Key Takeaways

With a market capitalization of over $100 trillion, real-world assets (RWAs) such as commodities, bonds, and stocks represent a huge potential for the next phase of growth in the crypto space. Institutional asset managers like BlackRock, Franklin Templeton, KKR, and Hamilton Lane are issuing tokenized RWA funds to capture this massive market.

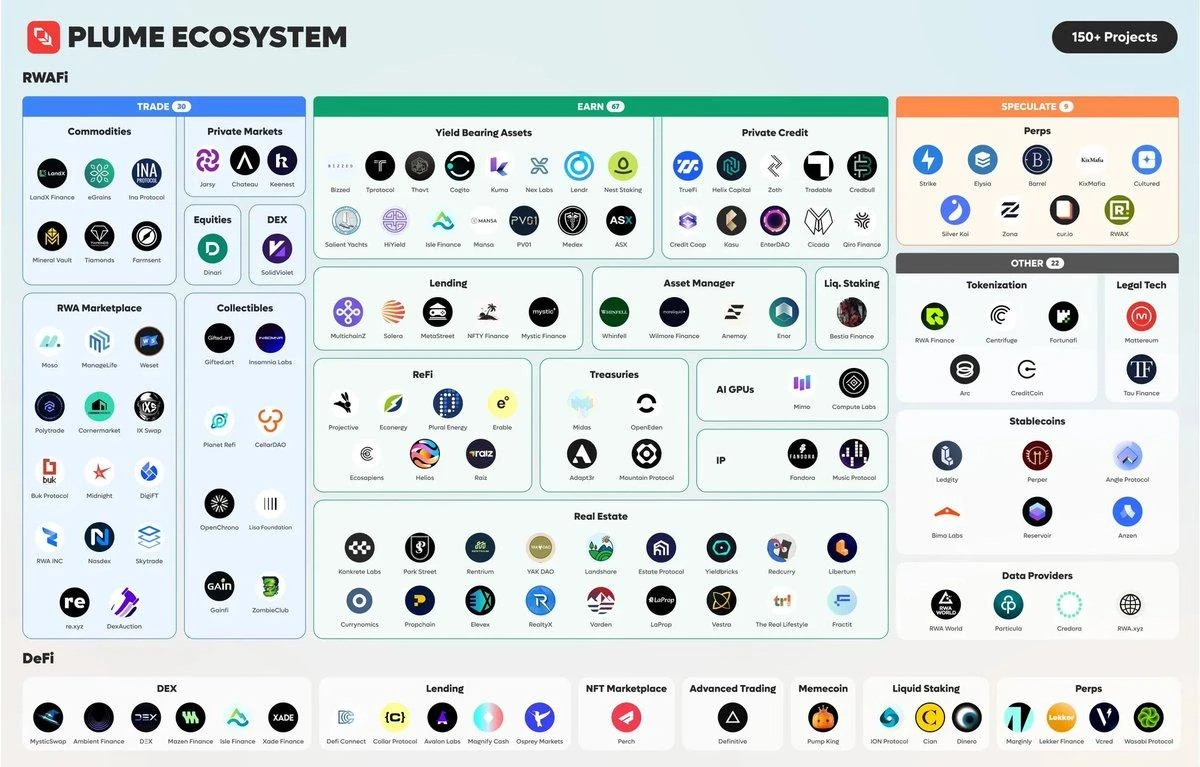

As a full-stack L1 blockchain, Plumes dedicated RWA chain is focused on bringing RWAs to the on-chain RWAfi ecosystem. The platform simplifies the tokenization, liquidity management, and listing process for RWA projects by integrating core functions such as custody services and KYC/KYB verification into a single solution. Plumes RWAfi vision goes far beyond simple tokenization.

By building a complete on-chain ecosystem and RWA community, Plume enables new use cases for abstract concepts ranging from traditional assets to GPU price indices and economic indicators - blurring the boundaries between the real world and the crypto world.

Over 180 teams are now building on the thriving Plume ecosystem, including specialized lending protocols, perpetual contracts, real estate, and even hotel booking services. This diverse range of applications demonstrates how the platform can change the way we interact with RWAs and view them as utility products and useful services.

