Original author: BitMEX

A quick overview (TL;DR)

As expected, the market had a nice rebound last week. However, the Solana ecosystem is currently facing severe challenges: the market is widely questioning the manipulation of memecoins within its ecosystem. Multiple whistleblowers revealed a conspiracy involving billions of dollars of insider trading, including a project codenamed $LIBRA, where coordinated insider selling caused the price to plummet. These revelations, coupled with concerns about network stability, have caused many traders to begin to distance themselves from Solana ecosystem assets.

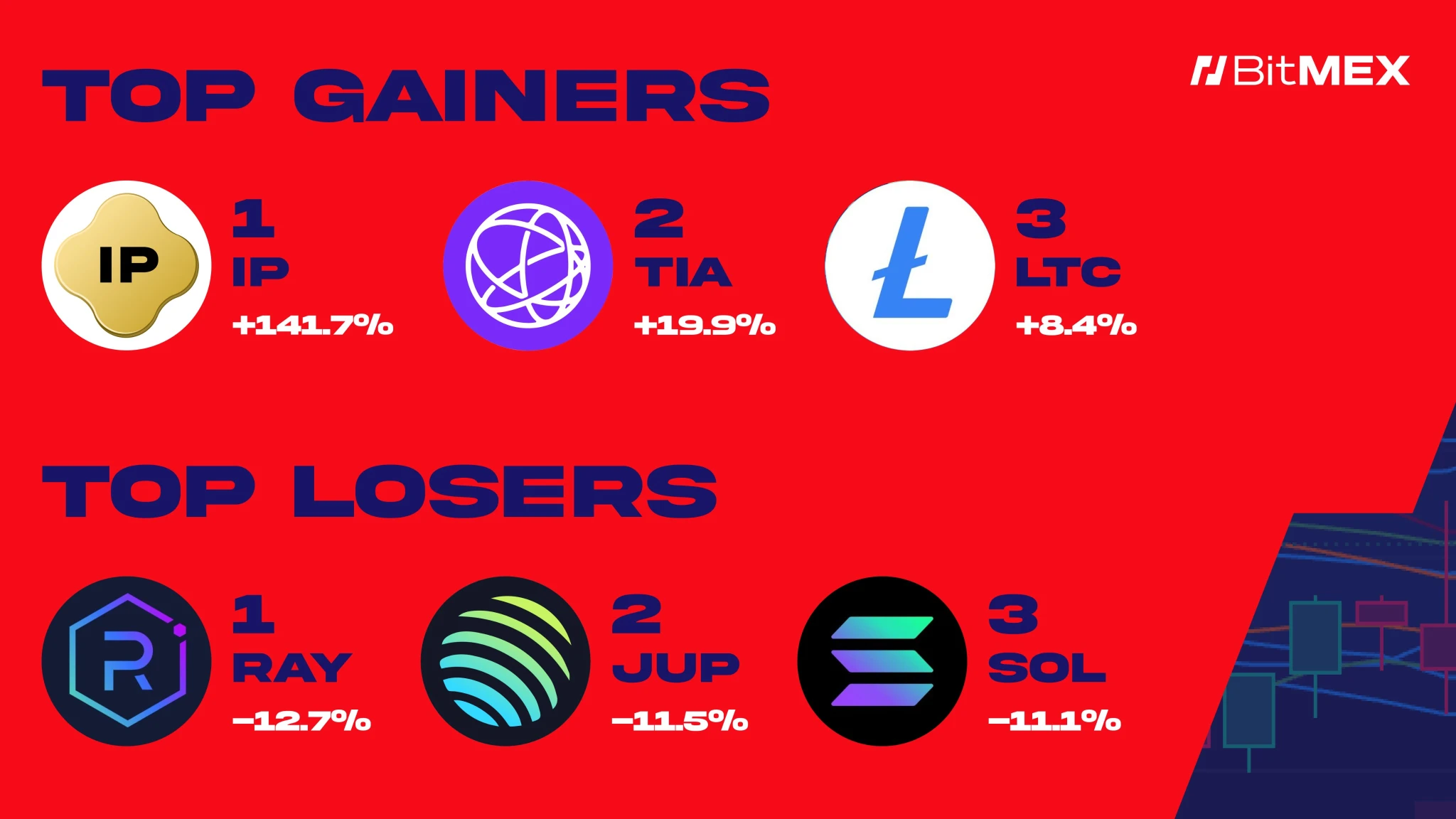

The best performing currencies this week: IP, TIA and LTC, rose by 141.7%, 19.9% and 8.4% respectively; while RAY, JUP and SOL under the Solana ecosystem performed poorly, with declines ranging from -12.7% to -11.1%.

