1. Outlook

1. Macro-level summary and future forecasts

The US CPI rose 3.0% year-on-year and 0.5% month-on-month in January, the largest increase since August 2023, indicating that the slowdown in inflation has been reversed and interest rates may be cut only once this year. It is expected that the Trump administration will continue to implement protectionist policies and strengthen economic and trade cooperation and competition with other countries. Geopolitical risks will continue to affect the stability of international trade and financial markets. Investors need to pay close attention to international economic dynamics and policy changes to cope with potential risks.

2. Cryptocurrency market changes and warnings

Overall, prices are affected by multiple factors, including global economic data, monetary policy expectations, and changes in market sentiment. Due to the large divergence between long and short positions in the market, Bitcoin and Ethereum are still fluctuating at low levels and have failed to form a sustained unilateral market.

The prices of other mainstream cryptocurrencies and altcoins also showed great volatility. Some altcoins rose by more than 30% in a short period of time, but the market lacked clear upward momentum, and price trends were significantly affected by news events. Investors still need to continue to be vigilant about the potential impact of policy risks, market volatility risks, and global economic uncertainty on the crypto market.

3. Industry and track hot spots

Legend, founded by former Compound executives and invested by A16Z and Coinbase, provides decentralized financial services, emphasizes security, transparency and scalability, integrates DEX, lending, staking and other functions to create a comprehensive DeFi ecosystem; ZenGo, using MPC technology, eliminates seed phrase risks, provides a secure self-hosted wallet experience, supports multiple assets, 3D facial unlocking, and convenient recovery, leading a new trend in on-chain wallets; Mirai Labs launched Partnr, a consumer-oriented on-chain agent product to promote user-agent interaction, optimize communication, and increase participation. The tokenized DeFi strategy vault assists on-chain operations and drives new momentum for on-chain activities.

2. Market hot spots and potential projects of the week

1. Potential track performance

1.1. What is special about Legend, a DeFi platform founded by former Compound executives and in which A16Z and Coinbase jointly invested $15 million?

Introduction

Legend is a decentralized finance (DeFi) platform that aims to provide a range of financial services with a focus on security, transparency and scalability. Based on blockchain technology, Legend aims to provide users with tools for decentralized trading, lending, staking and yield farming while maintaining control over their assets.

Legends key features include:

Decentralized Exchange (DEX): A user-friendly platform for exchanging various cryptocurrencies and tokens, leveraging smart contract technology to ensure secure peer-to-peer transactions without the need for a centralized authority.

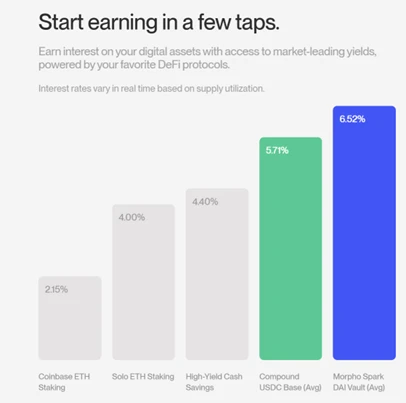

Lending: Users can lend their digital assets to earn interest, or use their assets as collateral to borrow. The platform operates through smart contracts, automatically enforcing terms and conditions without the need for intermediaries.

Staking: Allows users to participate in the network’s consensus mechanism or liquidity provision, and receive rewards for contributing to the security and liquidity of the platform.

Yield Farming: Providing users with the opportunity to earn passive income by providing liquidity to various liquidity pools, usually receiving rewards in the form of the platform’s native token.

Security and Transparency: Based on blockchain technology, Legend ensures that all transactions are publicly verifiable and immutable, reducing the risk of fraud or manipulation.

Scalability: Utilizing a second-layer solution or sidechains, Legend is designed to handle high transaction throughput while minimizing transaction fees and network congestion.

Governance: Users may have the opportunity to participate in governance decisions such as protocol upgrades or fee adjustments, typically through a decentralized autonomous organization (DAO).

