Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

The Emperor of Sichuan called for orders and the market rebounded.

A big positive line quickly covered up the pain of the plunge, and the emotion of FOMO rushed into the brain. Calls for 100,000 or even new highs began to appear... How will the story end this time? The market changes rapidly and is unpredictable. If you want to win steadily in an uncertain market, you need to find those certain paths.

Last week, we shared the first issue of U-based Financial Management Strategy More Suitable for Lazy People (February 24) , which aims to cover the relatively low-risk (systemic risks can never be ruled out) income strategies based on stablecoins (and their derivative tokens) in the current market, and help those users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

This week we will update the second issue as scheduled. Starting from this issue, we will no longer repeat some repetitive section descriptions (please refer to the previous period if necessary), and the focus will be on new opportunities from the previous week.

Base rate

Coverage: Tentatively covers the single-currency financial solutions of mainstream CEX, as well as mainstream on-chain lending, DEX LP, RWA and other DeFi deposit solutions.

There is not much to say about the base interest rate. This is the least efficient financial management plan. The current apy of single-currency financial management in CEX is bleak. Most of the mainstream DeFi protocols on the chain are not ideal except for the stablecoin pools of Fluid and Morpho.

There are two points I would like to mention.

One is that the Launchpad/Launchpool on the CEX side still has a high participation value . For example, last week Binance opened the Redstone Launchpool and supported USDC deposit mining for the first time. Based on the current price of RED of US$0.8 (there is a daily limit, the actual price will be higher), the comprehensive yield of the USDC pool is about 33%.

Another is that some CEXs will launch some limited-time subsidy activities in order to attract new users . For example, Bitget currently gives new users 80% apy for 20 days (limited to 1,500 USDT).

Pendle Zone (with RateX, Exponent)

