Original author: Steven E2MResearch

This article quotes other peoples articles and opinions for some introductions and opinions. This article is more focused on literature review and reflections based on some current situations.

The data level and business part are compared with Compound to have a better understanding of Aaves current market position.

Compound and Aave have too many similarities, but some detailed differences can reveal the different strategies of the two teams, so it is a pity not to compare them together.

After CZ recently resigned and Binance was punished, will it be able to further encourage users to get closer to decentralized products based on Defi? It is also an issue worth observing.

Some questions I’m still thinking about:

The appeal of decentralized lending?

Is leverage the reason why decentralized lending is relatively popular at this stage? In a bear market, users who are bullish on Web3.0 are very suitable to add leverage to hold mainstream assets.

Can you tell how much leverage is added (mainly asking Brother Mo)? Example: If you are long on ETH, then over-collateralize ETH, exchange US dollars to buy ETH, and then continue to over-collateralize ETH. Or A token can be pledged and exchanged for U.S. dollars before returning to

The short-term competition in lending and borrowing is about leverage and amount of funds, but in the long term, like Uni, should it return to product competition to compete on security risk control, regulatory certification, user experience, etc. As a leader in lending, Aave has advantages over Compound and MakerDAO in these aspects.

Following the above point, Aave has begun to cooperate with traditional banks. I personally think this is a more correct development idea than RWA.

Aaves token empowerment will not redistribute most of the value it creates to users like Balancer, Curve and GMX. However, fees generated by the protocol go into the vault and token holders can control them. Personally, I feel that the security modules are actually gimmicks.

Compared with traditional banks

Why do traditional banks generally like to use illiquid real estate to borrow money? Is digital asset lending a revolutionary innovation? What are the advantages and disadvantages of highly liquid collateral assets such as Bitcoin, ETH, and DAI? Will decentralized lending be able to apply to real estate in the future?

Over-collateralization allows decentralized lending to eliminate the need for a loan repayment period; Defi also has enough advantages in the liquidation mechanism to make the probability of bad debts much lower than in centralized lending.

Defi LEGO model

The splicing of Defi is lending, stablecoins and decentralized virtualization. What should be the outlook for the final form?

Aaves moat

Sushi vampire attacks Uniswap, Blur attacks Opensea, and the competition between Aave and Compound all have different results in the end.

What Aave shows is very abundant and clear. In other words, open source is doing very well.

TVL is very high

other

Although it is much more difficult to implement than a Dex aggregator, there will also be needs for aggregators (like 1inch’s Routing function) or comprehensive Dashboards. Users will have their own preferences for LTV, debit/credit interest rates, pledge income, pledge conditions, risks/returns, etc., which is closer to financial management products. Unlike being a DEX aggregator, Swap is a one-time transaction and only needs to consider the issue of wear and tear, while the factor of lending is more difficult to quantify. At a time when the TVL of decentralized lending has exceeded the TVL of decentralized exchanges, this track deserves attention.

Background introduction

Some articles to read before reading this article:

Related reading: You can read more about the development history of lending2023 Global DeFi Lending Track Overview: New Opportunities for Financial Technology Development

Related reading: Some conceptual introductions and pictures are quoted from a popular science article written by Spinach Spinach.Read Aave in one article - Decentralized Bank

1. Decentralized lending track data

1.1 Defi overall situation

Overall TVL

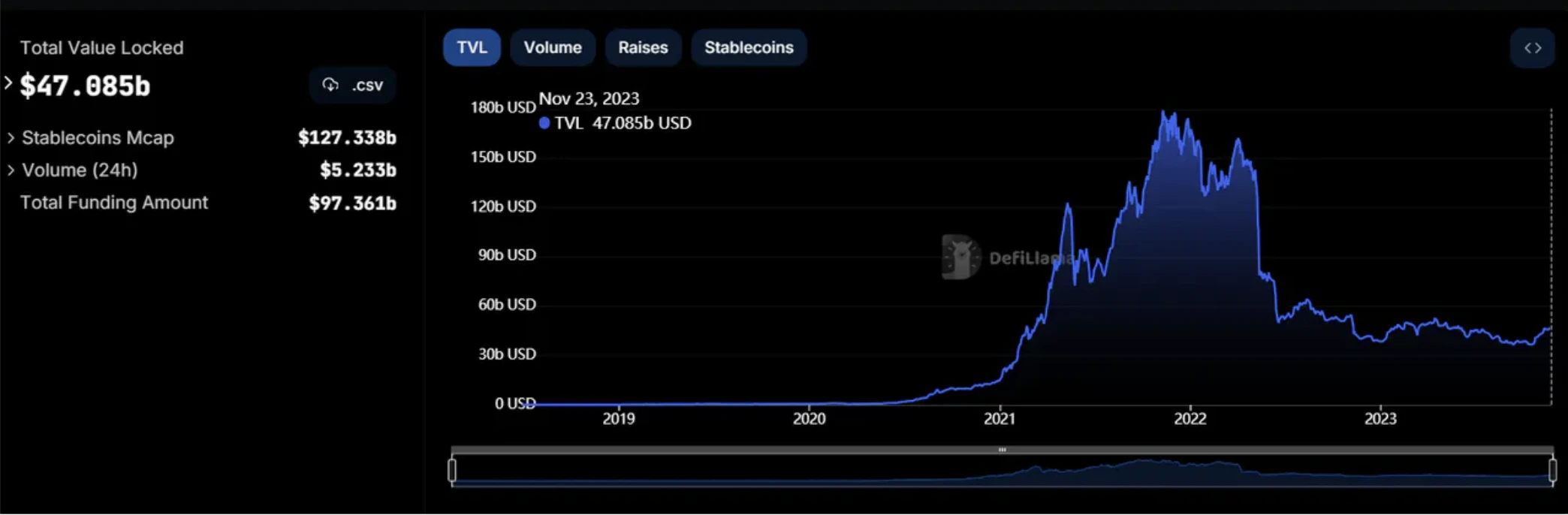

The lowest Defi TVL was less than 36 b on October 13. In BlackRock’s Ishares Bitcoin Spot ETF, after two farces on October 16 and October 24, BlackRock registered Ethereum again a few days ago. The market has full confidence in the adoption of Bitcoin and Ethereum spot ETFs. The most direct one is the rise in the prices of Bitcoin and Ethereum. CZ and Binance’s settlement with the Department of Justice also caused some money to flow into Defi, and Defi TVL recovered, reaching $47.085b.

Data Sources:https://defillama.com/

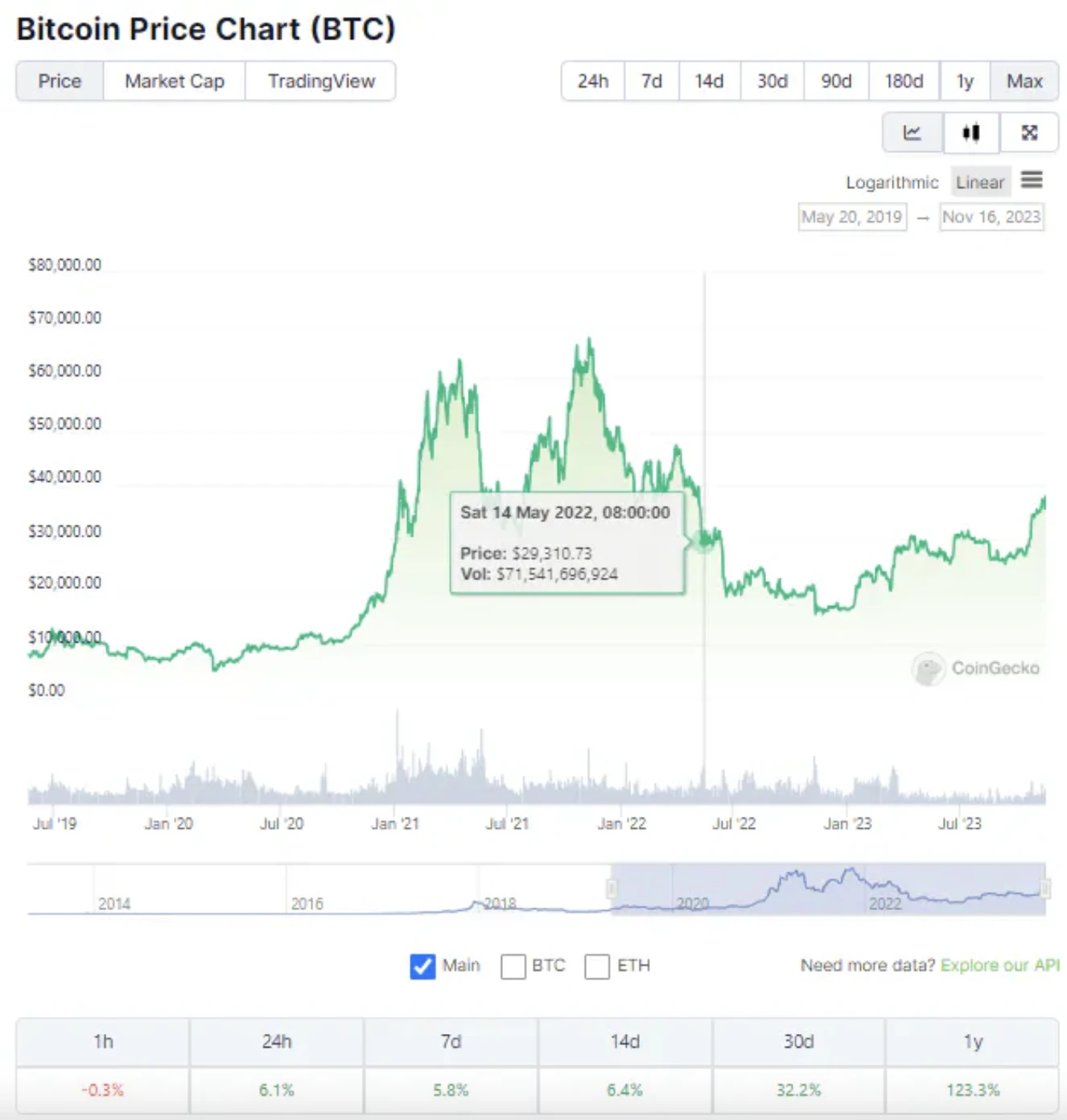

The market value of stablecoins rose to $126b after November, but in fact it only recovered to the situation on July 24 this year. Interestingly, at that time in May 22, the stablecoin was still $160b, while the corresponding Bitcoin price had dropped by $30,000 at that time, which was still a long way off.

Data source: https://defillama.com/

Data Sources:https://www.coingecko.com/en/coins/bitcoin

Track TVL comparison

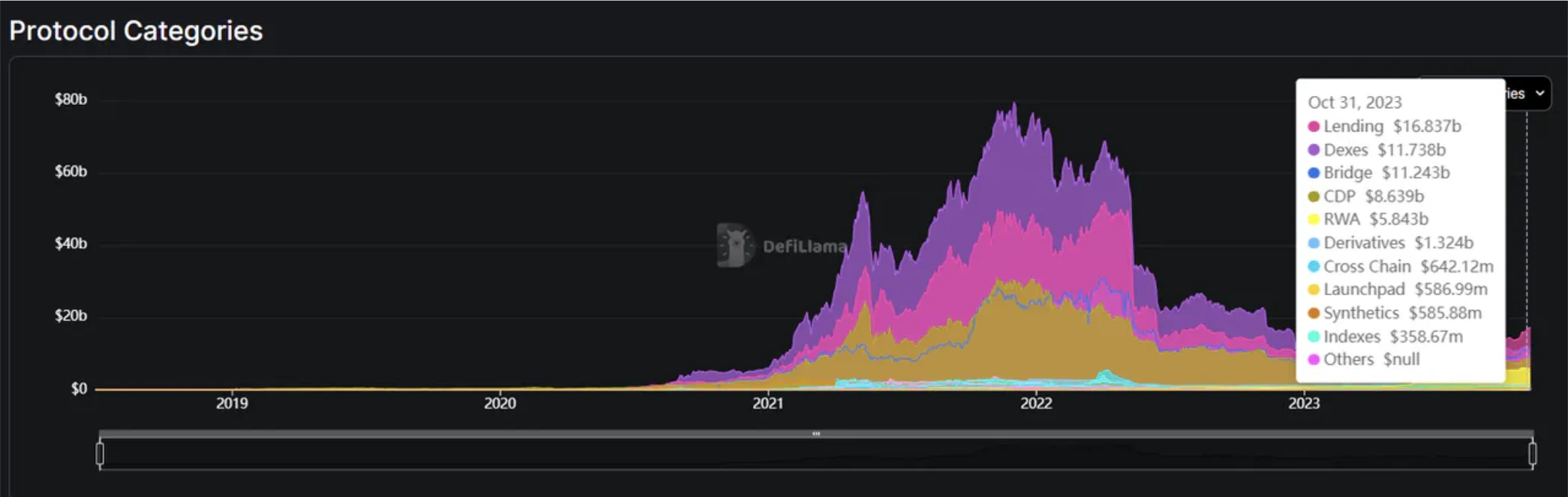

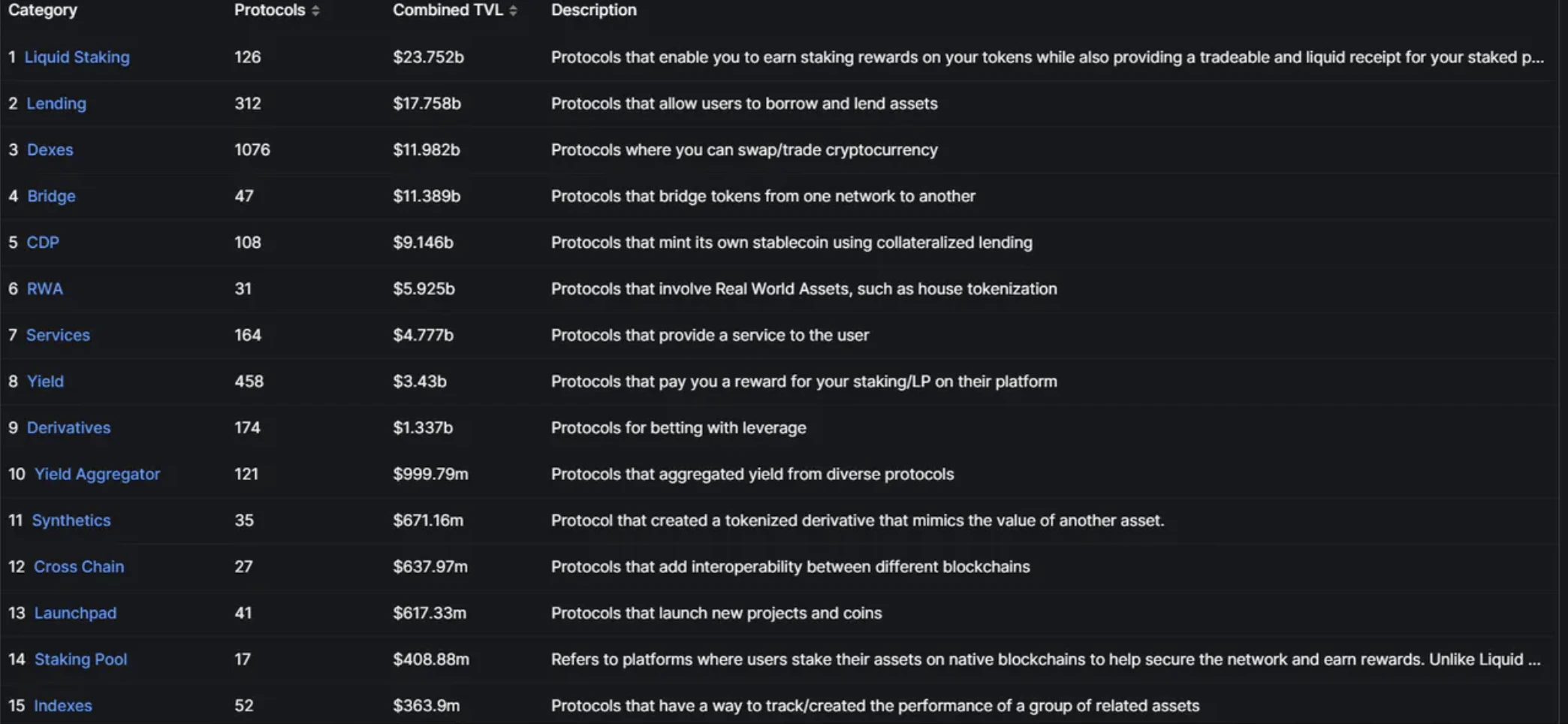

On July 30, 2023 (Curve Thunderstorm), the total TVL of the Lending track exceeded the TVL of Dexes for the first time since September 2020, and the gap between the two has become wider and wider in the days since. Leaving aside the LSD track, the top five tracks in TVL as of November 5 are:

Lending: $16.837 b; leading projects: JustLend ($5.773 b), Aave ($5.647 b), Compound ($2.229 b)

Decentralized exchanges (Dexes): $11.738 b; leading projects: Uniswap ($3.408 b), Curve ($1.689 b), Pancake ($1.45 b)

Bridge: $11.243 b; Head projects: WBTC ($5.748 b), JustCryptos ($3.991 b)

CDP: $8.639 b; Head project; Head project: MakerDAO ($5.119 b), JustStables ($1.709 b)

RWA: $5.843 b; Head projects: Maker RWA ($2.97 b), stUSDT ($2.294 b)

In addition to decentralized exchanges, Tron Ecosystem has a place in other leading Defi tracks, but it does not match the market discussion. TVL, which has no new projects for the time being, is subverting the traditional Defi.

Data source: https://defillama.com/categories

Data Sources:https://defillama.com/categories

1.2 Lending track situation

Although JustLend TVL is the highest in the lending field, it remains to be verified how much of JustLend TVL is Sun Ges assets and how much is real assets.

Data Sources:https://defillama.com/protocols/Lending

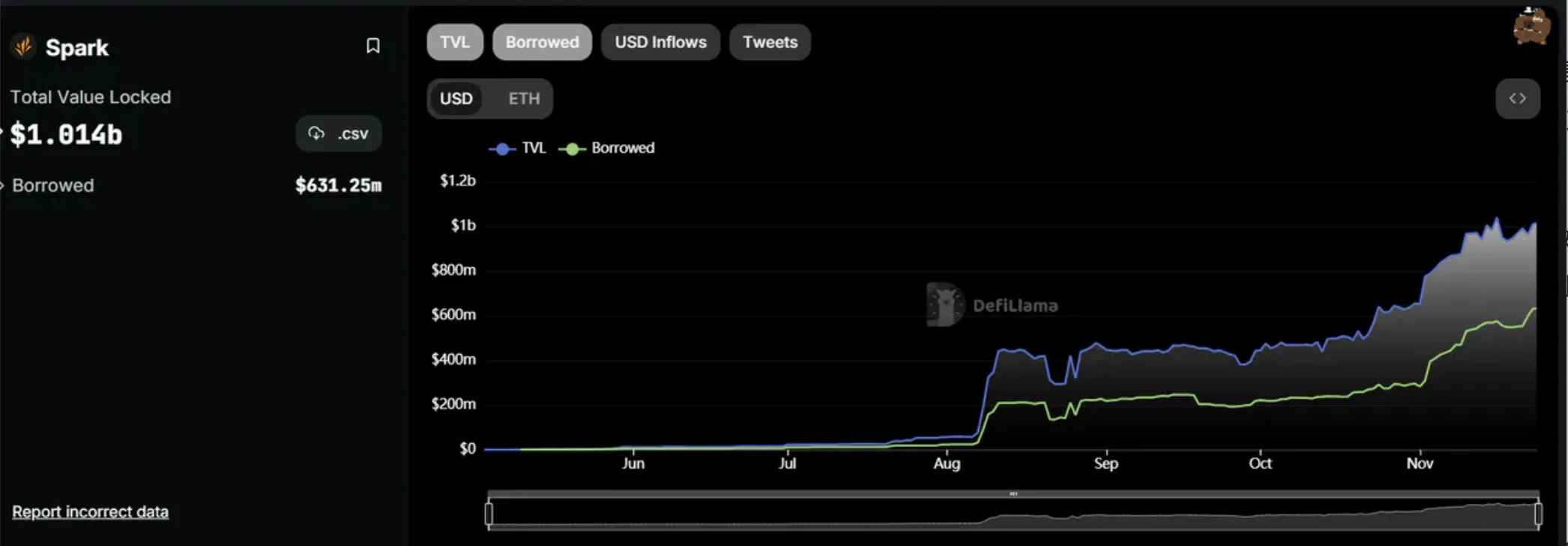

The fourth place is Spark launched by Maker DAO, which clearly indicates that it is Forks Aave V3 (that is, 10% of the protocol fee must be paid to Aave). Since the 8% interest rate was adjusted on August 7, the TVL has been rising steadily, even if it is adjusted back. After 5%, the growth rate is still very fast, and the TVL is US$1 billion.

(Fork: A fork, a change to a blockchains protocol. When these changes are minor, this will result in a soft fork. When the changes are more fundamental, this may result in a hard fork, resulting in the formation of a chain with a different An independent chain of rules. See also: hard-fork, soft-fork.)

Data Sources:https://defillama.com/protocol/spark?borrowed=true

There is no surprise here because in the MakerDAO End Game, the market believes that Spark, as one of the early ecosystems of the End Game, will have airdrop expectations, and it can also be regarded as a kind of mining in disguise.

