Original author: BitMEX

Quick Facts

Affected by the hawkish attitude of Federal Reserve Chairman Powell on the prospect of interest rate hikes in 2025 at the latest FOMC meeting, the entire market suffered a sharp sell-off this week, and Bitcoin fell below $100,000. The meme coin sector suffered a heavy blow, and many projects fell by more than 30% in a single week.

In the Trading Insights section, we take a closer look at $USUAL, an innovative stablecoin protocol that has seen strong price performance thanks to its unique token economics and real-world yield mechanism.

Data Overview

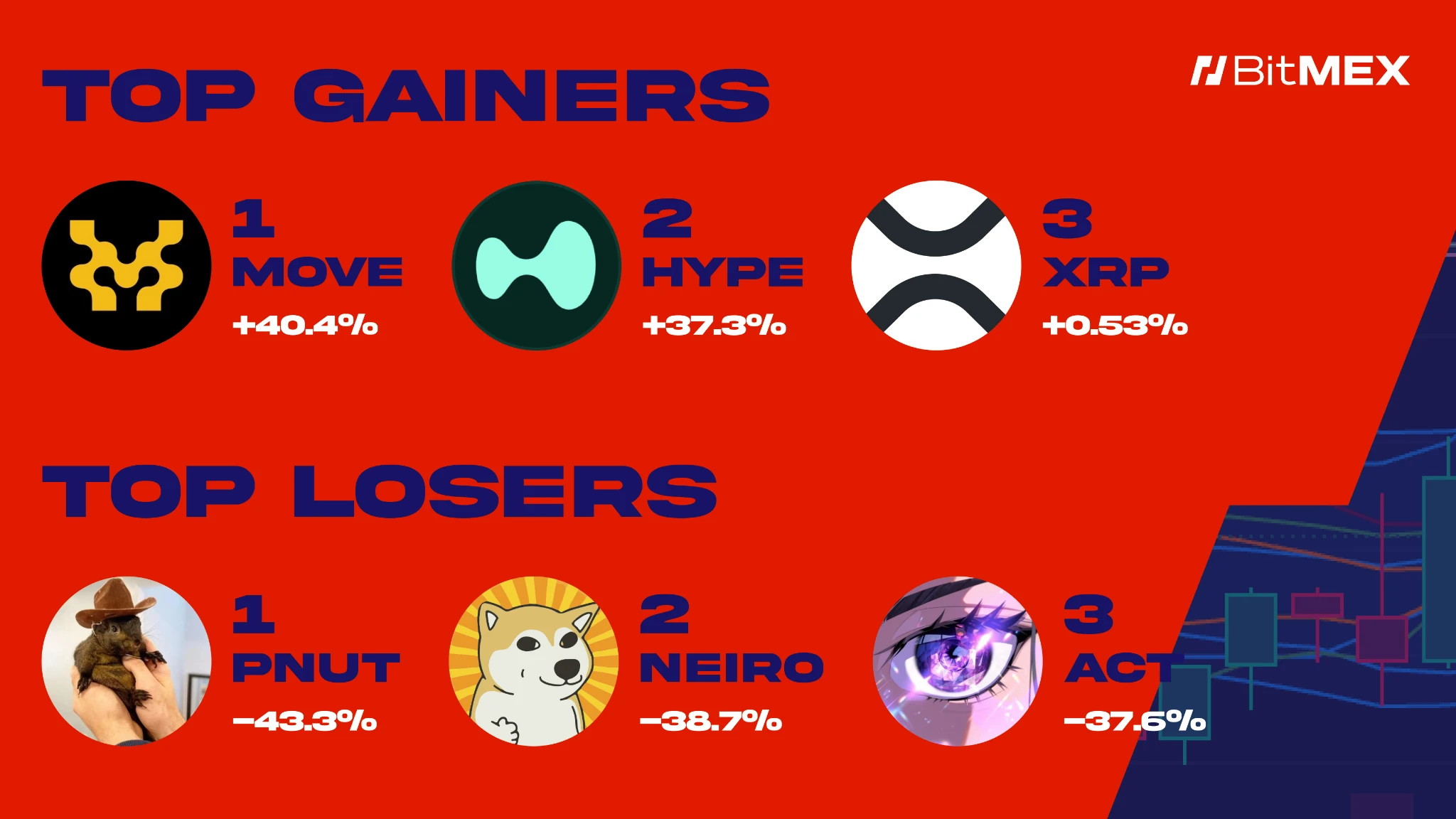

Best performers of the week

$MOVE (+ 40.4%): The token price is in a strong upward trend with sufficient momentum

$HYPE (+37.3%): DEX trading volume hits record high, continuing strong performance

$XRP (+0.53%): Remaining positive despite overall market decline

Worst performer of the week

$PNUT (-43.3%): PNUT is plagued by legal issues, and the overall meme coin sector is sluggish

$NEIRO (-38.7%): fell sharply as $DOGE performed poorly

$ACT (-37.6%): A significant weekly drop, with a serious market value evaporation

This weeks news

Macro dynamics

ETH ETF weekly net inflows: +$137.8 million ( source )

BTC ETF weekly net inflows: +$734.2 million ( source )

The scale of Bitcoin spot ETFs listed in the United States is about to surpass gold ETFs ( source )

The Fed’s hawkish stance caused Bitcoin to fall to $101,000, and the altcoin market fell sharply ( source )

Hut 8 surpasses Tesla and becomes the fourth largest listed company holding more than 10,000 Bitcoins ( source )

El Salvador to accelerate Bitcoin purchases despite IMF deal ( Source )

Project News

Aptos Labs CEO resigns ( source )

Craig Wright received suspended sentence for contempt of court ( Source )

Solana hits a new record of 66.9 million transactions per day, thanks in large part to Pengu tokens ( source )

21 shares registered Polkadot Trust in Delaware to prepare for ETF ( source )

Bitget announced a strategic partnership with TRON blockchain and acquired $10 million of TRX ( Source )

Polygon accuses Aave of monopolistic behavior in the DeFi space (source )

German regulators ask Worldcoin to strengthen biometric data privacy protection measures ( source )

Ethena Labs introduces sUSDe to Trump-backed WLFI protocol as collateral ( source )

Trading ideas

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news and it is recommended that you do your own research before making any transactions. We are not responsible for any transaction results and do not guarantee returns.

