Growth is crucial for investment returns, however, in web 3, there are very few projects that can successfully expand into new businesses, and existing projects often struggle to compete with new projects in the same industry.

subDAO + Execution may be the answer to this problem. From Pendle's Penpie to Radiant's Radpie, Magpie is rapidly expanding through the subDAO model. This thread will analyze the best practices of subDAO using this as an example.

A. What is a subDAO?

Currently, subDAOs like MakerDAO's Spark have not been successful, but projects without independent token are in the incubation stage and are not referenceable. A qualified subDAO should have the following characteristics:

subDAO has an independent token and the ability to expand independently

ParentDAO holds a significant stake in subDAO

There is mutual benefit between ParentDAO and subDAO

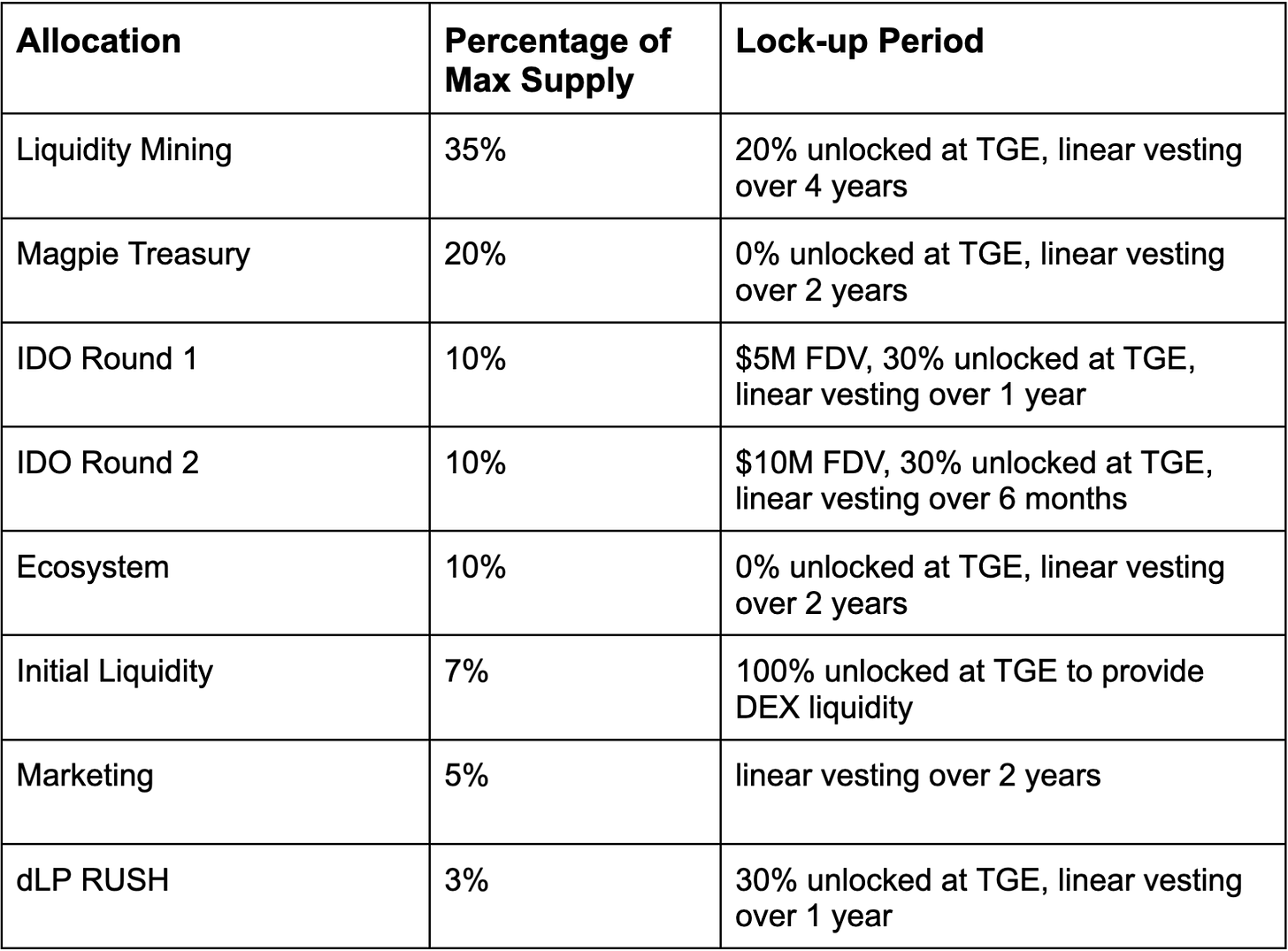

Take Magpie's subDAO, Radiant's yield booster Radpie, as an example. Radpie will issue $RDP, of which Magpie Treasury holds 20%, and an additional 30% of IDO shares will be given to MGP. This means:

MGP holders can share IDO profits

MGP holders will be able to enjoy "dividends" from $RDP in the future

Magpie has significant control over Radpie and therefore has governance rights over Radiant

Radpie will utilize Magpie's team resources for a rapid launch

What are the advantages of the B. subDAO model?

