Original author: Ash

Original translation: TechFlow

Similar to stablecoins and payments, RWA (real asset tokenization) is an important growth vector in the crypto space, with the potential to bring trillions of traditional financial assets on-chain.

Recent Institutional Developments:

@BlackRock launches BUIDL (Tokenized Treasury Bond Fund)

@FTI_Global launches FOBXX (On-chain Money Market Fund)

@stripe acquires @Stablecoin for $1.1B to strengthen stablecoin infrastructure

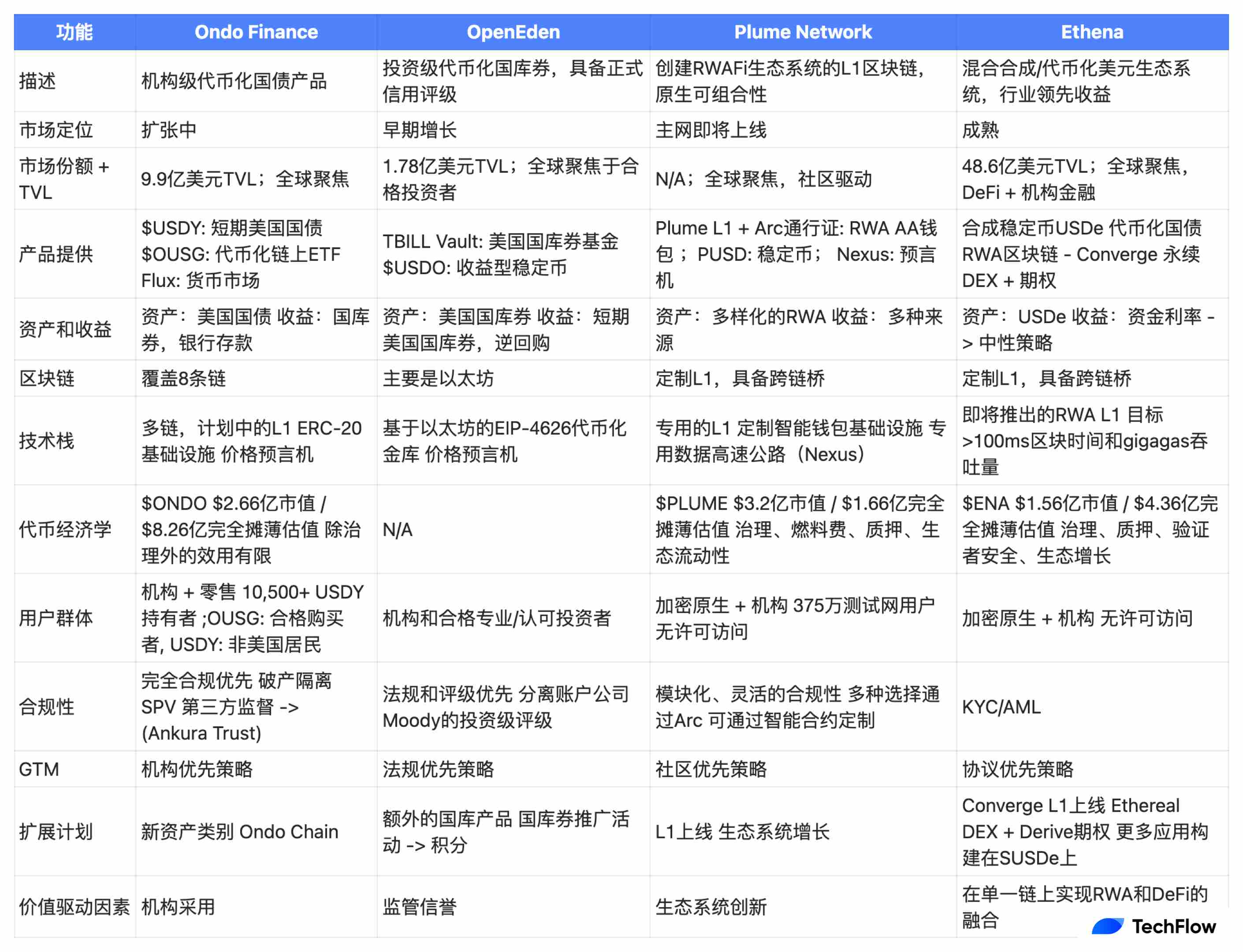

Comparative Analysis

@OndoFinance ( @nathanlallman )

a) Core Value Proposition

With a total locked value (TVL) of $990 million, it provides institutional-grade tokenized treasury products across eight chains

With over 10,500 USDY holders, it adopts a regulation-first strategy to legally combine traditional finance with decentralized finance.