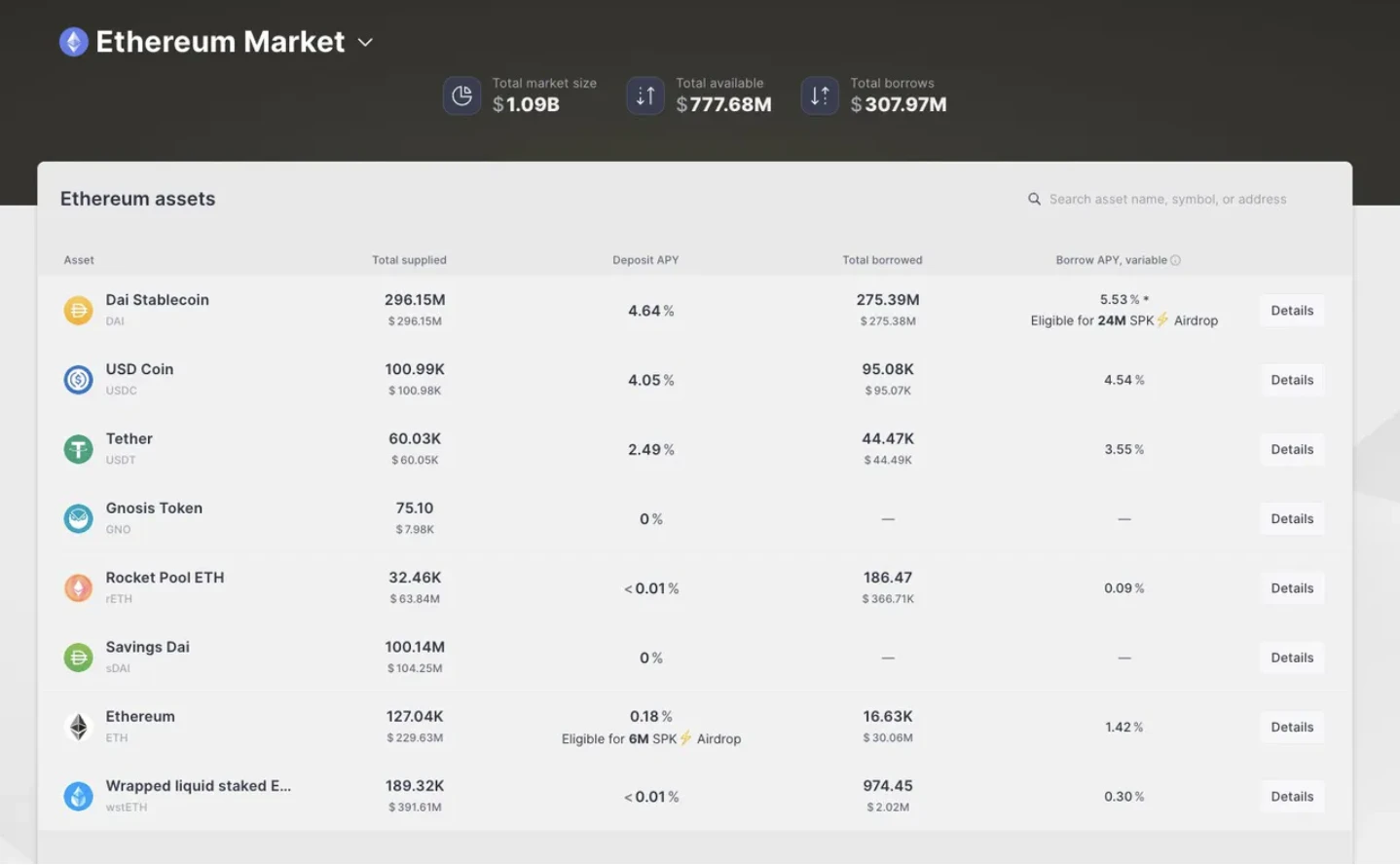

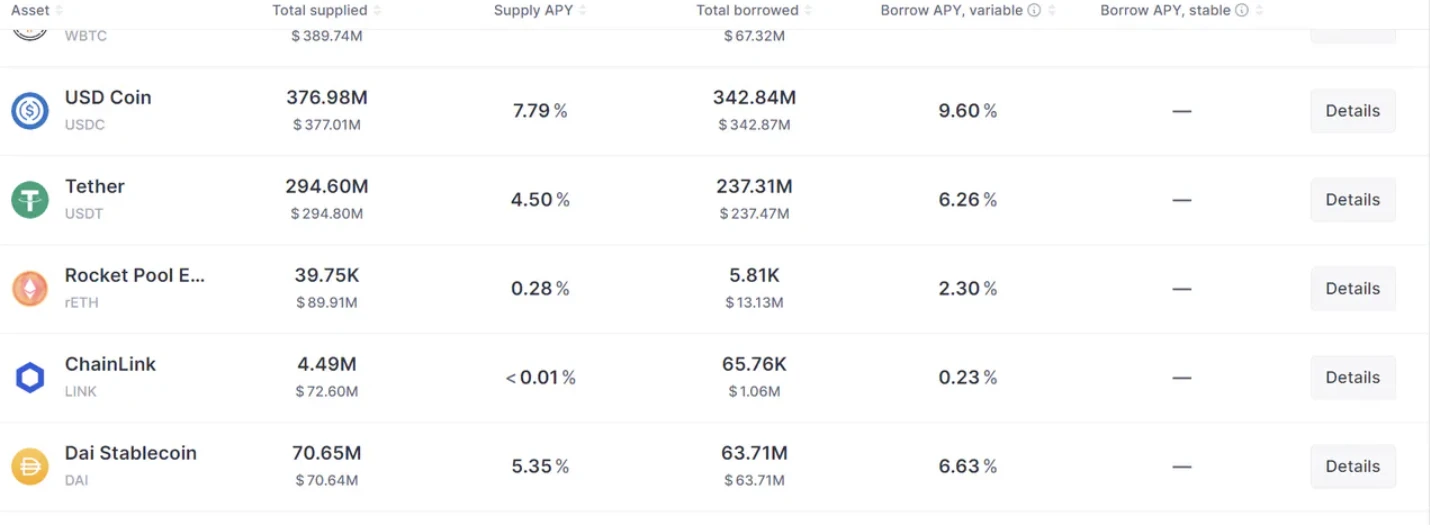

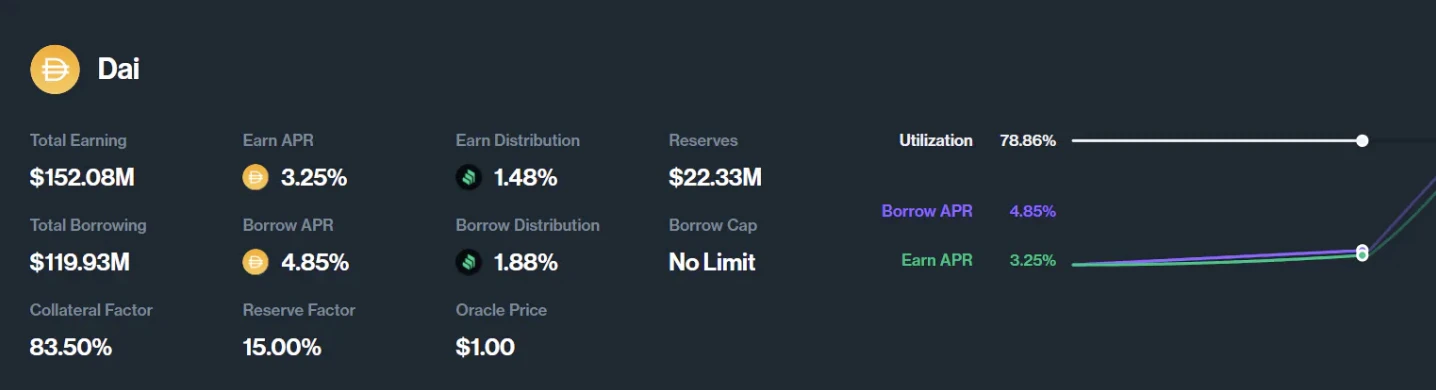

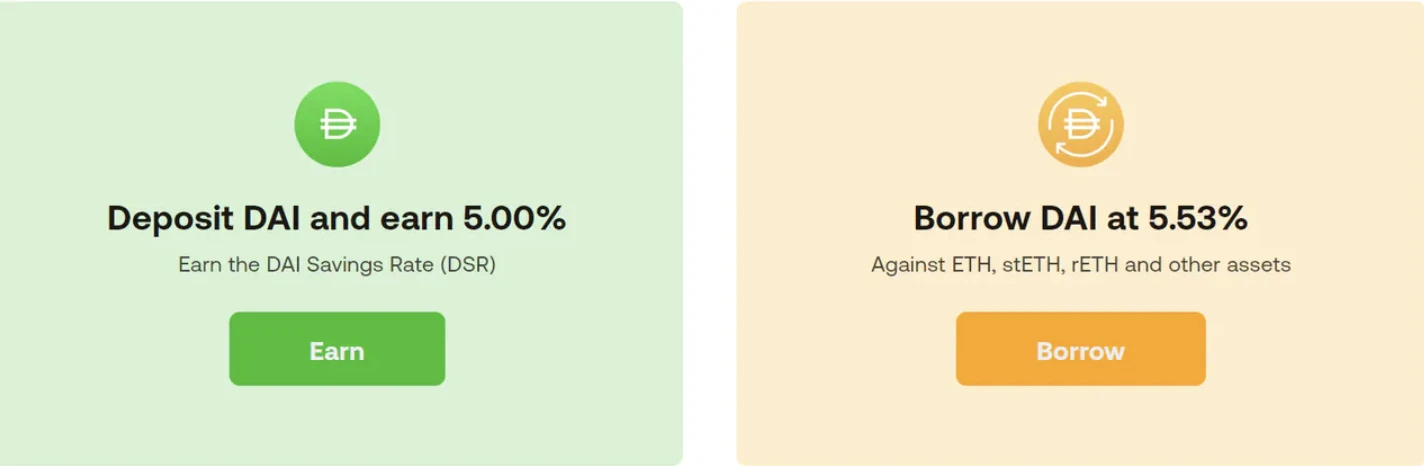

In comparison, looking at the return rate brought by MakerDAO, Aave, and Compounds storage (Deposit) Dai, Aave (5.35%) > MakerDAO ( 5.00% ) > Compound ( 3.25% ), I have to sigh with emotion at that time MakerDAOs 8% It is a very tempting number.

Data source: https://app.Aave.com/markets/

Data source: https://app.compound.finance/markets/v2

Data source: https://spark.fi/, New website blocked VPN, sparking a small wave of controversy

Sparks lending/mortgage assets are all traditional mainstream assets without much innovation. The main reason is that there are airdrop expectations without lower interest rates than other lending platforms. In addition, Maker DAO’s August proposal will change DAI’s LTV and liquidation rate to 0.01%, thereby reducing the use of DAI as collateral for borrowing and improving DAI’s liquidity.

Data Sources:https://twitter.com/sparkdotfi/status/1719769678837416325/photo/1

2. About Aave

2.1 The difference between decentralized lending and traditional lending

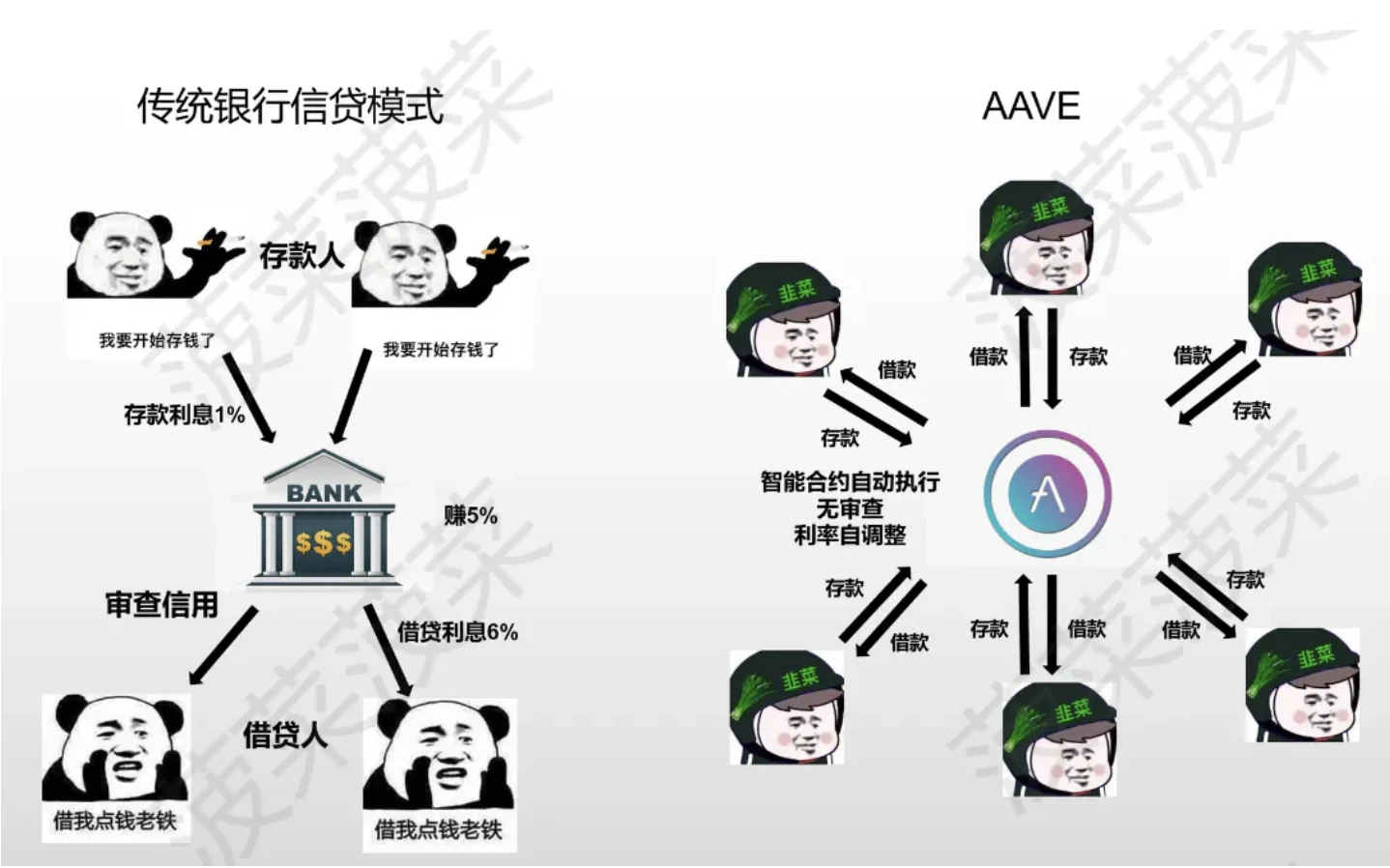

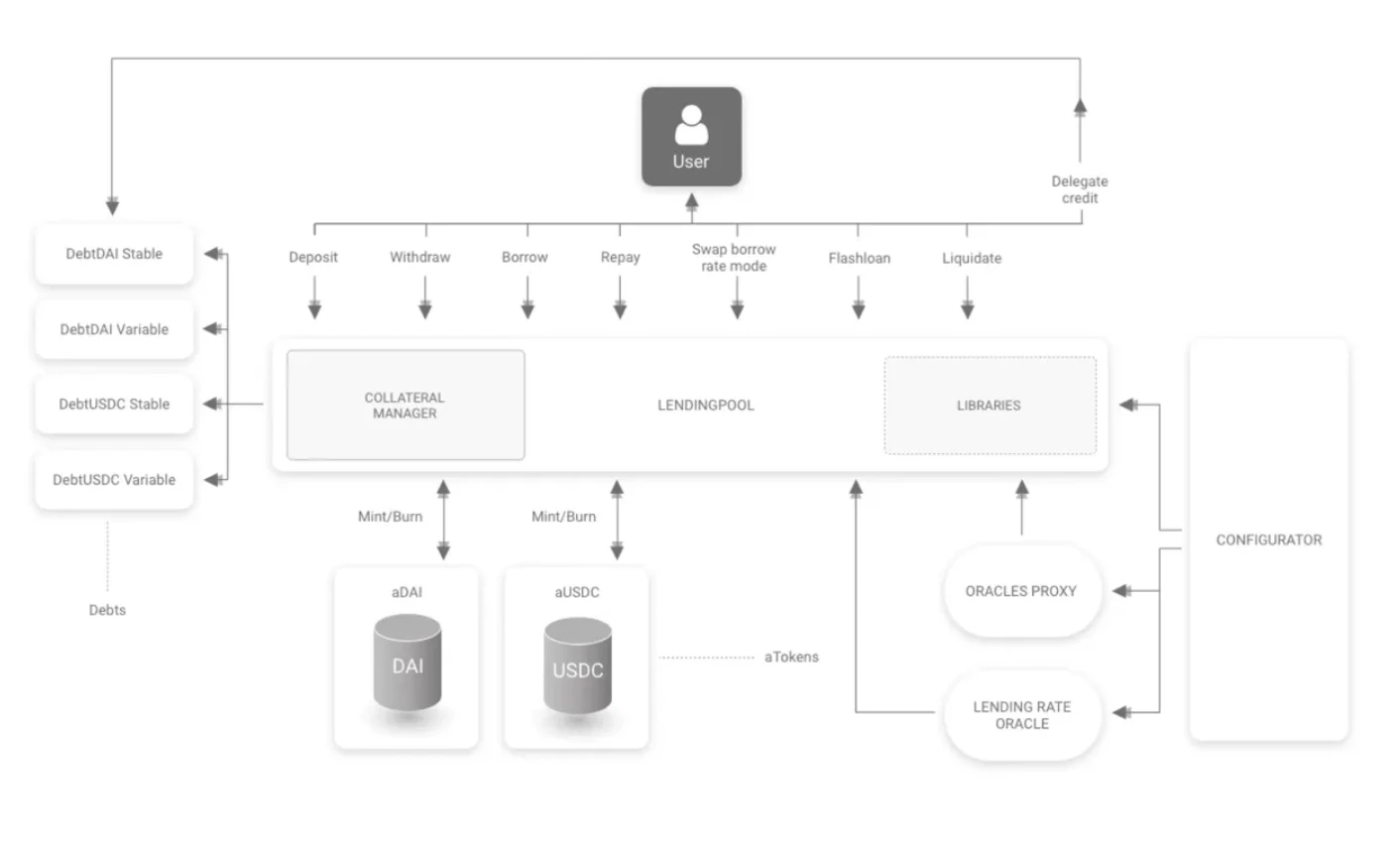

The banks lending business is very similar in structure to Aave and Compound. They are both peer-to-peer pool lending, consisting of several core parts such as lenders, borrowers, intermediaries (matchmakers), and liquidators. The biggest change is that the banks manual credit review process is replaced by smart contracts.

Banks mortgages are mainly illiquid, value-preserving and high-value mortgages such as credit and real estate. The collateral of Web3.0 is mainstream encrypted assets with good liquidity on the chain and does not require trust. The price for achieving these two characteristics is over-collateralization.

In addition, decentralized lending makes the loan period unlimited. As long as the borrowers assets have not been liquidated, the borrower can continue to borrow money forever.

Traditional banks have low efficiency in liquidating collateral and poor timeliness of the value of collateral. In extreme cases, such as a financial crisis, the bad debt rate will be too high (generally 1-2.5% for banks), causing the bank to become insolvent and collapse.

“Aave” means “ghost” in Finnish (their logo is also a little ghost). Expressed their vision to use blockchain technology to make the middlemen between lenders and borrowers like ghosts.

2.2 ETHLend and Aave v1

Aaves founder and CEO is Stani Kulechov, who is the companys main public face. Stani was studying law at the University of Helsinki when he discovered Ethereum and its capabilities. He began exploring how it might impact the TeFi system and came up with Aaves previous name, ETHLend.

ETHLend offers a fully decentralized peer-to-peer lending smart contract that runs on the Ethereum blockchain and uses digital tokens as collateral.

In fact, if you think about it from another angle, traditional banks themselves are a peer-to-pool lending method, with banks acting as pools. It’s no surprise that ETHLend itself doesn’t offer peer-to-peer lending like Dydx or that the derivatives exchange fails.

It was originally called ETHLend when it was launched. It received $1,650 in ICO investment in November 2017. The token name is LEND. The project content is to do peer-to-peer lending of cryptocurrency. After the currency price reached a high in January 2018, it fell all the way. From late 2018 to May 2020, the currency price has been very sluggish. ETHLend is a peer-to-peer lending system. While heavily working on ETHLend in 2018, the Aave team realized the inefficiencies of peer-to-peer lending and decided to abandon it. Switched to a peer-to-peer contract lending platform in 2018 and has been doing so ever since.

The founder stated in the interview that the name change was to break through ETH (Ethereum) and LEND (loan) imaginary constraints.

Aave raised US$3 million from Framework Ventures and Three Arrows Capital in July 2020, and also released an economic proposal (Aavenomics), including converting the original token Lend to Aave and issuing an additional 3 million tokens, security modules, and lending incentives wait.

LinkedIn lists 95 employees, but there are probably more.

Image Source:https://uk.linkedin.com/company/avaraxyz

In comparison, Compound only has 19 employees on LinkedIn, which is exactly 5 times the number. Therefore, Aave’s labor expenditure is much higher than that of Compound (especially Web3.0 engineers themselves are high-paying positions).

Image Source:https://www.linkedin.com/company/compound-labs?trk=similar-pages

To put it simply, Aave V1 learned from Compound and made a “peer-to-pool” loan, but there was no concept of aToken at that time.

2.3 Aave v2

The following updates will be released in December 2020.

Reference article:The Aave Protocol V2

Yield and Collateral Swaps

In DeFi, assets used as collateral are tied up, but now with V2, they can be freely traded. **Users can trade their deposited assets between all currencies supported by the Aave protocol, even if they are used as collateral. Collateral swaps are a useful tool to avoid liquidation. **For example, if the price of your collateral starts to drop, you can simply trade it into a stablecoin so you dont have to worry about price fluctuations and potential liquidations. This feature also allows you to swap assets for the best yields on the market, essentially creating the first market for collateral and yield trading in DeFi.

Flash loan upgrade

Flash loans were the first undercollateralized lending option to shake up the DeFi space, leading to the creation of many innovative tools and “currency Lego.” Flash Loans continues to inspire creativity and make new features in Aave V2 possible.

mortgage repayment

Prior to V2, if a user wanted to use part of the collateral to repay a loan, they had to first withdraw the collateral, use the collateral to purchase the borrowed asset, and then eventually repay the debt and unlock the deposited collateral. This requires at least 4 transactions across multiple protocols, which consumes time and money, and the overall experience is not that seamless. This new feature allows users to close loan positions by paying directly with collateral in one transaction – fluid and simple.