1. Background - The emergence of the Onchain RWA market

1.1 The potential of RWA in the crypto market

Real World Assets (RWAs) represent the next big opportunity for crypto, and for good reason: their market size is staggering. While the entire cryptocurrency market is currently $3-4 trillion, individual sectors such as commodities, bonds, and stocks each control markets exceeding $100 trillion. Such sheer size hints at the transformative potential of bringing RWAs on-chain.

In the crypto ecosystem, the market for tokenized RWAs continues to grow and has become one of the industry’s greatest success stories. Stablecoins are the leading example of RWAs, processing a staggering $10 trillion in on-chain transactions in 2023. Tether is one of the largest issuers, minting over $130 billion in stablecoins in the first half of 2024 alone and generating $5.2 billion in profits . In the on-chain protocol space, MakerDAO has generated over $27 billion in revenue in the past 12 months, accounting for 40% of all DeFi protocol revenue on Ethereum .

Meanwhile, protocols like Ondo, Ethena, and Frax are accelerating the on-chain transition of traditional assets. However, despite these remarkable achievements, we have only scratched the surface of RWA’s vast potential.

Source: rwa.xyz

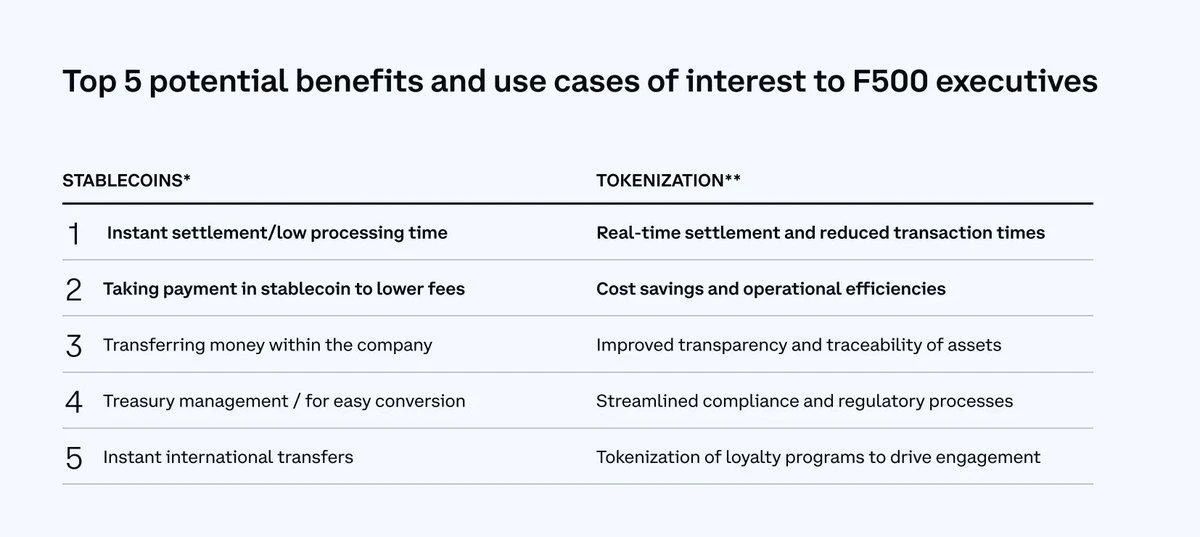

The trend towards tokenization has become an undeniable fact. Coinbase’s analysis shows that the number of Fortune 100 companies launching on-chain initiatives in the first quarter of 2024 increased by 39% year-on-year. While stablecoins remain the main driver of tokenization growth, interest in tokenizing off-chain assets such as U.S. Treasuries has grown rapidly. Since the beginning of 2023, the TVL of tokenized assets (excluding stablecoins) has more than doubled to $3 billion - a data that clearly shows where the market is heading.