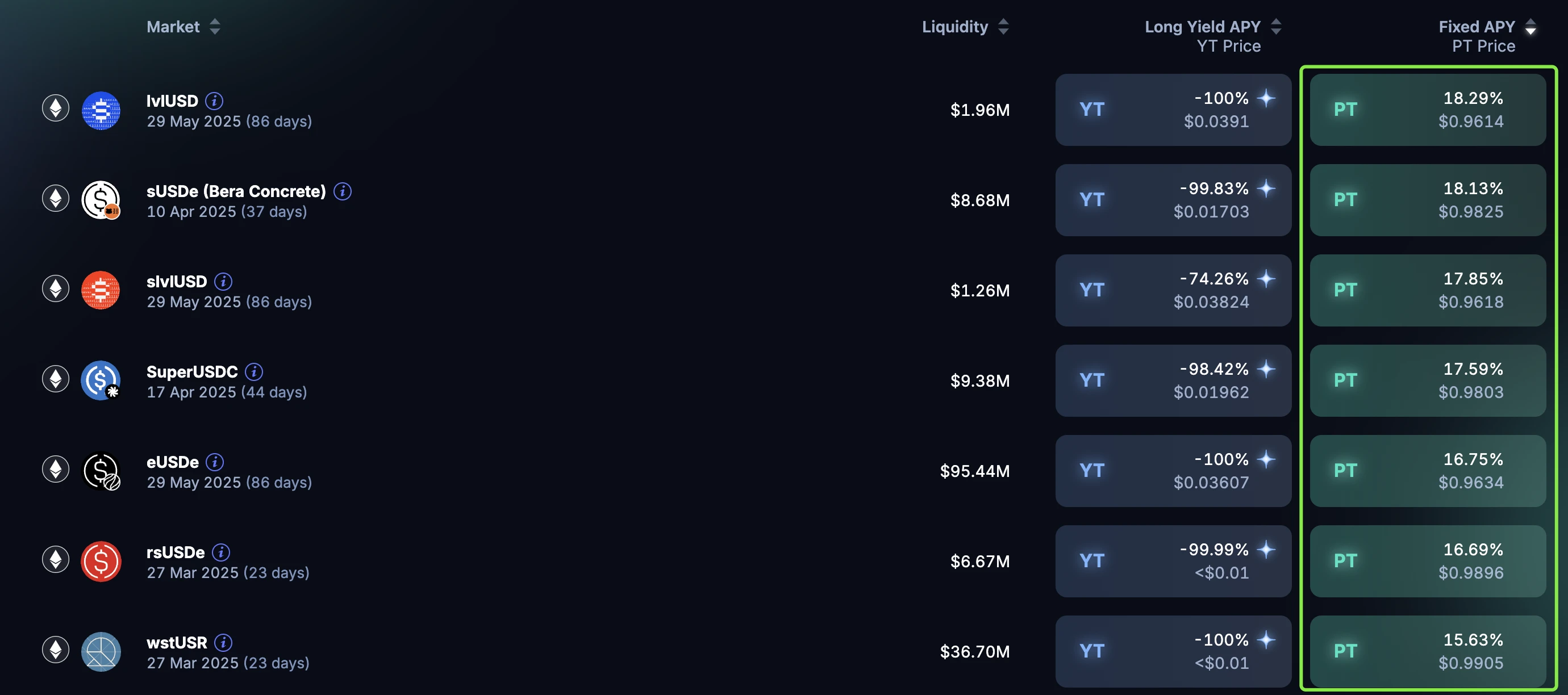

In terms of fixed income, the real-time ranking of PT yields of major stablecoin pools in Pendle on the main network is as follows. There are some higher pools on Base and BNB Chain (USR, asUSDF, etc.), with the highest approaching 20%.

In terms of LP, Pendle launched some new pools last week, among which there are two that are worthy of attention.