Lightning Liquidation

Previously, liquidators needed to have funds in their own wallet or obtain funds from elsewhere in order to liquidate positions and receive liquidation bonuses. Flash loans are a great equalizer, giving everyone access to liquidity to take advantage of the financial tools DeFi has to offer. With Aave V2, liquidators can utilize flash loans to borrow funds from the Aave protocol itself to perform liquidations.

Batch flash loan

Flash loans are getting more powerful. With V1, lightning borrowers can only borrow one currency at a time. Batch Flash Loans allow developers to perform flash loans using multiple assets in the same transaction. This means that lightning borrowers have access to virtually all of the protocol’s liquidity.

Debt Tokenization

In V2, debt positions are tokenized, so borrowers will receive tokens representing their debt. This debt tokenization enables native credit delegation in the Aave protocol and allows borrowers to manage their debt positions via cold wallets.

local credit entrustment

Undercollateralized lending in DeFi has become an increasingly popular way to obtain liquidity without existing capital, and Native Credit Commission will expand on this with V2.

The most important change in Aave v2 is actually a change in the underlying logic. The contract that originally held all the assets of the protocol by LendingPoolCore was changed to be recorded in aTokens in Aave v2 (this idea should be copied from Compound’s cToken), which is officially called “Debt Tokenization”

aToken is a yield-generating token minted and burned on and. The value of aTokens is linked to the value of the corresponding deposited assets at a 1:1 ratio and can be safely stored, transferred or traded. All interest collected on the aTokens reserve will be distributed directly to aTokens holders by continuously increasing their wallet balances.

The advantage of aToken is that it is a universal ERC 20 standard token and can be understood as an interest-bearing deposit certificate for deposits. Because it is ERC-20, it means that it can support the free trading or remortgage of its own assets stored in Aave.

In other words, it is centralized controlled by smart contracts and hands over the control of bills to users, further improving liquidity, which is similar to Lido. The trade-off between security and liquidity is left to the users themselves.

Flash Loan is also a concept proposed in Aave, but currently it is purely an arbitrage method and has no practical value, so I won’t go into details. I will quote the content from an article written by teacher Chen Mo for reference. .

The following is quoted from:Aave V3: Multi-chain expansionism from the master of lending kings

Aave Flash Loan - DeFi Sword of Damocles

Aave is the first to propose and implement flash loan” agreement. This highly controversial innovation also paved the way for many major events in the DeFi world.

To understand what flash loans are, you first need to popularize a concept called:atomicity. Generally speaking, if the actions of a transaction process are coherent, indivisible and irreducible, it is atomic. Simply put: either all actions within the transaction are executed, or nothing happens. There is no in-between state.

Flash loans take advantage of atomicity, allowing users to borrow without submitting collateral. So how to solve the problem of borrower default and non-payment? First of all, strictly speaking, a flash loan is a transaction that includes multiple consecutive actions. For example, the simplest way is to borrow funds from a flash loan, buy them on platform A and then sell the assets with price differences on platform B, and finally return the borrowed funds and leave arbitrage profits. In this way, the simplest cost-free arbitrage of flash loans is completed. Yes, of course you need to pay a fee of 0.09% of the borrowed amount. All transactions must be completed within a block. If the loan is not eventually returned within a block, all transactions will be rolled back as if nothing happened. For example, if the arbitrage in the above example fails and the loan cannot be repaid in the end, then all you lose is the handling fee. But in the same situation, if you use your own funds to arbitrage, you may suffer a loss of principal if the arbitrage fails. Therefore, the emergence of flash loans has greatly improved the efficiency of arbitrage, lowered the capital threshold for arbitrage, and also provided a certain amount of fee income to the lending market.

Correspondingly, its side effects are also extremely powerful and can destroy the entire agreement. With the development of DeFi, flash loans have also become the scimitar of hackers, because as long as a complete set of transaction execution logic is programmed, flash loans can grant borrowers huge assets to complete N on-chain operations in one block, hackers Start unlimited testing projects on the market after getting natural free funds. For example, when a huge amount of money enters a trading pool, it can cause short-term price distortion. If other protocols quote this quotation at the same time, or if this quotation is used to mint some kind of asset, then there will be a vulnerability to be attacked. It is no exaggeration to say that according to incomplete statistics, the financial losses caused by flash loan attacks have exceeded hundreds of millions of dollars. Later, some protocols were forced to sacrifice user experience and performance and complete key functions through two blocks. In short, while flash loans have greatly promoted the development of DeFi, they have also cast a dark cloud on the financial market on the chain. Some people say that flash loans are like the sword of Damocles hanging over DeFi. When DeFi matures, perhaps Thats when the clouds are cleared and the sun is revealed.

2.4 Aave v3

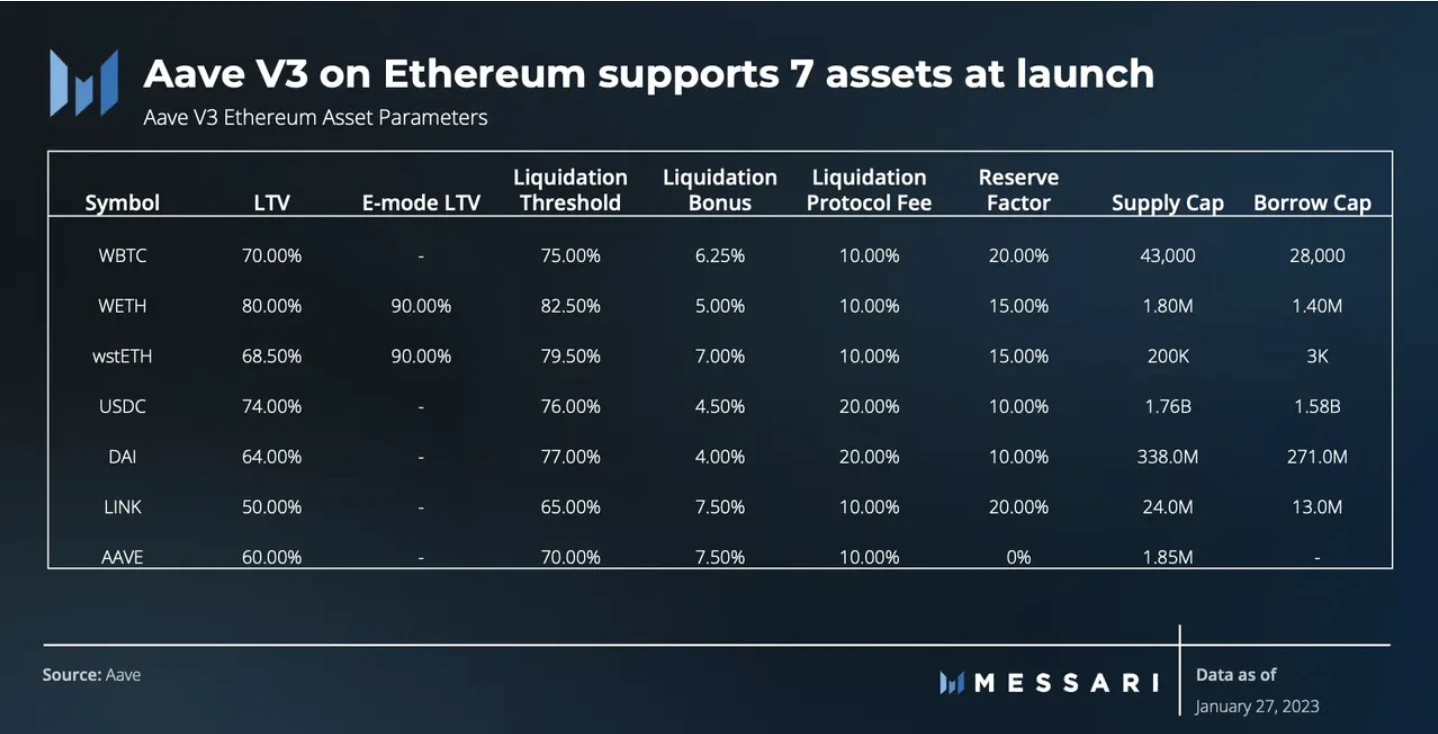

On January 27, 2023, Aave V3 was launched on Ethereum. V2 provides a total of 12 assets, while V3 currently provides 25 assets, 12 of which are isolated as high-risk assets.

The most anticipated feature is multi-chain support. This update also improves risk management and gas efficiency.

The following content is partly derived from:Aave V3 Technical Paper

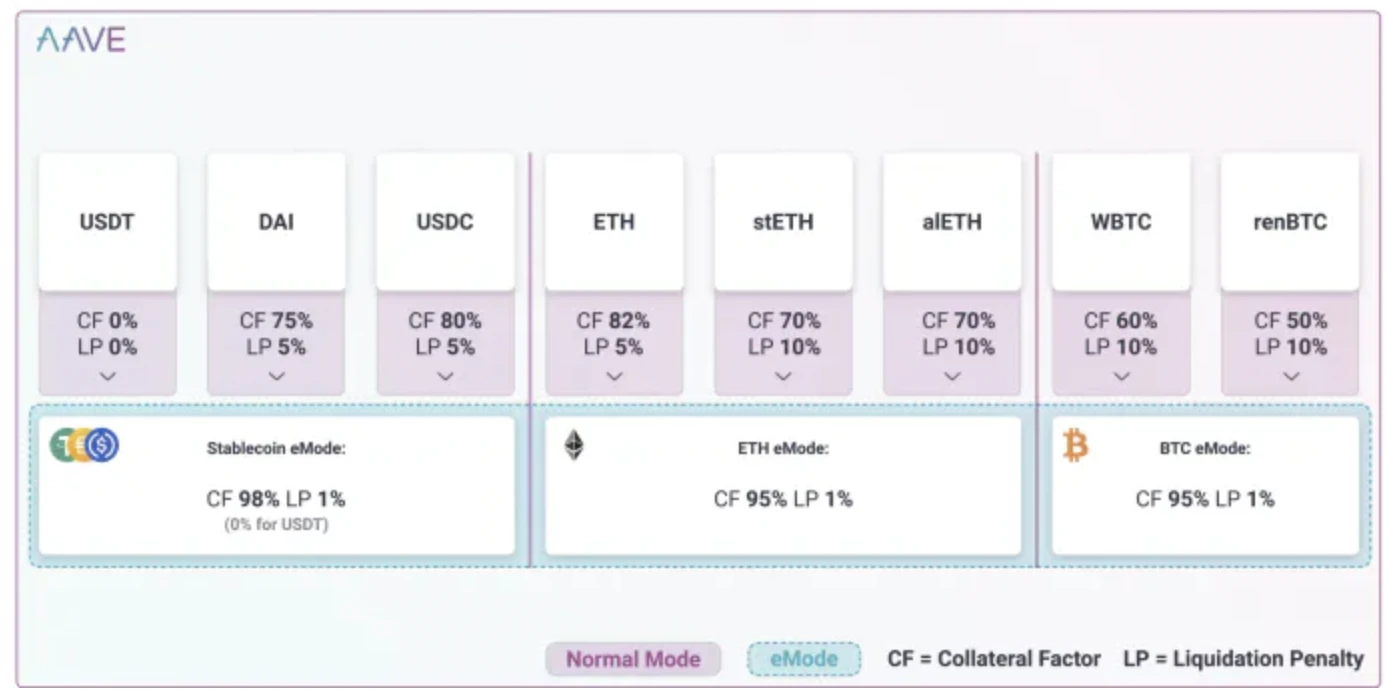

Efficient mode-eMode

To put it simply, the efficient model can classify assets, such as stablecoins. If the borrower provides a certain category of assets as collateral, there will be higher asset efficiency. Each category has 4 modifiable risk parameters.

LTV (actually the borrowing capacity, some contracts are called pledge coefficient)

liquidation threshold

Liquidation incentive coefficient

Customized price oracle (optional)

Examples from the white paper:

User selects E-Mode Category 1 (Stablecoin)

User provides DAI (usually with 75% LTV)

Users can now borrow other stablecoins (including DAI), with borrowing capacity defined by the E-Mode category (97%). As a result, users capital efficiency increased by 22%. Please note that users can still provide other assets and use them as collateral, but only collateral belonging to the same E-Mode category selected by the user will have enhanced risk parameters.

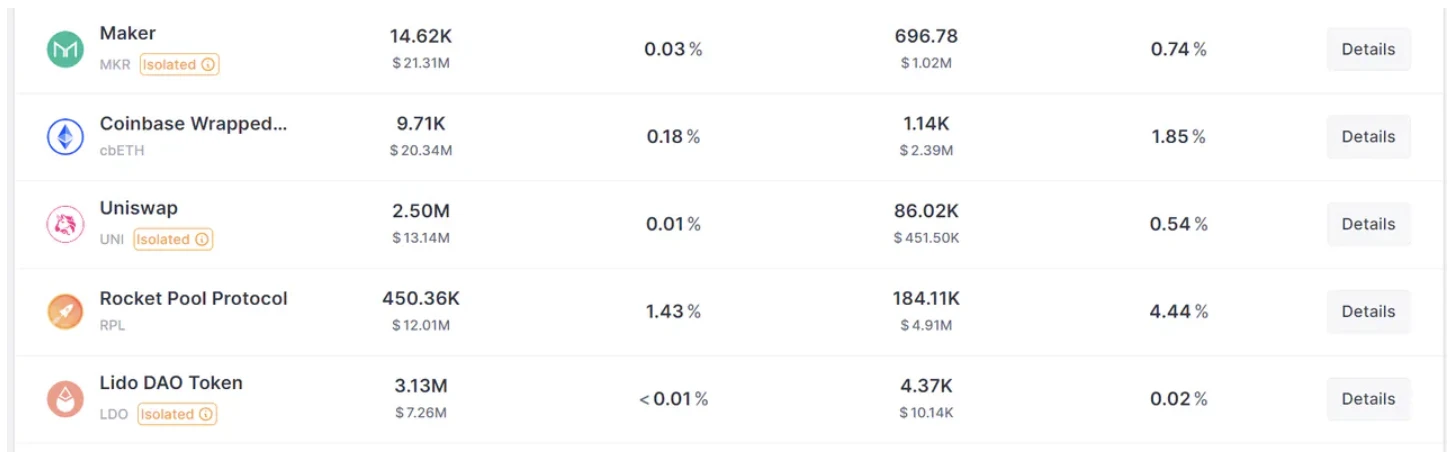

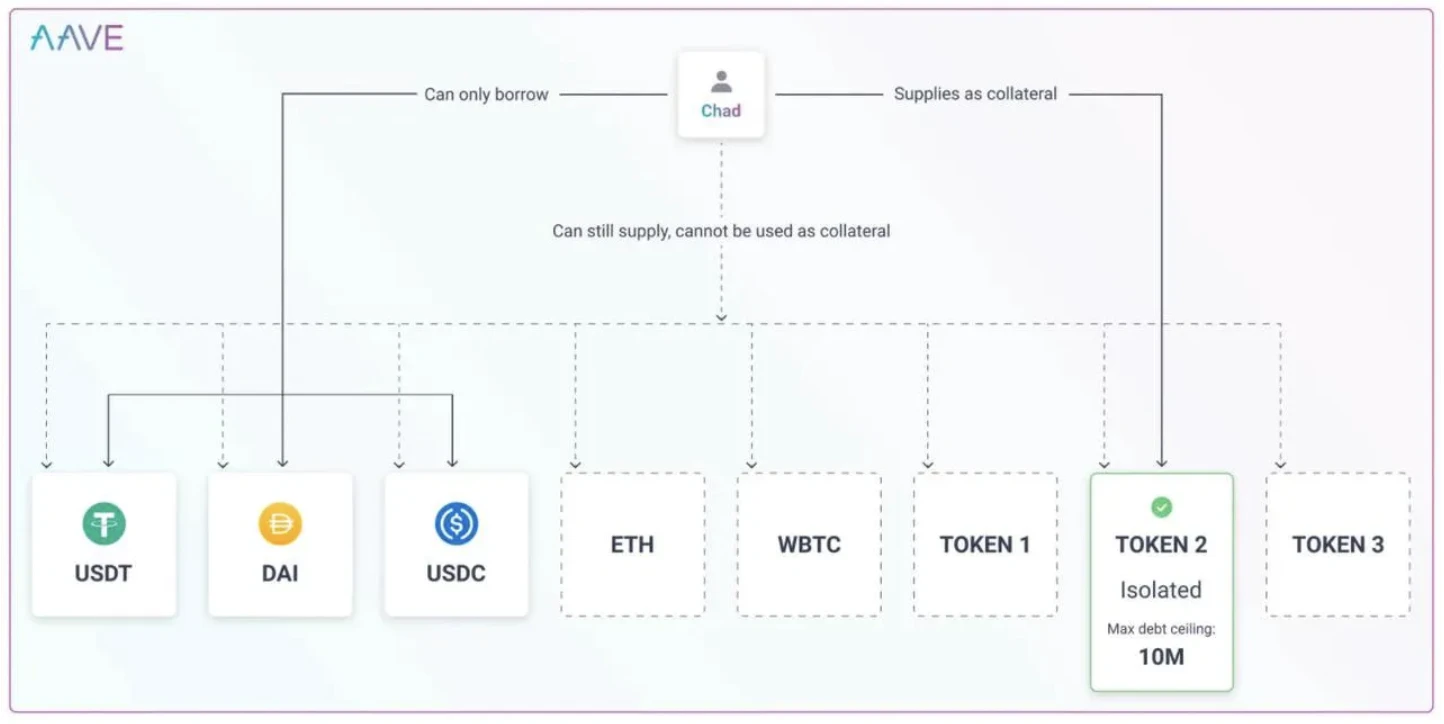

Isolation mode

The isolation mode was also first launched by Compound, and borrowers can only borrow one asset with specific collateral at a time. A simple understanding is that high-risk assets or individual assets decided after DAO voting act independently as a pool.

The official statement is: Isolated assets have limited borrowing power and other assets cannot be used as collateral. (The borrowing of isolated assets has an upper limit, and other assets cannot be used as collateral.)

Image Source:https://app.Aave.com/markets/

For example, Chad provides TOKEN 2 as collateral. TOKEN 2 is a segregated asset with a maximum debt limit of $10 million, with USDT, DAI and USDC as governance-permitted borrowable assets. After providing TOKEN 2 as collateral, Chad will be able to borrow up to $10 million in USDT, DAI, and USDC. Even if Chad provides another asset, such as ETH, WBTC, the system will not allow Chad to borrow against these assets due to the existence of isolation mode. But Chad will still earn from the ETH and WBTC provided. On the other hand, Chad can exit the isolation mode after disabling TOKEN 2 as collateral, and Chad can still continue to use other assets as collateral for lending.

The isolation mode is considered a very important breakthrough for Aave in balancing long-tail assets and mainstream assets, reducing the risk of mainstream assets being liquidated, while not completely rejecting the markets strong demand for altcoin lending.

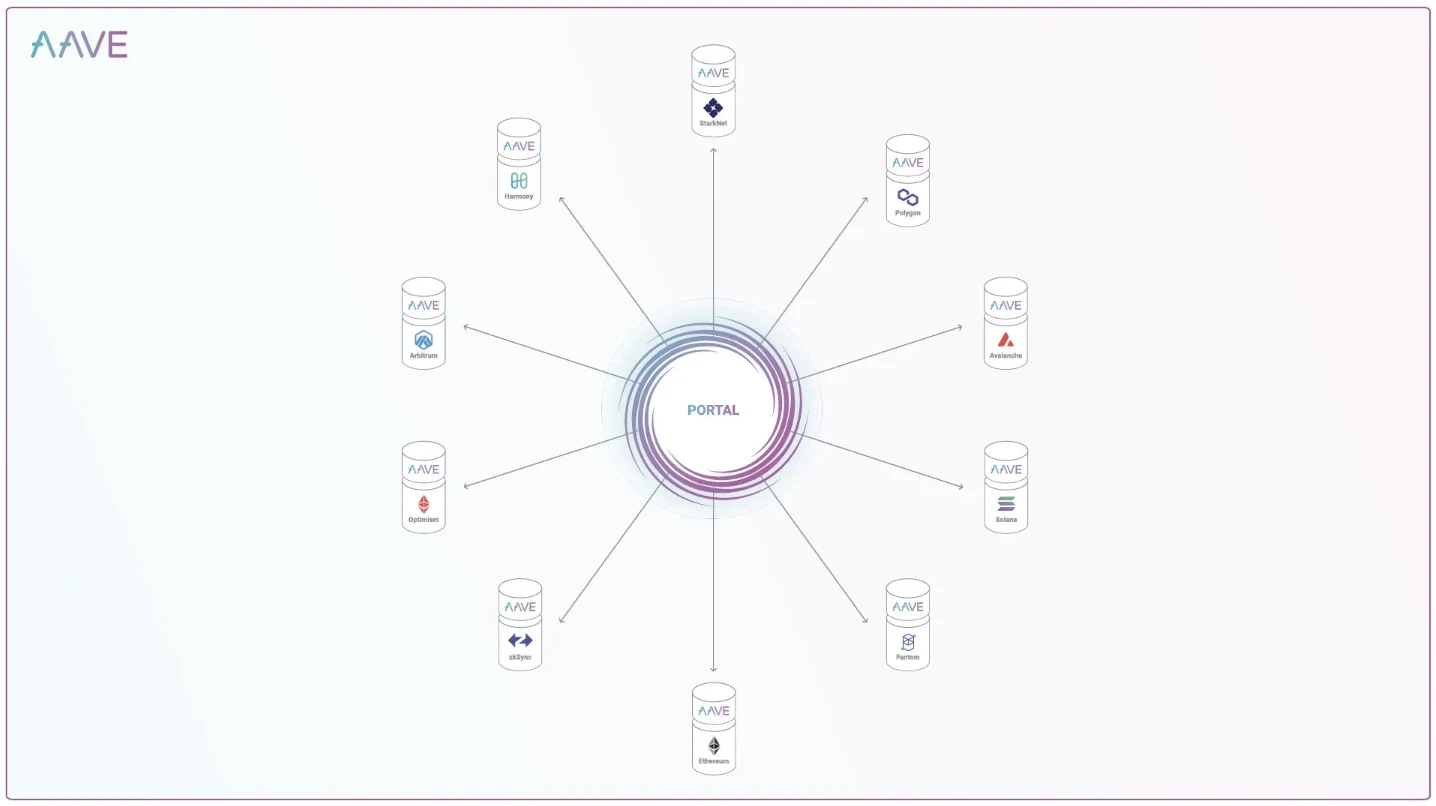

Portal - multi-chain support - cross-chain lending (not yet online)

Aave Protocol V3 allows approved bridges to destroy aTokens on the source network while immediately minting them on the target network. The underlying assets can then be transferred to the pool via the bridge and made available to Aave on the target network in a delayed manner. In order to achieve this goal, three features need to be added to the protocol:

Minting unbacked aToken

Unbacked aToken is restored to normal aToken

Provides a whitelisting mechanism for contracts that want to use these features.