Source: The Fortune 500 Moving Onchain

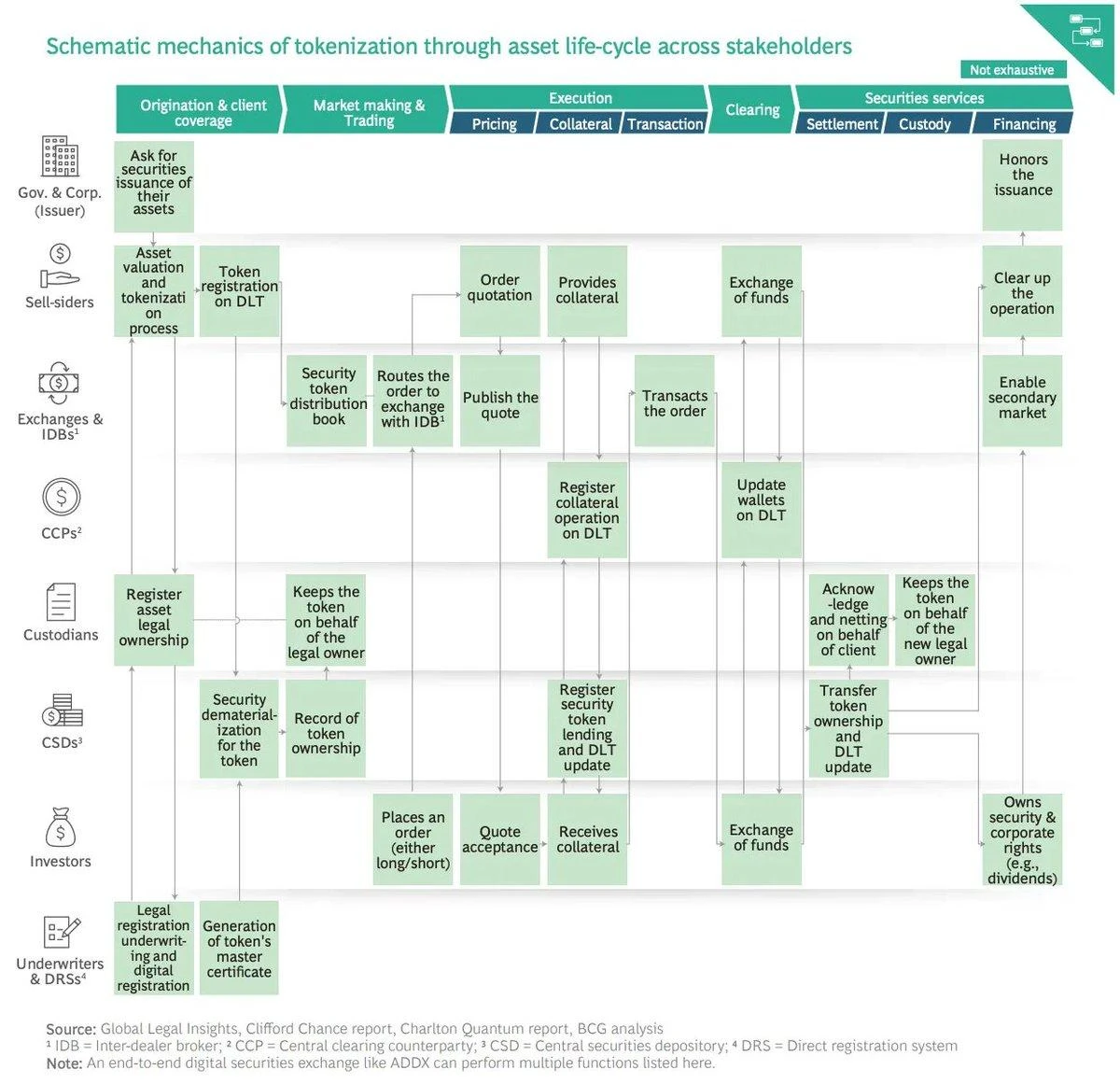

As the technology matures and its benefits become more apparent, the momentum behind tokenization seems unstoppable. The next generation of financial systems built today will naturally incorporate the key features of tokenized assets: 24/7 availability, instant global settlement, broader market access, seamless interoperability through shared technology, and customizable transparency. These benefits provide financial institutions with the foundation to enhance operational efficiency, increase liquidity, and create new revenue opportunities through innovative applications.

