Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

The cryptocurrency market suffered another heavy blow last night and this morning.

OKX market data shows that around 8:10 this morning, BTC fell below 91,000 USDT (fell to a low of 90,888 USDT) . As of around 10:15 (the same below), it was temporarily reported at 81,899.9 USDT, a 24-hour drop of 4.31%.

The altcoin market is even more bloody. The two major altcoin leaders ETH and SOL are competing with each other for misery . Affected by the accelerated money laundering by hackers, ETH fell below 2500 USDT and is currently reported at 2487.01 USDT, a 24-hour drop of 10.96%; SOL, which has been weak recently, has fallen below 140 USDT and is currently reported at 139.56 USDT, a 24-hour drop of 14.88%.

Looking around the market, except for a few recently launched new coins such as IP and LAYER that can still record positive growth, other coins generally fell by more than 10% or even 20%.

Alternative data shows that todays Fear and Greed Index has fallen from 49 to 25, entering the extreme panic state again after 5 months.

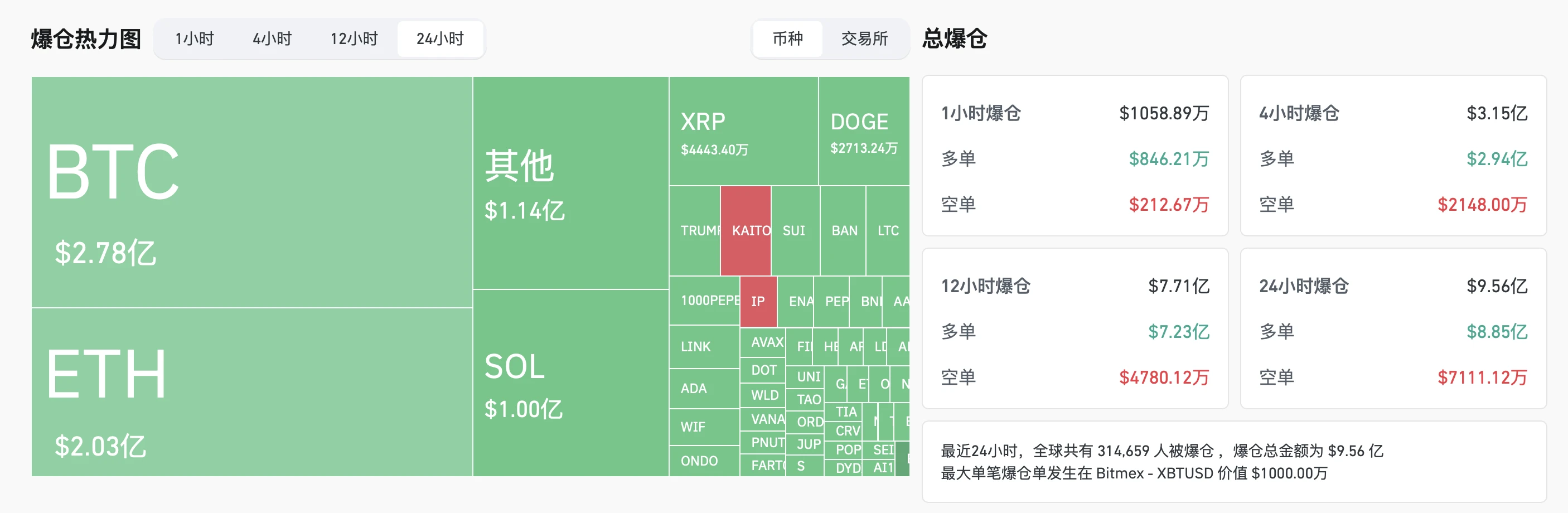

In terms of derivatives data, Coinglass data shows that in the past 24 hours, the entire network has liquidated $956 million, of which the vast majority are long orders, amounting to $885 million. In terms of currency, BTC liquidated $278 million and ETH liquidated $203 million.

Is the next step really 70,000?

As the market situation is confusing, many bigwigs have given their predictions about the future market.