The cross-chain lending (Portal) function has reached a deployable state as early as March 2022 when the V3 version was launched. However, due to security considerations, the team has been cautious in launching this function and has not yet officially deployed it. Because Aaves cross-chain lending is not controlled by the Aave protocol itself, but a third-party cross-chain bridge protocol is introduced.

To put it simply, aToken is used as a certificate that circulates on various chains. Users choose to pledge on a chain, and then through the portal, they can withdraw assets on the chain deployed by Aave at will.

Similar to the design logic of aToken, Aave hopes that users will have more decision-making power and be able to decide on which chain users provide liquidity in order to obtain more benefits.

If aToken is transferred, when the aToken is finally destroyed and the collateral is submitted, is it equivalent to the public chain holding the aToken?

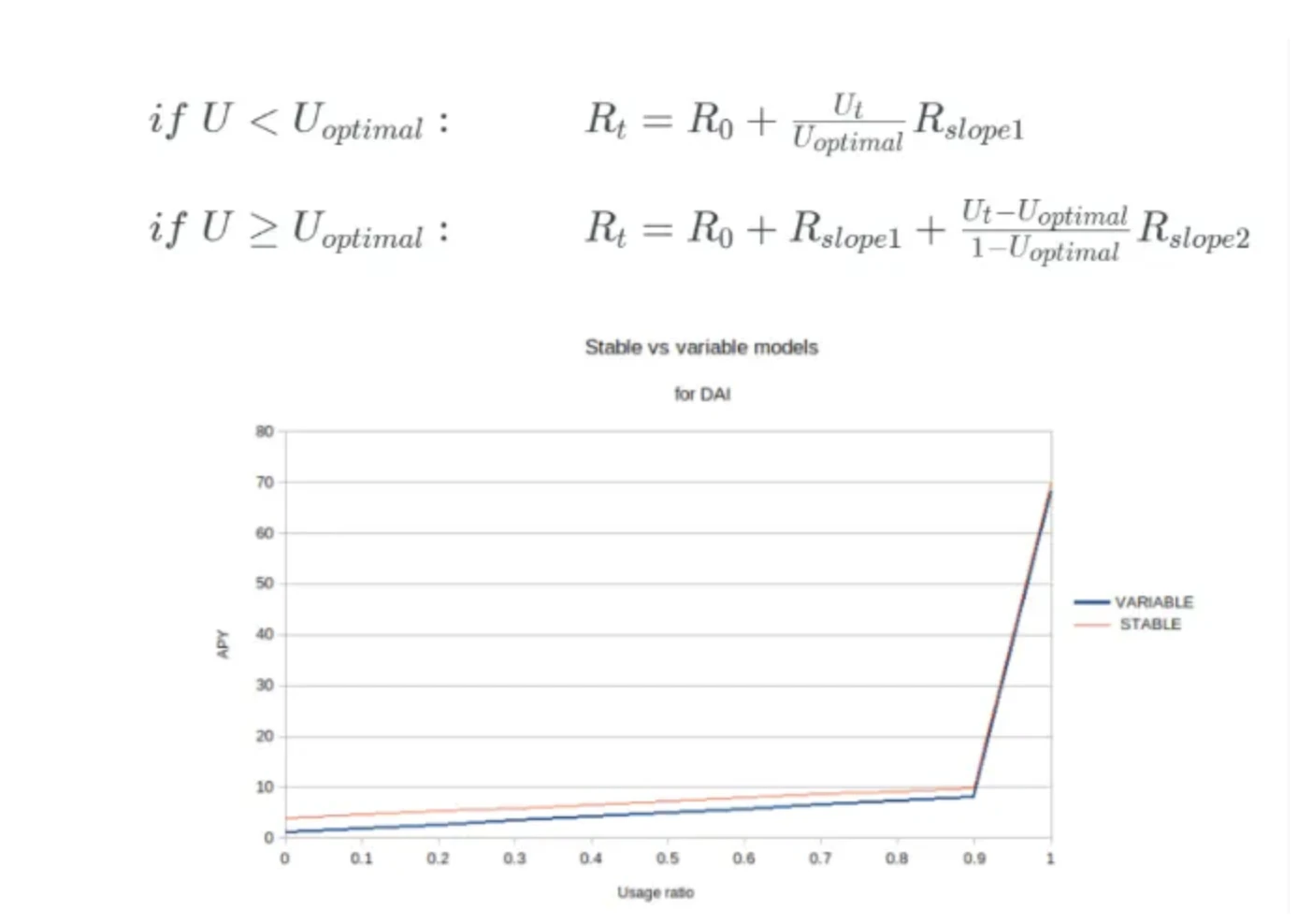

3. Interest rate strategy

Aaves liquidity interest rate is relatively easy to understand: simply put, the interest rate will increase linearly, but the slope will change. Before the fund pool reaches the optimal fund utilization rate, the interest rate will increase linearly at a relatively slow speed; after exceeding the optimal fund utilization rate, the slope will rise sharply, and the interest rate will rise linearly at a rapid rate.

Image source: https://medium.com/Aave/Aave-borrowing-rates-upgraded-f6c8b27973a 7

Further reading:Borrow Interest Rate

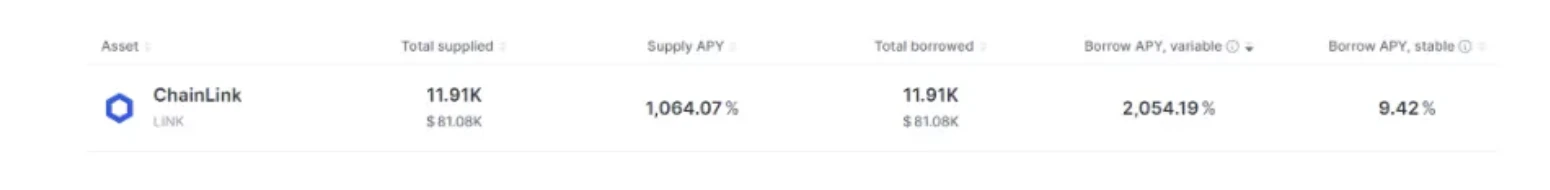

Aave has three different interest rate model strategies. The first strategy is mainly for volatile assets. For volatile assets, the need for liquidity at any time is very important, so the optimal fund utilization rate for volatile assets is 45%. When 45% of the assets in the asset liquidity pool are lent, deposit and loan interest rates will grow using a very high slope Rslope 2 of 300%.

Data Sources:https://docs.Aave.com/risk/liquidity-risk/borrow-interest-rate

Case: Due to a cross-chain bridge problem on the Harmony chain, all of ChainLink’s liquidity pools were borrowed (the reason is unknown). At this time, we can observe that the interest rate changes greatly. The return on depositing into ChainLink is 1064%, while borrowing ChainLinks interest rate is 2054%. This shows that the interest rate increase of volatile assets is very large when the asset utilization rate exceeds the optimal rate.

The second and third strategies are both for stablecoins, and have slightly different optimal fund utilization rates. Since the price of stablecoins is anchored to fiat currencies with very low fluctuations, the optimal fund utilization rate for stablecoins is very low. High, and the slope Rslope 2 when exceeding the optimal fund utilization rate is also far lower than that of volatile assets.

Data Sources:https://docs.Aave.com/risk/liquidity-risk/borrow-interest-rate

Case: When stablecoins are borrowed beyond the optimal usage rate, the interest rate growth is significantly lower than that of volatile assets. However, stablecoins with high interest rates can attract more people to deposit and repay loans than volatile assets, so there is almost no need to worry. Liquidity issues arise.

Partially quoted from:Understand AAVE—Decentralized Banking in one article

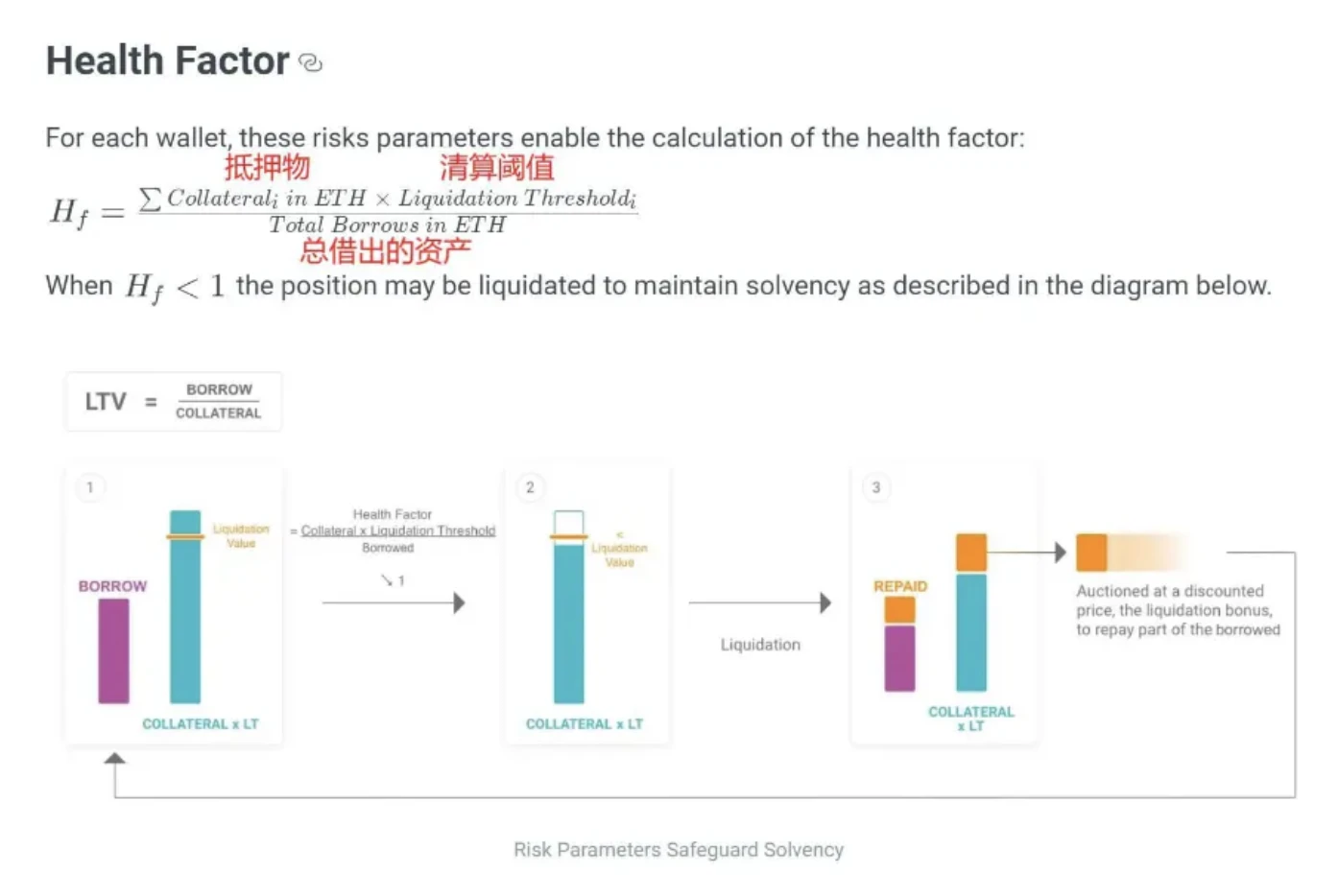

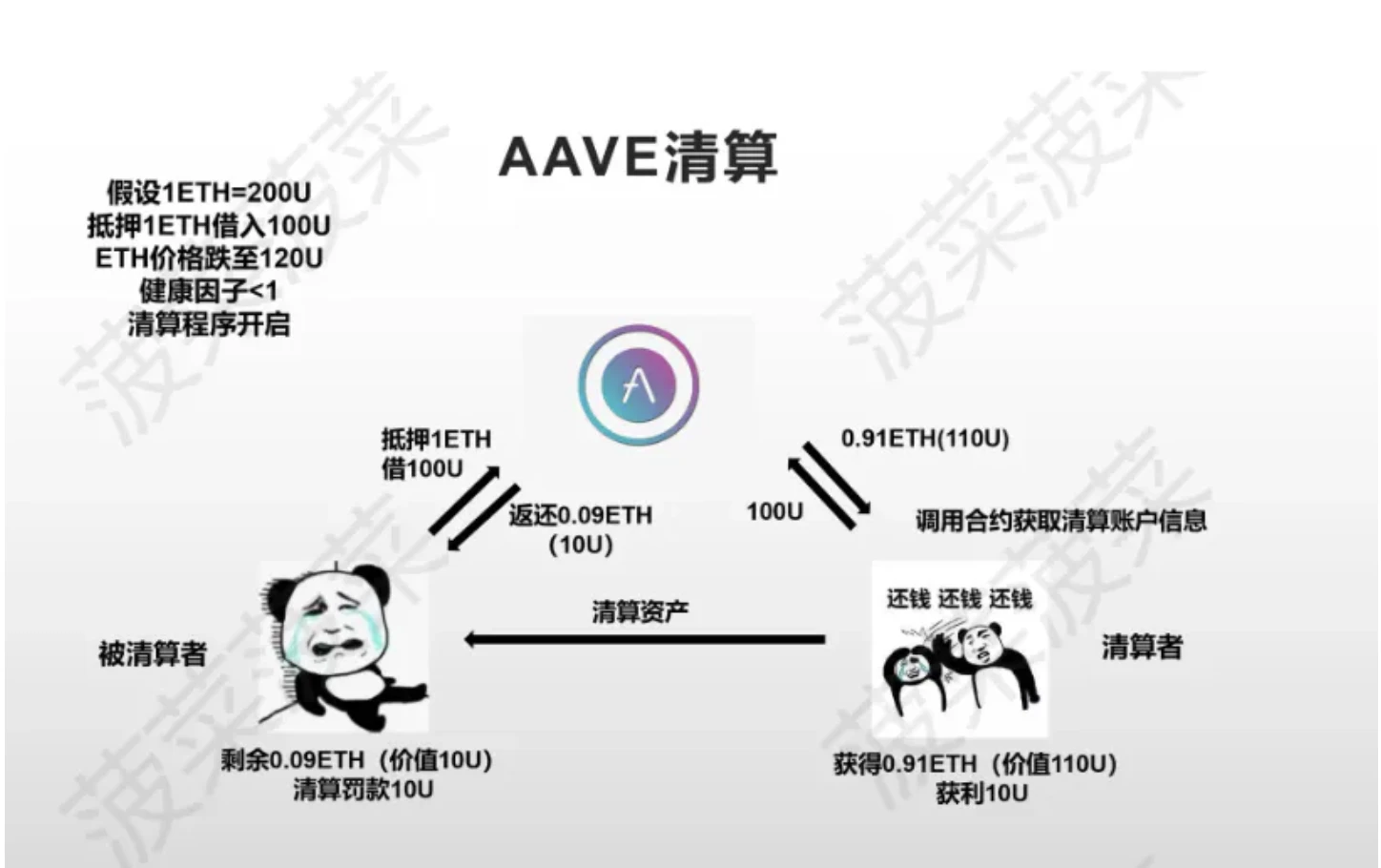

Usually, an important indicator to judge whether a user is facing liquidation is the health factor, which is the ratio of the value of the loaned assets to the value of the mortgaged assets. It can be obtained by the collateral × liquidation threshold ÷ the total lent assets. When When the health factor is less than 1, the AAVE protocol will face bad debts, and users will enter the liquidation process.

The smart contract of the AAVE protocol itself cannot automatically complete the liquidation operation, so the liquidation process of AAVE needs to be completed by a third party. The liquidator needs to call the liquidation smart contract of AAVE to obtain the information of the account facing liquidation and perform the liquidation operation. The liquidator needs to pay an additional liquidation penalty reward to the liquidator to encourage more people to participate in liquidation.

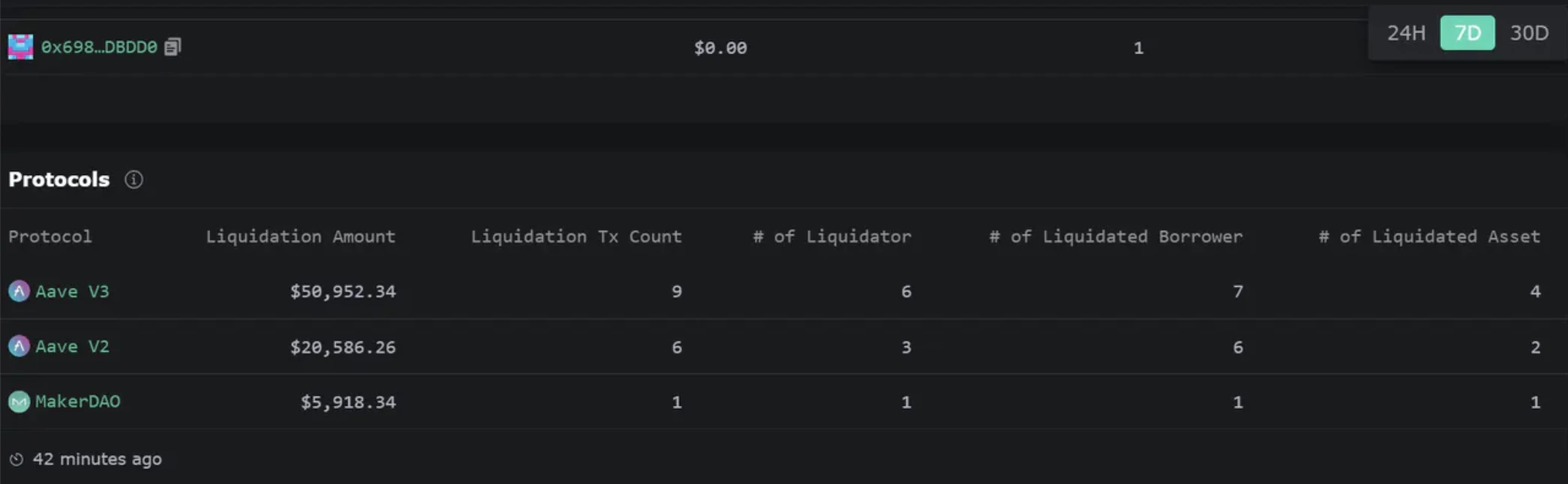

Although anyone can call the liquidation contract to act as a liquidator, the current threshold for liquidators is extremely high. It is usually executed by professional liquidation robots and requires a huge amount of funds. It is basically impossible for ordinary people to participate, and the leading liquidation robots With an absolute advantage, we can observe that the amount of liquidation that the number one liquidator in the top ten has recently participated in is greater than the total amount of all other liquidators.

Data Sources:https://eigenphi.io/mev/ethereum/liquidation

4. Comparison of business data between Aave and Compound

Aave and Compound are two leaders in decentralized lending. The trade-offs determined by some core concepts also determine the different development speeds of the two. From the data level, the development status of the two after different strategic focuses can be reflected.

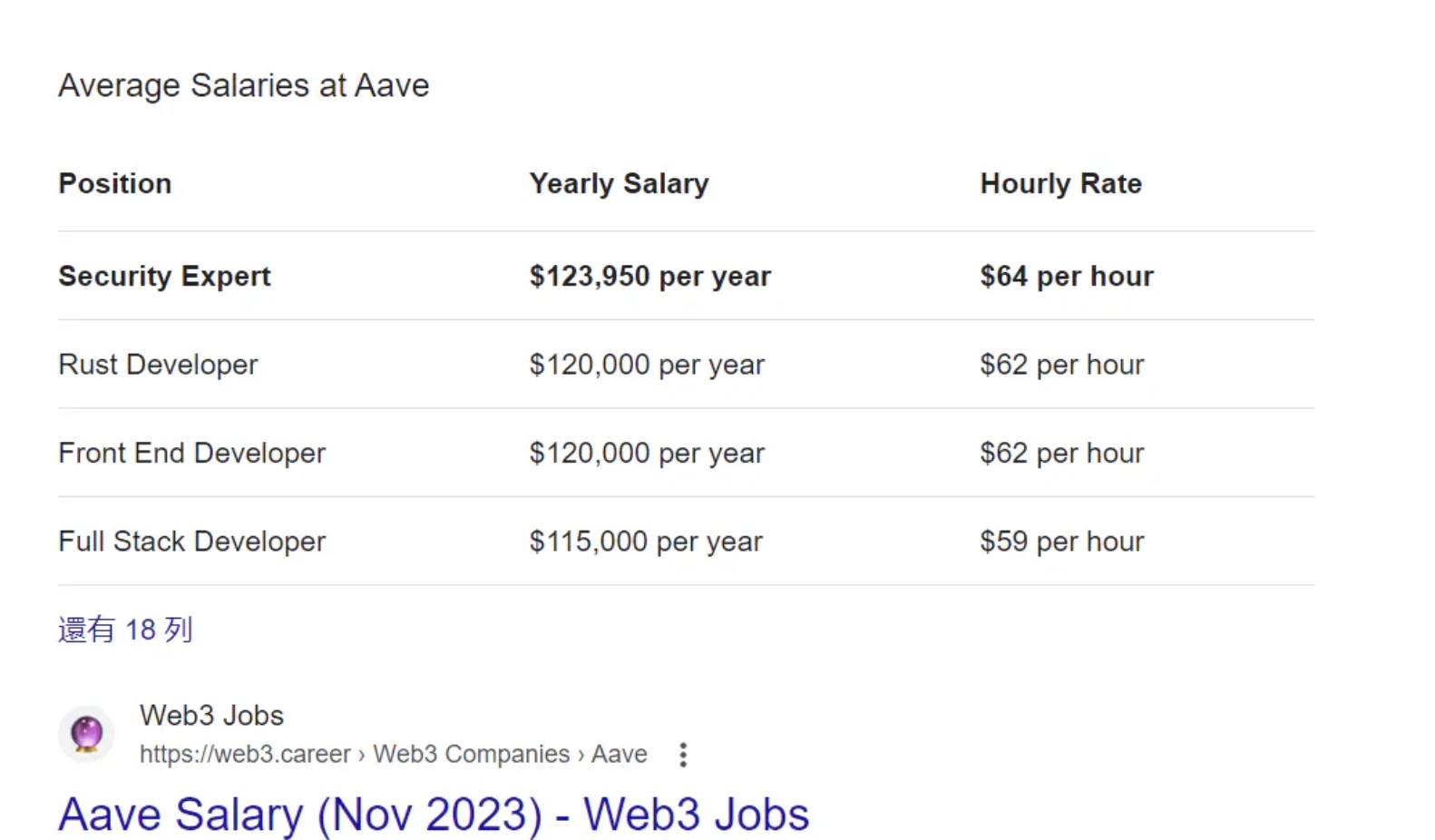

As a project party, there is one data that is often not disclosed in Defi projects, which is human capital. As mentioned earlier, Compound has 19 employees and Aave has 95 employees. How many times is the cost of this part?