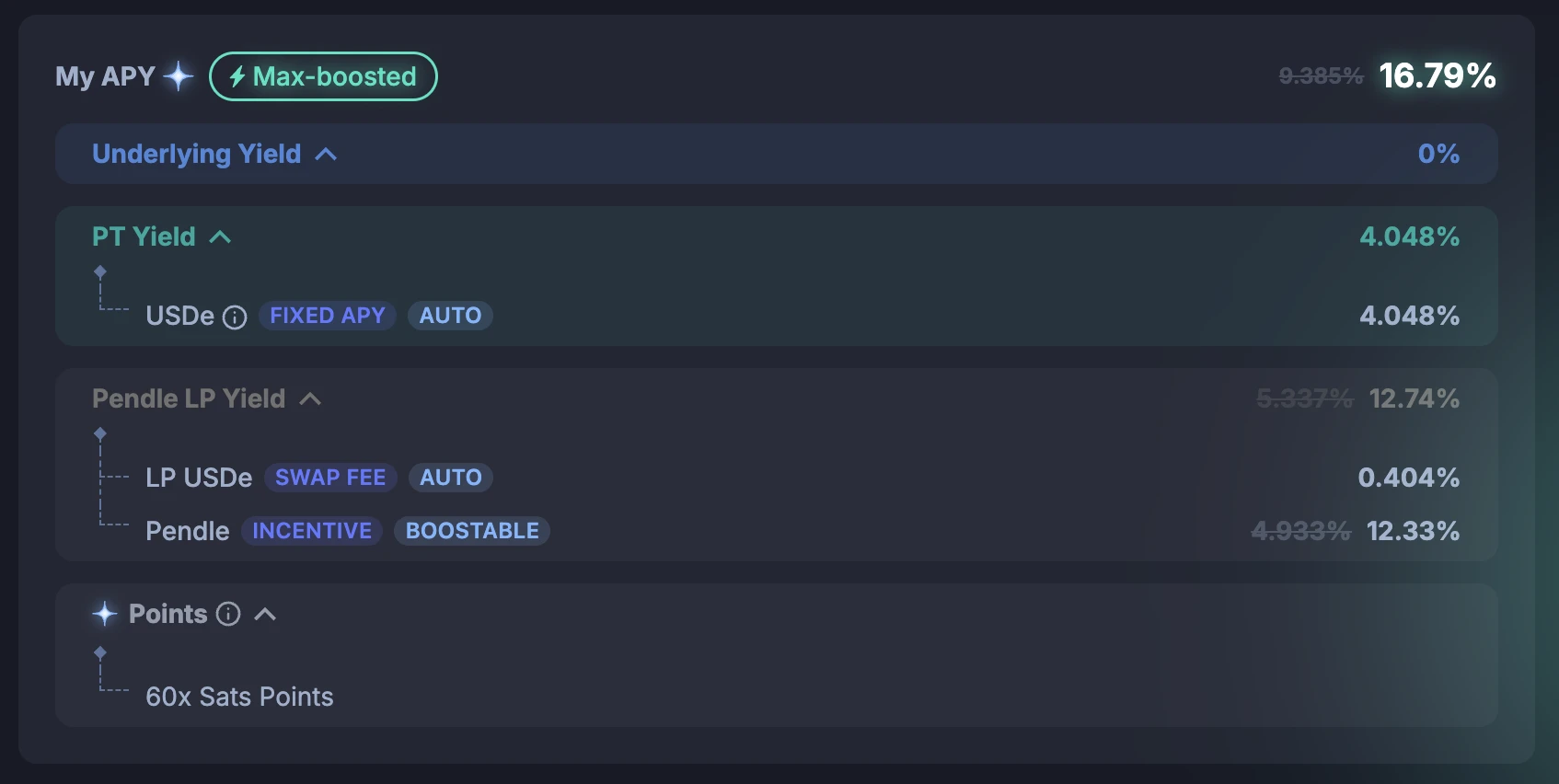

One is the USDe pool that expires on July 31. The current base apy of the pool as an LP is 9.385%. If there is sufficient PENDLE pledged, it can be as high as 16.79%. The feature of this pool is that Ethena has given a historically high 60x stas points bonus.

