Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This morning, we just published a market article titled Market Accelerates Decline, Is BTC Really Heading for 70,000? We thought we were prepared for the market to continue to fall, but we did not expect a new round of accelerated decline to come so quickly.

Around 15:30, BTC fell below the $90,000 mark again after nearly a month and a half. OKX market data shows:

BTC fell to as low as 88189 USDT, and was temporarily reported at 89204 USDT at 15:50, with a 24-hour drop of 6.80;

ETH fell to as low as 2315 USDT, and is currently trading at 2378.01 USDT, a 24-hour drop of 12.5%;

SOL fell to as low as 132.8 USDT and is currently trading at 136.5 USDT, a 24-hour drop of 15.12%;

There is no need to mention other altcoins and on-chain memes, the declines are generally greater than 10% or even 20%.

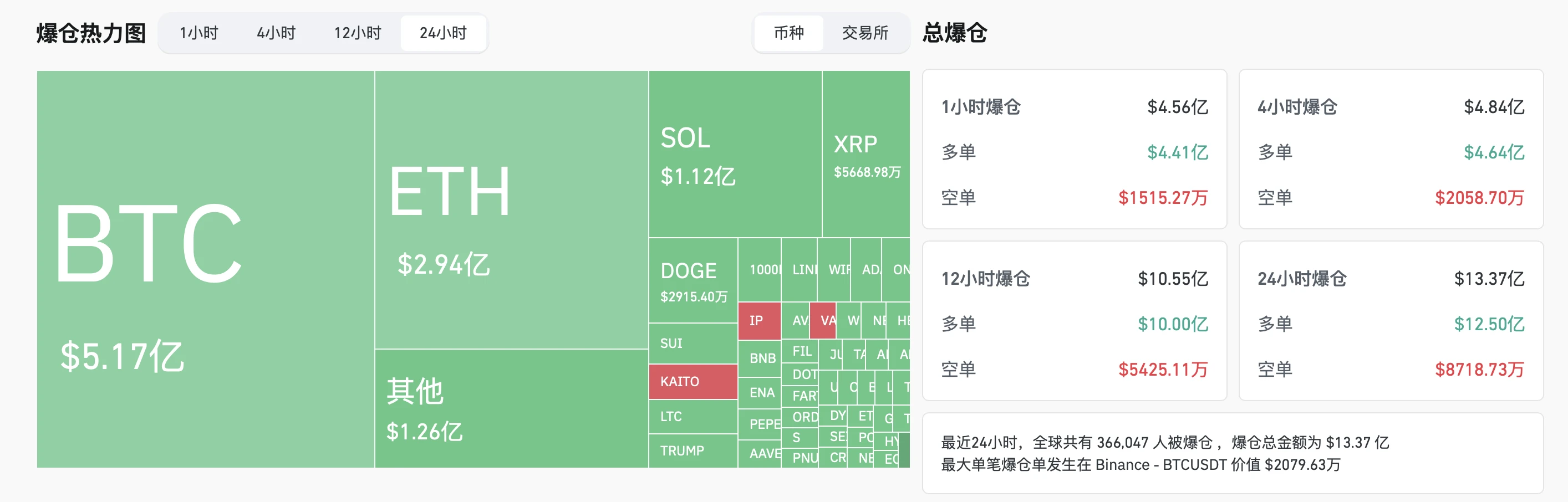

In terms of derivatives data, Coinglass data shows that in the past 24 hours, the entire network has liquidated $1.337 billion, of which the vast majority are long orders, amounting to $1.25 billion. In terms of currency, BTC liquidated $517 million and ETH liquidated $294 million.

Targeted attack on big contract holders?

Regarding the cause of this sharp drop, some community members interpreted it as a targeted attack by a powerful market maker on a large contract holder who opened long BTC contracts on CEX (nicknamed “Set 10 big targets first”).

Community screenshots show that the users average opening price was 100,320.8 USDT, the holding volume was as high as 5,184.527 BTC, and the estimated liquidation price was 82,592.68 USD.