By using Legend, individuals can access financial services that are typically controlled by traditional banks and other centralized institutions, but in a trustless and open source manner. Whether conducting transactions, earning interest, or participating in decentralized governance, Legend positions itself as a comprehensive DeFi ecosystem.

Reviews

Based on the limited information currently available, the main features of Legend are:

Mobile-first design: Legend adopts a mobile-first strategy, aiming to provide users with convenient mobile DeFi services.

Self-hosted wallet: The platform has a built-in self-hosted wallet, allowing users to safely manage their assets without relying on external wallets.

Cooperation with DeFi protocols: Legend cooperates with multiple decentralized financial protocols, integrates various services in the Ethereum ecosystem, and provides trading, lending and other functions.

Fiat Currency Channel: Legend Pay provides a compliant fiat currency channel for the Web3 platform, supporting recharges in multiple fiat currencies such as USD, EUR and GBP

By integrating multiple DeFi services, Legend is committed to providing users with a comprehensive, secure and convenient decentralized financial experience.

1.2. Tether deploys Web3 wallet business, and briefly analyzes ZenGo, the first self-hosted wallet using MPC technology architecture

Introduction

ZenGo is a self-hosted crypto wallet that uses multi-party computation (MPC) technology to provide enhanced security, eliminating the risk of seed phrases. It supports more than 380 assets, provides 3D face unlock and triple authentication recovery features, and allows secure trading, purchase and storage of cryptocurrencies.

1. ZenGo’s security model

Self-custody is more secure than hardware wallets

Upgrade to a crypto wallet that has no seed phrase vulnerabilities and is powered and protected by Multi-Party Computation (MPC) technology: the same technology used by institutions to custody billions of dollars in cryptocurrency. ZenGo has the world’s largest open source MPC library and holds patents for multiple consumer wallet security innovations.

MPC: Say Goodbye to Seed Phrase Vulnerabilities

ZenGo is the first crypto wallet to bring the advanced security features of MPC to consumer wallets, providing a self-hosted wallet with no seed phrase vulnerabilities. This is an order of magnitude more secure than seed phrase-based wallets: even more secure than hardware wallets.

2. What is MPC and how does it work?

MPC stands for Multi-Party Computation, a field of cryptography that originated 30 years ago.

In general, MPC allows two or more parties to jointly compute the output of a function without revealing their inputs. For example: using MPC, a group of friends can securely compute their average salary (the “output”) without revealing each person’s specific salary (the “input”).

For cryptocurrency wallets, MPC makes it possible to create a secure key management system with no single point of failure (i.e. the traditional private key), where multiple parties (such as remote servers and mobile phones) can jointly perform all required cryptographic functions (such as key generation, transaction signing, and transaction verification) without revealing their respective secrets. It is important to emphasize that in MPC, a single private key is never generated, split, or reconstructed: this makes it more secure than the traditional model based on a single private key.

By implementing this type of MPC technology, consumer-facing wallets (and institutional services) can safely design a decentralized asset management system that eliminates the single point of failure of private keys. This provides a more secure self-custody option that prevents private key theft (because no single private key can be stolen) as well as key loss because each party can individually back up their secret inputs in a way that will not be exposed and compromise the entire system.

This design brings many advantages:

Easy to recover

No single point of failure for phishing attacks

Full user control

3. What is Zengos Recovery Kit?

Your recovery kit allows you to restore your Zengo wallet in the event that you delete the app or change devices. For your own security, you will need to create a recovery kit before depositing funds into your wallet.

The recovery kit, prior to May 23, 2024, consists of 3 required authentication factors:

Email Verification

3D face unlock

Recover files (stored in your cloud service)

Now, there are only 2 required authentication factors:

Email Verification

Recover files (stored in your cloud service)

While 3D face unlock is not required for account recovery, it is recommended as an additional authentication factor for enhanced account security. However, 3D face unlock remains a requirement for Zengo Pros advanced security features, including Legacy Transfer and Theft Protection.

Reviews

ZenGo’s greatest contribution is the implementation and popularization of multi-party computing technology, making it possible to build user-controlled on-chain wallet services that are comparable to or even exceed custodial wallets in terms of quality, user experience and security.