Roughly speaking, based on the per capita annual salary of US$150,000, that is also an expenditure of US$3 million compared to an expenditure of US$15 million. This would be a heavy burden for an agreement that can only earn US$1-2 million in monthly income.

Therefore, in the process of comparing business data, one should consider one factor in real time. One is made by a team of 20 people, and the other is made by a team of 100 people. Aave may spend more than 10 million US dollars less than Compound.

Like Uniswap and many Web 3.0 projects, it is speculated that Aave must need to sell tokens to maintain it.

4.1 TVL

Comparing TVL over the past year, Aave has fluctuated between $4b and $6b, while Compound has fluctuated between $1.5b and $2.2b.

Data Sources:https://tokenterminal.com/terminal/projects/Aave/competitive-landscape

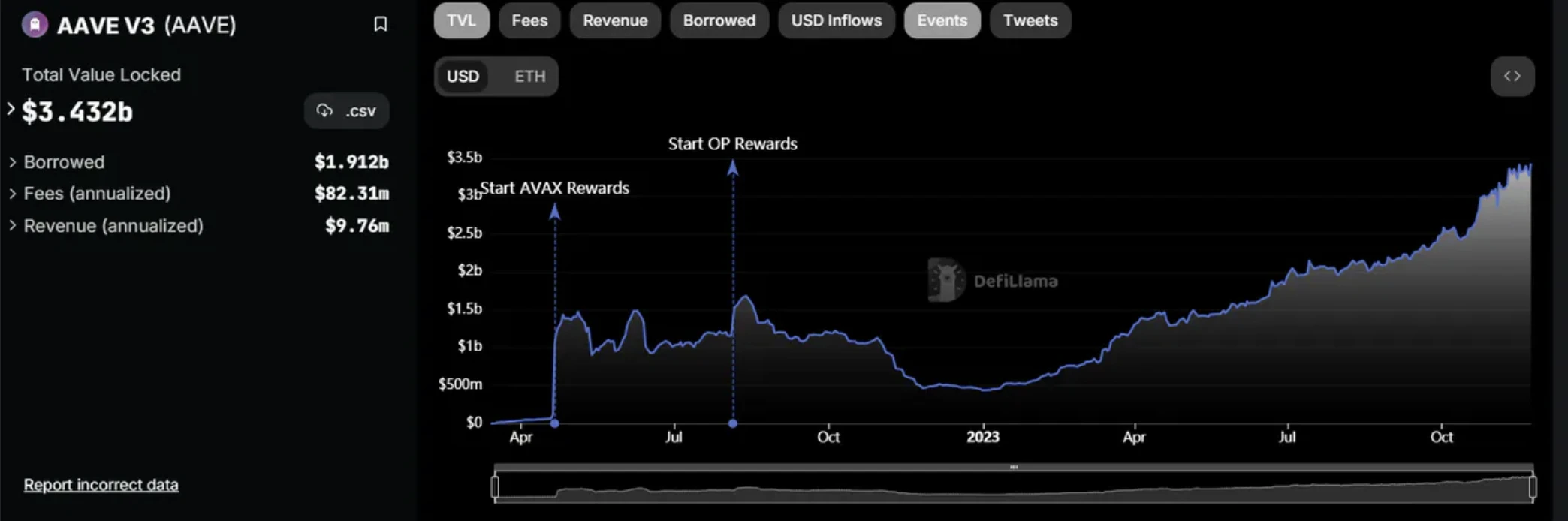

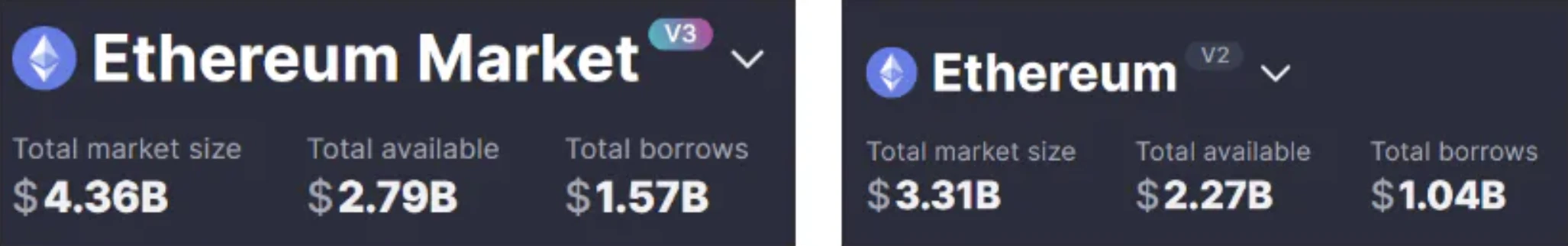

Aave V2 has dropped from around $4b to just over $2b. In turn, after the launch of Aave V3, the lowest price was less than $500m at the end of 2022 and now it has reached $3.42b.

Data Sources:https://defillama.com/protocol/Aave-v2

Data Sources:https://defillama.com/protocol/Aave-v3

4.2 Treasury Treasury

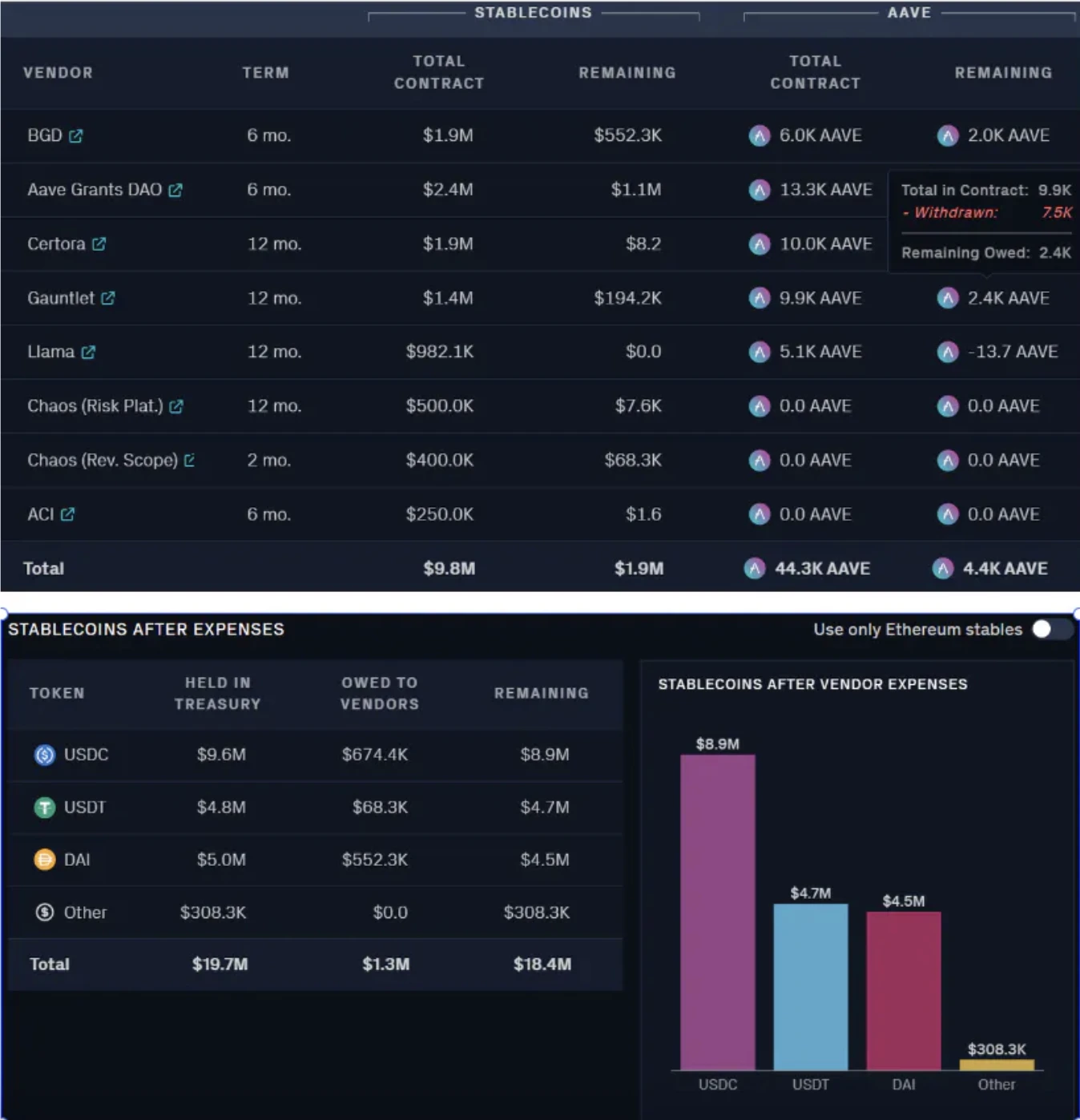

At the high point, the national treasury reached US$574 million. It is currently at US$121 million. Aave accounts for 70%. If Aave is not included, the total is US$35 million. Therefore, in fact, when the value of the treasury was at its highest, the currency standard may not be that exaggerated. It was more due to the higher currency price at that time.

Data Sources:https://community.llama.xyz/Aave

The Aave team relies heavily on the market value of Token, and many of their contracts are paid with a mix of stablecoins and Aave.

4.3 Runway

At present, the expenditure and income of stablecoins are basically even. Then due to the user rewards provided by staking and some services paid with Aave, it is probably enough to last for 2.2 years. Of course, after the user rewards are reduced (550 becomes 385), this period should become longer (will continue to talk about it later).

Data Sources:https://community.llama.xyz/Aave/runway

The corresponding Proposal can be found for every expenditure in Aave, and the payment progress is also very clearly marked. It can be understood that the decisions made at every shareholder meeting are open and transparent, giving a sense of community belonging and a high degree of decentralization (more on this later).

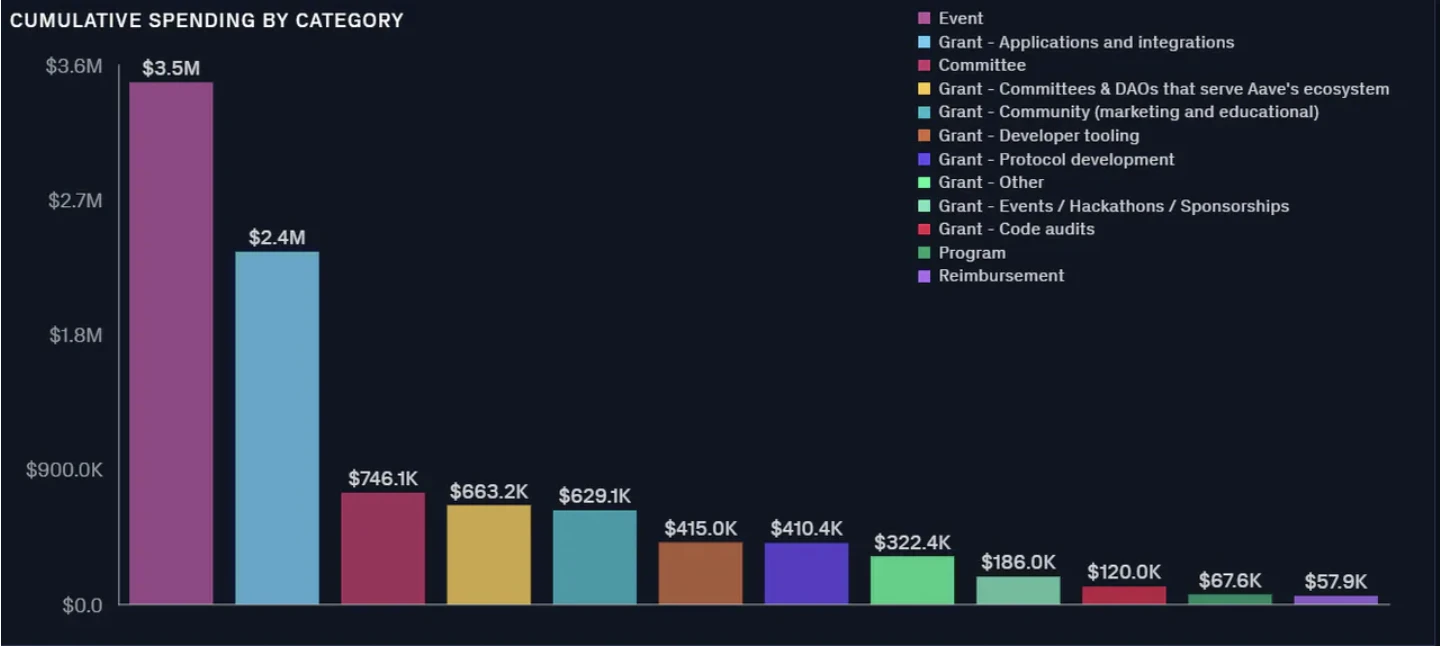

The expenditure area lacks the salary of the most important personnel. Although the Grant column has columns such as Protocol Development and Code audits, it is obvious from the magnitude judgment that it does not correspond to employee salary.

Data Sources:https://community.llama.xyz/Aave/grants

According to the companys recruitment post, the average annual salary of employees is calculated as US$100,000, and the annual expenditure of 100 employees is US$10m.

Let’s do a rough calculation based on the price of Aave $95. The annual labor cost is not included. The u-based overhead is:

[(5, 300+ 33, 000)* 95+ 1, 300, 000)]* 12 =$ 59, 262, 000

plus $10m labor cost

$ 59, 262, 000+$ 10, 000, 000

Income is approximately:

1, 200, 000* 12 =$ 14, 400, 000

Where does this $69-$14 = $55m come from? Aave has no financing after 20 years.

$ 55, 000, 000/100 = 550,000, need to sell 550k Aave tokens? The current staking reward released in one year is 12* 33 k= 396 k.

(The problem with the calculation is that the income estimate is based on the month. If the income can reach $5m, it will be three times the current monthly income to tie)

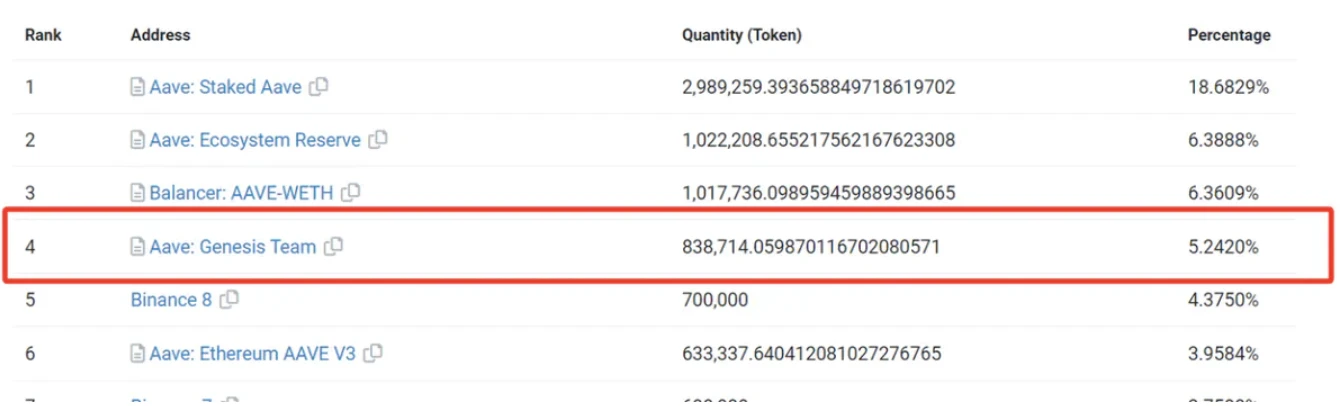

Later, looking at the Token Holder part, Aave: Genesis Team should pay employees, and there are more than 800,000 Aave. Calculated based on $100, there is still $80m that can be used to pay wages, plus they can also use it to pay wages. The income from staking and the short-term cash flow are healthier than imagined.

Data Sources:https://etherscan.io/token/tokenholderchart/0x7fc66500c84a76ad7e9c93437bfc5ac33e2ddae9

4.4 Mainstream asset lending interest rates and lending conditions

4.4.1 Indicator explanation

LTV: Aave uses the Loan to Value (LTV) ratio to measure the value of other assets that can be borrowed per 1 unit of collateral.

E-mode LTV: Lending in the same category can increase LTV

Liquidation Treshold: liquidation threshold

Liquidation Bonus: Reward for liquidators

Liquidation Protocol Fee: Liquidation fee to the protocol

Reserve Factor: Reserve factor, that is, the proportion of interest paid to the treasury

Supply Cap: supply upper limit

Borrow Cap: Borrowing limit

The concept of indicators can be seen with this picture

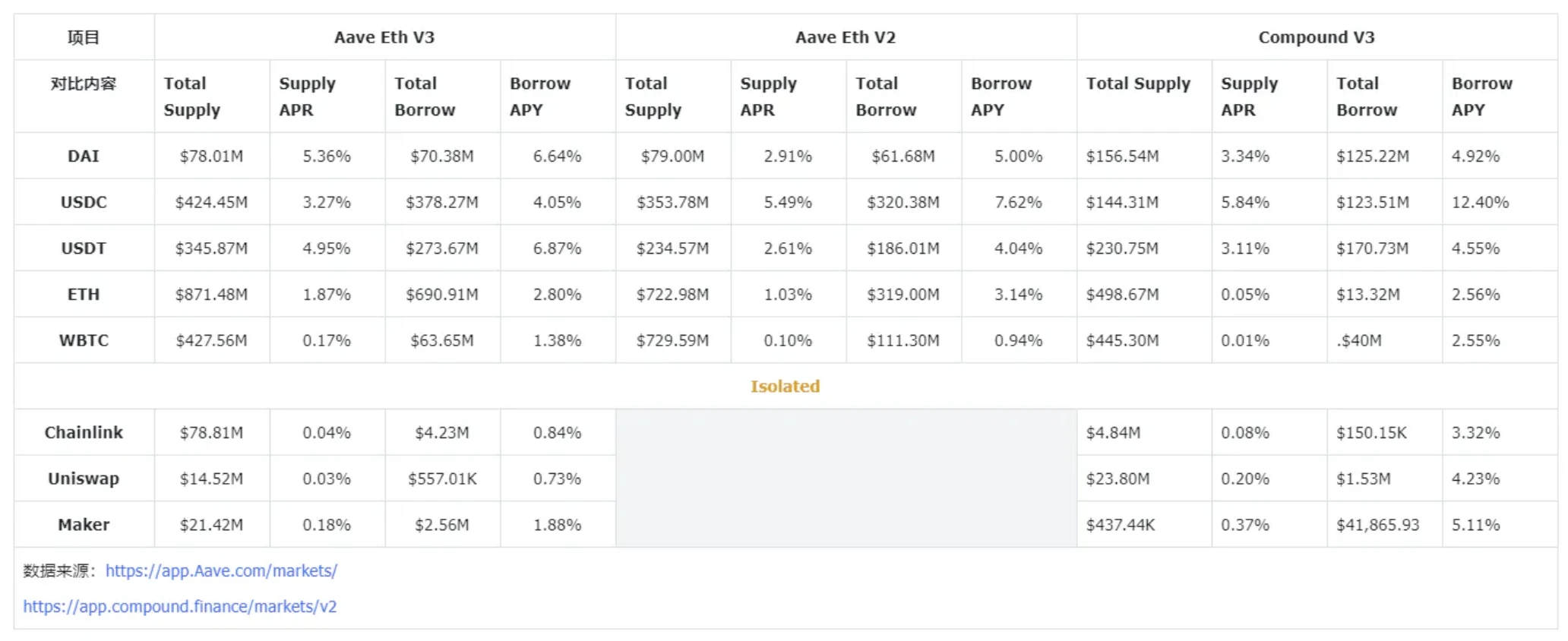

4.4.2 Compare Market

Aave:Ethereum V3/V2

Compound:Ethereum V2

Why do people still use Aave V2 version? The underlying speculation here is that if the corresponding assets of the pool in V3 reach optimal, then the liquidity pool of V2 will actually be more cost-effective.

Compound V3 is not included here. The main reason is that Compound V3 is a very back-to-basics operation. To put it simply, cToken is abandoned.