Credibility, subDAO inherits the accumulated credibility of ParentDAO, making it easier to launch

Growth, independent tokens enable it to have a sufficient incentive growth budget

Narrative, subDAO tokens follow new narratives, enabling ParentDAO to keep up with new narratives

Cycle, subDAO interacts with and shares resources within the ParentDAO ecosystem to improve efficiency

Leverage, ParentDAO on the governance track can achieve leverage governance through subDAO

B.1 Credibility

The biggest fear in the cryptocurrency world for new projects is rug pull. LP tokens often give a high risk discount to new projects. However, subDAO can inherit the credibility of ParentDAO, greatly alleviating this concern. Cooperation with KOLs and other project teams will also become smoother.

Moreover, credibility is an intangible asset that can be continuously accumulated. The success of existing projects will pave the way for new subDAOs in a snowball effect.

B.2&3 Growth and Narrative

Wang Huiwen, co-founder of Meituan, commented that web 3 has a more aggressive customer acquisition and financing model, and Token is the tool to achieve this. Existing projects often face a dilemma when developing new businesses. If a large number of tokens are issued to incentivize new projects, it will lead to a price drop. However, not doing so will make it difficult to win in the competition.

What's worse is that due to the large token plate of the old project, it is not suitable for speculation and its positioning is not clear. When the market is chasing new narratives, it will not include this token in the core discussion of the narrative. For example, in the past year, StakeDAO developed governance business similar to Convex, integrating 10 projects but with limited effect. Although it integrated Pendle, it did not share much of Pendle's popularity.

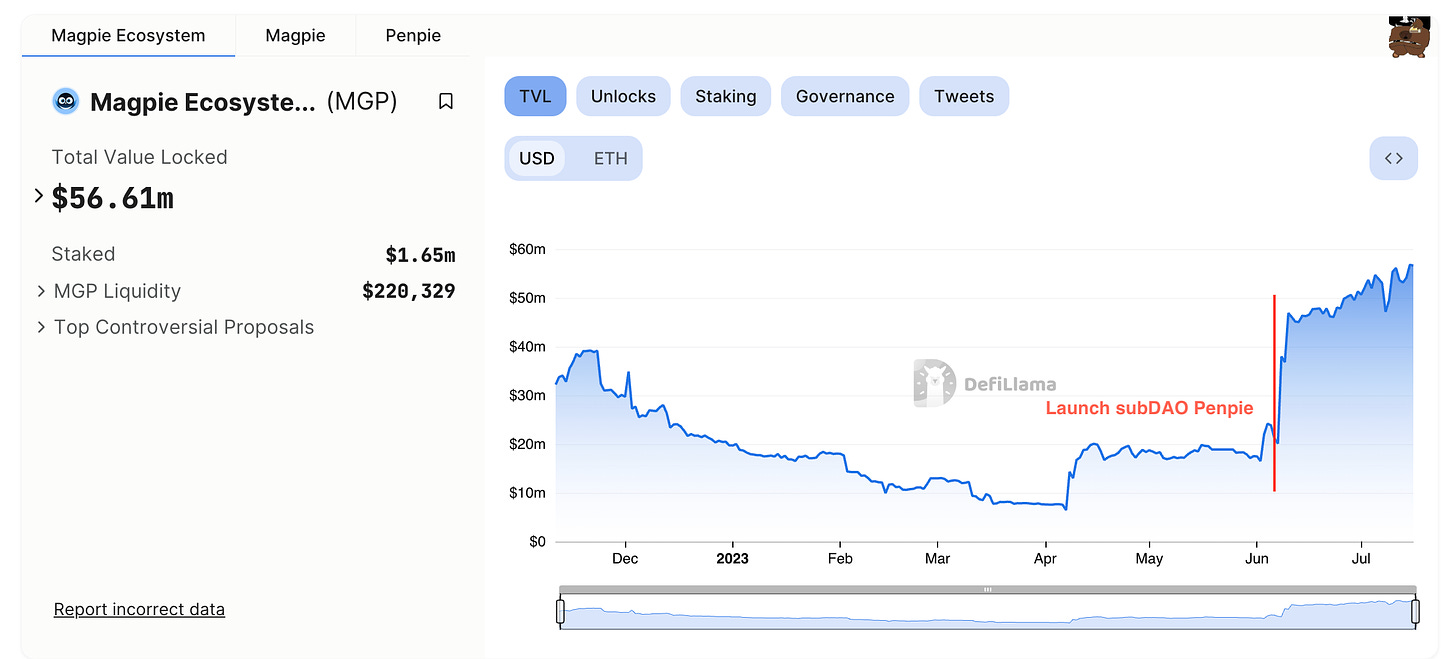

The subDAO model is different. For example, Penpie/$PNP as an independent project not only did not issue any $MGP, but also firmly bound itself to the narrative of Pendle. Although the surface price of $MGP has not changed much, MGP is a project started by Wombat, and a similar project WMX has recently fallen by 70%. Without Penpie, it is not difficult to imagine what would happen to MGP.