On-chain is not only the only way to achieve the industrys greater goals, but it is also the default mode that every financial service will eventually move to, as it will bring significant economic advantages, true transparency, openness, and universal access. We believe this is inevitable, and this process is already happening before our eyes, with the trend of funds flowing out of exchanges gradually becoming apparent.

The financial services of the future will be a lightweight layer of software that runs on your phone, partially or fully controlled by the user, driven by math and cryptography, decentralized enough to resist censorship, but simple enough for anyone to use to participate and build a better life.

1.3. Mirai Labs, a Web3 game studio famous for the horse racing game Pegaxy, has entered the AI field. What are the features of its AI agent Partnr?

Introduction

Partnr builds consumer-facing on-chain proxy crypto products. These products are designed to be used by regular users and crypto-native users, while also supporting proxy participation and interaction. The combination of these two will drive broader user adoption (users) and on-chain activity (agents).

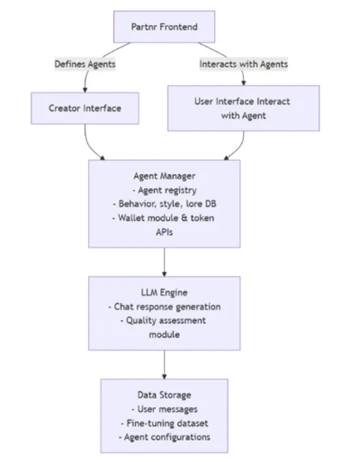

Architecture diagram

The architecture diagram shows the interactions between the front-end client, back-end server, hybrid inference engine, quality verification module, blockchain-based token management, external integration services, and memory sharing protocol.

Components

front end

Creator interface: allows configuring, creating and managing agents (setting their backstory, style, domain knowledge, etc.).

User Interface: For regular users to chat with agents and view rewards.

Proxy Manager

Responsibilities:

Maintains a registry of all agents and their configurations.

Handles agent-related business logic, such as conversation routing and state management.

Interfaces with the LLM engine, passing the context and receiving the response.

Architecture:

Stateless microservices, deployed in containers, support horizontal scaling.

Use a relational database or document store to persist proxy configuration.

LLM Engine

Responsibilities:

Generate chat responses based on the users incoming message and the agents context.

Evaluate the quality of user messages using custom scoring metrics.

Supports real-time interaction and asynchronous batch processing for data fine-tuning.

Architecture:

Deployed on GPU-enabled servers or dedicated hardware accelerators.

Use container orchestration such as Kubernetes to scale based on demand.

Modular design allows plug-ins to replace models (such as GPT-J, LLaMA, custom fine-tuned models).

Data storage

User Messages: Capture conversation history and annotations (quality assessment).

Fine-tuning datasets: regularly aggregated from labeled, high-quality interactions.

Agent Configuration: Stores the backstory, style, and custom logic associated with each agent.

Database: Use SQL (PostgreSQL, MySQL) or NoSQL (MongoDB) to store broker configuration, user messages, and reward transactions.

Reviews

User interactions in Partnr Chat optimize agents’ communication with users and increase their efficiency in developing monetization intentions. Chat will start with an initial set of agents and expand to include user-generated agents. Vaults are tokenized DeFi strategy vaults designed for agent ownership and control. These vaults can be designed as static DeFi strategies, or as “custodial” vaults that agents can access to perform on-chain DeFi and trading operations.

2. Detailed explanation of the projects of interest this week

2.1. Solana-based LRT protocol Fragmetric raised $7 million in seed round financing, briefly analyzing its potential in the SolanaLRT ecosystem