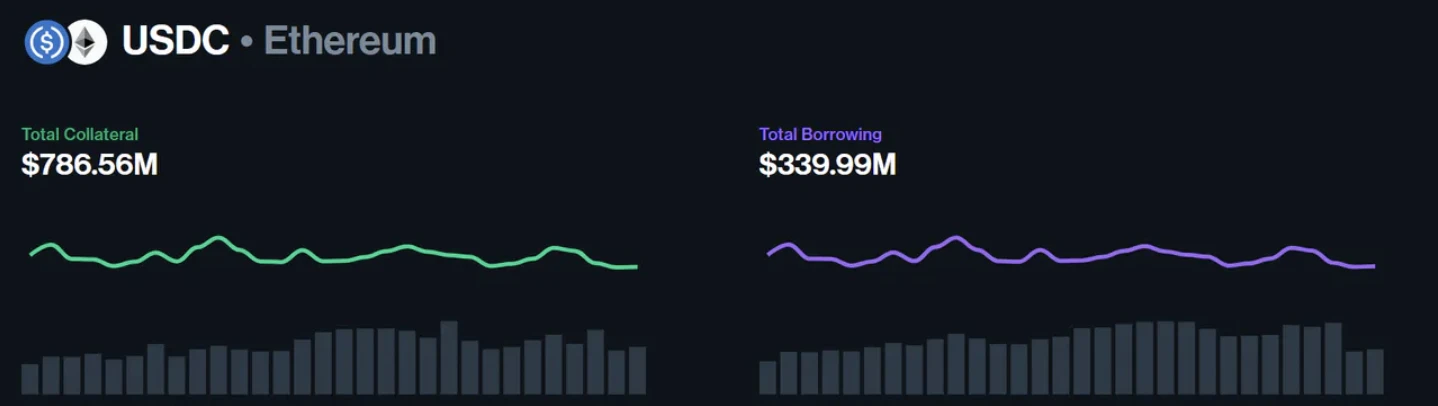

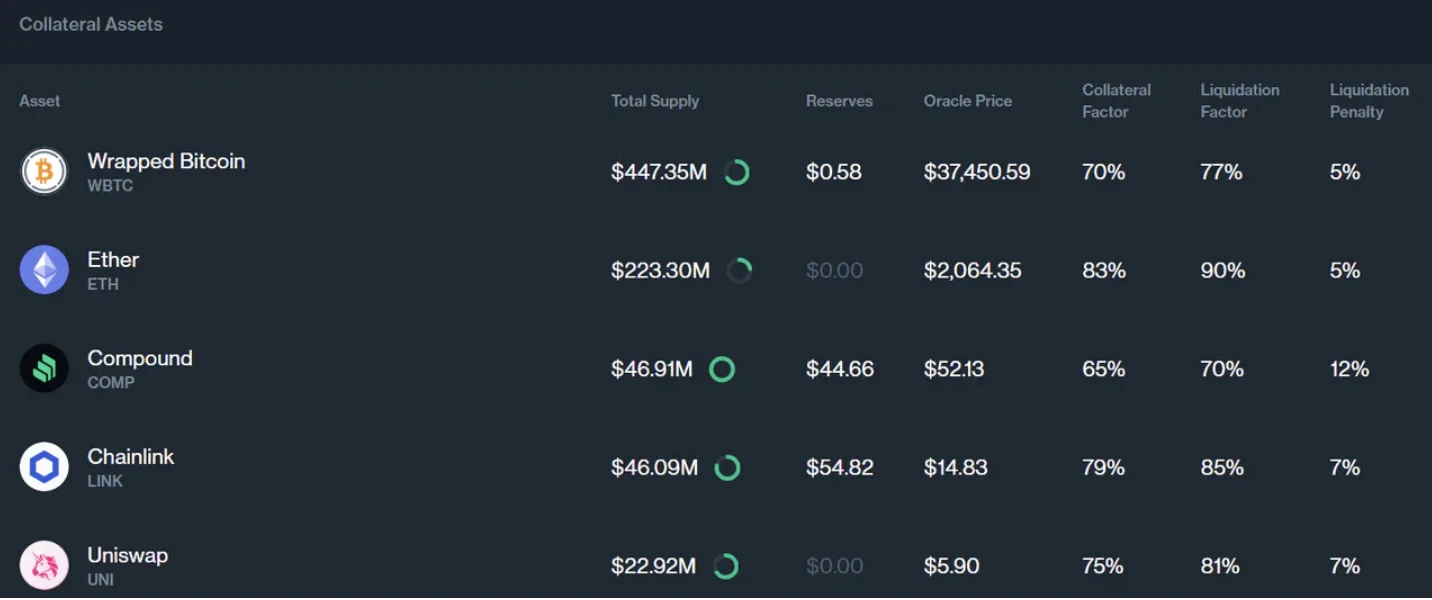

Taking USDC as an example, the overall situation is as follows:

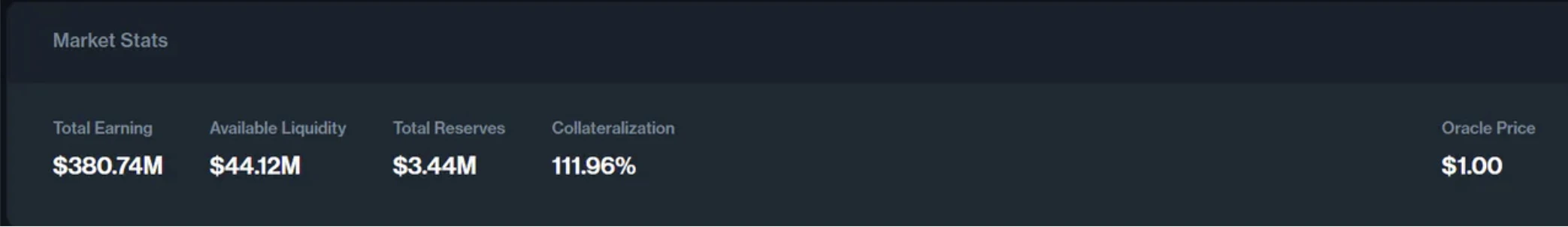

Lenders provide USDC and earn interest. Why is Totak Earning only $380.74m here instead of Total Collateral’s $786.56?

Because the borrower can only deposit the required collateral and then make a loan, this part of the collateral will no longer earn interest. The collateral here will be deposited in the corresponding contract and will not be loaned out. The borrowers collateral and the liquidity provided by the lender are separate.

So Compound V3 is more like DAI, except that Compound does not have its own stable currency.

Data Sources:https://app.compound.finance/markets/usdc-mainnet

4.5 Income situation

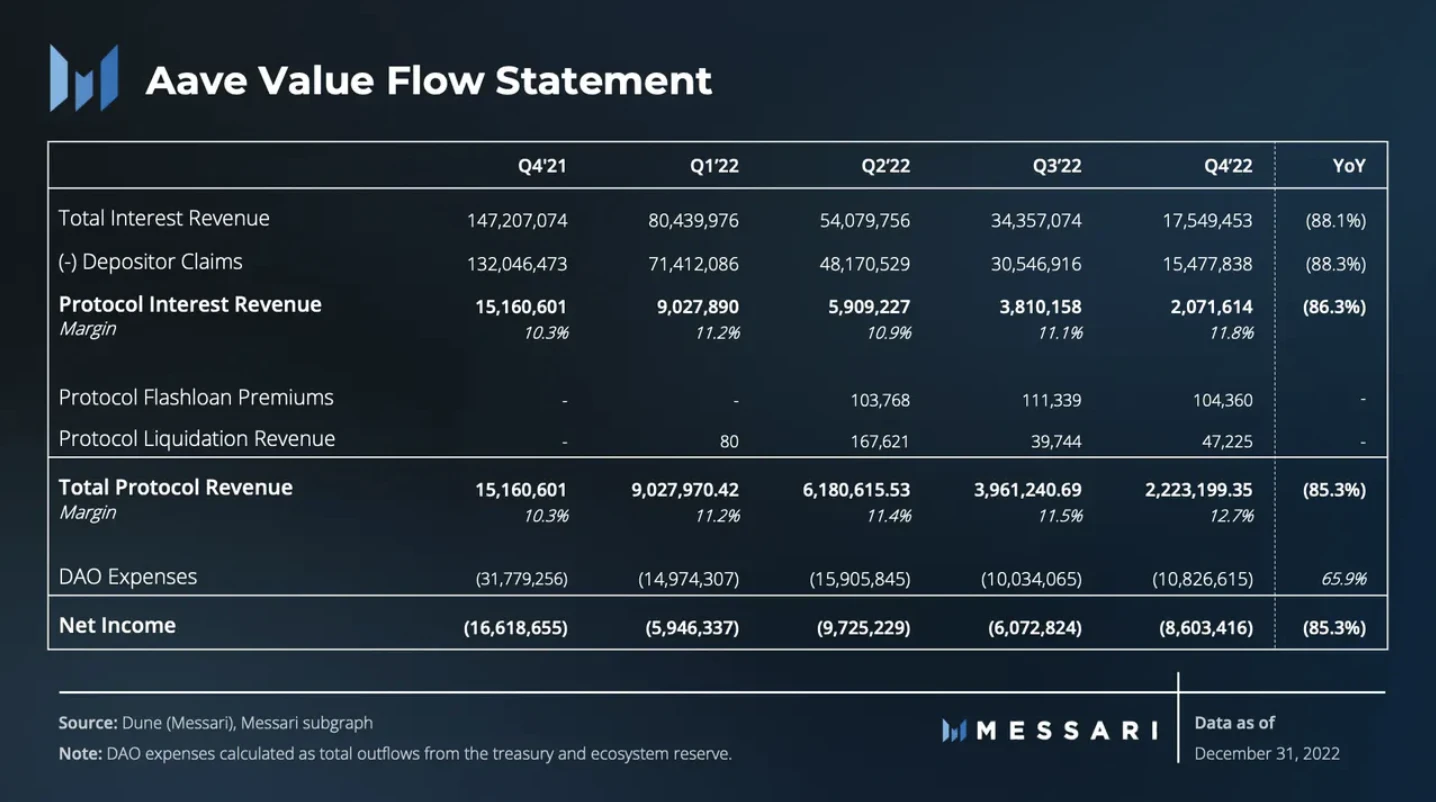

The following is quoted from:State of Aave Q4 2022

Income composition

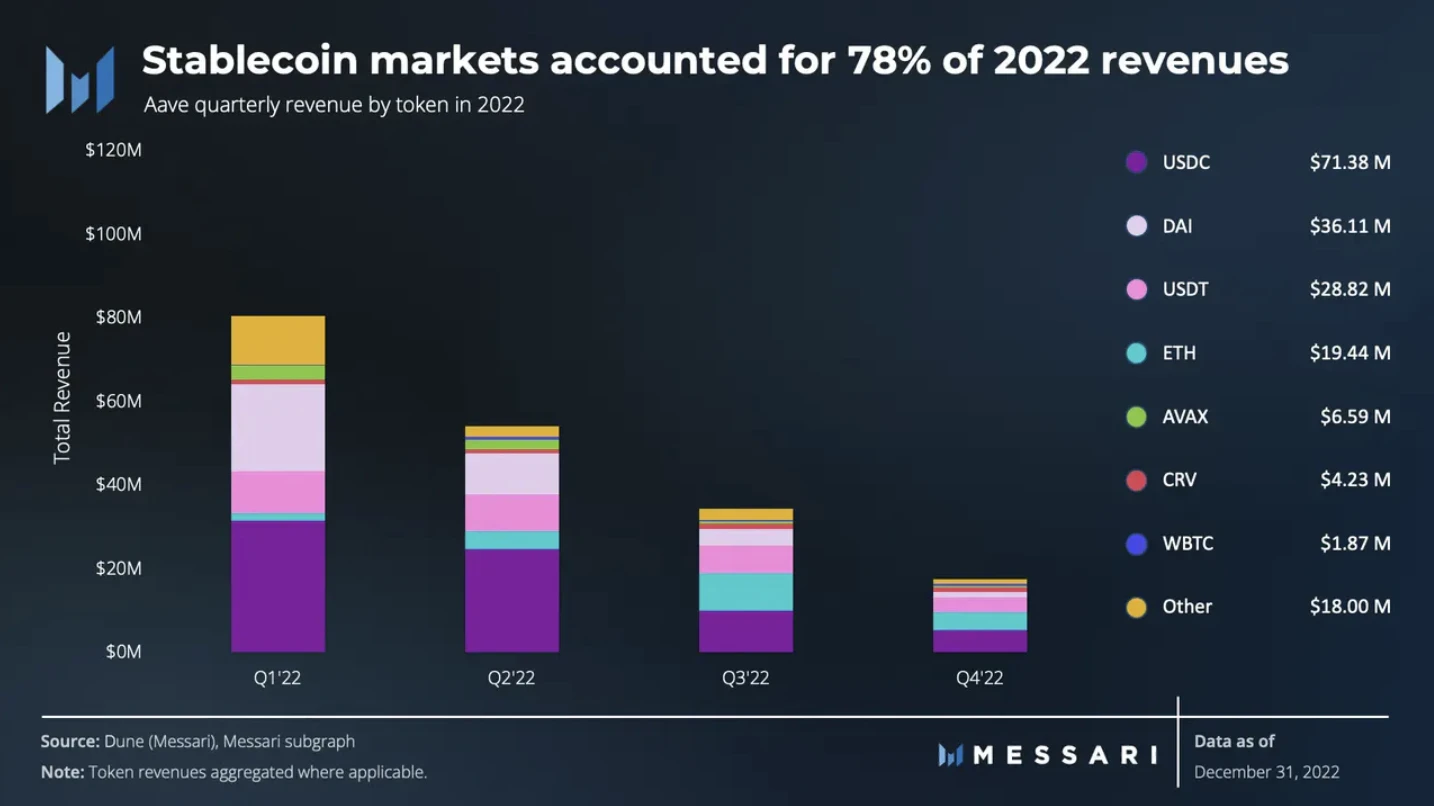

It can be seen that the income brought by the flash loan fees and liquidation income to the protocol is very small compared to the interest, only a fraction.

Among them, stablecoins have made the largest contribution to revenue.

4.6 Valuation comparison

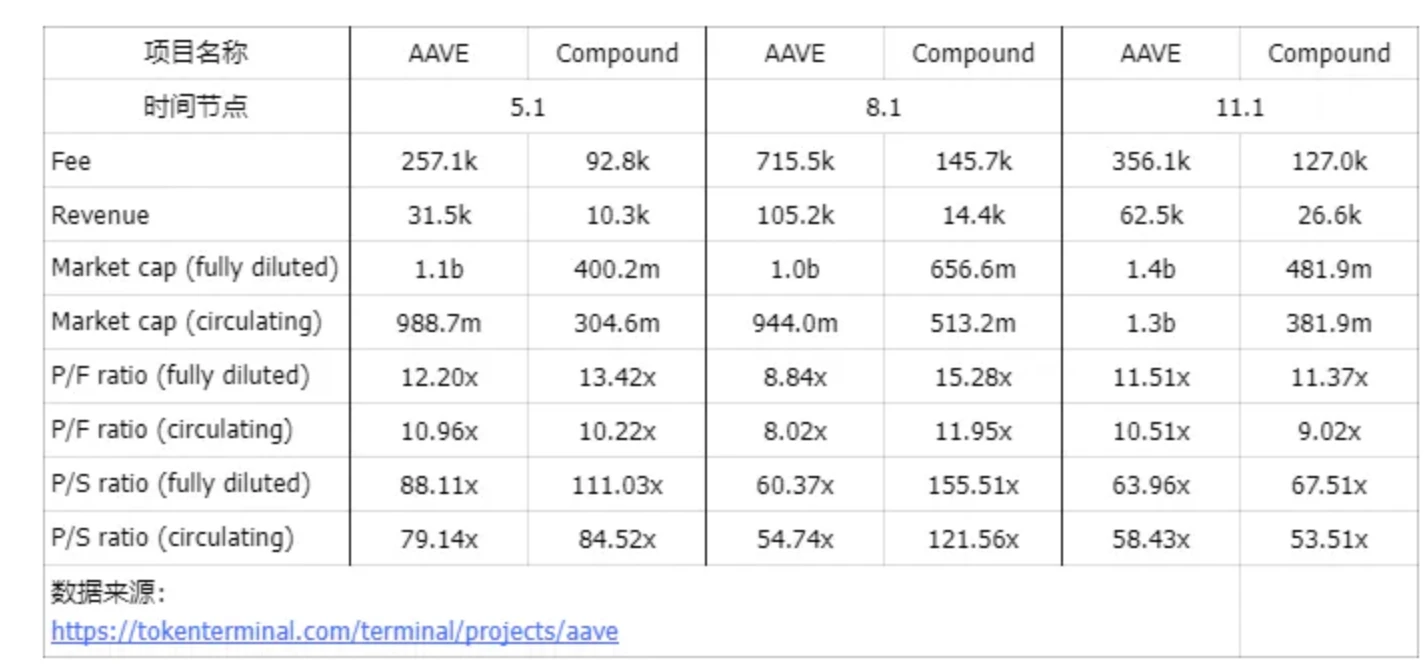

Although Aaves MC, Revenue, and Fee are much higher than Compound, the P/F and P/S are relatively close, and the markets valuation of decentralized lending is quite rational.

5. Stablecoin GHO

Discussion question: Why does everyone want to make stablecoins?

From MakerDAO-DAI, Curve-CrvUSD, Aave-GHO, why do different Defi protocols expand the same Defi business?

GHO is a direct benefit that can be brought to Aave DAO, and will increase linearly as the scale increases.

From the past proposals, after time verification, more problems are caused by the continuous decoupling caused by the majority of the uses of GHO minters for arbitrage; and the plans to stimulate demand are better interest rates and more empowerment, and there is no So-called real application scenarios.

So thinking about it from another angle, maybe it’s more of a marketing stage now? The most important thing is quantity.

dongzhen: The right to issue coins to private institutions is, like BTC, the prototype of denationalization of currency; whoever does stablecoins well and can do good application scenarios will be able to come out.

5.1 Basic situation

Aave Company on July 7, 2022Introducing GHOAave DAO。

After a period of discussion, the community voted to passSnapshotGive GHO the green light.

FirstGHO development updatesPublished on October 14, 2022.

the secondGHO development update (testnet version)Published on February 9, 2023.

GHO is an over-collateralized stablecoin minted using Aave-like deposits as collateral, further empowering Aave depositors. **So, in a sense it is similar to MakerDAO, but more efficient because all collateral will be productive assets that generate some interest - depending on their borrowing needs. GHO as a new asset inherently fits into the existing Aave protocol, meaning that interacting with protocols that borrow GHO is similar to interacting with other assets in the Aave pool.

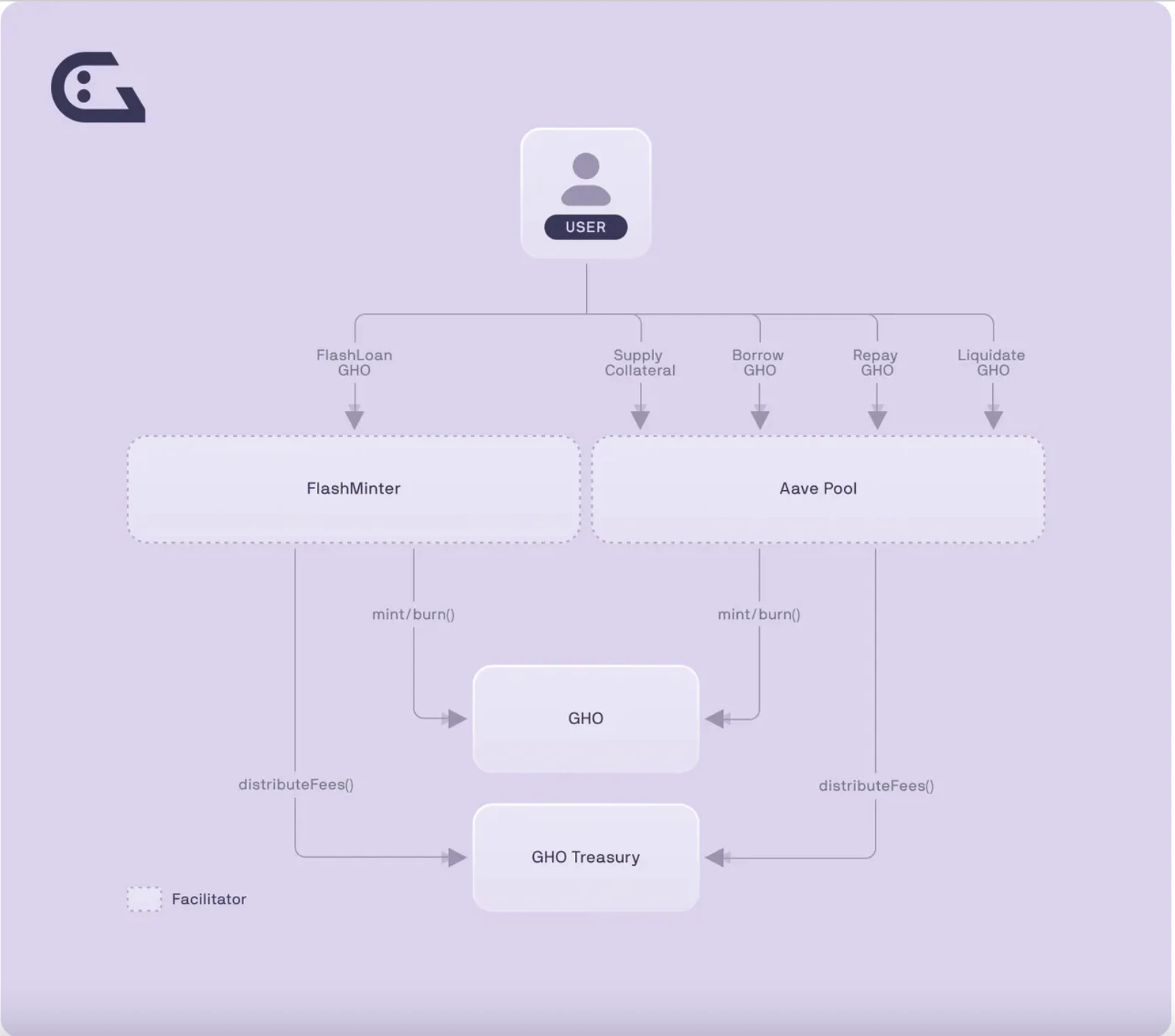

In the GHO model, 100% of the interest paid on borrowed GHO belongs to Aave DAO. Depending on GHOs demand, this could potentially bring significant revenue to the Aave DAO. besides,FlashMintThe module also generates revenue through transaction fees.