In this week’s Trading Ideas column, we will explore the fundamentals of BitMEX’s exchange token $BMEX and its price performance that has nearly doubled in the past month. Still need to be reminded: this is not investment advice.

Data plane

Top performing coins:

$IP (+141.7%): Story Protocol’s $IP has become the most amazing token this week. Although the project did not perform well at the beginning of TGE and once fell back to the private round valuation, it then rose rapidly and has become the focus of traders.

$TIA (+19.9%): TIA has experienced a “redemption rebound.” After experiencing a complete round trip from highs to lows, it has now rebounded from the lows, showing signs of recovery.

$LTC (+8.4%): LTC performed strongly on rumors of ETF approval.

Worst performing coins:

$RAY (-12.6%): Raydium, the largest decentralized exchange in the Solana ecosystem, has benefited greatly from memecoin trading, but now continues to weaken under the influence of the $LIBRA scandal.

$JUP (-8.9%): Jupiter is the largest aggregator in the Solana ecosystem and also profits from memecoin transactions; affected by the $LIBRA scandal, the price fell.

$SOL (-11.5%): SOL was also under downward pressure this week due to the $LIBRA scandal.

News Highlights

Macro dynamics

ETH ETF single-week net outflow: $85,000 ( source )

BTC ETF single-week net inflow: -$377.7 million ( source )

Federal Reserve official Jefferson said he can wait and see on the next interest rate decision ( source )

Canadas annualized inflation rate rose slightly to 1.9% in January, and the core inflation index also rose ( source )

Libra meme coin scandal escalates, token co-founder claims to manipulate Javier Milei with money ( source )

Javier Milei invited Vitalik Buterin to Argentina for Ethereum Devconnect event during $LIBRA controversy ( source )

The US SEC approved Figures Markets’ new yield-generating stablecoin YLDS ( source )

Hong Kong plans major crypto regulatory reforms, highlights $3 trillion market cap opportunity ( source )

The US SEC has begun reviewing more applications for Solana ETFs, and the probability of approval has increased ( source )

FTX creditors begin receiving $1.2 billion in repayments with interest ( source )

Project News

Ethereum Foundation plans to hire a “social media manager” in an attempt to further win community support ( source )

Litecoin ETF has been added to the DTCC website ( source )

Opensea regained NFT market share after announcing SEA token, now at 71.5% ( Source )

Tether intends to acquire Adecoagro, a South American renewable energy company with an annual power generation capacity of 1 million MWh ( Source )

Pi Network mainnet is officially launched, the token briefly rose but then fell by more than 50% ( Source )

Polymarket announced a partnership with UMA and Eigenlayer to create a new generation of oracle solutions ( source )

VanEck said that US Bitcoin mining companies are turning to AI and high-performance computing when transaction fee revenue is uncertain ( source )

Solana has been weak as weekly on-chain transaction volume has declined since mid-January ( source )

Pumpfun launches mobile app as memecoin popularity rises ( source )

Trading ideas

Risk Warning: The following content is only for the purpose of summarizing and sharing market information and does not constitute investment advice. Please do your own research (DYOR) before making any investment decisions. The content does not guarantee any returns. BitMEX is not responsible if the transaction does not meet expectations.

$BMEX: Full Analysis

Introduction

BMEX is the platform token of BitMEX, a crypto derivatives exchange. BitMEX is one of the oldest and most influential exchanges in the industry. It was the first to launch a perpetual contract without an expiration date, which has become the standard for crypto derivatives trading. Although BitMEX has not received the highest exposure in recent years, its solid industry background, huge insurance fund and loyal user base provide solid support for BMEX.