B.4 Loop

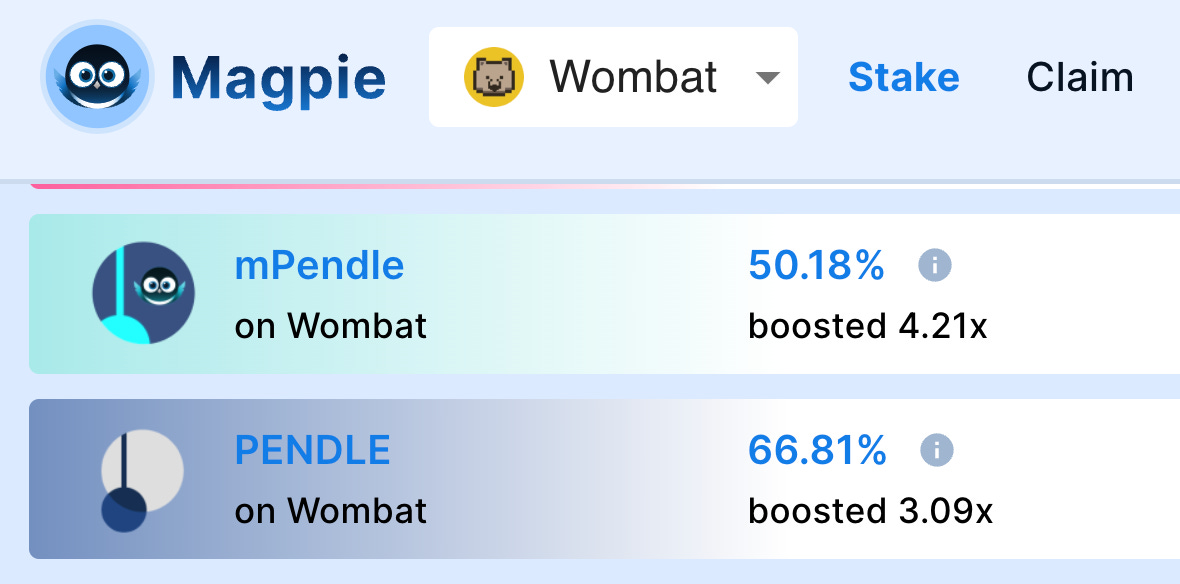

For example, recently mPendle/Pendle traded on Wombat and sought to use Bribe through MGP. This way, the incentive expenditure of PNP is in the hands of MGP holders.

Next, can mWOM/mDLP and the LP tokens on both sides also land on Pendle, and then use $MGP and $RDP to participate in Penpie's bribery market? Although there is no explicit information at present, it is likely.

Newly issued tokens are either bribed or kept within the Magpie system, which is called internal circulation, where the meat rots in the pot, reducing net external expenditures. With internal circulation, there naturally comes external circulation, achieving resource sharing between multiple projects to reduce costs and increase efficiency. For example, Ankr obtains Wom incentives through Magpie Bribes, and Penpie has also been successfully brought in.

The ultimate goal of Magpie should be that all incentive tokens are not issued directly but are used to improve efficiency and achieve mutual benefits within the ecosystem through bribes, as well as to establish a more competitive bribery market by sharing BD resources.

In addition, Magpie focuses on the governance track, which is a perfect combination with the subDAO model. This track is different from projects like Perp that require continuous cultivation. After the project is set up, there is relatively less work in the later stages and a high degree of homogeneity. For new projects, a large amount of previous work can be reused.