However, as the market accelerated its decline, the big investor seemed to have closed his position in advance. On-chain analyst Ai Yi monitored that the big investor who opened long BTC contracts had cut losses. In the past 5 minutes, the big investor cut 1783.48 BTC at an average price of $89,138, with a total value of $159 million.

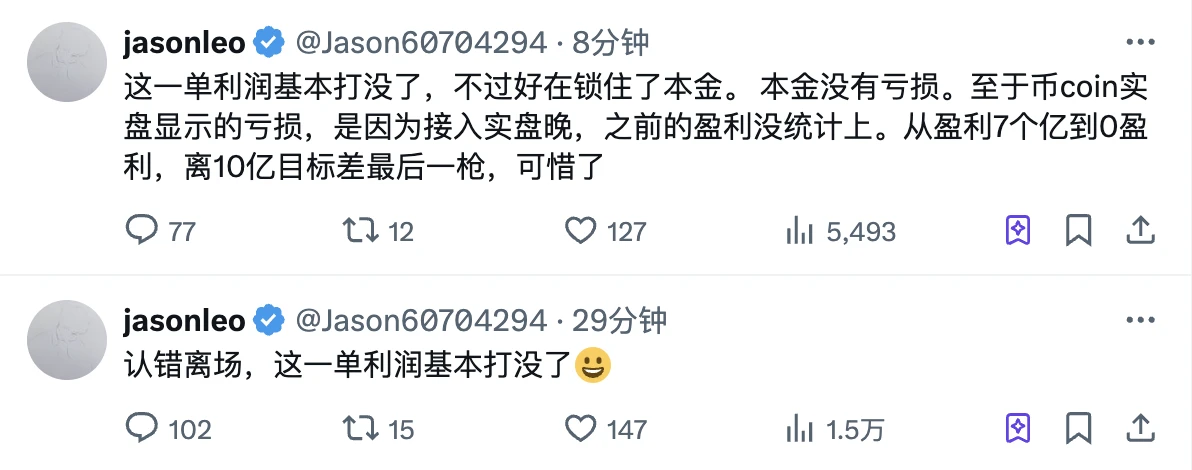

At the same time, the suspected big investor X user jasonleo also responded to the situation of the position. Jasonleo admitted that he admitted his mistake and left the market, and took profits, but also clarified that he did not cut his losses, and the principal is still there, because the real market was connected late, resulting in the on-chain data platform not counting the previous profits.

The investor finally said: From a profit of 700 million to 0 profit, it is just one shot away from the 1 billion goal. What a pity.

What do the various leaders/institutions think?

In this morning’s article, we briefly covered BitMEX co-founder Arthur Hayes and Placeholder partner Chris Burniske’s views on the market outlook - Arthur Hayes is still bearish to $70,000; Chris Burniske firmly believes that this is just a bullish correction.

In order to help everyone make a clearer judgment on the future market, we have once again sorted out the views of more bigwigs/institutions, the details are as follows.

OKX: Multiple factors triggered this round of decline, the key to the future market lies in the inflow of incremental funds

Zhao Wei, a senior researcher at OKX Research Institute, analyzed this round of decline and said that multiple factors such as global trade tensions, the plunge of US stocks, leveraged liquidation, withdrawal of institutional funds, frequent security incidents and the decline of SOL ecological hype have jointly driven this round of market decline.

At the macro level, liquidity tightening continues to put pressure on risky assets. Expectations of a rate hike by the Bank of Japan have increased, and the yen has broken through the 149 mark against the US dollar, directly impacting the worlds largest carry trade carrier. At the same time, the Nasdaq index fell by more than 4% for three consecutive days, the valuation of technology stocks fell, and the market risk appetite declined, further affecting high-β assets such as Bitcoin. In addition, the strengthening of the US dollar pushed up the risk-free rate, attracted funds to flow back to low-risk assets, and accelerated the outflow of funds from high-risk assets.