1.2 Intensified competition in the tokenization market

We are already seeing the industry shift towards tokenization. Traditional financial giants like BlackRock, WisdomTree, and Franklin Templeton are increasing their deposits in on-chain tokenized funds, while Web3 native projects like Ondo, Superstate, and Maple Finance are accelerating the adoption of tokenized money market funds. In a recent interview, Larry Fink, CEO of BlackRock, highlighted this trend , saying, We believe that the tokenization of financial assets is the next stage of evolution. Every stock, every bond will exist on a universal blockchain.

Source: Tokenization: The Future of Commodities

The opportunity has not gone unnoticed by the major protocols either. Both large and small protocols are vying to capture a share of this massive market:

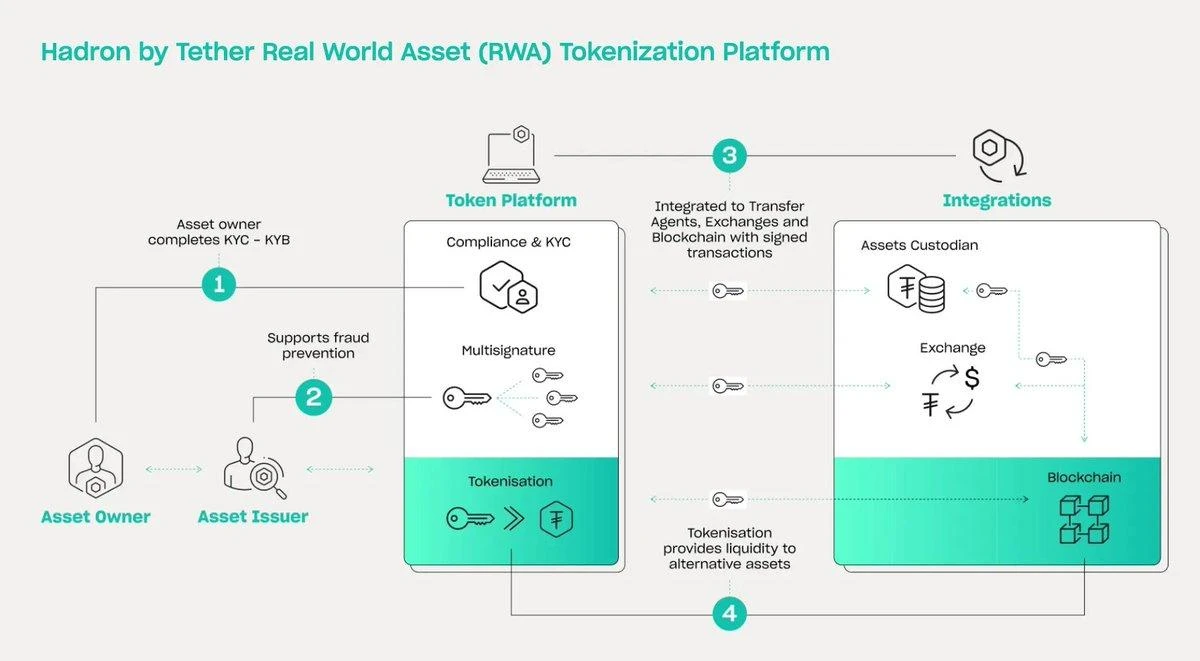

Tether, the largest stablecoin issuer of USDT, is entering the broader asset tokenization space through its Hadron platform. The platform provides comprehensive services for token issuance and management, including KYC/AML, risk management, and secondary market monitoring. It is particularly focused on helping countries and companies take advantage of alternative financing opportunities.

Ripple has announced the launch of the first tokenized money market fund on the XRP Ledger (XRPL). In partnership with UK-based Archax and Abrdn, the project aims to tokenize a portion of its £3.8 billion liquidity fund and plans to bring more real-world assets from asset managers to XRPL.

Aptos is building Aptos Ascend , an institutional-grade digital asset management platform. The platform is based on Microsoft Azure technology, combined with SK Telecoms Web3 wallet infrastructure and Brevan Howards financial market expertise. Its core mission is to help institutions efficiently manage digital assets and expand tokenized asset liquidity globally while maintaining compliance.

