Arrangement | Odaily

Author | Qin Xiaofeng

1. Overview

On September 15th, the Ethereum Holesky testnet was officially launched, replacing the current Goerli testnet. Subsequently, Christine Kim, Vice President of Research at Galaxy, stated that the Holesky testnet failed to start due to network configuration errors, and developers will restart it as soon as possible. The latest news is that developers plan to relaunch Holesky within a week, with a target date of September 28th, as revealed by Ethereum developer Michael Sproul in a GitHub pull request.

James Seyffart, an ETF analyst at Bloomberg, stated in an article on the X platform that crypto asset management company Hashdex has submitted an application for a physical Ethereum ETF. It is reported that the assets under management of Hashdex amount to $435 million.

In the secondary market, the price of ETH may continue to consolidate in the short term, with support at $1600 and resistance at $1650.

2. Secondary Market

1. Spot Market

OKX Quotes data shows that ETH fell to 1550 USDT last week but closed at 1629 USDT, a 1% increase compared to the previous week.

ETH Daily Chart, from OKX

The daily chart shows that the price is currently consolidating around $1630, with support at $1600. If it falls below this level, it may further decline to $1500. The resistance level above is $1650.

2. Network Performance

Etherscan data shows that the Ethereum network produced a total of 49,742 blocks in the past week, a decrease of 0.5% compared to the previous week. The number of weekly active addresses increased by 36.3% to 3,553,140. Block reward income decreased by 5.1% to 3,204 ETH. The weekly ETH burn amounted to 11,678, a 2% increase compared to the previous week.

According to ultrasound.money data, since the Ethereum merge upgrade in mid-September last year, over 680,000 ETH have been issued and over 980,000 ETH have been burned, resulting in a net supply reduction of nearly 300,000 ETH. The supply has decreased by 0.249% on an annualized basis.

3. Large-scale Changes

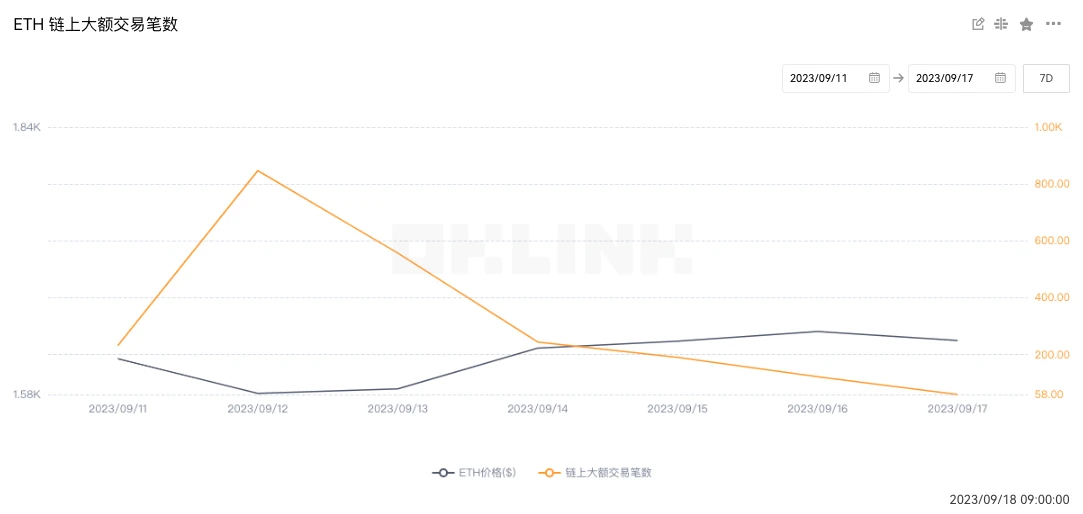

OKLink data shows that the number of on-chain large transactions reached 2,244 last week, a 116.6% increase compared to the previous week (1,036), indicating a significant increase in whale trading activity.

4. Rich List Address

OKLink Data shows that the current total deposit volume of ETH 2.0 has reached 26.87 million ETH, with a pledge rate of 22.35%; from the distribution of ETH holding addresses, exchanges account for 8.58%, a month-on-month increase of 0.05%; DeFi projects account for 30.78%, a month-on-month increase of 0.23%; large account addresses (excluding exchanges and DeFi projects) account for 29.38%, a month-on-month decrease of 0.01%; other addresses account for 31.26%, a month-on-month decrease of 0.27%.

