Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

Since February, Binance has launched five exclusive TGEs through Pancake, which are characterized by short duration and high single-account yield. In addition, multiple BNB Holder airdrops and Launchpools have been launched, providing Binance users with a lot of pork trotters.

However, due to the outstanding yield of Exclusive TGE, many users started an arms race to increase their accounts, and the number of BNB invested and the oversubscription rate continued to rise. Therefore, this article aims to review the data of Exclusive TGE and Launchpool in the past few periods to infer the reasonable price and participation strategy.

Exclusive TGE

Revenue

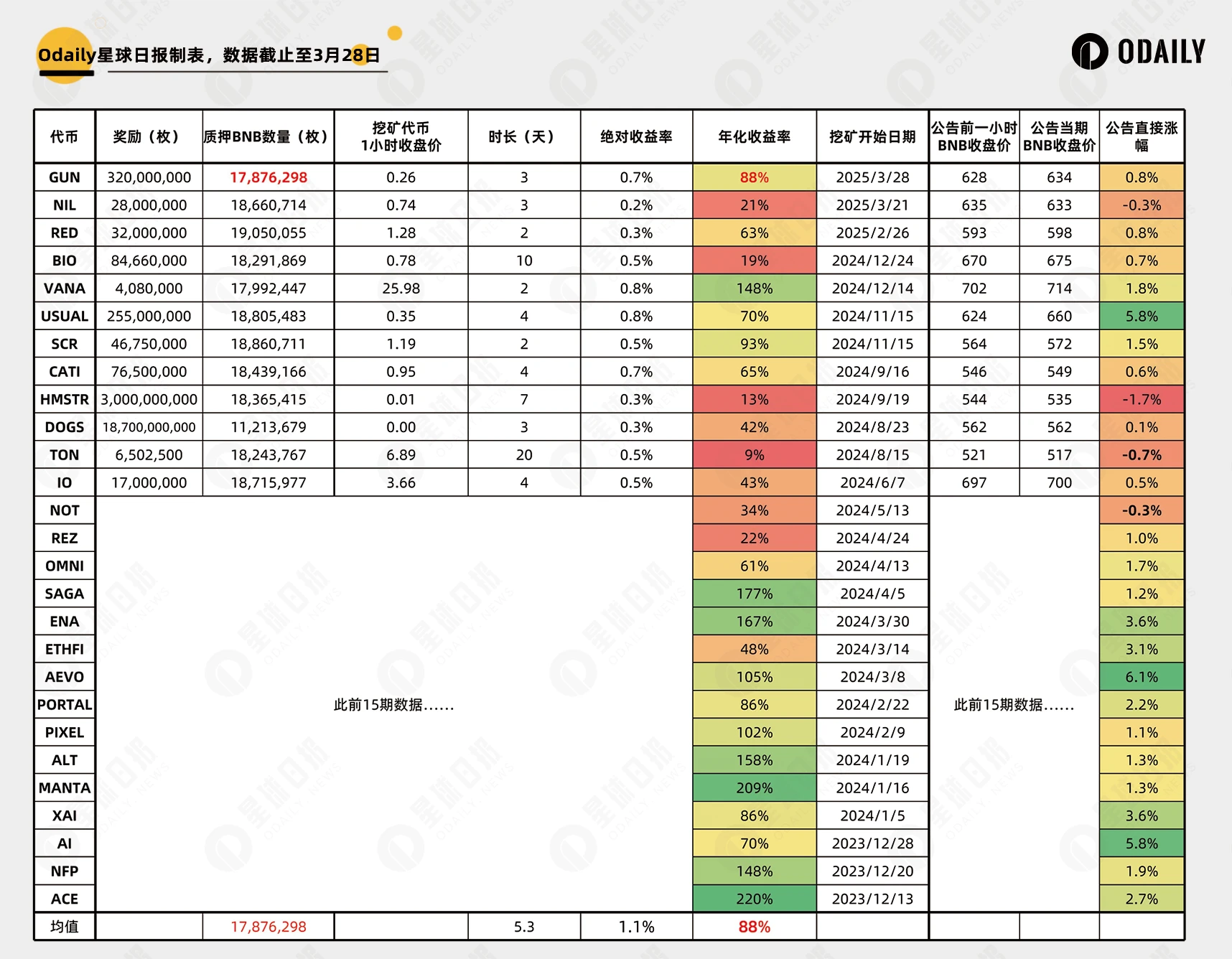

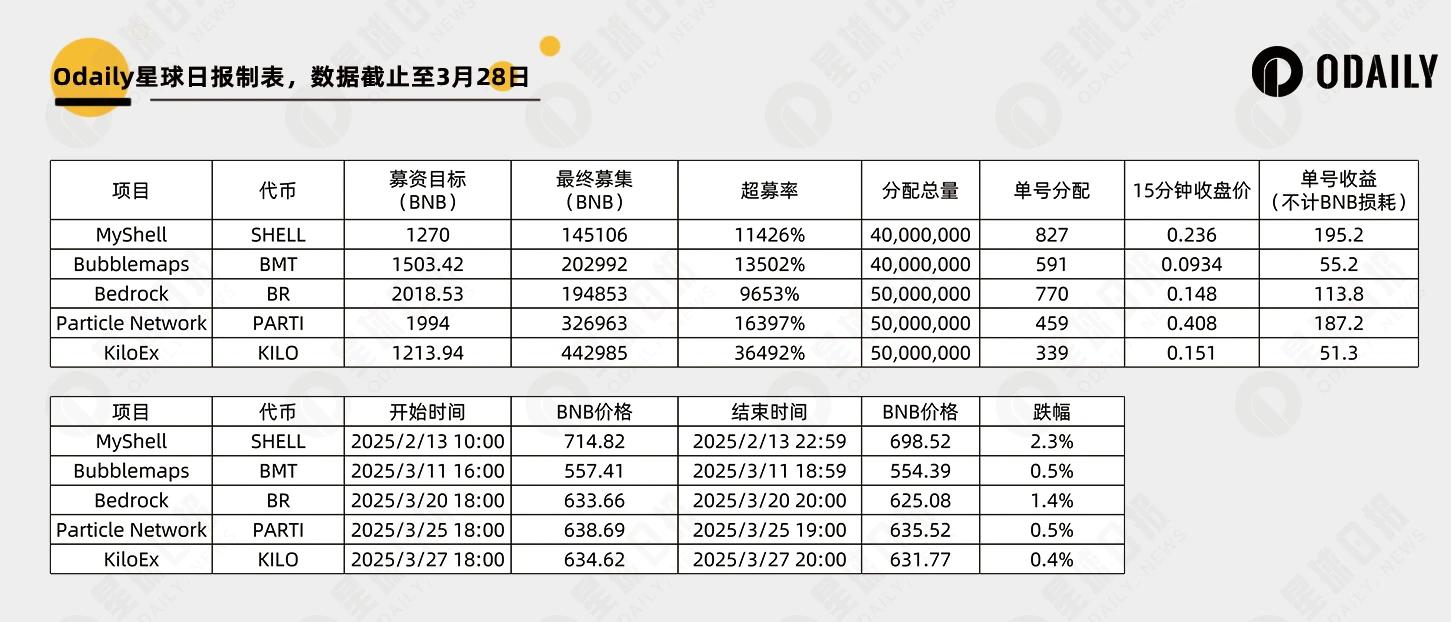

The past five projects are MyShell, Bubblemaps, Bedrock, Particle Network and KiloEx. The first phase of MyShell had the least BNB investment, totaling 145,106 BNBs, and the latest phase of KiloEx had the most BNB investment, totaling 442,985 BNBs, with a growth rate of 205%.

The single account income for each period is shown in the following figure:

At present, the guaranteed income for a single account is still around 50 USDT, which is 2.6% higher than the principal yield of 3 BNB. Even considering the loss of BNB in the IDO circulation channel, it is still worth participating.