2. Plume enables RWAfi

2.1 Plume Network: A blockchain built specifically for RWA

Plume Network is a full-stack architecture and ecosystem designed for the integration and use of on-chain RWAs. Its notable feature is that the tokenization process and compliance mechanisms are natively integrated into the blockchain architecture, allowing RWA holders and institutional investors to take advantage of the on-chain system without having to master a lot of technology or develop complex infrastructure.

This L1 RWA chain design is able to withstand attacks that general-purpose blockchains cannot handle, especially when trillions of RWA assets are on-chain. By introducing a new security model called Proof-of-Representation, tokenized RWA itself becomes part of the blockchain security model, directly linking its security to the value of the asset.

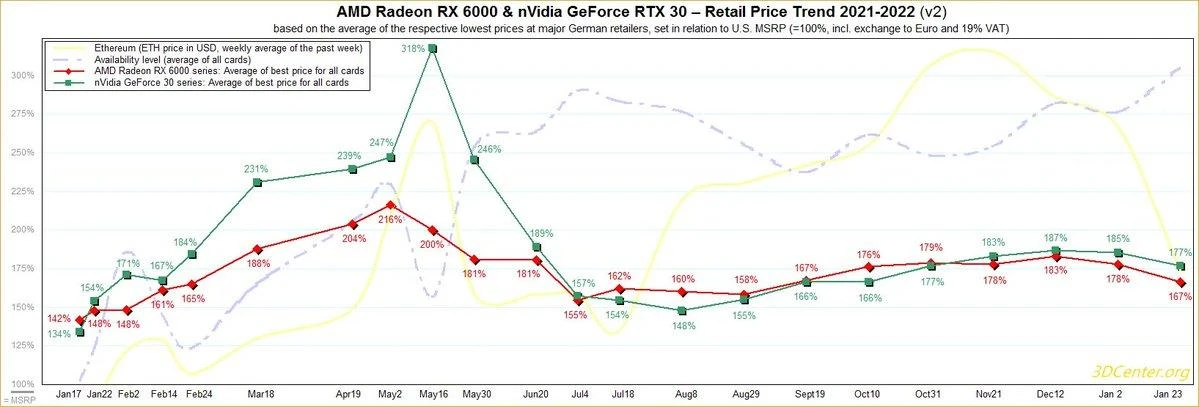

Source: Relevance of onchain asset tokenization in crypto winter

The current on-chain RWA market faces a classic startup dilemma. Market participants are stuck in an impasse: liquidity providers are hesitant without a strong asset selection, and asset providers are reluctant to tokenize without market depth guarantees. This self-reinforcing cycle poses a huge obstacle to market growth. Plume breaks this challenge by breaking down the tokenization process into manageable components and providing an integrated management solution, laying the foundation for RWA projects to effectively enter the market and try different approaches.

There are still multiple obstacles in the process of putting real-world assets (RWA) on the chain. Service providers need to deal with regulatory uncertainty, the complexity of access rights management, technical implementation challenges, custody issues, licensing requirements in different jurisdictions, and market fragmentation. For example, the real estate tokenization platform RealtyX reported that out of three years of service construction time, two years were spent on building on-chain service providers and workflows. This complex service provision process causes projects to take too long to implement, thereby limiting the realization of the RWA market potential.