In the crypto market, internal vulnerabilities were amplified in this decline. First, the reversal of institutional capital flows has become a key pressure point. Recently, Bitcoin and Ethereum spot ETFs have continued to have net outflows, and the cost line of some institutional positions has been broken, triggering programmatic selling. Secondly, in the derivatives market, large institutions Ethereum futures positions have been greatly reduced, showing a shift in their market expectations. In addition, the SOL ecosystem faces a liquidity dilemma, the on-chain Memecoin trading volume has declined, the withdrawal of speculative funds has caused market makers to reduce the quote depth, the on-chain liquidation volume has surged, and the protocol revenue has declined. The valuation model of the SOL ecosystem may face reconstruction. The leveraged liquidation wave has further exacerbated market turmoil, and the prices of some crypto assets have broken, triggering DeFi cascade liquidations. At the same time, a number of recent security incidents have exacerbated the markets trust crisis, users concerns about the security of their assets have increased, and confidence in the crypto market has been further frustrated.

The future market trend will be affected by both the macro environment and internal factors, but the core still depends on the continuous inflow of incremental funds. However, the current global economic situation is unclear, and tariff pressure has exacerbated the decline in risk appetite. The recovery of the crypto market still needs to wait for the return of institutional funds and new phenomenal applications to promote narrative reconstruction and achieve healthy market adjustments. At present, the crypto market is under the triple pressure resonance of macro liquidity contraction, internal ecological adjustments, and exposure of market structure fragility. Users should focus on the industrys technological innovation cycle, the performance of U.S. technology stocks financial reports, and the pace of global central bank policy adjustments. Only when the inflow of on-chain stablecoins resumes positive growth, futures positions rebound from the bottom, and the weekly level of major currencies stabilizes, can the market repair cycle be confirmed.

Matrixport: The possibility of further decline is high, and buying demand is limited

Matrixport released todays market volatility, saying: Bitcoin has fallen below the rising extended wedge. Although this is not what we want, this pattern usually indicates downside risk unless the price can quickly rebound and return to the wedge. Bitcoin is likely to fall further, especially since this break occurred during a period of low trading, and there is limited demand for buying on dips.

“While we expect prices to rise in the second half of this year, this technical breakout has made market sentiment more cautious. In addition, not only did Bitcoin break, but Ethereum also fell below the key support range of $2,600 to $2,800.”

Raoul Pal: Its just a callback. Learn to block out the noise

Raoul Pal, co-founder and CEO of Real Vision, said in response to the decline: Be patient. The current market structure is very similar to that of 2017. BTC has experienced 5 corrections greater than 28%, which lasted for 2-3 months before setting a new high. At the same time, altcoins generally fell by more than 65%. The market is full of noise. Do something more meaningful than watching the market.

Ansem: Pay attention to the recovery of 96500 and be wary of subsequent stock market declines

Well-known trader Ansem YuX said that the next key point is whether BTC can regain the position around 96,500, but the more important issue is that if the cryptocurrency is pre-reflecting the risk aversion trend of the entire market and the stock index also collapses in the next few weeks, then this is more likely to be the beginning of a downward trend rather than a small episode in the upward trend.

CoinDesk analyst: Nasdaq decline + Japans interest rate hike triggered the plunge

Omkar Godbole, editor-in-chief of CoinDesks market analysis team, released a market analysis, saying that the expectation of a rate hike by the Bank of Japan and the decline in Nasdaq futures led to the current plunge in the crypto market. Market data showed that Nasdaq futures fell 0.3%, indicating that the trend of three consecutive days of decline will continue. The technology stock index has fallen by more than 4% since February 18.

The safe-haven yen was at 149.38 per dollar, on track to challenge a nearly three-month high of 148.84 set on Monday. The yen has risen nearly 6% in six weeks as markets bet on a rate hike by the Bank of Japan. The BoJ rate hike talk and the yens strength were reminiscent of last July, when the yen surged as the central bank raised rates, ultimately sparking widespread risk aversion that caused Bitcoin to plunge from around $65,000 to $50,000 in a matter of days.