Why is $USUAL worth watching?

Stablecoins play an extremely important role in the crypto world. For many investors and users, stablecoins are not only a trading valuation tool (similar to casino chips), but also a means for them to circumvent legal currency restrictions and realize fund storage. This brings huge profits to stablecoin issuers.

The $USUAL project attempts to break the profit monopoly of traditional centralized stablecoin issuers and distribute the profits of this pie to the community and token holders. It can be said that $USUAL is launching a vampire-like challenge to stablecoin giants such as USDT and USDC, extracting their profits and feeding them back to users.

Why did no one buy it at first, but it became a dark horse?

In the early days of the $USUAL project, the overall environment was not ideal. The crypto market was at a low point in consensus, and many well-known KOL round projects were cutting leeks at the time. At this time, a seemingly inconspicuous French team claimed to challenge USDT with stablecoin mining, which sounded a bit like a fantasy at the time, and therefore missed the attention of many investors.

However, the $USUAL team made a way out of the cold market environment by listening deeply to the community and taking a steady and steady approach. In the end, it was successfully listed on Binance, which changed the fate of the project and the outside worlds views in one fell swoop, becoming a dark horse that cannot be ignored in this round of market.

Core Token Mechanics: $USUAL, $USUALx, $USD 0 and $USD 0++

1. $USUAL:

As a mining coin, 90% of the newly issued $USUAL are distributed to users holding $USD 0++/$USD 0, and 10% are distributed to users who pledge $USUAL.

The emission of $USUAL is linked to TVL (total value locked): the emission decreases when TVL increases, and the emission increases when TVL decreases.

2. $ USD0 :

RWA (real asset-backed) stablecoins similar to USDY invest the minted funds in low-risk assets such as short-term government bonds to provide real income support for the system.

3. $ USD0++ :

A bond-like token that encourages users to lock up their positions for the long term and reduce the short-term behavior of dig and sell.

Provide higher APY to attract more funds and increase TVL.

4. $USUALx:

After staking $USUAL, you can get 10% of the new $USUAL emission tax.

A 10% head tax is required when unlocking, creating a high APY effect in the short term, thereby guiding more people to pledge and hold for the long term.

Why does the price of $USUAL rise? The formation of the flywheel effect

The price increase of $USUAL comes from a positive cycle (flywheel effect):

The high APY of $USD 0++ attracted capital to enter the market, and TVL increased.

TVL growth strengthens $USUALs fundamentals and the token value is more stable.

Rising $USUAL prices in turn support higher APYs, further attracting new capital.

With more funds participating, TVL will increase again, consolidating this positive cycle.

When users and big investors are optimistic about future development, believe that TVL will be more than the current $1 billion, and expect more asset types (not only stablecoins, but also LST, USDe, etc.) to be able to join mining, they will be motivated to stock up when TVL is still low to prepare for later growth.

Gaming and coin prices: 7-day waiting period for new wallets

$USUALs economic model also has some game elements designed in, such as new wallets need to wait 7 days before they can start mining. This means that after the TGE (token generation event), the real test will come 7 days later. When early users mine and earn income while new users are still waiting for unlocking, this timing difference may affect the buying and selling behavior and price fluctuations in the secondary market.

In other words, next week (7 days after TGE) will be the real test for $USUAL: Are new participants willing to wait, hold, and invest more? Will early players take profits at this time? This will test the markets consensus and confidence in the long-term value of the project.

Risks and concerns similar to LUNA

Some people may ask: Will $USUAL collapse like LUNA?

Although $USD 0 and $USD 0++ are products that combine stablecoins and bonds, they are supported by real income assets and lock-up mechanisms. They have a certain depth in trading pools such as Curve, and there is a path to exchange USDC without loss.

Unlike LUNA/UST, $USUAL focuses more on real returns and long-term lock-up, reducing the possibility of a crash caused by short-term arbitrage. However, if the Curve pool is unpegged or the confidence of funds is shaken, the project may charge $USUAL for redemption, thus introducing new variables.

Binance’s Impact and Outlook

Listing on Binance has brought $USUAL to a broader stage, attracting more liquidity and attention. For experienced DeFi players, $USUAL’s innovation may not be huge, but the support of top exchanges paves the way for the project’s long-term expansion.

In the future, $USUAL will not only be limited to RWA stablecoins, but may also be expanded to other types of assets. This means that if $USUALs model continues to be successful, its TVL ceiling will increase significantly.

Summarize:

$USUAL is built on a complex but sophisticated economic system around stablecoins and real returns, forming a positive cycle through high APY, gradually expanding asset selection and reasonable incentive mechanisms. Looking to the future, it may continue to expand application scenarios and attract more funds and users. However, all this still needs to be verified by the market. The real test will come 7 days after the new wallet mining is unlocked - whether the inflow of funds and market consensus can continue to be maintained at that time will determine whether $USUAL will continue to soar or gradually fall back.