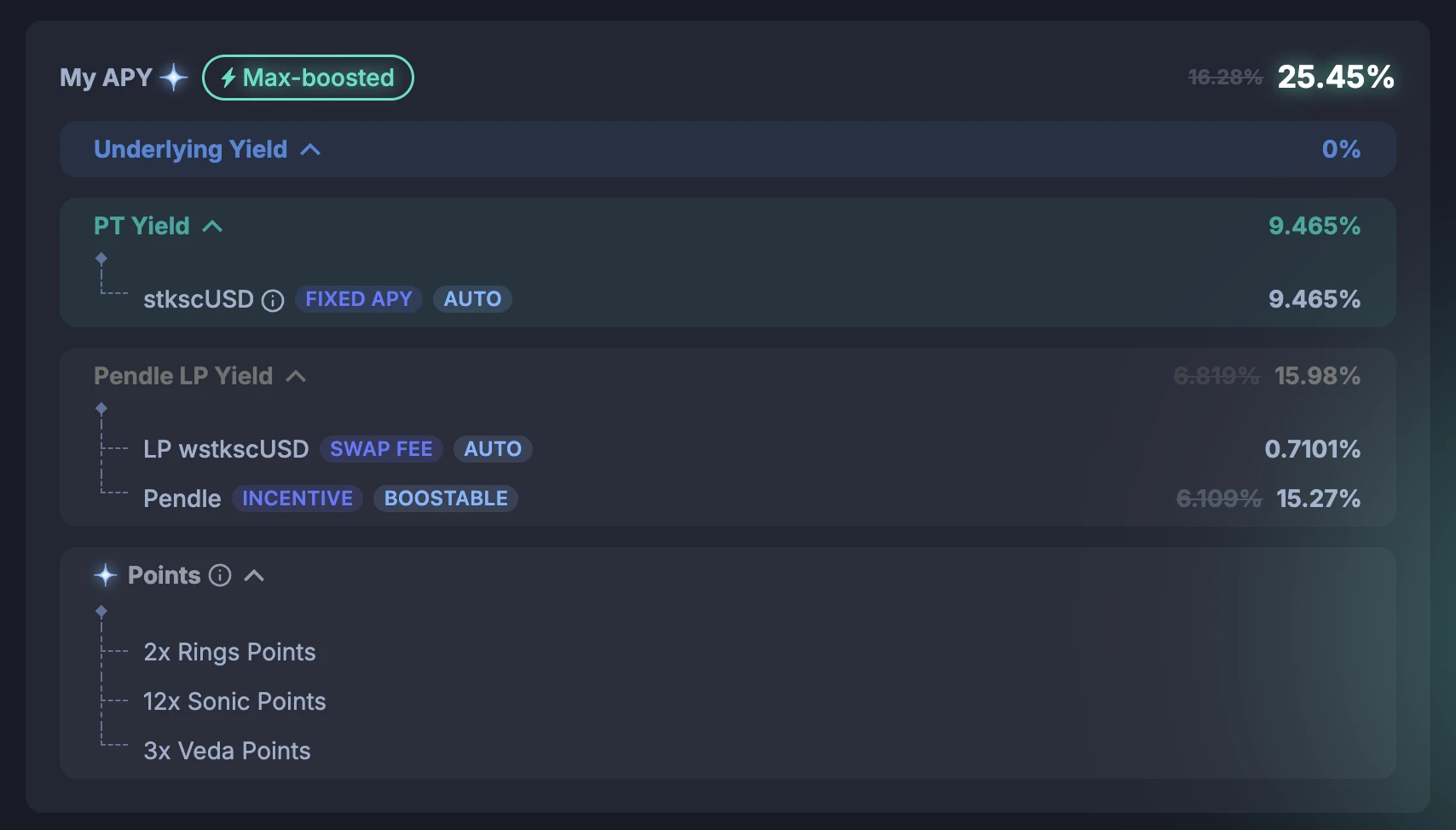

Another thing is that Pendle has recently expanded to the Sonic ecosystem. The current stablecoin pool only has wstkscUSD, which expires on May 29. The current base apy of the pool as an LP is 16.28%. If there is sufficient PENDLE pledged, it can be as high as 25.45%, and you can also get a 12-fold Sonic points bonus.

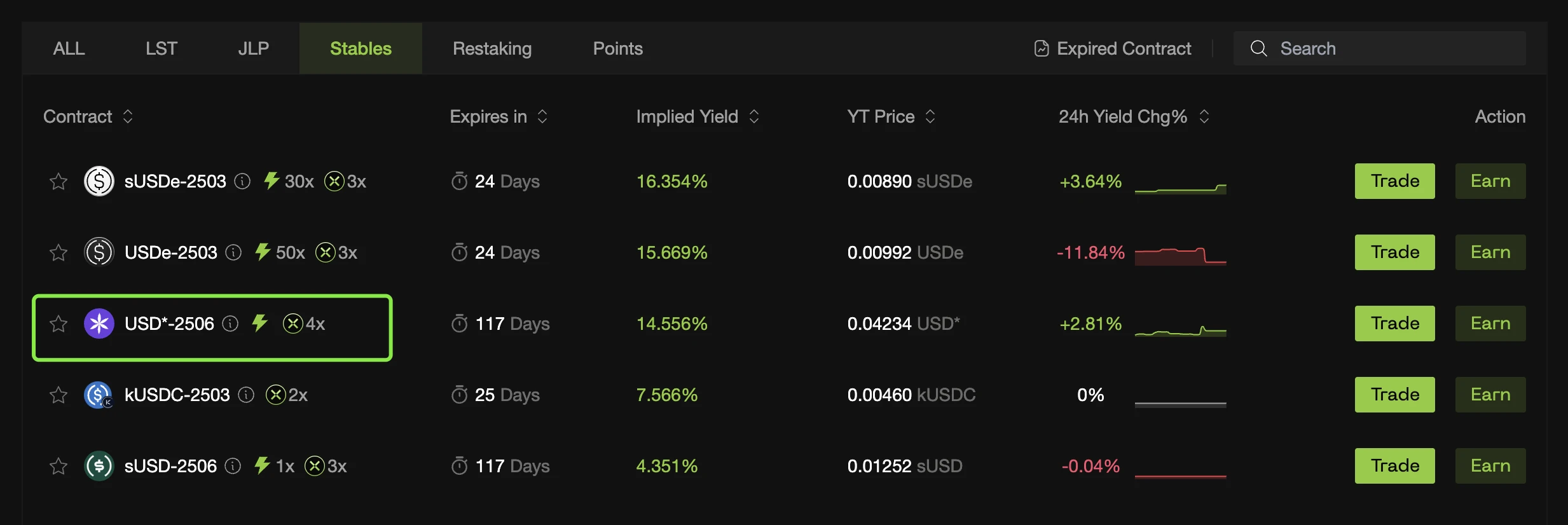

Last week, a friend asked if there are any products similar to Pendle in the Solana ecosystem. Of course there are, such as RateX and Exponent , but the overall TVL scale is currently much smaller than that of Pendle, and there are not many pools that can be mined.