5. Lock-up Data

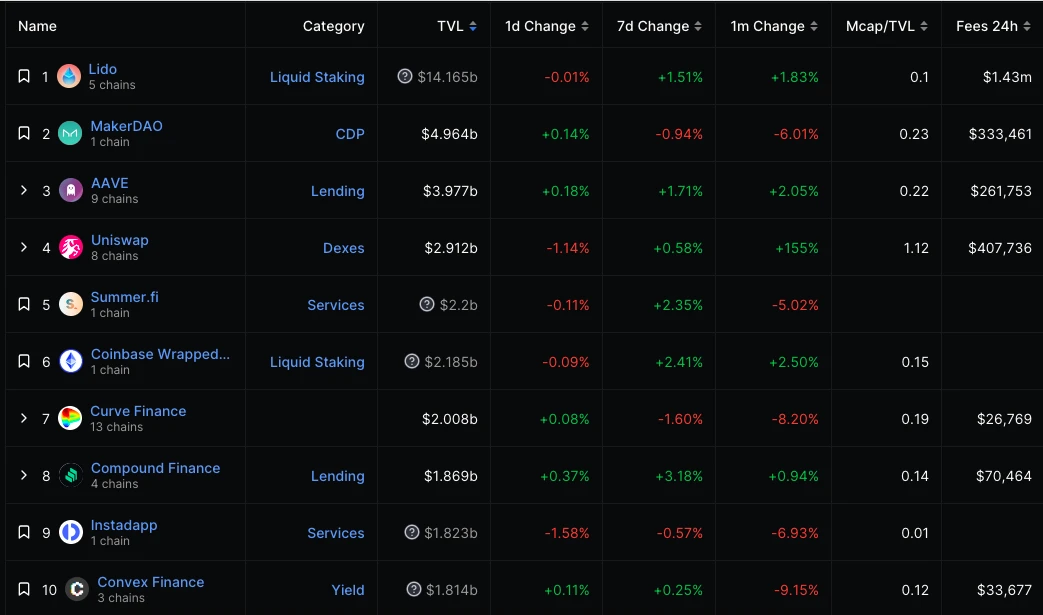

DeFiLlama data shows that the value of on-chain locked collateral increased from 21.26 billion USD last week to 21.33 billion USD, a month-on-month increase of 0.5%; looking at individual projects, the top three in terms of locked value are: Lido with 14.16 billion USD; MakerDAO with 4.96 billion USD; Aave with 3.97 billion USD;

III. Ecology and Technology

1. Technological Progress

Ethereum core developer Tim Beiko summarized the latest Ethereum Core Developer Execution Meeting (ACDE) on the X platform, which introduced Devnet updates, new features of Dencun, and provided a comprehensive overview of Reth:

1. Devnet-8 status update: The network is nearing completion, and many clients have started pushing new updates to it. Meanwhile, the developer tool system Kurtosis is being used to test MEV/block construction process. Nethermind shared that their blob transaction pool is ready and has been deployed on all Dencun test nodes after a few days of testing on a single node. Geth's blob transaction pool is also nearing completion. Besu is conducting a more extensive examination of its transaction pool (to limit the size of Blob+non-Blob transactions) and expects to release it in the next version. Erigon is still developing its pool, aiming to be ready for devnet-9.

2. Discussion on whether to add a constant ceiling to the validator activation queue. This proposal is officially named EIP-7514 (Adding Max Epoch Churn Limit). In the worst case scenario, this will slow down the growth rate of ETH stake percentage.

3. Adding an opcode in the EVM to expose the basic cost of Blob. We have a similar opcode that exposes the BaseFee of EIP-1559, which was introduced alongside the EIP activation. This enables L2 to more easily determine the correct gas price to charge users based on L1 data cost.

4. The meeting discussed some updates to EIP-4788, which stores the beacon root in a contract on EL. The contract has undergone multiple audits and fuzz testing, resulting in some minor changes described in this PR. The first change is to handle the 0 timestamp explicitly, rolling it back (like other invalid timestamps) instead of returning 0. The second change is the buffer size. Assuming the slot time changes, the original contract would result in storage waste considering the working principle of modular arithmetic. By using a prime number (8191), the buffer should always be used at 100% regardless of the slot time. Lastly, gas optimization was done, reducing the number of times to load CALLDATA. Auditors will review these changes and are expected to receive the final report before the next ACDE session. To ensure smooth progress with fuzz testing and implementation, developers agreed to merge the proposed changes now.

5. Discussed how the client should handle the situation if the system contract address is part of the state but is empty at the end of execution. Although this is practically impossible on the mainnet, it is an edge case that appeared in testing by setting the address at genesis. Considering the uniqueness of this edge case and the lack of explicit specified behavior, the developers agreed to spend more time thinking about this issue and continue the discussion in the testing conference call on Monday.

2. Community Voice

Vitalik Buterin mentioned at the Permissionless conference that cryptographically based solutions could potentially be more decentralized, privacy-focused, and secure than the current Web 2 environment. He highlighted examples such as ENS, POAP, Gitcoin Passport, etc. Vitalik expressed that Ethereum dreams of truly creating an independent open technology stack that can compete with companies like Google and Twitter.

Vitalik envisioned a gradual process where new Web3 users create an Ethereum address initially controlled by services like Gmail but utilize account abstraction to allow people to take ownership when they are ready to use more crypto-native methods.

Vitalik stated that people have the opportunity to step off the decentralized ladder and eventually enter this completely independent stack, where all the different parts can effectively collaborate (Blockworks).