Source: Plume

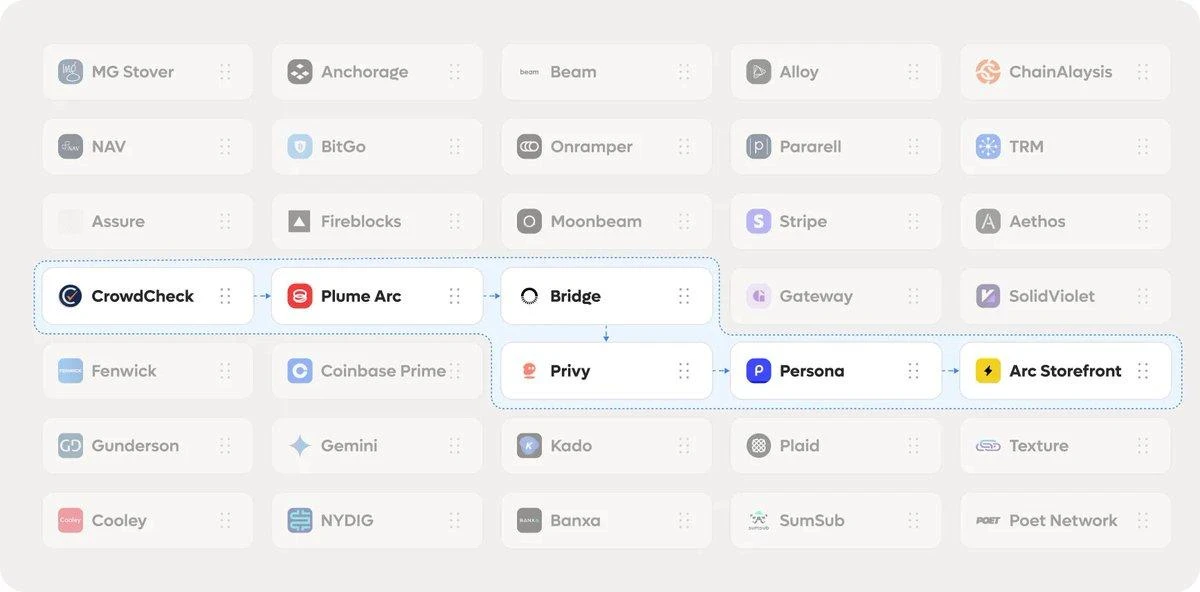

To address these challenges, Plume has integrated more than 50 different functions into a unified platform specifically for RWA tokenization. These functions combine the basic legal and management functions required for RWA on-chain tokenization, including custody services, on/off-chain channels, and KYC/KYB compliance systems. Instead of implementing a fixed or predetermined framework, Plume provides these functions as configurable modules, enabling projects to select and implement only the functions they need. These functions are integrated to run tightly, facilitating efficient data flow throughout the system.

Plume Arc is the core of the network, a comprehensive infrastructure solution for service providers who want to register RWA on-chain. Through a simplified tokenization process, Plume Arc significantly reduces the time and resources required for asset issuance. Service providers can use the compliance tools and asset management capabilities provided by Plume Network to significantly reduce technical complexity and legal uncertainty, allowing them to focus more on operating RWA-based services.

Plumes architecture lowers the barriers to entry that hinder the adoption of RWA on-chain. By handling the underlying infrastructure requirements for the project, Plume allows the team to focus on core business development, thereby helping the RWA market attract more high-quality liquidity providers and asset suppliers, and promoting the development and growth of the market.

2.2 RWAfi: Blurring the Boundary between Reality and the Chain

Source: 3D Center.org

RWA is seen as a potential driving force for the next stage of growth in the on-chain economy. By introducing off-chain assets into the blockchain system, the types of assets that can participate in the crypto ecosystem have been greatly expanded. This is not only about adding new asset types, but more importantly, it establishes a direct connection with the real world, bringing about the simultaneous expansion of market value and user scale.

Take the tokenization of the GPU market as an example. The volatility of GPU prices is often closely related to the demand for AI model training and Bitcoin mining. Traditionally, investors can only participate in the GPU market through indirect channels such as purchasing NVIDIA stocks or Bitcoin. In Plumes RWA market, the GPU price index can be directly on-chain, and traders can directly invest or hedge against GPU price trends.

The concept of tokenization is not limited to tangible assets. Plume also introduces abstract economic indicators into the investment field. Users can invest or hedge macroeconomic indicators through Plumes platform - from national and city economic growth rates to unemployment data and even indicators related to climate change. This framework breaks the boundaries between traditional finance, crypto markets and real economic activities, providing a new market structure and economic interaction model.