I personally have placed a small amount of funds in the USD* pool on RateX and Exponent (as an LP, earning both returns and points). Perena, the issuer of USD*, is suspected to be conducting a new round of financing recently, so there is a certain expectation of double gains.

In addition, there are many opportunities for fixed-income based on SOL on RateX and Exponent, and the highest you can get is 17%+, which is much higher than direct staking. You can assess the risks yourself and participate as appropriate.

Other Opportunities

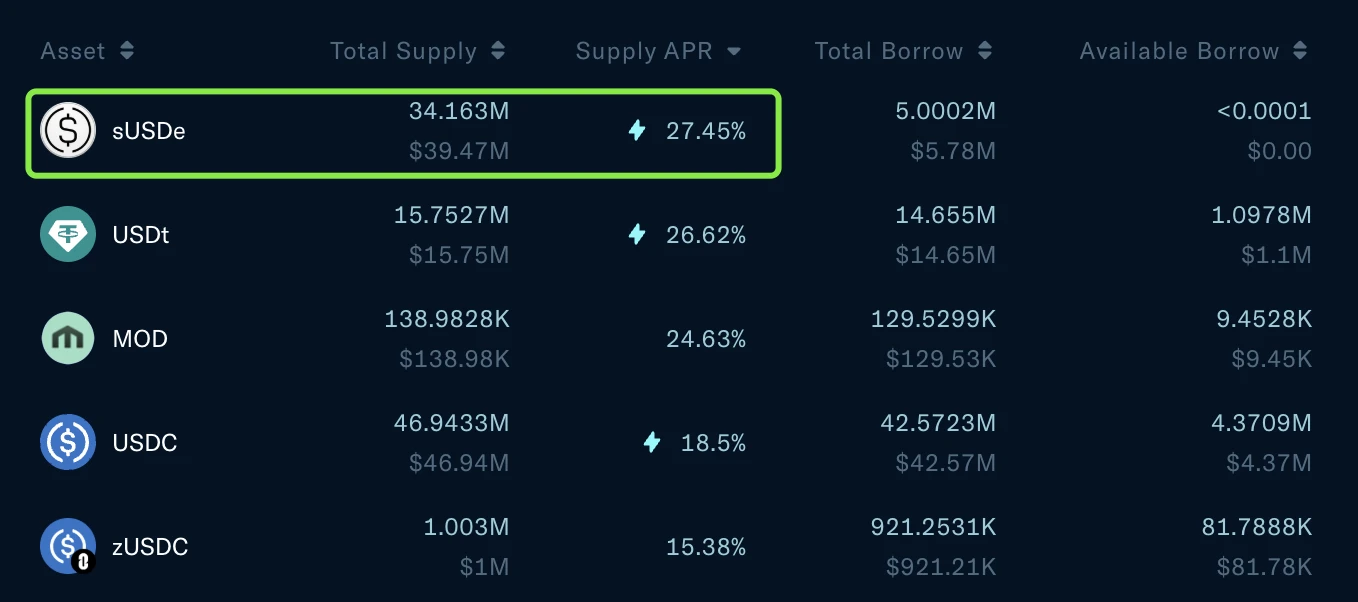

The most surprising pool last week was Echelon’s sUSDe pool on Aptos.

Ethena announced last week that it will enter the Move ecosystem. The first cooperation project is Echelon. sENA holders can share 5% of Echelon airdrops in the future. Echelon has been listed on the sUSDe pool. Under the official incentive of Aptos, the current apr (note that it is apr) of the pool is temporarily reported at 27.45%, and at the same time, you can get a hand of Echelon points.

Sonics current trend remains strong. In addition to Pendle, Aave and Compound will also be deployed soon . Users with lower risk appetite can consider it. After all, in addition to the base interest rate income, there is an additional income expectation of Sonic points.