Deep institutional relationships

Multi-chain strategy, and plans to launch a primary chain to consolidate its position as a leader in the tokenized U.S. Treasury market

$ONDO has a market cap of $2.6 billion and a fully diluted valuation of $8.2 billion. Limited utility beyond governance, would like to see more value flow back into the token

b) Challenges

Geographic restrictions (USDY is not open to US investors)

OUSG has high barriers to entry (only qualified purchasers and accredited investors)

Limited asset diversity and availability, limited to U.S. Treasuries

Competition from traditional financial institutions launching their own solutions

c) Effective marketing strategies

By partnering with major financial institutions, we adopt a top-down strategy, focusing first on institutional users and then expanding to the retail market.

@OpenEden_X ( @jeremyng 777 )

a) Core Value Proposition

Providing investment grade tokenized Treasury securities backed by a formal credit rating from Moody’s.

Its regulatory-first strategy focuses on accredited investors

Focus on U.S. Treasury securities, so that holders returns directly reflect the performance of the underlying U.S. Treasury portfolio

$USDO is a yield-generating stablecoin fully collateralized by US Treasury bonds

Currently, the promotion of treasury bonds is being carried out as a marketing strategy

b) Challenges

Smaller ecosystem and market influence than competitors

Less chain diversity (mostly focused on Ethereum)

Community development is not mature enough

c) Effective marketing strategies

Establish regulatory credibility first (obtain investment-grade rating from Moody’s)

@plumenetwork ( @chriseyin )

a) Core Value Proposition

Building a dedicated first-level chain specifically for RWAFi (Real Asset Finance) (defining the category)

Full ecosystem approach: RWA AA wallet + Arc (on-chain any asset) + pUSD stablecoin + nexus oracle (data highway)

A community-first strategy with a strong focus on composability and programmability

$PLUME has a market cap of $320 million and a fully diluted valuation of $1.6 billion. Used for governance, gas fees, staking, and ecosystem liquidity

b) Challenges

The new technology stack and RWAFi ecosystem are unproven

Compared to Ondo, the institutional recognition is lower

In a highly competitive blockchain space, the success of the primary chain ecosystem is critical

c) Effective marketing strategies

A community-first strategy to build a large ecosystem of RWA-focused protocols and dApps before the mainnet launch. Focusing on crypto-native users first, then expanding to institutional users.

@ethena_labs ( @gdog 97 _ )

a) Core Value Proposition

As the leading hybrid player, with approximately $10 billion in total locked value (TVL) and assets under management (AUM), of which Ethena products account for $6.4 billion and Securitize tokenized assets account for $4 billion

Rich product portfolio: USDe stablecoin + Ethereal perpetual contract decentralized exchange (DEX) + Derive options + building Converge primary chain

$ENA has a market cap of $1.5 billion and a fully diluted valuation of $4.3 billion. Used for governance, staking, validator security, and ecosystem growth

b) Challenges

The synthetic dollar model relies on centralized exchanges (CEX) for perpetual futures trading (which carries counterparty risk)

Converge’s first-tier chain infrastructure has limited differentiation

Profitability depends on positive funding rates

c) Effective marketing strategies

A two-pronged strategy that caters to on-chain DeFi whales while attracting institutional users, scaling through high yields, integrating USDe into dApps and CEXs, and building institutional credibility through strategic partnerships

Each protocol can be seen carving out its own market segment while forming an infrastructure that could fundamentally reshape global capital markets.

Image source: @ahboyash, compiled by TechFlow