Introduction

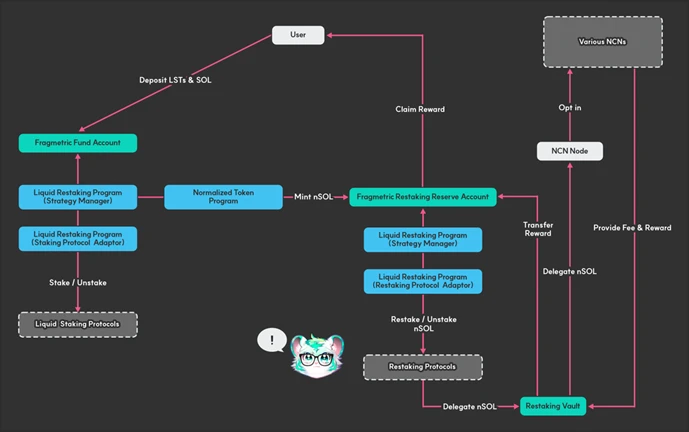

Fragmetric is a native liquidity re-staking protocol based on Solana, designed to enhance the security and economic potential of the Solana ecosystem. By leveraging Solanas token scaling capabilities, Fragmetric has effectively implemented NCN reward distribution. In addition, Fragmetric has designed a practical solution, the Normalized Token Program, to leverage a variety of Liquid Staking Tokens (LST) in the re-staking platform. Fragmetrics mission is to build a secure, transparent, and efficient re-staking infrastructure that empowers users and supports the stability of the Solana re-staking ecosystem.

Fragmetric’s three core goals

Developing security standards for Liquidity Re-collateralization Tokens (LRTs)

Fragmetric develops and maintains a first-class LRT standard to ensure accurate distribution of rewards to users. Through the established LRT standard, LRT can be used in various protocols, enabling users to earn both re-staking rewards and additional yields.

Entrust user deposits to the secure and profitable re-staking protocol NCN/AVS

Fragmetric will establish a governance-based risk management committee to verify the profitability and security of NCN and AVS to ensure optimal rewards for users.

Fostering Growth of the Solana Restaking Ecosystem with SANG

By restaking on Fragmetric, users become SANGs (Solana Network Guardians) - guardians who protect and enhance the Solana ecosystem. Fragmetric and SANG contribute to the ecosystem through research, development, and release of new NCN/AVS products, ensuring decentralization and continued growth.

Technical Analysis

Fragmetric Protocol

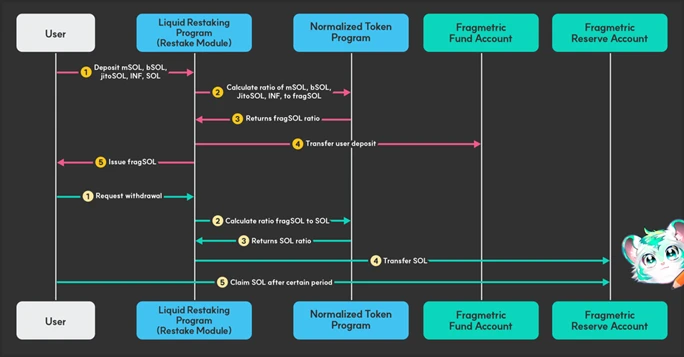

deposit

When users deposit SOL, LSTs, or other SPL tokens into Fragmetric, they will receive an equal amount of $fragmetric assets (e.g., fragSOL).

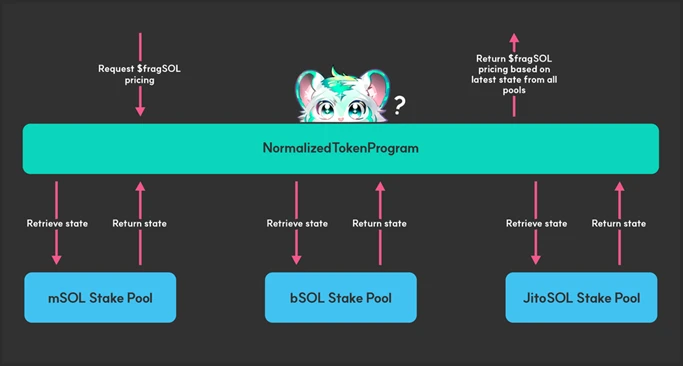

Standardized Token Procedures

This program developed by Fragmetric maintains an accurate conversion ratio between deposited assets and minted $fragmetric assets. Users combined deposits (SOL, LSTs, and other tokens) form a unified basket of assets that Fragmetric distributes across different re-staking protocols and NCN/AVS.