The amount of BNB raised is still rising. Here is a key data - the amount of BNB invested in Binances main site Launchpool. The average investment in the past 16 months is 17.87 million. It can be seen that the amount of BNB is not a problem at all. The variable lies in the number of real-name accounts, but because the number of users announced by Binance has exceeded 200 million, it is impossible to estimate the upper limit of participating accounts.

Therefore, assuming that the ultimate investment amount is 10% of Launchpool, the circulating market value of tokens is 50 million US dollars, and 20% is allocated to Exclusive TGE , the final theoretical return of a single account is 3 ÷ 1787000 × 50000000 × 20% = 16.8 USDT.

Is it feasible to short BNB based on the news?

In the second part of the above figure, we counted the decline of BNB from the beginning to the end of IDO. From the past data, BNB has been falling in this period, and usually after the Exclusive TGE news is announced, the BNB price is often higher than when the TGE starts. Therefore, the current short-selling strategy has a certain and clear profit margin .

Launchpool Revenue Estimates

The data of Launchpool for the past 27 periods is shown in the figure below. It can be clearly seen that the yield of Launchpool has a clear downward trend. The average annualized yield of 27 periods is 88%. According to this yield, the price of GUN is 0.26 USDT, but considering the poor performance of the previous periods, it is recommended to make a conservative estimate . According to half of the yield, the reasonable price is 0.13 USDT.