1. $LIBRA plunge: a crisis of trust caused by insider harvesting

On February 15, 2025, the meme coin $LIBRA, endorsed by Argentine President Javier Milei, staged an epic crash. The token price plummeted 96% from its peak of $4.61, and the market value evaporated from $4.5 billion to $200 million, while a trading volume of $1.2 billion was achieved in just 4 hours.

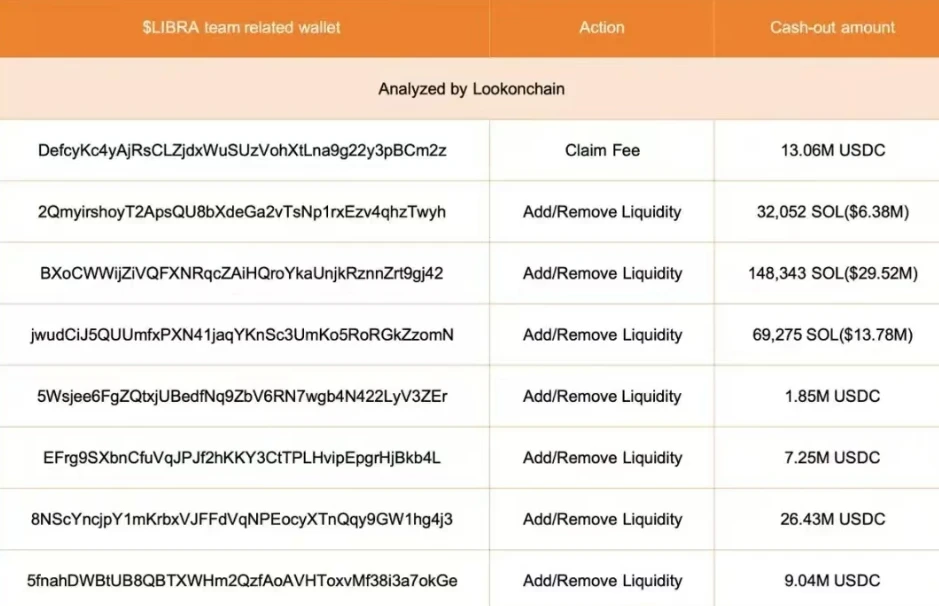

According to Lookonchain monitoring, before 12 noon, 8 wallets related to the LIBRA team withdrew USDC and SOL from the exchange a few hours before the tweet was released, and then sniped the chips the moment the token was launched, and then sold them in batches. They obtained 57.6 million USDC and 249,671 SOL (about 49.7 million US dollars) by adding liquidity, removing liquidity and claiming fees, and cashed out a total of about 107 million US dollars.

This crash caused a large number of KOLs to lose money. Some people called for legal rights protection, and some industry OGs believed that the industry would be destroyed. But as blockchain fundamentalists, we should think more: Can technology cure human greed? When regulation lags behind innovation, only more advanced tools can restore market fairness.

2. Industry paradox under the raging of Rug Pull: Crisis breeds innovation

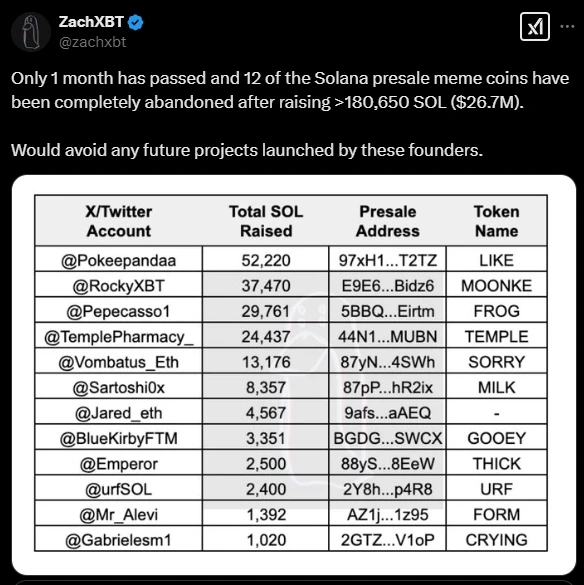

In April 2024, there were 18 presale meme rug pulls on SOL, with a total amount of $26.7M. By May, there were 41 projects with a total of $102M.