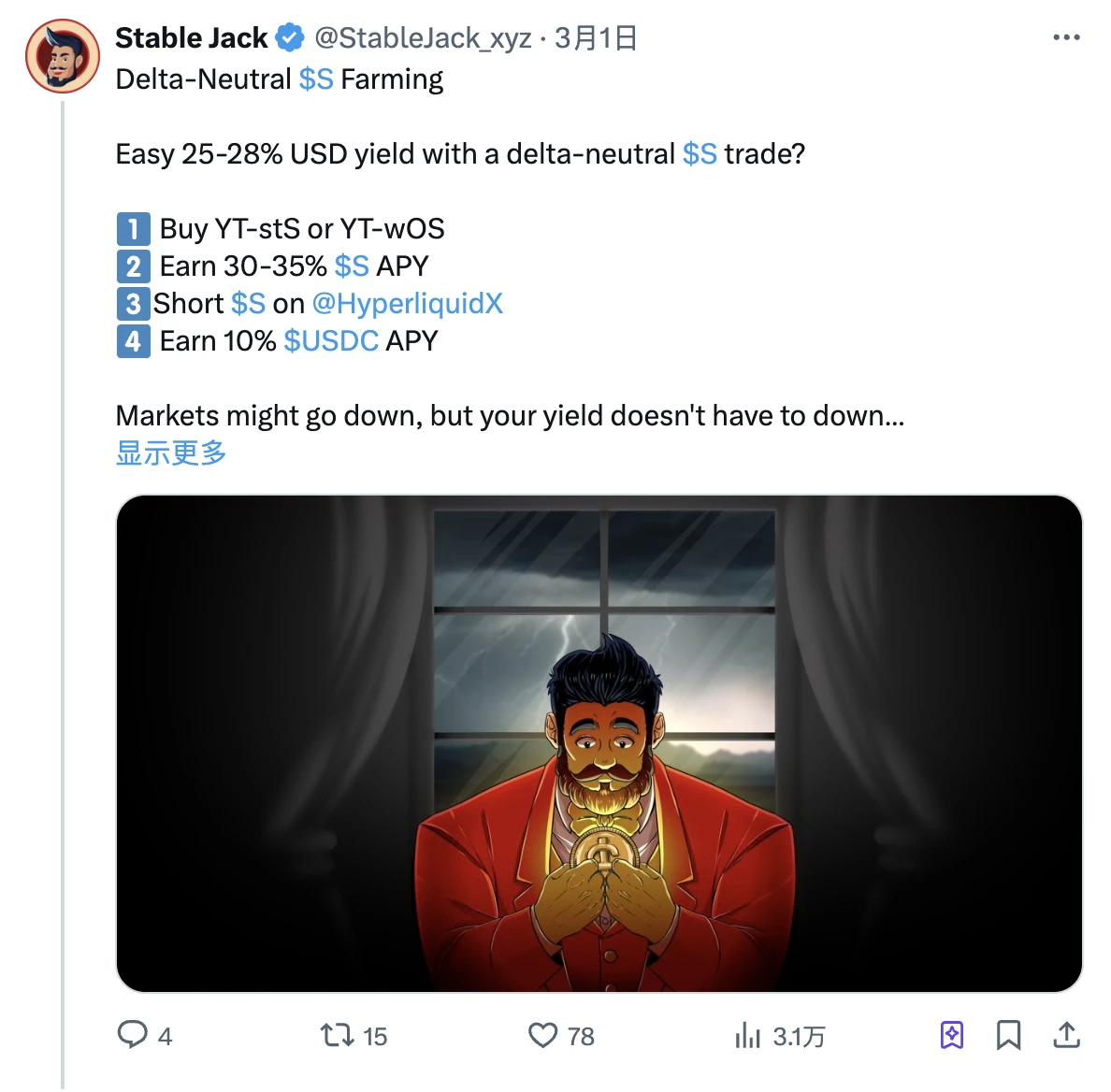

Another neutral way to play around Sonic is to do term arbitrage on S. KOL Stable Jack shared this strategy, and AC himself even forwarded it - the general path is as shown in the figure, and you can get a return of about 25% - 28% (not tested personally).

All in all, there are still many profit opportunities in the current market. If you are tired of the fast pace of PVP, you might as well try a different speed.

Finally, I would like to ask everyone to pay attention to me. The on-chain yield fluctuates rapidly. Although this column tries to update weekly, the frequency is still unable to match the market trends in real time. Friends who are interested can follow my X account @azuma_eth. Although I am lazy, I will share good pools as soon as possible.

Let us make friends with time, one step at a time.