Original author: BitMEX

Welcome back to our weekly Options Alpha series. Solana (SOL) recently fell below $170, mainly due to the following factors: FTX token unlocking and the violent market turmoil caused by the LIBRA scandal. Although these events have injected considerable volatility into the market, there are still signs that Solanas underlying technology and ecology may be enough to support its currency price and provide a certain price bottom support for this wave of decline.

In this context, we see that many market analysts, including our team, are cautiously optimistic and bearish about Solanas prospects. The upcoming FTX token unlocking will create a significant selling pressure on the market supply, and the memecoin incident has also raised questions about the user activity of SOL in the short term. However, based on Solanas strong developer community and the increasing interest of institutions in ETFs, it is still possible for Solana to maintain its resilience.

Because of this, we will next explore how to use options strategies to help you seek profits and protection in this volatile market. This article will introduce an options trading idea that aims to gain profits when Solana may fluctuate or continue to weaken during March, and at least break even or gain as long as $SOL can stay above $130 before March 28. We will analyze the trading structure in detail, show the benefits and risks in different scenarios, and point out the key points you must consider before trading.

Let’s get started.

Market Status

Solana has experienced a significant drop recently. As of now, SOL is trading at around $165, while it was above $200 in the past few weeks. The main reasons for this pullback include the following two points:

1. FTX Token Unlock

The 7.5 million SOLs expected to be unlocked on March 1, 2025 are FTX’s legacy assets. This unlocking scale accounts for a large proportion of Solana’s market value and may lead to a significant increase in the amount of SOL available for sale in the market, thereby exerting downward pressure on prices.

2. $LIBRA Scandal

The $LIBRA memecoin, endorsed by Argentine President Javier Milei, once soared, but then plummeted within hours, evaporating about $4.4 billion in market value. This incident not only caused huge losses to investors, but also added negative sentiment due to its connection with the Solana ecosystem, exacerbating concerns about SOL user activity in the short term.

Despite these negative factors, the following reasons suggest that Solana is likely to hold the key $130 level before March 28:

● Technical support: Technical analysis shows that $130 is an important support level, around which significant buying may occur.

● FTX repayment: On February 18, FTX creditors received a total of $1.2 billion in cash. If these creditors repurchase the SOL that was originally forced to be converted into US dollars because they are optimistic about Solana, it may provide additional support for the currency price.

● Ability to recover from past pullbacks: Historically, Solana has tended to be able to show some ability to rebound or recover after large pullbacks.

Trading strategies

Transaction Structure

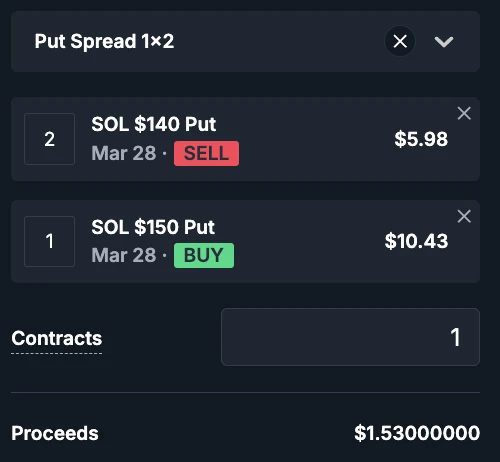

● Sell 2 SOL Put options (Put), strike price: $140 (expiration date: March 28)

● Buy 1 SOL Put option (Put), exercise price: $150 (expiration date: March 28)

Cost: You will receive a net premium of -$1.53 (i.e. the premium is collected)

Profit/Loss (PnL)

● Maximum profit: If the closing price of $SOL is around $140.6 on March 28, the maximum profit can be about $11.29.

● Breakeven point: $128.71

● (Note: As of 12:05 HKT on February 19, the current BTC price is $165.7 - this should correspond to the price of SOL, and it is possible that the original intention of the article is SOL price)

Why does this strategy work?

1. Limited upside risk

Selling two lower-strike puts and buying one higher-strike put allows you to collect a net premium that offsets some of the cost of buying the options. As long as the price of SOL does not drop significantly below the strike prices of the two puts, your risk is relatively limited.

2. Profit from a “controlled” decline

If the SOL price declines modestly, falling below the strike price of the put you bought ($150), but still above the strike price of the put you sold ($140), then you will make a profit on the put you bought, and retain some or all of the premium you collected on the put you sold.

Scenario Analysis and Benefits

1. SOL closes above $150

Both the two put options and one put option expired and became worthless, and your net premium of $1.53 is your profit.

Result: Small profit.

2. SOL between $130 - $150

When the price of SOL drops to around $140, the two put options you sold may be exercised, and you need to buy SOL at $140, but as long as the price is still above $130, it is still within the acceptable range of the strategy. If it is close to $140.5, you can get the maximum profit.

Result: Profits can be expected in the $130-$150 range, and maximum profit can be achieved if the contract expires near $140.5.

3. SOL falls below $130

Worst case scenario: The 2 put options you sold are deeply in the money, and the 1 put option you bought, although it can provide partial protection, is still not enough to hedge all the downside risk.

Result: The loss may be large, equivalent to the downside risk of holding a large amount of spot SOL.

Risks and precautions

1. Downside risks

If SOL plummets sharply to below $130, your losses will increase significantly, and although the purchased $150 put options provide some protection, they cannot fully offset your potential losses from selling the 2 put options.

2. Time decay and volatility

Option pricing is greatly affected by volatility. If implied volatility decreases, the value of both sold and bought options will decrease, and you need to pay attention to the resulting changes in gains or losses.

3. Strike price and expiration date selection

How to choose the right strike price and expiration date is very important. If the strike price is too close or too far from the current price, your potential profit may be limited or the risk may be too high.

Summarize

This put option combination strategy provides a way to profit from moderate declines or volatility in the current Solana market environment, while also providing you with some downside protection. Despite the recent volatility caused by the FTX unlock and memecoin scandal, Solanas ecosystem and market demand are still supportive, so the probability of falling below $130 before the end of March may not be too high.

This strategy buys a higher strike price put option (to provide partial protection for potential downside) and sells 2 lower strike price put options (to collect premiums) in the hope of making a profit when the market is stable or slightly corrected, and breaking even or maintaining a certain profit as long as SOL does not fall below $ 130. In any case, before making any options transactions, remember to carefully evaluate your risk tolerance and flexibly adjust the strike price, expiration time and position size.

I wish you a smooth transaction!