This article will explore BMEX’s fundamentals, recent price trends, token functionality, and compare it to other exchanges’ tokens.

1. Price performance

Price surge

+72% increase in the past month: In the current market environment that is considered a bear market for altcoins, BMEX has bucked the trend and become one of the few tokens that have performed well.

Technical Analysis

Strong Momentum: A monthly gain of 80%+ with limited correction indicates strong buying support and bullish market sentiment.

Consolidation or continued rise? : In the short term, especially for small-cap currencies, volatility may still be high. But for now, bullish sentiment is still continuing, and market confidence in the future of BitMEX and its platform currency seems to be increasing.

2. Fundamentals and functions

BitMEX’s historical position

The inventor of the perpetual contract: BitMEXs pioneering perpetual futures has changed the trading model of crypto derivatives.

Classic Brand: At its peak, BitMEX’s trading volume surpassed Binance, making it the world’s largest cryptocurrency exchange.

Large Insurance Fund: BitMEX’s insurance fund is worth up to $3.5 billion (converted into USD), which protects platform users from automatic liquidation (ADL) during extreme market volatility.

Security: Since the platform was founded 10 years ago, BitMEX has never been hacked and has never suffered any loss of user funds.

Buyback and destruction mechanism

Monthly (not quarterly) buyback: Unlike many exchanges that burn tokens quarterly, BMEX buys back and burns some tokens every month. This more frequent burning rhythm usually brings a more significant deflationary effect.

Annualized destruction: Currently, about $3.2 million of BMEX is destroyed each year, corresponding to a price/destruction ratio of ~8.1×, compared to ~22.3× for BNB. If inflation remains stable or demand rises, this higher proportion of buybacks and destruction may provide greater support for prices.

Token Function and Application Value

Transaction fee discounts: Staking BMEX can enjoy lower derivatives transaction fees, which is very attractive for intraday high-frequency traders.

Free withdrawals: BMEX stakers enjoy free withdrawals, which further reduces the cost of active trading.

Ecological potential: As BitMEX continues to develop spot trading, more product lines, etc., BMEX may also gain more application scenarios, thereby increasing demand.

3. Comparison with other exchange tokens

When measuring centralized exchange (CEX) tokens, market capitalization comparison is one of the common references, especially when the platform behind it has a certain scale of users or technical advantages, it is more meaningful.

Bitget(BGB)

Gate.io (GT)

HTX (HT)

In contrast, BMEX’s current market cap is only around $30 million, while tokens of other large exchanges often have market caps of hundreds of millions of dollars. Although this is not a guarantee that BMEX will grow, if BitMEX has a solid user base and unique technological advantages, its potential upside cannot be ignored.

4. Main drivers and risks

Possible drivers

1. BitMEX product line expansion: If BitMEX continues to invest and expand in spot trading, staking, lending and other innovative products, the demand and application scenarios of BMEX will also increase accordingly.

2. Brand recognition and trust: As an established derivatives exchange, BitMEX still has a strong reputation and credibility. Once market sentiment turns to trust more established exchanges, BMEX may benefit.

3. Deflationary advantage: Monthly buybacks and destruction, coupled with high pledge rates, reduce the number of circulating tokens. As long as demand is stable or rising, it is likely to drive prices higher.

Risks and precautions

1. Regulatory environment: Derivatives trading is subject to strict scrutiny in many parts of the world. Any unfavorable regulatory decision may impact BitMEX’s business and BMEX’s price.

2. Industry competition: Binance, Bybit, OKX, etc. have invested heavily in user acquisition and marketing. BitMEX needs to maintain product innovation to stand out from the competition.

3. Market volatility: Small-cap tokens are more volatile and may experience a rapid correction in the short term if market sentiment turns cold.

5. Conclusion

In the current market environment, BMEXs recent strong price performance is eye-catching. Its market value is currently about 30 million US dollars, which still has a certain imagination space compared with BGB, GT, HT and other exchanges with market values of hundreds of millions of dollars.

For investors who are optimistic about BitMEXs long-term strength, brand accumulation, and innovation in the derivatives field, BMEX may be worth paying attention to, especially if the exchange continues to work hard on product and ecological layout in the future.