Reward Distribution

Assets are delegated to cooperating validators who ensure the security of the NCN/AVS network. The proceeds from these delegations are distributed to $fragmetric asset holders. Fragmetric acts as both a portfolio manager and a liquidity layer between users and the re-staking protocol.

2. How do $fragmetric asset holders receive rewards?

Basic income

$fragmetric assets inherit the yield of any deposited assets, which naturally generate rewards, such as LSTs (liquidity staking tokens), which can generate staking and MEV returns. When users unstake, they may receive more SOL (or other base tokens) than they originally deposited, which reflects the average annualized yield (APR) of all yielding assets in the asset basket. Conversely, if a deposited asset does not generate any yield itself, then that portion of the deposit will not generate yield for the corresponding $fragmetric asset token.

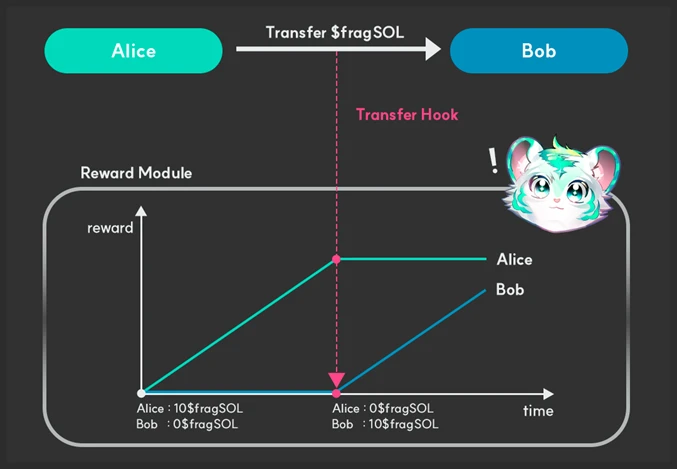

NCN/AVS Rewards

In addition to standard returns, the NCN/AVS protocol can also distribute rewards in the form of SOL, native tokens, or other assets. Fragmetric uses Solanas unique transfer hook function to accurately track and distribute these additional rewards. Each $fragmetric asset transfer will update the users eligibility for NCN/AVS returns, and users can claim these rewards at any time.

It is important to note that the $fragmetric asset is OPOS (Only Possible on Solana) LRT, whose advanced reward distribution mechanism relies on Solana-specific features that are not available on Ethereum.

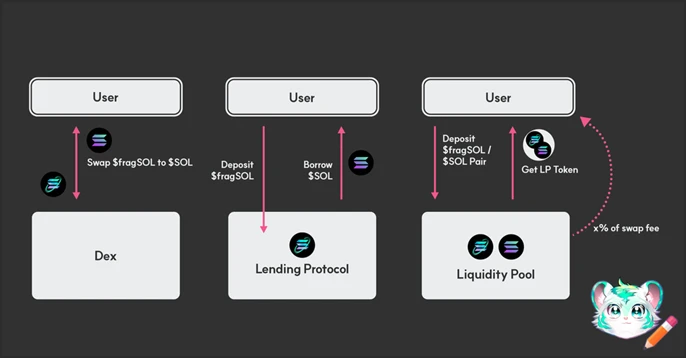

3. Using $fragmetric assets in DeFi

Because the $fragmetric asset is a Liquidity Restaking Token (LRT), it can be used for a variety of purposes in DeFi. For example, fragSOL can be used for:

Loan collateral

Use fragSOL as collateral in lending protocols to borrow other assets while still earning staking and re-staking rewards.

Liquidity provision

Providing fragSOL as liquidity in decentralized exchange (DEX) pools not only increases overall liquidity, but also allows liquidity providers to earn transaction fees on top of earning staking rewards.

Trading on DEX

Trade fragSOL on decentralized exchanges. Users can buy fragSOL directly without depositing it in Fragmetric, and can sell it at any time to get immediate liquidity.

fragSOL is the first $fragmetric asset launched by Fragmetric and is the core of the Fragmetric ecosystem.