Ironically, the industry did not die out because of this, but instead gave birth to Pump.fun, a launch platform that became popular because of the pool cannot be withdrawn. Its core logic is simple but fatal: lock liquidity through technology to prevent memes from rugged behavior.

By June, the ol’ presale meme prone to rug pulls had largely died out thanks to the explosion of pump.fun.

In July, Pump.funs trading volume reached its first peak, with a single-day revenue of US$2.31 million in July, even exceeding Ethereums daily revenue ($2.29 million), becoming one of the biggest engines of this bull market.

This reveals a cruel truth: the market never rejects risk, but hates injustice. When fraud is rampant, users will vote with their feet, and the protocol that truly solves the problem will receive excess returns.

3. Lessons from the US stock market: How short-selling tools can make the market healthier

The development history of traditional financial markets provides us with important insights. The reason why the US stock market has become the worlds most robust growth market is closely related to its mechanism that allows short selling. Short selling funds represented by **Muddy Waters** have squeezed out the abscess in the market by exposing corporate fraud (such as Luckin Coffee) through in-depth research.

The value of short selling:

Price discovery: short selling forces balance market sentiment and suppress bubbles.

Market purification: Short sellers eliminate low-quality assets by exposing fraud.

Long-term stability: After short selling of U.S. stocks was allowed, market transparency and investor confidence improved significantly.

The blockchain market also needs such a check and balance mechanism. Likwid can provide the infrastructure for the emergence of the Web3 version of Muddy Waters - through native short-selling tools, insider players will have nowhere to hide.

4. Solution: How native short-selling tools end insider hegemony

If we want to cure the $LIBRA-style collapse, we need to dismantle the monopoly advantage of insiders from a mechanism perspective. The existing DEFI leveraged trading products only support mainstream assets and cannot cover long-tail tokens because they rely on oracles.

Likwid’s answer: Building a permissionless native shorting protocol based on Uniswap v4.

Technical core: Through the formula **(x+x)(y+y)=k**, lending and trading are unified, allowing users to establish short positions at the moment of token launch.

Anti-manipulation design:

Truncated oracle: Set an upper limit on price fluctuations in each block to prevent flash loan sniping (proposed by Uniswap in 2020 and implemented by Likwid first).

Dual Liquidation Model: Combining the “repayment-based” and “swap-based” liquidation mechanisms to solve the problem of large-scale liquidation of tokens and protect the interests of LPs.

Dynamic Fees: Redistribute arbitrage profits to liquidity providers (LPs) rather than MEV robots.

Effect verification:

Sniping insiders: If Likwid exists, users who think the price is overvalued can establish a short position before $LIBRA insiders sell in large quantities. If insiders sell, users can earn short profits.

Healthy price discovery: Short-selling power naturally suppresses bubbles and malicious manipulation, reducing the vicious cycle of “pulling the market up and then dumping the market”.

LP income revolution: triple income including handling fees, leverage interest and liquidation penalty, attracting capital deposits.

5. The Ultimate Form of Web3 Market: Tools are Order

From Pump.fun to Likwid, the evolution of blockchain has proven that every crisis is a catalyst for technological advancement. While traditional finance relies on laws and regulations, Web3 chooses to rebuild trust with code.

At present, the likwid test network has been launched, and users are given a lot of test network incentives. You can follow likwid on Twitter to get relevant information. Click the link below to explore the first unaudited leveraged trading platform of web3: https://likwid.fi/

Conclusion: No need to wait for a savior, code is justice

The collapse of $LIBRA is not the end, but the beginning of a new paradigm. When the tools are powerful enough, insider hegemony will eventually be disintegrated - this is not idealism, but the inevitability foreshadowed by Pump.funs 200 million daily trading volume and Likwids Uniswap Grants.