Some basic information:

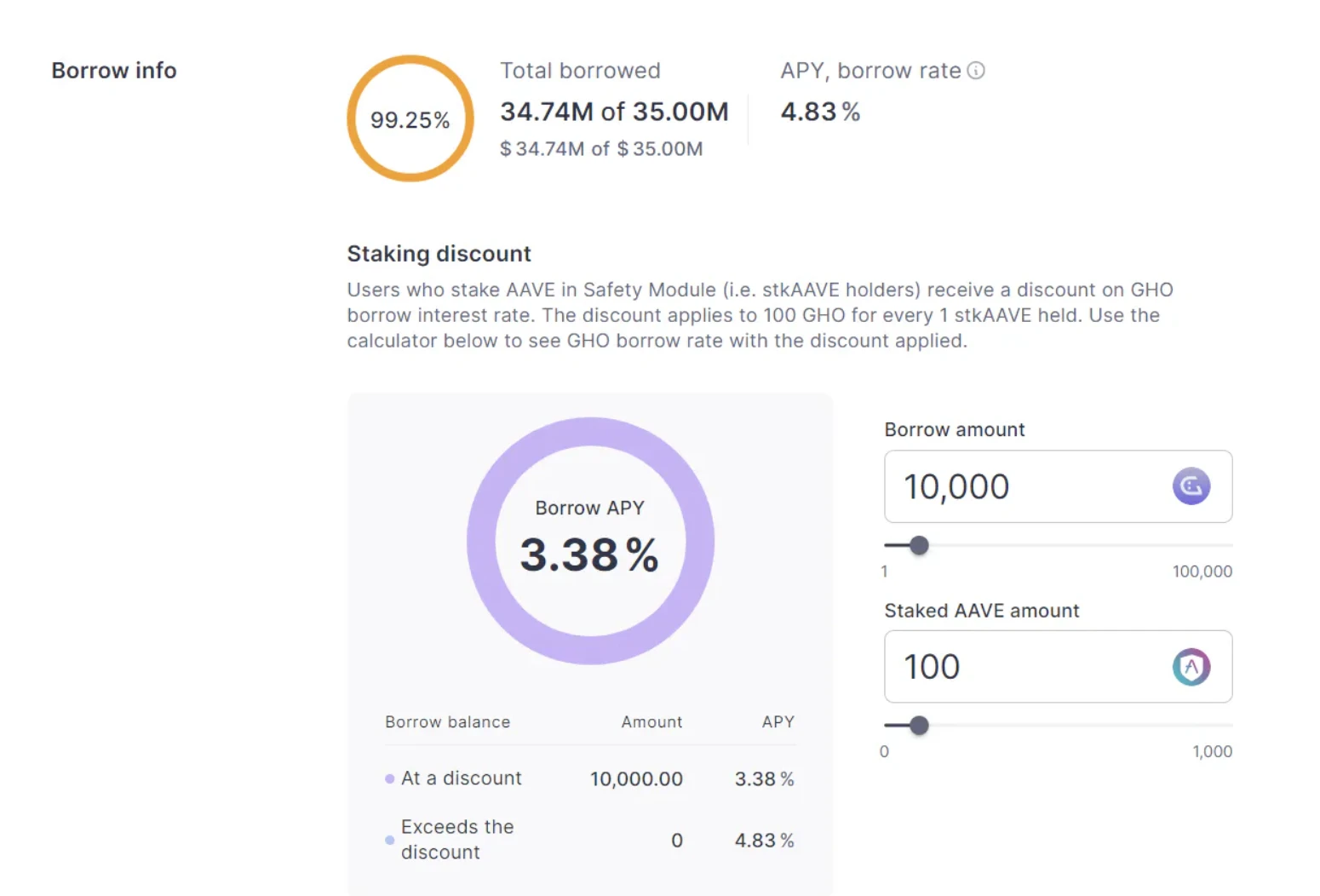

If you stake Aave, every 1 stkAave corresponds to a discount of 100 GHO, and the APY changes from 4.83% to 3.38%, with a 30% discount.

The current total issuance is 35 million, and 34.74 M have been loaned out.

It is worth noting that the current interest rate strategy of GHO is determined by voting by the DAO, rather than having a stable liquidity rate.

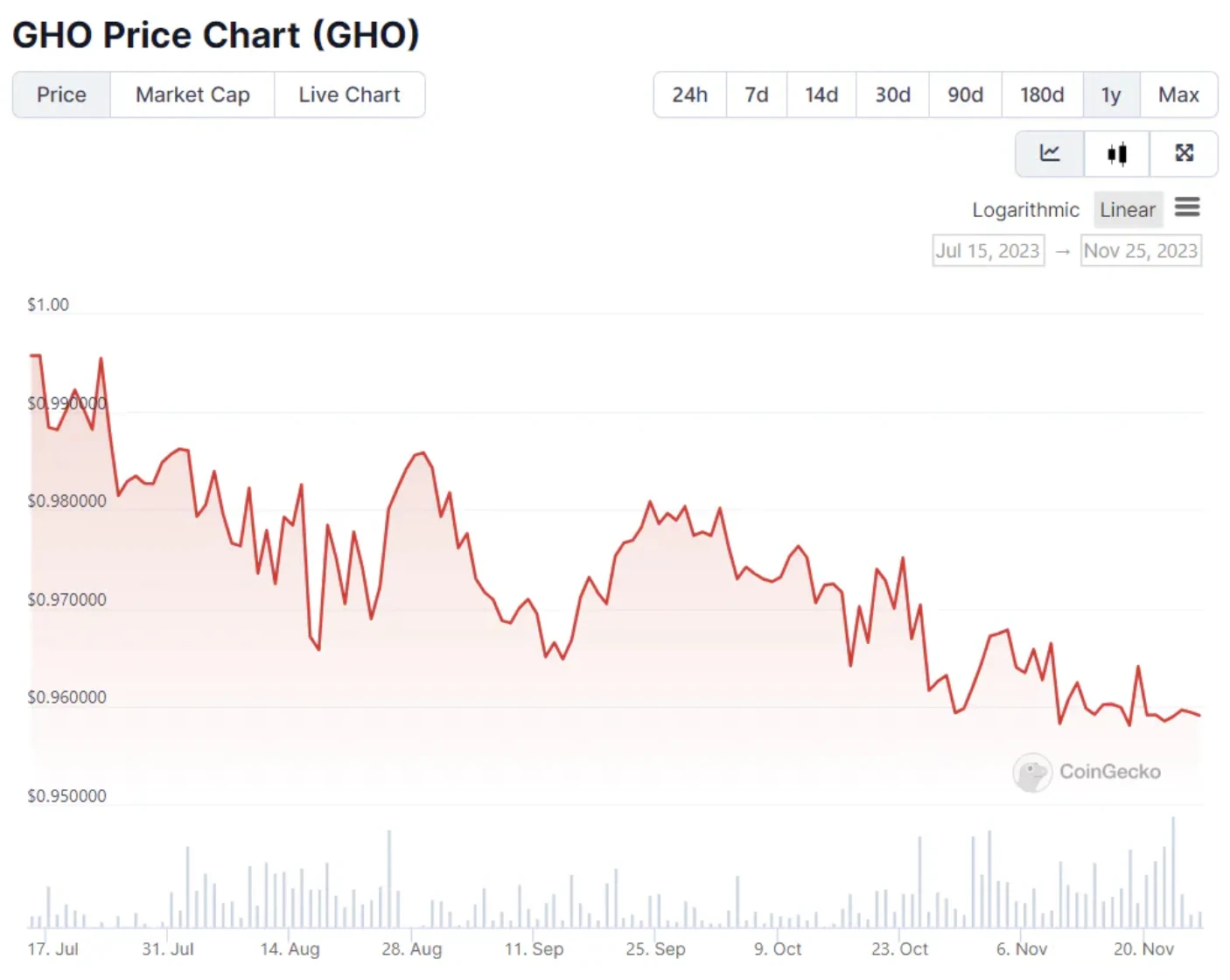

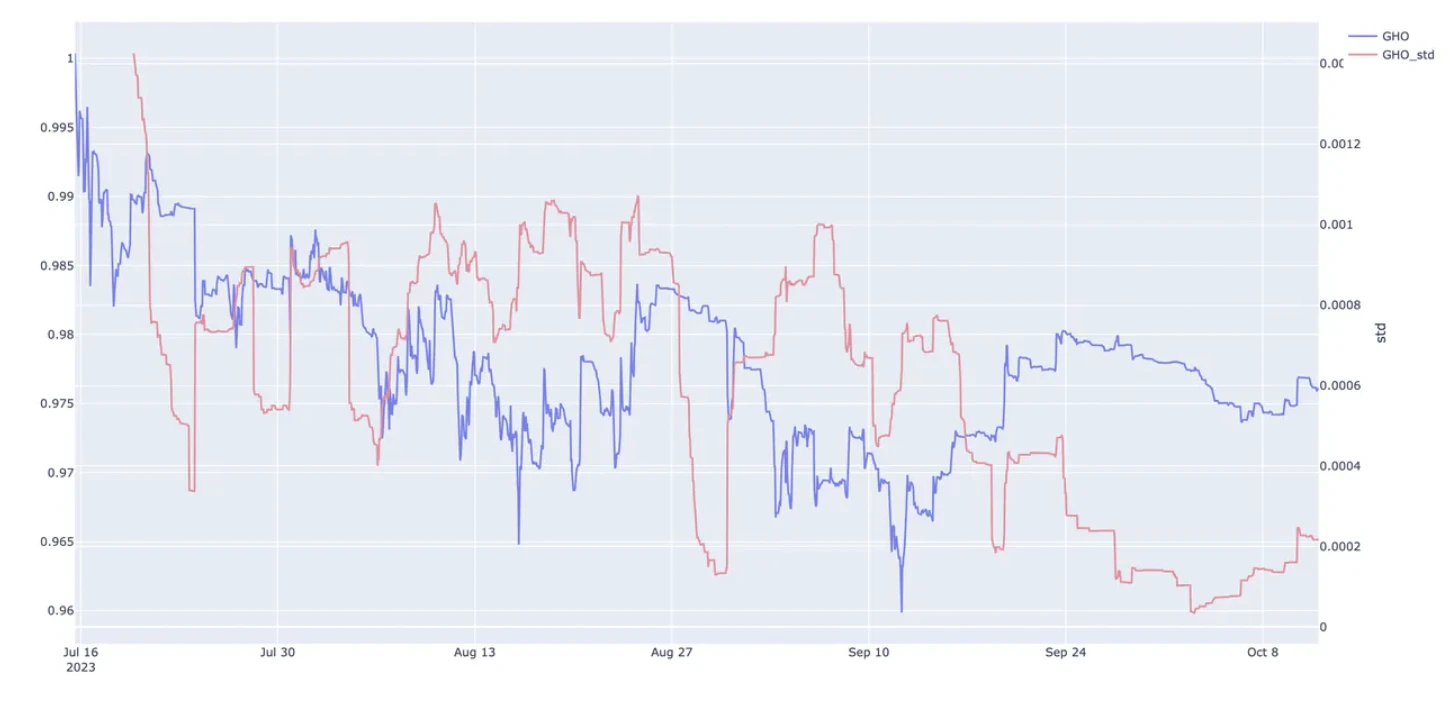

GHO has been in a state of steady decoupling.

Image Source:https://www.coingecko.com/en/coins/gho

Supply collateral –> Borrow GHO –> Repay GHO debt

GHOs are created (minted) or repaid (destroyed) by the coordinator. GHO is minted when the supply of the asset exceeds the value of GHO to be minted. GHO is designed to generate interest when borrowing money. This interest rate is determined byAave GovernanceDecide.

A little extra about Flash Minting:

FlashMinting is particularly important to GHO as it will help facilitate arbitrage, provide instant liquidity and have the ability to liquidate users.

Since FlashMinting offers currentflash loanStandards have the same functionality, so they work very similarly (e.g., all transactions must be completed within a block, and fees must be paid).

Image Source:https://docs.gho.xyz/concepts/how-gho-works/

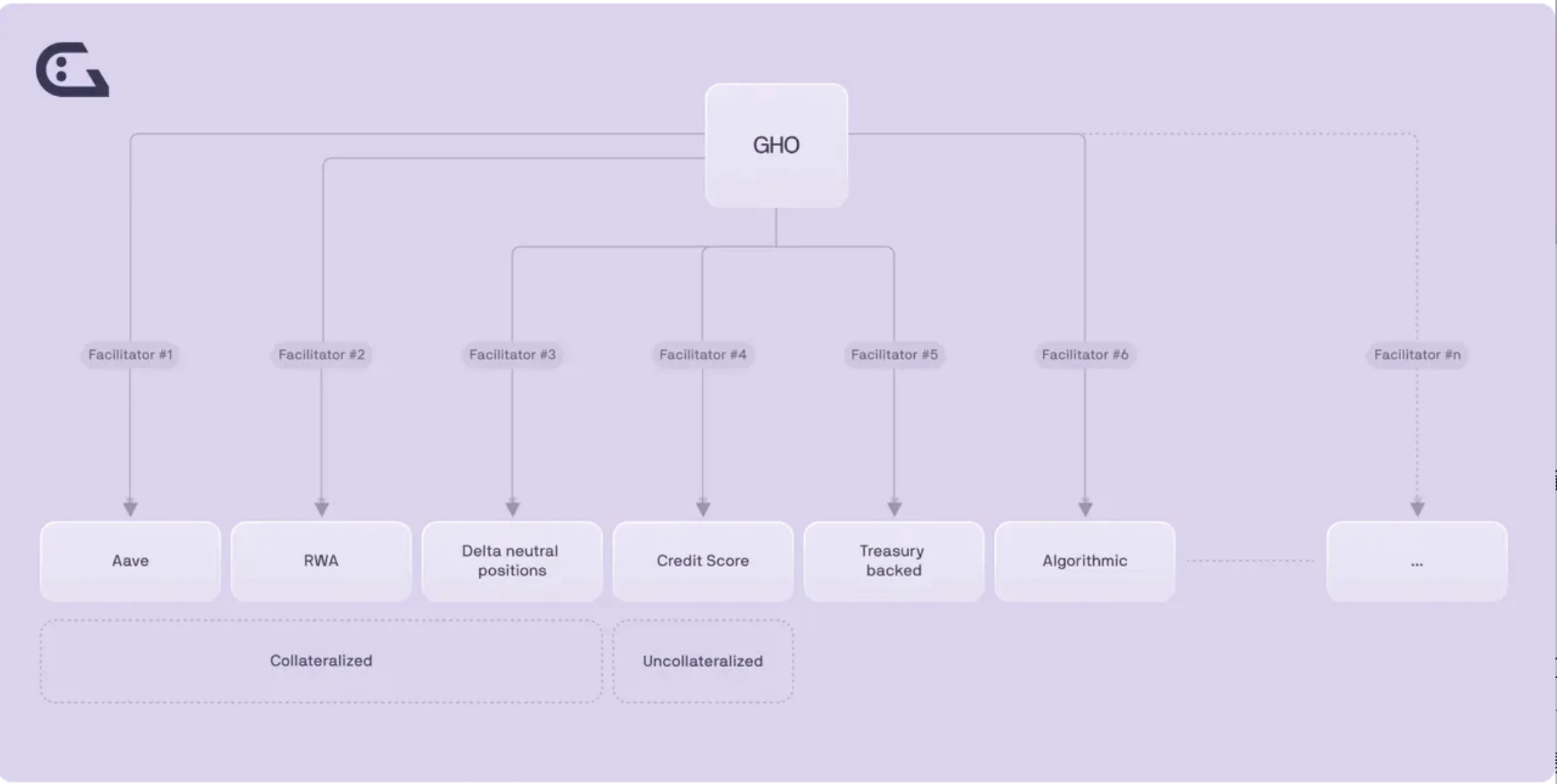

A very important role Facilitator (coordinator, facilitator) has been introduced into GHO to diversify the collateral behind GHO. New collateral includes Aave, RWA, credit points, delta neutral, and more.

Service providers can mint and destroy GHO tokens in a trustless manner through various strategies. These strategies can be formulated by different entities, which can adopt different strategies to integrate GHO (each entity is a coordinator). **Aave DAO allocates each Facilitator a Bucket with a specified capacity, which is the upper limit of GHO that a specific Facilitator can mint. **This limit is defined by the Aave DAO and can be changed.

5.2 Interest rate strategy

Compared to other assets in the Aave protocol, GHO smart contracts do not follow the supply and demand dynamics that typically affect interest rates.

For GHO, Aave protocol integration requires that rates be governed by a coordinating entity (specifically Aave Governance)Sure. The interest rate is set by Aave Governance, which statically adjusts the interest rate based on the need for contraction or expansion of GHO supply. This is a very inefficient and highly subjective solution. It also proves that GHO is still in its early stages, and its size and liquidity have not yet reached the stage that requires dynamic interest rates.

Any change in interest rates requires a governance proposal. This design acts as a stabilization mechanism and retains the flexibility of the Aave protocol’s borrowing rate model. It will be possible to implement any interest rate strategy that the Aave governance community deems appropriate in the future.

GHO price exceeds 1Dollar

If the market price of GHO is higher than $1, Aave Governance can lower the interest rate, as lower interest rates may encourage more users to access GHO.

GHO price is less than 1Dollar

If the market price of GHO falls below $1, Aave Governance can increase the interest rate. This will encourage more users to repay their GHO positions, thereby reducing the outstanding GHO supply.

