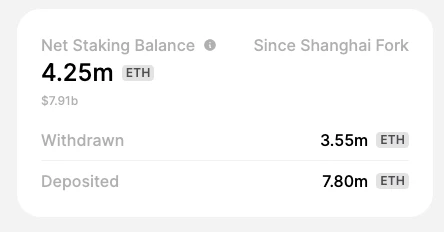

token.unlocks shows that currently, the total staking amount of ETH in the entire network is 20.66 million ETH, with a staking rate of 16.96%; since the upgrade in Shanghai, the cumulative deposit amount is 7.8 million ETH, last week's data was 7.11 million, with an increase of 690,000 over the past week; the cumulative withdrawal is 3.55 million, last week's data was 3.47 million; the total net staking amount has increased by 4.25 million, the previous week's data was 3.63 million, with an increase of 620,000 over the past week.

5. Lock-up Data

DeFiLlama data shows that the value of on-chain locked collateral increased from $26.52 billion to $26.98 billion last week, up 1.7% compared to the previous period. The top three projects in terms of locked collateral value are: Lido with $14.76 billion, MakerDAO with $6.24 billion, and Aave with $5.16 billion.

III. Ecosystem and Technology

1. Technological Progress

The Ethereum team will launch a new testnet called Holešky in September to replace Goerli

The blockchain validator and staking service provider Everstake announced that the Ethereum team is about to launch a new testnet called Holešky, and their team participated in the Holešky testnet release coordination conference.

Currently, Ethereum has two public testnets: Sepolia allows developers to test contracts and applications; Goerli allows protocol developers to test network upgrades and stakeholders to test running validators. According to the proposed Ethereum testnet lifecycle plan, Goerli will enter the long-term support phase in the first quarter of 2023. After the lifecycle termination date (scheduled for the fourth quarter of this year), it will no longer receive support from client teams. Therefore, the next testnet should be launched by the end of 2023 to prepare for the closure of Goerli.

Holešky will replace Goerli as the testnet for staking, infrastructure, and protocol developers. At the same time, decentralized applications (DApps) testing, smart contracts, and other Ethereum Virtual Machine (EVM) features will be tested on the Sepolia testnet. The Holešky network is named after Nádraží Holešovice train station located in Prague, Czech Republic (Goerli is also named after Goerlitzer Bahnhof station in Berlin).

In order to replace Goerli by the end of this year, the Ethereum team proposes to launch Holešky no later than September, and the genesis event is tentatively scheduled for September 15, 2023, 14:00 GMT.

2. Community Voice

As more and more ETH is staked to protect the network, the staking yield is decreasing. In the months following the major upgrade of Ethereum in September last year, the Ethereum staking yield fluctuated between 5% and 6%. Since then, the circulating Ethereum stake has surged from 11% to nearly 20%. This month, the staking yield hovers around 4.5% to 5%.

Some researchers predict that most Ethereum will eventually be staked. Mike Silagadze, the founder of the staking protocol ether.fi, said that if this happens, the yield may drop below 1%, which will force the protocol to seek new ways to increase the yield.

James Butterfill, the research director of CoinShares, said that by the end of this year, it is estimated that 25% of ETH will be staked, which is equivalent to a yield of around 3%. Darren Langley, the CEO of Rocket Pool, stated that Ethereum staking is considered one of the safest ways to earn rewards, even if the reward rate decreases significantly. (DL News)

(2) Vitalik Buterin: Staking Only a Modest Portion of Ethereum Due to Security Reasons

The founder of Ethereum, Vitalik Buterin, stated in a Bankless Podcast that he does not stake all of his Ethereum, but only a "relatively small portion" because staking for security requires multi-signatures, which is still a challenging process. Buterin explained that if you stake your ETH, the access to its keys must be made public on some online system. For security reasons, it must be multi-signature, and setting up multi-signature for staking is still quite difficult. It becomes complex in many ways. (Cryptoslate)

3. Project Updates

(1) AAVE Community Passes Two New Proposals

Snapshot voting page shows that the AAVE community's ARFC vote on Gauntlet's proposal for "DeFi risk manager Gauntlet's suggestion for Aave v2 on Ethereum regarding TUSD" has ended. Among the provided 4 options, the option "Iteratively decrease the LT liquidation threshold of TUSD to 77.5% and decrease the loan-to-value (LTV) ratio to 75%." received a support rate of 98.73%, while freezing TUSD supply received a support rate of 14.17%.

In addition, the governance page also shows that the Aave community has approved the proposal "Follow-up steps for Aave V2 to V3 migration" through on-chain voting. The proposal suggests freezing reserves of 1INCH, ENS, LINK, MKR, SNX, and UNI on the Aave V2 Ethereum pool. The proposal was initiated by the blockchain security firm Chaos Labs. Chaos Labs stated that these markets have smaller sizes and can be easily migrated. This is different from the consideration of freezing markets before the release of V3. With the launch of V3, freezing V2 markets does not hinder users from utilizing these markets. On the contrary, it enhances the community's ability to protect user funds more effectively because the advanced risk management mechanisms of V3 provide a safer environment. This proactive strategy aims to forcibly freeze low- and medium-capital assets on V2.