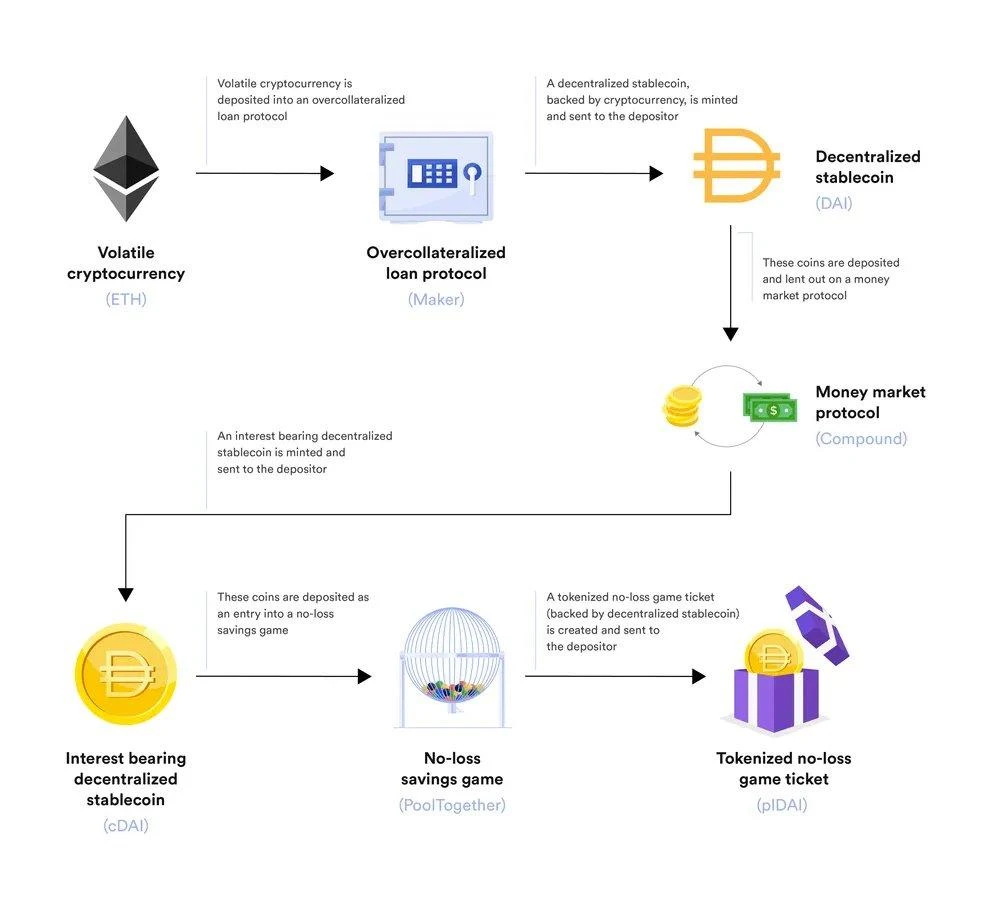

Source: DeFis Permissionless Composability is Supercharging Innovation

Most RWA projects focus primarily on the basic task of registering off-chain assets in a blockchain system. Plume goes a step further by introducing the concept of RWAfi - an on-chain ecosystem built around RWAs. The real advantage of an on-chain ecosystem lies in its composability and permissionless nature. The growth of DeFi is not driven by the success of a single protocol, but rather by multiple protocols interconnecting to create a larger ecosystem.

The same principle applies to RWAs - its real potential comes not only from registering assets on-chain, but also from creating an ecosystem where these assets can be traded, generate returns, serve as collateral for loans, and interact with various protocols. For example, tokenized real estate can be used as collateral for borrowing, and investors can also build a global portfolio through a single protocol. Plumes vision is to promote the realization of this innovative model through RWAfi.

Source: Plume Network

Plume maintains a diverse ecosystem that provides a variety of services to drive the potential of RWAfi. Users can earn income through a variety of channels, including earning 20% annualized stablecoin and token returns through actual farm staking, or trading sports cards and Pokémon cards on the chain, or even making leveraged investments in Jordan shoes or political events.

The Plume ecosystem currently hosts more than 180 projects in various fields, including RWA-specific lending protocols, RWA-specific perpetual futures DEX, real estate and stock tokenization protocols, collectibles markets, and consumer applications such as hotel reservation services. The Plume ecosystem not only puts traditional financial assets on the chain, but also creates new market opportunities for assets that were once illiquid or difficult to access.