4. Protocol Ecosystem

Fund

The Fund is the main module in the Fragmetric ecosystem responsible for managing user assets. It accepts deposits of SOL, LSTs, and other supported assets and mints the corresponding Fragmetric assets. The minting process utilizes pricing data from a standardized token pool (described in the next section). In addition, the Fund manages withdrawal requests by retaining sufficient liquidity and executing these requests regularly, allowing users to withdraw their assets in a timely manner.

Fund deposits and withdrawals

The following diagram shows the interaction between users, the $fragSOL fund, and the oracle system:

Deposit: Users deposit SOL or supported LSTs (including JitoSOL, mSOL, BNSOL, bbSOL) into the fund.

Minting fragSOL: After receiving the deposit, the fund mints fragSOL for the user. The number of tokens minted is determined by the current price data, reflecting the total value of the underlying assets.

Withdrawal: Users can request a withdrawal, causing the fund to destroy the corresponding amount of fragSOL and reserve an equal amount of SOL for the user to withdraw. These withdrawal requests are processed on a periodic schedule.

Pricing fragSOL: The price of fragSOL is dynamically calculated based on the total value of LSTs managed by the fund, ensuring that the token accurately represents each users share of the asset pool.

Operator

The Operator is responsible for managing staking, re-staking, withdrawal operations, and the execution of re-staking strategies. It handles all asset flows for funds and rewards, and configures investment strategies through integration with various staking and re-staking protocols.

Operators in the protocol are responsible for managing asset flows based on dynamically changing configurations that adjust based on withdrawal requests and governance-driven re-collateralization portfolios.

The Operator ensures that asset amounts are reconciled between the Fund, Reserved Fund, Re-Pledge Agreement, and Staking Agreement. Its tasks include setting target amounts for the Reserved Fund account (to process withdrawal requests) and determining un-pledge and re-pledge amounts to maintain these targets. The Operator configures investment allocations based on the latest configuration and delegates funds to the NCN Node Operator.

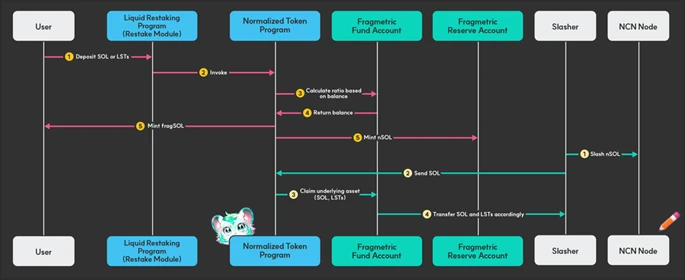

Standardized token pool

The standardized token pool is responsible for accurately minting and destroying fragSOL and nSOL tokens. By standardizing the price of deposited tokens, Fragmetric can only delegate or slash one token in the re-staking protocol, gaining a significant advantage in how to delegate or slash the number of tokens for each LST. The supply of nSOL and fragSOL is the same, and users of the Fragmetric protocol will only receive fragSOL, while nSOL will be re-staked and delegated to NCN nodes. When a slashing event occurs, the slasher who discovers malicious behavior of the NCN node will receive nSOL. The slasher can then claim SOL and LSTs from the standardized token pool by transferring and destroying nSOL.

Pricing based on staking pools

For LSTs like mSOL, bSOL, and JitoSOL, the pricing mechanism directly accesses the on-chain state data of their respective staking pools. This data includes the current value of the staked assets, the total amount of tokens issued by the staking pool, and any allocated performance indicators or rewards. By using this data, the system can accurately determine the price of these LSTs, and thus deduce the value of the corresponding fragSOL.

This direct access to staking pool data ensures that the price of fragSOL is closely related to the actual performance of the staking pool, providing users with a reliable and transparent pricing mechanism.