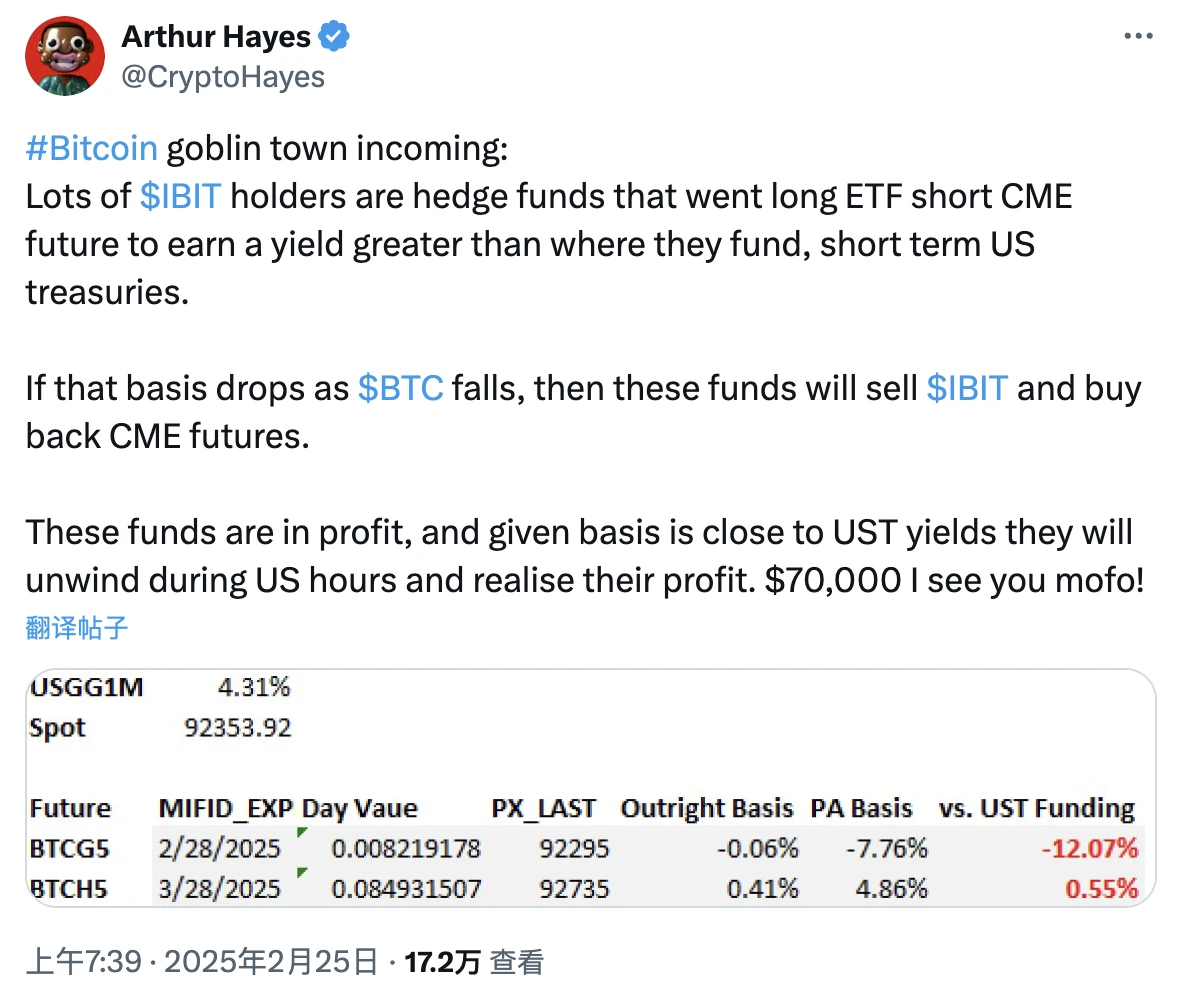

Arthur Hayes, co-founder of BitMEX, who has been shorting to $70,000 since the end of January, once again gave his analysis. Arthur said that many IBIT holders are hedge funds, who earn higher returns than short-term U.S. Treasuries by going long on ETFs and shorting CME futures . If the BTC price falls and the basis narrows, these funds will sell IBIT and buy back CME futures. These funds are currently in a profitable state, and considering that the basis is close to the U.S. Treasury yield, they will close their positions during the U.S. trading hours and realize their profits. In short, Arthur emphasized that he will continue to be bearish on Bitcoin to $70,000.