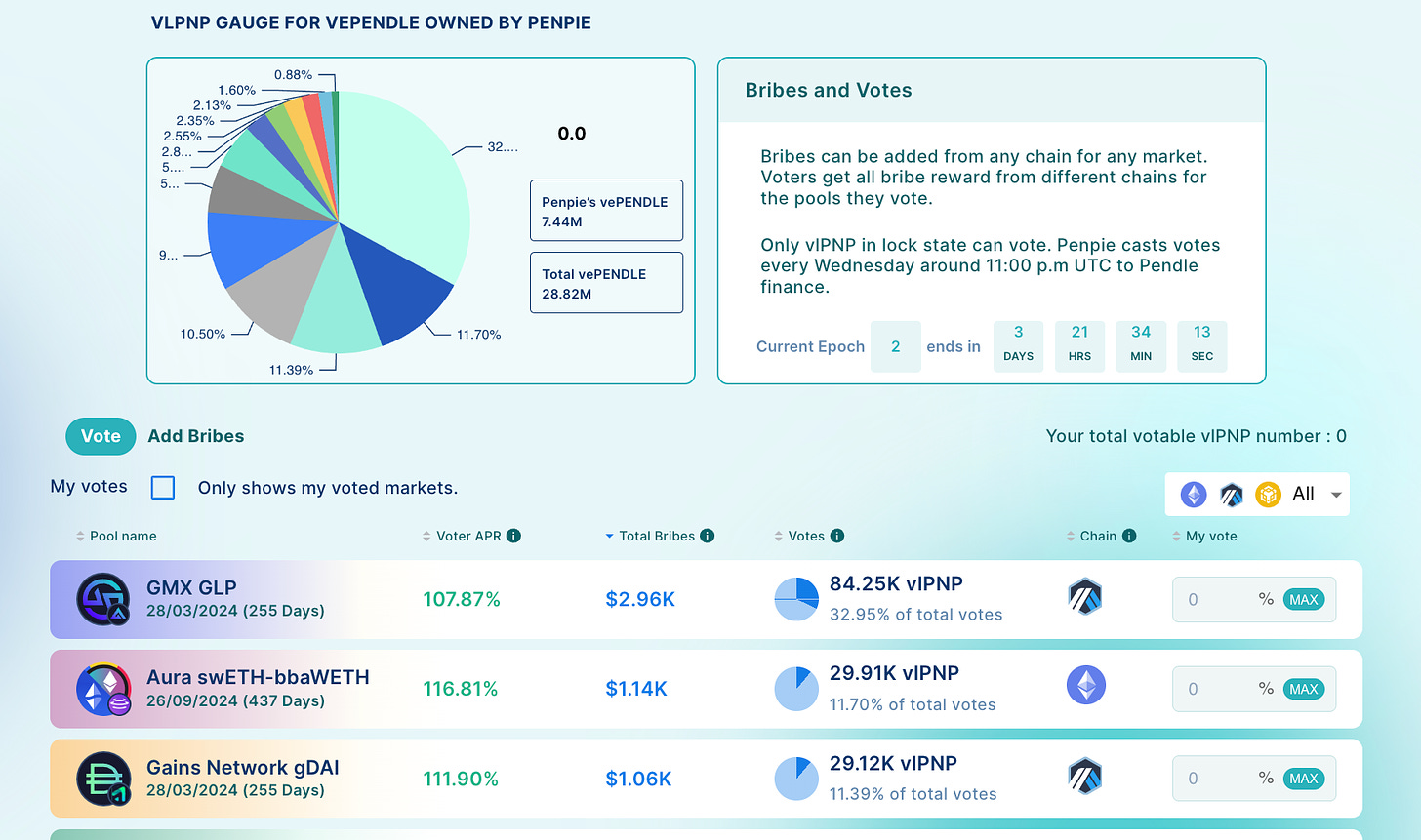

For example, Penpie quickly launched the bribery market. This market is very similar to the one Magpie previously created for Wom, which is also part of resource recycling.

B.5 Leverage

Take Magpie as an example. In name, Magpie controls 20% of Penpie's governance, and Penpie controls 25% of Pendle's governance. On the one hand, Magpie enjoys 20% x 25% = 5% of the benefits of vePendle. But on the other hand, when it comes to protocol governance and yes or no questions, the 20% voting power of Magpie will greatly influence Penpie's voting power, which means that it actually has nearly 25% of Pendle's governance.

This is the so-called leverage. Although subDAO dilutes the general equity portion, there is almost no dilution in protocol governance. In a sense, the entire Penpie is a unified actor, which means a leverage of 5 times (1/20% = 5).

C. Execution

The idea of subDAO is great, but it still depends on execution to become reality. MakerDAO's Spark has been released for half a year but hasn't shown progress. After all, it simply forked AAVE and there haven't been any major updates. There's no trace of token economics. Currently, it can't be regarded as a subDAO. So, the team's execution is what matters.

Summary

subDAO + execution pave the way for the growth of Web 3 projects. Through subDAO, rapid expansion can secure sufficient budget for new project growth, keep up with new narratives, achieve ecological linkage and resource sharing. Of course, all of this is built on the foundation of a team with excellent execution.

In the past, DeFi was mostly just a module, unable to compete with the vast systems of large CEX. However, if DeFi can expand horizontally and become a system quickly, the singularity may be approaching.