Summarize

For Fragmetric, user benefits are the biggest highlight. If the underlying deposit generates staking or MEV rewards (such as SOL or other LST), it will automatically compound, causing its value to grow over time. If the deposited assets do not generate staking or MEV rewards, only NCN/AVS rewards will be received through the protocol. These NCN/AVS rewards will be accumulated in a dedicated reserve account, and any user holding at least one $fragmetric asset can claim these rewards. The amount of rewards you receive is proportional to your holding time and the number of $fragmetric assets held. And fragSOL is also the core of Fragmetric, which represents the position held by users in the Jito re-staking process of the Fragmetric protocol. Similar to liquid staking tokens such as JitoSOL, BNSOL, and bbSOL, they provide users staking positions, and fragSOL provides users re-staking positions. If you hold fragSOL, you can claim rewards from the re-staking protocol and use it in DeFi applications at the same time.

3. Industry data analysis

1. Overall market performance

1.1 Spot BTCETH ETF

Analysis

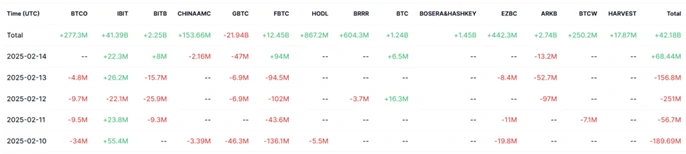

Last week (February 10 to February 14), the U.S. Bitcoin spot ETF had a cumulative net outflow of US$585.8 million. The specific institutional buying and selling conditions are as follows:

Analysis

Last week (February 10 to February 14), the Ethereum spot ETF had a net outflow of $26.3 million. The institutional buying and selling situation is as follows

Ethereum spot ETF total net outflow of $10.9256 million (November 1, EST)

1.2. Spot BTC vs ETH price trend

BTC

Analysis

This week, we will focus on the effectiveness of the support near $94,500. If it falls below, there is a high probability that a new bottom will continue to form near $90,000. Once a support pattern is formed, it can be regarded as a new entry point. As for the sign of a strong bull market, it is still to break through and stabilize at the $100,000 mark.

ETH

Analysis

For Ethereum, the range of $2,600 to $2,900 is still the relative bottom area and can be used as the second entry point. Once $2,600 is broken, the range of $2,100 to $2,600 can be considered the best entry area. Once the price stabilizes at $3,300, it can be considered a signal of a bullish turn. Before that, Ethereum may continue to experience a double bottom pattern of accumulation.

1.3. Fear Greed Index

2. Public chain data

2.1. BTC Layer 2 Summary

Analysis

This week, there have been several important developments in the Bitcoin Layer 2 (L2) ecosystem:

1. Blockstream enters the Japanese market

Blockchain technology company Blockstream has announced the opening of an office in Tokyo, aiming to accelerate the adoption of Bitcoin layer-2 solutions, self-custody options, and real-world asset tokenization in Japan.

2. Significant Growth of the Hemi Protocol

The emerging Bitcoin second-layer solution Hemi Protocol has locked $260 million in total value on its private mainnet before its official launch, demonstrating the markets strong interest in second-layer solutions that improve Bitcoins scalability and functionality.

These developments highlight the dynamics of the Bitcoin Layer 2 space, reflecting increased institutional interest, technological advances, and wider adoption of solutions designed to increase Bitcoin’s scalability and functionality.

2.2. EVM non-EVM Layer 1 Summary

Analysis

This week, there were several important developments in the EVM (Ethereum Virtual Machine) and non-EVM Layer 1 blockchain space:

EVM compatible with Layer 1 blockchain

Injective plans to add EVM support: Injective announced plans to add native high-performance EVM support on its Layer 1 blockchain. The move aims to increase the functionality of the network by enabling Ethereum-compatible decentralized applications to run on the Injective platform.

Sonic Mainnet is now live: Sonic, an EVM-compatible Layer 1 blockchain, has officially launched its mainnet. The platform offers developers attractive incentives and a robust infrastructure, with 10,000 transactions per second (TPS) and sub-second confirmation times.

Waterfall Network Performance Breakthrough: Waterfall Network achieved a new high of 12,778 transactions per second (TPS) on its mainnet, surpassing its previous peak and consolidating its position as a highly scalable EVM smart contract platform.