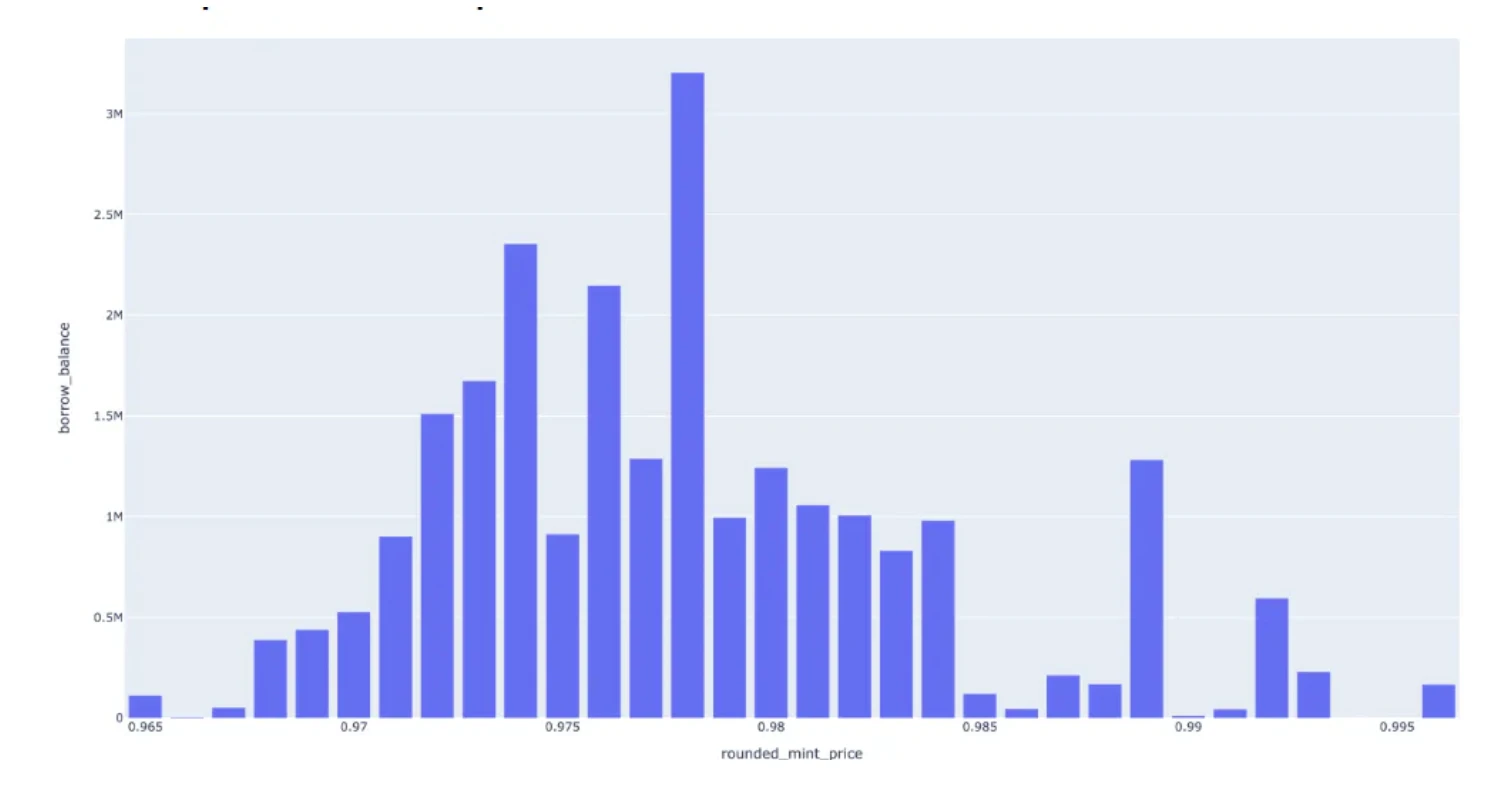

5.3 Chip distribution

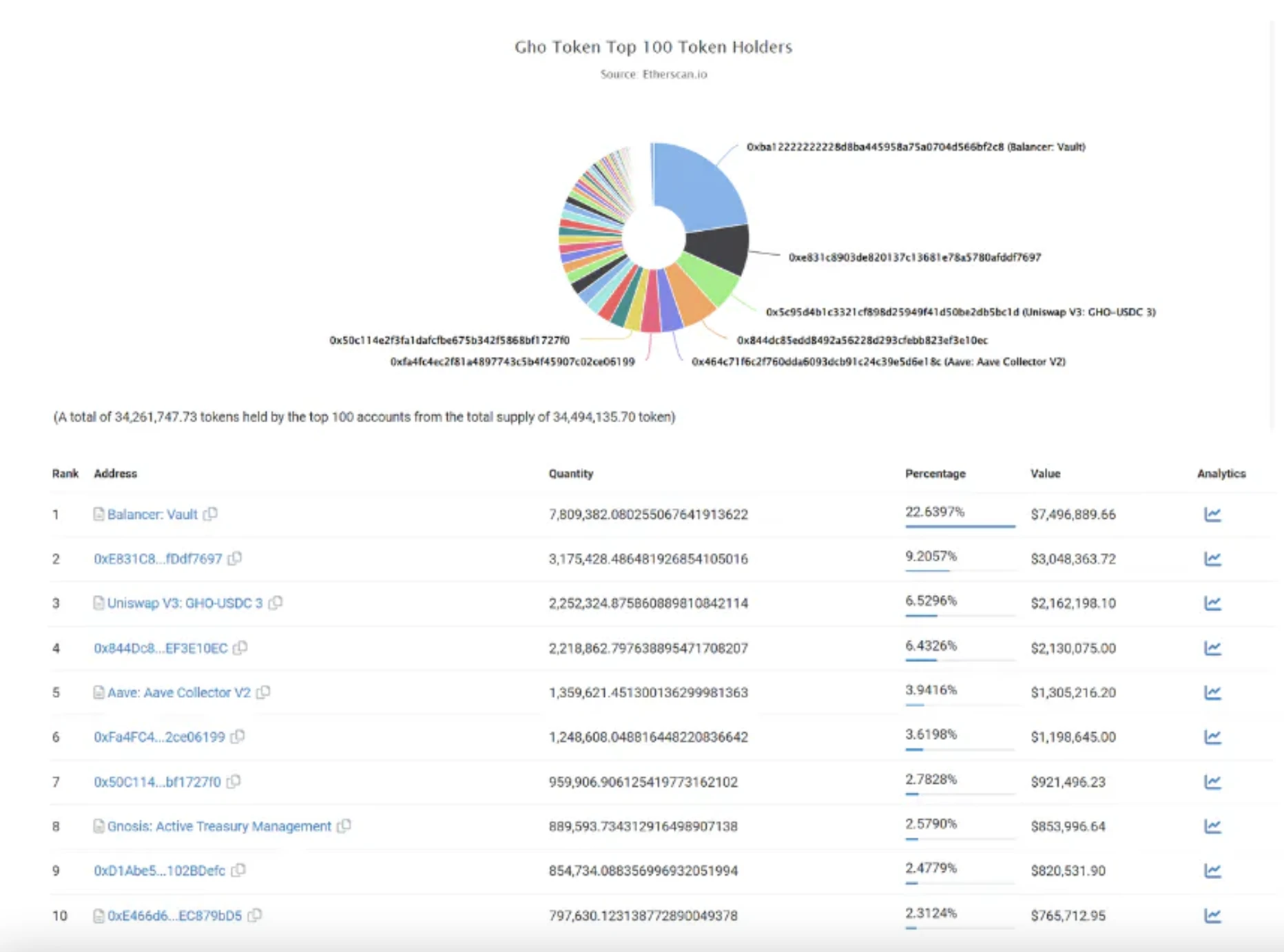

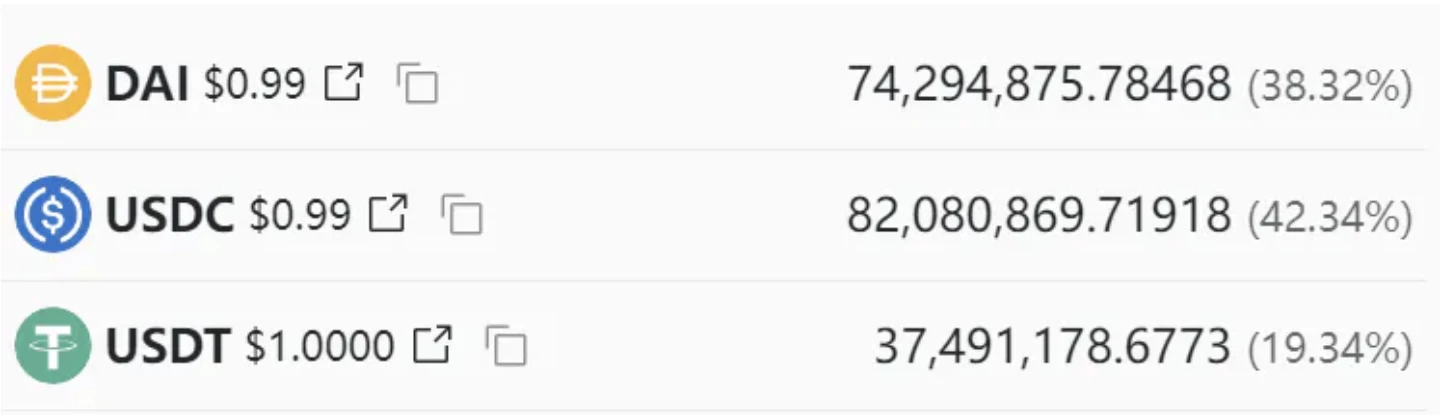

According to Etherscan, GHO is mainly distributed on Balancer and Uniswap.

Data source: https://etherscan.io/token/tokenholderchart/0x40D16FC0246aD3160Ccc09B8D0D3A2cD28aE6C2f

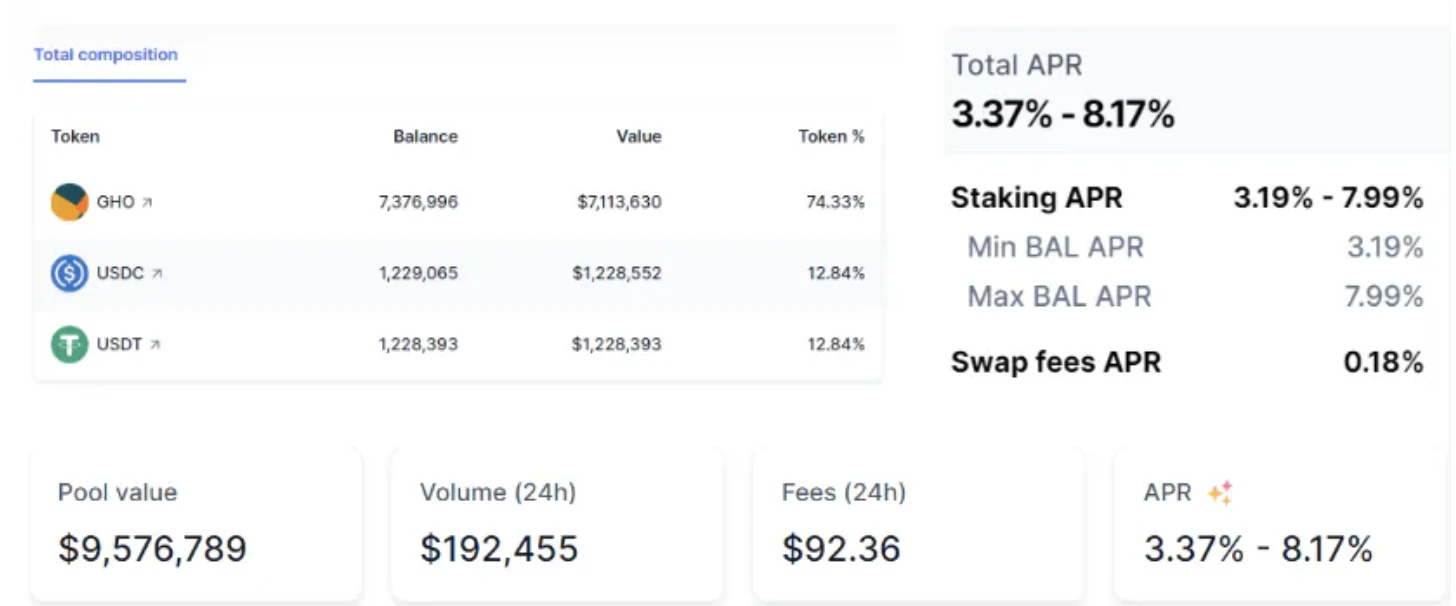

The address with the largest GHO holdings corresponds to a stablecoin liquidity pool of Balancer, with a 24-hour trading volume of $192,455 and a transaction fee of $92.36. The proportion of GHO here is as high as 74.33%, indicating that users have basically no demand for GHO.

Data Sources:https://app.balancer.fi/#/ethereum/pool/0x8353157092ed8be69a9df8f95af097bbf33cb2af0000000000000000000005d9

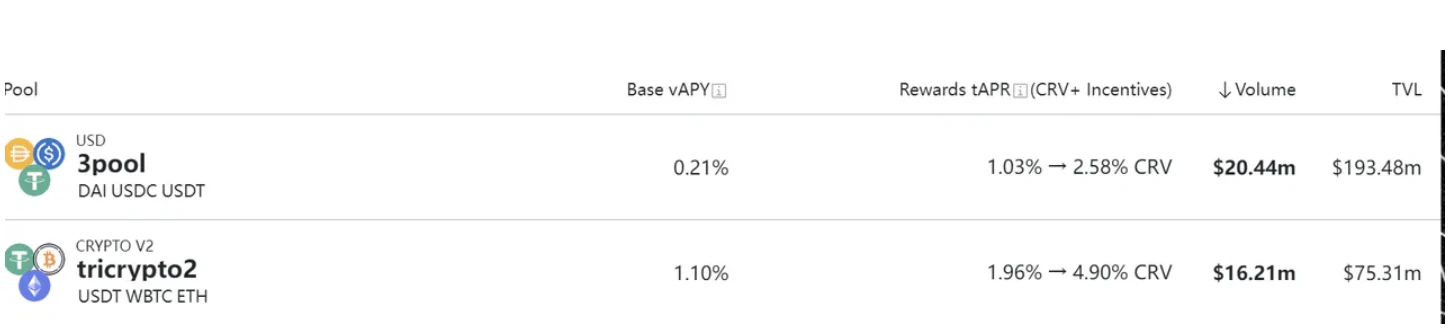

Comparing it with the daily trading volume of the Curve stablecoin liquidity pool, it is currently only 1% of the 3 pool.

Data Sources:https://curve.fi/#/ethereum/pools

In addition, compare the ratio of 3 pool and tricrypto 2.

3 pool:

Data Sources:https://curve.fi/#/ethereum/pools/3pool/deposit

tricrypto 2 :

Data Sources:https://curve.fi/#/ethereum/pools/tricrypto2/deposit

5.4 AIP – GHO Stability and Anchored Community Plan

Proposal details:https://governance.Aave.com/t/temp-check-community-plan-for-gho-stability-and-peg/15252

Since inception, GHO has traded below $1, exhibiting widespread negative drift and some price spikes, likely due to liquidations involving GHO debt and/or GHO repayments.

GHO has been working on the problem of decoupling and has proposed a variety of potential solutions:

GHO default borrowing rate increased from 1.5% to 2.5%

Raise lending rates

Enable wGHO as collateral

Create GHO stability module

However, in Community Plan for GHO Stability and Peg》Objections were raised in this Proposal:

A large number of early minters paid off their debts and profited from the drop in GHO prices (late 2023-08).

Approximately half of all GHO has been minted (approximately 25 million) as of August 11, 2023, when the GHO price was 0.981.

On August 11, 2023, 15 million GHO were minted, with an average price above 0.981.

As of October 21, 2023, there are still approximately 6 million GHO minted, and the average price is above 0.981, indicating that large positions have been paid off.

Conclusion on the current situation of GHO

Given the current status of the GHO demand vector, GHO minters can be divided into two types of users: GHO shorts who seek to profit when the future GHO price < mint price, and GHO LPers who mint GHO into LP on DEX. Both will create selling pressure on GHO

The GHO short market sells their minted GHO.

LPs can take a two-way liquidity position by minting GHO and selling half of the GHO for USDC, thereby generating GHO selling pressure.

This indicates that the following may be happening.

The planned 50 basis point increase in lending rates will encourage a portion of users to repay their GHOs, some passive LPers, and some shorts

GHO repayment briefly triggers GHO price recovery

New GHO shorts enter and mint GHO at this higher price point for market sale, new GHO LP opportunities to mint GHO due to increased trading volume and higher fees

An influx of users from (3) could restart the price decline.

GHO prices remain above (0.995, 1.005) per borrowing plan, leading to rate hike recommendations.

Therefore, without organic demand and buying pressure to respond to (4), the above sequence may cycle and repeat, possibly resulting in a reduction in GHO supply (additional costs from mints) without the need for re-pegging. **Ultimately, mint behavior may change once borrowing rates exceed base rates (e.g. Maker DSR) or borrowing rates exceed expected fee income from liquidity provision.

solution

Similar to PSM, staking GHO earns interest, and the cost of interest is provided by part of the liquidation fee - turning idle assets into interest-bearing assets

Pledge GHO to lower WETH/USDC/USDT/etc. borrowing interest rates

5.5 Why launch your own stablecoin? What are the advantages over traditional stablecoins?

Although GHO is currently launched at a similar time to CrvUSD, its development strategy is still relatively rigid.

In theory, Aave can apply all the functions in Aave V3 and V2 to its own stablecoin lending.

Similar to Dai, Defi Lego can be integrated into the stable currency system, which has a lot of room for imagination and increases leverage and capital efficiency. But in turn, corresponding risks must be borne.

Yield and collateral swaps to protect collateral

Flash Mint Arbitrage

stkAave Holder Better Interest Rates

All interest income is given directly to DAO, providing additional income, which can be distributed to Aave holders in the future.

Curve launched Llama’s liquidation algorithm at that time, which is also worth learning from GHO in the future:

What sets crvUSD apart from its competitors is its loan and debit clearing algorithm called LLAMA. As stated in the project’s white paper, this innovation continuously rebalances user collateral in response to cryptocurrency price fluctuations.

Lending-Liquidating AMM Algorithm (LLAMMA) for liquidation. Compared with the traditional stablecoin liquidation method, **LLAMMA uses a fixed price range for partial liquidation, avoiding the risk of complete liquidation. **This reduces the risk users face from price fluctuations and provides users with better asset protection.

Simply put, a traditional Collateralized Debt Position (CDP) operates with a clear liquidation price, and if the value of the collateral falls below that threshold, the collateral will be liquidated. In stark contrast, the LLAMA algorithm is a dynamic system that continuously adjusts collateral. In fact, if the price of collateral falls, the algorithm automatically swaps part of the collateral for borrowed assets, ensuring a balanced position even in volatile market conditions. This represents a fundamental shift in the way collateral is managed in the stablecoin space.

This algorithm can bring continuous additional liquidity to user collateral and generate more fees.

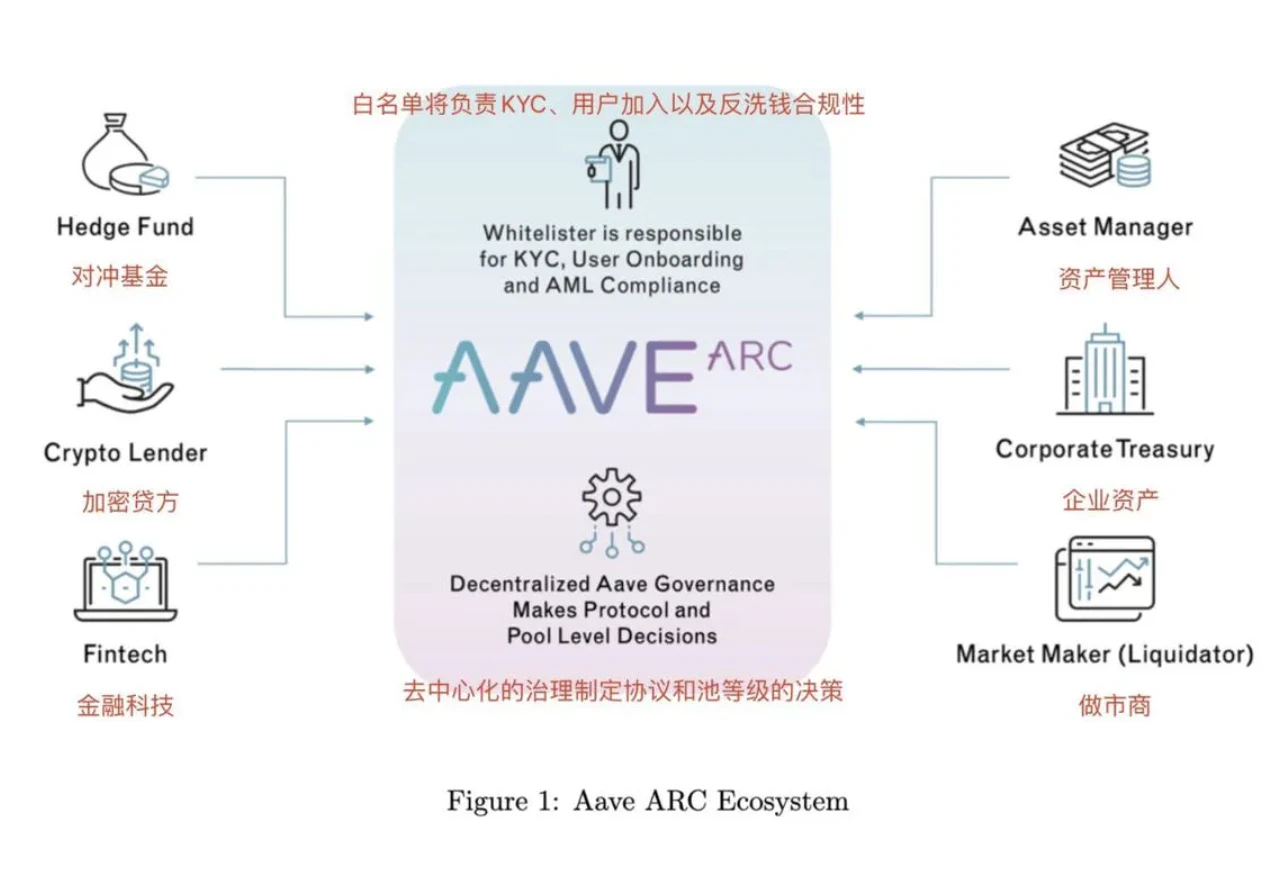

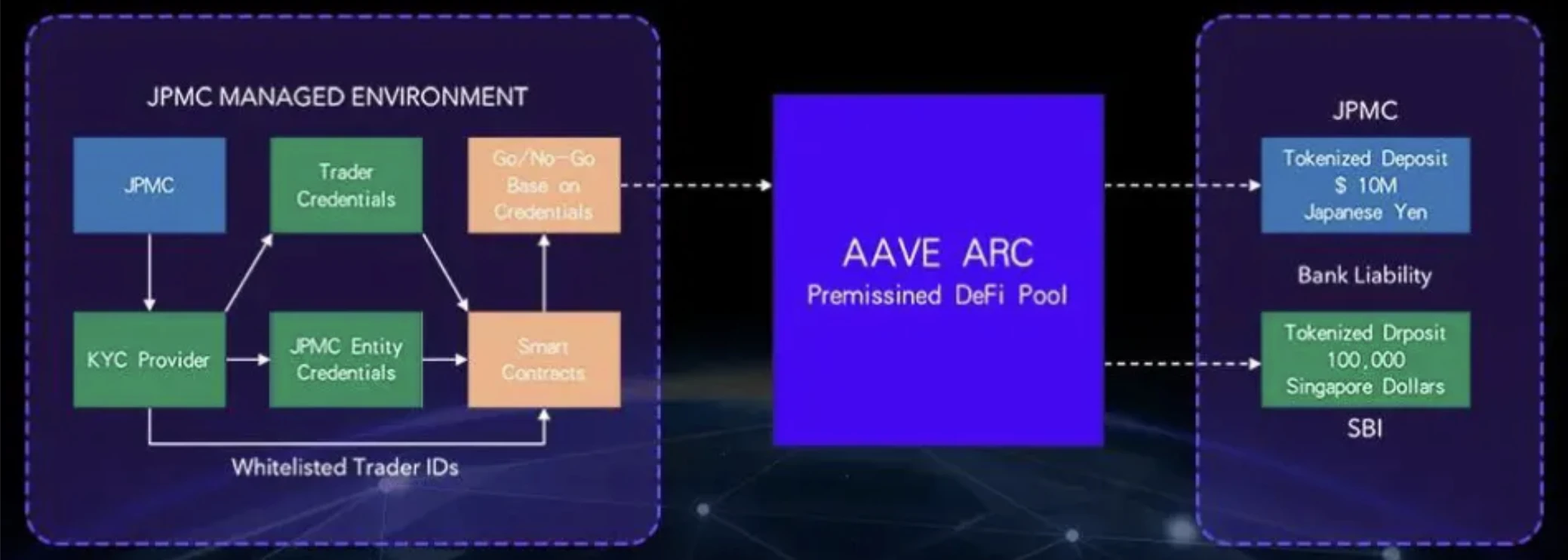

6.Aave Arc

Aave Arc aims to provide such DeFi protocols with limited capabilities to institutional investors facing strict regulatory requirements. Arc will provide private fund pools where only participants who pass KYC procedures will have access to lenders and borrowers.

The following is a diagram showing the economic system of Aave ARC. Aave Arc aims to be completely decentralized and managed by Aave Governance. Aave Protocol Governance can appoint or remove KYC and whitelisting of institutions and companies on Aave Arc.

Aave has done much worse than expected in embracing supervision. Looks like one or two companies tried it (JP Morgan?) and then cleared out pretty quickly.

Data source: https://defillama.com/protocol/aave-arc

The progress here is complete