(2) Circle's cross-chain transfer protocol CCTP has launched on Arbitrum

Circle announces the launch of Cross-Chain Transfer Protocol (CCTP) on Arbitrum. Circle has launched native USDC on Arbitrum on June 8th. CCTP is an open and permissionless on-chain tool introduced by Circle, which facilitates the transfer of USDC across different chains. Circle does not require liquidity on the target chain, but instead destroys USDC on the source chain and mints native USDC on the target chain, enabling USDC to flow cross-chain locally. It has already been launched on Ethereum and Avalanche. CCTP has been supported by Celer Network, Interport Finance, LI.FI, Router Protocol, O 3 Labs, Wanchain, Wormhole, and others.

BnkToTheFuture has launched the test version of Ethereum staking solution, with a total of 25 validator nodes available for staking 800 ETH. BnkToTheFuture allows eligible customers to invest in cryptocurrency companies, security tokens, and Bitcoin-centric retirement plans, and states that by combining registered securities business with registered lending business, it will be able to provide users with compliant lending and yield platforms.

Compound co-founder Robert Leshner announced the establishment of a new company Superstate that has completed seed funding. The specific amount of funding has not been disclosed. This round of funding was participated by ParaFi Capital, 1 kx, Cumberland, CoinFund, and Distributed Global. Superstate aims to create regulated financial products that connect traditional markets and the blockchain ecosystem. It will use the Ethereum blockchain as a supplementary record-keeping tool to create short-term government bond funds. The team has submitted a preliminary prospectus for the Superstate Short-Term Government Bond Fund to the U.S. Securities and Exchange Commission on Monday.

Digital asset management company 3iQ announced that on August 28th, 2023 or around that date, its The Ether Fund and 3 iQ Ether ETF will start offering staking services to its customers. This makes these products the first ETFs globally to offer such services. 3iQ is collaborating with its custodian Coinbase Custody to provide secure staking activities for the funds. 3iQ stated that its staking service will provide opportunities for increased returns to the funds and its unitholders. Through staking, the funds will receive rewards in the form of ETH, which will be reflected in the funds' Net Asset Value (NAV) as appreciation gains, while increasing the funds' exposure to ETH.

(6) Ethereum Foundation launches Devconnect scholar program

The Ethereum Foundation has launched the Devconnect Scholars Program to provide funding support for talent from underrepresented communities in terms of geography and demographics in the Ethereum community to participate in Devconnect, which will be held in Istanbul in November this year. Applications can be submitted before July 23.

According to official sources, the Ethereum restaking protocol EigenLayer announced that it will increase the upper limit of liquidity staking tokens (LST) to expand users' restaking opportunities. To modify the restaking limit, relevant protocol parameter changes also need to be approved by the multisignature governance system. As of June 30, the Operations multisignature transaction to raise the ceiling has been queued within a 10-day time lock to ensure compliance with governance procedures and security measures.

After the 10-day time lock expires, the Operations Multisig, responsible for supervising the protocol's daily operations and processes, needs to trigger the actions in the time lock contract, which will initiate parameter changes in the Executor Multisig and execute the modifications. EigenLayer is expected to raise the LST limit in the week of July 10. At that time, the upper limit of LST (including rETH, stETH, and cbETH) will increase to 15,000 tokens per type of LST, with no individual deposit limits. Once the total sum of LST deposits reaches 30,000 tokens, restaking of LST will be paused.

EigenLayer expresses that with the increase of the LST cap, the next step is to explore the EigenLayer roadmap. The focus is still on enhancing the staking experience while ensuring security and decentralization. The specific plan is to launch the Operator testnet in the third quarter and the Active Validation Service (AVS) testnet in the fourth quarter, with the AVS mainnet expected to launch in the first quarter of 2024.

French fashion brand Dior recently announced the launch of a new men's shoe collection equipped with a unique encrypted online identity verification system and "digital twin" collectibles (i.e., NFT) based on NFC chips. Shortly after the release of these exclusive sports shoes matched with NFTs, Dior will release six additional B33 sports shoe models. These styles will also have NFC chips placed on the sole of the right foot but will not be equipped with digital NFTs. The NFC chip will be associated with an encryption key that provides digital authenticity certificates and other undisclosed exclusive services. The price of these shoes ranges from $1000 to $1100. (Decrypt)

(9) CME to launch ETH/BTC exchange rate futures contract on July 31

The Chicago Mercantile Exchange (CME) will launch Ethereum to Bitcoin exchange rate futures contracts on July 31, allowing investors to trade the ETH/BTC exchange rate. Giovanni Vicioso, the head of CME's global cryptocurrency products, said, "This product allows investors to capture the risk exposure of ETH and BTC in a single transaction, without taking a directional view." He pointed out that the introduction of ETH/BTC complements the existing BTC/USD and ETH/USD cryptocurrency trading pairs. (yahoo)

(10) CME Ethereum Options' Open Interest Hits All-Time High

The Block's data shows that the open interest of CME's Ethereum options contracts this month reached a record high of $254 million. The open interest of CME's Bitcoin options contracts is also nearing an all-time high at $1.59 billion. The trading volume of CME's Ethereum options decreased in June but has been steadily growing for most of this year, rising from $84 million in January to a peak of $334 million in May. Meanwhile, the trading volume of Bitcoin options has been increasing for the third consecutive month but still remains below its peak in March. (The Block)