Non-EVM Layer 1 Blockchain

Aptos Foundation proposes Aave integration: The Aptos Foundation has made a governance proposal seeking community support for deploying Aave Protocol v3 to the Aptos mainnet. If approved, this will be the first time the Aave liquidity protocol has been deployed on a non-EVM blockchain.

Near Protocol is compatible with MetaMask: Near Protocol becomes the first non-EVM blockchain to be fully compatible with MetaMask. This integration increases the accessibility of the Near blockchain, facilitates the interaction of decentralized applications, and drives wider adoption of Web3 technologies.

2.3. EVM Layer 2 Summary

Analysis

This week, there have been several important developments in the Ethereum Virtual Machine (EVM) Layer 2 ecosystem:

1. Uniswap Labs launches Unichain L2 mainnet

After four months of testing and more than 100 million on-chain transactions, Uniswap Labs has officially launched its Ethereum-compatible Layer 2 network Unichain. The mainnet aims to increase transaction speed and reduce costs for users and developers within the Uniswap ecosystem.

2. Coinbase’s Base Network expands in NFT and DeFi

Coinbase’s Layer 2 network Base has seen significant growth in market share in the NFT and DeFi sectors. This expansion highlights the growing popularity of Base and its role in facilitating scalable and cost-effective decentralized applications.

3. Tezos’ Etherlink L2 contract deployment surges 184%

Etherlink, Tezos’ EVM-compatible Layer 2 solution, reported a 184% increase in contract deployments with over 1,700 new contracts deployed in Q4 2024. This growth highlights Etherlink’s growing adoption and its contribution to the scalability of the Tezos ecosystem.

4. Ramp Network introduces direct cash withdrawals on Ethereum L2 via MetaMask

Ramp Network has partnered with MetaMask to enable users to sell their cryptocurrencies directly from the Ethereum Layer 2 network. This integration simplifies the process of converting crypto assets to fiat, improving user experience and accessibility.

4. Macro data review and key data release nodes next week

The US CPI data for January exceeded market expectations, rising 3.0% year-on-year, higher than the previous value of 2.9% and the market expectation of 2.9%. The core CPI, which excludes food and energy prices, also exceeded expectations, rising 0.4% month-on-month, higher than the previous value. Affected by the increase in energy, used cars and service prices, the US CPI continued to rise both month-on-month and year-on-year.

Important macro data nodes this week (February 17-February 21) include:

February 20: U.S. initial jobless claims for the week ending February 15

February 21: Final value of the University of Michigan Consumer Confidence Index for February

V. Regulatory policies

As the heads of the two major U.S. regulatory agencies will be people familiar with the crypto industry, the United States has led the official arrival of an era of relaxed regulation. Although there has been no definite information on the establishment of U.S. Bitcoin reserves, in other countries and regions, relaxation has become the current mainstream narrative.

Japan

On February 10, according to the Nikkei, Japans Financial Services Agency (FSA) plans to lift the ban on Bitcoin and cryptocurrency ETFs.

South Korea

Kim So-young, vice chairman of the Financial Services Commission of South Korea, convened the third meeting of the Virtual Assets Committee and decided to promote the plan of legal persons opening real-name accounts for virtual assets in three stages. First, law enforcement agencies, non-profit legal persons, virtual asset exchanges and other institutions that need to open accounts for cashing purposes will be allowed to participate. In the future, it will be gradually expanded to professional investment legal persons (investment and financial purposes) and ordinary legal persons. In addition, the Financial Services Commission of South Korea intends to allow charities and universities to sell donated cryptocurrencies in the second quarter, and plans to gradually pilot 3,500 listed companies and professional investors in the second half of this year.

India

Indian authorities have seized nearly $190 million in cryptocurrency tied to Bitconnect in an ongoing investigation into a crypto Ponzi scheme that was uncovered in 2018 and caused 4,000 investors in 95 countries to lose approximately $2.4 billion. Bitconnect was launched in 2016 and collapsed in 2018. Bitconnect founder Satish Kumbhani (indicted by the U.S. Department of Justice in February 2022) built a global network of promoters who were paid commissions to promote the Ponzi scheme.