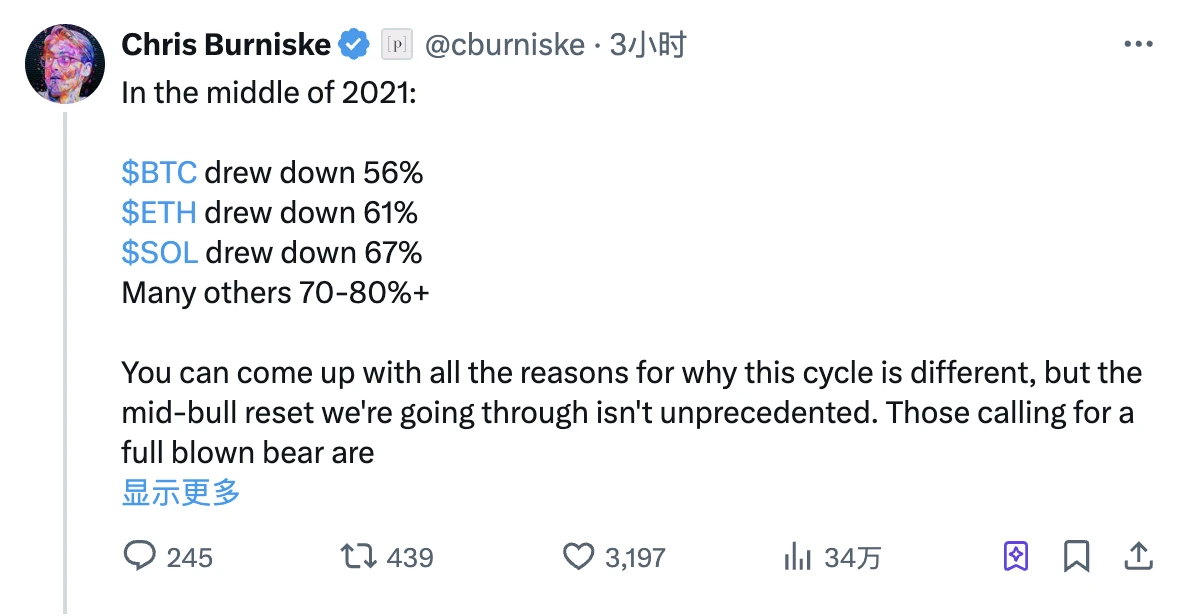

Another influential institutional boss, Chris Burniske, a partner of Placeholder, gave a different view. Burniske still firmly believes that this is just a mid-term bull market correction, not the beginning of a bear market , and reminds everyone to recall that in the mid-term of the 2021 bull market, BTC, ETH, SOL and other altcoins also experienced a correction of more than 50%.

The copycat leader can no longer bear it

Compared with BTC, which is gradually becoming more like a U.S. stock, retail investors may be more concerned about the future performance of the two major altcoins, ETH and SOL, but the situation is not optimistic at the moment.

ETH has suffered a sudden disaster recently. Originally, ETH Denver would have been a great opportunity for the entire Ethereum community to restore its faith, but the sudden Bybit $1.5 billion hacking incident dealt a heavy blow to ETH.

A few days ago, ETH holders could still comfort themselves by saying “Bybit will buy it back” and “it may take several years for the hacker to sell off”, but now Bybit has basically replenished the stolen ETH from the OTC and lending channels, and potential buying has been eliminated; at the same time, the speed at which hackers laundered money has far exceeded market expectations, and more than 20% of the funds have been laundered in just a few days.

SOL is even bleaker. On the one hand, affected by malicious events such as LIBRA, the wealth effect of meme tokens has gradually disappeared, and the golden shovel attribute of SOL is decreasing; on the other hand, the upcoming SOL large-scale auction unlocking on March 1 has also caused some holders to choose to temporarily avoid the limelight and withdraw to wait and see.

It is difficult to reproduce the general increase of all currencies and eliminating the false and retaining the true is in progress

In short, as the market evolves to this stage, the much-anticipated “altcoins” seem to be really gone, and this round of bull market is increasingly looking like a solo dance for BTC.

As for the future trend of altcoins, I personally tend to agree with what Wintermute founder and CEO Evgeny Gaevoy shared at the Consensus conference in Hong Kong last week - there will no longer be a comprehensive bull market, and investors will pay more attention to protocols that truly have practical uses and sustainable economic models.

The entire cryptocurrency industry seems to be undergoing a large-scale eliminating the false and retaining the true. Perhaps only after the sand and gravel are cleared away will the real gold usher in value discovery.