Ethereum core developer and co-author of EIP-1559, eric.eth, wrote on the X platform: "friend.tech will never surpass traditional social media because ordinary people won't spend $2,000 to read your terrible content. We are all in a gambling-style crypto bubble, which is fine for friend.tech, but please stop pretending it will become the next Twitter (now known as X)."

3. Project Trends

(1) Ethereum Holesky testnet has officially launched

On September 15th, the Ethereum Holesky testnet was officially launched to replace the current Goerli testnet. Subsequently, Christine Kim, Deputy Director of Galaxy Research, stated that the Holesky testnet failed to start due to network configuration errors and developers will restart it as soon as possible.

Nethermind, a blockchain tool and infrastructure developer, stated that the developers will relaunch Holesky within a week, with the planned time being September 22nd. Ethereum developer Michael Sproul revealed in a pull request on GitHub that the estimated relaunch time is September 28th. (CryptoSlate)

(2)Ethereum client Geth releases version V1.13

On September 12th, the Go Ethereum client Geth V1.13 was released. This version provides a new database model for storing Ethereum states, which is faster than the previous scheme and has proper pruning. The model supports proper and comprehensive pruning of historical states, which means there is no need to take the node offline again for resynchronization or manual pruning. Geth will continue to support the old data model (in addition, it will temporarily remain the default state) and can also be manually switched to the new model (when prompted, delete the state database but keep the old database).

On September 18th, the Ethereum client Prysm issued a reminder on the X platform, advising not to update Geth to version V1.13.0 because a bug was found in Geth that interferes with Prysm's block production. Subsequently, the Go Ethereum client released Geth V1.13.1, a hotfix version for V1.13.0, which fixes the following issues:

- Fixed activity fork detection on engine API (which caused signers to create invalid blocks) (#28135).

- Fixed database corruption due to snapshot synchronization exceptions in the path scheme (#28124, #28126).

- Fixed geth db inspect command for running against old hash scheme databases (#28108).

- Fixed regression on gas price calculation in RPC API (#28130).

In addition to the fixes, V1.13.1 also introduces support for configuring Geth through environment variables.

(3) Aave community proposes adding KNC as collateral on Ethereum Aave V3 market

According to the Aave governance page, Aave has proposed adding Kyber Network Crystal (KNC) tokens as supply and borrow collateral on the Aave V3 Ethereum market in isolation mode.

(4) Lido proposes adding 7 Ethereum operators to enhance decentralization

Lido has proposed adding 7 Ethereum operators to enhance decentralization and resilience, and introducing new organizations with powerful skills and alignment with Lido's values. The voting will end on September 18th with a current support rate of 100%. Lido received a total of 117 applications, of which 111 met the requirements and were selected by the Lido Node Operator Subgovernance (LNOSG) to enter the final candidate stage.

(5)Ankr and Tencent Cloud join forces to debut Blockchain RPC services for developers

Web3 infrastructure platform Ankr teams up with Tencent Cloud to launch "Tencent Cloud Blockchain RPC" to meet the needs of enterprises and organizations for efficient and reliable access to blockchain infrastructure. Tencent Cloud Blockchain RPC allows developers to easily retrieve data and conduct transactions on various blockchains, including Ethereum mainnet, BNB Chain, and Polygon PoS. (CryptoPotato)

(6)Crypto asset management company Hashdex has submitted a spot Ethereum ETF application

Bloomberg ETF analyst James Seyffart posted on X platform that crypto asset management company Hashdex has submitted a spot Ethereum ETF application. It is reported that the asset under management of Hashdex is $435 million.

(7)Ancient 8 launches Ethereum L2 Ancient 8 Chain

Ancient 8 announces the launch of Ethereum L2 Ancient 8 Chain, a game-centric and community-driven network developed with Optimism Superchain as the technical stack specifically for gaming. (CHAINWIRE)

(8) Report: Over $2 Billion of wash trading on Ethereum-based DEX since September 2020

According to a report released by Solidus Labs, since September 2020, token issuers and liquidity providers have engaged in wash trading activities worth over $2 billion on Ethereum-based DEX, manipulating the prices and trading volumes of more than 20,000 tokens.

The researchers conducted their investigation on three DEX platforms, and out of a sample of 30,000 Ethereum-based DEX liquidity pools, 67% of liquidity providers were found to be engaged in wash trading, accounting for 13% of the total trading volume in these pools.

Will Kueshner, a researcher at Solidus, stated in an interview, "The liquidity pools we studied represent only 1% of all the pools on each chain and DEX, so the actual scale of wash trading on DEX might be much larger than this."

According to Solidus, wash trading on Ethereum is not cheap, with each transaction potentially costing between $1 and $5, but the profits can outweigh the costs. For example, in May 2021, a token issuer of Shibafarm removed bilateral liquidity from a liquidity pool and made approximately $2 million in profit within two hours. (Bloomberg)